Syndicated Loans - Euromoney Institutional Investor PLC

Syndicated Loans - Euromoney Institutional Investor PLC

Syndicated Loans - Euromoney Institutional Investor PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

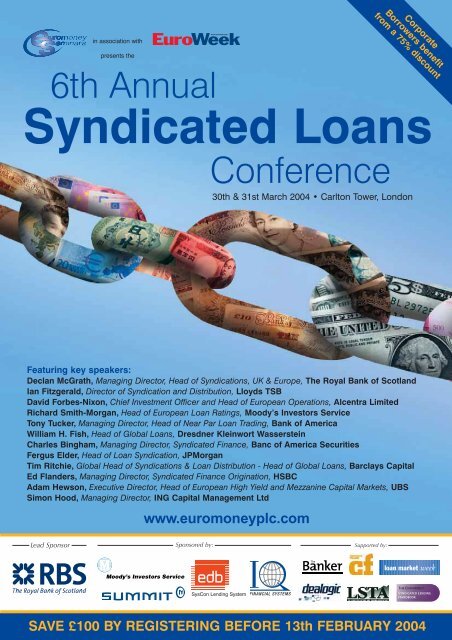

in association withpresents theCorporateBorrowers benefitfrom a 75% discount6th Annual<strong>Syndicated</strong> <strong>Loans</strong>Conference30th & 31st March 2004 • Carlton Tower, LondonFeaturing key speakers:Declan McGrath, Managing Director, Head of Syndications, UK & Europe, The Royal Bank of ScotlandIan Fitzgerald, Director of Syndication and Distribution, Lloyds TSBDavid Forbes-Nixon, Chief Investment Officer and Head of European Operations, Alcentra LimitedRichard Smith-Morgan, Head of European Loan Ratings, Moody’s <strong>Investor</strong>s ServiceTony Tucker, Managing Director, Head of Near Par Loan Trading, Bank of AmericaWilliam H. Fish, Head of Global <strong>Loans</strong>, Dresdner Kleinwort WassersteinCharles Bingham, Managing Director, <strong>Syndicated</strong> Finance, Banc of America SecuritiesFergus Elder, Head of Loan Syndication, JPMorganTim Ritchie, Global Head of Syndications & Loan Distribution - Head of Global <strong>Loans</strong>, Barclays CapitalEd Flanders, Managing Director, <strong>Syndicated</strong> Finance Origination, HSBCAdam Hewson, Executive Director, Head of European High Yield and Mezzanine Capital Markets, UBSSimon Hood, Managing Director, ING Capital Management Ltdwww.euromoneyplc.comLead SponsorSponsored by:Supported by:SysCon Lending SystemSAVE £100 BY REGISTERING BEFORE 13th FEBRUARY 2004

