Vidyarthi Group Mediclaim For Students/Scholars - Visva-Bharati

Vidyarthi Group Mediclaim For Students/Scholars - Visva-Bharati

Vidyarthi Group Mediclaim For Students/Scholars - Visva-Bharati

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

National Insurance Co Ltd.A Govt. of India UndertakingSURI BRANCHSURI BIRBHUMPresentsA unique Tailor made<strong>Vidyarthi</strong> <strong>Group</strong> <strong>Mediclaim</strong><strong>For</strong> <strong>Students</strong>/<strong>Scholars</strong>Of<strong>Visva</strong> <strong>Bharati</strong> UniversityShantiniketan1

Salient featuresVIDYARTHI-<strong>Mediclaim</strong> for <strong>Students</strong> is a unique policy designed to provideHealth and Personal accident cover to the students. It also provides forcontinuation of insured students education in case of death or permanent totaldisablement of the guardian due to accident.National Insurance Co. has come up with this unique plan to cover thestudents of this prestigious university with a promise to ensure that thestudents continue their studies in their best health and unhindered by anyfinancial burden in case of any untoward event.Policy HighlightsPolicy Coverage – The policy has been divided into 3 sections, to coverSection 1- Hospitalisation expenses of the student, in case of illness uptoRs.50000/- per yearSection 2- Personal Accident (death / Permanent, Total Disablement) ofthe Parent / Legal Guardian of the insured student to cover the study andother expenses of the student upto Rs.3(Rupees three) laks on happeningof such an event study upto PG studentsSection 3- Personal Accident death /permanent disability of the student.upto Rs.2(Rupees Two) laks on happening of the eventAll preexisting disease are covered from day one of policy start date,meaning the students can avail benefit in case of hospitalisation withoutany waiting period-2

Ambulance facility upto Rs1000 for transferring the sick student forbetter treatment to another higher care hospital/Nursing HomeCashless Access Service: The policy will be serviced by the authorizedTPA’s(MEDIASSIST India TPA Ltd.53-A,RafiAhmedKidwaiRoad,OppHotelGulshan,NearRippon Street.Kolkata-700016,Tel.+913339835722,www.mediassistindia.com) for hospitalization. Cashless Access Serviceshall be available through attached list hospitals / nursing homes of TPAfor hospitalization claims anywhere in India,National InsuranceCompany Limited will nominate one person who will be communicatedby the University nominated person during any incident ofhospitalization in approved Hospital/Nursing Home immediately.Tax Benefit: The Insured Student’s guardian will be eligible fordeduction under Sec80D of the income Tax Act, 1961Accrued Benefits: On attaining the age of 25 years the Student would beoutside the policy’s Purview and all accrued benefits would be availableto him / her under standard <strong>Mediclaim</strong> policy provided there is no breakin continuity of cover.However,any student getting himself treated in any other hospital notincluded in the TPA list shall also be given reimbursement of theexpenditure on submission of the documents as mentioned CLAIMPROCEDURE AND SERVICING under section-1Age covered- 3 – 25 years3

VIDYARTHI-<strong>Mediclaim</strong> for <strong>Students</strong>-detail Terms andConditionsSection I - Hospitalization for illness, diseases oraccidentSection II & III - Personal Accident to student andguardian of the studentEducation expenses after death of parents- Expensesupto Master Degree if continue to study in theUniversity(Rs.6000/- to Rs.36,000/-)Section I - Hospitalization for illness, diseases or accident4

