Annual report for 2010 to post-demutualisation with ... - Friends Life

Annual report for 2010 to post-demutualisation with ... - Friends Life

Annual report for 2010 to post-demutualisation with ... - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

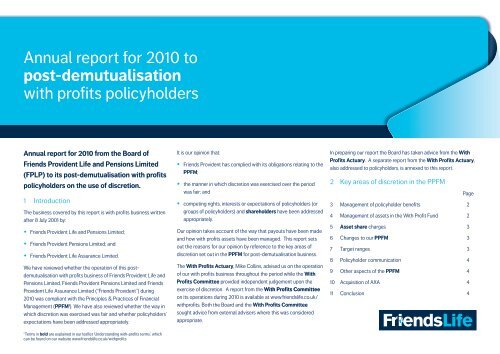

<strong>Annual</strong> <strong>report</strong> <strong>for</strong> <strong>2010</strong> <strong>to</strong> <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders3 Management of policyholder benefitsWith profits policies typically contain guarantees, usually in the <strong>for</strong>mof a minimum guaranteed amount <strong>to</strong> be paid on maturity, retiremen<strong>to</strong>r death. This is made up of an initial amount guaranteed at the star<strong>to</strong>f the policy which can then be increased in the <strong>for</strong>m of regularbonuses. In addition, a final bonus payment may be made.3.1 Regular bonusesFinancial markets continued <strong>to</strong> per<strong>for</strong>m well over <strong>2010</strong>. Weincreased the exposure of the With Profit Fund <strong>to</strong> equity andproperty from 26% at the end of 2009 <strong>to</strong> 49% by the end of<strong>2010</strong> and this increase enabled the Fund <strong>to</strong> better benefit fromthe s<strong>to</strong>ck market growth in the latter half of <strong>2010</strong>.As a result the Fund achieved an investment return of 12.9% in<strong>2010</strong>.When setting regular bonus rates we take a medium <strong>to</strong>long‐term view. It remains essential that we set regular bonusrates that are not only fair <strong>to</strong> cus<strong>to</strong>mers <strong>with</strong> plans maturing in2011, but also <strong>to</strong> cus<strong>to</strong>mers whose plans mature in the future. Inview of the improved financial position of the Fund and goodinvestment return earned over <strong>2010</strong>, we have decided <strong>to</strong>increase regular bonus rates modestly <strong>for</strong> all Pensions andsome Overseas business. For the rest of the business, we haveconcluded that current rates remain appropriate.3.2 Final bonus rates and payouts at maturityWe determine final bonus rates so as <strong>to</strong> target payouts at anappropriate level compared <strong>to</strong> underlying investment values, asrequired by our PPFM. The underlying investment value isrepresented by the plan’s asset share. For most plans, assetshare is the <strong>to</strong>tal payments made <strong>to</strong> the With Profit Fundincreased (or decreased) by the investment return achieved bythat part of the With Profit Fund backing asset shares, lesscharges, the cost of guarantees and tax.Current payout levels may be set above or below the long-termtarget level in order <strong>to</strong> smooth payouts <strong>with</strong>in limits. Over orunder-payments as a result of smoothing are intended <strong>to</strong> beneutral over the longer term.At this latest declaration (January 2011) we have increasedmost final bonus rates and maintained others unchanged. Therevised final bonus rates result in payouts that continue <strong>to</strong>reflect smoothed investment returns since inception <strong>for</strong> plansthat have a claim in the near future. We previously reviewedfinal bonus rates in Oc<strong>to</strong>ber <strong>2010</strong> and revised the majority ofthe rates upwards.We also reviewed final bonus rates in July <strong>2010</strong> but decided <strong>to</strong>leave rates unchanged at that time as investment values werelittle changed from the start of the year following falls in thesecond quarter.3.3 Surrender valuesTreating all policyholders fairly is the underlying principle whensetting surrender values and Market Value Reduction (MVR)levels.MVRs are applied <strong>to</strong> some policies as a way of ensuring thatthose policyholders leaving or wishing <strong>to</strong> take money out of theFund do not take more than their fair share at the expense ofthose policyholders who remain. The MVRs applied differdepending on the year and month the policy was taken out.Importantly, MVRs do not apply on maturity or if the policyholderdies.No MVRs have been applied <strong>to</strong> <strong>post</strong>-<strong>demutualisation</strong> businesssince 11 September 2009.3.4 <strong>Annual</strong> review of payoutsA review is carried out at least once a year <strong>to</strong> ensure thatclaims have been settled at the intended level. If it is identifiedthat any claims have been paid that are lower than theintended level, then additional payments are made out of theWith Profit Fund, <strong>with</strong> any overpayments being met byshareholders. No such issues were discovered in <strong>2010</strong> inrespect of <strong>post</strong>-<strong>demutualisation</strong> business.4 Management of assets in the With Profit FundWe determine the investment strategy <strong>for</strong> the With Profit Fund aftertaking in<strong>to</strong> account the current and