Schedules for Balance sheet and Profit & Loss Account - Ntpc

Schedules for Balance sheet and Profit & Loss Account - Ntpc

Schedules for Balance sheet and Profit & Loss Account - Ntpc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

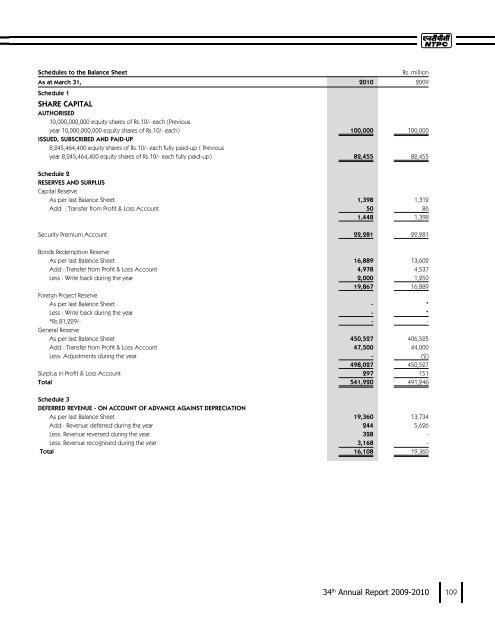

<strong>Schedules</strong> to the <strong>Balance</strong> Sheet Rs. milionAs at March 31, 2010 2009Schedule 1SHARE CAPITALAUTHORISED10,000,000,000 equitysharesofRs.10/- each (Previousyear10,000,000,000 equitysharesofRs.10/- each) 100,000 100,000ISSUED, SUBSCRIBED AND PAID-UP8,245,464,400 equitysharesofRs.10/- each fulypaid-up (Previousyear8,245,464,400 equitysharesofRs.10/- each fulypaid-up) 82,455 82,455Schedule 2RESERVES AND SURPLUSCapitalReserveAsperlast<strong>Balance</strong> Sheet 1,398 1,312Add :Transferfrom <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 50 861,448 1,398SecurityPremium <strong>Account</strong> 22,281 22,281BondsRedemption ReserveAsperlast<strong>Balance</strong> Sheet 16,889 13,602Add :Transferfrom <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 4,978 4,537Less:Write backduring the year 2,000 1,25019,867 16,889Foreign ProjectReserveAsperlast<strong>Balance</strong> Sheet - *Less:Write backduring the year - **Rs.81,229/- - -GeneralReserveAsperlast<strong>Balance</strong> Sheet 450,527 406,525Add :Transferfrom <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 47,500 44,000Less:Adjustmentsduring the year - (2)498,027 450,527Surplusin <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 297 151Total 541,920 491,246Schedule 3DEFERRED REVENUE - ON ACCOUNT OFADVANCE AGAINST DEPRECIATIONAsperlast<strong>Balance</strong> Sheet 19,360 13,734Add :Revenue defered during the year 244 5,626Less:Revenue reversed during the year 328 -Less:Revenue recognised during the year 3,168 -Total 16,108 19,36034 th Annual Report 2009-2010 109

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 4SECURED LOANSBonds10.00% Secured Non-ConvertibleTaxableBondsofRs. 10,00,000/- eachwithfiveequalSeparatelyTransferable2,000 3,000thereafterupto theend of10thyearrespectivelyfrom 5thSeptember2001 (TwelfthIssue- PrivatePlacement) 1Redeemable PrincipalParts(STRPP) redeemable atparatthe end ofthe 6th year<strong>and</strong> in annualinstalments9.55% Secured Non-CumulativeNon-ConvertibleTaxableRedeemableBondsofRs. 10,00,000/- eachredeemable6,000 6,750respectivelyfrom 18thApril2002 (ThirteenthIssue-PartA - PrivatePlacement) 2atparintenequalannualinstalmentscommencingfrom theend of6thyear<strong>and</strong> upto theend of15thyear9.55% Secured Non-CumulativeNon-ConvertibleTaxableRedeemableBondsofRs. 10,00,000/- eachwithten6,000 6,750- PartB- PrivatePlacement) 2equalSeparatelyTransferableRedeemablePrincipalParts(STRPP) redeemableatparattheend ofthe6thyear<strong>and</strong> inannualinstalmentsthereafterupto theend of15thyearrespectivelyfrom 30thApril2002 (ThirteenthIssue8.00% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 10,00,000/- eachredeemable1,000 1,000atparon10thApril2018 (SixteenthIssue-PrivatePlacement) 38.48% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 10,00,000/- eachredeemable500 500atparon1stMay2023 (SeventeenthIssue- Private Placement) 35.95% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 10,00,000/- eachwithfive4,000 5,000- PrivatePlacement) 4equalSeparatelyTransferableRedeemablePrincipalParts(STRPP) redeemableatparattheend of6thyear<strong>and</strong> inannualinstalmentsthereafterupto theend of10thyearrespectivelyfrom 15thSeptember2003 (EighteenthIssue7.50% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 10,00,000/- eachredeemable500 500atparon12thJanuary2019 (NineteenthIssue- PrivatePlacement) 57.552% Secured NonCumulativeNon-Convertible RedeemableTaxableBondsofRs. 20,00,000/- eachwith4,500 5,000Placement) 6twenty equalSeparately Transferable Redeemable PrincipalParts(STRPP) redeemable atparsemi-annualycommencing from 23rd September 2009 <strong>and</strong> ending on 23rd March 2019 (Twentieth Issue - Private7.7125% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 20,00,000/- eachwith 10,000 10,000commencingfrom 2nd August2010 <strong>and</strong> endingon2nd February2020 (Twentyfirstissue- PrivatePlacement) 7twenty equalSeparately Transferable Redeemable PrincipalParts(STRPP) redeemable atparsemi-annualy8.1771% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 20,00,000/- eachwith5,000 5,000commencing from 2nd July2011 <strong>and</strong> endingon2nd January2021 (Twentysecond issue- PrivatePlacement) 8twenty equalSeparately Transferable Redeemable PrincipalParts(STRPP) redeemable atparsemi-annualy8.3796% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 20,00,000/- eachwith5,000 5,000commencingfrom 5thAugust2011 <strong>and</strong> endingon5thFebruary2021 (Twentythird issue- PrivatePlacement) 8twenty equalSeparately Transferable Redeemable PrincipalParts(STRPP) redeemable atparsemi-annualy8.6077% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs. 20,00,000/- eachwith5,000 5,000Placement) 8twenty equalSeparately Transferable Redeemable PrincipalParts(STRPP) redeemable atparsemi-annualycommencing from 9th September2011 <strong>and</strong> ending on 9th March 2021 (Twenty fourth issue - Private9.37% Secured Non-Cumulative Non-Convertible Redeemable Taxable Bonds ofRs.70,00,000/- each with5,000 5,000from 4thJune2012 <strong>and</strong> endingon4thDecember2018 (Twentyfifthissue- PrivatePlacement) 9fourteenSeparatelyTransferableRedeemablePrincipalParts(STRPP) redeemableatparsemi-annualycommencing9.06% Secured Non-Cumulative Non-Convertible Redeemable Taxable Bonds ofRs.70,00,000/- each with5,000 5,000from 4thJune2012 <strong>and</strong> endingon4thDecember2018 (Twentysixthissue- PrivatePlacement) 9fourteenSeparatelyTransferableRedeemablePrincipalParts(STRPP) redeemableatparsemi-annualycommencing11.25% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs.10,00,000/- eachredeemable3,500 3,500seventhissue- PrivatePlacement) 9atparinfiveequalannualinstalmentscommencingfrom 6thNov2019 <strong>and</strong> endingon6thNov2023 (Twenty11% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs.10,00,000/- eachredeemable 10,000 10,000atparon21stNovember2018 (TwentyEighthissue- PrivatePlacement) 98.65% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs.10,00,000/- eachredeemable5,500 5,500atparon4thFebruary2019 (Twentyninthissue- PrivatePlacement) 97.89% Secured Non-CumulativeNon-ConvertibleRedeemableTaxableBondsofRs.10,00,000/- eachredeemable7,000 -atparon5thMay2019 (Thirtiethissue- PrivatePlacement) 9Loans <strong>and</strong> Advances from BanksForeignCurencyTerm Loans(Guaranteed byGovernmentof India) (Due<strong>for</strong>repaymentwithinoneyearRs.1,3755,286 7,180milion,PreviousyearRs.1,398 million) 10Other Loans <strong>and</strong> AdvancesObligationsunderfinancelease (Due<strong>for</strong>repaymentwithinoneyearRs. 6 milion,PreviousyearRs.4 milion) 11 13 16TOTAL 90,799 89,69611034 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetSchedule 4SECURED LOANSNote:1 Secured by(I) English mortgage,on firstcharge basis,ofthe office premisesofthe CompanyatMumbai,(I) Hypothecation ofalthe present<strong>and</strong> future movable assets(excluding receivables) ofSingrauliSuperThermalPowerStation,AntaGasPowerStation,AuraiyaGasPowerStation,Barh SuperThermalPowerProject,FarakkaSuperThermalPowerStation,Kahalgaon SuperThermalPowerStation,Koldam HydelPowerProject,SimhadriSuperThermalPowerProject,SipatSuperThermalPowerProject,TalcherThermalPowerStation,TalcherSuperThermalPowerProject,T<strong>and</strong>aThermalPowerStation,VindhyachalSuperThermalPowerStation,NationalCapitalPowerStation,DadriGasPowerStation,Feroze G<strong>and</strong>hiUnchaharPowerStation,Loharinag PalaHydro PowerProject<strong>and</strong> Tapovan-Vishnugad Hydro PowerProjectasfirstcharge,ranking pari-passu with charge,ifany,alreadycreated infavourofthe Company'sBankerson such movable assetshypothecated to them <strong>for</strong>working capitalrequirement<strong>and</strong> (I) Equitable Mortgage ,bywayoffirstcharge,bydepositoftitle deedsofthe immovable propertiespertaining to SingrauliSuperThermalPowerStation.2 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai,(I) Hypothecation ofalthe present<strong>and</strong> future movable assets(excluding receivables) ofSingrauliSuperThermalPowerStation,AntaGasPowerStation,AuraiyaGasPowerStation,Barh SuperThermalPowerProject,FarakkaSuperThermalPowerStation,Kahalgaon SuperThermalPowerStation,Koldam HydelPowerProject,SimhadriSuperThermalPowerProject,SipatSuperThermalPowerProject,TalcherThermalPowerStation,TalcherSuperThermalPowerProject,T<strong>and</strong>aThermalPowerStation,VindhyachalSuperThermalPowerStation,NationalCapitalPowerStation,DadriGasPowerStation,Feroze G<strong>and</strong>hiUnchaharPowerStation,Loharinag PalaHydro PowerProject<strong>and</strong> Tapovan-Vishnugad Hydro PowerProjectasfirstcharge,ranking pari-passu with charge,ifany,alreadycreated in favourofthe Company’sBankerson such movable assetshypothecated tothem <strong>for</strong>working capitalrequirement<strong>and</strong> (I) Equitable mortgage ofthe immovable properties,on firstpari-passu charge basis,pertaining toSingrauliSuperThermalPowerStation byextension ofcharge alreadycreated.3 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai<strong>and</strong> (I) Equitablemortgage,bywayoffirstcharge,bydepositoftitle deedsofthe immovable propertiespertaining to NationalCapitalPowerStation.4 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai,(I) Hypothecation ofalthe present<strong>and</strong> future movable assets(excluding receivables) ofSingrauliSuperThermalPowerStation,AntaGasPowerStation,AuraiyaGasPowerStation,Barh SuperThermalPowerProject,FarakkaSuperThermalPowerStation,Kahalgaon SuperThermalPowerStation,Koldam HydelPowerProject,SimhadriSuperThermalPowerProject,SipatSuperThermalPowerProject,TalcherThermalPowerStation,TalcherSuperThermalPowerProject,T<strong>and</strong>aThermalPowerStation,VindhyachalSuperThermalPowerStation,NationalCapitalPowerStation,DadriGasPowerStation,Feroze G<strong>and</strong>hiUnchaharPowerStation,Loharinag PalaHydro PowerProject<strong>and</strong> Tapovan-Vishnugad Hydro PowerProjectasfirstcharge,ranking pari-passu with charge,ifany,alreadycreated in favourofthe Company’sBankerson such movable assetshypothecated tothem <strong>for</strong>working capitalrequirement<strong>and</strong> (I) Equitable mortgage ofthe immovable properties,on firstpari-passu charge basis,pertaining toNationalCapitalPowerStation byextension ofcharge alreadycreated.5 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai<strong>and</strong> (I) Hypothecation ofalthe present<strong>and</strong> future movable assets(excluding receivables) ofSingrauliSuperThermalPowerStation,AntaGasPowerStation,AuraiyaGasPowerStation,Barh SuperThermalPowerProject,FarakkaSuperThermalPowerStation,Kahalgaon SuperThermalPowerStation,KoldamHydelPowerProject,SimhadriSuperThermalPowerProject,SipatSuperThermalPowerProject,TalcherThermalPowerStation,TalcherSuperThermalPowerProject,T<strong>and</strong>aThermalPowerStation,VindhyachalSuperThermalPowerStation,NationalCapitalPowerStation,DadriGasPowerStation,Feroze G<strong>and</strong>hiUnchaharPowerStation,Loharinag PalaHydro PowerProject<strong>and</strong> Tapovan-Vishnugad Hydro PowerProjectasfirstcharge,ranking pari-passu with charge,ifany,alreadycreated in favourofthe Company’sBankerson such movable assetshypothecatedto them <strong>for</strong>working capitalrequirement.6 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai<strong>and</strong> (I) Equitable mortgage,bywayoffirstcharge,bydepositoftitle deedsofthe immovable properties pertaining to Ramagundam SuperThermalPowerStation.7 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai, (I) Hypothecation ofalthe present<strong>and</strong> future movable assets(excluding receivables) ofBarh SuperThermalPowerProjecton firstpari-pasu charge basis,ranking paripassu with charge alreadycreated in favourofTrustee<strong>for</strong>otherSeriesofBonds<strong>and</strong> (I) Equitable mortgage ofthe immovable properties,onfirstpari-passu charge basis,pertaining to Ramagundam SuperThermalPowerStation byextension ofcharge alreadycreated.8 Secured by(I) English mortgage,on firstpari-passu charge basis,ofthe office premisesofthe CompanyatMumbai<strong>and</strong> (I)Equitablemortgage,bywayoffirstcharge,bydepositofthe title deedsofthe immovable propertiespertaining to SipatSuperThermalPowerProject.9 Secured by(I) English mortgage,on firstparipassu charge basis,ofthe office premisesofthe CompanyatMumbai<strong>and</strong> (I) Equitable mortgageofthe immovable properties,on firstpari-passu charge basis,pertaining to SipatSuperThermalPowerProjectbyextension ofcharge alreadycreated.10 Secured byEnglish mortgage/hypothecation ofalthepresent<strong>and</strong> future fixed <strong>and</strong> movable assetsofRih<strong>and</strong> SuperThermalPowerStation asfirstcharge,ranking pari-passu with charge alreadycreated,subjectto however,Company’sBanker’sfirstcharge on certain movable assetshyphothecated to them <strong>for</strong>working capitalrequirement.11 Secured againstfixed assetsobtained underfinance lease.Note:Securitycovermentioned <strong>for</strong>sl. no. 1 to 9 isabove 100% ofthe debtsecuritiesoutst<strong>and</strong>ing.34 th Annual Report 2009-2010 111

