Revision of Enhanced Rate of Ordinary Family Pension in respect of ...

Revision of Enhanced Rate of Ordinary Family Pension in respect of ...

Revision of Enhanced Rate of Ordinary Family Pension in respect of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

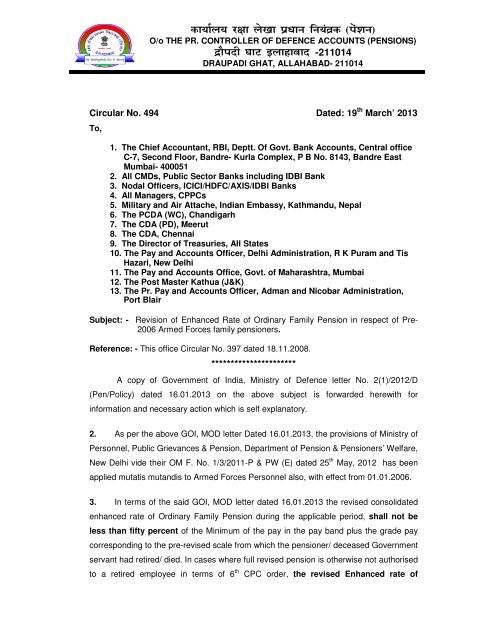

()O/o THE PR. CONTROLLER OF DEFENCE ACCOUNTS (PENSIONS)-211014DRAUPADI GHAT, ALLAHABAD- 211014Circular No. 494 Dated: 19 th March’ 2013To,1. The Chief Accountant, RBI, Deptt. Of Govt. Bank Accounts, Central <strong>of</strong>ficeC-7, Second Floor, Bandre- Kurla Complex, P B No. 8143, Bandre EastMumbai- 4000512. All CMDs, Public Sector Banks <strong>in</strong>clud<strong>in</strong>g IDBI Bank3. Nodal Officers, ICICI/HDFC/AXIS/IDBI Banks4. All Managers, CPPCs5. Military and Air Attache, Indian Embassy, Kathmandu, Nepal6. The PCDA (WC), Chandigarh7. The CDA (PD), Meerut8. The CDA, Chennai9. The Director <strong>of</strong> Treasuries, All States10. The Pay and Accounts Officer, Delhi Adm<strong>in</strong>istration, R K Puram and TisHazari, New Delhi11. The Pay and Accounts Office, Govt. <strong>of</strong> Maharashtra, Mumbai12. The Post Master Kathua (J&K)13. The Pr. Pay and Accounts Officer, Adman and Nicobar Adm<strong>in</strong>istration,Port BlairSubject: - <strong>Revision</strong> <strong>of</strong> <strong>Enhanced</strong> <strong>Rate</strong> <strong>of</strong> <strong>Ord<strong>in</strong>ary</strong> <strong>Family</strong> <strong>Pension</strong> <strong>in</strong> <strong>respect</strong> <strong>of</strong> Pre-2006 Armed Forces family pensioners.Reference: - This <strong>of</strong>fice Circular No. 397 dated 18.11.2008.**********************A copy <strong>of</strong> Government <strong>of</strong> India, M<strong>in</strong>istry <strong>of</strong> Defence letter No. 2(1)/2012/D(Pen/Policy) dated 16.01.2013 on the above subject is forwarded herewith for<strong>in</strong>formation and necessary action which is self explanatory.2. As per the above GOI, MOD letter Dated 16.01.2013, the provisions <strong>of</strong> M<strong>in</strong>istry <strong>of</strong>Personnel, Public Grievances & <strong>Pension</strong>, Department <strong>of</strong> <strong>Pension</strong> & <strong>Pension</strong>ers’ Welfare,New Delhi vide their OM F. No. 1/3/2011-P & PW (E) dated 25 th May, 2012 has beenapplied mutatis mutandis to Armed Forces Personnel also, with effect from 01.01.2006.3. In terms <strong>of</strong> the said GOI, MOD letter dated 16.01.2013 the revised consolidatedenhanced rate <strong>of</strong> <strong>Ord<strong>in</strong>ary</strong> <strong>Family</strong> <strong>Pension</strong> dur<strong>in</strong>g the applicable period, shall not beless than fifty percent <strong>of</strong> the M<strong>in</strong>imum <strong>of</strong> the pay <strong>in</strong> the pay band plus the grade paycorrespond<strong>in</strong>g to the pre-revised scale from which the pensioner/ deceased Governmentservant had retired/ died. In cases where full revised pension is otherwise not authorisedto a retired employee <strong>in</strong> terms <strong>of</strong> 6 th CPC order, the revised <strong>Enhanced</strong> rate <strong>of</strong>

