Special Economic Zones Scheme - Noida Authority Online

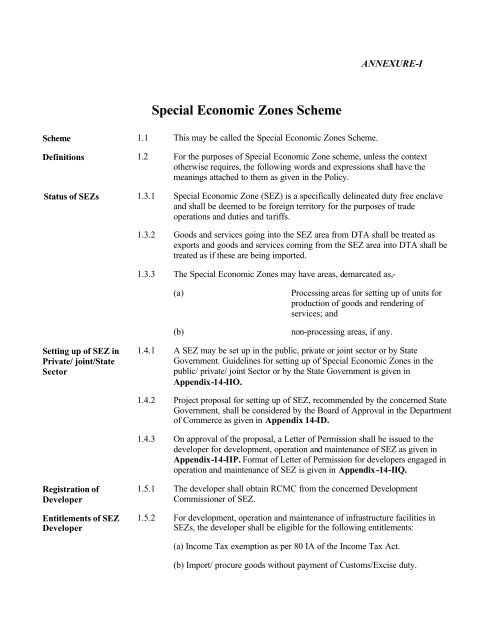

Special Economic Zones Scheme - Noida Authority Online

Special Economic Zones Scheme - Noida Authority Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Positive NFE = A – B >0Where:A : is the FOB value of exports by the SEZ unit; andB: is the sum total of the CIF value of all imported inputs and the CIF valueof all imported capital goods, and the value of all payments made in foreignexchange by way of commission, royalty, fees, dividends, interest on externalborrowings during the first five year period or any other charges. "Inputs"mean raw materials, intermediates, components, consumables, parts andpacking materials.1.12.2 If any goods are obtained from another SEZ/EOU/ EHTP/ STP unit orbonded warehouses or procured from an international exhibitions held inIndia or precious metals procured from nominated agencies or from advancelicencing holder in fulfillment of his export obligation, the value of suchgoods shall be included under B.1.12.3 If any capital goods imported duty free or leased from a leasing company,received free of cost and/or on loan basis or transfer, the CIF value of thecapital goods shall be included pro-rata, under B for the period it remainswith the unit.1.12.4 For annual calculation of NFE, the value of imported capital goods andlumpsum payment of foreign technical know-how fee shall be amortized asunder;1 st –10th Year : 10% each yearMaintenance ofaccounts1.13.1 SEZ unit shall maintain proper account, and shall submit quarterly and annualreport as prescribed in annexures to Appendix-14-IF to the DevelopmentCommissioner/Customs.1.13.2 The unit shall be able to account for the entire quantity of each category ofhomogenous goods imported/procured duty free, by way of exports,sales/supplies in DTA or transfer to other SEZ/EOU/EHTP/STP units andbalance in stock. However, at no point of time the units shall be required toco-relate every import consignment with its exports, transfer to other SEZ/EOU/ EHTP/STP units, sales in the DTA and balance in stock. Any matterfor clarification as to whether goods are homogenous or not shall be decidedby the Unit Approval Committee. The unit approval committee shall alsoreview imported/domestically procured goods not utilized within fiveyearperiod as part of annual performance review.Monitoring ofperformance1.14.1 The performance of SEZ units shall be monitored by the Unit ApprovalCommittee as per the guidelines given in Appendix-14-IG.1.14.2 Failure to ensure positive NFE or to abide by any of the terms and conditionsof the LOP/LUT shall render the unit liable to penal action under theprovisions of the Foreign Trade (Development & Regulation) Act, 1992 and

