Equine Proposal Form - AIS Insurance Brokers

Equine Proposal Form - AIS Insurance Brokers

Equine Proposal Form - AIS Insurance Brokers

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

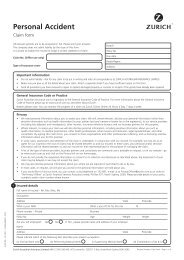

APPLICATION AND PROPOSAL FORMBASIC COVER - MORTALITY THEFT & ENTRY FEESSECTION 1 – MORTALITYCover for death, or euthanasia on humane grounds, resulting from an injury or illness.Includes up to $200 for an Autopsy report following a claim.Upper age limit is 16 years of age.$nil to each claim.SECTION 2 – THEFT & STRAYINGTheft or straying where the horse is not recovered within 90 days, plus up to $300 for advertising and reward.SECTION 3 – ENTRY FEESLoss of irrevocable entry fees up to $300 following a claim under Section 1 – Mortality.OPTIONAL EXTENSIONSSECTION 4 – PUBLIC LIABILITYCover for your legal liability in respect of accidental:i) death, bodily injury, illness, or disease of any person;ii) loss of, or damage to, tangible property arising from your ownership and use of the insured horse.This includes legal costs.Limit of liability Options - $1,000,000, $5,000,000 or $10,000,000An excess of $250 to each property damage claim.SECTION 5 – LOSS OF USERestricted – Cover in the event of an injury or illness that that results in the horse becoming totally and permanently incapable offulfilling its principle use as stated. This does not cover infertility or cosmetic scarring. Horses 2 to 16 years of ageBreeding – Cover in the event of injury or illness that renders the Stallion/Colt totally and permanently impotent, infertile orincapable of natural service. Horses 2 to 16 years of age.Cosmetic – Covers permanent scarring following an injury, illness and/or cosmetic condition which renders your horsepermanently incapable of fulfilling its principle use as stated in the schedule because of its appearance. Horses 2 to 16 years ofage.SECTION 6 – SADDLERY & TACKLoss or damage to your riding equipment up to the value of $20,000.An excess of $50 applies to each claim.SECTION 7 – HORSE TRAILERS / FLOATSLoss or damage caused by fire, theft or accidental damage for horse floats up to the value of $20,000.An excess of $200 applies to each claim.SECTION 8 – PERSONAL ACCIDENT & DENTAL$5,000 for death, permanent disability, loss of sight or limb.$2,500 for death if the deceased is under 18 years of age.$750 for dental treatment.Veterinary Certificates – will be required in the following instances: If the horse is to be insured for over $17,500 If the horse is over 12 years of age If the foal is under 6 months of age If the horse is to be used for Show jumping / Eventing / Polo / Polocrosse / Endurance If the horse is to be insured for loss of useFor a full explanation of the cover provided, including conditions and exclusions, please refer to the policy wording.Page 2

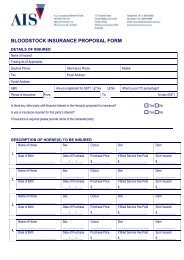

YOUR DETAILSAPPLICATION AND PROPOSAL FORMYour Full NameYour Postal AddressPhone: Work Home MobileEmailRegistered for GST? Yes No ABN ITC Proportion claimed %Is there any other party with financial interest in the Horse(s) proposed for insurance? Yes NoIf yes, is insurance required for that party’s interest?Has any <strong>Insurance</strong> Company declined a proposal from you, cancelled or refused to renew your Certificate or required specialterms to insure you? Yes NoIf “Yes, provide detailsDESCRIPTION OF THE HORSE TO BE INSUREDName:Sex: Filly Mare Colt Stallion GeldingColour Height Date of BirthSire Dam BreedMicrochip number Registration Number Reg. with (Assoc/Society)Primary Address of HorseUse: Dressage Jumping Eventing Showing Campdrafting Reining Barrel Racing Pleasure Polo/Crosse Pony/Riding Club OtherPlease note Brands and markings below:Page 3

COVERAGESECTIONS 1, 2 & 3: MORTALITY, THEFT & ENTRY FEESProposed Period of <strong>Insurance</strong>: From: ToSum Insured $ Date of purchase Purchase Price $OPTIONAL EXTENSIONS:SECTION 4: Public Liability $1 Million Yes No$5 Million Yes No$10 Million Yes NoAny one claim and in the aggregateSECTION 5: Loss of Use Restricted Yes NoBreeding Yes NoCosmetic Yes NoSECTION 6: Saddlery & Tack Yes NoNominated items Sum Insured $SECTION 7: Horse Trailers/Floats Yes NoMake & ModelRegistration No Year Sum Insured $SECTION 8: Personal Accident & Dental Cover Yes NoHORSE HEALTH / CARE1. Does a farrier regularly attend the Horse? Yes NoIf “Yes” (a) Frequency (b) Any corrective shoeing2. How often is the horse under supervision? Constant Daily Weekly3. Does the horse suffer from any congenital and/or conformation fault? Yes NoIf “Yes, provide details4. Has the horse suffered from or been treated for any injury, illness or disease Yes NoIf “Yes, provide details5. Has any industry professional advised that items outlined in question 3 and 4 may predispose the horse to future injury,illness or disease. Yes NoIf “Yes, provide details6. Provide the name and address of the your regular Veterinary SurgeonNameAddressPhone No7. Have you ever sustained a loss or losses by any contingencies against which you now propose to insure? YesIf “Yes”, state details of the losses NoPage 4

