Study Notes for the Long Term Insurance Examination (2011 Edition)

Study Notes for the Long Term Insurance Examination (2011 Edition)

Study Notes for the Long Term Insurance Examination (2011 Edition)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

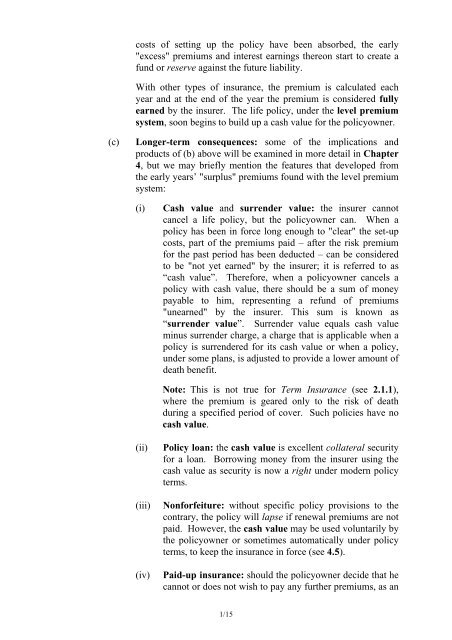

costs of setting up <strong>the</strong> policy have been absorbed, <strong>the</strong> early"excess" premiums and interest earnings <strong>the</strong>reon start to create afund or reserve against <strong>the</strong> future liability.With o<strong>the</strong>r types of insurance, <strong>the</strong> premium is calculated eachyear and at <strong>the</strong> end of <strong>the</strong> year <strong>the</strong> premium is considered fullyearned by <strong>the</strong> insurer. The life policy, under <strong>the</strong> level premiumsystem, soon begins to build up a cash value <strong>for</strong> <strong>the</strong> policyowner.(c)<strong>Long</strong>er-term consequences: some of <strong>the</strong> implications andproducts of (b) above will be examined in more detail in Chapter4, but we may briefly mention <strong>the</strong> features that developed from<strong>the</strong> early years’ "surplus" premiums found with <strong>the</strong> level premiumsystem:(i)Cash value and surrender value: <strong>the</strong> insurer cannotcancel a life policy, but <strong>the</strong> policyowner can. When apolicy has been in <strong>for</strong>ce long enough to "clear" <strong>the</strong> set-upcosts, part of <strong>the</strong> premiums paid – after <strong>the</strong> risk premium<strong>for</strong> <strong>the</strong> past period has been deducted – can be consideredto be "not yet earned" by <strong>the</strong> insurer; it is referred to as“cash value”. There<strong>for</strong>e, when a policyowner cancels apolicy with cash value, <strong>the</strong>re should be a sum of moneypayable to him, representing a refund of premiums"unearned" by <strong>the</strong> insurer. This sum is known as“surrender value”. Surrender value equals cash valueminus surrender charge, a charge that is applicable when apolicy is surrendered <strong>for</strong> its cash value or when a policy,under some plans, is adjusted to provide a lower amount ofdeath benefit.Note: This is not true <strong>for</strong> <strong>Term</strong> <strong>Insurance</strong> (see 2.1.1),where <strong>the</strong> premium is geared only to <strong>the</strong> risk of deathduring a specified period of cover. Such policies have nocash value.(ii)(iii)(iv)Policy loan: <strong>the</strong> cash value is excellent collateral security<strong>for</strong> a loan. Borrowing money from <strong>the</strong> insurer using <strong>the</strong>cash value as security is now a right under modern policyterms.Non<strong>for</strong>feiture: without specific policy provisions to <strong>the</strong>contrary, <strong>the</strong> policy will lapse if renewal premiums are notpaid. However, <strong>the</strong> cash value may be used voluntarily by<strong>the</strong> policyowner or sometimes automatically under policyterms, to keep <strong>the</strong> insurance in <strong>for</strong>ce (see 4.5).Paid-up insurance: should <strong>the</strong> policyowner decide that hecannot or does not wish to pay any fur<strong>the</strong>r premiums, as an1/15