Stockholding Notification of Deutsche Bank

Stockholding Notification of Deutsche Bank

Stockholding Notification of Deutsche Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MEDIA RELEASE<br />

Winterthur, March 5, 2008<br />

Page 1 <strong>of</strong> 5<br />

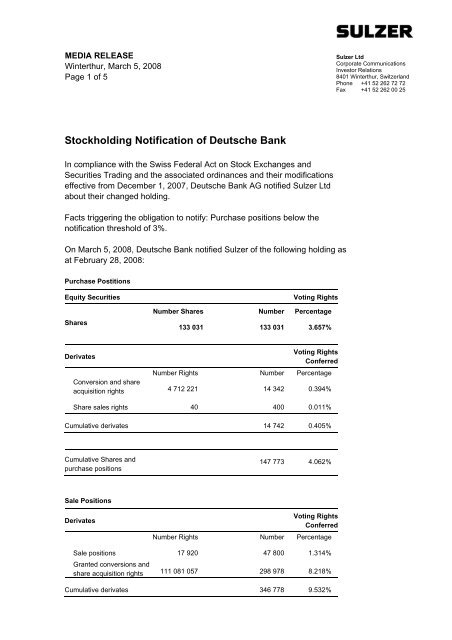

<strong>Stockholding</strong> <strong>Notification</strong> <strong>of</strong> <strong>Deutsche</strong> <strong>Bank</strong><br />

In compliance with the Swiss Federal Act on Stock Exchanges and<br />

Securities Trading and the associated ordinances and their modifications<br />

effective from December 1, 2007, <strong>Deutsche</strong> <strong>Bank</strong> AG notified Sulzer Ltd<br />

about their changed holding.<br />

Facts triggering the obligation to notify: Purchase positions below the<br />

notification threshold <strong>of</strong> 3%.<br />

On March 5, 2008, <strong>Deutsche</strong> <strong>Bank</strong> notified Sulzer <strong>of</strong> the following holding as<br />

at February 28, 2008:<br />

Purchase Postitions<br />

Equity Securities Voting Rights<br />

Shares<br />

Number Shares Number Percentage<br />

133 031 133 031 3.657%<br />

Derivates<br />

Voting Rights<br />

Conferred<br />

Number Rights Number Percentage<br />

Conversion and share<br />

acquisition rights 4 712 221 14 342 0.394%<br />

Share sales rights 40<br />

400 0.011%<br />

Cumulative derivates 14 742 0.405%<br />

Cumulative Shares and<br />

purchase positions<br />

Sale Positions<br />

Derivates<br />

Sale positions<br />

Granted conversions and<br />

17 920<br />

share acquisition rights 111 081 057<br />

147 773 4.062%<br />

Number Rights Number<br />

Voting Rights<br />

Conferred<br />

Percentage<br />

47 800 1.314%<br />

298 978 8.218%<br />

Cumulative derivates 346 778 9.532%<br />

Sulzer Ltd<br />

Corporate Communications<br />

Investor Relations<br />

8401 Winterthur, Switzerland<br />

Phone +41 52 262 72 72<br />

Fax +41 52 262 00 25

MEDIA RELEASE<br />

Winterthur, March 5, 2008<br />

Page 2 <strong>of</strong> 5 / <strong>Stockholding</strong> <strong>Notification</strong> <strong>of</strong> <strong>Deutsche</strong> <strong>Bank</strong><br />

