- Page 1: AnnualReport07

- Page 5 and 6: ANNUAL REPORT 2007KEY GROUP FIGURES

- Page 7 and 8: LETTER FROM THE CHAIRMANSANTANDER A

- Page 9 and 10: “We create value through acquisit

- Page 11 and 12: LETTER FROM THE CHIEF EXECUTIVE OFF

- Page 13 and 14: “The ABN AMRO acquisition has a p

- Page 15 and 16: “Economic growth forecasts are gr

- Page 17: FORMULA 1 TM SANTANDER BRITISH GRAN

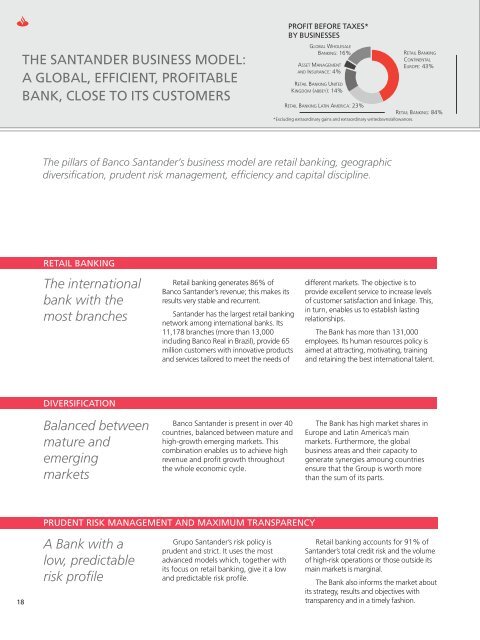

- Page 21 and 22: ATTRIBUTABLE PROFIT* 2007BY GEOGRAP

- Page 23 and 24: Santander Totta branch, Rua do Ouro

- Page 25 and 26: Santander Consumer Finance Headquar

- Page 27 and 28: Branch, Gracechurch Street, London,

- Page 29 and 30: Branch, Sao Paulo. BrazilBrazil Mex

- Page 31 and 32: ACHIEVEMENTS IN 2007• Leading big

- Page 33 and 34: ASSET MANAGEMENTGLOBAL BUSINESSESWI

- Page 35 and 36: INSURANCEGLOBAL BUSINESSESSANTANDER

- Page 37 and 38: CORPORATE GOVERNANCESANTANDER’S C

- Page 39 and 40: Investors’ Day held in Santander

- Page 41 and 42: JULY• Santander, RBS and Fortis p

- Page 43 and 44: ANNUAL REPORT 07CORPORATEGOVERNANCE

- Page 45 and 46: 5 31 242. SANTANDER’S BOARD OF DI

- Page 47 and 48: 14 15 16 17 18 19 20LORD BURNS (TER

- Page 49 and 50: Meeting). In view of the fact that

- Page 51 and 52: executive Chairman of Abbey Nationa

- Page 53 and 54: All current Directors have been app

- Page 55 and 56: - RISK COMMITTEEThe Rules and Regul

- Page 57 and 58: 3. RIGHTS OF THE SHAREHOLDERS AND G

- Page 59 and 60: ANNUAL GENERAL SHAREHOLDERS’ MEET

- Page 61 and 62: 4. SANTANDER’S SENIOR MANAGEMENT1

- Page 63 and 64: - The Code for Conduct in Securitie

- Page 65 and 66: ANNUAL REPORT 2007FINANCIAL REPORTC

- Page 67 and 68: Another factor is the Group’s exc

- Page 69 and 70:

GRUPO SANTANDER RESULTSGrupo Santan

- Page 71 and 72:

NET INTEREST INCOME(W/O DIVIDENDS)M

- Page 73 and 74:

NET LOAN LOSS PROVISIONSVariationMi

- Page 75 and 76:

CUSTOMER LOANSVariationMillion euro

- Page 77 and 78:

CREDIT RISK MANAGEMENT (*)Variation

- Page 79 and 80:

CUSTOMER FUNDS UNDER MANAGEMENTBill

- Page 81 and 82:

SHAREHOLDERS' EQUITY AND MINORITY I

- Page 83 and 84:

1. PRINCIPAL SEGMENTS OR GEOGRAPHIC

- Page 85 and 86:

CONTINENTAL EUROPEContinental Europ

- Page 87 and 88:

SANTANDER BRANCH NETWORKThe Santand

- Page 89 and 90:

• The consumer unit, which groups

- Page 91 and 92:

New loans rose 6% as a result of a

- Page 93 and 94:

year earlier, and coverage was 117%

- Page 95 and 96:

UNITED KINGDOM (ABBEY)Abbey continu

- Page 97 and 98:

LATIN AMERICAVariationMillion euros

- Page 99 and 100:

LATIN AMERICANET OPERATING INCOME A

- Page 101 and 102:

LATIN AMERICA. MAIN UNITSBrazil Mex

- Page 103 and 104:

Attributable profit was 17.6% highe

- Page 105 and 106:

CHILESantander Chile is the largest

- Page 107 and 108:

The focus in 2007 was on boosting r

- Page 109 and 110:

FINANCIAL MANAGEMENT AND EQUITY STA

- Page 111 and 112:

RETAIL BANKING. RESULTSGross operat

- Page 113 and 114:

Of note in Mergers and Acquisitions

- Page 115 and 116:

ASSET MANAGEMENT AND INSURANCEThis

- Page 117 and 118:

Its objective is to achieve global

- Page 119 and 120:

ANNUAL REPORT 2007RISK MANAGEMENTIN

- Page 121 and 122:

2. CREDIT RISKCredit risk is the po

- Page 123 and 124:

DISTRIBUTION OF LENDING BYGEOGRAPHI

- Page 125 and 126:

MORTGAGE PORTFOLIO UNITED KINGDOMMi

- Page 127 and 128:

CONCEPT OF EXPECTED LOSSAs well as

- Page 129 and 130:

2.3 TEST OF REASONABLENESS IN EXPEC

- Page 131 and 132:

2.5 MONITORING AND CONTROL SYSTEMSA

- Page 133 and 134:

OTC DERIVATIVES DISTRIBUTION BY NET

- Page 135 and 136:

coordinates management of the rest

- Page 137 and 138:

Coordination with other areasEvery

- Page 139 and 140:

HISTOGRAM OF VaR BY RISK FACTORMill

- Page 141 and 142:

EVOLUTION OF RISK (VAR) OF THE STRU

- Page 143 and 144:

MATURITY AND REPRICING GAPSStructur

- Page 145 and 146:

In Latin America, the larger volume

- Page 147 and 148:

E. STRUCTURED FINANCING OPERATIONSG

- Page 149 and 150:

GRUPO SANTANDER: DISTRIBUTION OF TH

- Page 151 and 152:

• Appropriate confirmation of ope

- Page 153 and 154:

INTERNAL VALIDATION OF INTERNAL RIS

- Page 155 and 156:

Grupo Santander’s capital plannin

- Page 157 and 158:

Of the 28 products approved as of N

- Page 159 and 160:

ANNUAL REPORT 07GRUPO SANTANDER’S

- Page 162 and 163:

ANNUAL REPORT 2007AUDITORS’ REPOR

- Page 164:

2. The relative importance of fees

- Page 167 and 168:

Santander GroupConsolidated balance

- Page 169 and 170:

Translation of consolidated financi

- Page 171 and 172:

Santander GroupConsolidated cash fl

- Page 173 and 174:

StandardsObligatory Applicationin t

- Page 175 and 176:

Following the submissions phase, in

- Page 177 and 178:

standard tax rate for income tax pu

- Page 179 and 180:

indirectly half or more of the voti

- Page 181 and 182:

- Loans and receivables: this categ

- Page 183 and 184:

All derivatives are recognised in t

- Page 185 and 186:

In Millions of EurosFair Value Reas

- Page 187 and 188:

2. It is effective in offsetting ex

- Page 189 and 190:

- The various types of risk to whic

- Page 191 and 192:

2. Country risk allowance:Country r

- Page 193 and 194:

Depreciation is calculated, using t

- Page 195 and 196:

An impairment loss recognised for g

- Page 197 and 198:

When the requirements stipulated in

- Page 199 and 200:

Post-employment benefits are recogn

- Page 201 and 202:

Group plc, Fortis N.V. and Fortis S

- Page 203 and 204:

ut, unless expressly authorised oth

- Page 205 and 206:

d) Off-shore entitiesAt 31 December

- Page 207 and 208:

Thousands of EurosInterim dividends

- Page 209 and 210:

Thousands of Euros2007 2006 2005Tot

- Page 211 and 212:

The amounts in the “Accrued pensi

- Page 213 and 214:

Concessions GrantedExercisedOptions

- Page 215 and 216:

million at 31 December 2007 (31 Dec

- Page 217 and 218:

Director Corporate Name Number of S

- Page 219 and 220:

8. OTHER EQUITY INSTRUMENTSa) Break

- Page 221 and 222:

Thousands of Euros 2007 2006 2005Ba

- Page 223 and 224:

) DetailFollowing is a detail, by l

- Page 225 and 226:

This amount, after deducting the re

- Page 227 and 228:

12. NON-CURRENT ASSETS HELD FOR SAL

- Page 229 and 230:

14. INSURANCE CONTRACTS LINKED TO P

- Page 231 and 232:

) Property, plant and equipment for

- Page 233 and 234:

At least once per year (or whenever

- Page 235 and 236:

20. DEPOSITS FROM CENTRAL BANKS AND

- Page 237 and 238:

22. MARKETABLE DEBT SECURITIESa) Br

- Page 239 and 240:

23. SUBORDINATED LIABILITIESa) Brea

- Page 241 and 242:

25. PROVISIONSa) BreakdownThe break

- Page 243 and 244:

3. The estimated retirement age of

- Page 245 and 246:

Plan assetsPost-Employment PlansMil

- Page 247 and 248:

The changes in the present value of

- Page 249 and 250:

The changes in the present value of

- Page 251 and 252:

- LANETRO, S.A.: claim (ordinary la

- Page 253 and 254:

27. TAX MATTERSa) Consolidated Tax

- Page 255 and 256:

d) Tax recognised in equityIn addit

- Page 257 and 258:

28. MINORITY INTERESTS“Minority i

- Page 259 and 260:

30. SHAREHOLDERS’ EQUITY“Shareh

- Page 261 and 262:

) BreakdownThe breakdown of the bal

- Page 263 and 264:

35. OFF-BALANCE-SHEET ITEMS“Off-b

- Page 265 and 266:

The detail of the cumulative credit

- Page 267 and 268:

Additionally, following is a detail

- Page 269 and 270:

40. INCOME FROM EQUITY INSTRUMENTS

- Page 271 and 272:

44. INSURANCE ACTIVITY INCOME“Ins

- Page 273 and 274:

47. SALES AND INCOME FROM THE PROVI

- Page 275 and 276:

c) Share-based paymentsi. The BankI

- Page 277 and 278:

- Monte Carlo valuation model: perf

- Page 279 and 280:

In 2005 the Group designed a Medium

- Page 281 and 282:

51. OTHER OPERATING EXPENSESThe bre

- Page 283 and 284:

Millions of Euros 31 December 2005A

- Page 285 and 286:

54. GEOGRAPHICAL AND BUSINESS SEGME

- Page 287 and 288:

Millones de Euros 2007 2006Financia

- Page 289 and 290:

Millions of Euros 2007 2006AssetAss

- Page 291 and 292:

Millions Of Euros 2005Associatesand

- Page 293 and 294:

B. CREDIT RISKCredit risk is the po

- Page 295 and 296:

operational risks and related mitig

- Page 297 and 298:

) Net interest margin (NIM) sensiti

- Page 299 and 300:

• Thus, in Latin America the exce

- Page 301 and 302:

Role of insurance in operational ri

- Page 303 and 304:

Procedures Manual for the Marketing

- Page 305 and 306:

Appendix ISUBSIDIARIES OF BANCO SAN

- Page 307 and 308:

Appendix ISUBSIDIARIES OF BANCO SAN

- Page 309 and 310:

Appendix IILISTED COMPANIES IN WHIC

- Page 311 and 312:

Appendix IVNOTIFICATIONS OF ACQUISI

- Page 313 and 314:

The Group holds 66,822,519,695 ordi

- Page 315 and 316:

Translation of a report originally

- Page 317 and 318:

commercial banking units (Santander

- Page 319 and 320:

The figures for this area reflect o

- Page 321 and 322:

The Group’s gross loans and recei

- Page 323 and 324:

These figures illustrate the Group

- Page 325 and 326:

Furthermore, as part of the celebra

- Page 327 and 328:

- Green loans. In the United Kingdo

- Page 329 and 330:

OUTLOOKThe economic outlook for 200

- Page 331 and 332:

• In Insurance, the Group will ta

- Page 333 and 334:

Significant direct and indirect own

- Page 335 and 336:

- Powers of the General MeetingAs p

- Page 337 and 338:

This Committee has been permanently

- Page 339 and 340:

Banco Santander, S.A. Balance Sheet

- Page 341 and 342:

Proposed Distribution of Income (31

- Page 343 and 344:

Banco Santander, S.A. Balance Sheet

- Page 345 and 346:

APPENDICESREPUTATIONAL RISK AND THE

- Page 347 and 348:

Grupo Santander’s prevention syst

- Page 349 and 350:

HISTORICAL DATA 1997-2007Without IF

- Page 352:

www.santander.com