<strong>Ord<strong>in</strong>ary</strong> <strong>Family</strong> <strong>Pension</strong> shall be restricted to that amount. However, the amount <strong>of</strong>revised <strong>Enhanced</strong> rate <strong>of</strong> <strong>Ord<strong>in</strong>ary</strong> <strong>Family</strong> <strong>Pension</strong> <strong>in</strong> no case shall be less than thirtypercent <strong>of</strong> the sum <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> the pay <strong>in</strong> the pay band plus the grade pay or thirtypercent <strong>of</strong> m<strong>in</strong>imum pay scales <strong>in</strong> case <strong>of</strong> HAG and above.4. Table show<strong>in</strong>g M<strong>in</strong>imum <strong>of</strong> the pay <strong>in</strong> the pay band plus the grade paycorrespond<strong>in</strong>g to the pre-revised scale, from which the pensioner/ deceasedGovernment servant had retired/ died, is enclosed herewith to facilitate payment <strong>of</strong>revised <strong>Enhanced</strong> <strong>Family</strong> <strong>Pension</strong> <strong>in</strong> terms <strong>of</strong> GOI, MOD letter dated 16.01.2013.5. In all cases where fixation <strong>of</strong> enhanced rate <strong>of</strong> family pension where above GOI,MOD letter is more beneficial the PDAs are hereby advised to pay revised rate <strong>of</strong>enhanced family pension accord<strong>in</strong>gly to the GOI, MOD letter. However, if the PDAs are<strong>in</strong> any doubt about the fixation <strong>of</strong> enhanced rate <strong>of</strong> family pension, the case may bereferred to concerned PSAs with full details.6. This circular has been uploaded on this <strong>of</strong>fice website www.pcdapension.nic.<strong>in</strong>for dissem<strong>in</strong>at<strong>in</strong>g across the all concerned.No. Grants/Tech/0113/LXIIDated: 19 th March’ 2013(ALOK PATNI)ACDA (P)

Copy to:-1. The Dy. Secretary, Govt. <strong>of</strong> India, M<strong>in</strong>istry <strong>of</strong> PPG & P (Deptt. <strong>of</strong> P & PW), Lok NayakBhawan, New Delhi.2. Director (<strong>Pension</strong>s), Govt. <strong>of</strong> India, M<strong>in</strong>istry <strong>of</strong> Defence D(Pen/Sers), Sena Bhawan,W<strong>in</strong>g ‘A’ New Delhi.3. Army HQrs AG’s Branch, PS-4(b) DHQ, PO New Delhi – 110011.4. AHQ GS Branch, TA Directorate, DHQ PO New Delhi – 110011.5. Naval HQrs, PP & A, DHQ PO New Delhi.6. DPA, Vayu Bhawan, New Delhi – 11.7. Air HQrs Ad PP & P – 3, West Block-VI, R. K. Puram, New Delhi – 110066.8. Sr. Dy. CGDA(AT-II), O/O the CGDA, Ulan Batar Road, Palam Delhi Cantt– 110010.9. PCDA (Navy) No.-1, Cooperage Road, Mumbai – 400039.10. PCDA (WC), Chandimandir, Chandigarh11. CDA (AF), West Block-V, R. K. Puram, New Delhi – 110066.12. CDA, Chennai13. CDA (PD), Meerut14. JCDA (AF) Subroto Park, New Delhi – 110010.15. Director <strong>of</strong> Audit, Defence Service, New Delhi16. Director MP 8 (I <strong>of</strong> R) Integrated HQ <strong>of</strong> MOD (Army) AG’s Branch, Addl Dte Gen <strong>of</strong>MP/ MP 8 (I <strong>of</strong> R) West Block-III, RK Puram, New Delhi 11006617. All Addl CsDA/ Jt. CsDA <strong>in</strong> Ma<strong>in</strong> Office.18. All GOs <strong>in</strong> Ma<strong>in</strong> Office.19. The OI/C, G-1(M), AT (ORs)-Tech. & G-1/Civil (Tech.)20. All SAOs/ AOs/ AAOs <strong>in</strong> Gts/ Ors Complex.21. The OI/C, EDP Manual.22. The OI/C, EDP Centre.23. The OI/C, EDP PHP Section.24. Defence <strong>Pension</strong> Liaison Cell.25. All Sections <strong>in</strong> Ma<strong>in</strong> Office.26. OIC,G -2 Section27. OI/C, G - 3 Sections.28. OI/C, G - 4 Sections29. OI/C O & M Cell30. OI/C Compla<strong>in</strong>t Cell31. The OI/C, Reception Centre32. The OI/C, EDP Centre (Website) For putt<strong>in</strong>g this Circular on the website.33. The OI/C, DPTI Cell34. Spare(S C SAROJ)Accounts Officer (<strong>Pension</strong>s)