YOUR DUTY OF DISCLOSUREBefore you enter into a contract of general insurance with an Underwriter, you have a duty, under the <strong>Insurance</strong> Contracts Act1984, to disclose to the Underwriter every matter that you know, or could reasonably be expected to know, is relevant to theUnderwriters decision whether to accept the risk of the insurance and, if so, on what terms.You have the same duty to disclose those matters to the Underwriter before you renew, vary or reinstate a contract of generalinsurance.Your duty, however, does not require disclosure of matters:that diminishes the risk to be assumed by the Underwriterthat is of common knowledgethat your Underwriter knows or, in the ordinary course of his business, ought to knowas to which compliance with your duty is waived by the UnderwriterYour duty of disclosure extends to not only answering the questions on the proposal form, but to all matters which are relevant tothe risk, and you must notify the Underwriter of changes in the risk between the time of you answering the question on theproposal form and the date the contract of insurance is entered into.NON DISCLOSUREIf you fail to comply with your duty of disclosure, the Underwriter may be entitled to reduce his liability under the contract for aclaim or may cancel the contract. If your non-disclosure is fraudulent, the Underwriter may also have the option of avoiding thecontract from its beginning.DECLARATION OF HEALTH AND FACTSI/We hereby acknowledge that my/our duty of disclosure has been brought to my/our notice as per the disclosure noticeprinted with this <strong>Proposal</strong> <strong>Form</strong>I/We declare that the Horse/s proposed for this insurance is/are in good health and is/are free from injury, disability,abnormality or illness and have been so for the past twelve (12) months and that I/We have not withheld any informationlikely to affect acceptance of this <strong>Proposal</strong>.I/We hereby acknowledge that no insurance is in force until any Veterinary Certificates requested have been accepted by<strong>AIS</strong> <strong>Insurance</strong> <strong>Brokers</strong>.I/We also declare that the information provided in this <strong>Proposal</strong> <strong>Form</strong> by me/us is correct in every particular.Signature or Proposer/sNo <strong>Insurance</strong> is in force until this proposal and any Veterinary Certificate has been accepted by the Underwriter.DatePAYMENTCredit Card Payment Authority CCV _______Expiry Date _____/_____Cardholder NameAmountSignatureDatePage 5

INSURANCE APPLICATION - VETERINARY CERTIFICATE OF EXAMINATIONInsured Name:Address:Name of Horse:Use of Horse:Cover requestedSum Insured$___________________Mortality, Theft & Straying only Yes NoPolicy extension/s:Restricted Loss of use Yes NoBreeding loss of use Yes NoCosmetic Loss of Use Yes NoAnimal presented as:Sire:Dam:Colour: Breed: Sex: Height:Microchip no:Age/DOB:Person requesting examination:Place of examination:Does your practice normally attend this property? Never Occasionally RegularlyHas your practice previously attended this horse? Never Occasionally RegularlyDraw brands and/or markings:Mark whorls as X, scars asPage 6

MANDATORY QUESTIONSMORTALITY INSURANCE EXAMINATIONPulse normal? Yes NoHeart ausculated and found normal? Yes NoRespiration normal? Yes NoAny indication of infection or disease? Yes NoVice/s? Yes NoTemperature normal? Yes NoEyes clinically normal? Yes NoSkin conditions? Yes NoFeet in good condition/maintained? Yes NoAny physical evidence of laminitis? Yes NoIs the horse lame at the walk or trot? Yes NoIs there evidence of ataxia? Yes NoIs there any obvious evidence ofprevious abdominal surgery? Yes NoDetails:OPTIONAL EXTENSIONSRESTRICTED LOSS OF USE EXAMINATIONHoof Tests: LF RF LH RHFlexion Tests: LF RF LH RHDetails:BREEDING LOSS OF USE EXAMINATION FOR STALLIONS/COLTSAre the external genitalia palpably and visibly normal? Yes NoDetails:COSMETIC LOSS OF USE EXAMINATION Scars Windgalls Splints If yes, please note on the diagram on page 1.Please give your opinion as to the significance of any abnormalities mentioned above (add additional sheets if needed):I have today performed a clinical examination on this horse in accordance with PROFESSIONAL/INDUSTRYSTANDARDS guidelines and declare that to the best of my professional knowledge the horse is clinically normal and ina satisfactory condition, except where noted.Signature:Name:Practice Stamp/Address:Date:Contact Number:AVA No:VPB No:Page 7