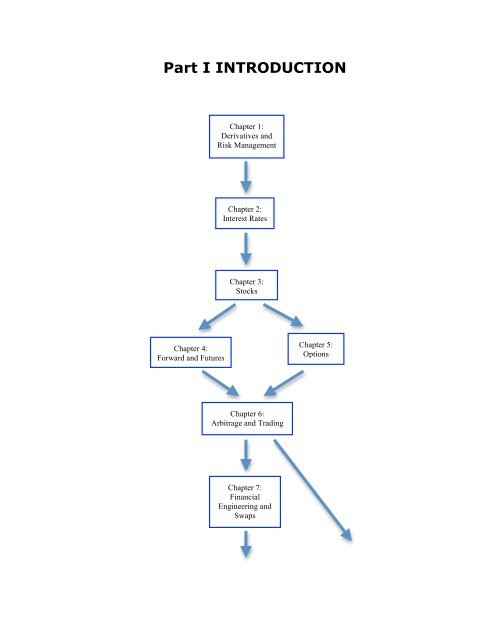

Part I INTRODUCTION - Hibiscus :: Select Client

Part I INTRODUCTION - Hibiscus :: Select Client

Part I INTRODUCTION - Hibiscus :: Select Client

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 21.1 IntroductionThe bursting of the housing price bubble, the credit crisis of 2007, the resulting losses ofhundreds of billions of dollars on credit default swaps (CDS) and credit debt obligations(CDOs), and the failure of prominent financial institutions have forever changed the way theworld views derivatives. Today derivatives are not only of interest to "Wall Street" but alsoto "Main Street!" Credit derivatives are cursed as one of the causes of The Great Recessionof 2007-09, a period of decreased economic output and high unemployment.But what are derivatives? A derivative security or a derivative is a financial contractthat derives its value from an underlying asset’s price such as a stock, a commodity, or evenfrom an underlying financial index like an interest rate. A derivative can both reduce risk—by providing insurance (which, in finance parlance, is referred to as hedging)—or it canmagnify risk—by speculating on future events. Derivatives provide unique and differentways of investing and managing ones wealth that ordinary securities do not.Derivatives have a long and checkered past. In the Sixties only a handful of individualsstudied derivatives. There were no academic books on the topic and no college or universitycourses were available. Derivatives markets were small, located mostly in the United Statesof America and Western Europe. Derivative users included only a limited number of tradersin futures markets and on Wall Street. The options market existed as trading betweenfinancial institutions (called the over-the-counter market) with little activity. In addition,cheating charges often gave it disrepute. Derivatives discussion did not add sparkle tococktail conversations; nor did it generate the allegations and condemnations that it doestoday. Brash young derivatives traders who drive exotic cars and move millions of dollarswith the touch of a computer key didn’t exist. Although Einstein had developed the theory ofrelativity and astronauts had landed on the moon, no one knew how to price an option. That’sbecause in the Sixties nobody cared and derivatives were unimportant.What a difference 50 years has made! Beginning in the early 1970s, derivatives haveundergone explosive growth in the types of contracts traded and in their importance to thefinancial and real economy. Figure 1.1 shows that after 2006, the total notional value ofoutstanding derivative contracts exceeded $450 trillion. The markets are now global andmeasured in trillions of dollars. Hundreds of academics study derivatives and thousands ofarticles have been written on the topic of pricing derivatives. Colleges and universities nowoffer numerous derivative courses using textbooks written on the subject. Derivative expertsare in great demand. In fact, Wall Street firms hire Ph.D.s in mathematics, engineering, andthe natural sciences to understand derivatives—these folks are admirably called “rocketscientists” (“quants” is another name). If you understand derivatives, then you know coolstuff, you are hot and possibly dangerous. Today understanding derivatives is an integral partof the knowledge needed in the risk management of financial institutions.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 3FIGURE 1.1 Global Derivatives MarketTotal No(onalAmount at the Yearend(in billions ofdollars)50000045000040000035000030000025000020000015000010000050000019871988198919901991199219931994199519961997199819992000200120022003200420052006200720082009YearSource: ISDA Market Survey of notional amounts outstanding at year-end of all surveyedderivative contracts, 1987-2009. This includes interest rate, currency, equity, and creditderivatives.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 4Markets have changed to accommodate derivatives trading in three related ways: theintroduction of new contracts and new exchanges, the consolidation and linking ofexchanges, and the introduction of computer technology. Sometimes these changes happenedwith astounding quickness. For example, when twelve European nations replaced theircurrencies with the euro in 2002, financial markets for euro denominated interest ratederivatives sprang up almost overnight, and in some cases, they quickly overtook the dollardenominated market for similar interest rate derivatives.This chapter tells the fascinating story of this expansion in derivatives trading and thecontroversy surrounding its growth. An understanding of the meaning of financial risk isessential in fully understanding this story. Hence, a discussion of financial “risk” comes nextfrom the regulator’s, the portfolio manager’s, and the corporate financial manager’s point ofview. We explain each of their unique perspectives, using them throughout the book toincrease our understanding of the uses and abuses of derivatives. A summary completes thechapter.1.2 Financial InnovationDerivatives are at the core of financial innovation, for better or for worse. They are theinnovations alluded to in the Wall Street Journal (WSJ) article entitled “A Source of OurBubble Trouble” dated January 17, 2008 by columnist David Wessel:Modern finance is, truly, as powerful and innovative as modern science. More people ownhomes -- many of them still making their mortgage payments -- because mortgages wereturned into securities sold around the globe. More workers enjoy stable jobs because financeshields their employers from the ups and downs of commodity prices. More genius inventorssee dreams realized because of venture capital. More consumers get better, cheaper insuranceor fatter retirement checks because of Wall Street wizardry.Expressed at a time when most of the world was in the Great Recession, this view ischallenged by those who blame derivatives for the crisis. Indeed, this article goes on to saythat “…tens of billions of dollars of losses in new-fangled investments [in derivatives andother complex securities] at the largest U.S. financial institutions – and the belated realizationthat some of those Ph.D.-wielding, computer-enhanced geniuses were overconfident in theextreme – strongly suggests some of the brainpower drawn to Wall Street would have beenmore productively employed elsewhere in the economy.”But derivatives have been trading in various guises for over two thousand years. Theyhave continued to trade because, when used properly, they enable market participants toreduce risk from their portfolios and to earn financial rewards from trading on special skillsand information. Indeed, derivatives help to advance or postpone cash-flows (borrowingand lending), to accumulate wealth (saving), to protect against unfavorable outcomes(insurance or hedging), to commit funds to earn a financial return (investment), and toaccept high risks in the hopes of big returns (speculation or gambling), which often goesalong with magnifying the scale of one’s financial returns (leverage). Financial markets

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 6Given these regulatory changes and well-functioning interest rate and foreign currencyderivative markets, just a few years ago, many economists believed that a new era of greatermacroeconomic stability had dawned, dubbed The Great Moderation. During the twodecades before the new millennium, fluctuations in the growth of real output and inflationhad declined, stock market volatility was reduced, and business cycles tamed. A prominentsupporter of this view, Princeton University professor and chairman of the Fed, BenBernanke, provided three explanations in his February 2004 speech: structural change(changes in economic institutions, technology, or other features of the economy), improvedmacroeconomic policies, and good luck (“the shocks hitting the economy became smallerand more infrequent”).However, in a surprise to these economists the tides soon turned. In 2007-09 manynations were mired in the Great Recession with declining economic output and largeunemployment. Stock market volatility, as measured by the widely followed VIX index, shotup from 10 percent to an astonishing 89.53 percent in October 2008 (see the Chicago BoardOptions Exchange’s website http://www.cboe.com). Volatility had returned with avengeance!Two Economic MotivesRegulatory changes have powerful impacts on markets. In fact, Economics Nobel laureateMerton Miller argued in a 1986 article that regulations and taxes cause financial innovation.The reason is because derivative securities are often created to circumvent governmentregulations that prohibit otherwise lucrative transactions. And, because most countries taxincome from different sources (and uses) at different rates, financial innovation are oftendesigned to save tax dollars as well. The desire to lower transactions costs also influencesfinancial innovation. This perspective comes from another Nobel Prize winning University ofChicago economist Ronald Coase. Financial institutions often devise derivatives so thatbrokerage commissions, the difference between a securities dealer’s buying and sellingprices, are minimized (see Insert 1.1).This leads us to an (almost) axiomatic truth that will guide us throughout the book:trading moves to those markets where transactions costs and regulatory constraints areminimized.1.3 Traded Derivative SecuritiesA security, such as a stock or a bond, gives its holder ownership rights over some assets. Itexists as a paper document or an electronic entry record, and usually trades in an organizedmarket. You may be familiar with bonds, which are debts of the issuer, and stocks, whichgive investors equity in the issuing company. Bonds and stocks require an initial investment.Most bonds pay back a promised amount (principal) at maturity. Some bonds pay interest(coupons) on a regular basis, typically semiannually, while others are zero-coupon bondsthat pay no interest but are sold at a discount from the principal. The investment in stock isnever repaid. Stockholders usually get paid dividends on a quarterly basis as compensationfor their stock ownership. Stock prices can increase and create capital gains for investors

