Raphael Dang-Quang Cung - U.S. Tax Court

Raphael Dang-Quang Cung - U.S. Tax Court

Raphael Dang-Quang Cung - U.S. Tax Court

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

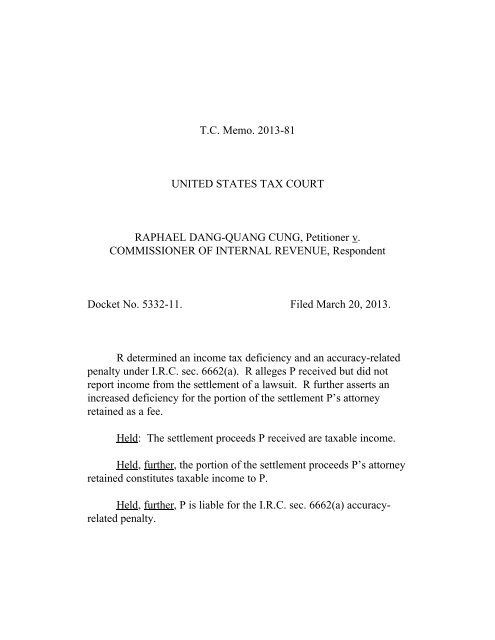

T.C. Memo. 2013-81UNITED STATES TAX COURTRAPHAEL DANG-QUANG CUNG, Petitioner v.COMMISSIONER OF INTERNAL REVENUE, RespondentDocket No. 5332-11. Filed March 20, 2013.R determined an income tax deficiency and an accuracy-relatedpenalty under I.R.C. sec. 6662(a). R alleges P received but did notreport income from the settlement of a lawsuit. R further asserts anincreased deficiency for the portion of the settlement P’s attorneyretained as a fee.Held: The settlement proceeds P received are taxable income.Held, further, the portion of the settlement proceeds P’s attorneyretained constitutes taxable income to P.Held, further, P is liable for the I.R.C. sec. 6662(a) accuracyrelatedpenalty.

[*2] <strong>Raphael</strong> <strong>Dang</strong>-<strong>Quang</strong> <strong>Cung</strong>, pro se.Eugene Kim, for respondent.- 2 -MEMORANDUM FINDINGS OF FACT AND OPINIONWHERRY, Judge: This case is before the <strong>Court</strong> on a petition forredetermination of a $5,449 income tax deficiency and a $1,090 accuracy-relatedpenalty under section 6662(a) respondent determined for petitioner’s 2008 taxableyear. 1 The deficiency stems from unreported dividend and interest income,unreported lawsuit settlement proceeds petitioner received, and correspondingcomputational adjustments. By way of an amended answer filed March 19, 2012,respondent alleges an increase to income of $2,000 on the grounds that the lawsuitsettlement proceeds totaled $17,000, of which petitioner’s attorney retained$2,000 per their fee agreement. Respondent also concedes that $2,000 of the$17,000 is deductible as a miscellaneous itemized deduction, subject to the 2%floor of section 67(a). Because of that increase to income and the corresponding1Unless otherwise indicated, all section references are to the Internal RevenueCode of 1986 as amended and in effect for the taxable year at issue. The Rulereferences are to the <strong>Tax</strong> <strong>Court</strong> Rules of Practice and Procedure.

- 3 -[*3] deduction, respondent seeks to increase the deficiency by $313 and theaccuracy-related penalty by $62.40.After concessions 2 the issues for decision are: (1) whether respondent hasconceded $2,000 of the settlement income; (2) whether petitioner’s settlementproceeds constitute taxable income; and (3) whether an accuracy-related penaltyunder section 6662(a) should be imposed.FINDINGS OF FACTSome of the facts have been stipulated. The stipulation of facts withaccompanying exhibits and the stipulation of settled issues are incorporated hereinby this reference. At the time the petition was filed, petitioner resided inCalifornia. Petitioner is employed as an attorney and practices entertainment lawand civil litigation.In September 2007 petitioner saw an online advertisement atwww.autotrader.com for a “Certified Pre-Owned” 2004 BMW 645Ci convertible.The advertisement listed the price at $36,864 but did not list the mileage on thecar. The seller was Lithia Seaside, Inc., d.b.a. BMW of Monterey (Lithia).Petitioner called Lithia, told the salespeople that he was interested in buying the2Respondent concedes that petitioner is not responsible for self-employmenttax on the settlement proceeds. Petitioner concedes (1) $272 of unreported dividendincome and (2) $458 of unreported interest income.

