Presentation to Client XYZ - JP Morgan Asset Management

Presentation to Client XYZ - JP Morgan Asset Management

Presentation to Client XYZ - JP Morgan Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>JP</strong><strong>Morgan</strong> JF ASEAN Equity Off Shore Fund(An Open-ended Fund of Funds Scheme)Oc<strong>to</strong>ber 2011

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJan-002001Jan-01Jan-022002Jan-032003Jan-042004Jan-052005Jan-062006Jan-072007Jan-08Jan-092008Jan-102009Jan-112010Oct-072000Feb-082001Jun-082002Oct-082003Feb-09Jun-092004Oct-092005Feb-102006Jun-102007Oct-102008Feb-112009Jun-112010ASEAN has de-coupled over the last 10 years?ASEAN relative performance since 2000ASEAN relative performance since Oct-200730025020015010050ASEAN - FTSE All world series (USD)MSCI Asia ex-JapanS&P 50014012010080604020ASEAN - FTSE All world series (USD)MSCI Asia ex-JapanS&P 500Oct-07 – March 09,ASEAN fell 56%S&P fell 56%00ASEAN EPS defensive vs. APAC and S&P ASEAN and S&P consensus EPS trend 200060%40%ASEAN ex Singapore ASIA ex JAPAN S&P500350300ASEAN ex SingaporeS&P50020%0%250200150-20%-40%100500Source: UBS, Bloomberg. Updated as of August 19, 2011

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptValuation – could a move <strong>to</strong> premium be sustained?ASEAN forward Price <strong>to</strong> Earnings ratio relative <strong>to</strong>Jan-2005 <strong>to</strong> Aug 2011 rangeASEAN Price <strong>to</strong> Book ratio relative <strong>to</strong> Jan-2005<strong>to</strong> Jul 2011 range18.016.016.015.514.515.05.04.04.14.014.012.010.08.012.612.213.9 13.913.010.213.711.811.59.010.63.02.01.02.2 2.32.62.82.72.32.32.21.81.91.5 1.6 1.66.00.0Singapore Malay sia Indonesia Philippines ThailandSingapore Malay sia Indonesia Philippines ThailandCurrentAv erageCurrentAv erageShaded area shows +/- one standard deviation from average over Jan 2005 - Aug 2011 periodSource: Bloomberg, UBS Estimates, Updated as on 19-Aug-2011

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJun-00Jun-01Jun-02Jun-03Jun-04Jun-05Jun-06Jun-07Jun-08Jun-09Jun-10Jun-11Jun-00Jun-01Jun-02Jun-03Jun-04Jun-05Jun-06Jun-07Jun-08Jun-09Jun-10Jun-11Valuations can stay high: India as an example* Higher rates of investment have helped lift Indian growth performance – which has supported premium valuations* Can ASEAN achieve the same?India - Trailing Price <strong>to</strong> BookIndia – Investment share of GDP and P/B6.05.04.03.02.01.00.06.05.04.03.02.01.00.045%40%35%30%25%20%MSCI IndiaMSCI Asia Pac ex JapanMSCI IndiaIndian nominal investment spending share of GDP (rhs)Source: IBES consensus estimatesSource: HAVER, IBES

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJan-04Jul-04Jan-05Jul-05Jan-06Jul-06Jan-07Jul-07Jan-08Jul-08Jan-09Jul-09Jan-10Jul-10Jan-11Jul-11In ASEAN the credit cycle has recovered...•Credit growth outside Indonesia is now showing more sustained strength than in the years prior <strong>to</strong> 2008* Thai, S’porean, M’sian and Philippine bank credit growth averaged 4.5% yoy from 2001-07. Since 2008 the average has been 11.5%.40.030.0Bank credit growth, % yoy20.010.00.0-10.0Indonesia Malaysia PhilippinesSingaporeThailandSource: Haver, CEIC, UBS

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.ppt199019921994199619982000200220042006200820101985198719891991199319951997199920012003200520072009...and the ASEAN investment cycle should follow* ASEAN still at early stages of investment cycle45%Nominal investment spending, % GDP50%Nominal investment spending, % GDP35%40%30%25%20%15%10%Thailand Indonesia MalaysiaSingaporePhilippinesChina India ASEANRussiaBrazilSource: Haver, CEIC, UBS

