Presentation - Reliance Infrastructure

Presentation - Reliance Infrastructure

Presentation - Reliance Infrastructure

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Reliance</strong> <strong>Infrastructure</strong> LtdInvestor <strong>Presentation</strong>May 2011

Forward looking statements – Important NoteThis presentation and the discussion that follows may contain “forward looking statements” by<strong>Reliance</strong> <strong>Infrastructure</strong> that are not historical in nature. These forward looking statements,which may include statements relating to future results of operation, financial condition,business prospects, plans and objectives, are based on the current beliefs, assumptions,expectations, estimates, and projections of the directors and management of <strong>Reliance</strong><strong>Infrastructure</strong> about the business, industry and markets in which <strong>Reliance</strong> <strong>Infrastructure</strong>operates. These statements are not guarantees of future performance, and are subject toknown and unknown risks, uncertainties, and other factors, some of which are beyond<strong>Reliance</strong> <strong>Infrastructure</strong> control and difficult to predict, that could cause actual results,performance or achievements to differ materially from those in the forward looking statements.Such statements are not, and should not be construed, as a representation as to futureperformance or achievements of <strong>Reliance</strong> <strong>Infrastructure</strong>. In particular, such statements shouldnot be regarded as a projection of future performance of <strong>Reliance</strong> <strong>Infrastructure</strong>. It should benoted that the actual performance or achievements of <strong>Reliance</strong> <strong>Infrastructure</strong> may varysignificantly from such statements.Slide 2

The Structure<strong>Reliance</strong> <strong>Infrastructure</strong><strong>Reliance</strong>Power (38%)EPC100%PowerGenerationPowerTransmissionPowerDistributionPowerTradingSpecialtyReal EstateRoadsMetros Cement AirportsBusiness segmentation for focused leadershipSlide 4

<strong>Infrastructure</strong>BusinessSlide 6

<strong>Infrastructure</strong> PortfolioBusiness No. of projects Project CostRoads 11 projects ` 120 BnMetros 3 projects ` 160 BnTransmission 5 projects ` 66 BnSealink 1 project ` 46 BnAirports 5 projects ` 5 BnTotal 25 projects ` 400 BnLargest private sector infrastructure developer in IndiaSlide 7

Road BusinessSlide 8

Roads – Project DetailsParticularsNamakkal Karur(NK Toll Road)DindigulSamyanallore(DS Toll Road)Trichy Karur(TK Toll Road)Trichy Dindigul(TD Toll Road)SalemUlenderpet(SU Toll Road)GurgaonFaridabad(GF TollRoad)Length (kms)4453808813666Project Cost(` Bn)3.54.27.35.410.67.8Debt (` Bn)2.83.35.13.26.45.8Equity (` Bn)0.50.50.71.12.12.0Grant/Premium(` Bn)0.20.31.51.12.11.5 @ConcessionPeriod (years) #202030302517ClientNHAINHAINHAINHAINHAIHaryanaStateTamil NaduTamil NaduTamil NaduTamil NaduTamil NaduHaryanaCODOperationalsince Q2 FY10Operationalsince Q2 FY10Q1 FY12Q1 FY12Q1 FY12Q2 FY12# Includes construction period P- stands for Premium sharing @ GF Toll road – Upfront payment of Rs 1.5 Bn paid to Haryana GovtSlide 10

Roads – Project DetailsParticularsJaipur Reengus(JR Toll Road)Pune Satara(PS Toll Road)*Kandla Mundra(KM Toll Toad)Hosur Krishnagiri(HK Toll Road)*Delhi Agra(DA Toll Road)*Length (kms)521407160180Project Cost(` Bn)5.619.911.39.229.4Debt (` Bn)3.910.97.9--Equity (` Bn)0.78.93.4--Grant/Premium(` Bn)1.00.9 (P)0.4 (P)0.7 (P)1.8ConcessionPeriod (years) #1824252426ClientNHAINHAINHAINHAINHAIStateRajasthanMaharashtraGujaratTamil NaduUttar PradeshCODQ4 FY12Tolling startedsince Oct’10Q4 FY13Tolling to start inQ1 FY12Tolling to startQ1 FY12* Six laning proiects # Includes construction period P – stands for Premium sharingSlide 11