- 4 -[*4] car, and set an appointment for the next day to finalize the deal. When hecalled the dealership later that day to confirm the final price including sales tax andother fees, the dealership told petitioner that the $36,864 price was a mistake. Thedealership told petitioner that he could purchase the car for $56,000 plus sales taxbut that it could not sell it to him for the price listed on line. Petitioner demandedthat the dealership honor the original price, and the dealership refused. After someback and forth, petitioner filed a lawsuit in California Superior <strong>Court</strong> in the Countyof Los Angeles on September 28, 2007. See <strong>Cung</strong> v. Lithia Seaside, Inc., No.07E09254 (Cal. Super. Ct. filed Sept. 28, 2007). The complaint alleged variousviolations of California statutory law and a breach of contract. Petitioner soughtinjunctive relief, including a court order that Lithia sell him the car for the advertisedprice, damages of no less than $20,000, punitive damages, attorney’s fees and costs,and other legal or equitable relief.Petitioner and Lithia engaged in some discovery, and he learned that the carhad since been sold to a Seattle, Washington, affiliate of Lithia. Eventuallypetitioner decided that a settlement was in his best interests and settled the suit for$17,000 in July 2008. The settlement check was payable to petitioner’s attorneywho, per their agreement, kept $2,000 as a fee and wrote a check to him for

- 5 -[*5] $15,000. Petitioner’s attorney issued him a Form 1099-MISC, MiscellaneousIncome, for the 2008 tax year listing nonemployee compensation of $15,000.Petitioner decided that the $15,000 he received was not taxable income andthat he did not need to report the amount on his income tax return. He did some, butnot a lot of, research on the issue and concluded that the amount was excludablefrom income on the grounds that it represented compensation to offset a loss.Petitioner’s return was prepared by a tax return preparer, but he never gave thepreparer the Form 1099-MISC issued by the law firm.On November 29, 2010, respondent issued a notice of deficiency. Petitionertimely petitioned this <strong>Court</strong> for redetermination. The case was set for trial at the<strong>Court</strong>’s Los Angeles, California, session that began on March 19, 2012, and thetrial was held on March 23, 2012.OPINIONI. Amended AnswerAt trial petitioner renewed his objection to the amended answer, this time onthe grounds that respondent had waived any increase in the deficiency byacknowledging in the stipulation of settled issues that the sole remaining issues inthe case involved $15,000 of settlement proceeds and the section 6662(a)accuracy-related penalty. Specifically, petitioner contends that respondent foot-

- 6 -[*6] faulted and waived the increase by having the stipulation of settled issuesentered into the record before the amended answer was entered. We toldpetitioner that we would consider his objection and decide the issue in ouropinion.Generally, the <strong>Court</strong> “will not permit a party to a stipulation to qualify,change, or contradict a stipulation in whole or in part, except * * * where justicerequires”, Rule 91(e), or “good cause is shown”, Saigh v. Commissioner, 26 T.C.171, 176 (1956); see also Bail Bonds by Marvin Nelson, Inc. v. Commissioner,820 F.2d 1543, 1547 (9th Cir. 1987) (stipulations should be enforced “unlessmanifest injustice would result”), aff’g T.C. Memo. 1986-23. In deciding whetherto allow a party to set aside or modify a stipulation, we look at factors such asinconvenience to the <strong>Court</strong> and possible injustice to the moving party if thestipulation was enforced. Dorchester Indus. Inc. v. Commissioner, 108 T.C. 320,334-335 (1997) (citing Adams v. Commissioner, 85 T.C. 359, 375 (1985)), aff’dwithout opinion, 208 F.3d 205 (3d Cir. 2000). Furthermore, we have likenedstipulations of settled issues and settlement agreements to contracts and look tocontract law in construing such agreements. Stamos v. Commissioner, 87 T.C.1451, 1455 (1986). In construing the stipulation and the intent of the parties, welook first within the four corners of the agreement. Rink v. Commissioner, 100