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 5UNSECURED LOANSFixed Deposits 134 14Bonds(Due <strong>for</strong>repaymentwithin one yearRs.6 million,PreviousyearRs.7 milion)8.78 % Secured Non Cumulative Non-Convertible Redeemable Taxable BondsofRs. 10,00,000/- eachredeemable atparon 9 th March 2020 (Thirtyfirstissue- Private Placement)*8.8493% Secured Non Cumulative Non-Convertible Redeemable Taxable BondsofRs. 15,00,000/- eachwith fifteen equalSeparatelyTransferable Redeemable PrincipalParts(STRPP) redeemable atparatthe endof6 th year<strong>and</strong> in annualinstalmentsthereafterupto the end of20 th yearrespectivelycommencing from 25 thMarch 2016 <strong>and</strong> ending on 25 th March 2030 (Thirtysecond Issue - Private Placement)*8.73 % Secured Non Cumulative Non-Convertible Redeemable Taxable BondsofRs. 10,00,000/- eachredeemable atparon 31 st March 2020 (Thirtythird issue- Private Placement)*Foreign Currency Bonds /Notes5.50 % Eurobondsdue <strong>for</strong>repaymenton 10 th March 2011 (Due <strong>for</strong>repaymentwithin one yearRs.9,134million, PreviousyearRs.Nil)5,000 -1,050 -1,950 -9,134 10,3105.875 % Fixed Rate Notesdue <strong>for</strong>repaymenton 2 nd March 2016 13,701 15,465Loans <strong>and</strong> AdvancesFrom Banks <strong>and</strong> Financial InstitutionsForeign CurencyTerm Loans(Guaranteed byGovernmentofIndia) (Due <strong>for</strong>repaymentwithin one yearRs.610 million,PreviousyearRs.498 milion)OtherForeign CurencyTerm Loans (Due <strong>for</strong>repaymentwithin one yearRs.5,884 million,PreviousyearRs.2,296 milion)Rupee Term Loans (Due <strong>for</strong>repaymentwithin one yearRs.17,907 million,Previous yearRs.19,301milion)From Others26,383 28,84249,034 49,439180,785 151,911Loans from Government of India (Due <strong>for</strong>repaymentwithin one yearRs.nil, PreviousyearRs.1 milion) - 1TOTAL 287,171 255,982* To be secured byregistered <strong>and</strong>/orequitable mortgage on immovable properties.11234 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetSchedule 6FIXED ASSETSRs. milionGrossBlock Depreciation Net BlockAs at Deductions/ As at Upto For Deductions/ Upto As at Asat1.04.2009 Additions Adjustments 31.03.2010 31.03.2009 theyear Adjustments 31.03.2010 31.03.2010 31.03.2009TANGIBLE ASSETSL<strong>and</strong> :(includingdevelopmentexpenses)Freehold 16,224 1,239 (35) 17,498 - - - - 17,498 16,224Leasehold 4,719 160 85 4,794 554 65 7 612 4,182 4,165Roads,bridges,culverts& helipads 4,253 141 (137) 4,531 875 77 (2) 954 3,577 3,378Building :FreeholdMainplant 24,495 2,603 28 27,070 10,218 701 1 10,918 16,152 14,277Others 19,141 859 (153) 20,153 5,319 465 (7) 5,791 14,362 13,822Leasehold 498 - (2) 500 173 17 - 190 310 325Temporaryerection 260 59 (5) 324 260 60 (4) 324 - -WaterSupply,drainage& seweragesystem 5,742 72 (1) 5,815 2,286 292 - 2,578 3,237 3,456MGRtrack<strong>and</strong> signaling system 8,659 306 (40) 9,005 5,240 260 (1) 5,501 3,504 3,419RailwaySiding 2,895 - 1 2,894 1,047 139 - 1,186 1,708 1,848Earth Dam Reservoir 1,757 41 - 1,798 558 84 - 642 1,156 1,199Plant<strong>and</strong> machinery 520,971 38,197 1,300 557,868 258,872 24,601 856 282,617 275,251 262,099Furniture,fixtures& otherofficeequipment 4,105 387 5 4,487 2,593 179 31 2,741 1,746 1,512EDP,WPmachines<strong>and</strong> satcom equipment 2,986 433 40 3,379 2,055 273 54 2,274 1,105 931Vehiclesincluding speedboats 92 11 7 96 68 4 6 66 30 24Construction equipments 1,157 185 74 1,268 738 74 87 725 543 419ElectricalInstalations 2,183 430 (183) 2,796 1,213 96 (9) 1,318 1,478 970CommunicationEquipments 788 50 8 830 394 29 14 409 421 394HospitalEquipments 232 17 1 248 142 9 1 150 98 90Laboratory<strong>and</strong> workshop equipments 156 74 (1) 231 103 5 - 108 123 53Leased assets- Vehicles 20 3 1 22 6 5 - 11 11 14Capitalexpenditure on assetsnotowned by 1,387 471 (5) 1,863 1,032 96 - 1,128 735 355theCompanyAssetsofGovernment 28 - - 28 - - - - 28 28Less:Grantsfrom Government 28 - - 28 - - - - 28 28Assetsheld <strong>for</strong>disposalvalued atnetbook 20 - (7) 27 - - - - 27 20value ornetrealisablevaluewhicheverislessINTANGIBLE ASSETSRightofUse - L<strong>and</strong> 13 51 6 58 - 3 - 3 55 13- Others - 84 - 84 - 1 - 1 83 -Software 777 47 (38) 862 407 233 (1) 641 221 370Total 623,530 45,920 949 668,501 294,153 27,768 1,033 320,888 347,613 329,377Previousyear 533,680 77,205 (12,645) 623,530 272,743 25,224 3,814 294,153 329,377 260,9372010 2009Deduction/Adjustments from Gross Block <strong>for</strong> the year includes:Disposal/Retirementofassets 1,344 1,852Costadjustments 60 (18,243)Assetscapitalised with retrospectiveefect/Writebackofexcesscapitalisation (557) 4,281Others 102 (535)949 (12,645)34 th Annual Report 2009-2010 113