Western Freeway Sea Link Project• Operation & Maintenance of Bandra to Worli SeaLink and development of Worli to Haji Ali Sea link• Estimated project cost of ` 45.5 Bn• Upfront payment of ` 16.3 Bn to MSRDC• Viability gap funding of ` 13.9 Bn• R Infra have tolling right of entire 11.5 kms stretch• Concession agreement signed in July 10 for aperiod of 40 yrs• Tie-up with Briza of Portugal for O&MStretchRevenue to StartBandra –WorliFY12Worli –Haji AliFY15• Key consultants appointed and preliminary designcompletedTraffic PCU’s52,00050,000Toll Rate*` 65` 45* To be increased @ WPI every yearR Infra owns the first Sea Link of the countrySlide 12

Metro Business3 Projects I 66 kms I ` 160 BnSlide 13

Metro Rail – Current ProjectsProjectProjectCost (` Bn)Debt :Grant :EquityLength(Km)CODConcessionPeriod*ShareholdingDelhi AirportExpress Link24.570:0:3023Feb 201130 Yearsa) R Infra: 95%b) CAF (Spain): 5%a) R Infra: 69%MumbaiMetro – Line I25.051:27:2211Q4 FY1235 Yearsb) MMRDA: 26%c) Veolia (France): 5%a) R Infra: 48%MumbaiMetro – Line II110.064:21:1532Within 5year35 Years^b) R Com: 26%c) SNC Lavalin(Canada): 26%Total159.566* Including construction period ^ Could be extended for further 10 yrsLargest & established private player in Metro RailSlide 14

Delhi Airport Metro Express Link Project• Metro express link connecting New DelhiRailway Station to Dwarka through IGIAirport – 6 stations along the corridor• Traffic forecast : ~30,000 /day in I st yearof operationFare Structure*CategoriesBetween New Delhi Station & IGI AirportBetween Dwarka Sector 21 & IGI Airport* Fares to be increased every 2 yr @ WPIFare /Trip` 150` 30• Introductory fare of ` 80 for limited period• Real Estate area of 1,32,000 sqmtrsFastest, comfortable and economical commute to the airportSlide 15

Delhi Airport Metro Express Link – Status Update• All Eight trains received from CAF, SpainShivajiStadiumNew Delhi RailwayStation• Real estate deals closed with key players at NewDelhi & Shivaji Stadium stations• Agreement signed for advertisement space withleading vendors• Connected with existing DMRC network at bothends i.e New Delhi and Dwarka stationsNH-8DhaulaKuanIGIAirportDwarkasector -21Commercial operationcommenced from Feb, 2011Delhi Airport Metro Express LinkSlide 16

Mumbai Metro Line I Project• Elevated metro rail connectingVersova – Andheri – GhatkoparNature of workMajor contractorsBusiness Partners• Provides East to West connectivity• 12 stations along the corridor• Traffic forecast: 0.6 Mn per dayCategoriesTraffic < 3 km8 km 3 kmTraffic > 8 kmFare StructureFares at Base Year (2004)*\` 6` 8` 10* Fares to be increased @11% every 4 th year• Real Estate of 1,000 sqmtrs at eachstationProject ManagementConsultantsViaductStation WorkSpecial BridgesRolling stockSupplierTraffic StudySignalingCommunicationTraction & PowerSupplyTrack workConsortium of Parsons-Brinckerhoff(USA) & Systra (France)Simplex <strong>Infrastructure</strong>Sew ConstructionSew <strong>Infrastructure</strong>CSR Nanjing Puzhen, ChinaConsulting Engineering Services(CES)SiemensThalesABBVNC Rail One“Project of the Year” – 2 nd KPMG <strong>Infrastructure</strong> Today AwardsSlide 17

Mumbai Metro Line I – Status Update• First train arrived at site• Construction work in full swing:• Foundation works at Mithi River Special Bridgecompleted• Viaduct and Station works are in advance stages ofcompletion• Western Railway has approved all design• Girder fabrication commenced over Western Railwaytrack at Andheri• Over 4,000 people are working on site• Obtained viability gap funding of ~` 3.3 Bn fromMMRDASlide 18