- 7 -[*7] T.C. 319, 325 (1993), aff’d, 47 F.3d 168 (6th Cir. 1995). If an agreement suchas a statute of limitations extension is ambiguous, we may look to extrinsic evidenceto determine the intent of the parties. Woods v. Commissioner, 92 T.C. 776, 780(1989).We begin with the language of the stipulation. The relevant portion of thestipulation of settled issues reads as follows:The parties agree that the adjustments set forth in the notice ofdeficiency dated November 29, 2010 for the taxable year 2008 uponwhich this case is based are settled as follows:* * * * * * *4. The remaining issues in this case are:(a) Whether the $15,000 petitioner received is taxable.(b) Whether petitioner is liable for the I.R.C. § 6662 accuracyrelatedpenalty.5. All other adjustments are computational.Both parties signed and dated this document on March 19, 2012, the day of thecalendar call. Petitioner contends that paragraphs 4 and 5 unambiguously foreclosethe issue of the $2,000 increase, while respondent wants us to give effect to theintent of the parties.We disagree with petitioner. The stipulation of settled issues on its faceapplies only to the notice of deficiency, and the parties could not have settled morethan what respondent determined in the notice. Even if we were to find the

- 8 -[*8] stipulation ambiguous, the parties clearly did not intend to settle respondent’sincrease to income. Respondent, as evidenced by the outstanding motion for leaveto amend the answer, did not so intend. In such a case, the overt act of pursuingthat motion indicates a lack of mutual assent, without which there is no contract.Dorchester Indus. Inc. v. Commissioner, 108 T.C. at 330 (citing Manko v.Commissioner, T.C. Memo. 1995-10). In addition, the stipulation of facts includesthe following statement: “either party may introduce other and further evidence notinconsistent with the facts herein stipulated.” The lack of a similar statement in thestipulation of settled issues further supports the conclusion that respondent did notintend to foreclose the increased settlement amount. Therefore, respondent was freeto assert in the amended answer an increased deficiency pursuant to section 6214(a)and a corresponding increase in the section 6662(a) accuracy-related penalty. Weoverrule petitioner’s oral objection. 33We note that petitioner admitted receipt of the full $17,000 in his petition:“In about April 2008, Dealer agreed to compensate petitioner for some of his loss,in the sum of $17,000. After payment to his attorneys, petitioner received $15,000.”Respondent, however, alleged that he “was not aware of this information at the timethe answer was filed in this case”, which is hard to square with the language in thepetition. Even if the erroneous Form 1099-MISC clouded the issue, respondent wasat the very least on notice of the issue one year before filing the motion for leave toamend. Diligence at the pleading stage of this litigation or careful drafting of thestipulation might have prevented this issue from arising.

- 9 -[*9] II. Settlement ProceedsAs a general rule, the Commissioner’s determination of a taxpayer’s liabilityin the notice of deficiency is presumed correct, and the taxpayer bears the burden ofproving that the determination is improper. See Rule 142(a); Welch v. Helvering,290 U.S. 111, 115 (1933).Section 61(a) defines gross income as “all income from whatever sourcederived”. We interpret this definition broadly to include all accessions to wealth.Commissioner v. Glenshaw Glass Co., 348 U.S. 426, 429-430 (1955). Consistentwith the broad definition is the corollary that “exclusions from income must benarrowly construed.” Commissioner v. Schleier, 515 U.S. 323, 328 (1995).Petitioner bears the burden of proving an exclusion from income is proper. SeeEspinoza v. Commissioner, 636 F.3d 747, 749 (5th Cir. 2011), aff’g T.C. Memo.2010-53. Petitioner failed to point to any statute, regulation, or caselaw thatpurports to exclude proceeds from a lawsuit.Appropriately, petitioner does not argue that the settlement proceeds shouldbe excluded from taxable income under section 104(a), which deals withcompensation for personal injury. Rather, petitioner’s argument appears to bemore along the lines that the settlement proceeds represent lost value or aconstructive reduction of the improperly asserted price of the car. Settlement