Surgical Operation : means manual and /or operating procedure<strong>For</strong> correction of deformities and defects,repair of injuries,diagnosis andcure of diseases,relief of suffering and prolongation of lifeOther benefits1. The guardian of the insured will be eligible for deduction under Section80 D of the Income Tax Act 1961 as amended from time to time, for thepremium paid under this section of the policy subject to limits specifiedin the Income Tax Act.2. The Policy will be serviced by Third Party Administrators (TPA) forhospitalization expenses.3. Expenses of Hospitalization for minimum period of 24 hours areadmissible. However, this time limit is not applied to specific treatmentsi.e. day care treatment for stitching of wound/s, close reduction/s andapplication of POP casts, Dialysis, Chemotherapy, Radiotherapy,Arthroscopy, Eye surgery, ENT surgery, Laparoscopic surgery,Angiographies, Endoscopies, Lithotripsy (Kidney stone removal), D & C,Tonsillectomy taken in the Hospital/Nursing Home and the Insured isdischarged on the same day. The treatment will be considered to be takenunder Hospitalization benefit. This condition will also not apply in case ofstay in Hospital of less than 24 hours provided –the treatment is suchthat it necessitates hospitalization and the procedure involves specializedinfrastructural facilities available in Hospitals and due to technologicaladvances hospitalization is required for less than 24 hours only.4. Any One Illness will be deemed to mean continuous period of illness andit includes relapse within 120 days from the date of last consultationwith the Hospital/Nursing Home where treatment may have been taken.Occurrence of same illness after a lapse of 45 days as stated above willbe considered as fresh illness for the purpose of this policy.5. Pre Hospitalisation: Relevant Medical Expenses incurred during periodup to 30 days prior to hospitalisation on disease/illness/injurysustained will be considered as part of claim mentioned under item 1.0above6. Post Hospitalisation: Relevant Medical Expenses incurred up to 60 daysafter hospitalisation/ domiciliary hospitalisation ondisease/illness/injury sustained will be considered as part of claimmentioned under item 1.0 above6

.Exclusions: as per the IRDA(Isurance Regulatory & DevelopmentAuthority) guidelines applicable to all Health Insurance policies in IndiaThe Company shall not be liable to make any payment under this Policy inrespect of any expenses whatsoever incurred by any person in connection withor in respect of :1. Injury or disease directly or indirectly caused by or arising from orattributable to War Invasion Act of <strong>For</strong>eign Enemy Warlike operations(whether war be declared or not).2. Circumcision unless necessary for treatment of a disease not excludedhereunder or as may be necessitated due to an accident, vaccination orinoculation or change of life or cosmetic or aesthetic treatment of anydescription, plastic surgery other than as may be necessitated due to anaccident or as part of any illness.3. The cost of spectacles and contact lenses hearing aids.4. Any Dental treatment or surgery which is a corrective, cosmetic oraesthetic procedure, including wear and tear, unless arising fromaccidental injury and which requires hospitalization for treatment.5. Convalescence general debility `Run Down’ condition or rest cure,congenital external disease or defects or anomalies, sterility, venerealdisease, intentional self-injury and use of intoxicating drugs / alcohol,rehabilitation therapy in any form.6. All expenses arising out of any condition directly or indirectly caused toor associated with Human T-Cell Lymphotrophic Virus Type III (HTLB-III)or Lymphadinopathy Associated Virus (LAV) or the Mutants Derivative orvariations Deficiency Syndrome or any Syndrome or condition of a similarkind commonly referred to as AIDS.7. Charges incurred at Hospital or Nursing Home primarily for diagnostic, X-Ray or laboratory examinations or other diagnostic studies not consistentwith nor incidental to the diagnosis and treatment of positive existence or7

presence of any ailment, sickness or injury for which confinement isrequired at a Hospital/Nursing Home.8. Expenses on vitamins and tonics unless forming part of treatment forinjury or disease as certified by the attending physician.9. Injury or disease directly or indirectly caused by or contributed to bynuclear weapons/materials.10. Treatment arising from or traceable to pregnancy childbirth includingcaesarean section.11. Naturopathy treatmentSection II & III - Personal Accident to student and guardian of the studenta. Scope of CoverIf the Insured persons shall sustain any bodily injury resulting solely anddirectly from Accident caused by external violent and visible means then theCompany shall pay to insured the sum hereinafter set forth that is to say(a)If such injury within twelve calendar months of its occurrence shall be thesole and direct cause of the death of the Insured persons the Capital SumInsured stated in the Schedule.(b)If such injury within twelve calendar months of its occurrence shall be thesole and direct cause of the total and irrecoverable loss of sight of both eyes ortotal and irrecoverable loss of use of two hands or two feet, or of one hand andone foot or of such loss of sight of one eye and such loss of use of one hand orone foot, the capital sum insured stated in the schedule hereto.(c)If such injury within twelve calendar months of its occurrence shall be thesole and direct cause of the total and irrecoverable loss of sight of one eye ortotal and irrecoverable loss of use of a hand or foot, fifty percent to the capitalsum insured stated in the schedule hereto.(d)If such injury within twelve calendar months of its occurrence shall be thesole and direct cause of permanently totally and absolutely disabling theInsured from engaging in being occupied with or giving attention to anyemployment or occupation of any description whatsoever the Sum Insured8