Mumbai Metro Line II ProjectCharkop• 32 km elevated track along the Mankhurd-Bandra-Charkop corridor having 27 stations• Estimated project cost of ` 110 Bn• Viability Gap Funding of ` 23 Bn• Concession period of 35 yrs - Concessionagreement signed in January’10• Achieved Financial closure for debt of ` 70 Bn• M/s Systra (Design consultants) has commencedwork and pre-design completedBandra• Topographical survey of the alignment completed &Geo-technical investigation is in progressMankhurd• Detailed traffic survey of alignment completedLargest financial closure for a PPP project in the countrySlide 19

Airports345• Developing 5 brownfield regional airports inMaharashtra• Concession period of 95 yrs• Passenger traffic have increased from 0 to over6,000 per month• Over 125 commercial flights are operating permonth• Setting up flight training academy in Nandedand Osmanadabad12Will provide requisite regional air connectivitySlide 20

Airports - Project DetailsAirportsRunway Length(mtrs)Land Area(hectares)Opportunities on the anvilNanded2,300105• Cargo and Logistics Hub• Air Connectivity – Pune, Hyderabad, Amritsar &Tirupati, pilgrims visiting ‘Sachkhand Gurudwara’Latur2,420145• Warehousing & Food Storage hub• Air Logistics hub• Aviation Engg Inst. & Aviation Themed film studioYavatmal2,100113• Air Connectivity - Mumbai, Nagpur & Delhi• Emerging Power and Cement Mfg hub• Aircraft Recycling ZoneBaramati2,350182• Aircraft Parking Plaza• MRO HubOsmanabad1,20055• Textile and Leather SEZs of Govt. of Italy• Aviation & Aeronautical Engineering InstituteTotal600Slide 21

Cement Business – Status UpdateLocationCapacityMadhya PradeshSatna5.0 mtpaMaharashtraYavatmal5.0 mtpaLand acquired Yes YesEnvironment Clearance(EC) Applied AppliedLimestone Reserves AcquiredYesYesForest Clearance Cleared by DFO*, forwarded to CCF^ Cleared by DCF # forwarded to CCF^RailWaterGot rail transport clearance for Maihar &GondavaliGround water – NOC received & Surfacewater - Cleared by Jila Jal UpyogApplied for rail transport clearanceGround water & Surface Water - AppliedCoal Linkage Recommended by DIPP Recommended by DIPPFinancial ClosureProject CostExpected CODDone` 27.8 Bn2012-13Underway` 25.2 Bn2013*District Forest Officer ^Chief Conservator of Forest #Divisional Conservator of ForestTarget to reach 25 mn tons in next 5 yearsSlide 22

Specialty Real EstateCBD & Trade Tower• Developing a 100 storeyed Trade Tower& Business District in Hyderabad on 80acres of land• Unlimited FSI & no restriction on mix use• Clear titled land : APIIC in possession ofthe entire land• R Infra have 89% stake; 11% by APIICSEZ• Setting-up IT/ITES SEZ at DAKC, NaviMumbai• Over 45 acres area - Initial saleable areaof 4 Mn sqft• BOA approved and notification processunderway• Complete land is in possession• Strategic location – 6 kms from newinternational airportSlide 23

EPC DivisionEngineering, Procurement& ConstructionSlide 24

EPC Business – ProjectsRevenue ` Bn40353025201510514Revenue (` Bn)EBIT Margin(%)25353612 • Order Book of ` 296 Bn as on March 31, 11• R Power & Internal Power projects10864EBIT margin (%)oooo3,960 MW Sasan UMPP600 MW Butibori TPP*2,400 MW Samalkot power projectWestern Region Strengthening project• External Power projectso 1,200 MW Raghunathpur TPP*oo1,200 MW Rajiv Gandhi TPP* at Hisar500 MW Parichha TPP* BOP package• Road projectsooooooGurgaon Faridabad Toll RoadJaipur Reengus Toll RoadPune Satara Toll RoadKandla Mundra Toll RoadHosur Krishnagiri Toll RoadDelhi Agra Toll Road0FY08 FY09 FY10 FY112EBIT (%) 9.1% 8.2% 8.6% 10.0%* Thermal Power ProjectSlide 25