projected financial position ofthe Fund.We instruct our investment managers, F&C, <strong>to</strong> carry out thestrategy and we moni<strong>to</strong>r their per<strong>for</strong>mance in achieving returnsrelative <strong>to</strong> an appropriate benchmark. F&C was previously asubsidiary of <strong>Friends</strong> Provident plc but it was demerged in 2009, andis now an independent, publicly listed, company.During <strong>2010</strong> the return achieved in respect of assets backing assetshares was 12.9%. Asset shares have there<strong>for</strong>e risen over the yearby a similar percentage.We delegate investment decisions <strong>to</strong> our investment managers, whooperate <strong>with</strong>in the limits we set out in the mandates. We increasedour limits on exposure <strong>to</strong> equity significantly during the year. Thisincreased the benefit <strong>to</strong> the Fund from the s<strong>to</strong>ck market growth in2

<strong>Annual</strong> <strong>report</strong> <strong>for</strong> <strong>2010</strong> <strong>to</strong> <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholdersthe latter half of <strong>2010</strong>. As a result, the equity backing ratio (thepercentage of the Fund invested in equities and property), of 49%,is significantly higher than last year, as shown in the charts below,and has returned <strong>to</strong> close <strong>to</strong> the mid 2008 level (51%), reversingthe reductions made in late 2008 <strong>to</strong> counteract the effects of thefinancial crisis.Fixed interestand other74%Investment split31 December 2009 31 December <strong>2010</strong>Equity17%Property9%Fixed interestand other51%Property 8%Equity41%In addition <strong>to</strong> investing assets <strong>to</strong> back asset shares, the Fundalso holds investments that back the cost of guarantees. Theseinvestments are in fixed interest assets and derivative contractsthat protect the Fund, and there<strong>for</strong>e policyholders, from significantchanges in the cost of providing these guarantees. We continuallyreview these derivative contracts <strong>to</strong> ensure that they appropriatelyreflect the guarantees that have been provided. There are certainasset classes (corporate bonds and property) where there islimited availability of cost effective derivatives <strong>to</strong> mitigate risk.To overcome this limitation, the Fund made use of a techniqueknown as asset share shorting <strong>to</strong> help protect against the effec<strong>to</strong>f adverse market conditions. This involves holding fewer assetsin the asset share pool than the amount of asset share liabilities,which gives some downside protection when investment marketsfall in value but <strong>for</strong>egoes some investment profit when investmentmarkets do well.The With Profit Fund has the resources <strong>to</strong> meet fully the benefitexpectations of all our <strong>with</strong> profits policyholders and has sufficientworking capital <strong>to</strong> enable it <strong>to</strong> <strong>with</strong>stand extreme adverse events.Our aim remains that the Fund should be managed such that innormal circumstances shareholder support is not required <strong>to</strong> meetadverse events.In <strong>2010</strong>, we continued our review of the risk appetite of the Fundand, as mentioned last year as a possibility, decided that thereshould be differing investment mixes <strong>for</strong> the assets backing policiestaken out be<strong>for</strong>e and after <strong>demutualisation</strong> on 9 July 2001. Thisapproach has been taken <strong>to</strong> ensure a suitable investment mix <strong>to</strong>align the risk/reward balance of each section of the Fund and willcome in<strong>to</strong> effect in early 2011.The <strong>post</strong>-<strong>demutualisation</strong> business has fewer guarantees and canthere<strong>for</strong>e af<strong>for</strong>d <strong>to</strong> take on greater investment risk than the pre<strong>demutualisation</strong>business. We are there<strong>for</strong>e likely <strong>to</strong> continue <strong>to</strong>increase the proportion of the Fund backing <strong>post</strong>-<strong>demutualisation</strong>asset shares invested in equities during 2011 albeit perhaps only <strong>to</strong>a small degree.5 Asset share chargesWe have made an annual charge <strong>to</strong> asset shares since the end of2002 <strong>to</strong> spread the cost of guarantees both now and in the future.As usual we reviewed the charges during the year and as a resul<strong>to</strong>f this investigation we have removed guarantee charges from allproduct lines except <strong>for</strong> Regular Premium <strong>Life</strong> contracts where ithas been halved from 0.2% <strong>to</strong> 0.1% of asset share <strong>with</strong> effect from1 January <strong>2010</strong>.We expect that the accumulated value of the annual guaranteecharges that we make will be equivalent <strong>to</strong> the cost of