TOWARDS GROWTH AND PROSPERITY - WOQOD

TOWARDS GROWTH AND PROSPERITY - WOQOD

TOWARDS GROWTH AND PROSPERITY - WOQOD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

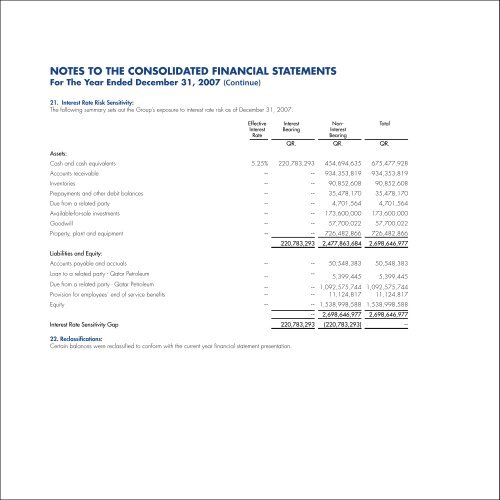

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor The Year Ended December 31, 2007 (Continue)21. Interest Rate Risk Sensitivity:The following summary sets out the Group’s exposure to interest rate risk as of December 31, 2007.Assets:EffectiveInterestRateInterestBearingNon-InterestBearingTotalQR. QR. QR.Cash and cash equivalents 5.25% 220,783,293 454,694,635 675,477,928Accounts receivable -- -- 934,353,819 934,353,819Inventories -- -- 90,852,608 90,852,608Prepayments and other debit balances -- -- 35,478,170 35,478,170Due from a related party -- -- 4,701,564 4,701,564Available-for-sale investments -- -- 173,600,000 173,600,000Goodwill -- -- 57,700,022 57,700,022Property, plant and equipment -- -- 726,482,866 726,482,866Liabilities and Equity:220,783,293 2,477,863,684 2,698,646,977Accounts payable and accruals -- -- 50,548,383 50,548,383Loan to a related party - Qatar Petroleum----5,399,445 5,399,445Due from a related party - Qatar Petroleum-- -- 1,092,575,744 1,092,575,744Provision for employees´ end of service benefits -- -- 11,124,817 11,124,817Equity -- -- 1,538,998,588 1,538,998,588-- 2,698,646,977 2,698,646,977Interest Rate Sensitivity Gap 220,783,293 (220,783,293) --22. Reclassifications:Certain balances were reclassified to conform with the current year financial statement presentation.