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 7and this profit is realized by selling the stock. Alternately, stock prices can decrease andcreate capital losses.Stocks and bonds are often used to create new classes of securities called derivatives andthat’s where the variety comes in. As previously noted, a derivative security is a financialcontract whose value is derived from one or more underlying assets or indices—a stock, abond, a commodity, a foreign currency, an index, an interest rate, or even another derivativesecurity. Forwards, futures, and options are the basic types of derivatives. These will beexplained later in the book.Some common terminology will help us to understand the various derivative contractstraded.a) Real assets include land, buildings, machines, commodities, and financial assets includestocks, bonds, currencies – both real and financial assets have tangible values.b) Notional variables include interest rates, inflation rates, and security indexes, whichexist as notions rather than as tangible assets.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 8≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡INSERT 1.1 The Influence of Regulations, Taxes, and Transactions Costs on FinancialInnovationIn the old days finance mainly consisted of legal issues, institutional description, and investmentrules of thumb. This changed in the middle of the twentieth century when financial economicssprang to life as an offshoot of economics. In a little over two decades, a new finance based on arigorous analytics emerged. James Tobin and Harry Markowitz’s Portfolio theory (late 1940s andearly 1950s), Franco Modigliani and Merton Miller’s M&M propositions concerning the irrelevance of afirm’s capital structure and dividend policy (late 1950s and early 1960s), William Sharpe, John Lintnerand Jan Mossin’s Capital Asset Pricing model (mid 1960s), and Fischer Black, Myron Scholes andRobert Merton’s Option Pricing model (early 1970s) established the basic theories. All of these workshave been celebrated with the Sveriges Riksbank (Bank of Sweden) Prize in Economic Sciences inMemory of Alfred Nobel, popularly known as the Economics Nobel Prize. 2, 3 Other NobelLaureates including Kenneth Arrow, Ronald Coase, Gerard Debreu, John Hicks, and PaulSamuelson also contributed to finance. One of the most well known economists of all time, JohnMaynard Keynes, studied the properties of futures prices, the role of speculators, and stockmarkets. Two of these Nobel laureates’ views concern financial innovation.Miller’s View: Regulations and Taxes Spur Financial InnovationWhat leads to revolutionary changes in financial institutions and instruments? The University ofChicago professor Merton Miller (1923-2000) argued that a major cause of financial innovations isregulations and taxes. Innovative financial securities are often created to avoid governmentregulations that prohibit otherwise lucrative transactions. And, because most countries tax incomefrom different sources (and uses) at different rates, derivative securities can be designed to savetax dollars.Miller (1986) gives several examples:• Regulation Q of the United States placed a ceiling on the interest rate that commercial bankscould pay on time deposits. Although this wasn’t a problem during much of the post-warperiod, U.S. interest rates rose above this ceiling during the late 1960s and early 1970s. Whenthis occurred, U.S. banks started losing customers. U.S. banks realized, however, thatRegulation Q did not apply to dollar-denominated time deposits in their overseas branches,and they soon began offering attractive rates via Eurodollar accounts. Interestingly,Regulation Q has long been repealed but the Eurodollar market still continues to flourish.• In the late 1960s, the U.S. government imposed a 30-percent withholding tax on interestpayments to bonds sold in the United States to overseas investors. Consequently, for non-U.S.citizens, the market for dollar-denominated bonds moved overseas to London and other moneycenters on the continent. This created the Eurobond market that still continues to grow today.• The British government restricted dollar financing by British firms, and sterling financing bynon-British firms. Swaps, transactions in which counterparties exchange one form of cashflows for another, were developed to circumvent these restrictions.• It was found in 1981 that U.S. tax laws allowed a linear approximation for computing theimplicit interest for long-term deep discount zero-coupon bonds. This inflated the presentvalue of the interest deductions so much that a taxable corporation could actually profit byissuing a zero-coupon bond and giving it away! Not surprisingly, U.S. corporations started

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 9issuing zero-coupon bonds in large numbers. Not surprisingly, this supply dwindled after theU.S. Treasury fixed this blunder.Coase’s View: Transactions Costs are a Key Determinant of Economic ActivityIn 1937 Ronald Coase, a twenty seven year old faculty member at the London School ofEconomics, published a simple but profound article entitled The Nature of the Firm. Coase arguedthat transactions incur costs which come from “negotiations to be undertaken, contracts have to bedrawn up, inspections have to be made, arrangements have to be made to settle disputes, and soon” and firms often appear when they can lower these transactions costs. With respect to financialmarkets, this logic implies that market participants often trade where they can achieve theirobjectives at minimum costs. Financial derivatives are often created so that these costs areminimized as well.The lowering of transactions costs as an economic motivation was especially important duringthe nineties and the new millennium. Changes in the economic and political landscape and the ITrevolution have made it possible to significantly lower transactions costs, even eliminating age-oldprofessions like brokers and dealers from many trading processes. For example, this motive was amajor reason why traders migrated from Treasury securities to Eurodollar markets. Eurodollarmarkets, being free from Fed regulations and the peculiarities of the Treasury security auctioncycle have fewer market imperfections and lower liquidity costs.≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 10Writing financial contracts on cash flows determined by future realizations of real assetprices, financial asset prices, or notional variables creates a derivative security. Earlyderivatives were created solely from financial and real assets. For example, in the nineteensixties, agricultural commodity based futures were the most actively traded derivativecontracts in the United States. However, as the economy has evolved notional variables andderivative securities based on these notional variables have also been created.Notional variables are often introduced to help summarize the state of the economy. Justopen the Money and Investing Section of the Wall Street Journal and you will be amazed bythe variety of indexes out there. Not only will you find regular stock price indexes like theDow-Jones and the Standard and Poor’s, but a whole range of other indexes including thosebased on technology stocks, pharmaceuticals stocks, Mexican stocks, utility stocks, bonds,and interest rates. And, notional values are often useful for the creation of variousderivatives. Perhaps the most famous example of this is a plain vanilla interest rate swapwhose underlyings are floating and fixed interest rates.Diverse Views on DerivativesIt is easy to speculate with derivatives: buy them, take huge one-sided bets, and laugh on theway to the bank or cry on the way to bankruptcy! Imprudent risk taking using derivatives isnot uncommon as illustrated by huge losses at many institutions including Procter & Gambleand Barings. People are uncomfortable with derivatives because they are complexinstruments, difficult to understand, highly leveraged, and often times not backed bysufficient collateral. High leverage means that small changes in the underlying security’sprice can cause large swings in the derivative’s value.For these reasons derivatives attract strong views from both sides of the aisle. Therenowned investors Warren Buffett and Peter Lynch dislike derivatives. Lynch once statedthat options and futures on stocks should be outlawed (Lynch, 1989). In his Chairman’sLetter to the shareholders in Berkshire Hathaway’s 2002 Annual Report, Buffettcharacterized derivatives as “time bombs, both for the parties that deal in them and theeconomic system.” These concerns were vindicated by the hundreds of billions of dollars ofderivatives related losses suffered by financial institutions during 2007 and 2008, whichcontributed to the severe economic downturn (see bio sketch of Buffett in the insert).By contrast, former Fed chairman Alan Greenspan opined in a speech delivered beforethe Futures Industry Association in 1999 that derivatives “unbundle” risks by carefullymeasuring and allocating them “to those investors most able and willing to take it,” aphenomenon that has contributed to a more efficient allocation of capital (see bio sketch ofGreenspan in the insert). And, in Merton Miller on Derivatives (1997) the Nobel Laureateassessed the impact of the “derivatives revolution” in glowing terms:Contrary to the widely held perception, derivatives have made the world a safer place, not amore dangerous one. They have made it possible for firms and institutions to deal efficientlyand cost effectively with risks and hazards that have plagued them for decades, if not forcenturies. True, some firms and some financial institutions have managed to lose substantial