ARMY (PBOR)TABLE NO. 1ENHANCED RATE OF FAMILY PENSION- JUNIOR COMMISSIONED OFFICERS (INCLUDINGHONORARY COMMISSIONED OFFICERS),NON-COMMISSIONED OFFICERS AND OTHER RANKS OFREGULAR ARMY,DSC AND TASl. No.Present Scale Revised Pay Structure <strong>Enhanced</strong> <strong>Family</strong>Rank Exist<strong>in</strong>g Scales PayBandCorrespond<strong>in</strong>gPay BandGradePayX GroupPayMilitaryServicePay<strong>Pension</strong>= 50% <strong>of</strong>sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP+'X' (GP)1 2 34 5 6 7 8 9X Group(a) Sepoy 3600-70-4650 PB-1 5200-20200 2000 2000 1400 5300(b) Naik 3700-85-4975 PB-1 5200-20200 2400 2000 1400 5500(c) Havildar 4150-100-5650 PB-1 5200-20200 2800 2000 1400 5700(d) Nb Sub 5770-140-8290 PB-2 9300-34800 4200 2000 1400 8450(e) Subedar 6750-190-9790 PB-2 9300-34800 4600 2000 1400 8650(f) Sub Maj 7250-200-10050 PB-2 9300-34800 4800 2000 1400 8750Y Group(a) Sepoy 3250-70-4300 PB-1 5200-20200 2000 2000 NA 4600(b) Naik 3425-85-4700 PB-1 5200-20200 2400 2000 NA 4800(c) Havildar 3600-100-5100 PB-1 5200-20200 2800 2000 NA 5000(d) Nb Sub 5620-140-8140 PB-2 9300-34800 4200 2000 NA 7750(e) Subedar 6600-170-9320 PB-2 9300-34800 4600 2000 NA 7950(f) Sub Maj 6750-200-9550 PB-2 9300-34800 4800 2000 NA 8050Z Group(a) Sepoy 3050-55-3875 PB-1 5200-20200 2000 2000 NA 4600(b) Naik 3150-70-4200 PB-1 5200-20200 2400 2000 NA 4800(c) Havildar 3250-85-4525 PB-1 5200-20200 2800 2000 NA 5000(d) Nb Sub 5200-125-7450 PB-2 9300-34800 4200 2000 NA 7750(e) Subedar 6170-155-8650 PB-2 9300-34800 4600 2000 NA 7950(f) Sub Maj 6600-200-9400 PB-2 9300-34800 4800 2000 NA 8050Hony Commissioned Officer(a) Hony Lieutenant 10500 PB-3 15600-39100 5400 6000 NA 13500(b) Hony Capta<strong>in</strong> 10850 PB-3 15600-39100 6100 6000 NA 13850Note:(i) In cases where the pension authorized on retirement was less than 50% <strong>of</strong> the last pay drawnand amount <strong>of</strong> pension revised after 01.01.2006 is also less than 50% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP (where admissible) or 50% <strong>of</strong> <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> revised pay sclale <strong>in</strong> case <strong>of</strong> HAG andabove, the revised enhanced family pension may be less than 50% and shall be restricted to thatamount.(ii) In the case <strong>of</strong> a pensioner who died prior to 01.01.2006, the notional revised pension as on01.01.2006 shall be taken <strong>in</strong>to account for the purpose <strong>of</strong> calculation as above. In all cases, theamount <strong>of</strong> revised enhanced family pension shall not be less than 30% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP (where admissible) or 30% <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> pay scales <strong>in</strong> case <strong>of</strong> HAG and above.