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJan-98Jan-99Jan-00Jan-01Jan-02Jan-03Jan-04Jan-05Jan-06Jan-07Jan-08Jan-09Jan-10Jan-11Mar-07Sep-07Mar-08Sep-08Mar-09Sep-09Mar-10Sep-10Mar-11Sep-11High export exposure does not necessarily mean earnings exposure15104832120Real GDP index: Q1 2008 = 1005161100-50-16100-10-3290Global PMI: New orders less inven<strong>to</strong>ry index (lhs)ASEAN-5 USD export growth, % yoy 3mma (rhs)G7 Malaysia PhilippinesSingapore Indonesia Thailand100%75%50%Percentage of ASEAN companies (individualcountry) by operation orientationIndonesia andMalaysiainsulated100%75%50%Share of C2011 consensus recurring profit ofASEAN companies (individual country)25%25%0%ASEAN Thailand Singapore Indonesia MalaysiaDomesticly OrientatedGlobally linked0%ASEAN Thailand Singapore Indonesia MalaysiaDomesticly OrientatedGlobally linkedSource: UBS, Haver, CEICSource: Factset, <strong>Morgan</strong> Stanley Research

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJan-00Jan-01Jan-02Jan-03Jan-04Jan-05Jan-06Jan-07Jan-08Jan-09Jan-10Jan-11G-7S'pore*HungaryIndiaBrazilPolandMalaysiaPakistanKenyaPhils.ThailandLithuaniaUkraineLatviaMexicoArgentinaS. AfricaTurkeyRomaniaColombiKoreaIndonesiPeruBulgariaChinaNigeriaRussiaChileS. ArabiaEs<strong>to</strong>niaHKSlowdown => no need <strong>to</strong> worry about inflation = easier policy settings* Slower growth should reduce inflation risks* Central banks can use the opportunity <strong>to</strong> keep interest rates low* ASEAN government debt <strong>to</strong> GDP is less than half that of G7 – ASEAN governments have room <strong>to</strong> ease fiscal policy* Easier policy settings supporting credit expansion and economic growth18Short term interbank interest rates120General gov ernment gross debt, % GDP12Indonesia80See notePhilippines6MalaysiaThailand400Singapore0Source: UBS, Haver, CEICSource: IMF EstimatesNote: * Singapore’s government has large financial asset holdings through Temasek and GIC.As such the net asset position is one of the most favorable in the world.

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptDec-01Dec-02Dec-03Dec-04Dec-05Dec-06Dec-07Dec-08Dec-09Dec-10Dec-11Dec-99Dec-00Dec-01Dec-02Dec-03Dec-04Dec-05Dec-06Dec-07Dec-08Dec-09Dec-10Dec-11Income has proven resilient outside S’pore & commodity sec<strong>to</strong>r profits0%-1%-2%-3%-4%-5%-6%-7%-8%UBS coverage: 2007-2009 EPS CAGR (USD)-1.8%-4.1%-4.9%Outside commoditiesor Singapore,earnings haveproven relativelyresilient0%-1%-1%-2%-2%-3%-3%-4%UBS coverage: 2007-2009 EPS CAGR (USD)-1.1%Commodity s<strong>to</strong>cks comprise15% of <strong>to</strong>tal market cap-9%-10%-9.0%ASEAN-ex SG ASEAN Asia ex Japan Emerging Markets-4%-5%-4.1%ASEANASEAN ex commodityMalaysia commodity sec<strong>to</strong>r USD income growth and real consumption403020100-10...in part because theswings in income inthe commodity sec<strong>to</strong>rare not fully translatedthrough the labourmarket in<strong>to</strong> realconsumption.Indonesia commodity sec<strong>to</strong>r USD income growth and real consumption403020100-10Commodity value added, USD bn 4 qtr ma % yoy growth (lhs)Consumption expenditure, real 4 qtr ma % yoy growth (lhs)Commodity value added, USD bn 4 qtr ma % yoy growth (lhs)Consumption expenditure, real 4 qtr ma % yoy growth (lhs)Source: UBS, Haver, CEIC