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 11sums on derivatives, but some firms and institutions will always find ways to lose money.Good judgment and good luck cannot be taken for granted. For all the horror stories aboutderivatives, it’s still worth emphasizing that the world’s banks have blown away vastly morein bad real estate deals than they’ll ever lose on their derivatives portfolios.”Interestingly, in 2008 Greenspan admitted in testimony before the U.S. Congress that “hehad put too much faith in the self-correcting power of free markets and had failed toanticipate the self-destructive power of wanton mortgage lending (New York Times,Greenspan Concedes Error on Regulation, October 23, 2008).” In relation to MertonMiller’s quote, the losses in this credit crisis were due to both bad real estate loans and poorinvestments in complex derivatives that none could price and few could understand (seeChapter 26 for a detailed analysis of this crisis).Nobel Laureate physicist David Gross provides a nice analogy. He views knowledge asexpanding outward like a growing sphere and ignorance as the surface of that sphere. Withrespect to derivatives, we have accumulated significant knowledge over the past 30 years, butwith respect to the causes of tsunami-like financial crisis, there is still much for us to learn.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 12Bio Sketches of Warren Buffett and Alan GreenspanSon of a congressman from Omaha,Nebraska, Warren Buffett (born 1930)attended the Wharton School at the Universityof Pennsylvania, graduated from theUniversity of Nebraska-Lincoln and got anM.S. (Economics) from Columbia University,where he became a disciple of BenjaminGraham, the famed pioneer of value investing.Buffett filed his first tax return at 13, becamea millionaire at 32, and topped the Forbesmagazine’s list of World’s Billionaires in2008. Famous for his homespun wit, some ofhis sayings include “It’s far better to buy awonderful company at a fair price than a faircompany at a wonderful price,” “Our favoriteholding period is forever,” “Price is what youpay. Value is what you get.” A strong critic ofderivatives, Buffett nonetheless tradesderivatives when he understands the risksinvolved.Alan Greenspan (born 1926) studied clarinetat the famed Juilliard School, joined atraveling orchestra, but returned to study atNew York University where he got all hisdegrees in economics, including a Ph.D. Hefounded an influential economic consultingfirm, served as the Chairman of the U.S.president’s Council of Economic Advisors(1974-77), and Chairman of the FederalReserve Board (1987-2006). Greenspanearned an early reputation for his competenthandling of the Stock Market Crash of 1987and was revered for his deep understanding ofthe markets. Awarded the highest civilianaccolade of the U.S., the Presidential Medalof Freedom, Greenspan’s steadfast support forfree markets and opposition to greaterregulation of derivatives came under heavycriticism during the financial crisis of 2008-10.Sources: Warren Buffett from www.forbes.com/lists/2008/10/billionaires08_Warren-Buffett_C0R3.html; quotes fromwww.brainyquote.com/quotes/authors/w/warren_buffett.html, and Alan Greenspanbiography from www.alangreenspan.org/.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 13Applications and Uses of DerivativesDerivatives trade in zero net supply markets, where each buyer has a matching seller. Whenhedging with a derivative, the other side of the transaction (counterparty) may be using itfor speculative reasons. Hedging and speculation are often “two sides of the same coin.” Andit is a zero-sum game because one trader’s gain is the other’s loss. Example 1.1 illustratesthese concepts:EXAMPLE 1.1 Hedging and Speculation in a Derivative Transaction• April is the time when income tax returns are due. It is also the beginning of the corngrowing season, the commodity used in our example.• Consider Mr. Short, a farmer in the Midwestern United States. Short combines land,labor, seeds, fertilizers, and pesticides to produce cheap corn. He hopes to sell his cornharvest in September.• Expertise in growing corn does not provide a crystal ball for forecasting September cornprices. If Short likes sleeping peacefully at night, he may decide to lock in the sellingprice for September corn when he plants it in April.• To see how this is done, let’s assume that everyone expects corn to be worth $10.00 perbushel in September. Ms. Long, a trader and speculator, offers to buy Short’s corn inSeptember for $9.95 per bushel, which is the forward price.• To remove his risk, Short readily agrees to this forward price. Together they have createda forward contract—a promise to trade at a fixed forward price in the future. AlthoughShort expects to lose 5 cents, he is happy to fix the selling price. The forward contract hasremoved output price uncertainty from his business. Short sees 5 cents as the insurancepremium he pays for avoiding unfavorable future outcomes. Having hedged his cornselling price, Short can focus on what he knows best which is growing corn.• Ms. Long is also happy—not that she is wild about taking risks. But she is rational andwilling to accept some unwanted risk expecting to earn 5 cents as compensation for thisactivity. Later in the book you will see how a speculator may manage her risks byentering into another transaction at a better price, but on the other side of the market. gThis simple example illustrates a key principle of historical importance—it was preciselyto help farmers hedge grain prices that the first modern derivatives exchange, the ChicagoBoard of Trade, was established in 1848. Even the bitterest critics of derivatives haveacknowledged this beneficial role.Nowadays, the uses of derivatives are many. Consider these possibilities:• Hedging output price risk: A gold mining company can fix the selling price of gold byselling gold futures.• Hedging input cost: A sausage maker can hedge input prices by buying pork bellyfutures.• Hedging currency risk: An American manufacturer buying machines from Germany forwhich the payment is due in three months can remove price risk from the dollar / euroexchange rates by buying a currency forward contract.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 14• Hedging interest rate risk: A pension fund manager who is worried that her bondportfolio will get clobbered by rising interest rates can use Eurodollar futures (or optionson those futures) to protect her portfolio.• Protecting a portfolio against a market meltdown: A money manager whose portfolio hasreaped huge gains can protect these gains by buying put options.• Avoiding market restrictions: A trader can avoid short selling restrictions that anexchange might impose by taking a “sell” position in the options or the futures market.• Ruining oneself: And, a wretch can gamble away his inheritance with derivatives.Before you finish this book, you will have a better understanding of the role derivativesplay in each of these scenarios, except for the last one. The proclivity to gamble and losearises from the depths of the human psyche to which we have no special understanding.A Quest for Better ModelsA great recognition for derivatives came in 1997 when Robert Merton and Myron Scholeswon the Nobel Prize in Economics for developing the Black-Scholes-Merton (BSM) modelfor option valuation. A co-originator of the model, Fischer Black, died earlier and missedreceiving the prize, which is not given posthumously. This formula has become a staple ofmodern option pricing. Although extremely useful—option traders have it programmed intotheir computers – the BSM model makes a number of restrictive assumptions. Theserestrictive assumptions limit the application of the model to particular derivatives, thosewhere interest rate risk is not relevant (the BSM assumptions will be discussed in laterchapters).Subsequent researchers have relaxed these restrictive assumptions and developed pricingmodels suitable for derivatives with interest rate risk. The standard model used on WallStreet for this application is the Heath-Jarrow-Morton (HJM) model. The HJM model canbe used to price interest rate derivatives, long-lived financial contracts, and credit derivatives.Credit derivatives are among the newest class of derivatives to hit Wall Street. Started in theearly 1990s, they now compose a huge market, and they are the subjects of intense publicdebate, following the 2007 credit crisis and their role therein.Introductory texts avoid the HJM model due to its complex mathematics. A uniquecontribution of our book is a simple intuitive presentation of the HJM model and one of itspopular versions, known as the Libor model. Civilization is replete with examples of today’sesoteric notions attaining widespread understanding—what once belonged to specialists soonbelongs to the public. This happened to the BSM model. Learning HJM and the Libor modelswill give you an advantage in trading derivatives—it will help you to understand the presentand be prepared for the future.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 15