NAVY (PBOR)TABLE NO.2ENHANCED RATE OF FAMILY PENSION- JUNIOR COMMISSIONED OFFICERS (INCLUDING HONORARYCOMMISSIONED OFFICERS),NON-COMMISSIONED OFFICERS AND OTHER RANKS OF NAVY (SAILARS)Sl. No.Present ScaleRank Exist<strong>in</strong>g Scales PayBandPay <strong>in</strong> PayBandRevised Pay StructureGradePayMilitaryServicePayX GroupPay1 2 3 4 5 6 7 8 9(a) Apprentice 3200-60-3260 PB-1 5200-20200 2000 2000 1400 5300(b) Artificer V 4150-70-4360 PB-1 5200-20200 2400 2000 1400 5500(c) Artificer IV 4550-100-6350 PB-1 5200-20200 2800 2000 1400 5700(d) Artificer III-I 5120-100-7120 PB-2 9300-34800 3400 2000 1400 8050(e) Chief Artificer 6000-125-8250 PB-2 9300-34800 4200 2000 1400 8450(f) MCPO II 6750-190-9790 PB-2 9300-34800 4600 2000 1400 8650(g) MCPO I 7400-200-10200 PB-2 9300-34800 4800 2000 1400 8750Y Group(a) Seaman II and 3325-60-3445 PB-1 5200-20200 2000 2000 NA 4600Equivalents(b) Seaman I and 3650-60-4550 PB-1 5200-20200 2000 2000 NA 4600Equivalents(c) Lead<strong>in</strong>g Seaman 3900-70-4950 PB-1 5200-20200 2400 2000 NA 4800and Equivalent(d) Petty Officer 4320-85-5595 PB-1 5200-20200 2800 2000 NA 5000(e) Chief Petty 5620-140-8140 PB-2 9300-34800 4200 2000 NA 7750Officer(f) MCPO II 6660-170-9320 PB-2 9300-34800 4600 2000 NA 7950(g) MCPO I 6750-200-9550 PB-2 9300-34800 4800 2000 NA 8050Z Group(a) Seaman II &Equivalent(b) Seaman I &Equivalent(c) Lead<strong>in</strong>g Seaman& Equivalent<strong>Enhanced</strong> <strong>Family</strong><strong>Pension</strong>= 50% <strong>of</strong> sum<strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP+'X' (GP)3050-55-3215 PB-1 5200-20200 2000 2000 NA 46003080-60-3980 PB-1 5200-20200 2000 2000 NA 46003200-70-4250 PB-1 5200-20200 2400 2000 NA 4800(d) Petty Officer 3775-85-5050 PB-1 5200-20200 2800 2000 NA 5000(e) Chief Petty 5200-125-7450 PB-2 9300-34800 4200 2000 NA 7750Officer(f) MCPO II 6170-155-8650 PB-2 9300-34800 4600 2000 NA 7950(g) MCPO I 6600-200-9400 PB-2 9300-34800 4800 2000 NA 8050Honorary Commissioned Officers(a) Hon. Sub 10500 PB-3 15600-39100 5400 6000 NA 13500Lieutenant(b) Hon. Lieutenant 10850 PB-3 15600-39100 6100 6000 NA 13850Note: (i) In cases where the pension authorized on retirement was less than 50% <strong>of</strong> the last pay drawn andamount <strong>of</strong> pension revised after 01.01.2006 is also less than 50% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP(where admissible) or 50% <strong>of</strong> <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> revised pay sclale <strong>in</strong> case <strong>of</strong> HAG and above, the revisedenhanced family pension may be less than 50% and shall be restricted to that amount.(ii) In the case <strong>of</strong> a pensioner who died prior to 01.01.2006, the notional revised pension as on 01.01.2006shall be taken <strong>in</strong>to account for the purpose <strong>of</strong> calculation as above. In all cases, the amount <strong>of</strong> revisedenhanced family pension shall not be less than 30% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP (whereadmissible) or 30% <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> pay scales <strong>in</strong> case <strong>of</strong> HAG and above.