EPC Business – Major Initiatives• Signed MOU with Black & Veatch, USA• Mentoring support to projects based on SuperCritical Technology• Remote surveillance of project sites• Established “Centre of Excellence” to enhancetechnical capabilities• Developing competencies in infrastructure sectorsviz Roads, Metro/Mono Rail, etc.• Well positioned for 30,000 MW from R Power• Over 25,000 people are working on site• Including 1,600 of engineering staffSlide 26

PowerBusinessSlide 27

Power GenerationParameterCapacityTypeOff-takeArrangementsDahanu PowerStation500 MWThermalMumbai DiscomSamalkot PowerStation220 MWCombinedCycleAndhra Pradesh GridGoa PowerStation48 MWCombinedCycleGoa GridKerela PowerStation165 MWNapthaKerela State ElectricityBoardWind Farm,Karnataka8 MWWindKarnataka PowerTransmission Corp. LtdDahanu Station running at PLF of ~100%from last 7 yearsOutperformance of normsleading to high ROEsOperate one-of-the-most efficient thermal plants of IndiaSlide 28

Future Power Generation through <strong>Reliance</strong> Power• R Infra owns 38% of R Power• R Power to develop all future power generationassets in India and overseas• Develop, construct and operate ~37,000 MW ofgenerating capacity• Well diversified portfolio consisting of Coal, Gas &Hydroelectric power based projects across India• Aggregate Investment in R Power of `17.2 BnLargest private power generation portfolio in IndiaSlide 29

<strong>Reliance</strong> Power – project portfolioDadri GasUrthing Sobla (400 MW)Projects in ArunachalPradesh (4220 MW)Project phaseOperating phaseCapacity600 MWRosa (1200 MW)Chitrangi (5,940 MW)Construction phaseDevelopment phase21,420 MW14,980 MWBharuch GasSasan (5,940 MW)Tilaiya (5940 MW)Total37,000 MWShahapur GasButibori (600 MW)Shahapur Coal (1200 MW)Samalkot (2,400 MW)Krishnapatnam (5,940 MW)Operating projectsProjects under constructionProjects under developmentSlide 30

Power Transmission - Current ProjectsParbati KoldamNorth Karanpura - UMPPWestern RegionStrengthening SystemMumbai TransmissionTariff Based ProjectRegulated Return ProjectTalcher II - UMPP5 Projects I 10 States I ` 66 BnSlide 31

Power Transmission – Project DetailsProject NameWestern RegionStrengthening Scheme(WRSS)Parbati KoldamMumbaiStrengtheningNorth Karanpura(UMTP)Talcher – II (UMTP)TotalProject Cost(` Bn)13.810.718.015.58.266.2• Solapur Karad line in Maharashtra became operational in Feb ’11 – First100% privately owned transmission line commissioned in India• Limdi Vadavi line in Gujarat became operational in May’ 11• Over 2,500 people working on site• Project will be fully commissioned by Q2 FY12• Financial closure achieved – signed financing agreement with PFC & RECfor debt amount of ` 7.7 Bn• Obtained approval from MOP for commencement of work• Tower supply, erection packages ordered and construction activities started• Revenue to commence from Q1FY13• All major equipment orders such as GIS, 125 MVA transformers & 220 Kvcables has been placed• Registered all time high availability of 99.8% v/s regulatory target of 98%• 3 receiving stations charged in FY11• Acquisition process completedUpdate• Transmission license received and projection execution commencedLargest private player in transmission sectorSlide 32

Power DistributionMumbai• Serves 2 out of 3 homes inMumbai & Delhi• Serve over 5.4 millioncustomers• Distributes over 5,000 MWof powerLargest private sector distributor of powerSlide 33

Mumbai Distribution• Distributing power to over 2.8 million customers• 1,671 MW of peak demand• Among the lowest AT&C loss levels in the country• AT&C losses of