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 16Why develop and study better pricing models? Suppose you trade a variety of securitiesmany times a day. If your models are better, you have an edge over your competitors indetermining fair value. Over many transactions, when trading based on fair value your edgewill pay off. Investment banking and Wall Street firms have no choice but to use the bestmodels. It’s just too important for their survival. Powerful models also help traders managerisks.1.4 Defining, Measuring, and Managing RiskRisk is an elusive concept and it’s hard to define. In finance and business risk can be definedand measured in many ways, none of them completely universal. Risk often depends on theuser’s perspective. We begin by looking at risk from a regulator’s eyes. Next, we discuss riskfrom an individual’s as well as an institutional trader’s viewpoint. Finally, we discuss riskfrom the corporate management perspective.1.5 The Regulators’ Classification of RisksIn 1994 the international banking and securities regulators issued guidelines for supervisingthe booming derivatives market. The Basel Committee on Banking Supervision and theInternational Organization of Securities Commissions (IOSCO) recommended that for astable world financial system, the national regulators must ensure that banks and securitiesfirms have adequate controls over the risks they incur when trading derivatives. 4The Basel Committee’s Risk Management Guidelines for Derivatives (July 1994)identified the following risks in connection with an institution’s derivative activities.IOSCO’s Technical Committee also issued a similar paper at the time (for both reports seewww.bis.org/publ):• “Credit risk (including settlement risk) is the risk that a counterparty will fail to perform on anobligation.• Market risk is the risk to an institution’s financial condition resulting from adverse movementsin the level or volatility of market prices. This is the same as price risk.• Liquidity risk in derivative activities can be of two types: one related to specific products ormarkets and the other related to the general funding of the institution’s derivative activities. Theformer is the risk that an institution may not be able to, or cannot easily, unwind or offset aparticular position at or near the previous market price because of inadequate market depth ordisruptions in the marketplace. Funding liquidity risk is the risk that the institution will be unableto meet its payment obligations on settlement dates or in the event of margin calls (which, weexplain later, is equivalent to coming up with more security deposits).• Operational risk [also known as operations risk] is the risk that deficiencies in informationsystems or internal controls will result in unexpected loss. This risk is associated with humanerror, system failures and inadequate procedures and controls.• Legal risk is the risk that contracts are not legally enforceable or documented correctly.”

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 17Managing market or price risk is the subject of this book. Initially, this topic attracted theattention of academics and practitioners alike. It still remains the most important risk for usto understand and to manage. The other risks only appear when normal market activityceases. Credit risk evaluation is currently a subject of advanced research. 5 As we will explainlater, exchange-traded derivative markets are so designed that they are nearly free from creditrisk. Liquidity risk is a persistent problem for traders who choose markets where securitiesare easily bought and sold. Chapter 3 discusses what makes markets illiquid. Operational riskis a reality one has to live with. It is part of running a business and appropriate managementchecks and balances reduce it. Legal risk isn’t a problem for exchange-traded contracts;however, it’s a genuine problem in OTC markets. Let’s leave this topic for the courts and lawschools.This jargon-laded Basel Committee report also cited the need for appropriate oversight ofderivatives trading operations by boards of directors and senior management, and the needfor comprehensive internal control and audit procedures. It urged national regulators toensure that firms and banks operate on a basis of prudent risk limits, sound measurementprocedures and information systems, continuous risk monitoring, and frequent managementreporting. The Basel Committee reports have been extremely influential in terms of theirimpact on derivatives regulation. We will return to the issues again in the last chapter of thebook, after mastering the basics of derivative securities.1.6 Portfolio Risk ManagementLet us examine some issues in connection with portfolio risk management from theperspective of an individual or institutional trader. One of the first pearls of wisdom learnt infinance is: to earn higher expected returns, one has to accept higher risks. This maximapplies to the risk of a portfolio, called portfolio risk, which is measured by the portfolioreturn’s standard deviation.This portfolio risk, when applied to a single security, can be broken into two parts: (1)nondiversifiable risk that comes from market wide sources, and (2) diversifiable risk that isunique to the security and can be eliminated via diversification. Pioneering works byMarkowitz, Sharpe, Lintner and Mossin gave us the Capital Asset Pricing Model – thealphas, the betas – ideas and concepts used by market professionals and finance academics.Modern portfolio theory encourages investors to construct a portfolio in a top downfashion. This involves three steps: (1) do an asset allocation, which means deciding how tospread your investment across broad asset classes such as cash, bonds, stocks, and real estate,(2) do security selection, which means deciding which securities to hold within each assetclass, and (3) periodically revisiting these issues and rebalancing the portfolio accordingly.Portfolio risk management is critical for investment companies like hedge funds and mutualfunds. These financial intermediaries receive money from the public, invest them in variousfinancial securities, and pass on the gains and losses to investors after deducting expensesand fees. Mutual funds have more restricted investment policies and lower management feesthan do hedge funds. Hedge funds typically make leveraged high-risk bets and are only opento wealthy investors who may scream and shout if their investments decline, but who will notbecome destitute.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 181.7 Corporate Financial Risk ManagementRisks that Businesses FaceTo understand the risks that businesses face, let’s take a look at a typical company’s balancesheet, a vital accounting tool that gives a snapshot of its financial condition by summarizingits assets, liabilities and ownership equity on a specific date. An asset provides economicbenefits to the firm while a liability is an obligation that requires payments at some futuredate. The difference between the two accrues to the owners of the company as shareholder’sequity (hence the identity assets equals liabilities plus shareholder’s equities). Depending onwhether they are for the short term (one year or less) or for the long haul, assets andliabilities are further classified as current or non-current, respectively. 6 Table 1.1 illustratessome risks that affect different parts of a balance sheet.We see that a typical company faces three kinds of risks: currency risk, interest raterisk, and commodity price risk. These are the three components of market risk.(a) If a big chunk of your business involves imports and exports or if you have overseasoperations that send back profits, then exchange rate risk can help or hurt. This is a risk thatyou must understand and decide to hedge or not to hedge using currency derivatives.(b) No less important is interest rate risk. It is hard to find companies like Microsoft withtens of billions of dollars in cash holdings that can be quickly deployed for value-enhancinginvestments. Most companies are cash-strapped. Interest rate fluctuations therefore affecttheir cost of funds and influence their investment activities. Interest rate derivatives offermany choices for managing this risk.(c) Unless a finance company, most businesses are exposed to fluctuations in commodityprices. A rise in commodity prices raises the cost of buying inputs that may not always bepassed on to customers. For example, if crude oil prices go up, so does the price of jet fueland an airline’s fuel costs. Sometimes airlines levy a fuel surcharge, but it is usuallyunpopular and often rolled back. Another option is to hedge such risks by using oil-pricederivatives.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 19TABLE 1.1 Risks that a Business FaceAssetsCurrent assets• Cash and cash equivalents (interest raterisk)• Accounts receivable (interest rate risk,currency risk)• Inventories (commodity price risk)Long-term assets• Financial assets (interest rate risk,market risk, currency risk)• Property, plant and equipment (interestrate risk, commodity price risk)Liabilities• Accounts payable (interest rate risk andcurrency risk)• Financial liabilities (interest rate risk,currency risk)• Pension fund obligations (interest raterisk, market risk)Equity• Ownership shares