the Rules and Orders made there under without prejudice to action under anyother law/rules and cancellation or revocation of LOP.DTA Sale andSupplies1.15.1 (a) SEZ unit may sell goods, including by-products, and services in DTA inaccordance with the import policy in force, on payment of applicable duties.1.15.2 DTA sale by service/trading unit shall be subject to achievement of positiveNFE cumulatively. Similarly for units undertaking manufacturing andservices/ trading activities against a single LOP, DTA sale shall be subject toachievement of NFE cumulatively.1.15.3 Scrap/waste/remnants/rejects arising out of production process or in connection there with may besold in the DTA on payment of applicable duty.1.15.4 Scrap/dust/sweeping of gold/silver/platinum may be sent to the Governmentof India Mint/Private Mint from the SEZ units and returned to them instandard bars in accordance with the procedure prescribed by the Customsauthorities or may be permitted to be sold in the DTA on payment ofapplicable Customs duty, on the basis of gold/silver/platinum content, as maybe notified by Customs authorities.DTA Supplies tocount towards NFE1.16.1 The following supplies effected in DTA by SEZ units will be counted for thepurpose of fulfillment of positive NFE:(a) Supplies effected in DTA to holders of advance licence for annualrequirement/DFRC under the duty exemption/remission scheme/FPCGscheme.(b) Supplies made to free trade Warehousing set up under the Policy and/orunder Section 65 of the Customs Act where payment is received in freeforeign exchange.(c) Supplies against special entitlements of duty free import of goods.(d) Supplies of goods and services to such organizations which are entitled forduty free import of such items in terms of general exemption notificationissued by the Ministry of Finance(e) Supply of services (by services units) relating to exports paid for in freeforeign exchange or for such services rendered in Indian Rupees which areotherwise considered as having been paid for in free foreign exchange byRBI.(f) Supplies of Electronic and IT Hardware items, having zero Customs dutyprovided the items are manufactured in the unit.Supplies to otherEOU/STP/EHTP/SEZunits1.16.2 Supplies to other EOU/SEZ/ EHTP/ STP units shall also be counted towardsNFE provided that such goods are permissible for procurement by units.

Entitlement forSupplies from theDTA1.17.1 DTA supplier to SEZ shall be entitled for:-(a) DrawbackorDEPB in lieu of Drawback(b) Discharge of export performance, if any.1.17.2 Notwithstanding the above, SEZ units/SEZ Developer shall, on production ofa suitable disclaimer from the DTA supplier, be eligible for obtaining theentitlement of Drawback or DEPB in lieu of Drawback.1.17.3 SEZ units shall be entitled for:-(a) Exemption from Central Sales Tax;(b) Exemption from payment of Central Excise Duty on all goods eligible forprocurement.(c) Reimbursement of Central Excise Duty, including additional exciseduty, if any, paid on bulk tea procured from licenced auction centers byDevelopment Commissioner of concerned Zone so long as levy on bulk teain this regard is in force. The unit shall submit documentary evidenceshowing that the tea was procured from licenced auction centers alongwith the claim.(d) Reimbursement of Duty paid on fuels or any other goods procured fromDTA as per the rate of drawback notified by the Directorate General ofForeign Trade from the date of such notification.1.17.4 Supplier of precious and semi-preciousstones, synthetic stones and processed pearlsfrom Domestic Tariff Area to the unitssituated in SEZ shall be eligible for grant ofReplenishment Licenses at the rates and forthe items mentioned in of the Handbook(Vol. I).1.17.5 The procedure for submission of applicationfor grant of Replenishment Licence for cutand polished diamonds, precious and semipreciousstones, synthetic stones andprocessed pearls shall be as contained in thePolicy. However, the application shall bemade to the Development Commissioner ofthe SEZ concerned.1.17.6 The entitlements under paragraph 7.17.1 and 7.17.3 (b) above shall be