theguarantees built up by regular bonuses but if it proves <strong>to</strong> be largerthan needed we will credit back any excess <strong>to</strong> asset shares.6 Changes <strong>to</strong> our PPFMThe PPFM document was updated during <strong>2010</strong> <strong>to</strong> reflect:• the intention <strong>to</strong> allow differing investment mixes backing policiestaken out be<strong>for</strong>e and after <strong>demutualisation</strong> on 9 July 2001;• more detail on the way risk is managed including as a possiblepractice the ability <strong>to</strong> make use of the technique known as assetshare shorting. There are certain asset classes (corporatebonds and property) where the availability of cost effectivederivatives <strong>to</strong> mitigate risk is limited. To overcome this limitation,the Fund can make use of a technique known as asset shareshorting <strong>to</strong> help hedge against the impacts of adverse marketconditions. An asset share shorting solution involves holdingfewer assets in the asset share pool than the amount of assetshare liabilities. The remaining assets are held outside the assetshare pool, but <strong>with</strong>in the pool of assets backing the expectedcost of basic benefit guarantees, invested in low risk assets. Therisk that the shorted assets per<strong>for</strong>m better than the low riskassets, causing a loss <strong>to</strong> the Fund, is offset by the basic benefitguarantee costs reducing in these circumstances, generating aprofit <strong>for</strong> the Fund.There were no changes <strong>to</strong> Principles, only Practices. Our PPFMdocument along <strong>with</strong> a summary of the changes can be found atwww.friendslife.co.uk/<strong>with</strong>profits.7 Target rangesSince <strong>demutualisation</strong> we have sought <strong>to</strong> target payouts <strong>with</strong>ina range around asset share. Any divergence from time <strong>to</strong> timereflects the normal smoothing applicable <strong>to</strong> <strong>with</strong> profits business.This distinguishes <strong>with</strong> profits business from the generally morevolatile payouts associated <strong>with</strong> unit linked plans.3

<strong>Annual</strong> <strong>report</strong> <strong>for</strong> <strong>2010</strong> <strong>to</strong> <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholdersFor most of our business we target payouts using a sample assetshare methodology. For this business we manage payouts <strong>with</strong>in+/- 20% of the sample asset share target, effectively givingtarget ranges of 80% <strong>to</strong> 120% of asset share <strong>for</strong> maturities andsurrenders. Our analysis of both maturity and surrender claimsduring <strong>2010</strong> confirmed that the vast majority of policy paymentsduring the year still fell <strong>with</strong>in our target ranges.8 Policyholder communication8.1 Progress noticesMost policyholders receive an annual progress notice givingdetails of the units added <strong>to</strong> their policy and other importantin<strong>for</strong>mation relating <strong>to</strong> their policy and the management of theWith Profit Fund. Holders of mortgage endowments receive afurther annual notice setting out the progress their policies aremaking <strong>to</strong>wards repaying the target mortgage.8.2 With Profits SummariesOn 31 December 2005 we first published With ProfitsSummaries <strong>to</strong> give <strong>with</strong> profits policyholders more detail ofhow we manage our <strong>with</strong> profits business. These were mailed<strong>to</strong> policyholders during 2006 <strong>with</strong> any progress notice. Therehave been no material changes <strong>to</strong> the With ProfitsSummaries since. If we make a material change <strong>to</strong> thesummaries in the future then we will distribute updated versions<strong>with</strong> a future progress notice. The With Profits Summarieswere consumer-tested <strong>for</strong> clarity and ease of understandingduring 2008 and were revised in February 2009 based on thefeedback received. The changes were not material and noother changes have been made <strong>to</strong> these documents since2009. They are available at www.friendslife.co.uk/<strong>with</strong>profits oron request.8.3 Other communicationsFurther in<strong>for</strong>mation is provided atwww.friendslife.co.uk/<strong>with</strong>profits covering:• With Profits Summary Supplementary In<strong>for</strong>mation• Bonus news releases• With Profits Committee <strong>report</strong>• PPFMIn addition policyholders have access <strong>to</strong> individual quotationsand projections on request through our cus<strong>to</strong>mer helpline on0845 602 9199.We believe that there is an appropriate frequency of proactivecommunication and a good range of in<strong>for</strong>mation sourcesavailable <strong>to</strong> <strong>with</strong> profits policyholders and we are committed <strong>to</strong>maintaining a consistently high