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptJan-05Jan-05Jan-06Jan-06Jan-07Jan-07Jan-08Jan-08Jan-09Jan-09Jan-10Jan-10Jan-11Jan-11Jan-12Jan-05Jan-05Jan-06Jan-06Jan-07Jan-07Jan-08Jan-08Jan-09Jan-09Jan-10Jan-10Jan-11Jan-11Jan-12Commodity exports are a money spinner for Malaysia and IndonesiaMerchandise trade balance contributions from primary commodities3000200010000-1000USD mn, 3mmaThailand6000400020000-2000USD mn, 3mmaIndonesia-2000Balance of commodity tradeBalance of non-commodity tradeTrade balanceSmall ‘stable’commoditysurplus/deficit-4000Balance of non-commodity tradeBalance of commodity tradeTotal balanceLarge‘booming’commoditysurplus60004000USD mn, 3mmaSingapore50004000USD mn, 3mmaMalaysia2000300002000-200010000Balance of commodity tradeBalance of non-commodity tradeTotal balanceBalance of non-commodity tradeBalance of commodity tradeTotal balanceSource: UBS, Haver, CEIC

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptRise of the middle class* Rising incomes in ASEAN are shifting millions of people out of poverty, changing consumption potential and patternsChange in absolute size of middle class and aggregate yearly expenditure of themiddle class by country (1990-2008, based on household survey means)Change in ‘middleclass’ population(million)Change in yearlyexpenditures of‘middle class’(billion USD)2010 Population(million)Change in middleclass populationas a % of 2010populationBangladesh 19 24 149 12%India 205 256 1225 17%Malaysia 7 22 28 23%Philippines 24 48 94 25%Thailand 17 55 67 26%Cambodia 4 6 15 27%Lao PDR 2 2 6 30%Pakistan 66 81 174 38%ASEAN* 216 379 537 40%Indonesia 114 168 238 48%Vietnam 49 77 89 55%PRC 845 1825 1341 63%Middle Class defined as household incomes between USD2 and USD20 per day in 2005 purchasing power parity USD.Source: ADB, Chun (2010) *ASEAN = Indonesia, Thailand, Malaysia, Philippines, Lao, Cambodia

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptDec-00Dec-01Dec-02Dec-03Dec-04Dec-05Dec-06Dec-07Dec-08Dec-09Dec-10Dec-11Thai and Indonesian FDI: Reflecting corporate investment themes* Malaysian net FDI flows have been outward reflecting available funding, diversification and regionalism on the part ofcompanies. Still strong inward FDI highlights faith in the domestic economy.* Reflecting availability of funding and increased regionalization, outward FDI by Thais has jumped in recent quarters.* Commodity initiated increases in Indonesian wealth and incomes are attracting increasing amounts of FDI in<strong>to</strong>manufacturingIndonesian, Thai and Malaysian Net FDI flows1510Net foreign direct inv estment, USD bn 4 qtr sum50-5-10Indonesia Malay sia ThailandSource: Haver, CEIC, UBS

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptDec-80Dec-84Dec-88Dec-92Dec-96Dec-00Dec-04Dec-08Links with China• FDI’s from China <strong>to</strong> ASEAN has increased in recent years•As labor costs continue <strong>to</strong> increase in China, we are seeing manufacturing outsourcing moving back <strong>to</strong> ASEAN600050004000300020001000USD mn25%20%15%10%5%HK and China share of <strong>to</strong>tal exportsMalaysiaSingaporeASEAN-5PhilippinesThailandIndonesia02000 2100 2002 2003 2004 2005 2006 2007 2008 20090%FDI from ASEAN <strong>to</strong> ChinaFDI from China <strong>to</strong> ASEANSource: World Bank Estimates, UBS, CEIC, Haver

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptThailand politics versus retail sales growthTotal sales growth (YoY) (CPALL and ROBINS)25%26 Feb 10: Courtseizes Bt77 bn ofThaksin's assets14-17 May 10: 'Red shirtdemonstra<strong>to</strong>rs' and authoritiesbattle in Central BKK. Two monthdispute ends but 90 people arekilled20%26 Nov 08: 'Yellow shirt'demonstra<strong>to</strong>rs occupyBangkok airport11 Apr 09: 'Red shirtdemonstra<strong>to</strong>rs' break in<strong>to</strong>the hotel hosting anASEAN summit3 Jul 11: ThailandGeneral Election15%10 Apr 10: 'Red shirtdemonstra<strong>to</strong>rs' and authoritiesbattle at Phan Pah Bridge, BKK.10%5%0%1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11Source: CP ALL and Robinson sales growth y/y