<strong>Schedules</strong> to the <strong>Balance</strong> SheetSchedule 6FIXED ASSETSSchedule 7CAPITAL WORK-IN-PROGRESSAsat Deductions& As at1.04.2009 Additions Adjustments Capitalised 31.03.2010Developmentofl<strong>and</strong> 2,929 661 38 31 3,521Roads,bridges,culverts& helipads 583 203 165 141 480Piling <strong>and</strong> foundation 7,949 1,553 3,187 - 6,315Buildings:Main plant 10,035 7,421 (3,074) 2,603 17,927Others 2,611 2,002 109 859 3,645Temporaryerection 42 52 25 53 16Watersupply,drainage <strong>and</strong> sewerage system 370 120 (9) 69 430Hydraulic works,barages,dams,tunnels<strong>and</strong> powerchannel 18,690 5,922 1,573 - 23,039MGRtrack<strong>and</strong> signaling system 2,729 1,014 21 306 3,416Railwaysiding 637 436 14 - 1,059Earth dam reservoir 890 189 (28) 41 1,066Plant<strong>and</strong> machinery 155,262 83,775 2,556 38,069 198,412Furniture,fixtures<strong>and</strong> otheroffice equipment 68 137 8 143 54EDP/WPmachines& satcom equipment 31 108 12 117 10Vehicles - 3 - 1 2Construction equipments - 43 2 41 -Electricalinstalations 702 412 228 414 472Communication equipment 22 42 16 28 20HospitalEquipments - 2 - 2 -Laboratory<strong>and</strong> Workshop Equipments - 16 (2) 16 2Intangible assets- software 1 14 1 9 5Capitalexpenditure on assetsnotowned bythe company 738 1,426 41 470 1,653Exploratorywels-in-progress 32 45 - - 77Developmentofcoalmines 967 392 1 - 1,358205,288 105,988 4,884 43,413 262,979Expenditure pending allocationSurvey,investigation,consultancy<strong>and</strong> supervision charges 691 165 23 - 833Diference in exchange on <strong>for</strong>eign curencyloans 2,063 (10,984) (6,457) - (2,464)Expenditure towardsdiversion of<strong>for</strong>estl<strong>and</strong> 1,677 3 - - 1,680Pre-commisioning expenses(net) 233 498 728 - 3Expenditure during construction period (net) 2,407 20,337* (42) - 22,786Less:A located to related works - 18,049 - - 18,049212,359 97,958 (864) 43,413 267,768Less:Provision <strong>for</strong>unserviceable works 148 - 4 - 144Total 212,211 97,958 (868) 43,413 267,624Previousyear 184,389 121,880 21,302 72,756 212,211* Brought from Expenditure during construction period (net)- Schedule 25Rs. milion2010 2009Deduction/Adjustments from Depreciation <strong>for</strong> the year includes:Disposal/Retirementofassets 1,098 1,328Assetscapitalised withretrospectiveefect/Writebackofexcesscapitalisation (166) 2,391Others 101 951,033 3,814Depreciation <strong>for</strong> the year is allocated as given below:Charged to <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 26,501 23,645A located to the fuelcost 1,195 1,043Transfered to Expenditure during constructionperiod (net) - (Schedule25) 192 141Transfered to developmentofcoalmines 3 2AdjustmentwithDefered Income/Expensefrom Defered Foreign CurencyFluctuation (123) 39327,768 25,22411434 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 8CONSTRUCTION STORES AND ADVANCESCONSTRUCTION STORES*(Atcost)Steel 9,816 10,844Cement 222 169Others 9,354 6,36519,392 17,378Less:Provision <strong>for</strong>shortages 12 1119,380 17,367ADVANCES FORCAPITALEXPENDITURESecured 4 1,273Unsecured,considered goodCovered bybankguarantees 26,264 28,757Others 7,771 4,441Considered doubtful 22 6734,061 34,538Less:Provision <strong>for</strong>bad & doubtfuladvances 22 6734,039 34,471Total 53,419 51,838* Includesmaterialin transit,underinspection <strong>and</strong> with contractors 11,781 9,433As at March 31, 2010 2009Schedule 9INVESTMENTS(Valuation asper<strong>Account</strong>ing PolicyNo.10) Numberof Face value pershares/bonds/ share/bond/securities securityCurentYear/(PreviousYear)CurentYear/(PreviousYear)(Rs.)I. LONG TERM (Trade - unless otherwise specified)A) Quoteda) Government ofIndia Dated Securities (Non-Trade) -- - 1,875(19139000) (100)Less:Amortisation ofPremium - 10- 1,865b) Equity Shares (fully paid-up)PTC IndiaLtd. 1200000010 120 120(12000000)(10)Sub Total (A) 120 1,985B) Unquoted (fully paid-up)a) Bondsi) 8.50 % Tax-Free State Government Special Bondsofthe Government of(#)AndhraPradesh 75639001000 7,564 8,824(8824550) (1000)Assam 3087841000 309 360(360248) (1000)Bihar 113664001000 11,366 13,261(13260800) (1000)Chatisgarh 2899320(3382540)1000(1000)2,899 3,382Gujarat 5023440(5860680)1000(1000)5,024 5,86134 th Annual Report 2009-2010 115

<strong>Schedules</strong> to the <strong>Balance</strong> SheetAs at March 31, 2010 2009Schedule 9INVESTMENTS(Valuation asper<strong>Account</strong>ing PolicyNo.10) Numberof Face value pershares/bonds/ share/bond/securities securityCurentYear/(PreviousYear)Haryana 6450000(7525000)HimachalPradesh 200328(233716)Jammu <strong>and</strong> Kashmir 2204160(2571520)Jharkh<strong>and</strong> 5760736(6720856)Kerala 6014400(7016800)MadhyaPradesh 4985040(5815880)Maharashtra 2288400(2669800)Orissa 6617244(7720118)Punjab 2077380(2423610)Rajasthan 870000(1160000)Sikkim 205176(239372)U tarPradesh 23939400(27929300)U taranchal 2397900(2797550)WestBengal 7045448(8219736)i) Other Bonds10.00 % Secured Non-Cumulative Non-Convertible Redeemable Grid Corporation-ofOrissa(GRIDCO) PowerBonds,Series-1/2003,06/2002,06/2009(3744)10.00 % Secured Non-Cumulative Non-Convertible Redeemable Grid Corporation-ofOrissa(GRIDCO) PowerBonds,Series-1/2003,09/2002,09/2009(3780)10.00 % Secured Non-Cumulative Non-Convertible Redeemable Grid Corporation-ofOrissa(GRIDCO) PowerBonds,Series-1/2003 - 10/2002,10/2009(5970)b) Equity Shares in Joint Venture CompaniesUtilityPowertech Ltd. (includes1,000,000 bonusshares) 2000000(2000000)NTPC-Alstom PowerServicesPrivate Ltd. 3000000(3000000)NTPC-SAILPowerCompany Private Ltd. 475250050(475250050)NTPC-TamilNadu EnergyCompanyLtd. 425000000(190000000)CurentYear/(PreviousYear)(Rs.)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)1000(1000)-(12500)-(12500)-(25000)10(10)10(10)10(10)10(10)6,450 7,525200 2342,204 2,5715,761 6,7216,014 7,0174,985 5,8162,289 2,6706,617 7,7202,077 2,424870 1160205 23923,939 27,9292,398 2,7987,046 8,220- 47- 47- 14910 1030 304,752 4,7524250 1,900RatnagiriGas& PowerPrivate Ltd. 592900000(500000000)AravaliPowerCompanyPrivate Ltd. 658524200(458524200)NTPC-SCCLGlobalVenturesPrivate Ltd.50000(*Curent/previousyearRs.5,00,000/-)(50000)10(10)10(10)10(10)5,929 5,0006,585 4,585* *11634 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetAs at March 31, 2010 2009Schedule 9INVESTMENTS(Valuation asper<strong>Account</strong>ing PolicyNo.10) Numberof Face value pershares/bonds/ share/bond/securities securityCurentYear/(PreviousYear)CurentYear/(PreviousYear)(Rs.)NTPC BHELPowerProjectsPrivate Ltd.2500000010 250 1*(*previousyearRs.5,00,000/-)(50000)(10)MejaUrjaNigam Private Limited 3017980010 302 1(100000)(10)BF-NTPC EnergySystemsLtd.102900010 10 1*(*previousyearRs.4,90,000/-)(49000)(10)NationalPowerExchange Ltd. 83350010 8 8(833500)(10)NabinagarPowerGenerating CompanyPrivate Ltd.5000010 1* 1*(*curent/previousyearRs.5,00,000/-)(50000)(10)Trans<strong>for</strong>mer<strong>and</strong> ElectricalKeralaLtd. 1916343810 314 -(-)(10)NationalHigh PowerTestLabortoryPrivate Ltd. 87500010 9 -(-)(-)InternationalCoalVenturesLtd. 10000010 1 -(-)(-)c) Equity Shares in Subsidiary CompaniesPipavavPowerDevelopmentCompanyLtd. 37500010 4 4(375000)(10)NTPC Electric SupplyCompanyLtd.8091010 * **(curent/previousyearRs.8,09,100/-)(80910)(10)NTPC VidyutVyaparNigam Ltd. 2000000010 200 200(20000000)(10)NTPC Hydro Ltd. 10079904010 1,008 924(92426200)(10)KantiBijlee Utpadan Nigam Ltd.5715100010 572 *(FormerlyVaishaliPowerGenerating CompanyLtd.) (*previousyearRs.5,10,000/-) (51000)(10)BhartiyaRailBijlee CompanyLtd. 29600000010 2,960 1,850(185000000)(10)d) Shares in Cooperative Societies ß ßSub Total (B) 125,412 134,242C Share application money pending allotment in :NTPC Hydro Ltd. 18 3KantiBijlee Utpadan Nigam Ltd.22 594(FormerlyVaishaliPowerGenerating CompanyLtd.)BhartiyaRailBijlee CompanyLtd. 712 571NTPC-Tamilnadu EnergyCompanyLtd., 155 160RatnagiriGas& PowerPrivate Ltd. 1,000 1,929MejaUrjaNigam Private Limited 192 301NTPC BHELPowerProjectsPrivate Ltd. - 50NabinagarPowerGenerating CompanyPvt. Ltd. 950 -BF-NTPC EnergySystemsLtd. 49 -EnergyEfficiencyServicesLtd. 6 -Sub Total (C) 3,104 3,608Total (I) 128,636 139,835II. CURRENT (Non-trade - unquoted)Mutual FundsSBI-SHFUltraShortterm Fund -IP- DDR* 424791050(-)10(-)4,250 -34 th Annual Report 2009-2010 117