in association withpresents the6th Annual<strong>Syndicated</strong> <strong>Loans</strong>Conference30th & 31st March 2004Carlton Tower, LondonDAY ONE: TUESDAY 30th MARCH, 200408:30 Registration and refreshments09:00 Opening remarks from the ChairmanDeclan McGrath, Managing Director, Head ofSyndications, UK & Europe, The Royal Bank of Scotland09:10 A year in review■ Overview and analysis of market developments■ Key trends and transactions- self-arranged deals; a sign of the times?- loan portfolio management; how will it withstand the wall of liquidity?- deals which defined 2003 and lessons learned■ The outlook for 2004Tim Ritchie, Global Head of Syndications & LoanDistribution - Head of Global <strong>Loans</strong>, Barclays Capital09:50 Market liquidity: have borrowers ever had it so good?■ Ever greater pressure on pricing■ The re-emergence of the five year maturity■ Where is the floor for blue-chip pricing?■ How many refinancings are left for 2004?■ When will these favourable conditions end?■ Which borrowers qualify?Ed Flanders, Managing Director,<strong>Syndicated</strong> Finance Origination, HSBC10:30 Morning coffee and networking break11:00 Keynote Presentation byDeclan McGrath, Managing Director, Head ofSyndications, UK & Europe, The Royal Bank of Scotland11:40 Relationship banking: shifts in attitude■ How reliant is the loan market on relationship banking?■ 2003 – a stormy year for old relationships:- VW / Deutsche Bank- RSA■ The balance of power - how much leverage do banks have overborrowers, and vice-versa?■ Strategic deployment of capital - is this compatible with a highliquid market?Fergus Elder, Head of Loan Syndication, JPMorgan12:20 Bank loans: safer than bonds? Relative default rates oncorporate bonds and loans■ Increasing importance of ratings (bonds and loans)■ Probability of default and severity of loss■ Parameters of the loan default study■ Compared and contrasted - US vs. Europe■ Preliminary implications and tentative conclusionsRichard Smith-Morgan, Head of European Loan Ratings,Moody’s <strong>Investor</strong>s Service13:00 LunchC O N F E R E N C14:30 Can the European secondary market continue itsincredible growth?■ Review of historical volumes, trends and players■ The role of increased portfolio management amongst global andEuropean banks■ Will the European market begin to resemble the US?■ What happens now that most of the liquid telecom names aregoing away?■ Where will growth come from in 2004?Tony Tucker, Managing Director,Head of Near Par Loan Trading, Bank of America15:10 Roundtable: Leveraged buyouts■ Will pricing ever change?■ How are fees being distributed - who is getting the lion’s share?■ CDO dynamics■ <strong>Institutional</strong> investors: how can they take a bigger share of the market?■ The race to be MLA: will banks previously not in the market continueto aggressively go after these roles?Moderator: Greg Lomas, Managing Director,Head of Loan Underwriting and Distribution, Europe,CIBC World MarketsDavid Forbes-Nixon, Chief Investment Officer andHead of European Operations, Alcentra LimitedDavid Wilmot, Director, Duke Street CapitalRichard Howell, Managing Director,Head of Leveraged Capital Markets, Lehman Brothers16:00 Afternoon tea and networking break16:30 How mezzanine has developed over the past 3 yearsin Europe■ Mezzanine growth in Europe - the drivers; The providers;Warranted/contractual; High Yield/mezzanine comparison; PricingMezzanine; Prospects for the mezzanine marketPaul McKenna, Managing Director,Head of Leveraged <strong>Syndicated</strong> Finance, ING17:10 Roundtable: Warranted vs. warrantless mezzanine■ Who is investing in warrantless mezzanine?■ Pricing trends for both warranted and warrantless■ Evaluating which deals benefit from warrantless■ The future of warrantless mezzanine■ Hybrids: will the market see this structure again?Moderator: Taron Wade, <strong>Loans</strong> Editor, EuroWeekPaul Piper, Head of UK Mezzanine,Intermediate Capital GroupAdam Hewson, Executive Director, Head of European HighYield and Mezzanine Capital Markets, UBSSimon Hood, Managing Director, ING Capital Management LtdKirk Harrison, Head of Mezzanine, Barclays Capital18:00 Chairman’s closing remarks and end of Day OneDrinks reception to follow© <strong>Euromoney</strong> Seminars 2003