- 10 -[*10] proceeds that represent compensation for lost value or capital are generallynot taxable, and proceeds that represent lost profits are taxable as ordinary income.Milenbach v. Commissioner, 318 F.3d 924, 933 (9th Cir. 2003), aff’g on this issue106 T.C. 184 (1996). Petitioner bears the burden of showing that the settlementproceeds represent what he claims they represent. See id. To determine whether asettlement represents lost profit or lost value, we ask: “‘In lieu of what were thedamages awarded?’” Id. at 932 (quoting Getty v. Commissioner, 913 F.2d 1486,1490 (9th Cir. 1990), rev’g 91 T.C. 160 (1988)). We take a broad approach inanswering that question, which is a question of fact. Id.When a taxpayer receives damages from a settlement rather than a verdict,“the tax consequences of the settlement depend on the nature of the claim that wasthe basis for the settlement, rather than the validity of the claim.” Healthpoint,Ltd. v. Commissioner, T.C. Memo. 2011-241 (citing United States v. Burke, 504U.S. 229, 239 (1992)). The complaint in the civil suit alleged four causes ofaction: (1) violation of California unfair competition law; (2) violation ofCalifornia false advertising law; (3) violation of the California consumer legalremedies act; and (4) breach of contract. Petitioner sought specific performance,compensatory damages, and punitive damages. The settlement agreement,however, is silent as to the allocation of the award. Petitioner has not shown that

- 11 -[*11] the parties intended the $15,000 as a settlement of the breach of contractclaim or as a settlement for any of the other California consumer protection lawclaims. Petitioner has failed to carry his burden of showing that the proceedsrepresent what he claims they represent, lost value. See Milenbach v.Commissioner, 318 F.3d at 933.Furthermore, petitioner made no showing as to how much of the settlementwas intended as compensatory damages and how much was meant to settle theclaim for punitive damages. Because petitioner has failed to carry his burden ofproof and never owned the BMW 645Ci, there is no sale or exchange. 4 We sustainrespondent’s determination in the notice of deficiency that the settlement proceedsare taxable as ordinary income.Finally, the Supreme <strong>Court</strong> has stated that “as a general rule, when alitigant’s recovery constitutes income, the litigant’s income includes the portion ofthe recovery paid to the attorney as a contingent fee.” Commissioner v. Banks,543 U.S. 426, 430 (2005). Respondent asserts by way of amended answer that4A settlement of a lawsuit is not a sale or exchange; and because there is nosale or exchange, the proceeds constitute ordinary income. Trantina v. UnitedStates, 512 F.3d 567 (9th Cir. 2008); Nahey v. Commissioner, 111 T.C. 256, 262(1998), aff’d, 196 F.3d 866 (7th Cir. 1999); Eckersley v. Commissioner, T.C.Memo. 2007-282, aff’d, 336 Fed. Appx. 633 (2009); Steel v. Commissioner, T.C.Memo. 2002-113, aff’d, 78 Fed. Appx. 585 (9th Cir. 2003).

- 12 -[*12] petitioner’s attorney retained $2,000 of the settlement as a fee for representinghim in the lawsuit. Respondent bears the burden of proof with respect to theincreased deficiency. See Rule 142(a). Respondent has met that burden of proof byintroducing uncontested evidence that the settlement consisted of $17,000, of whichpetitioner’s attorney retained $2,000. Therefore, the $2,000 is taxable income ofpetitioner, and we sustain respondent’s assertion of the increased deficiency.III.Section 6662(a) PenaltyWhen the Commissioner seeks the imposition of penalties or additions to tax,the Commissioner bears the burden of production. See sec. 7491(c); Higbee v.Commissioner, 116 T.C. 438, 446-447 (2001). To meet this burden, theCommissioner must produce sufficient evidence establishing that it is appropriate toimpose the penalties or additions to tax. See Higbee v. Commissioner, 116 T.C. at446. However, the burden to establish the defense of reasonable cause pursuant tosection 6664(c) remains with the taxpayer. Id. at 447.Section 6662(a) imposes an accuracy-related penalty equal to 20% of anunderpayment of tax attributable to one of five causes specified in subsection (b).Respondent contends that petitioner is liable for the penalty because of negligence