<strong>Schedules</strong> to the <strong>Balance</strong> SheetAs at March 31, 2010 2009Schedule 9INVESTMENTS(Valuation asper<strong>Account</strong>ing PolicyNo.10) Numberof Face value pershares/bonds/ share/bond/securities securityCurentYear/(PreviousYear)CurentYear/(PreviousYear)(Rs.)1000(-)10(-)UTITreasuryAdvantage Fund - IP- DDR 7681994(-)7,684 -CanaraRobeco TreasuryAdvantage Super- IP-DDR 6045535777,501 -(-)Total (II) 19,435 -Total (I + II) 148,071 139,835Quoted InvestmentsBookValue 120 1,985MarketValue 1,336 2,755Unquoted InvestmentsBookValue 147,951 137,850(#) IncludesbondsofRs.65,333 milion (PreviousyearRs.65,623 milion) permited <strong>for</strong>transfer/trading byReserve BankofIndia. <strong>Balance</strong> can be transfered/traded subjectto priorapprovalofReserve BankofIndia.Detailsofpurchase <strong>and</strong> sale ofcurentinvestmentsduring the yearMutual Funds No.ofUnits Purchase CostSBI-Magnum InstaCash Fund-DDR 701,540,002 11,751SBIPremierLiquid Fund Super-IP-DDR 598,839,538 6,008SBI-SHFUltraShortTerm Fund-IP-DDR 1,024,023,977 10,246UTILiquid Cash Plan Institutional-DDR 23,509,975 23,967UTITreasuryAdvantage Fund-IP-DDR 1,999,572 2,000CanaraRobeco Liquid Super- IP-DDR 2,404,768,759 24,146CanaraRobeco TreasuryAdvantage Super- IP-DDR 616,951,242 7,655* InstitutionalPlan - DailyDividend ReinvestmentRs. Rs.ß Shares in Co-operative societies (unquoted) 2010 2009NTPC EmployeesConsumers<strong>and</strong> ThriftCo-operative SocietyLtd. Korba 50010 5,000 5,000(500)(10)NTPC EmployeesConsumers<strong>and</strong> ThriftCooperative SocietyLtd. Ramagundam 25010 2,500 2,500(250)(10)NTPC EmployeesConsumersCooperative SocietyLtd. Farakka 50010 5,000 5,000(500)(10)NTPC EmployeesConsumersCooperative SocietyLtd. Vindhyachal 10825 2,700 2,700(108)(25)NTPC EmployeesConsumersCooperative SocietyLtd. Anta 50010 5,000 5,000(500)(10)NTPC EmployeesConsumersCooperative SocietyLtd. Kawas 50010 5,000 5,000(500)(10)NTPC EmployeesConsumersCooperative SocietyLtd. Kaniha 25020 5,000 5,000(250)(20)30,200 30,20011834 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 10INVENTORIES(Valuation asper<strong>Account</strong>ing PolicyNo.11)Components<strong>and</strong> spares 16,500 15,662Loose tools 50 46Coal 11,175 11,133Fueloil 1,716 1,797Naphtha 1,001 860Chemicals& consumables 298 281SteelScrap 120 116Others 3,121 3,02933,981 32,924Less: Provision <strong>for</strong>shortages 30 51Provision <strong>for</strong>obsolete/unserviceable items/dimunition in value ofsurplusinventory 474 439Total 33,477 32,434Inventoriesinclude materialin transit,underinspection <strong>and</strong> with contractors 1,584 1,527Schedule 11SUNDRY DEBTORS(Considered good,unlessotherwise stated)Debtsoutst<strong>and</strong>ing oversixmonthsUnsecured,considered doubtful 8,361 8,3618,361 8,361OtherdebtsUnsecured 66,514 35,84274,875 44,203Less:Provision <strong>for</strong>bad & doubtfuldebts 8,361 8361Total 66,514 35,842Schedule 12CASH & BANK BALANCESCash on h<strong>and</strong>25 15(includescheques,drafts,stampson h<strong>and</strong> Rs.25 million,previousyearRs.15 milion)<strong>Balance</strong> with Reserve BankofIndiaearmarked <strong>for</strong>fixed depositsfrom public 308 308<strong>Balance</strong>swith scheduled banksCurent<strong>Account</strong>s(a) 6007 2,395Term Deposit<strong>Account</strong>s(b) 138,255 159,998Total 144,595 162,716(a) IncludesRs.226 million ofUnclaimed Dividend (PreviousyearRs.58 milion)(b) Rs.116 million (PreviousyearRs.103 milion) deposited assecuritywith GovernmentAuthorities/Othersaspercourtorders34 th Annual Report 2009-2010 119

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 13OTHER CURRENT ASSETSInterestaccrued :Bonds 4,525 5,236GovernmentofIndiadated securities - 47Term deposits 3,607 4,242Others 138 138Otherrecoverables 149 120Others 21 11Total 8,440 9,794Schedule 14LOANS AND ADVANCES(Considered good,unlessotherwise stated)LOANSEmployees(including accrued interest)Secured 4,002 3,927Unsecured 1,167 1,044Considered doubtful 2 2Loan to State Governmentin setlementofduesfrom customersUnsecured 6,222 7,179Loan to aSubsidiaryCompany(including accrued interest)Secured 263 308OthersSecured 1,917 2,200Unsecured 1 1ADVANCES(Recoverable in cash orin kind or<strong>for</strong>value to be received)SubsidiaryCompaniesUnsecured 270 247Contractors& suppliers,including materialissued on loanSecured 24 134Unsecured 11,904 9,911Considered doubtful 3 1Employees(including imprest)Unsecured 1,539 3,283Considered doubtful 1 1Advance tax& taxdeducted atsource 91,101 69,697Less:Provision <strong>for</strong>taxation 70,457 34,73420,644 34,963OthersUnsecured 796 599Considered doubtful 151 152ClaimsrecoverableUnsecured 4,830 3,325Considered doubtful 30 3453,766 67,311Less:Provision <strong>for</strong>bad <strong>and</strong> doubtfulloans,advances<strong>and</strong> claims 187 19053,579 67,121DEPOSITSDepositswith customs,porttrust<strong>and</strong> others(#) 1,552 1,346Total 55,131 68,467(#) SalesTaxdeposited underprotestwith salestaxauthorities 115 271Due from Directors& Officersofthe CompanyDirectors 1 3Officers 904 1,145Maximum amountoutst<strong>and</strong>ing during the yearDirectors 4 3Officers 1,820 1,44312034 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Balance</strong> SheetRs. milionAs at March 31, 2010 2009Schedule 15CURRENT LIABILITIESSundry CreditorsForcapitalexpenditureMicro & SmalEnterprises(#Rs.2,71,460/- ,*Rs.2,03,017/-) # *Others 30,091 23,673Forgoods<strong>and</strong> servicesMicro & SmalEnterprises 5 10Others 25,810 28,392Bookoverdraft 153 115Deposits,retention moneyfrom contractors<strong>and</strong> others 12,904 12,411Less:Bankdeposits/Investmentsheld assecurity 119 13268,844 64,469Advancesfrom customers<strong>and</strong> others 2,935 4,520Otherliabilities 1,356 1,951Unclaimed dividend (#) 226 58Interestaccrued butnotdue :Loansfrom GovernmentofIndia(*Rs.60,080/-) - *Foreign curencyloans/bonds 322 443Rupee term loans 1,191 921Bonds 1,992 2,025Fixed depositsfrom public 10 4Total 76,876 74,391(#) No amountisdue <strong>for</strong>paymentto InvestorEducation <strong>and</strong> Protection FundSchedule 16PROVISIONSIncome/Fringe BenefitTaxAsperlastbalance <strong>sheet</strong> - -Additionsduring the year 19,482 11,594Amountadjusted during the year (50,975) (23,140)Less:Setofagainsttaxespaid 70,457 34,734- -Proposed dividendAsperlastbalance <strong>sheet</strong> 6,596 6,596Additionsduring the year 6,596 6,596Amountsused during the year 6,596 6,5966,596 6,596Taxon proposed dividendAsperlastbalance <strong>sheet</strong> 1,103 1,121Additionsduring the year 1,072 1,103Amountspaid during the year 1,103 1,1211,072 1,103Employee benefitsAsperlastbalance <strong>sheet</strong> 21,927 15,293Additionsduring the year 7,278 8,541Amountspaid during the year 8,642 1,907Amountsreversed during the year 218 -20,345 21,927Obligationsincidentalto l<strong>and</strong> acquisitionAsperlastbalance <strong>sheet</strong> 2,842 -Additionsduring the year 222 2,842Amountspaid during the year 361 -Amountsreversed during the year 35 -2,668 2,842OthersAsperlastbalance <strong>sheet</strong> 27 806Additionsduring the year 2 5Amountsadjusted during the year - 783Amountsreversed during the year 5 124 27Total 30,705 32,49534 th Annual Report 2009-2010 121

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 17SALESEnergySales(including ElectricityDuty) * 460,575 423,861Less:Advance againstdepreciation defered (net) (84) 5,626Add : Revenue recognized outofadvance againstdepreciation 3,168 -Add : Exchange fluctuation receivable from customers 319 1,894464,146 420,129Consultancy,projectmanagement<strong>and</strong> supervision fees(including turnkeyconstruction projects) 1,539 1,325Total 465,685 421,454* Includes(-) Rs.7,199 million (PreviousyearRs.7,583 milion) on accountofincome taxrecoverable from customersasperCERC Regulations,2004<strong>and</strong> Rs.2,485 million (PreviousyearNil) on accountofdefered taxrecoverable from customersasperCERC Regulations,2009Schedule 18PROVISIONS WRITTEN BACKDoubtfulDebts 1 1Doubtfulloans,advances<strong>and</strong> claims 4 145Doubtfulconstruction advances 45 -Shortage in construction stores 7 4Shortage in stores 20 11Obsolescence/Dimunition in value ofsurplusstores 41 8Unserviceable Capitalwork-in-progress 5 -Others 5 1128 17012234 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 19OTHER INCOMEIncome from Long Term InvestmentsTradeDividend from Subsidiaries 105 78Dividend from JointVentures 68 60InterestNon-TradeGovernmentSecurities(8.5% taxfreebondsissued bytheStateGovernments) 9,401 10,805OtherBonds(Gross) (Taxdeducted atsourceRs.4 million,PreviousyearRs.12 milion) 7 43Interestfrom GovernmentofIndiaSecurities(Gross) 18 131Less:Amortisation ofpremium - 1018 121<strong>Profit</strong>on redemption ofInvestments 50 -Income from Current Investments (Non-Trade)Dividend from MutualFund Investments 604 361Income from OthersInterest(Gross) (Taxdeducted atsource Rs.1,948 million,previousyearRs.3,672 milion)Loan to State Governmentin setlementofduesfrom customers 590 671Indian banks 13,429 15,803Foreign banks - (15)Employees'loans 165 175Customers 600 967Others 669 530SubsidiaryCompany 35 42Intereston Income Taxrefunds 4,526 3,306Less:Refundable to customers 4,526 1,107- 2,199Surcharge received from customers 623 67Hire charges<strong>for</strong>equipment 28 13<strong>Profit</strong>on disposaloffixed assets 70 127Exchange diferences 291 24Miscelaneousincome 2,254 1,150Less: Transfered to Expenditure during construction29,007 33,221period (net) - Schedule 25 379 413Transfered to Defered Foreign CurencyFluctuationLiability 66 268Transfered to Developmentofcoalmines - 1Total 28,562 32,539Schedule 20EMPLOYEES'REMUNERATION AND BENEFITSSalaries,wages,bonus,alowances& benefits 23,351 19,677Contribution to provident<strong>and</strong> otherfunds 3,315 6,130Welfare expenses 2,802 3,16929,468 28,976Less:A located to fuelcost 1,522 1,228Transfered to developmentofcoalmines 219 158Transfered to expenditure during construction period (net) - Schedule 25 3,603 2,959Total 24,124 24,63134 th Annual Report 2009-2010 123