AIR FORCE (PBOR)TABLE NO.3ENHANCED RATE OF FAMILY PENSION– JUNIOR COMMISSIONED OFFICERS (INCLUDING HONORARYCOMMISSIONED OFFICERS), NON- COMMISSIONED OFFICERS AND OTHER RANKS OF AIR FORCESl NoPresent ScaleRevised Pay StructureRank Exist<strong>in</strong>g Scales Pay Band Pay <strong>in</strong> Pay Band GradePayMilitaryServicePayX GroupPay<strong>Enhanced</strong> <strong>Family</strong><strong>Pension</strong>= 50% <strong>of</strong>sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP+'X' (GP)1 2 3 4 5 6 7 8 9X Group(a) AC 3675 PB-1 5200-20200 2000 2000 1400 5300(b) LAC 4025-60-4925 PB-1 5200-20200 2000 2000 1400 5300(c) CPL 4150-70-5200 PB-1 5200-20200 2400 2000 1400 5500(d) SGT 4670-85-5945 PB-1 5200-20200 2800 2000 1400 5700(e) JWO 5530-125-7780 PB-2 9300-34800 4200 2000 1400 8450(f) WO 6750-190-9790 PB-2 9300-34800 4600 2000 1400 8650(g) MWO 7250-200-10050 PB-2 9300-34800 4800 2000 1400 8750Y Group(a) AC 3250 PB-1 5200-20200 2000 2000 NA 4600(b) LAC 3650-60-3980 PB-1 5200-20200 2000 2000 NA 4600(c) CPL 3900-70-4950 PB-1 5200-20200 2400 2000 NA 4800(d) SGT 4320-85-5595 PB-1 5200-20200 2800 2000 NA 5000(e) JWO 5620-140-8140 PB-2 9300-34800 4200 2000 NA 7750(f) WO 6600-170-9320 PB-2 9300-34800 4600 2000 NA 7950(g) MWO 6750-200-9550 PB-2 9300-34800 4800 2000 NA 8050Z Group(a) AC 3050 PB-1 5200-20200 2000 2000 NA 4600(b) LAC 3080-60-3980 PB-1 5200-20200 2000 2000 NA 4600(c) CPL 3200-70-4250 PB-1 5200-20200 2400 2000 NA 4800(d) SGT 3775-85-5050 PB-1 5200-20200 2800 2000 NA 5000(e) JWO 5200-125-7450 PB-2 9300-34800 4200 2000 NA 7750(f) WO 6170-155-8650 PB-2 9300-34800 4600 2000 NA 7950(g) MWO 6600-200-9400 PB-2 9300-34800 4800 2000 NA 8050Hony Commissioned Officers(a) Hony Fg 10500 PB-3 15600-39100 5400 6000 NA 13500Officer(b) Hony Flt Lt. 10850 PB-3 15600-39100 6100 6000 NA 13850Note: (i) In cases where the pension authorized on retirement was less than 50% <strong>of</strong> the last pay drawn and amount <strong>of</strong>pension revised after 01.01.2006 is also less than 50% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP (where admissible) or 50%<strong>of</strong> <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> revised pay sclale <strong>in</strong> case <strong>of</strong> HAG and above, the revised enhanced family pension may be lessthan 50% and shall be restricted to that amount.(ii) In the case <strong>of</strong> a pensioner who died prior to 01.01.2006, the notional revised pension as on 01.01.2006shall be taken <strong>in</strong>to account for the purpose <strong>of</strong> calculation as above. In all cases, the amount <strong>of</strong> revisedenhanced family pension shall not be less than 30% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP (where admissible)or 30% <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> pay scales <strong>in</strong> case <strong>of</strong> HAG and above.