available provided the goods supplied are manufactured in India.Export through Statusholder1.18 SEZ unit may also export goods manufactured or software developed by it,through a merchant exporter/ status holder recognized under this Policy orany other EOU/SEZ/ EHTP/STP unit subject to following conditions:(a) The goods/software shall be produced/developed in the SEZ unitconcerned.(b) The level of NFE or any other conditions relating to the imports andexports as prescribed shall continue to be discharged by the SEZ unitconcerned.(c) The export orders so procured shall be executed within the parameters ofSEZ <strong>Scheme</strong> and the goods shall be directly transferred from the SEZ unit tothe port of shipment.(d) Fulfillment of positive NFE by SEZ unit in regard to such exports shall bereckoned on the basis of the price at which the goods and services aresupplied by SEZ units to the status holder/merchant exporter or other EOU/EPZ/SEZ/ EHTP/ STP unit.(e) All export entitlements, including recognition as status holder wouldaccrue to the exporter in whose name foreign exchange earnings are realized.However, such export shall be counted towards fulfillment of obligationunder SEZ scheme only.Inter-unit Transfer 1.19.1 SEZ units may transfer goods, including partly processed/semi-finished goodsand services from one SEZ unit to another SEZ/EOU/ EHTP/STPunit. However, trading units in SEZ may sell/transfer imported goods toanother SEZ/EOU/EHTP/STP units.1.19.2 Goods imported/procured by a SEZ unit may be transferred or given on loanto another unit within the same SEZ, which shall be duly accounted for, butnot counted towards discharge of export performance.1.19.3 Capital goods imported/procured may be transferred or given on loan toanother SEZ/EOU/ EHTP/ STP unit with prior permission of theDevelopment Commissioner and Customs Authorities.1.19.4 Transfer of goods as per paragraphs 7.19.1 and 7.19.2 within the same SEZshall not require any permission but the units shall maintain proper accountsof the transaction.Other Entitlements 1.20.1 Units set up in SEZs established by the Government will be charged rent forlease of industrial plots and standard design factory buildings/ sheds as perrates fixed from time to time.1.20.2 Exemption from Service tax.1.20.3 Exemption from income tax as per the provisions of the Income Tax Act.

1.20.4 FOB Value of export of a SEZ unit can be clubbed with FOB value of exportof its parent company in the DTA, or vice versa, for the purpose of accordingExport House, Trading House, Star Trading House or Super Star TradingHouse status;1.20.5 Foreign Equity up to 100% is permissible for all manufacturing activitiesunder automatic route except for the following:(a) arms and ammunition, explosives and allied items of defence equipment,defence aircraft and warships(b) atomic substances;(c) narcotics and psychotropic substances and hazardous chemicals(d) distillation and brewing of alcoholic drinks; and( e) cigarettes/cigars and manufactured tobacco substitutes1.20.6 Sectoral norms as notified by the Government shall apply to foreigninvestment in services and trading activities1.20.7 SEZ units may retain 100% of their export proceeds in their EEFC account.1.20.8 Export value of goods, software and services by SEZ units may be realizedand repatriated to India as per the RBI instructions in the matter.1.20.9 Software units may, in addition, also be allowed to use the computer systemfor training purpose (including commercial training) subject to the conditionthat no computer terminal shall be installed outside the Zone premises for thepurpose1.20.10 Procurement of raw materials and export of finished products shall be exemptfrom Central levies.1.20.11 Exemption from Industrial Licensing for manufacture of items reserved forSSI sector1.20.12 State Trading Enterprises Policy shall not apply to SEZ manufacturing units.Export of iron ore shall however be subject to the decision of the Governmentfrom time to time. Requirements of other conditions like minimum exportprice/export in consumer pack as per Exim Policy shall apply in case the rawmaterials are indigenous and exported without furtherprocessing/manufacturing by the SEZ unit. Export of textile items shall becovered by bilateral agreements, if any. Wood based units shall comply withthe direction of Hon'ble Supreme Court contained in its order dated12.12.1996 in Writ (civil) No, 202 of 1995- T.N.Godavarman Thirrumulppadv/s Union of India and others with WP(Civil) no 171 of 1996 in regard to useof timber/other wood.1.20.13 SEZ unit may install one fax machine at a place of its choice, outside theZone, subject to intimation of its location to the concerned Customs/Central

