- Page 4 and 5: CORPORATE BODIES

- Page 6 and 7: ADVISORY BOARDAntónio do Pranto No

- Page 9 and 10: In 2010, we were deeply grieved by

- Page 11 and 12: 1. EconomicSituation

- Page 13 and 14: 1.2 - DEVELOPMENT OF THE MAIN ECONO

- Page 15 and 16: enefited from the high demand for c

- Page 17 and 18: The aid package will cover budgetar

- Page 20 and 21: growth in domestic demand, the high

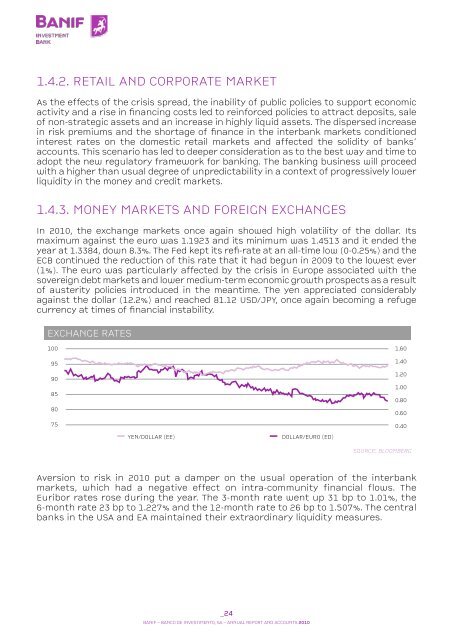

- Page 22 and 23: Growth in prices in 2010, after a p

- Page 26 and 27: U.S. TREASURY BONDSYIELD (%)4.43.93

- Page 28 and 29: EQUITY MARKETS - INDEXES (RELATIVE

- Page 30 and 31: 2.1 overviewThe profits of Banif -

- Page 32 and 33: 2.2.2 Structured FinanceIn 2010, th

- Page 34 and 35: 2.3 Treasury & Markets2.3.1 capital

- Page 36 and 37: As at 31 December 2010 Gamma had to

- Page 38 and 39: 2.5.2. Corporate ClientsThe mission

- Page 40 and 41: management area focusing on the fin

- Page 42 and 43: This fund invests directly and indi

- Page 44 and 45: FCR funds and its subsidiaries. The

- Page 46 and 47: Officer of Banif - Banco de Investi

- Page 48 and 49: 3. Business activityof investmentba

- Page 50 and 51: 3.3 The uNITED STATESBanif Securiti

- Page 52 and 53: The Board of Directors proposes to

- Page 54 and 55: Sadly, Comendador Horácio da Silva

- Page 56 and 57: José Paulo Baptista FontesRaul Man

- Page 58 and 59: 6.1 INDIVIDUAL financial statements

- Page 60 and 61: COMPREHENSIVE INCOME STATEMENT NotE

- Page 62 and 63: 1. GENERAL INFORMATIONNOTES TO THE

- Page 64 and 65: Other improvements in the IFRSNOTES

- Page 66 and 67: NOTES TO THE FINANCIAL STATEMENTS A

- Page 68 and 69: 3.7 FINANCIAL INSTRUMENTSNOTES TO T

- Page 70 and 71: NOTES TO THE FINANCIAL STATEMENTS A

- Page 72 and 73: NOTES TO THE FINANCIAL STATEMENTS A

- Page 74 and 75:

3.11 Income taxNOTES TO THE FINANCI

- Page 76 and 77:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 79 and 80:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 81 and 82:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 83 and 84:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 85 and 86:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 87 and 88:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 89 and 90:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 91 and 92:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 93 and 94:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 95 and 96:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 97 and 98:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 99 and 100:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 101 and 102:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 103 and 104:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 105 and 106:

27. EQUITY TRANSACTIONSNOTES TO THE

- Page 107 and 108:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 109 and 110:

32. PERSONNEL COSTSThis item consis

- Page 111 and 112:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 113 and 114:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 115 and 116:

liabilities and by main currencies.