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 20Non-hedged RisksIn spite of the development of many sophisticated derivatives useful for hedging (andspeculation), some risks are difficult if not impossible to hedge. For example, it is very hardto hedge operational risk. Recall that operational risk is the risk of a loss due to events likehuman error, fraud, or faulty management. Although a bank can buy insurance to protectitself from losses due to fire, no insurance company will insure a bank against the risk that atrader presses the wrong computer button and enters the wrong bond trade. For examples ofsuch operational risk losses, see Chapter 26. Other difficult or impossible to hedge risksinclude losses due to changes in commodity prices for which there are no futures contractstrading.We will now take a bird’s eye view of how a blue chip company uses derivatives for riskmanagement.Risk Management in a Blue Chip CompanySFAS (Statement of Financial Accounting Standards) No. 133, “Accounting forDerivative Instruments and Hedging Activities,” as amended, requires U.S. companies toreport all derivative instruments on the balance sheet at fair value and establishes criteria fordesignation and effectiveness of hedging relationships. Let us take a look at Form 10-K(Annual Report) filed with the U.S. Securities and Exchange Commission by Procter &Gamble, a giant company that owns some of world’s best-known consumer products brands(source: www.pg.com/content/pdf/home/PG_2008_AnnualReport.pdf on December 28,2008).P&G heavily uses derivatives for risk management. A careful reading of this annualreport reveals several interesting characteristics of P&G’s risk management activity:• P&G is exposed to the three categories of risks that we just mentioned.• P&G consolidates these risks and tries to naturally offset them, which means some riskscancel each other. It then tries to hedge the rest with derivatives.• P&G does not hold derivatives for trading purposes.• P&G monitors derivative positions using techniques including market value, sensitivityanalysis and value at risk (VaR). When data is unavailable, P&G uses reasonable proxiesfor estimating volatility and correlations of market factors.• P&G uses interest rate swaps to hedge its underlying debt obligations and enters intocertain currency interest rate swaps to hedge the Company's foreign net investments.• P&G manufactures and sells its products in many countries. It mainly uses forwards andoptions to reduce the risk that the Company's financial position will be adversely affectedby short-term changes in exchange rates (corporate policy limits how much it can hedge).• P&G uses futures, options, and swaps to manage price volatility of raw materials.• P&G designates a security as a hedge of a specific underlying exposure and monitors itseffectiveness in an ongoing manner.• P&G’s overall currency and interest rate exposures are such that the Company is 95%confident that fluctuations in these variables (provided they don’t deviate from their

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 21historical behavior) would not materially affect its financial statements. P&G neitherexpects significant risk from commodity hedging activity, nor from credit risk exposure.• P&G grants stock options and restricted stock awards to key managers and directors(employee stock options are valued by using a binomial model that you will learn toimplement in <strong>Part</strong> III of the book).How does one understand, formulate, and implement hedging and risk managementstrategies like the ones adopted by Procter & Gamble? Read on for that is a major purpose ofthis book.1.8 Risk Management Perspectives in This BookThe Basel Committee’s risk nomenclature has become the standard way that marketparticipants see, classify, and understand different types of risks in derivatives markets. Inthis book we restrict our focus on market or price risk. For this we will usually wear fourseparate hats and look at risk management from the perspectives of an individual trader, afinancial institution, a non-financial corporation, and a dealer.In early chapters we start by examining financial securities and their markets from anindividual trader’s standpoint. This simple and intuitive approach makes it easier tounderstand the material. It’s also historically correct because many markets, including thosefor stocks, futures, and options, were started by individual traders.But today’s derivatives markets have become playing fields for financial institutions.This is no surprise because as an economy develops, a greater share of its gross domesticproduct comes from services, of which financial institutions are a major constituent. Theseinstitutions generally engage in sophisticated ways of investing. We discuss derivatives andrisk management from a financial institution’s viewpoint because you may eventually beworking for one; or, at the very least, you are likely to have financial dealings with them on aregular basis. The term “institution” is a catchall phrase that includes commercial andinvestment banks, insurance companies, pension funds, foundations, finance companies likemutual funds and hedge funds. In later chapters, we study swaps and interest rate derivatives,whose markets are the near-exclusive domain for financial (and non-financial) institutions.Non-financial companies do much more than financial companies do. Non-financialsgive us food, develop medicines, build homes, manufactures cars, refine crude oil to creategasoline, generate electricity, provide air travel, create household chemicals, and makecomputers to save and express our ideas. They buy one or more inputs to produce one ormore outputs and different kinds of risks (including exchange rate risk, interest rate risk, andcommodity price risk) can seriously affect their businesses. This takes us to financialengineering, which applies engineering tools to develop financial contracts to meet the needsof an enterprise. This is our third hat: looking at derivatives from a non-financial company’srisk management perspective.Sometimes we take a dealer’s perspective. A dealer is a financial intermediary who postsprices at which she can buy (wholesale or bid price) or sell (retail or ask price) securities toher customers. Trying to make a living from the spread, or the difference between these twoprices, the dealer focuses on managing books, which means carefully controlling her

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 22inventory of securities so as to minimize risks. Both an individual trader and a financialinstitution can play a dealer’s role in financial markets.These four perspectives aren’t ironclad and we will flit from one to another as thediscussion demands. In the final analysis, this shifting from one category to another isn’t badfor the aspiring derivatives expert. In the words of the immortal bard William Shakespeare’sHamlet (if we take the liberty of forgetting about spirits and applying this to the mundane),“There are more things in heaven and earth, Horatio, than are dreamt of in your philosophy.”So, stay awake and study derivatives, develop a sense for risk situations, understand themarkets, learn pricing models, and know their applications.1.9 Summary1. Derivatives are financial securities that derive their value from some underlying assetprice or index. Derivatives are often introduced to hedge risks caused by increasinglyvolatile asset prices. For example, during the last three decades of the twentieth century,we have moved away from a regime of fixed to a world of floating exchange rates. Themarket determined foreign exchange rates increased their volatility, creating the need forforeign currency derivatives.2. In today’s interconnected global economy, risks coming from many different sources canmake or break businesses. Derivatives can both magnify risk (leverage and gambling) orreduce risk (hedging). While gambling with derivatives remains popular in some circlesand derivatives mishaps grab newspaper headlines, most traders prudently use derivativesto remove unwanted risks affecting their business.3. There are many types of risks. Besides market risk, the regulators are concerned aboutcredit risk, liquidity risk, operational risk, and legal risk. Though unglamorous, thesefactors can eat away profits, and jolt the running of smooth functioning derivativesmarkets.4. Derivatives are very useful for managing the risk of a portfolio, which is a collection ofsecurities. Portfolio risk management is important for both individual investors as well asfinancial companies like hedge funds and mutual funds.5. Many businesses are exposed to exchange rate risk, interest rate risk, and commodityprice risk and use derivatives to hedge them. U.S. companies report derivatives usage andexposure in 10K forms filed annually with the Securities and Exchange Commission(SEC). For example, Procter & Gamble reports that it is exposed to exchange rate risk,interest rate risk, commodity price risk, and credit risk. P&G consolidates risks andattempts to naturally offset them, and tries to hedge the remaining risk with derivatives.6. We look at risk management from several different perspectives: that of an individualtrader, a financial institution, a non-financial corporation, and a dealer. Theseperspectives aren’t ironclad and we will flit from one to other as the discussion demands.

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 231.10 CasesHamilton Financial Investments: A Franchise Built on Trust (Harvard Business School Case#198089-PDF-ENG).The case discusses various risks faced by a finance company that manages mutual funds andprovides discount brokerage services.Grosvenor Group Ltd. (Harvard Business School Case #207064-PDF-ENG).The case considers whether a global real estate investment firm should enter into a propertyderivative transaction to alter its asset allocation and manage its business.Societe Generale (A and B): The Jerome Kerviel Affair (Harvard Business School Cases#110029 and 110030-PDF-ENG).The case illustrates the importance of internal control systems in a business environment thatinvolves a high degree of risk and complexity in the context of a derivatives trader indulgingin massive directional trades that was undetected for over a year.1.11 Questions and Problems1.1) What is a derivative security? Give an example of a derivative and explain why it is aderivative.1.2) List some major applications of derivatives.1.3) Evaluate the statement: “Hedging and speculation go hand in hand in the derivativesmarket.”1.4) What risks does a business face?1.5) Explain why financial futures have replaced agricultural futures as the most activelytraded contracts.1.6) Explain why derivatives are zero-sum games.1.7) Explain why all risks cannot be hedged? Give an example of a risk that cannot behedged.1.8) What is a notional variable and how does it differ from an asset’s price?