Excise authorities.1.20.14 SEZ units may, temporarily take out of the Zone duty free laptop computersand video projection systems for working upon by persons authorised by unit1.20.15 SEZ units may install personal computers not exceeding two in numberimported/ procured duty free in the registered/administrative office subject tothe guidelines issued by Department of Revenue in this behalf1.20.16 For IT and IT enabled services, persons authorized by the software units mayaccess the facility installed in the SEZ unit through communication links.Sub- Contracting 1.21.1 SEZ unit, including gem and jewellery units, may subcontract a part of theirproduction or production process through units in the DTA or through otherSEZ/EOU/EHTP/ STP units with the annual permission of Customsauthorities. Subcontracting of part of production process may also bepermitted abroad with the approval of the Development Commissioner.1.21.2 All units, including gem and jewellery, may sub-contract part of theproduction or production process through other units in the same SEZ withoutpermission of Customs authorities subject to records being maintained byboth the supplying and receiving units1.21.3 Sub-contracting by SEZ gems and jewellery units through units in other SEZor EOUs or units in DTA shall be subject to following conditions:-(a) Goods, finished or semi-finished, including studded jewellery, takenoutside the zone for sub- contracting shall be brought back to the unit within90 days.(b) No cut and polished diamonds, precious and semi-precious stones (exceptprecious/semi-precious stones and synthetic stones having zero duty) shall beallowed to be taken outside the zone for sub-contracting.(c) Receive plain gold/silver/platinum jewellery from DTA/EOU/SEZ units inexchange of equivalent quantity of gold/silver/ platinum and the wastagethereon as may be notified, as the case may be, contained in the saidjewellery.(d) SEZ units shall be eligible for wastage as applicable for sub-contractingand against exchange1.21.4 Scrap/waste/remnants generated through job work may be cleared from thejob worker’s premises on payment of applicable duty or destroyed in thepresence of Customs/Excise authorities or returned to the unit. Destructionshall not apply to gold, silver, platinum, diamond, precious and semi preciousstones.1.21.5 Export of finished goods from the job worker's premises may be permittedprovided such premises are registered with the Central Excise authorities.Where the job worker is SEZ/EOU/EHTP/STP unit, no such exciseregistration is required and export may be effected either from the job

workers’ premises or from the premises of the unit. Export of such productsfrom the job worker's premises shall not be allowed through third parties asprovided in the Policy.1.21.6 SEZ units may, on the basis of annual permission from the Customsauthorities, undertake jobwork for export, on behalf of DTA exporter,provided the finished goods are exported directly from SEZ units and exportdocument shall jointly in the name of DTA/SEZ unit. For such exports, theDTA units will be entitled for refund of duty paid on the inputs by way ofBrand Rate of duty drawback.1.21.7 SEZ units may be permitted to remove moulds, jigs, tools, fixtures, tackles,instruments, hangers and patterns and drawings to the premises of subcontractors,subject to the conditions that these shall be brought back to thepremises of the units on completion of the job work within a stipulatedperiod. The raw materials may or may not be sent along with these goods.1.21.8 In case of sub-contracting of production process abroad, the goods may beexported from the sub-contractor premises subject to the conditions that jobwork charges shall be declared in the export declaration forms, invoices etc.and full repatriation of foreign exchange shall be ensured by the SEZ unit.Contract Farming 1.21.9 SEZ units engaged in production/processing of agriculture/horticultureproducts, may on the basis of annual permission from the Customs authoritiestake out inputs and equipments (specified at Appendix-14-IJ to the DTAfarm subject to the following conditions:(a) Supply of inputs by the SEZ to the contract farm(s) shall be subject to theinput-output norms approved by the DGFT/BOA.(b) There shall be contract farming agreement between the SEZ and the DTAfarmer(s);(c) The unit has been in existence for at least two years and engaged in exportof agriculture/horticulture products; otherwise it shall furnish bank guaranteeequivalent to the duty foregone on the capital goods/inputs proposed to betaken out to the Deputy/Assistant Commissioner of Customs/Central Excisetill the unit completes two years.Export ThroughExhibitions1.22.1 SEZ units may export goods for holding/ participating in exhibitions abroadwith the permission of Development Commissioner subject to the followingconditions(a) the unit shall produce to the Customs authorities the letter in original or itscertified copy containing approval of the Development Commissioner. Forgems and jewellery items, a self-certified photograph of the products shallalso be submitted.(b) in case of re-import, such items on arrival shall be verified along with theexport documents before clearance(c) items not sold abroad shall be re-imported within 60 days of the close of