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 21GENERATION, ADMINISTRATION & OTHER EXPENSESPowercharges 1,109 1,010Less:Recovered from contractors& employees 142 126967 884Watercharges 1,296 932Storesconsumed 311 310Rent 216 158Less:Recoveries 62 56154 102Repairs& maintenanceBuildings 1,054 940Plant& machineryPowerstations 10,960 9,379Construction equipment 6 910,966 9,388Others 882 804Insurance 795 461Rates<strong>and</strong> taxes 228 198Watercess& environmentprotection cess 262 255Training & recruitmentexpenses 725 417Less:Fees<strong>for</strong>application <strong>and</strong> training 40 36685 381Communication expenses 331 275Traveling expenses 1,340 1,274Tenderexpenses 235 217Less:Receiptfrom sale oftenders 19 20216 197Paymentto auditors 24 25Advertisement<strong>and</strong> publicity 156 109Securityexpenses 2,245 1,663Entertainmentexpenses 114 137Expenses<strong>for</strong>guesthouse 112 94Less:Recoveries 13 1299 82Education expenses 216 183Brokerage & commission 17 14Donations 5 1Communitydevelopment<strong>and</strong> welfare expenses 205 138Less:Grants-in-aid 1 9204 129Ash utilisation & marketing expenses 22 47Less:Sale ofash products 1 -21 47Directorssiting fee 3 2Books<strong>and</strong> periodicals 19 17Professionalcharges<strong>and</strong> consultancyfees 411 292Less:Grants-in-aid 16 -395 292Legalexpenses 111 46EDPhire <strong>and</strong> othercharges 162 122Printing <strong>and</strong> stationery 109 102Oil& gasexploration expenses 34 87Claims/advanceswriten of - 2Hiring ofvehiles 369 316Miscelaneousexpenses 599 1,027Storeswriten of 2 2Survey&Investigation expenseswriten of 43 36<strong>Loss</strong>on disposal/write-ofoffixed assets 276 40324,710 21,245Less: A located to fuelcost 1,829 1,450Transfered to developmentofcoalmines 174 84Transfered to Expenditure during construction period (net) - Schedule 25 1,767 1,519Total 20,940 18,192Sparesconsumption included in repairs<strong>and</strong> maintenance 6,628 5,92212434 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 22PROVISIONSDoubtfuladvances<strong>and</strong> claims 1 4Shortage in stores 18 41Obsolete/Dimunition in the value ofsurplusstores 76 172Shortage in construction stores 9 8Unserviceable capitalwork-in-progress 3 16Others 2 5Total 109 246Schedule 23INTEREST AND FINANCE CHARGESInterest on :Bonds 7,664 6,052Loansfrom GovernmentofIndia - 5Foreign curencyterm loans 1,883 2,301Rupee term loans 13,530 11,361Public deposits 11 3Foreign curencybonds/notes 1,704 1,738Amountspayable to customers 14 72Others 386 701Exchange diferencesregarded asadjustmentto interestcost 1 2,68825,193 24,921Finance Charges :Bondsservicing & public depositexpenses 19 18Guarantee fee 397 339Managementfee 3 1Commitmentcharges/exposure premium 27 9Rebate to customers 6,937 6,700ReimbursementofL.C.chargeson salesrealisation 72 133Bankcharges 27 21Bond issue expenses 5 45Legalexpenseson <strong>for</strong>eign curencyloans 1 -Foreign curencybonds/notesexpenses 1 1Up-frontend fee 206 -Others 9 267,704 7,293Sub-Total 32,897 32,214Less: Transfered to Expenditure during construction period (net) - Schedule 25 14,808 12,252Total 18,089 19,96234 th Annual Report 2009-2010 125

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 24PRIOR PERIOD INCOME/EXPENDITURE (NET)INCOMESales (325) 4,640Others 25 26(300) 4,666EXPENDITURESalary,wages,bonus,alowances& benefits (994) (5)Repairs<strong>and</strong> Maintenance (3) 3Depreciation 166 (2,391)Interestincluding exchange diferencesregarded as adjustmentto interestcost 102 7,539Traveling expenses (2) -Insurance - (1)Advertisement<strong>and</strong> publicity 2 1Professionalconsultancycharges - 2Rates& Taxes 5 (14)PowerCharges 3 -Rent 3 1Depreciation adjsutmentoutofDefered Expenses/Income from Foreign Curency- 736FluctuationExchange diferences 36 (469)Others (56) 19(738) 5,421Net Expenditure/(Income) (438) 755Less: Transfered to Expenditure during construction period (net) - Schedule 25 346 (78)Transfered to DevelopmentofCoalMines (5) -Transfered to Defered Foreign CurencyFluctuation Asset/Liability - (250)Total (779) 1,08312634 th Annual Report 2009-2010

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 25EXPENDITURE DURING CONSTRUCTION PERIOD (NET)A. Employees remuneration <strong>and</strong> other benefitsSalaries,wages,alowances<strong>and</strong> benefits 3,119 1,949Contribution to provident<strong>and</strong> otherfunds 337 678Welfare expenses 147 332Total (A) 3,603 2,959B. Other ExpensesPowercharges 565 502Less:Recovered from contractors& employees 8 8557 494Watercharges 87 -Rent 26 18Repairs& maintenanceBuildings 41 44Construction equipment 2 4Others 76 92119 140Insurance 2 11Rates<strong>and</strong> taxes 4 23Communication expenses 38 36Traveling expenses 240 241Tenderexpenses 65 62Less:Income from sale oftenders 1 164 61Advertisement<strong>and</strong> publicity 7 13Securityexpenses 231 173Entertainmentexpenses 19 22Guesthouse expenses 22 8Education expenses 1 1Books<strong>and</strong> periodicals 7 6Communitydevelopmentexpenses 12 7Professionalcharges<strong>and</strong> consultancyfee 82 47Legalexpenses 5 3EDPHire <strong>and</strong> othercharges 8 7Printing <strong>and</strong> stationery 10 8Miscelaneousexpenses 226 200Total (B) 1,767 1,519C. Depreciation 192 141Total (A+B+C) 5,562 4,61934 th Annual Report 2009-2010 127

<strong>Schedules</strong> to the <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong>Rs. milionFor the year ended March 31, 2010 2009Schedule 25EXPENDITURE DURING CONSTRUCTION PERIOD (NET)D. Interest <strong>and</strong> Finance ChargesInterestonBonds 4,748 3,225Foreign curencyterm loans 882 1,179Rupee term loans 8,382 6,305Foreign curencybonds/notes 472 651Exchange diferencesregarded asadjustmentto interestcost - 811Finance ChargesCommitmentcharges 2 6Foreign curencybonds/notesexpenses - 2UpfrontFee 206 -Others 116 73Total (D) 14,808 12,252E. Less:Other IncomeInterestfromIndianbanks - 6Foreign banks - 7Others 276 242Hire charges 19 12Sale ofscrap 1 4Miscelaneousincome 83 142TOTAL (E) 379 413F. Prior Period Adjustments 346 (78)G. Income/Fringe Benefit Tax - 11GRAND TOTAL (A+B+C+D-E+F+G) 20,337* 16,391* <strong>Balance</strong> carried to Capital Work-in-progress - (Schedule 7)12834 th Annual Report 2009-2010