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 241.9) Explain how derivatives give traders high leverage?1.10) Explain the essence of Merton Miller’s argument explaining what spurs financialinnovation.1.11) Explain the essence of Ronald Coase’s argument explaining what spurs financialinnovation.1.12) Does more volatility in a market lead to more use of financial derivatives? Explain youranswer.1.13) When the international banking regulators defined risk in their 1994 report, whatdefinition of risk did they have in mind? How does this compare with the definition of riskfrom modern portfolio theory?1.14) What’s the difference between real and financial assets?1.15) Explain the differences between market risk, credit risk, liquidity risk, and operationsrisk.1.16) Briefly present Warren Buffett and Alan Greenspan’s views on derivatives.1.17) Consider the situation in sunny Southern California in 2005 where house prices haveskyrocketed over the last few years and are at an all time high. Nathan, a software engineer,buys a second home for $1.5 million. Five years back, he bought his first home in the sameregion for $350,000 and financed it with a 30-year mortgage. He has paid off $150,000 of thefirst loan. His first home is currently worth $900,000. Nathan plans to rent out his first homeand move in the second. Is Nathan speculating or hedging?1.18) During the early years of the new millennium, many economists described the past fewdecades as the period of “The Great Moderation.” For example,• An empirical study by economists Olivier Blanchard and John Simon found that “thevariability of quarterly growth in real output (as measured by its standard deviation) haddeclined by half since the mid-1980s, while the variability of quarterly inflation haddeclined by about two third.”• An article entitled “Upheavals Show End of Volatility Is Just a Myth” in the Wall StreetJournal dated March 19, 2008, observed that an important measure of stock marketvolatility, “the Chicago Board Options Exchange’s volatility index, had plunged about75% since October 2002, the end of the latest bear market, through early 2007.” Thejournal article also noted that “In the past 25 years, the economy has spent only 16months in recession, compared with more than 60 months for the previous quartercentury.”a) What were the explanations given for the Great Moderation?

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 25b) Does the experience of the U.S. economy during January 2007 to December 2010 stilljustify characterizing this as a period of Great Moderation? Report (1) quarterly values forchanges in the gross domestic product, (2) quarterly values for changes in the inflation rate,and (3) volatility index VIX’s value during this period to support your answer.1.19) Drawing on your experience, give examples of two risks that they can easily hedge andtwo risks that they cannot hedge.1.20) Download Form 10-K (Annual Report) filed by Procter & Gamble from the company’swebsite or the U.S. Securities and Exchange Commission’s website. Answer the followingquestions based on a study of this report:a) What are the different kinds of risks that P&G is exposed to?b) How does P&G manage its risks? Identity and state the use of some derivatives in thisregard.c) Name some techniques that P&G employs for risk management.d) Does P&G grant employee stock options? If so, briefly discuss this program. Whatvaluation model does the company use for valuing employee stock options?Endnotes1 Courses in Macroeconomics, Money and Finance, Banking, or Financial Markets and Institutions help tounderstand how central banks fine tune the economy using the tools of monetary policy: (1) setting the rate atwhich member banks can borrow from it (called the discount rate in the U.S.), (2) fixing bank reserverequirements (which is the percentage of money that a member bank must keep in its vault to support the loansit has made), and (3) buying and selling of government debt / bonds (Open Market Operations).2 Named after the Swedish inventor-industrialist Alfred Bernhard Nobel (1833-96). While working in Paris,Nobel came across the highly explosive liquid nitroglycerine. Despite some setbacks he managed to make itsafer by adding a chalk like rock and patented it under the name of dynamite. Dynamite made him very wealthyand after his death, he left the bulk of his fortune to fund annual prizes in Physics, Chemistry, Physiology orMedicine, Literature, and Peace. (Based on Alfred Nobel—His Life and Work, retrieved from the NobelFoundation’s website).3 While celebrating its 300 th anniversary in 1968, the Swedish central bank (Sveriges Riksbank) established TheSveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. The prize is awarded andcelebrated along with the Nobel prizes every December in Sweden.4 In 1974 the Group of Ten countries’ central-bank governors established the Basel Committee on BankingSupervision. The Basel (or Basle) Committee formulates broad supervisory standards and recommendsstatements of best practice in the expectation that individual authorities will take steps to implement themthrough detailed arrangements - statutory or otherwise - which are best suited to their own national systems (seeHistory of the Basel Committee and its Membership, www.bis.org/bcbs/history.htm). The InternationalOrganization of Securities Commissions, which originated as an inter-American regional association in 1974,was restructured as IOSCO in 1983. It has evolved into a truly international cooperative body of securitiesregulators (see www.iosco.org/about/about).5 Companies like the Moody’s and the Standard and Poor assess the credit risk of a company or a securityoffering by assigning a credit rating. The HJM model provides a way of taking such credit ratings and buildingthem into a pricing model (Jarrow and Turnbull, 2000).6 Current assets are cash, cash equivalent, assets held for collection, sale, or consumption within theenterprise's normal operating cycle; or assets held for trading within the next 12 months. All other assets arenoncurrent [see 1.57]. Current liabilities are those to be settled within the enterprise's normal operating cycleor due within 12 months, or those held for trading, or those for which the entity does not have an unconditionalright to defer payment beyond 12 months. Other liabilities are noncurrent [see IAS 1.60]. These definitions

© Jarrow & Chatterjea 2012 Derivatives and Risk Management Chapter 1, Page 26appear under the “Statement of Financial Position” in “Summary of IAS 1.” IAS refers to “InternationalAccounting Standards” that were developed by the IASC. (Source: www.iasplus.com)

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 1Chapter 2Interest RatesJanuary 5, 20122.1 Introduction2.2 Rate of ReturnINSERT 2.1 Conventions and Rules for Rounding, Reporting Numbers, andMeasuring Time2.3 Basic Interest Rates—Simple, Compound, and Continuously Compounded2.4 Discounting (PV) and Compounding (FV)—Moving Money across TimeINSERT 2.2 Moving Multiple Cash Flows across Time2.5 U.S. Treasury Securities2.6 U.S. Federal Debt Auction MarketsINSERT 2.3 Discriminatory Auctions vs. Uniform Price Auctions2.7 Different Ways of Investing in Treasury SecuritiesThe Treasury Auction and Its Associated MarketsThe Repo and the Reverse Repo MarketINSERT 2.4 A Repurchase AgreementInterest Rate Derivatives2.8 Treasury Bills, Notes, Bonds, and STRIPs2.9 Libor vs. Bbalibor2.10 Summary2.11 Cases2.12 Questions and Problems

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 22.1 IntroductionGentlemen prefer bonds. Perhaps you are chuckling at our “misquote” of the famous MarilynMonroe movie title “Gentlemen Prefer Blondes.” In fact former U.S. Treasury SecretaryAndrew Mellon made this observation about bonds many decades before the movie. 1 In alllikelihood, he said this because bonds are considered safer than stocks. Corporations maymiss dividend payments on stocks, but bonds are legally bound to pay promised interest onfixed dates. If the interest payments are not paid, default occurs and the corporations arevulnerable to lawsuits and bankruptcy. However, at this stage in our presentation we willassume that all bonds considered have no default (credit) risk. This greatly simplifies theanalysis. Consequently the bonds considered in this chapter are best viewed as U.S. Treasurysecurities. Credit risk will be considered only later in the book (in Chapter 26) after we havemastered default free securities.Most U.S. bonds make interest payments according to a fixed schedule. Hence bonds arealso called fixed income securities. Bonds are useful for moving money from one period toanother. Does money retain its value over time? Not really. Inflation, the phenomenon of arise in the general price level, chips away money’s buying power little by little, year by year.A popular measure of the U.S. inflation rate is the change in the consumer price index. Ateach date the CPI measures the price of a fixed bundle of nearly 200 goods and services thata typical U.S. resident consumes. Unless you are buying computers and electronic gizmoswhose prices have drastically fallen due to technological advances, a hundred dollar billdoesn’t quite buy as much as it did ten years ago. To reduce the cost of inflation, moneyearns interest. Instead of stashing cash under a mattress, one can put it into a savings accountand see it grow safely.What then is an interest rate? An interest rate is the rate of return earned on moneyborrowed or lent. Ponder and you realize that the cost of borrowing a hundred dollar bill isthe interest of perhaps $5 per year that’s paid to the lender. Suppose that the inflation rate is 3percent per year, which is close to the US inflation rate in the new millennium. If the interestrate for risk-free loans is 3.10 percent per year, then borrowing is incredibly cheap; while 30percent for such loans would be awfully expensive. Interest rates partly compensate thelender for inflation and partly reward her for postponing consumption to a later date.There are many ways of computing interest rates. Simple, compound, and continuouslycompounded rates are the three basic kinds. Each interest rate concept has its own use infinance theory as well as in practice. There are interest rates for risky as well as risklessloans. The first interest rates studied in this book are risk-free rates.