stated in the Schedule.PROVISOSProvided always that the Company shall not be liable under this Policy for1.Compensation under more than one of the aforesaid sub-clauses (a) (b) (c)or (d) in respect of the same injury or disablement.2.Any payment in excess of Sum Insured under the Policy during any oneperiod of Insurance.3.Payment of compensation in respect of injury or disablement directly orindirectly arising out of or contributed to be or traceable to any disabilityexisting on the date of issue of this policy.This policy will also cover:Transport cost of insured’s dead body(death due to accident only) to the place ofresidence subject to a maximum of 2% of the Capital Sum Insured or Rs.1000/-whichever is lower. This cover is applicable both for Section II & III.b.Exclusions1.Payment of compensation in respect of death of the insured person/Guardian.(a) from intentional self injury, suicide or attempted suicide(b)whilst under influence of intoxicating liquor or drugs(c) whilst engaging in Aviation or Ballooning, whilst Mounting into, Dismountingfrom or Travelling in any aircraft other than as a passenger (fare paying orotherwise), in any duly licensed standard type of aircraft anywhere in the worldand in goods carrying vehicles(d)directly or indirectly caused by venereal disease or insanity,(e)arising or resulting from the insured committing any breach of the law withcriminal intent.Note:“Standard type of aircraft” means any aircraft duly licensed to carrypassengers (for hire or otherwise) by appropriate authority irrespective ofwhether such an aircraft is privately owned OR chartered OR operated by aregular airline OR whether such an aircraft has a single engine or multipleengines.9

2.Payment of compensation in respect of death of the insured due to or arisingout of directly or indirectly connected with or traceable to war, invasion, Act offoreign enemy, Hostilities (Whether war be declared or not) Civil War, Rebellion,Revolution, Insurrection, Mutiny, Military or Usurped Power, Seizure, Capture,Arrests, restraints and Detainment of all kings, princes and people ofwhatsoever nation, condition or quality.3.Payment of compensation in respect of death of the insured:Directly or indirectly caused by or contributed to by or arising from ionisingradiations or contamination by radioactivity from any nuclear fuel or from anynuclear waste from the combustion of nuclear fuel. <strong>For</strong> the purpose of thisexception, combustion shall include any self-sustaining process of nuclearfission.Directly or indirectly caused by or contributed to by or arising from nuclearweapon material.4.Pregnancy Exclusion Clause: The insurance under this Policy shall notextend to cover death or disablement resulting directly or indirectly caused byor contributed to by or aggravated to prolonged by childbirth or pregnancy or inconsequence thereof.Provided also that due observance and fulfilment of the terms and conditions ofthis Policy (which conditions and all endorsements here on are to be read aspart of this Policy) shall so far as they relate to anything to be done or not to bedone by the insured be a condition precedent to any liability of the Companyunder this Policy.Section-ICLAIMS PROCEDURE AND SERVICINGClaims will be settled by the Third Party Administrators (TPA). .Documents to be submitted: in original for reimbursement1. Claim form to be collected from TPA or Download from Website .2. First Consultation documents duly signed by the Registered Doctor.3. Copy of admission advice duly signed by Registered Doctor4. Discharge Summary by the Registered Nursing home/Hospital.10