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.ppt1993199519971999200120032005200720092011198520002001199020022003200419952005200620002007200820092005201020112010Indonesia - commodity investment boom has opened up the regions* Indonesia’s investment spending boom has occurred in commodity richregions.60Indonesian air passenger traffic by destination* But boom has resulted in broader economic development – improvingtransport links* The result has been an improved income potential for households acrossthe economyIndonesian investment <strong>to</strong> GDP outside Java lifted by commodity prices4020050403020% regional GDPUSD Index: year 2000 = 100500400300200100240190Domestic, passengers mnInternational, passengers mnIndonesian cement consumptionIndex: year 2000 = 100100140Ex-Java nom. invest. (lhs)Java nom. Invest. (lhs)90WB agri price (rhs)Thermal coal price (rhs)Cement: JavaCement: Ex-JavaSource: UBS, CEIC, Haver, World Bank

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptFY03FY05FY07FY09FY11FY13fFY15fMalaysia – uniquely defensive, Offshore emerging as a big sec<strong>to</strong>r* Malaysia’s markets are relatively defensive due <strong>to</strong> the size of the domestic financial system relative <strong>to</strong> the levels of foreignholdings or external debt.* At the same time structural investment opportunities are appearing. The government and the state owned energycompany, Petronas, are working <strong>to</strong> lift oil and gas activity.Petronas’ capex (RMbn)Expenditure in Malaysia E&P sec<strong>to</strong>r (RM bn)6030.028.7504030201025.020.015.010.012.816.319.821.522.3-5.0Domestic International Future CAPEX Total-FY2005 FY2006 FY2007 FY2008 FY2009 FY2010Source: UBS, Haver, CEIC

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptSingapore – Switzerland of Asia ?25%20%15%10%5%0%-5%-10%-15%Global AUM growthAsia Pac AUM growthThe lure of Asia Pacific2005 2006 2007 2008 2009 2010 CAGR10-15Global AUM by region 2010 ($ trillions)SingaporeSwitzerlaQatarHongKuwaitUAEUSTaiwanIsraelBelgiumConcentration of millionaire households globally 2011% of millionaire households (2011)0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16Growth in AUM by region 2005-2010 CAGR150100121.815.010.02005-2010 CAGR excludingeffect of change in reportingcurrency versus USD12.47.550038.2 37.1N.AmericaEurope21.7 16.8APac ex<strong>JP</strong>JapanGlobal5.00.01.9NorthAmerica*3.0EuropeAsia-Pacific(ex Japan)**0.2JapanLatinAmerica***5.8MENA3.9GlobalSource: BCG Global Wealth Report

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptValuation summaryCountry/PE PB EPS Growth(%)ROE(%)Region 2011 2012 2011 2012 2011 2012 2011 2012China 9.3 8.1 1.6 1.4 14.6 15.1 17.2 17.5Hong Kong 12.2 12.9 1.3 1.3 24.6 -5.5 10.9 9.7Indonesia 15.1 12.8 3.6 3.1 18.1 18.1 24.0 24.2India 12.9 11.0 2.7 1.9 16.9 17.1 19.2 17.2South Korea 7.8 7.0 1.1 1.0 12.3 12.8 14.1 13.8Malaysia 15.1 13.3 2.1 1.9 12.5 13.9 13.9 14.6Philippines 14.7 13.2 2.6 2.4 6.2 11.1 17.7 17.8Singapore 12.5 11.3 1.4 1.3 6.6 10.8 11.3 11.7Taiwan 12.7 10.4 1.6 1.5 5.0 21.3 13.0 14.8Thailand 11.6 10.1 2.0 1.8 18.9 15.0 17.4 17.8Asia Pac ex <strong>JP</strong> 10.9 9.6 1.6 1.5 14.6 13.1 14.7 15.1Data based on MSCI Universe, IBES Consensus EstimatesNumbers are aggregated based on company full market capSource: UBS Quantitative Research, MSCI, IBES