SCHEDULE-26NOTES ON ACCOUNTS1. a) The conveyancing ofthe title to 10,884 acres offreehold l<strong>and</strong> ofvalue Rs.5,071 million (Previousyear10,844 acresofvalue Rs.4,950milion) <strong>and</strong> buildings& structuresvalued atRs.1,491 million (previousyearRs.1,137 milion),asalso execution oflease agreements<strong>for</strong>8,958 acres ofl<strong>and</strong> ofvalue Rs.2,447 million (previousyear8,820 acres,value Rs.2,720 milion) in favourofthe Companyare awaitingcompletion oflegal<strong>for</strong>malities.b) Leasehold l<strong>and</strong> includes30 acres valuing Rs.1 million (previousyear30 acresvaluing Rs.1 milion) acquired on perpetuallease <strong>and</strong>accordinglynotamortised.c) L<strong>and</strong> doesnotinclude costof1,181 acres (previousyear1,181 acres) ofl<strong>and</strong> in possession ofthe Company. Thiswilbe accounted <strong>for</strong>on setlementofthe price thereofbythe State GovernmentAuthorities.d) L<strong>and</strong> includes1,247 acres ofvalue Rs.151 million (previousyear1,223 acresofvalue Rs.110 milion) notin possession oftheCompany.The Companyistaking appropriate steps<strong>for</strong>repossession ofthe same.e) L<strong>and</strong> includesan amountofRs.1,153 million (previousyearRs.1,243 milion) deposited with variousauthoritiesin respectofl<strong>and</strong> inpossession which issubjectto adjustmenton finaldetermination ofprice.f) Possession ofl<strong>and</strong> measuring 98 acres (previousyear98 acres) consisting of79 acres offree-hold l<strong>and</strong> (previousyear79 acres) <strong>and</strong> 19acres oflease hold l<strong>and</strong> (previousyear19 acres) ofvalue Rs.2 million (previousyearRs.2 milion) wastransfered to U tarPradesh RajyaVidyutUtpadan Nigam Ltd. (erstwhile UPSEB) <strong>for</strong>aconsideration ofRs.2 million. Pending approval<strong>for</strong>transferofthe said l<strong>and</strong>,the area<strong>and</strong> value ofthisl<strong>and</strong> hasbeen included in the totall<strong>and</strong> ofthe Company. The consideration received from erstwhile UPSEB isdisclosedunder‘OtherLiabilities’in Schedule-15-‘CurentLiabilities’.g) During the year,freehold l<strong>and</strong> measuring 36 acres wash<strong>and</strong>ed overbythe GovernmentofU tarPradesh to Companyin exchange offreehold l<strong>and</strong> measuring 35 acres withoutanyfinancialconsideration.h) The costofrightofuse ofl<strong>and</strong> <strong>for</strong>laying pipelinesamounting to Rs.58 million (previousyearRs.13 milion) isincluded underintangibleassets. The rightofuse,otherthan perpetualin nature,are amortised overthe legalrightto use.i) Costofacquisition ofthe right<strong>for</strong>drawlofwateramounting to Rs.84 million (previousyearnil) isincluded underintangible assets– RightofUse - Others. The rightofdrawlofwateris<strong>for</strong>thirtyyears<strong>and</strong> the costisaccordinglyamortized.2 a) The CentralElectricityRegulatoryCommission (CERC) notified the TarifRegulations,2009 in January2009,containing inter-aliathe terms<strong>and</strong> conditions<strong>for</strong>determination oftarifapplicable <strong>for</strong>aperiod offive yearswith efectfrom 1 st April2009. Pending determination ofstation-wise tarifbythe CERC,saleshave been provisionalyrecognized atRs.444,739 million during the yearended 31 st March 2010 onthe basisofprinciplesenunciated in the said Regulationson the capitalcostconsidering the ordersofAppelate Tribunal<strong>for</strong>Electricity(ATE) <strong>for</strong>the tarifperiod 2004-2009 including asrefered to in para2 (e).The TarifRegulations,2009 provide thatpending determination oftarifbythe CERC,the Companyhasto provisionalybilthe beneficiariesatthe tarifapplicable ason 31 st March 2009 approved bythe CERC. The amountprovisionalybiled during the yearended 31 st March2010 on thisbasisisRs.437,651 million.b) Forthe unitscommissioned during the year,pending the determination oftarifbyCERC,salesofRs.17,354 million have been provisionalyrecognised on the basisofprinciplesenunciated in the TarifRegulations,2009. The amountprovisionaly biled <strong>for</strong>such unitsisRs.15,365 million.c) Salesof(-) Rs.6,006 million (previousyearRs.10,201 milion) pertaining to previousyearshasbeen recognized based on the ordersissued bythe CERC/ATE.d) In termsofRegulation 39,CERC TarifRegulations,2009,notified bythe CERC,the Companyhasdetermined the amountofthe DeferedTaxLiability(net) materialised during the yearpertaining to the period upto 31 st March 2009 byidentifying the majorchangesin theelementsofDefered TaxLiability/Asset,asrecoverable from the beneficiaries<strong>and</strong> accordinglyasum ofRs.2,485 million (net) hasbeenrecognised asSalesduring the year.e) In respectofstations/unitswhere the CERC had issued tari<strong>for</strong>dersapplicable from 1 st April2004 to 31 st March 2009,the Companyaggrievedovermanyofthe issuesasconsidered bythe CERC in the tari<strong>for</strong>ders,filed appealswith the ATE. The ATE disposed ofthe appealsfavourablydirecting the CERC to revise the tari<strong>for</strong>dersasperthe directions<strong>and</strong> methodologygiven. The CERC filed an appealwith theHon’ble Supreme CourtofIndiaon some ofthe issuesdecided bythe ATE which ispending. The Companyhassubmited thatitwouldnotpress<strong>for</strong>determination ofthe tarifbythe CERC asperATE orderspending disposalofthe appealbythe Hon’ble Supreme Court.Considering expertlegalopinionsobtained that,itisreasonable to expectultimate colection,the sales<strong>for</strong>the tarifperiod 2004-2009amounting to Rs.10,443 million were recognised in earlieryearsbased on provisionaltarifworked outbythe Companyasperthemethodology<strong>and</strong> directionsasdecided bythe ATE. Due to furtherCERC tari<strong>for</strong>dersreceived during the year,the provisionalsalesofRs.10,443 milion hasnow been reduced to Rs.10,256 million.The salesaccounted asabove issubjectto finaloutcome ofthe decisionofthe Hon’ble Supreme CourtofIndia<strong>and</strong> consequentialefect,ifany,wilbe given in the financialstatementsupon disposalofthe appeal.3. Sundrydebtors– OtherDebts,Unsecured (Schedule 11) includesRs.10,011 million (previousyearRs.3,901 milion) towardsrevenueaccountedin accordance with the accounting policyno. 12.1 which isyetto be biled.4. GovernmentofIndiain January2006 notified the TarifPolicyunderthe provisionsofthe ElectricityAct,2003 which providesthatthe ratesofdepreciation notified bythe CERC would be applicable<strong>for</strong>the purpose oftarifaswelasaccounting. Subsequentto the notification ofthe TarifPolicy,CERC through Regulations,2009 notified the ratesofdepreciation.CERC exercising itspowersunderSection 79 ofthe ElectricityAct,2003 requested the MinistryofPowerto advise the MinistryofCorporateA fairsto notifythe ratesofdepreciation considered bythe CERC <strong>for</strong>tarifdetermination asdepreciation underSection 205 (2) (c) oftheCompaniesAct,1956. MinistryofCorporate A fairsisyetto notifysuch ratesunderSection 205 (2) (c) ofthe CompaniesAct,1956.34 th Annual Report 2009-2010 129

The Companyhasalso obtained legalopinionsthatthe TarifPolicycannotoveride the provisionsofthe CompaniesAct,1956 <strong>and</strong> itisrequired tofolow Schedule XIV ofthe CompaniesAct,1956 in the absence ofanyspecific provision in the ElectricityAct,2003. Hence provisionsofSection616 ofthe CompaniesAct,1956 are also notapplicable in thisregard. Accordingly,the Companyischarging depreciation consistentlyatthe ratesspecified in Schedule XIV ofthe CompaniesAct,1956 with efectfrom the financialyear2004-05 exceptasstated in accountingpolicyno.12.2.1.5. Due to uncertaintyofrealisation in the absence ofsanction bythe GovernmentofIndia(GOI),the Company’sshare ofnetannualprofitsofoneofthe stationstaken overbythe Companyin June 2006 <strong>for</strong>the period 1 st April1986 to 31 st May2006 amounting to Rs.1,155 million (previousyearRs.1,155 milion) being balance receivable in termsofthe managementcontractwith the GOIhasnotbeen recognised.6. The payrevision ofthe employeesofthe Companywasdue w.e.f. 1 st January2007.Based on the guidelinesissued byDepartmentofPublic Enterprises(DPE),GovernmentofIndia(GOI),the payrevision ofthe executive categoryofemployeeshasbeen approved during the year. Pending finalisation ofpayrevision in respectofemployeesin the non-executive category,provision ofRs.3,145 million <strong>and</strong> Rs.6,590 million (previousyearRs.1,767 milion <strong>and</strong> Rs. 3,445 milion) hasbeen made <strong>for</strong>the year<strong>and</strong> uptoyearrespectivelyon an estimated basishaving regard to the guidelinesissued byDPE. A sum ofRs.1,387 million (previousyearRs.748 milion)paid asadhoc advance towardspayrevision to the employeesin the non-executive categoryisincluded in ‘Loans<strong>and</strong> Advances’(Schedule 14).7. The amountreimbursable to GOIin termsofPublic Notice No.38 dated 5 th November,1999 <strong>and</strong> Public Notice No.42 dated 10 th October,2002towardscash equivalentofthe relevantdeemed exportbenefitspaid byGOIto the contractors<strong>for</strong>one ofthe stationsamounted to Rs.2,768million (previousyearRs.2,768 milion) outofwhich Rs.2,696 million (previousyearRs.2,696 milion) hasbeen deposited with the GOI<strong>and</strong>liability<strong>for</strong>the balance amountofRs.72 million (previousyearRs.72 milion) hasbeen provided <strong>for</strong>. No interesthasbeen provided on thereimbursable amountsasthere isno stipulation <strong>for</strong>paymentofinterestin the public noticescited above.8. Asperthe direction ofthe MinistryofPower(MOP),amemor<strong>and</strong>um ofunderst<strong>and</strong>ing wassigned between the Company,GujaratPowerCorporation Ltd. (GPCL) <strong>and</strong> GujaratElectricityBoard (GEB) on 20 th February2004 to setup PipavavPowerProject. The Companydisassociatedfrom the PipavavPowerProject,awholyowned subsidiaryofthe Company,on 24 th May2007 afterobtaining approvalfrom the MOP. MOP,GovernmentofIndia,conveyed itsapprovalvide PresidentialDirective No. 5/5/2004-TH- Idated 3 rd July2009 <strong>for</strong>winding-up ofthe PipavavPowerDevelopmentCompanyLtd. (PPDCL) pending finalsetlementofclaimswith GPCL/GovernmentofGujarat. The Board ofDirectorsofNTPCLtd. have also given consent<strong>for</strong>winding up ofthe PPDCL.MOP,GOIthrough itsfurtherPresidentialDirective No. 5/5/2004-TH- Idated 15 th April2010 conveyed the approvalofGOIto permitNTPC<strong>for</strong>winding up ofPPDCLthrough striking ofthe name underSection 560 ofthe CompaniesAct,1956. Accordingly,necessaryapplication/declarationshave been filed with the RegistrarofCompanies(ROC) <strong>for</strong>striking ofthe name ofthe Companyfrom the RegisterofCompaniesmaintained bythe ROC.Pending liquidation ofthe PPDCL,an amountofRs.4 million (PreviousyearRs.4 milion) received from GPCLisincluded in otherliabilitiesunder‘CurentLiabilities’(Schedule-15). Asfulamounthasbeen received towardsequityinvested,no provision isconsidered necessary<strong>for</strong>diminution in the value ofinvestment.9. Consequentto the notification no.S.O.2804 (E) dated 3 rd November2009,issued byMinistryofEnvironment<strong>and</strong> Forest(MoEF),GovernmentofIndia,direct/indirectexpensesrelating to flyash <strong>for</strong>the period from 3 rd November2009 to 31 st March 2010 amounting to Rs.8 million hasbeenadjusted from ‘Ash Utilisation <strong>and</strong> MarketingExpenses’(Schedule 21) <strong>and</strong> transfered to the subsidiarycompanyNTPC VidyutVyapaarNigamLimited <strong>for</strong>adjustmentwith reserve. The reserve in termsofthe said notification ismaintained bythe said subsidiarycompany.10. Asaresultofissuance ofthe New CoalDistribution Policy(NCDP) byMinistryofCoalin October2007,the Company<strong>and</strong> CoalIndiaLtd (CIL)renegotiated the ModelCoalSupplyAgreement(CSA) <strong>and</strong> ModelCSA wassigned between the Company& CILon 29 th May2009. Based onthe ModelCSA,coalsupplyagreementshave been signed with the varioussubsidiarycompaniesofCILbyalexcepting three ofthe coalbasedstationsofthe Company. The CSAsare valid <strong>for</strong>aperiod of20 yearswith aprovision <strong>for</strong>review afterevery5 years.11. The Companychalenged the levyoftransitfee/entrytaxon suppliesofcoalto some ofitspowerstations<strong>and</strong> haspaid underprotestsuch transitfee/entrytaxto CoalCompanies/SalesTaxAuthorities. Further,in line with the agreementwith GAILIndiaLtd.,the Companyhasalso paid entrytax<strong>and</strong> salestaxon transmission chargesin respectofsuppliesmade to variousstationsin the state ofU tarPradesh. GAILIndiaLtd. haspaid suchtaxesto the appropriate authoritiesunderprotest<strong>and</strong> filed apetition be<strong>for</strong>e the Hon’ble High CourtofA lahabad chalenging the applicabilityofrelevantAct. In case the Companygetsrefund from CoalCompanies/SalesTaxAuthorities/GAILIndiaLtd. on setlementofthese cases,thesame wilbe passed on to respective beneficiaries.12. Fixed assets,capitalwork-in-progress<strong>and</strong> construction stores<strong>and</strong> advancesinclude Rs.6,765 million in respectofone ofthe hydro powerproject,the construction ofwhich hasbeensuspended temporarilyfrom 18 th May2009 on the advice ofthe MinistryofPower,GOI. Presently,the issue regarding resumption ofthe projectisunderconsideration with the GOI. Pending decision,borowing costsofRs.237 million havenotbeen capitalised from the date ofsuspension.13. Progressofworkunderthe contract<strong>for</strong>steam generator<strong>and</strong> auxiliariespackage atone ofthe projecthasbeen afected dueto certain disputeswith the contractor. While the contractual<strong>and</strong> otherrelated issuesare underdeliberation,the contractcontinuesto be in <strong>for</strong>ce <strong>and</strong> suppliesofequipment/structuralitemshave been madebythe contractorduring the year. Construction ofothersystems<strong>for</strong>the projectisalso in progress.Since activitiesthatare necessaryto prepare the asset<strong>for</strong>itsintended use are in progress,borowing costscontinue to be capitalised.14. Issuesrelated to the evaluation ofper<strong>for</strong>mance <strong>and</strong> guarantee testresultsofsteam/turbine generatorsatsome ofthe stationsare underdiscussionwith the equipmentsupplier. Pending setlement,liquidated damages<strong>for</strong>shortfalin per<strong>for</strong>mance ofthese equipmentshave notbeen recognised.15. The Companyisexecuting athermalpowerprojectin respectofwhich possession certificates<strong>for</strong>1,489 acresofl<strong>and</strong> hasbeen h<strong>and</strong>ed overtothe Company<strong>and</strong> alstatutory<strong>and</strong> environmentclearances<strong>for</strong>the projecthave been received. Subsequently,ahigh powercommitee hasbeenconstituted asperthe directionsofGOIto explore alternate location ofthe projectsince presentlocation isstated to be acoalbearing area.Aggregate costincured up to 31 st March 2010 Rs.1,831 million isincluded in Fixed Assets(<strong>Schedules</strong>6,7 <strong>and</strong> 8). Managementisconfidentofrecoveryofcostincured,hence no provision isconsidered necessary.16. a) Certain loans& advances<strong>and</strong> creditorsin so farasthese have since notbeen realised/discharged oradjusted are subjectto confirmation/reconciliation <strong>and</strong> consequentialadjustment,ifany.13034 th Annual Report 2009-2010