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 3

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 4How do you find risk-free interest rates? The United States Government Treasurysecurities (the “Treasuries”) are considered default free because of the taxing authority of themighty federal government. Risk-free interest rates of various maturities can be easilyextracted from their prices. We briefly explain how to do this extraction. Then, we explainhow the U.S. Treasury Securities market works, and describe the bills, notes, bonds, andSTRIPS that trade in these markets. We conclude this chapter with a discussion of LondonInterbank Offered Rates (libor), a key rate used in the global interest rate derivatives market.We begin by introducing the concept of a rate of return. This, in turn, will lead us to adiscussion of the three basic types of interest rates.2.2 Rate of ReturnIn finance we constantly talk about rates of return computed from prices. Rates of returnmeasure how much an investment has earned. For example, if you buy a security for $50today and sell it for $52 after six months, then you have earned $2 on your investment. Therate of return earned on your investment over this time period is52 − 5050= 0.04 or 4 percent (when multiplied by 100 to express as a percentage).€It is hard to compare rates of return unless we explicitly mention the time interval overwhich they are computed. We need to know whether we are computing these over sixmonths, or 37 weeks, or 91 days. Consequently, it is worthwhile to standardize by computingthem over a year. In this case, the “annualized rate of return” is:⎛ 12⎞⎜ ⎟ × 0.04 = 0.08 or 8 percent per year.⎝ 6 ⎠€A more accurate value for the rate of return may be obtained by looking at the actualnumber of days for which the money was invested since there are 365 days in a year (somecomputations use 366 days in case of a leap year). Assuming that there were 181 days in thissix-month period, we find the (annualized) rate of return asor 8.07 percent per year.The capital gain, the difference between the selling (final) and buying (initial) price, isthe $2 that you earned on this investment. But there could be other cash flows at intermediatedates. For example, bonds make coupon payments and stocks pay dividends. If our $50investment also received $0.50 interest at some intermediate date, then the (annualized) rateof return is

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 5or 10.08 percent per year.A profit of $2.50 is made on your investment. Expenses like brokerage account fees cancut into your profit. A profit occurs when there’s an overall gain from an investment orbusiness activity. Businesses define it as total revenue minus total costs and record a profit ifthis is a positive number, a loss if it’s negative. In finance, we defineProfit or loss = (Selling price + Income) – (Buying price + Expenses) … (2.1)where the selling price is the final price, the buying price is the initial price, and the profit orloss happens if the result is positive or negative, respectively. 2We generalize this to develop a formula for computing the annualized rate of return(which is also called arithmetic return):RESULT 2.1 Annualized Rate of ReturnThe annualized arithmetic rate of return is⎛= 365 ⎞ ⎛⎜ ⎟ × ⎜⎝ T ⎠ ⎝profit or lossBuying price⎞⎟ … (2.2)⎠where T is the time interval, measured by the number of days over which theinvestment is held andincome € and expenses denotes positive or negative cash flows, respectively fromthe investment(rate of return is often multiplied by 100 and expressed as a percentage).We need some reasonable conventions regarding rounding and reporting numbers and formeasuring time which we use throughout the book. They are discussed in Insert 2.1.

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 6≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡INSERT 2.1 Conventions and Rules for Rounding, Reporting Numbers, and MeasuringTimeTo maintain consistency and to minimize unwanted errors, we follow some rules for rounding andreporting numbers. We usually round to four places after the decimal point in calculations:- If the number in the 5 th place is more than 5, then add 1 to the 4 th digit; e.g., 0.23456 becomes0.2346.- If the number in the 5 th place is less than 5, then keep it unchanged; e.g., 0.11223 becomes0.1122.- If it’s exactly 5 and there are numbers after it, then add 1 in the 4 th place; e.g., 0.123452becomes 0.1235.In some contexts we need to round to more places after the decimal point. The context willindicate when this is appropriate.Though we typically report numbers rounded to four places after the decimal point, the finaldollar result is usually rounded to two places after the decimal. The dollar sign “$” is usuallyattached only in the final answer. We sometimes omit dollar signs from the prices when the contextis understood.Different markets follow different time conventions. Treasury bill prices use the actual numberof days to maturity under the assumption that there are 360 days in a year. Many banks payinterest that gets compounded daily. Swaps use simple interest applied to a semiannual period.And, many formulas use a continuously compounded rate.Most models measure time in years. If we start computing at time 0 and the security matures attime T, then it has a life of T years. If we start our clock at time t, then the life is (T – t) years. Weprefer to use the first convention in our formulas. Time periods are converted by the followingconventions:- If the time period is computed in days, then use the exact number of days and assume 365 daysin the year (unless noted otherwise); e.g., 32 days will be 32/365 = 0.0877 year.- If the time period is computed in weeks, use 52 weeks in the year; e.g., 7 weeks will be 7/52 =0.1346 year.- If the time period is computed in months, use 12 months in the year; e.g., 5 months will be 5/12= 0.4167 year.To summarize, we get the following rules and conventions:Rules of Rounding, Conventions of Reporting Numbers and Measuring Time• Round to four places after the decimal point in calculations.• The final dollar result is rounded to two places after the decimal with the $ sign attachedonly in the final answer.• Time is measured in years. If we start computing from time 0 and the security matures attime T, then it has a life of T years; if the clock starts at time t, then the security has a lifeof (T – t) years.≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡≡

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 72.3 Basic Interest Rates—Simple, Compound, and Continuously CompoundedAn interest rate is the rate of return promised (in case the money is yet to be lent) or realized(in case the money had already been lent) on money loans. There seem to be a zillion ways ofcomputing interest. Financial institutions like banks and credit card companies have devisedclever ways of charging interest, which appear less than they really are. That’s why manygovernments came up with a standard yardstick to help customers understand interest costs.For example, in the USA, all lenders have to disclose the rate they are charging on loans interms of an APR (Annual Percentage Rate), a rate that annualizes using a simple interestrate.There are many different ways of computing interest rates. For a certain quoted rate, therealized interest can vary with: (1) the method of compounding, (2) the frequency ofcompounding (yearly, monthly, daily, or continuously compounded), (3) the number of daysin the year (52 weeks, or 360 days or 365, or 366 for a leap year), (4) the number of days ofthe loan (actual, or in increments of months), as well as (5) other terms and conditions(collect half of the loan now, the other half later; or, keeping a compensating balance). Ratherthan bombard you with a list of interest rate conventions for different markets, we focus onthe three basic methods: simple, compound, and continuously compounded interest rates.Understanding these concepts will lead to discounting and compounding, which will enableus to transfer cash flows over time.A simple interest rate is used in some sophisticated derivatives like caps and swaps.Money is not compounded under simple interest rates. An annual rate is quoted. Whencomputed over several months, a fraction of the annual rate is used.Compound interest is when interest is earned on both the original principal as well asthe accrued interest. Banks offer interest on daily balances that you keep in your account.When compounding interest, divide the annual rate by the number of compounding intervals(daily, weekly, monthly) and multiply these interest components together to compute the loanvalue at maturity.Continuous compounding pays interest on a continuous basis. One can view continuouscompounding as the limit of compound interest when the number of compounding intervalsgets very large and the time between earning interest gets very small! Example 2.1demonstrates these three methods of interest computation.EXAMPLE 2.1 Simple, Compound, and Continuously Compounded Interest RatesSimple interest rates• Suppose you invest $100 today and 6 percent is the simple interest rate per year.- A year from now it will grow to $106.- After 6 months it will grow to- After 1 day it will be- After 250 days it will be