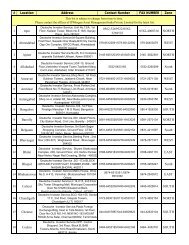

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptASEAN specialists biographiesPauline Ng is an investment manager and ASEAN country specialist with the Pacific Regional Group. Based in Singapore, Pauline joined the firmin 2005. Previously, she spent four years with AllianzDresdner <strong>Asset</strong> <strong>Management</strong>, initially as an Asia ex Japan telecommunications analyst andfrom 2004 as a fund manager responsible for Malaysia and emerging Asia. Pauline obtained a Bachelor degree in Accounting from NanyangTechnological University in Singapore. She is a CFA charterholder and a Certified Public Accountant.Jenny Tan is an investment manager and a Malaysia and Singapore country specialist with the Pacific Regional Group. Based in Singapore,Jenny joined the firm in 2006. Previously, she spent two years each at Merrill Lynch and <strong>Morgan</strong> Stanley Capital International where she was anequity research analyst covering the technology hardware sec<strong>to</strong>r and Asian equities respectively. Jenny began her career with Sumi<strong>to</strong>mo MitsuiBanking Corp as a money market dealer responsible for Singapore portfolio in 1999. Jenny obtained a Bachelor degree in finance from NationalUniversity of Singapore. She is also a CFA charterholder.Sarinee Sernsukskul is an investment manager and a Thailand and Indonesia country specialist with the Pacific Regional Group. Based inSingapore, she joined the firm in 2007 from Credit Suisse Securities in Bangkok where she spent 6 years, latterly as head of research. Prior <strong>to</strong>joining Credit Suisse, Sarinee worked at Fidelity Investments in Hong Kong for two years as an investment analyst and before that was anassociate at McKinsey & Company in Bangkok for 2 years. Sarinee began her career in 1994 with BZW Securities, Bangkok as a seniorinvestment analyst. She obtained a B.A. in Economics & International Relations from Tufts University, Massachusetts and an M.B.A. (Hons) infinance & marketing from Sasin Institute of Business Administration.18

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptOur ASEAN Team• Our ASEAN Funds are managed by our 3-member strong team, which is based in Singapore. The team has, onaverage, over 12 years’ investment experience and is dedicated <strong>to</strong> managing assets in the ASEAN region.• Company visits and local knowledge, we believe, gives us an edge – in 2010 we conducted over 350 companyvisits in the ASEAN Region.• We have a bot<strong>to</strong>m up investment strategy for s<strong>to</strong>ck selection and believe in active, on the ground research viafrequent company visits.• We aim <strong>to</strong> construct a concentrated portfolio of high conviction s<strong>to</strong>cks and invest in the long-term prospects ofsmall cap companies with strong business models and attractive valuations.• We launched our first ASEAN fund in Hong Kong in 1983 and have a long and successful track record inmanaging assets in the region.As at 31 Dec 2010

Fund Features (<strong>JP</strong> <strong>Morgan</strong> Funds: JF ASEAN Equity Fund)20

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.ppt<strong>JP</strong><strong>Morgan</strong> Funds: JF ASEAN Equity Fund<strong>Asset</strong> allocationMSCI SouthFundEast Asia NetCountry % %Singapore 36.8 36.8Indonesia 23.0 21.2Thailand 18.3 13.1Malaysia 13.0 24.2Philippines 0.5 4.7Cash 8.4 -100.0 100.0MSCI SouthFund East Asia NetSec<strong>to</strong>r % %Financials 36.9 38.2Industrials 15.7 15.1Consumer Discretionary 12.8 10.1Consumer Staples 9.5 10.0Telecommunication Services 9.5 11.4Energy 4.1 6.7Materials 3.1 4.0Utilities 0.0 4.1Health Care 0.0 0.4Cash 8.4 0.0100.0 100.0As at September 30, 2011Source: JFAM21

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.ppt<strong>JP</strong><strong>Morgan</strong> Funds: JF ASEAN Equity FundTop 10 holdingsFundHolding Sec<strong>to</strong>r %Singapore Telecommunications Ltd. Telecommunication Services 4.5Oversea-Chinese Banking Corp. Ltd. Financials 4.0Bank Mandiri (Persero) Financials 3.2Keppel Industrials 3.1DBS Group Holding Financials 3.1Bank Negara Indonesia Financials 3.0Genting Consumer Discretionary 3.0Astra International Consumer Discretionary 2.8United Overseas Bank Financials 2.7Bumiputra-Commerce Financials 2.5As at 31 Aug 2011Source: JFAM22