the exhibition. However, in case the exporter is participating in more than oneexhibition within 45 days of close of the first exhibition, then the 60 daysshall be counted from the date of close of the last exhibition.(d) In case of personal carriage of goods and for holding/participating inoverseas exhibitions, the value of gems and jewellery shall not exceed US $ 2millionPersonal Carriage ofgems and jewelleryfor Export promotiontours1.22.2 Personal carriage of gold/silver/ platinum jewellery, cut and polisheddiamonds, precious, semi-precious stones, beads and articles as samples uptoUS $ 100,000 for export promotion tours and temporary display/sale abroadby SEZ units is also permitted with the approval of the DevelopmentCommissioner subject to the following conditions:(a) SEZ units shall bring back the goods or repatriate the sale proceeds within45 days from the date of departure through normal banking channel(b) The unit shall declare personal carriage of such goods to the Customswhile leaving the country and obtain necessary endorsement.Export through showrooms abroad /DutyFree Shops1.23.1 Export of goods is also permitted for display/sale in the permitted shops setup abroad or in the show rooms of their distributors/agents. The items notsold abroad within 180 days shall be re-imported within 45 days.1.23.2 SEZ unit may set up show rooms/retail outlets at the International Airports forsale of goods in accordance with the procedure laid down by the Customsauthorities. The items remaining unsold after a period of 60 days shall beexported or returned to the respective SEZ units.Personal carriage ofImport/ExportParcels includingthrough foreignbound passengers1.24.1 Import/ export through personal carriage of gem and jewellery items may beunder-taken as per the procedure prescribed by Customs. The export proceedsshall, however, be realized through normal banking channel. Import/exportthrough personal carriage for units , other than gem and jewellery units, shallbe allowed provided the goods are not in commercial quantity.1.24.2 For Personal carriage of goods by foreign bound passenger, the followingdocuments shall be submitted by SEZ units as proof of exports.(a) Copy of the shipping bill filed by the SEZ units;(b) A copy of the Currency Declaration Form filed by the Foreign buyer withthe Customs at the time of his arrival; and(c) Foreign Exchange Realisation/ Encashment Certificate from the Bank.(d ) Personal carriage of parts by foreign bound passenger shall also beallowed in case the same are required for repairs of exported goods atcustomer site. The following documents shall be submitted as proof of export:(i) permission letters from Customs for exports.(ii) Invoice with value (for payment or free of charge).

1.24.3 In addition to this, Personal Carriage by foreign bound passenger onDocument Against Acceptance (DA)/Cash On Delivery (COD) basis is alsoallowed. The SEZ units will have to furnish the following documents as proofof export.(a) Copy of Shipping Bill.(b) Bank Certificate of Export and Realisation.1.24.4 The procedure for personal carriage of import parcels will be the same as forimport of goods by airfreight except that the parcels shall be brought to theCustoms by the SEZ unit/ foreign national for examination and release.Instructions issued by the Customs authorities in this regard should befollowed mutatis mutandis.Export/Import byPost / CourierReplacement/ Repairof Goods1.25 Goods including free samples, may be exported/imported by airfreight orthrough Foreign Post Office or through courier subject to the proceduresprescribed by Customs.1.26.1 The general provisions of Policy relating to export of replacement/ repairedgoods shall apply equally to SEZ units, save that, cases not covered by theseprovisions shall be considered on merits by the Development Commissioner.1.26.2 The units may send capital goods abroad, for repair and return. Any foreignexchange payment for this purpose will also be allowed.1.26.3 The goods sold in the DTA and to be defective may be brought back forrepair or replacement under intimation to the Development Commissioner.1.26.4 Goods or parts thereof, on being imported/ indigenously procured and founddefective or otherwise unfit for use or which have been damaged or becomedefective after import/ procurement may be returned and replacementobtained or destroyed. In the event of replacement, the goods may be broughtback from the foreign suppliers or their authorised agents in India or theindigenous suppliers. However, destruction shall not apply to precious andsemi-precious stones and precious metals.1.26.5 Goods may be transferred to DTA/abroad for repair/ replacement, testing orcalibration, quality testing and R & D purpose under intimation to Customsauthorities and subject to maintenance of records.1.26.6 SEZ units may transfer goods for quality testing/R & D purpose to anyrecognized laboratory/ institution, upto Rs 5 lakhs per annum withoutpayment of duty, on giving suitable undertaking to the customs for return ofthe goods. However, if the goods have been consumed/destroyed in theprocess of testing etc. a certificate from the laboratory/ institution to thiseffect shall be furnished to the Customs.Samples 1.27.1 SEZ units may, on the basis of records maintained by them, and on priorintimation to Customs authority supply or sell samples in the DTA fordisplay/market promotion on payment of applicable duties.