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 8• Summoning the power of algebra, we replace numbers with symbols to develop aformula for money growth under simple interest. Here L = $100 is the principal, which isthe original amount invested. It is invested at the rate of interest i = 6 percent per yearfor T years, where T is measured in years or a fraction of a year. In the aboveexpressions, T takes the values 1, 1/2, 1/365, and (250/365), respectively. Consequentlyunder simple interest, L dollars invested at i percent per year becomes after one year L(1+ i) and after T years L(1 + iT). This is illustrated in Figure 2.1. Notice that simpleinterest is also the rate of return. This is verified by plugging the values in relation (2.2)to get (365/365)[L(1 + iT) – L]/L = i as T is 1 year.Compounded interest rates• What about interest earning interest? This leads to the notion of compounding, whichinvolves computing interest on both the principal as well as the accumulated interest. Wesplit the time period T over which we are investing our money into m intervals. Withineach interval, money earns simple interest. At the end of each interval, the principal andaccumulated interest becomes the new principal on which interest is earned.- If the interest is compounded semiannually, one year from now $100 will grow to 3€100 × [ 1+ 0.06( 1 2)] × [ 1+ 0.06( 1 2)]=100 × [ 1+ 0.06( 1 2)] 2= $106.09.- Compounding 3 times a year, one year from now it will grow to.- What about daily compounding that your local bank offers? With daily compounding,a year from now the amount invested will grow to- Let us now consider loans for T years. Continuing with our example of dailycompounding, after 250 days (or, 250/365 year) $100 will grow to

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 9FIGURE 2.1 Simple, Compound, and Continuously Compounded Interest RatesSimple Interest(interest does not earn interest)Time 0 1 year Time T| | |L L(1 + i) L(1 + iT)Investment Value after 1 year Value at time TCompound Interest(interest earns interest)Time 0 Time 1/m Time 2/m 1 year Time T| | | | |L L(1 + i/m) L(1 + i/m) 2 L(1 + i/m) m L(1 + i/m) mTInvestment Value after 1 year Value at time TContinuously Compounded Interest(Interest earns interest continuously)Time 0 1 year Time T| | |L Le r1 Le rTInvestment Value after 1 year Value at time T

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 10- Rewriting the second line of the above expression with an eye towards generalization,we get(The book’s appendix gives rules for these manipulations)• As before, we replace numbers with symbols to develop a formula for computingcompound interest. Let L = $100 be the principal, which is invested at i = 6 percent peryear for T years; however, the interest is compounded m times every year. In the aboveexpressions, m takes the values 1/2, 1/3, and 1/365, respectively. T = 1 year except in thelast part where it takes the value (250/365). Consequently, under compound interest, Ldollars invested for one year become L 1+ i m(which is also shown in Figure 2.1)( ) m , and when invested for T years it becomes€.Continuously compounded interest rates• But why stop at 365? Why not compound one million times a year? Then, yourinvestment will grow to $106.1836545 at year-end. Two things are happening. As thecompounding frequency increases, so does earned interest, but it grows at a decreasingrate—the money doesn’t grow very fast after a while. For example, compounding 10million times will only give $106.1836547 at year-end.• So we can talk about “continuous compounding,” where the interest rate r (we now use rinstead of i to denote the interest rate) is continuously compounded. This happens whenthe annual frequency of compounding m becomes larger and larger, but the interest ratecharged r/m becomes smaller and smaller during each of those compounding intervals. Inthat case, $1 becomes at the yearend, where the exponential function e is the base ofthe natural logarithm [mathematically, we define logx ≡ ln(x) = M as equivalent to e M =x]. It is approximated as 2.7183. Calculators have this as e x or exp(…) denoting theexponential function.• But that was for one year. The dollar investment grows to e rT after T years. Tosummarize, under continuous compounding, L dollars invested at r percent per yearcontinuously compounded for one year becomes Le r and when invested for T yearsbecomes Le rT . (The Appendix shows how this happens and Figure 2.1 illustrates theresult in a diagram). In our example this will give at the yearend:100e 0.06 = $106.1836547.Notice that the APR remains at 6 percent but the effective annual interest rate= e r – 1 = 6.1837 percent. g

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 11This is an example of a continuously compounded return (or logarithmic return).Continuously compounded interest rates are used as an input in the Black-Scholes-Mertonmodel. Our example suggests that continuous compounding (which gives $106.18 at yearend) is a much better approximation to daily compounding (which also gives $106.18) than asimple interest (which only gives $106).We collect these three interest computation methods as Result 2.2:RESULT 2.2 Simple, Compound, and Continuously Compounded Interest Ratesa) Simple InterestA principal of L dollars when invested for T years becomesL(1 + iT) … (2.3a)where i percent per year is the simple interest rate.b) Compound InterestL dollars invested for T years becomesL[1 + (i/m)] mT … (2.3b)where i percent per year is the compound interest rate andm is the number of times the interest is compounded every year.c) Continuously Compounded InterestL dollars invested for T years becomesLe rT… (2.3c)where r percent per year is the continuously compounded interest rate, ande is the exponential function.2.4 Discounting (PV) and Compounding (FV)—Moving Money across TimeWe can use interest rates to find the dollar return or to price a zero-coupon bond. If we investa dollar today and it continues to earn interest that we do not withdraw on any intermediatedate, then the final amount on the maturity date is the dollar return. The dollar returnmeasures how an invested dollar grows over time. In real life, you can earn the dollar returnby investing in a money market account (mma), which earns the risk-free rate in eachperiod.The inverse of a dollar return is the price of a zero-coupon bond. A zero-coupon bond(or zero) sells at a discount, makes no interest (or coupon) payments over the bond’s life, andpays back the principal (or the par value) on the maturity date.A zero-coupon bond and a money market account are closely related securities, under theassumption of constant interest rates, the price of a zero-coupon bond (B) and the dollar

© Jarrow & Chatterjea 2012 Interest Rates Chapter 2, Page 12return (1+R) obtained from investing in a money market account are inverses of one another,B ≡ 1/(1+R). Both mmas and zeros help us move funds across time. Example 2.2 shows howto compute a dollar return and the price of a zero.EXAMPLE 2.2 Computing a Dollar Return, Pricing a Zero, and Moving Funds acrossTime• Suppose that the simple interest rate is 6 percent per year. Today is time 0 and bondsmature at time T. Then the dollar return after six months of investing in an mma is1+R = 1 × [1 + 0.06(1/2)] = $1.03.This dollar return is the future value of $1 invested today.• Today’s price of a zero-coupon bond that pays $1 after six months isB ≡ 1/(1+R) = 1/1.03 = $0.9709 = $0.97.This is the present value of $1 received after six months.gRESULT 2.3 Compounding and Discounting Cash Flows with Dollar Returns andZero-Coupon Bonds (See Figure 2.2).Consider cash flows C(0) available today (time 0) and C(T) available at some later date(time T). Then,multiplication of today’s C(0) by the dollar return (or equivalently, division by azero-coupon bond price) gives the future value,C(0)R = C(0)/B,… (2.4a)multiplication of the future C(T) by a zero-coupon bond price (or division by thedollar return) gives the present value (or discounted value),BC(T) = C(T)/(1+R)… (2.4b)where (1+R) is the dollar return at time T from investing one dollar today,B ≡ 1/(1+R) is today’s price of a zero-coupon bond that pays one dollar at timeT, andT is the time to maturity in years.In the case of simple interest,1+R = (1 + i × T) … (2.4c)