quality of service.9 Other aspects of the PPFMFor <strong>post</strong>-<strong>demutualisation</strong> business, charges are set out in plandocuments. The approach <strong>to</strong> taxation and rules <strong>for</strong> transfers <strong>to</strong>shareholder funds are set out in the Scheme. Investigations havebeen carried out <strong>to</strong> confirm that these Scheme requirements havebeen adhered <strong>to</strong> and an annual certificate will be provided <strong>to</strong> theFinancial Services Authority.In 2009 we reviewed and ratified our decision that the With ProfitFund should remain open <strong>to</strong> new business. No <strong>for</strong>mal review wascarried out in <strong>2010</strong>, but a further review is likely <strong>to</strong> be carried out in2011.10 Acquisition of AXADuring <strong>2010</strong> FPLP’s parent company Resolution purchased themajority of AXA’s UK life business. This was not initially purchased byFPLP, although in March 2011 the two AXA life companies, AXA Sun<strong>Life</strong> plc and Sun <strong>Life</strong> Assurance Society plc, have been transferredin<strong>to</strong> the ownership of FPLP. However, the FPLP With Profit Fundwill continue <strong>to</strong> be managed separately from the AXA <strong>with</strong> profitsbusiness.11 ConclusionIt is our opinion that:• FPLP has complied <strong>with</strong> its obligations relating <strong>to</strong> the PPFM;• the manner in which discretion was exercised over the periodwas appropriate; and• competing rights, interests or expectations of policyholders (orgroups of policyholders) and shareholders have been addressedappropriately.Trevor MatthewsChief Executive31 March 2011David HynamExecutive Direc<strong>to</strong>r4

ANNEX<strong>Annual</strong> <strong>report</strong> <strong>for</strong> <strong>2010</strong> from the With ProfitsActuary <strong>to</strong> the <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong>profits policyholders of <strong>Friends</strong> Provident <strong>Life</strong>and Pensions Limited (“the Firm”)I have reviewed the Firm’s annual <strong>report</strong> <strong>to</strong> <strong>post</strong>-<strong>demutualisation</strong><strong>with</strong> profits policyholders. I have also reviewed the discretionexercised by the Firm during <strong>2010</strong> in so far as this affects theinterests of <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders. Post<strong>demutualisation</strong><strong>with</strong> profits policyholders are those having <strong>with</strong>profits policies written after 8 July 2001 by:• <strong>Friends</strong> Provident <strong>Life</strong> and Pensions Limited• <strong>Friends</strong> Provident Pensions Limited• <strong>Friends</strong> Provident <strong>Life</strong> Assurance LimitedThis <strong>report</strong> is made solely <strong>for</strong> the purpose of section 4.3.16A(4)of the FSA Supervision manual. It is made solely <strong>to</strong> the Firm’s<strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders, and accordingly, <strong>to</strong>the fullest extent permitted by law, I do not accept or assume anyresponsibility <strong>to</strong> any other person in connection <strong>with</strong> this <strong>report</strong>.Respective responsibilities of With ProfitsActuary and direc<strong>to</strong>rsThe direc<strong>to</strong>rs are responsible <strong>for</strong> the establishment of governancearrangements designed <strong>to</strong> ensure that the Firm complies <strong>with</strong> itsPrinciples and Practices of Financial Management (PPFM) and<strong>for</strong> the exercise of discretion in the management of <strong>with</strong> profitsbusiness. The direc<strong>to</strong>rs must prepare annual <strong>report</strong>s <strong>to</strong> each classof <strong>with</strong> profits policyholder stating whether, throughout the financialyear <strong>to</strong> which the <strong>report</strong> relates, the Firm believes that it hascomplied <strong>with</strong> the obligations relating <strong>to</strong> its PPFM. The <strong>report</strong> mustset out the direc<strong>to</strong>rs’ reasons <strong>for</strong> that belief.As With Profits Actuary my responsibilities are primarily <strong>to</strong>advise the Firm on key aspects of the discretion <strong>to</strong> be exercised inrespect of each class of the Firm’s <strong>with</strong> profits policyholders. In soadvising I am required by statute <strong>to</strong> cover the implications <strong>for</strong> thefair treatment of the Firm’s <strong>with</strong> profits policyholders and <strong>to</strong> takein<strong>to</strong> account their in<strong>for</strong>mation needs and the extent <strong>to</strong> which anycommunication may be regarded as clear, fair and not misleading. Iam required <strong>to</strong> <strong>report</strong> <strong>to</strong> the Firm’s governing body once a year onkey aspects of the discretion exercised by the direc<strong>to</strong>rs