Details Conversion and Share Acquisition Rights<br />

(Purchase Positions)<br />

Conversion and Share<br />

Acquisition Rights<br />

Security ID Number or basic<br />

terms<br />

Voting Rights<br />

Conferred<br />

Number<br />

rights Exercise period Number Percentage<br />

ESUM 08-03 1240.00 OC 100 31.03.2008 1 000 0.027%<br />

ESUM 08-03 1800.00 OC 16 31.03.2008 160 0.004%<br />

ESUM 08-04 1240.00 OC 150 30.04.2008 1 500 0.041%<br />

ESUM 08-12 1360.00 OC 33 31.12.2008 330 0.009%<br />

ESUM 08-12 1600.00 OC 5 31.12.2008 50 0.001%<br />

SUZF 08-03 17 31.03.2008 170 0.005%<br />

CH0037302350 200 000 401 0.011%<br />

CH0037049340 100 000 201 0.006%<br />

CH0036782891 100 000 201 0.006%<br />

CH0034366143 100 000 201 0.005%<br />

CH0028816038 3 400 000 8 502 0.234%<br />

CH0026424348 651 000 1 303 0.036%<br />

CH0028003645 160 900 323 0.009%<br />

Cumulative 4 712 221 14 342 0.394%<br />

Details Share Sales Rights (Purchase Positions)<br />

Share Sales Rights<br />

Voting Rights<br />

Conferred<br />

Security ID Number or basic Number<br />

terms<br />

rights Exercise period Number Percentage<br />

ESUM 08-03 1400.00 OP 40 31.12.2007 400 0.011%<br />

Cumulative 40 400 0.011%

MEDIA RELEASE<br />

Winterthur, March 5, 2008<br />

Page 3 <strong>of</strong> 5 / <strong>Stockholding</strong> <strong>Notification</strong> <strong>of</strong> <strong>Deutsche</strong> <strong>Bank</strong><br />

Details Sale Positions (Sale Positions)<br />

Sale Positions<br />

Voting Rights<br />

Conferred<br />

Security ID Number or basic Number<br />

terms<br />

rights Exercise period Number Percentage<br />

ESUM 08-03 1480.00 OP 295 31.03.2008 2 950 0.081%<br />

ESUM 08-03 1520.00 OP 200 31.03.2008 2 000 0.055%<br />

ESUM 08-03 1720.00 OP 100 31.03.2008 1 000 0.027%<br />

ESUM 08-06 1400.00 OP 100 30.06.2008 1 000 0.027%<br />

ESUM 08-06 1560.00 OP 220 30.06.2008 2 200 0.060%<br />

ESUM 08-06 1720.00 OP 100 30.06.2008 1 000 0.027%<br />

ESUM 08-09 1800.00 OP 700 30.09.2008 7 000 0.192%<br />

ESUM 08-12 1120.00 OP 500 31.12.2008 5 000 0.137%<br />

ESUM 08-12 1280.00 OP 200 31.12.2008 2 000 0.055%<br />

ESUM 08-12 1400.00 OP 200 31.12.2008 2 000 0.055%<br />

ESUM 08-12 1440.00 OP 5 31.12.2008 50 0.001%<br />

ESUM 08-12 1840.00 OP 200 31.12.2008 2 000 0.055%<br />

ESUM 08-12 1920.00 OP 500 31.12.2008 5 000 0.137%<br />

SUN.S 08-03 1440 EP OTC 2 600 20.03.2008 2 600 0.071%<br />

SUN.S 08-05 1576 EP OTC 7 000 13.05.2008 7 000 0.192%<br />

SUN.S 08-06 1010 EP OTC 5 000 20.06.2008 5 000 0.137%<br />

Cumulative 17 920 47 800 1.314%

MEDIA RELEASE<br />

Winterthur, March 5, 2008<br />

Page 4 <strong>of</strong> 5 / <strong>Stockholding</strong> <strong>Notification</strong> <strong>of</strong> <strong>Deutsche</strong> <strong>Bank</strong><br />