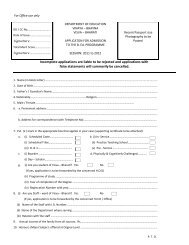

5. Prescription with bills in Original.6. Test Reports in Original(s) from Registered Laboratory7.Hospital bill and payment receipt in Original(s).7. Any other document required by TPA.The amount payable under this section will be paid to the insured personor as may be decided by the InsuredProcedure for availing Cashless Access Services in NetworkHospital/Nursing Home.Claims in respect of Cashless Access Services will be through the list of thenetwork of Hospitals/Nursing Homes and is subject to pre admissionauthorization. The TPA shall, upon getting the related medical information fromthe insured persons/ network provider, verify that the person is eligible to claimunder the policy and after satisfying itself will issue a pre-authorisation letter/guarantee of payment letter to the Hospital/Nursing Home mentioning the sumguaranteed as payable, also the ailment for which the person is seeking to beadmitted as a patient.The TPA reserves the right to deny pre-authorisation in case the insured personis unable to provide the relevant medical details as required by the TPA. TheTPA will make it clear to the insured person that denial of Cashless Access is inno way construed to be denial of treatment. The insured person may obtain thetreatment as per his/her treating doctors advice and later on submit the fullclaim papers to the TPA for reimbursement subject to admissibility of claims asterms and conditions of the policy.The TPA may repudiate the claim, giving reasons, if not covered under the termsof the policy. The insured person shall have right of appeal to the insurancecompany if he/she feels that the claim is payable. The insurance company’sdecision in this regard will be final and binding on TPA/insured person.Section-II & III:Claims will be dealt by the Underwriting Office of the companyDocuments to be submitted:1.FIR2.Death Certificate11

3.Post Mortem Certificate wherever required4.Any other Documents required by CompanyPayment of ClaimAll claims under this policy shall be payable in Indian currency. All medicaltreatments for the purpose of this insurance will have to be taken in India only.All payments to be made through Bank and bank details to be submittedinitially.Section-I: Claim will be paid to the guardian.Section II: In case of PTD- claim will be paid to the guardian. In case of Death-Claim amount will be paid to the nominee named in the schedule.Section III: Claim will be paid to the guardian.CLAIMS SERVICINGHelp Desk service at the door step of the Insured- MEDI ASSIST India TPAshall set up an exclusive Help Desk service at the campus of the University atthe place allotted by the authority. The executives of the TPA shall visit as perschedule dates once in a week to collect the claim files and answer to all thequeries that may arise out of the policy and shall help the insured members toutilize the benefits as stated in the policy schedule.If any difficulties arises TPAwill assist for hospitalizations.Cashless service to the members in case of sickness requiring hospitalizationanywhere in India within their Network of Hospitals, to ensure speedytreatment at a reasonable cost within the limits of the Sum Insured24 hours Help Line number to help the insured feel that the need duringemergency is just a call awayClaim settlement- The claim documents collected through the help deskservice at the university campus, shall be processed with speed at the TPA’s Kolkataregional office, and the amount credited to the insured’s persons Gurdiansdesignated bank within 30 days of receipt of complete claim documents12

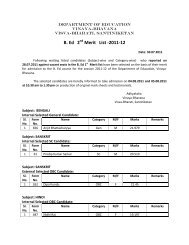

Settlement through NEFT- such settlement of claim results in hassle free andearly disbursement of approved amount to the insured’s bank account directly.Tie up with the’Pearson Memorial Hospital of <strong>Visva</strong> <strong>Bharati</strong> University’ l-to render additional services as may be required of us to ensure the studentsstay in best of their health due their study period and recover at the earliestwithout being burdened by the treatment expenses.Net premium Rs.516/- + S.T 12.36%Net Premium including Service Tax Rs.580/- per studentPREMIUM STRUCTUREStudent mediclaim Section- I SI- 50000 premium Rs 582/- (as per tariff)PA to ParentsPA to <strong>Students</strong>Section- II SI-300000 premium Rs 90/- (as per tariff)Section- III SI-200000 premium Rs 68/- (as per tariff)----------------------------Total Rs. 740/-Less 15% G.D Rs. 110/-13

------------------------------Rs. 630/-Less discount 11.43% for good underwriting aspect ofThe <strong>Visva</strong>bharati University Rs. 72/-(per student)Total premiumRs.558/-LESS SPL.DISCOUNT 7.5% Rs. 42/-___________________________NET PREMIUM Rs. 516/- + S.T 12.36%Net Premium including Service Tax Rs.580/- per student14