ENHANCED RATE OF FAMILY PENSION – COMMISSIONED OFFICERS INCLUDING AMC, ADC, RVC, SL, RCOs, APS, DSC, BRO & TATable- 4Equivalent RanksCommissioned Officers other than MNSCommissioned Officers (MNS)ARMY NAVY AIR FORCEM<strong>in</strong>. <strong>in</strong>PayBandGradePayMilitryServicePayTotal<strong>Enhanced</strong> <strong>Family</strong><strong>Pension</strong>= 50% <strong>of</strong> sum<strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSPM<strong>in</strong>. <strong>in</strong>PayBandGradePayMilitryServicePayTotal<strong>Enhanced</strong> <strong>Family</strong><strong>Pension</strong>= 50% <strong>of</strong> sum<strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB+GP+MSP1 2 3 4 5 6 7 8 14 15 16 17 18 19Lt./ 2nd Lt. Sub Lt. Fg Offr. 15600 5400 6000 27000 13500 Lt. 15600 5400 4200 25200 12600Capta<strong>in</strong> Lt. Flt. Lt. 15600 6100 6000 27700 13850 Capt. 15600 5700 4200 25500 12750Major Lt. Cdr. Sqn Ldr. 15600 6600 6000 28200 14100 Major 15600 6100 4200 25900 12950Lt. Colonel(TS)Cdr. (TS) Wg. Cdr (TS) 37400 8000 6000 51400 25700 Lt. Col. 15600 6600 4200 26400 13200Lt. Colonel Cdr. (S) Wg. Cdr (S) 37400 8000 6000 51400 25700 Colonel 37400 7600 4200 49200 24600Colonel (TS) Capt.(TS) Gp. Capt.(TS) 37400 8700 6000 52100 26050 Brigadier 37400 8400 4200 50000 25000Colonel Capt. Gp. Capt. 37400 8700 6000 52100 26050 Major General 37400 90004200(Notional)50600 25300Brigadier Commodore Air Cmde 37400 8900 6000 52300 26150Major General Real Admiral AVM 37400 10000 6000 53400 26700Lt. General Vice Admiral Air Marshal 67000 Nil6000(Notional)73000 36500DGAFMS80000 Nil Nil 80000 40000Lt. General(Army Cdr/VCOAS)Vice Admiral(FOC-<strong>in</strong>-C)Air Marshal(AOC-<strong>in</strong>-C)/VCAS80000 Nil Nil 80000 40000RanksCOAS/ FieldMarshalNote:CNS CAS 90000 Nil Nil 90000 45000(i) In cases where the pension authorized on retirement was less than 50% <strong>of</strong> the last pay drawn and amount <strong>of</strong> pension revised after 01.01.2006 is also less than50% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP (where admissible) or 50% <strong>of</strong> <strong>of</strong> m<strong>in</strong>imum <strong>of</strong> revised pay sclale <strong>in</strong> case <strong>of</strong> HAG and above, the revised enhanced familypension may be less than 50% and shall be restricted to that amount.(ii) In the case <strong>of</strong> a pensioner who died prior to 01.01.2006, the notional revised pension as on 01.01.2006 shall be taken <strong>in</strong>to account for the purpose <strong>of</strong> calculationas above. In all cases, the amount <strong>of</strong> revised enhanced family pension shall not be less than 30% <strong>of</strong> the sum <strong>of</strong> M<strong>in</strong>. <strong>of</strong> PB +GP+MSP (where admissible) or 30% <strong>of</strong>m<strong>in</strong>imum <strong>of</strong> pay scales <strong>in</strong> case <strong>of</strong> HAG and above.