during theyear affecting the <strong>with</strong> profits business of the Firm. The scope ofthat <strong>report</strong> includes those aspects on which I have already providedadvice <strong>to</strong> the direc<strong>to</strong>rs. I am further required <strong>to</strong> make a written<strong>report</strong> <strong>to</strong> the Firm’s <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders,<strong>to</strong> accompany the Firm’s annual <strong>report</strong>. This <strong>report</strong> fulfils thatrequirement. My responsibilities as With Profits Actuary are set outin statute and in the actuarial guidance.Basis of opinionI was appointed by the Firm as With Profits Actuary on 1 May2006. My appointment covers all classes of <strong>with</strong> profits businesswritten by the Firm and by two other UK group companies - <strong>Friends</strong>Provident <strong>Life</strong> Assurance Limited and <strong>Friends</strong> Provident PensionsLimited but not in respect of the AXA companies acquired by thegroup in <strong>2010</strong>.I <strong>report</strong> <strong>to</strong> you my opinion as <strong>to</strong> whether, based on the in<strong>for</strong>mationand explanations provided <strong>to</strong> me by the Firm, and taking in<strong>to</strong>account where relevant the rules and guidance in section 20.4.7of the FSA Conduct of Business Sourcebook, the Firm’s annual<strong>report</strong> and the discretion exercised by the Firm in <strong>2010</strong> may beregarded as taking, or having taken, the interests of the Firm’s<strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders in<strong>to</strong> account in areasonable and proportionate manner.During <strong>2010</strong> I have advised the Firm on key aspects of discretion <strong>to</strong>be exercised in respect of:• regular bonus rates applied <strong>to</strong> <strong>with</strong> profits policies• final bonus rates <strong>to</strong> be applied <strong>to</strong> policies at maturity and on thedeath of a policyholder• charges <strong>to</strong> asset shares <strong>for</strong> guarantees• The risk appetite of the Fund and the appropriate investmentstrategy <strong>to</strong> support this appetite.• investment policy and the level of equity and property assetsbacking With Profit Fund asset shares• surrender value bases (including market value reductions)• new business and its impact on the security of benefits ofexisting business• investment fees <strong>to</strong> be charged <strong>to</strong> <strong>with</strong> profits business• changes <strong>to</strong> the PPFM and <strong>to</strong> the With Profits Summaries,which give a brief summary of the PPFM• communications <strong>with</strong> policyholders• assets required <strong>to</strong> be retained in the Non-Profit Fund of the Firm<strong>to</strong> provide capital support <strong>to</strong> its <strong>with</strong> profits businessI have carried out a review of key aspects of the discretionexercised by the Firm in <strong>2010</strong> affecting each class of <strong>with</strong> profitsbusiness of the Firm. Following this review I have <strong>for</strong>mally <strong>report</strong>ed<strong>to</strong> the direc<strong>to</strong>rs that the management of the Firm’s <strong>with</strong> profitsbusiness during <strong>2010</strong> has complied <strong>with</strong> the relevant PPFM andthat the exercise of discretion over the period was appropriate andmaintained fairness between different categories of policy andbetween policyholders and the company.I have reviewed the Firm’s annual <strong>report</strong> <strong>to</strong> its <strong>post</strong>-<strong>demutualisation</strong><strong>with</strong> profits policyholders <strong>for</strong> <strong>2010</strong>.In carrying out my reviews I have sought such in<strong>for</strong>mation andexplanations as I considered necessary in order <strong>to</strong> provide me <strong>with</strong>sufficient evidence <strong>to</strong> give the opinion required.5

OpinionIn my opinion the Firm’s annual <strong>report</strong> <strong>for</strong> <strong>2010</strong> and the discretionexercised by the Firm during <strong>2010</strong> takes, or has taken, the interestsof the Firm’s <strong>post</strong>-<strong>demutualisation</strong> <strong>with</strong> profits policyholders in<strong>to</strong>account in a reasonable and proportionate manner.M A Collins FIAWith Profits Actuary<strong>Friends</strong> Provident <strong>Life</strong> and Pensions Limited31 March 2011<strong>Friends</strong> <strong>Life</strong> is a business name of <strong>Friends</strong> Provident <strong>Life</strong> and Pensions Limited<strong>Friends</strong> Provident <strong>Life</strong> and Pensions LimitedRegistered Office: Pixham End, Dorking, Surrey RH4 1QAIncorporated company limited by shares and registered in England number 4096141www.friendslife.com Telephone 0845 602 9189Policyholder Report (FPLP <strong>post</strong>) 03.11