1.27.2 SEZ units may also remove samples to DTA without payment of duty underprior intimation to the Customs authorities subject to the condition that thegoods shall be brought back within a stipulated period.1.27.3 SEZ units may export free samples, without any limit, including samplesmade in wax moulds, silver mould and rubber moulds through all permissiblemode of export including through couriers agencies/post.Sale of unutilizedmaterial/destruction1.28.1 In case a SEZ unit is unable, for valid reasons, to utilize the goods, andservices, imported or procured from DTA, it may be transferred to otherEOU/SEZ/EHTP/STP units or disposed off in the DTA on payment ofapplicable duties and submission of import license by DTA unit, whereverapplicable or exported. Such transfer from SEZ unit to anotherSEZ/EOU/EHTP/STP unit would be treated as import for the receiving unit.1.28.2 Capital goods and spares that have become obsolete/surplus may either beexported, transferred to another SEZ/EOU/EHTP/STP unit or disposed of inthe DTA on payment of applicable duties. The benefit of depreciation, asapplicable will be available in case of disposal in DTA.1.28.3 SEZ unit may be allowed by Customs authorities concerned to donateimported/ indigenously procured (bought or taken on loan) computer andcomputer peripherals, including printer, plotter, scanner, monitor, key-boardand storage units without payment of duty, two years after theirimport/procurement and use by the units, to recognized non-commercialeducational institutions, registered charitable hospitals, public libraries, publicfunded research and development establishments, organisations of theGovernment of India or Government of a State or Union Territory as perCustom/ Central Excise notification issued in this regard.1.28.4 No duty shall be payable in case capital goods, raw material, consumables,spares, goods manufactured, processed or packaged and scrap/waste/remnants/rejects are destroyed within the Zone after intimation to the Customauthorities or destroyed outside the Zone with the permission of Customauthorities. Destruction as stated above shall not apply to gold, silver,platinum, diamond, precious and semi precious stones.Self-Certification 1.29 All activities of SEZ units within the Zone, unless otherwise specified,including export and re-import of goods shall be through self certificationprocedure.Distinct identity 1.30 If an industrial enterprise is operating both as a domestic unit as well as anSEZ unit, it shall have two distinct identities with separate accounts,including separate bank accounts. It is, however, not necessary for it to be aseparate legal entity, but it should be possible to distinguish the imports andexports or supplies effected by the SEZ units from those made by the otherunits of the enterprise.Powers of UnitsApproval Committee1.31 The powers and functions of the Unit Approval Committee notified by theGovernment

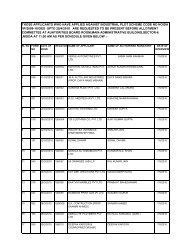

(Appendix-14-IIR) shall be as under:(a) To consider the applications for setting up of units in SEZ other thanproposals for setting up of unit in the services sector (except R&D, softwareand IT enabled services, trading or any other service activity as may bedelegated by the BOA) and items of manufacture requiring industrial licenceunder the Industrial (Development & Regulation) Act, 1951 shall beconsidered by the BOA;(b) To consider and permit conversion of EOU into SEZ unit;(c) to monitor the performance of the Units;(d) to supervise and monitor permission, clearances, licences granted to theunits and take appropriate action in accordance with law;(e) to call for information required to monitor the performance of the unitunder the permission, clearances, licence granted to it;(f) to perform any other function delegated by the Central Government or itsagencies.(g) to perform any other function delegated by the State Governments or itsagencies.(h) to grant all approvals and clearances for theestablishment and operation of Units in the <strong>Special</strong><strong>Economic</strong> Zone.Management of SEZ 1.32.1 SEZ will be under the administrative control of the DevelopmentCommissionerRegistration-cum-Member-shipCertificatePowers of theDevelopmentCommissionerImporter-ExporterCode No.1.32.2 Registering authority for SEZ units, shall be the Development Commissionerof the SEZ concerned. A separate Registration-cum-Membership Certificateshall not be required in their cases as provided for in the Policy. However,SEZ units may also obtain RCMC from the Export Promotion Councilfor EOU & SEZ units.1.32.3 Apart from the original power delegated elsewhere, the DevelopmentCommissioners of SEZ will exercise the following powers in respect of SEZunits. Jurisdiction of Development Commissioners is given in Appendix-14-IK.(a) allot Importer-Exporter code number for SEZ units and SEZ developer.(b) Approve all matters relating to post approval operation of the unitincluding import/procurement of additional capital goods, increase in value ofcapital goods on account of foreign exchange rate fluctuations, enhancementof production capacity, broad banding/diversification, change in name of thecompany or the implementing agency and change from a company to anotherprovided the new implementing agency /company undertakes to take over the