Delhi DistributionBSES Rajdhani Power Limited (BRPL)• Both Discoms was privatized in 2002AT&C Losses (%)4237322722171231.329.927.326.720.623.5Earned incentive of` 0.9 Bn till FY1118.920.216.817.0FY07 FY08 FY09 FY10 FY11• R Infra owns 49% in both discoms• Distributing power to over 2.6 million customers• 3,050 MW of peak demand• AT&C loss reduction of ~35% since takeover:• In BRPL from 51% to 17%• In BYPL from 63% to 20%TargetAchieved• Yearly investment of ` 4-5 BnBSES Yamuna Power Limited (BYPL)Recent DevelopmentsAT&C Losses (%)474237322722171239.040.034.830.0Earned incentive of` 2.0 Bn till FY1130.524.026.322.922.019.9FY07 FY08 FY09 FY10 FY11• Earned cumulative incentive of ` 2.9 Bn till FY11• File petition for tariff hike and FAC pass-through toregulator• Delhi High court issued an order asking Delhi ElectricityRegulatory Commission to issue fresh tariff orderTargetAchieved“India Power Award 2010” for Overall Utility Performance in Urban AreasSlide 35

Power TradingFY 11No of units traded (in MU's)5,550• <strong>Reliance</strong> Energy Trading Ltd traded5,550 MU’s in FY11FY 103,300• Quantum (in units) under assured tradingarrangements is 30,000 MU’s• Signed 6 short term arrangements thathelped increase in tradingFY 091,934• Integration with generation capacity of RPower & captive distribution businessesFY 081,022Achieved volume growth of over 5x in4 yearsAmong the top 5 trading licensees in volume by CERCSlide 36

Financial Strengths

Financials PerformanceStandaloneConsolidatedAmount In ` BnParticularsFY 09FY 10FY 11ParticularsFY 09FY 10FY11Total OperatingIncome98.7100.396.2Total OperatingIncome128.5148.7154.1EBITDA17.719.116.9EBITDA21.123.524.7Interest3.32.92.4Interest4.45.36.3PAT11.411.510.8PAT13.515.215.5Cash Profit13.314.413.4Cash Profit16.319.419.8EPS49.551.143.3EPS59.067.462.0Slide 38

Sound Financial Status*• Debt of ` 40.5 Bn – Debt free at net level• Converted 4.2 Mn warrants to equity shares issuedto promoters at ` 929 per share• Increase promoter holding to 48%• Increase in networth by ` 40 Bn• Announced buy back of ` 10 Bn at a maximumprice of ` 725 per share• Bought back 18 lakh shares worth ` 1.2 Bn tillMay 26, 11• Balance Sheet StrengthParticularsNetworthStandalone` 177 BnConsolidated` 240 BnBook Valueper share*As on March 31, 11` 660` 958Received AA + from CRISIL & AA from FITCH credit rating agencySlide 39

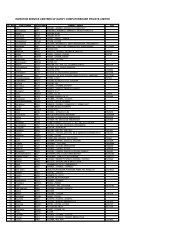

Shareholding Pattern*CategoryPromotersInsurance CoFIIMutual Funds/Banks & FIBodies CorporatePublicTotal*As on March 31, 11No. of Shares(In Mn)128.246.444.812.16.929.0267.4%Holding4817174311100No outstanding instruments left for conversion to equitySlide 40

To sum up……

Moving Ahead….• <strong>Infrastructure</strong> – Expanding footprint in all high growthsectors• Roads• Metros• Sea Link• Airports: 11 projects: 3 projects: 1 project: 5 projects• Cement – Developing two projects totaling 10 Mn tons• EPC – Healthy EPC order book of ` 296 BnLargest infrastructure company in the countrySlide 42

Moving Ahead….• Generation - Developing ~37,000 MW through<strong>Reliance</strong> Power• Transmission - Developing 5 projects with total outlayof ` 66 Bn• Distribution - Existing distribution businesses to growat 4-5% pa• Power Trading - Among top 5 trading licensees involume by CERC• Healthy Balance Sheet to capitalize on growthopportunitiesGrowth at explosive pace……Slide 43

Thank You