The loan market continues to bethe biggest source of capital forEuropean corporates, and it alsohit new highs in 2003 with the Euromarket'slargest ever LBO for Seat Pagine Gialle.Nonetheless a falling number of deals,lack of M&A driven transactions, fallingpricing and heightened competition formandates have made the loan marketa very challenging environment in 2003.<strong>Loans</strong> bankers are coming underincreasing pressure to make lendingrelationships realise greater return onequity for their houses. In a time ofuncertainty and opportunity, theviews of experienced market leadersare invaluable.E A G E N D ADAY TWO: WEDNESDAY 31st MARCH, 200409:00 Morning refreshments09:30 Opening remarks from the ChairmanDeclan McGrath, Managing Director, Head ofSyndications, UK & Europe, The Royal Bank of Scotland09:40 M&A activity■ Are we witnessing a recovery in corporate confidence?■ When will M&A volumes return?■ Which sectors will see early activity: banking,health insurance, tobacco?■ Leverage and ratings■ Short term acquisition vs. long dated fundsChristopher Baines, Managing Director,Head of European Loan Distribution, SG CIB10:20 Fallen angels on the road to recovery:the restructuring process■ Case study: Heidelberg Cement■ Why was Heidelberg Cement so special?■ Taking the pressure off loan investors - the high yield bondin restructuring■ Assessing restructurings for ABB, Alstom and othersWilliam H. Fish, Head of Global <strong>Loans</strong>,Dresdner Kleinwort Wasserstein11:00 Morning coffee and networking break11:30 Roundtable: Challenges for top tier arrangers in aborrowers' market■ Selling a borrower's story amid falling pricing and weaker structures■ Bigger MLA groups - who really drives the deals?■ Where have the asset takers gone? Raising liquidity outside the corerelationship banks■ The spectre of club and self-arranged deals - is the arrangers' roleunder threat?■ A wider channel for distribution - making use of the secondary loan marketModerator: Adam Harper, <strong>Loans</strong> Reporter, EuroWeekRichard Cartledge, Managing Director & Global Head,<strong>Syndicated</strong> Finance, HSBCSean Boylan, Head of Transaction Management,Loan Syndications & Trading, BNP ParibasPeter Ellemann, Executive Director,European Head of Origination, ABN Amro12:20 Case study: The UK syndicated loans market■ Its component parts: borrowers and banks■ The current market situation: volumes, pricing and how we got there■ The futureIan Fitzgerald, Director of Syndication and Distribution,Lloyds TSB13:00 LunchAttend the 6th Annual <strong>Syndicated</strong> <strong>Loans</strong>Conference and you will:■ Network with leading industrycounterparts (nearly 900 peoplehave attended in the last five years)■ Determine where the nextM&A growth will come from■ Learn the true value of relationshipbanking to your bottom lineThe 6th Annual <strong>Syndicated</strong> <strong>Loans</strong>Conference will discuss and debate thelatest trends in this ever changingmarket and is your opportunity to learnfrom and network with leading figures inthe industry.EMEA <strong>Syndicated</strong> Loan Volume14:30 Emerging market syndications - focus onproject finance■ Regional overview - how is the deal pipeline looking?■ How is market capacity changing?■ How will Basel II impact activity?■ The Equator Principles - the effect on syndication for projectfinance and other asset classesChris Vermont, Head of Project and Structured Finance,ANZ Investment Bank15:10 A comparison between the European and USsyndicated loan markets■ A look at both the investment grade and leveraged markets■ Volumes■ Pricing■ Structural issues■ <strong>Investor</strong>sCharles Bingham, Managing Director, <strong>Syndicated</strong>Finance, Banc of America Securities15:40 Telecom finance: back for the long term?■ Telecoms - not one but a number of different markets■ 2000-2002 from hero to zero - how did it happen?■ Equity sponsors and telecoms■ The situation today - why the market is on the up andlooking forwardPaul Gibbon, Head of Media & Telecom Syndications,Loan Syndications and Trading, BNP Paribas16:20 Chairman’s closing remarks and close of conferenceAfternoon tea to followLoan Market WeekTake a trial to the news service for the loan syndication anddistressed debt markets. www.loanmarketweek.com/freetrialDerivatives WeekTake a trial to the global news service for the over-the-counterderivatives professional. www.derivativesweek.com/freetrialBond WeekTake a trial to the news service for the fixed income and creditmarkets. www.bondweek.com/freetrial<strong>Euromoney</strong> Seminars reserves the right to alter the venue and/or speakers. <strong>Euromoney</strong> Seminars and EuroWeek are divisions of <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong>.US$mSource: DealogicTo register - email:Please refer to emailor visit our website atwww.euromoneyplc.comCorporate Finance magazine looks at cash, capitaland risk management in short accessible articlesdesigned to help cut down your workload and ensurethat you have the tools to make an informed decisionat the drop of a hat. Claim your free 1 month access atwww.corporatefinancemag.com**YTD (Mid December)