assets and liabilities of the existing unit and merger of two or more SEZ units.(c) Cancel LOP/ LOI/IL wherever warranted.(d) Adjudication under Section 13 read with Section 11 of Foreign Trade(Development & Regulation) Act, 1992 in respect of SEZ units.(e) Action under the Public Premises Eviction Act in case the rent on theplot/built up premises allotted to the units is in arrears or if the plot/shed isnot utilised for the purpose for which the same has been allotted.(f) Valuation of exports declared on SOFTEX form by the units located in<strong>Special</strong> <strong>Economic</strong> <strong>Zones</strong>.(g) Issuing eligibility certificates for grant of employment visa to low levelforeign technicians to be engaged by SEZ units.(h) Issue of Green Card after execution of Legal Undertaking by the unit.(i) Import of second hand capital goods without agerestrictions.(j) Grant/renew Status Holder Certificate in respectof SEZ units provided it does not involve clubbingof FOB value of exports of its parent company inthe DTA.Exit from SEZ scheme 1.33.1SEZ unit may opt out of the scheme with the approval of the DevelopmentCommissioner. Such exit from the scheme shall be subject to payment ofapplicable Customs and Excise duties on the imported and indigenous capitalgoods, raw materials etc. and finished goods in stock. In case the unit has notachieved positive NFE, the exit shall be subject to penalty, that may beimposed by the adjudicating authority under Foreign Trade (Development andRegulation) Act, 1992.1.33.2 Broad conditions governing exit of units from the SEZ scheme are indicatedat Appendix-14-IL.1.33.3 In the event of a gem and jewellery unit ceasing its operation, gold and otherprecious metals, alloys, gem and other materials available for manufacture ofjewellery, shall be handed over to an agency nominated by the Ministry ofCommerce and Industry (Department of Commerce) at the price to bedetermined by that agency.1.33.4 SEZ unit may also be permitted by the Development Commissioner, as onetime option, to exit from SEZ scheme on payment of duty on capital goodsunder the prevailing EPCG <strong>Scheme</strong>, subject to the unit satisfying theeligibility criteria of that <strong>Scheme</strong> and standard conditions, as per paragraphabove.Depreciation normsfor Capital goods1.33.5 The depreciation upto 100% is permissible for computer and computerperipherals in 5 years and in case of others capital goods in 10 years, as per

the norms notified by the Department of Revenue.1.33.6 Depreciation for computers and computer peripherals shall be as follows:10% for every quarter in the first year,8% for every quarter in the 2nd year,5% for every quarter in the 3rd year1% for every quarter in the fourth and fifth year.1.33.7 For capital goods, other than the above, the depreciation rate would be asfollows:-4% for every quarter in the first year;3% for every quarter for the second and thrid year;2.5% for every quarter for the fourth and fifth year; and2% for every quarter thereafter.1.33.8 Clearance of capital goods imported as second hand shall be allowed as perthe Policy under EPCG <strong>Scheme</strong>. In respect of second hand capital goodswhich are less than 10 years old on date of import, clearance in the DTA maybe allowed, on payment of applicable duties, after 2 years from the date ofimport. In addition, where the second hand capital goods are more than 10years old, clearance in the DTA may be allowed only against an importlicence and payment of applicable duties.Revival of Sick units 1.34 Subject to a unit being declared sick by the appropriate authority, proposalsfor revival of the unit or its take over may be considered by the Board ofApproval as per guidelines in Appendix-14-IM.