- Page 1 and 2: Annual Report 09

- Page 4 and 5: ANNUAL REPORT 20093Index46810121516

- Page 6 and 7: ANNUAL REPORT 2009 52009 %y-o-y 200

- Page 8 and 9: ANNUAL REPORT 2009 7energetic effic

- Page 10 and 11: ANNUAL REPORT 2009 9EUROPE/ASIA2,25

- Page 12 and 13: ANNUAL REPORT 200911Opened sales of

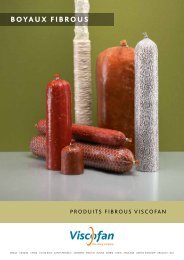

- Page 14 and 15: ANNUAL REPORT 2009 13Fibrous casing

- Page 16 and 17: tureGroup Structure

- Page 18 and 19: ANNUAL REPORT 2009 17Organisational

- Page 20 and 21: egyCorporate strategy

- Page 22 and 23: ANNUAL REPORT 2009 21Value creation

- Page 24 and 25: ANNUAL REPORT 2009 23Particularly s

- Page 26 and 27: ANNUAL REPORT 2009 25Viscofan offer

- Page 28 and 29: ANNUAL REPORT 2009 27As a result, a

- Page 30 and 31: essBusiness performance

- Page 32 and 33: ANNUAL REPORT 200931Amortization of

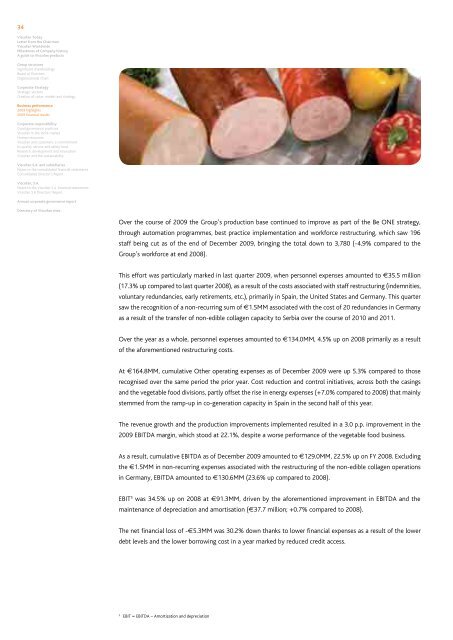

- Page 36 and 37: ANNUAL REPORT 200935The revenue gro

- Page 38 and 39: ANNUAL REPORT 200937of 2009, 179 do

- Page 40 and 41: ANNUAL REPORT 200939Cumulative EBIT

- Page 42 and 43: sibilityCorporate responsibility

- Page 44 and 45: ANNUAL REPORT 200943Relating to the

- Page 46 and 47: ANNUAL REPORT 200945The General Mee

- Page 48 and 49: ANNUAL REPORT 200947The Board compr

- Page 50 and 51: ANNUAL REPORT 200949VISCOFAN VS. IB

- Page 52 and 53: ANNUAL REPORT 200951STOCK EXCHANGE

- Page 54 and 55: ANNUAL REPORT 200953The challenges

- Page 56 and 57: ANNUAL REPORT 200955The Company’s

- Page 58 and 59: ANNUAL REPORT 200957At present ther

- Page 60 and 61: ANNUAL REPORT 200959Viscofan Bioeng

- Page 62 and 63: ANNUAL REPORT 200961Climate changeS

- Page 64 and 65: ANNUAL REPORT 200963WASTE REDUCTION

- Page 66 and 67: ncialANNUAL REPORT 2009 65entsVisco

- Page 68 and 69: ANNUAL REPORT 200967Consolidated Fi

- Page 70 and 71: ANNUAL REPORT 200969Consolidated in

- Page 72 and 73: ANNUAL REPORT 200971Consolidated st

- Page 74 and 75: ANNUAL REPORT 200973Viscofan S.A. a

- Page 76 and 77: ANNUAL REPORT 200975IFRS improvemen

- Page 78 and 79: ANNUAL REPORT 200977(4) Significant

- Page 80 and 81: ANNUAL REPORT 200979(b) Amortizatio

- Page 82 and 83: ANNUAL REPORT 200981(4.6) Leases(a)