To register for this event please complete your details below:_____ Delegate/s Full Registration Fee £1095_____ Delegate/s Early Registration Fee £995(by 13th February 2004) Save £1006th Annual <strong>Syndicated</strong> <strong>Loans</strong> Conference30th & 31st March 2004 - Carlton Tower, LondonCorporate Borrowers benefit from a 75% discountIf you are a corporate borrower and would like to be considered for aspecially discounted place (£275 + VAT) please contact Jamie Balderstonby telephone: +44(0)20 7779 8539 or email: jbalderston@euromoneyplc.comfor further information. Discount applies to non-financial institutions only.+VAT@17.5%Total Remittance5 EASY WAYS TO REGISTERFax: +44 (0)207 246 5200email:Please refer to emailTel: Please refer to emailwww.euromoneyplc.comComplete and return to: Alberto Anido,<strong>Euromoney</strong> Hotline, Nestor House,Playhouse Yard, London EC4V 5EX, UKPlease quote the 12 digit reference number that starts 203 in all correspondenceFor further information including sponsorship orexhibition opportunities please contact William KelsoTel: +44 (0) 20 7779 8514Fax: +44 (0) 20 7779 8603email: wkelso@euromoneyplc.com(PLEASE PRINT)Title/First Name/Last Name:Position:Company:Address:Postcode:Tel:Country:Fax:METHOD OF PAYMENTPayment must be received BEFORE the conference date to guarantee your placeInvoice meBank transfer quoting ELE646.Account No: 01938032 Sort code: 30-00-02, Lloyds TSB, PO Box 72, Bailey Drive,Gillingham Business Park, Kent ME8 0LS, UKIBAN no: GB 53 LOYD 300002 01938032 Swift Address: LOYD GB2 LCTYPlease find cheque enclosed (please make payable to <strong>Euromoney</strong> Seminars)Please debit my credit card MasterCard Visa Amex Diners ClubCardholder’s Name:(exactly as it appears on the card)Card No: __ __ __ __ / __ __ __ __ / __ __ __ __ / __ __ __ __Card Verification Check: __ __ __ __ (last 3/4 digits printed on signature strip of card)Expiry date __ __ / __ __Please include billing address if different from address given(e.g. if your credit card bill is sent to your home address):Email:Please photocopy this form for additional delegates.The information you provide will be safeguarded by the <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong>group, who may share it with the sponsors of this event. As an international group, we maytransfer your data internationally and our subsidiaries may use it to keep you informed ofrelevant products and services. If you object to being contacted by telephone ■, fax■ or email ■, please tick the relevant box. We occasionally make your details availableto other reputable organisations who may wish to contact you. Please tick this box ■ if youwould prefer your details to remain confidential.Please note that in completing this booking form you undertake to adhere to thecancellation and payment terms listed below.Signature:Date:Approving Manager:Position:ADMINISTRATIVE INFORMATION6th Annual <strong>Syndicated</strong> <strong>Loans</strong> Conference • 30th & 31st March 2004 - Carlton Tower, LondonCANCELLATION POLICY:If you cannot attend you must cancel your registrationin writing before 16th March 2004 to receive a refundless a 10% administration charge. We cannot acceptverbal cancellations. Cancellations received after16th March 2004 are liable for the full conference fee.We suggest you send a substitute to attend in your placeat no extra charge.REGISTRATION FEE:The registration fee includes participation in theconference, lunches and documentation material,which will be distributed at the beginning of the event.All bookings are considered binding on receipt of thebooking form.CANNOT ATTEND?Please pass this brochure on to a colleague or you canpurchase the documentation for £330 (includescourier despatch). If your company is registered withinthe EU please supply your VAT number.For immediate information onthis and related events, pleasecall our HotlinesTELEPHONEPlease refer to emailorFAX+44 (0)207-246-5200or alternatively emailPlease refer to emailVENUE:Carlton Tower2, Cadogan PlaceLondon SW1X 9PYUnited KingdomTel: +44 (0)20 7235 1234Fax: +44 (0)20 7235 9129Nearest Underground Station: KnightsbridgeTRAVEL & ACCOMMODATION:Delegates wishing to take advantage ofpreferential room rates in London shouldcontact In Business Reservations (IBR)on +44 (0)1332 285 521 or emailreservations@ibr.co.uk. IBR can findaccommodation to suit any budget - pleasemention that you are attending <strong>Euromoney</strong> Seminars’6th Annual <strong>Syndicated</strong> <strong>Loans</strong> Conference.