- 13 -[*13] or disregard of rules or regulations or, alternatively, because theunderpayment is due to a substantial understatement of income tax. Sec. 6662(b)(1)and (2).For the purposes of the penalty, “‘negligence’ includes any failure to make areasonable attempt to comply with the provisions of this title”. Sec. 6662(c). Undercaselaw, “‘Negligence is a lack of due care or the failure to do what a reasonableand ordinarily prudent person would do under the circumstances.’” Freytag v.Commissioner, 89 T.C. 849, 887 (1987) (quoting Marcello v. Commissioner, 380F.2d 499, 506 (5th Cir. 1967), aff’g on this issue 43 T.C. 168 (1964) and T.C.Memo. 1964-299), aff’d, 904 F.2d 1011 (5th Cir. 1990), aff’d, 501 U.S. 868(1991). A substantial understatement of income tax in the case of an individual is(with certain modifications which do not apply in this case) an understatement ofincome tax that exceeds the greater of (1) 10% of the tax required to be shown onthe return for the taxable year or (2) $5,000. Sec. 6662(d)(1)(A).There is an exception to the section 6662(a) penalty when a taxpayer candemonstrate (1) reasonable cause for the underpayment and (2) that the taxpayeracted in good faith with respect to the underpayment. Sec. 6664(c)(1).Regulations promulgated under section 6664(c) further provide that the

- 14 -[*14] determination of reasonable cause and good faith “is made on a case-by-casebasis, taking into account all pertinent facts and circumstances.” Sec.1.6664-4(b)(1), Income <strong>Tax</strong> Regs.Respondent has met his burden of production. He has shown that theunderstatement exceeds $5,000, which is greater than 10% of the tax required to beshown on the return.While petitioner did not file a brief, he did argue at trial that he should not besubject to the penalty because the position he took on his return was not clearlyuntenable. As support, petitioner cited Matthews v. Commissioner, 92 T.C. 351(1989), aff’d, 907 F.2d 1173 (D.C. Cir. 1990), for the proposition that a position thatis not clearly untenable should not give rise to a section 6662(a) accuracy-relatedpenalty. In Matthews, we concluded that the taxpayers were not liable for anaccuracy-related penalty for negligence or intentional disregard of rules andregulations because the taxpayers acted with a good-faith belief, disclosed theirpositions, and met their burden of proving that they did not act negligently orintentionally. Id. at 362-363. Petitioner, at trial, argued that the key words inMatthews were “not clearly untenable”. See id. at 362. But the reason we foundthe taxpayers’ position in Matthews not clearly untenable was that the taxpayerswere able to point to statutory language which, they argued, allowed them to

- 15 -[*15] exclude certain amounts from income. Petitioner cannot point to a statutorysource for his belief that the settlement proceeds stemming from a suit overCalifornia consumer protection and breach of contract laws should be excluded fromincome.In addition, petitioner makes no attempt to show that the failure to report anyof the income was due to reasonable cause. When cross-examined, he stated that hereceived multiple Forms 1099 from banks and that he gave this information to hisreturn preparer. Petitioner does not remember giving the preparer the Form 1099-MISC he received from his attorney, but he testified that he probably did not. Wefind by a preponderance of the evidence that he did not give the preparer the Form1099-MISC. Regardless, petitioner did not provide any evidence tending to showreasonable cause through reliance on a tax professional. See Neonatology Assocs.,P.A. v. Commissioner, 115 T.C. 43, 99 (2000), aff’d, 299 F.3d 221 (3d Cir. 2002).Petitioner has failed to show reasonable cause, and we find that he is liable for thesection 6662(a) accuracy-related penalty.

- 16 -[*16] The <strong>Court</strong> has considered all of petitioner’s and respondent’s contentions,arguments, requests, and statements. To the extent not discussed herein, weconclude that they are moot, irrelevant, or without merit. To reflect the foregoingand concessions by the parties,An appropriate decision will beentered.