- Page 84 and 85:

ANNUAL REPORT 200983When arranging

- Page 86 and 87:

ANNUAL REPORT 200985(4.12) Cash and

- Page 88 and 89:

ANNUAL REPORT 200987(b) Termination

- Page 90 and 91:

ANNUAL REPORT 200989(4.19) Income t

- Page 92 and 93:

ANNUAL REPORT 200991(4.23) Non-curr

- Page 94 and 95:

ANNUAL REPORT 200993The Group’s b

- Page 96 and 97:

ANNUAL REPORT 200995The following t

- Page 98 and 99:

ANNUAL REPORT 200997The major compo

- Page 100 and 101:

ANNUAL REPORT 200999(11) Trade and

- Page 102 and 103:

ANNUAL REPORT 2009101(13.3) Reserve

- Page 104 and 105:

ANNUAL REPORT 2009103(13.6) Distrib

- Page 106 and 107:

ANNUAL REPORT 2009105Details of the

- Page 108 and 109:

ANNUAL REPORT 2009107The following

- Page 110 and 111:

ANNUAL REPORT 2009109The Group expe

- Page 112 and 113:

ANNUAL REPORT 2009111recoverability

- Page 114 and 115:

ANNUAL REPORT 2009113Group entities

- Page 116 and 117:

ANNUAL REPORT 2009115Thousands of e

- Page 118 and 119:

ANNUAL REPORT 2009117Thousands of e

- Page 120 and 121:

ANNUAL REPORT 2009119Thousands of e

- Page 122 and 123:

ANNUAL REPORT 2009121(21) Other Inc

- Page 124 and 125:

ANNUAL REPORT 2009123The breakdown

- Page 126 and 127:

ANNUAL REPORT 2009125These changes

- Page 128 and 129:

ANNUAL REPORT 2009127Viscofan S.A.

- Page 130 and 131:

ANNUAL REPORT 2009129Principal Grou

- Page 132 and 133:

ANNUAL REPORT 2009131Consolidated F

- Page 134 and 135:

ANNUAL REPORT 2009133ActivityManufa

- Page 136 and 137:

ANNUAL REPORT 2009135ActivityManufa

- Page 138 and 139:

ANNUAL REPORT 2009137Tinned Food El

- Page 140 and 141:

ANNUAL REPORT 2009139North America

- Page 142 and 143:

ANNUAL REPORT 2009141Transfers 31.1

- Page 144 and 145:

ANNUAL REPORT 2009143Transfers 31.1

- Page 146 and 147:

ANNUAL REPORT 2009145entsViscofan,

- Page 148 and 149:

ANNUAL REPORT 2009 147Consolidated

- Page 150 and 151:

ANNUAL REPORT 2009149VISCOFAN, S.A.

- Page 152 and 153:

ANNUAL REPORT 2009151VISCOFAN, S.A.

- Page 154 and 155:

ANNUAL REPORT 2009153VISCOFAN, S.A.

- Page 156 and 157:

ANNUAL REPORT 20091552.2 Comparison

- Page 158 and 159:

ANNUAL REPORT 2009157Following init

- Page 160 and 161:

ANNUAL REPORT 20091594.5 Financial

- Page 162 and 163:

ANNUAL REPORT 2009161The reversal o

- Page 164 and 165:

ANNUAL REPORT 20091634.11 Cash and

- Page 166 and 167:

ANNUAL REPORT 20091654.19 Environme

- Page 168 and 169:

ANNUAL REPORT 20091676. PROPERTY, P

- Page 170 and 171:

ANNUAL REPORT 2009169The principal

- Page 172 and 173:

ANNUAL REPORT 20091717.1 Descriptio

- Page 174 and 175:

