pathfinder - The Institute of Chartered Accountants of Nigeria

pathfinder - The Institute of Chartered Accountants of Nigeria

pathfinder - The Institute of Chartered Accountants of Nigeria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

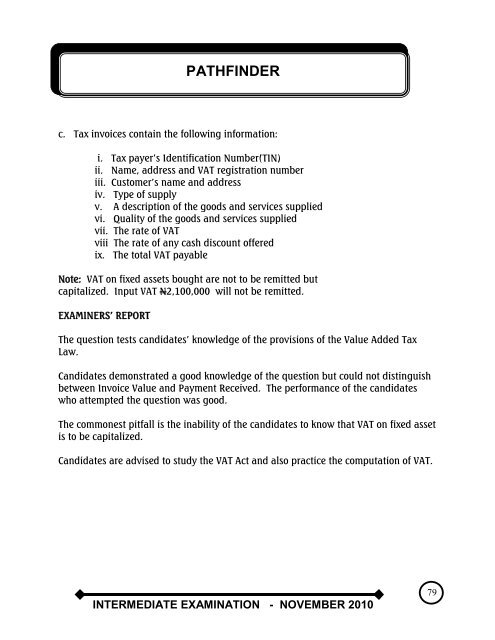

PATHFINDERc. Tax invoices contain the following information:i. Tax payer‟s Identification Number(TIN)ii. Name, address and VAT registration numberiii. Customer‟s name and addressiv. Type <strong>of</strong> supplyv. A description <strong>of</strong> the goods and services suppliedvi. Quality <strong>of</strong> the goods and services suppliedvii. <strong>The</strong> rate <strong>of</strong> VATviii <strong>The</strong> rate <strong>of</strong> any cash discount <strong>of</strong>feredix. <strong>The</strong> total VAT payableNote: VAT on fixed assets bought are not to be remitted butcapitalized. Input VAT N2,100,000 will not be remitted.EXAMINERS‟ REPORT<strong>The</strong> question tests candidates‟ knowledge <strong>of</strong> the provisions <strong>of</strong> the Value Added TaxLaw.Candidates demonstrated a good knowledge <strong>of</strong> the question but could not distinguishbetween Invoice Value and Payment Received. <strong>The</strong> performance <strong>of</strong> the candidateswho attempted the question was good.<strong>The</strong> commonest pitfall is the inability <strong>of</strong> the candidates to know that VAT on fixed assetis to be capitalized.Candidates are advised to study the VAT Act and also practice the computation <strong>of</strong> VAT.INTERMEDIATE EXAMINATION - NOVEMBER 201079