- Page 117 and 118:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 120 and 121:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 122 and 123:

35.4. Rexchange rate riskNOTES TO T

- Page 124 and 125:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 126 and 127:

As at 31 December 2009 it was as fo

- Page 128 and 129:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 130 and 131:

6.2 CONSOLIDATED FINANCIAL STATEMEN

- Page 132 and 133:

COMPREHENSIVE CONSOLIDATED INCOME S

- Page 134 and 135:

CONSOLIDATED CASH FLOW STATEMENT NO

- Page 136 and 137:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 138 and 139:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 140 and 141:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 142 and 143:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 144 and 145:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 146 and 147:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 148 and 149:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 150 and 151:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 152 and 153:

4.1 - Business SEGMENTSNOTES TO THE

- Page 154 and 155:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 156:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 160 and 161:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 162 and 163:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 164 and 165:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 166 and 167:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 168 and 169:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 170 and 171:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 172 and 173:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 174 and 175:

16. OTHER TANGIBLE ASSETSNOTES TO T

- Page 176 and 177:

19.2 current taxesNOTES TO THE FINA

- Page 178 and 179:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 180 and 181:

25. IMPAIRMENTNOTES TO THE FINANCIA

- Page 182 and 183:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 184 and 185:

Interest paid and similar costsNOTE

- Page 186 and 187:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 188 and 189:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 190 and 191:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 192 and 193:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 194 and 195:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 196 and 197:

Main risk indicators for Banif Ibé

- Page 198 and 199:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 200 and 201:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 202 and 203:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 204 and 205:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 206 and 207:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 208 and 209:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 210 and 211:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 212 and 213:

36.8. LIQUIDity riskNOTES TO THE FI

- Page 214 and 215:

NOTES TO THE FINANCIAL STATEMENTS A

- Page 216 and 217:

7. Notes to theAnnual Reportand fin

- Page 218 and 219:

On 21/12/10 he purchased 214,264 BA

- Page 220 and 221:

João Manuel Mora de Ibérico Nogue

- Page 222 and 223:

BANIF - SGPS, S.A.Movements Positio

- Page 224 and 225:

BANIF - SGPS, S.A.Movements Positio

- Page 226 and 227:

Banif - Banco Internacional do Func

- Page 228 and 229:

Banif Finance LtdMovements Position

- Page 230 and 231:

(continued)Banif - Banco de Investi

- Page 232 and 233:

(continued)Banif - Banco de Investi

- Page 234 and 235:

(continued)Banif - Banco de Investi

- Page 236 and 237:

(continued)Banif - Banco de Investi

- Page 238 and 239:

(continued)Banif - Banco de Investi

- Page 240 and 241:

(continued)Banif - Banco de Investi

- Page 242 and 243:

Artur Manuel da Silva FernandesChai

- Page 244 and 245:

- Banif Securities Inc.- Banif Mult

- Page 246 and 247:

€38,500.00 - Joaquim Filipe Marqu

- Page 248 and 249:

7. The overall remuneration of the

- Page 250 and 251:

7.7 INFORMATION pursuant to article

- Page 252 and 253:

Activities and their contribution t

- Page 254 and 255:

In 2009, there was a strong general

- Page 256 and 257:

12. Breakdown of write-downs accord

- Page 258 and 259:

18. Detailed disclosure of exposure

- Page 260 and 261:

18.2 - BREAKDOWN OF PORTFOLIO BY IS

- Page 262 and 263:

24. Detailed disclosure of informat

- Page 264 and 265:

7.10 MANAGEMENT AS AT 31/12/2010*CO

- Page 266 and 267:

AUDIT BOARD REPORT AND OPINIONSenho

- Page 268 and 269:

Ernst & YoungAudit & Associados - S

- Page 270 and 271:

Ernst & YoungAudit & Associados - S