ANNUAL REPORT 2009173The descriptio

- Page 176 and 177:

ANNUAL REPORT 2009175These amounts

- Page 178 and 179:

ANNUAL REPORT 20091778.2 Hedging de

- Page 180 and 181:

ANNUAL REPORT 200917911.3 ReservesT

- Page 182 and 183:

ANNUAL REPORT 200918113. EQUITY - G

- Page 184 and 185:

ANNUAL REPORT 2009183These amounts

- Page 186 and 187:

ANNUAL REPORT 2009185Loans at a sub

- Page 188 and 189:

ANNUAL REPORT 200918716. TAXESThe b

- Page 190 and 191:

ANNUAL REPORT 2009189Increases from

- Page 192 and 193:

ANNUAL REPORT 2009191The Company ha

- Page 194 and 195:

ANNUAL REPORT 200919317.5 Finance c

- Page 196 and 197:

ANNUAL REPORT 2009195Transactions e

- Page 198 and 199:

ANNUAL REPORT 2009197During 2009 an

- Page 200 and 201:

ANNUAL REPORT 2009199Interest rate

- Page 202 and 203:

ANNUAL REPORT 200920121.3 Informati

- Page 204 and 205:

ANNUAL REPORT 2009203Outlook for th

- Page 206 and 207:

ANNUAL REPORT 2009205Information to

- Page 208 and 209:

ANNUAL REPORT 2009207G) The powers

- Page 210 and 211:

ANNUAL REPORT 2009209I) Any agreeme

- Page 212 and 213:

orateANNUAL REPORT 2009 211nanceAnn

- Page 214 and 215:

ANNUAL REPORT 2009213A.3. Complete

- Page 216 and 217:

ANNUAL REPORT 2009215Indicate wheth

- Page 218 and 219:

ANNUAL REPORT 2009217EXTERNAL DIREC

- Page 220 and 221:

ANNUAL REPORT 2009219B.1.6. Indicat

- Page 222 and 223:

ANNUAL REPORT 2009221b) On account

- Page 224 and 225:

ANNUAL REPORT 2009223B.1.14. Descri

- Page 226 and 227:

ANNUAL REPORT 2009225B.1.17. Indica

- Page 228 and 229:

ANNUAL REPORT 2009227Measures to mi

- Page 230 and 231:

ANNUAL REPORT 2009229In particular,

- Page 232 and 233:

ANNUAL REPORT 2009231B.1.33. Is the

- Page 234 and 235:

ANNUAL REPORT 2009233B.1.40. Indica

- Page 236 and 237:

ANNUAL REPORT 2009235B.2.2. State w

- Page 238 and 239:

ANNUAL REPORT 2009237Resolutions sh

- Page 240 and 241:

ANNUAL REPORT 2009239Executive Comm

- Page 242 and 243:

ANNUAL REPORT 2009241with the Recom

- Page 244 and 245:

ANNUAL REPORT 2009243C. RELATED-PAR

- Page 246 and 247:

ANNUAL REPORT 2009245 In view of th

- Page 248 and 249:

ANNUAL REPORT 2009247D.3. Indicate

- Page 250 and 251:

ANNUAL REPORT 2009249Article 15.- S

- Page 252 and 253:

ANNUAL REPORT 2009251Votes in favou

- Page 254 and 255:

ANNUAL REPORT 20092537. The Board p

- Page 256 and 257:

ANNUAL REPORT 200925515. When women

- Page 258 and 259:

ANNUAL REPORT 200925727. The propos

- Page 260 and 261:

ANNUAL REPORT 200925937. The compen

- Page 262 and 263:

ANNUAL REPORT 200926146. The member

- Page 264 and 265:

ANNUAL REPORT 2009263Consolidated F

- Page 266 and 267:

ANNUAL REPORT 2009265Consolidated F

- Page 268 and 269:

toryDirectory of Viscofan Sites

- Page 270 and 271:

ANNUAL REPORT 2009269Manufacturing

- Page 273 and 274:

Annual Report 2009This report is al