Details Granted Conversion and Share Acquisition<br />

Rights (Sale Positions)<br />

Granted Conversion and<br />

Share Acquisition Rights<br />

Security ID number or basic<br />

terms<br />

Voting Rights<br />

Conferred<br />

Number<br />

rights Execise period Number Percentage<br />

DE000DB0PRY5 580 000 580 0.016%<br />

DE000DB1FXW6 215 000 215 0.006%<br />

CH0037211379 1 000 4 0.000%<br />

CH0037211387 11 700 30 0.001%<br />

CH0037211361 72 000 121 0.003%<br />

CH0037080394 1 629 650 4 076 0.112%<br />

CH0037080397 1 100 5 0.000%<br />

CH0037080428 50 000 101 0.003%<br />

CH0033465086 14 202 350 19 885 0.547%<br />

CH0032268812 1 200 3 0.000%<br />

CH0037080402 2 450 8 0.000%<br />

CH0036979513 10 000 28 0.001%<br />

CH0033465094 179 300 234 0.006%<br />

CH0032268820 432 274 347 0.010%<br />

CH0034987708 100 000 251 0.007%<br />

CH0033465060 15 000 24 0.001%<br />

42 112 100 84 226 2.315%<br />

CH0032268796 145 000 291 0.008%<br />

CH0030845439 6 228 000 12 458 0.342%<br />

CH0028907167 430 000 1 076 0.030%<br />

CH0028907175 1 446 400 2 895 0.080%<br />

CH0030695727 1 521 900 3 805 0.105%<br />

CH0030695750 418 000 1 046 0.029%<br />

CH0037211353 4 000 12 0.000%<br />

CH0037080410 80 000 176 0.005%<br />

Ch0036979489 10 999 900 36 299 0.998%<br />

CH0033465078 14 100 000 19 742 0.543%<br />

CH0030759218 541 000 867 0.024%<br />

CH0030760224 96 200 155 0.004%<br />

CH0032268804 95 500 97 0.003%<br />

CH0030760240 744 500 1 490 0.041%<br />

CH0030760257 105 000 211 0.006%<br />

14 450 000 47 687 1.311%<br />

60 533 60 533 1.664%<br />

Cumulative 111 081 057 298 978 8.218%<br />

Simplification <strong>of</strong> reporting requirements<br />

By recommendation <strong>of</strong> the Disclosure Office <strong>of</strong> SWX Swiss Exchange<br />

dated February 8, 2008, a simplification <strong>of</strong> the reporting requirements was<br />

granted to <strong>Deutsche</strong> <strong>Bank</strong> AG, according to which it can forbear to disclose<br />

data pursuant to Art. 17 para. 1 bis SESTO-SFBC (BEHV-EBK) regarding<br />

certain written conversion and share acquisition rights. The simplification<br />

was granted in particular due to the short period between passing and

MEDIA RELEASE<br />

Winterthur, March 5, 2008<br />

Page 5 <strong>of</strong> 5 / <strong>Stockholding</strong> <strong>Notification</strong> <strong>of</strong> <strong>Deutsche</strong> <strong>Bank</strong><br />

coming into effect <strong>of</strong> the revised regulations <strong>of</strong> the SESTO-SFBC (BEHV-<br />

EBK) by 1 December 2007.<br />

Details Relevant Group<br />

The following companies are reported to form a group together with<br />

<strong>Deutsche</strong> <strong>Bank</strong> AG Frankfurt, Theodor-Heuss-Allee 70, 60486 Frankfurt<br />

am Main, Germany:<br />

• <strong>Deutsche</strong> <strong>Bank</strong> Securities Inc., 60 Wall Street, New York,<br />

NY 10005-2858, USA<br />

• <strong>Deutsche</strong> Asset Management (Japan) Limited, Nagata-cho,<br />

Chiyoda-ku, Sanno Park Tower 2-11-1, Tokyo, Japan<br />

• <strong>Deutsche</strong> Asset Management Investmentgesellschaft mbH,<br />

Mainzer Landstr. 178–190, 60327 Frankfurt am Main, Germany<br />

• DWS Investment GmbH, Mainzer Landstr. 178–190, 60327<br />

Frankfurt am Main, Germany<br />

• <strong>Deutsche</strong> <strong>Bank</strong> Trust Company Americas, 60 Wall Street, New<br />

York, NY 10005-2858, USA<br />

• <strong>Deutsche</strong> Investment Management Americas Inc., 345 Park<br />

Avenue, New York, NY 10154, USA<br />

• Tilney Investment Management, Royal Liver Building, Pier Head,<br />

Merseyside, Liverpool, L3 1NY, UK<br />

and with the following companies (indirect holdings):<br />

• DB U.S. Financial Markets Holding Corporation, 1209 Orange<br />

Street, Wilmington, DE 19801, USA<br />

• Taunus Corporation, 1209 Orange Street, Wilmington, DE 19801,<br />

USA<br />

The shareholder’s contact person for the present notification is<br />

Dirk Hadlich, <strong>Deutsche</strong> <strong>Bank</strong> AG, Zurich Branch, Switzerland.<br />

Sulzer was founded in 1834 in Winterthur, Switzerland, and today is active in machinery<br />

and equipment manufacturing and surface engineering at over 120 locations worldwide.<br />

The divisions are global leaders in their respective customer segments, which include the<br />

oil and gas, hydrocarbon processing, chemical process, power generation, pulp and<br />

paper, aviation, and automotive industries.<br />

Inquiries:<br />

Media Relations: Verena Gölkel, Media Spokesperson<br />

Phone +41 52 262 26 82, Fax +41 52 262 00 25, news@sulzer.com<br />

Investor Relations: Philippe Dewitz, Head <strong>of</strong> Investor Relations<br />

Phone +41 52 262 20 22, Fax +41 52 262 00 25, investor.relations@sulzer.com