) In the opinion ofthe management,the value ofcurentassets,loans<strong>and</strong> advanceson realisation in the ordinarycourse ofbusiness,wilnotbe lessthan the value atwhich these are stated in the <strong>Balance</strong> Sheet.17. Efectofchangesin <strong>Account</strong>ing Policies:a) TarifRegulations,2009 issued bythe CERC provide thatthe balance depreciable value ofthe each ofthe existing stationsason 1 st April,2009 shalbe worked outbydeducting the cumulative depreciation including the Advance AgainstDepreciation (AAD) asadmited bythe CERC up to 31 st March 2009 from the grossdepreciable value ofthe assetstherebymerging AAD with depreciation <strong>for</strong>tarifrecovery.Underthe said TarifRegulations,the CERC also hasnotified the revised ratesofdepreciation <strong>and</strong> removed the provision <strong>for</strong>AAD.In view ofthe change in CERC TarifRegulations,2009,the Companyrevised itsaccounting policyno. 12.1.2 <strong>and</strong> the amountofAADrequired to meetthe shortfalin the componentofdepreciation in revenue overthe depreciation to be charged ofin future yearshasbeen assessed station-wise <strong>and</strong> whereveran excesshasbeen determined ason 1 st April2009,the same amounting to Rs.3,115million hasbeen recognised assalesduring the year. In addition,Rs.53 million hasbeen recognised assalesduring the yearoutofAADconsequentto thischange.b) Claimson the Company<strong>for</strong>price variation which were hitherto accounted <strong>for</strong>on acceptance. During the year,unsetled liabilities<strong>for</strong>pricevariation/exchange rate variation in case ofcontractsare accounted <strong>for</strong>on estimated basisaspertermsofthe contracts. Consequently,profit<strong>for</strong>the yearislowerbyRs.20 million, fixed assetsarehigherbyRs.2,849 million <strong>and</strong> curentliabilitiesarehigherbyRs.2,869 million.18. Revenue grantsrecognised during the yearisRs.17 million (previousyearRs.9 milion).19. Disclosure as per <strong>Account</strong>ing St<strong>and</strong>ard (AS)15:Generaldescription ofvariousdefined employee benefitschemesare asunder:A. Provident FundCompanypaysfixed contribution to providentfund atpredetermined ratesto aseparate trust,which investsthe fundsinpermitedsecurities. Contribution to familypension scheme ispaid to the appropriate authorities. The contribution ofRs.1,597 million (PreviousyearRs. 985 milion) to the funds<strong>for</strong>the yearisrecognised asexpense <strong>and</strong> ischarged to the <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong>. The obligation oftheCompanyisto make such fixed contribution <strong>and</strong> to ensure aminimum rate ofreturn to the membersasspecified byGOI. Asperreportofthe actuary,overalinterestearnings<strong>and</strong> cumulative surplusismore than the statutoryinterestpaymentrequirement. Henceno furtherprovision isconsidered necessary.B. Gratuity & PensionThe Companyhasadefined benefitgratuityplan. Everyemployee who hasrendered continuousservice offive yearsormore isentitledto getgratuityat15 dayssalary(15/26 X lastdrawn basic salaryplusdearnessalowance) <strong>for</strong>each completed yearofservice subjecttoamaximum ofRs.1 million on superannuation,resignation,termination,disablementoron death.The Companyhasascheme ofpension atone ofthe stationsin respectoftaken overemployeesfrom erstwhile State GovernmentPowerUtility.These schemesare funded bythe Company<strong>and</strong> are managed byseparate trusts. The liability<strong>for</strong>the same isrecognised on the basisofactuarialvaluation.C. Post-Retirement Medical Facility (PRMF)The CompanyhasPost-RetirementMedicalFacility(PRMF),underwhich retired employee <strong>and</strong> the spouse are provided medicalfacilitiesinthe Companyhospitals/empaneled hospitals. Theycan also availtreatmentasOut-Patientsubjectto aceiling fixed bythe Company.D. Terminal BenefitsTerminalbenefitsinclude setlementathome town <strong>for</strong>employees& dependents<strong>and</strong> farewelgiftto the superannuating employees. Further,the Companyalso provides<strong>for</strong>pension in respectoftaken overemployeesfrom erstwhile State GovernmentPowerUtilityatanotherstation.E. LeaveThe Companyprovides<strong>for</strong>earned leave benefit(including compensated absences) <strong>and</strong> half-payleave to the employeesofthe Companywhich accrue annualyat30 days<strong>and</strong> 20 daysrespectively. 75 % ofthe earned leave isen-cashable while in service <strong>and</strong> amaximum of300 dayson superannuation. Half-payleave isen-cashable onlyon superannuation up to the maximum of240 daysaspertherulesoftheCompany. The liability<strong>for</strong>the same isrecognised on the basisofactuarialvaluation.The above mentioned schemes(C,D <strong>and</strong> E) are unfunded <strong>and</strong> are recognised on the basisofactuarialvaluation.The summarised position ofvariousdefined benefitsrecognised in the profit<strong>and</strong> lossaccount,balance <strong>sheet</strong>are asunder:(Figuresgiven in {}are <strong>for</strong>previousyear)i) Expenses recognised in <strong>Profit</strong> & <strong>Loss</strong> <strong>Account</strong> Rs. milionGratuity/PensionCurentService Cost 489{496}PastService Cost -{4,144}Interestcoston benefitobligation 781{376}Expected return on plan assets (427){(371)}Netactuarial(gain)/lossrecognised in the year (399){192}Expensesrecognised in the <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong> 444{4,837}PRMF Leave TerminalBenefits8233550{77} {391}{54}---{-}{-}{-}16048694{123} {361}{71}---{-}{-}{-}116345361{212} {1,111} {165}3581,166505{412} {1,863} {290}34 th Annual Report 2009-2010 131

i) The amount recognised in the <strong>Balance</strong> Sheet Rs. milionGratuity/PensionPresentvalue ofobligation asat31.03.2010 10,649{10,409}Fairvalue ofplan assetsasat31.03.2010 9,871{5,364}Netliabilityrecognised in the <strong>Balance</strong> Sheet 779{5,045}PRMF Leave TerminalBenefits2,4445,8511,675{2,133} {6,479} {1,255}---{-}{-}{-}2,4445,8511,675{2,133} {6,479} {1,255}i) Changes in the present value ofthe defined benefit obligations: Rs. milionGratuity /PensionPresentvalue ofobligation asat1.04.2009 10,409{5,361}Interestcost 781{376}CurentService Cost 489{496}PastService Cost -{4,144}Benefitspaid (886){(211)}Netactuarial(gain)/losson obligation (144){243}Presentvalueofthedefined benefitobligationasat31.03.2010 10,649{10,409}PRMF Leave TerminalBenefits2,133{1,750}160{123}82{77}-{-}(47){(29)}116{212}2,444{2,133}6,479{5,160}486{361}335{391}-{-}(1,794){(544)}345{1,111}5,851{6,479}1,255{1,017}94{71}50{54}-{-}(85){(52)}361{165}1,675{1,255}iv) Changes in the fair value ofplan assets: Rs. milionGratuity/PensionFairvalue ofplan assetsasat1.04.2009 5,364{4,623}Expected return on plan assets 427{371}Contributionsbyemployer 4,691{512}Benefitpaid (866){(193)}Actuarialgain /(loss) (255){51}Fairvalue ofplan assetsasat31.03.2010 9,871{5,364}PRMF Leave TerminalBenefits---{-}{-}{-}---{-}{-}{-}---{-}{-}{-}---{-}{-}{-}---{-}{-}{-}---{-}{-}{-}v) The efectofone percentage pointincrease/decrease in the medicalcostofPRMFwilbe asunder: Rs. milionParticulars Increase by Decrease byService <strong>and</strong> Interestcost 50 39Presentvalue ofobligation 422 336F. Other Employee BenefitsProvision <strong>for</strong>Long Service Award <strong>and</strong> FamilyEconomic Rehabilitation Scheme amounting to Rs.34 million (credit)(previousyeardebitofRs.16 milion) <strong>for</strong>the yearhave been made on the basisofactuarialvaluation atthe yearend <strong>and</strong> credited to the <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong>.G. Details ofthe Plan AssetsThe detailsofthe plan assetsatcostason 31 st March are asfolows: Rs. milion2010 2009i) State Governmentsecurities 2,292 938i) CentralGovernmentsecurities 3,177 1,824i) Corporate Bonds/debentures 4,221 2,236iv) RBISpecialDeposit 240 240v) MoneyMarketInstruments 249 NilTotal 10,179 5,23813234 th Annual Report 2009-2010