J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> Standard Template 2009.pptRisk Fac<strong>to</strong>rsThe information contained in this document does not constitute investment advice, or an offer <strong>to</strong> sell, or a solicitation of an offer <strong>to</strong> buy any security, investment product or service.Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investment involves risk. Funds which are invested inemerging markets and smaller companies may also involve a higher degree of risk and are usually more sensitive <strong>to</strong> price movements.Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject <strong>to</strong> change withoutnotice. We believe the information provided here is reliable but should not be assumed <strong>to</strong> be accurate or complete. Informational sources are considered reliable but you shouldconduct your own verification of information contained herein. The value of investments and the income from them may fluctuate and your investment is not guaranteed. Pastperformance is not necessarily a guide <strong>to</strong> future performance and inves<strong>to</strong>rs may not get back the full amount invested. The economic and political situations may be more volatilethan in established economies and these may adversely influence the value of investments made. As an inves<strong>to</strong>r you are advised <strong>to</strong> conduct your own verification and consultyour own financial advisor before investing.<strong>JP</strong><strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> India Pvt. Ltd. offers only the units of the schemes under <strong>JP</strong><strong>Morgan</strong> Mutual Fund, a mutual fund registered with SEBI.Investment Objective: <strong>JP</strong><strong>Morgan</strong> JF ASEAN Equity Off-shore Fund (An open ended fund of funds scheme): The primary investment objective of the Scheme is <strong>to</strong> provide longterm capital growth by investing predominantly in <strong>JP</strong><strong>Morgan</strong> Funds – JF ASEAN Equity Fund, an equity fund which invests primarily in companies of countries which aremembers of the Association of South East Asian Nations (ASEAN). However, there can be no assurance that the investment objective of the Scheme will be realized. LoadStructure: Entry Load: Nil. Exit Load: Within 12 months from the date of allotment in respect of Purchase made other than through SIP – 1% and Within 12 months from thedate of allotment in respect of each of the Purchase made through SIP – 1%. Terms of Issue and Mode of Sale: Issue of Units of Rs. 10 per Unit at Net <strong>Asset</strong> Value (NAV)subject <strong>to</strong> applicable Loads (if any) thereafter. Inves<strong>to</strong>r benefit and General services: NAVs will be calculated on all business days and published in at least two dailynewspapers. Purchase/redemption on all business days.Risk Fac<strong>to</strong>rs: Mutual funds and securities investments are subject <strong>to</strong> market risks and there is no assurance or guarantee against loss in the Scheme or that theScheme's objectives will be achieved. As with any investment in securities, the NAV of the Units issued under the Scheme can go up or down depending on variousfac<strong>to</strong>rs and forces affecting capital markets. Past performance of the Sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme. Inves<strong>to</strong>rsin the Scheme are not being offered a guaranteed or assured rate of return. <strong>JP</strong><strong>Morgan</strong> JF ASEAN Equity Off-shore Fund is only the name of the Scheme and it doesnot in any manner indicate the quality of the Scheme or its future prospects and returns. Mutual funds invest in securities which may not always be profitable andthere can be no guarantee against loss resulting from investing in the Scheme. For scheme specific risk fac<strong>to</strong>rs and other details please refer <strong>to</strong> the SchemeInformation Document.Statu<strong>to</strong>ry details: Sponsor: <strong>JP</strong><strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> (Asia) Inc. Trustee: <strong>JP</strong><strong>Morgan</strong> Mutual Fund India Private Limited, a company incorporated under the Companies Act,1956. <strong>Asset</strong> <strong>Management</strong> Company: <strong>JP</strong><strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> India Private Limited, a company incorporated under the Companies Act, 1956. <strong>JP</strong><strong>Morgan</strong> Mutual Fund hasbeen established as a Trust under the Indian Trusts Act, 1882, by <strong>JP</strong><strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> (Asia) Inc., liability restricted <strong>to</strong> initial contribution of Rs.1 lakh. Please refer <strong>to</strong>the Scheme Information Document (SID), Statement of Additional Information (SAI) and other scheme related documents before investing. Scheme InformationDocument, SAI, Key Information Memorandum and application forms are available at Inves<strong>to</strong>r Service Centres and distribu<strong>to</strong>rs.