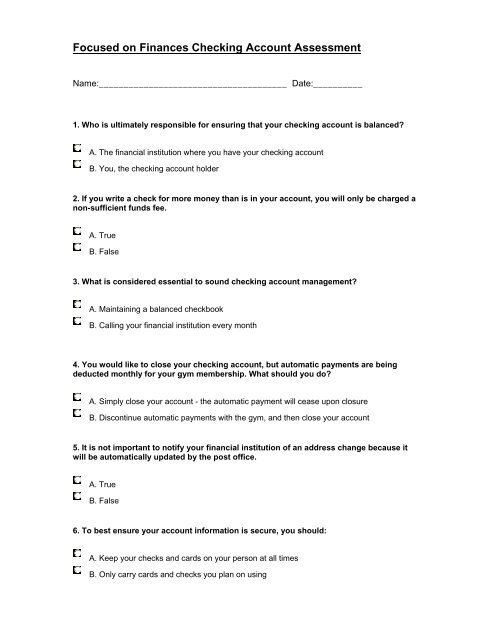

Focused on Finances Checking Account Assessment - Charter Oak ...

Focused on Finances Checking Account Assessment - Charter Oak ...

Focused on Finances Checking Account Assessment - Charter Oak ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7. When should you list debits and credits in your checkbook register?A. Every time you make a transacti<strong>on</strong>B. M<strong>on</strong>thly8. When is it appropriate to write a postdated check?A. When you know the funds will be in the account <strong>on</strong> a specific dateB. Writing a postdated check is never recommended9. To stay <strong>on</strong> top of your account, you should rec<strong>on</strong>cile your checkbook:A. At least <strong>on</strong>ce a m<strong>on</strong>thB. Never10. Under what circumstances may you be held resp<strong>on</strong>sible for repayment of a check thathas been fraudulently cashed?A. If you fail to notify the financial instituti<strong>on</strong> in a timely manner that a check was lost orstolenB. Never - state law protects c<strong>on</strong>sumers from being resp<strong>on</strong>sible for forged checks11. Adopting this m<strong>on</strong>ey management technique can help you from overdrawing youraccount:A. Know your net income and when you are paidB. Count <strong>on</strong> "float" time to help you when there isn't enough m<strong>on</strong>ey in your account to coverchecks you write12. If you use a debit card:A. M<strong>on</strong>ey is immediately taken out of your checking accountB. The amount is deducted from your checking account at a specific time each m<strong>on</strong>th13. You want to deposit a check into your checking account. You should:A. Endorse the check with your signatureB. Endorse the check with your signature and account number

14. To keep track of the checks you write, make sure you always record:A. The date the check was cashedB. What the check was for, the dollar amount, and the date you wrote it.Secti<strong>on</strong> 11. Matching - write the correct letter of the word <strong>on</strong> the line that matches the definiti<strong>on</strong>A. PIN ____ A for profit company, owned by investorsin its stock.B. Insufficient funds or overdraft fees ____ an account which allows the holder to writechecks against deposited funds.C. Returned check fees ____ Instead of drawing <strong>on</strong> a line of credit, theyact like a check, deducti<strong>on</strong> the amount of yourpurchase from your checking account.D. Stop Payment fees ____ a place to deposit m<strong>on</strong>ey you d<strong>on</strong>’t plan tospend right away.E. Credit uni<strong>on</strong> ____ A total of your deposits, withdrawals, andinterest earned over a given period of time.F. Debit cards ____ when you ask your financial instituti<strong>on</strong> tostop a check drawn <strong>on</strong> your account from beingcashed.G. Statement ____ Financial instituti<strong>on</strong>s owned by theircustomers, who are also called members.H. Savings account ____ if a check deposited into your account isreturned for insufficient funds.I. Bank ____pers<strong>on</strong>al identificati<strong>on</strong> number.J. <strong>Checking</strong> <strong>Account</strong> ____ when you write a check but d<strong>on</strong>’t haveenough m<strong>on</strong>ey in your account to cover it.