H. Actuarial AssumptionsPrincipalassumption used <strong>for</strong>actuarialvaluation are :2010 2009i) Method used Projected UnitCreditMethodi) Discountrate 7.50% 7.00%i) Expected rate ofreturn on assets:- Gratuity- Pension8.00%7.00%8.00%9.00%iv) Future salaryincrease 5.00% 4.50%Theestimatesoffuturesalaryincreasesconsidered inactuarialvaluation,takeaccountofinflation,seniority,promotion<strong>and</strong> otherrelevantfactors,suchassupply<strong>and</strong> dem<strong>and</strong> intheemploymentmarket. Further,theexpected returnonplanassetsisdetermined consideringseveralapplicablefactorsmainlythecompositionofplanassetsheld,assessed riskofassetmanagement<strong>and</strong> historicalreturnsfrom planassets.I. Actualreturn on plan assetsRs.681 million (previousyearRs.423 milion).J. The Company’sbestestimate ofthe contribution towardsGratuity/Pension <strong>for</strong>the financialyear2010-11 isRs.320 million.20. The efectof<strong>for</strong>eign exchange fluctuation during the yearisasunder:i) The amountofexchange diferences(net) credited to the <strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong>isRs.189 million (previousyeardebitofRs.244 milion). i) The amountofexchange diferences(net) credited to the carying amountoffixed assets<strong>and</strong> Capitalwork-in-progressisRs.11,815 million {previousyearRs.11,649 milion (debit)}.21. Borowing costscapitalised during the yearare Rs.14,804 million (previousperiod Rs.12,221 milion).22. Segmentin<strong>for</strong>mation:a) BusinessSegments:The Company’sprincipalbusinessisgeneration <strong>and</strong> sale ofbulkpowerto State PowerUtilities. Otherbusinessincludesprovidingconsultancy,projectmanagement<strong>and</strong> supervision,oil<strong>and</strong> gasexploration <strong>and</strong> coalmining.b) SegmentRevenue <strong>and</strong> Expense :Revenue directlyatributable to the segmentsisconsidered asSegmentRevenue. Expensesdirectlyatributable to the segments<strong>and</strong>common expensesalocated on areasonable basisare considered asSegmentExpenses.c) SegmentAssets<strong>and</strong> Liabilities:Segmentassetsinclude aloperating assetsin respective segmentscomprising ofnetfixed assets<strong>and</strong> curentassets,loans<strong>and</strong> advances.Construction work-in-progress,construction stores<strong>and</strong> advancesare included in unalocated corporate <strong>and</strong> otherassets. Segmentliabilitiesinclude operating liabilities<strong>and</strong> provisions.Rs. milionBusiness SegmentsGeneration Others TotalCurrent Year PreviousYear Current Year PreviousYear Current Year PreviousYearRevenue :Sale ofEnergy/Consultancy,ProjectManagement 461,687 417,913 1,539 1,325 463,226 419,238<strong>and</strong> Supervision fees*Internalconsumption ofelectricity 551 514 - - 551 514Total 462,238 418,427 1,539 1,325 463,777 419,752SegmentResult# 101,524 90,531 582 418 102,106 90,949Unalocated Corporate Interest<strong>and</strong> OtherIncome 24,677 30,615Unalocated Corporate expenses, interest <strong>and</strong>17,929 27,969finance charges<strong>Profit</strong>be<strong>for</strong>e TaxIncome/Fringe BenefitTaxes(Net) 21,572 11,582<strong>Profit</strong>afterTax 87,282 82,013Otherin<strong>for</strong>mationSegmentassets 469,569 424,333 1,433 1,045 471,002 425,378Unalocated Corporate <strong>and</strong> otherassets 657,735 626,870Totalassets 469,569 424,333 1,433 1,045 1,128,737 1,052,248Segmentliabilities 75,066 85,967 889 722 75,955 86,689Unalocated Corporate <strong>and</strong> otherliabilities 428,407 391,858Totalliabilities 75,067 85,967 889 722 504,362 478,547Depreciation 26,180 23,376 2 2 26,182 23,378Non-cash expensesotherthan Depreciation 109 245 - - 109 245CapitalExpenditure 98,647 130,843 1,139 277 99,786 131,121* Includes(-) Rs.6,006 million (previousyearRs.10,201 milion) <strong>for</strong>salesrelated to earlieryears.# Generationsegmentresultwould havebeenRs.107,530 million (previousperiod Rs.80,330 milion) withoutincludingthesalesrelated to earlieryears.d) The operationsofthe Companyare mainlycaried outwithin the country<strong>and</strong> there<strong>for</strong>e,geographicalsegmentsare inapplicable.34 th Annual Report 2009-2010 133

23. Related Party Disclosures:a) Related parties:i) Jointventures:UtilityPowertech Ltd.,NTPC-Alstom PowerServicesPrivate Ltd.,BF-NTPC EnergySystemsLtd.i) KeyManagementPersonnel:ShriR.S. Sharma Chairman <strong>and</strong> ManagingDirectorShriCh<strong>and</strong>an RoyShriR.K. Jain 1Director(Operations)Director(Technical)ShriA.K. Singhal Director(Finance)ShriR.C. Shrivastav Director(Human Resources)ShriK.B. Dubey 2Director(Projects)ShriI.J. Kapoor Director(Commercial)Shri.B.P.Singh 31. Superannuated on 31 st December2009.Director(Projects)2. Superannuated on 31 st July2009. 3. W.e.f. 1 st August2009.b) Transactionswith the related partiesata(i) above are asfolows: Rs. milionParticulars Current Year PreviousYearTransactions during the year• Contracts<strong>for</strong>Works/Services<strong>for</strong>servicesreceived bythe Company:-- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd.• Deputation ofEmployees:- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd• Dividend Received:- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd.• Amountrecoverable <strong>for</strong>contracts<strong>for</strong>works/servicesreceived:- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd• Amountpayable <strong>for</strong>contracts<strong>for</strong>works/servicesreceived:- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd• Amountrecoverable on accountofdeputation ofemployees:- UtilityPowertech Ltd.- NTPC-Alstom PowerServicesPrivate Ltd2,17699The Companyhasreceived bankguaranteesfrom UtilityPowertech Ltd. <strong>for</strong>an amountofRs.40 million (previousyearRs.39 milion).c) Remuneration to keymanagementpersonnel<strong>for</strong>the yearisRs.26 million (previousyearRs.14 milion) <strong>and</strong> amountofduesoutst<strong>and</strong>ing tothe Companyason 31 st March 2010 areRs.1 million (previousyearRs.3 milion).24. Disclosure regarding leases:a) Finance leasesThe Companyhastaken on lease certain vehicles<strong>and</strong> hasthe option to purchase the vehiclesaspertermsofthe lease agreements,detailsofwhich are asunder:1745363163611477181,8533551323126179281143537Rs. milion31.03.2010 31.3.2009a) Obligationstowardsminimum lease payments• Notlaterthan one year 7 6• Laterthan one year<strong>and</strong> notlaterthan five years 8 14• Laterthan five years - -Total 15 20b) Presentvalue of(a) above• Notlaterthan one year 6 4• Laterthan one year<strong>and</strong> notlaterthan five years 7 12• Laterthan five years - -Total 13 16c) Finance Charges 2 413434 th Annual Report 2009-2010

) Operating leasesThe Company’ssignificantleasing arangementsare in respectofoperating leasesofpremises<strong>for</strong>residentialuse ofemployees,offices<strong>and</strong> guesthouses/transitcamps. These leasing arangementsare usualyrenewable on mutualyagreed termsbutare notnon-cancelable.Schedule 20 - Employees’remuneration <strong>and</strong> benefitsinclude Rs.689 million (previousperiod Rs.307 milion) towardslease payments,netofrecoveries,in respectofpremises<strong>for</strong>residentialuse ofemployees. Lease paymentsin respectofpremises<strong>for</strong>offices<strong>and</strong> guesthouse/transitcampsare shown asRentin Schedule 21 – Generation,Administration <strong>and</strong> OtherExpenses.25. Earning per share:The elementsconsidered <strong>for</strong>calculation ofEarning PerShare (Basic <strong>and</strong> Diluted) are asunder:Current YearPreviousYearNet<strong>Profit</strong>afterTaxused asnumerator- Rs. milion 87,282 82,013Weighted average numberofequitysharesused asdenominator 8245,464,400 8245,464,400Earning pershare (Basic <strong>and</strong> Diluted) - Rupees 10.59 9.95Face value pershare – Rupees 10/- 10/-26. a) The item-wise detailsofdefered taxliability(net) are asunder: Rs. milion31.03.2010 31.03.2009Defered taxliabilityi) Diference ofbookdepreciation <strong>and</strong> taxdepreciation 41,046 70,045Less:Defered taxassetsi) Provisions& Otherdisalowances<strong>for</strong>taxpurposes 8,478 15,310i) Disalowancesu/s43B ofthe Income TaxAct,1961 2,074 3,38510,552 18,695Defered taxliability(net) 30,494 51,350During the year,the defered taxliability(net) <strong>and</strong> the defered taxrecoverable from the beneficiariesasat31 st March 2009 amounting toRs.51,349 milion have been reviewed <strong>and</strong> restated to Rs.24,942 million. In termsofRegulation 39,CERC TarifRegulations,2009,the Companyhasdetermined the amountofthe defered taxliability(net) materialised during the yearpertaining to the period up to 31 st March 2009 byidentifying the majorchangesin the elementsofdefered taxliability/asset,asrecoverable from the beneficiaries. Accordingly,defered taxliability(net) <strong>and</strong> the defered taxrecoverable from the beneficiariesasat31 st March 2010 worksoutto Rs.30,494 million <strong>and</strong> Rs.28,402 millionrespectively.The netincrease during the yearin the defered taxliabilityisRs.2,091 million (previousyeardecrease Rs.4,488 milion) hasbeendebited to<strong>Profit</strong>& <strong>Loss</strong><strong>Account</strong>.27. Research <strong>and</strong> developmentexpenditure charged to revenue during the yearisRs.206 million (previousperiod Rs.81 milion).28. Interest in Joint Ventures:a) Joint Venture Entities:CompanyProportion ofownership interest as on(Excluding Share Application Money)31.03.2010 31.03.2009% age % age1. UtilityPowertech Ltd. 50 502. NTPC - Alstom PowerServicesPrivate Ltd. 50 503, NTPC-SAILPowerCompanyPrivate Ltd. 50 504. NTPC -Tamilnadu EnergyCompanyLtd. 50 505. RatnagiriGas<strong>and</strong> PowerPrivate Ltd.* 29.65 28.336. AravaliPowerCompanyPrivate Ltd. 50 507. NTPC - SCCLGlobalVenturesPrivate Ltd. 50 508. MejaUrjaNigam Private Ltd. 50 509. NTPC - BHELPowerProjectsPrivate Ltd. 50 5010. BF- NTPC EnergySystemsLtd. 49 4911. NabinagarPowerGenerating CompanyPrivate Ltd. 50 5012. NationalPowerExchange Ltd.* 16.67 16.6713. InternationalCoalVenturesPrivate. Ltd.* 14.28 -14. NationalHigh PowerTestLaboratoryPrivate Ltd. 25 -15. Trans<strong>for</strong>mers& ElectricalKeralaLtd.* 44.60 -16. EnergyEfficiencyServicesPrivate Ltd.* 25 -* The accountsare unaudited34 th Annual Report 2009-2010 135