debenture offer apri.. - Jules Akel

debenture offer apri.. - Jules Akel

debenture offer apri.. - Jules Akel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

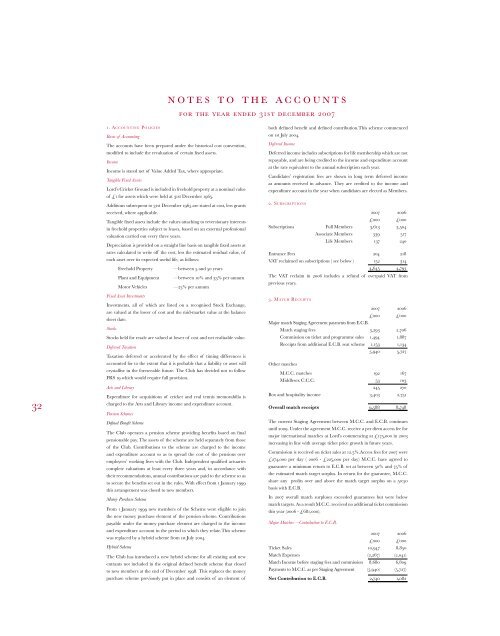

n o t e s t o t h e ac c o u n t sn o t e s t o t h e ac c o u n t sfor the year ended 31st december 2007 for the year ended 31st december 20071. Accounting PoliciesBasis of AccountingThe accounts have been prepared under the historical cost convention,modified to include the revaluation of certain fixed assets.IncomeIncome is stated net of Value Added Tax, where appropriate.Tangible Fixed AssetsLord’s Cricket Ground is included in freehold property at a nominal valueof £1 for assets which were held at 31st December 1965.Additions subsequent to 31st December 1965 are stated at cost, less grantsreceived, where applicable.Tangible fixed assets include the values attaching to reversionary interestsin freehold properties subject to leases, based on an external professionalvaluation carried out every three years.Depreciation is provided on a straight line basis on tangible fixed assets atrates calculated to write off the cost, less the estimated residual value, ofeach asset over its expected useful life, as follows:Freehold Property —between 5 and 50 yearsPlant and Equipment —between 10% and 33% per annumMotor Vehicles—25% per annumFixed Asset InvestmentsInvestments, all of which are listed on a recognised Stock Exchange,are valued at the lower of cost and the mid-market value at the balancesheet date.StocksStocks held for resale are valued at lower of cost and net realisable value.Deferred TaxationTaxation deferred or accelerated by the effect of timing differences isaccounted for to the extent that it is probable that a liability or asset willcrystallise in the foreseeable future. The Club has decided not to followFRS 19 which would require full provision.Arts and LibraryExpenditure for acquisitions of cricket and real tennis memorabilia ischarged to the Arts and Library income and expenditure account.Pension SchemesDefined Benefit SchemeThe Club operates a pension scheme providing benefits based on finalpensionable pay. The assets of the scheme are held separately from thoseof the Club. Contributions to the scheme are charged to the incomeand expenditure account so as to spread the cost of the pensions overemployees’ working lives with the Club. Independent qualified actuariescomplete valuations at least every three years and, in accordance withtheir recommendations, annual contributions are paid to the scheme so asto secure the benefits set out in the rules. With effect from 1 January 1999this arrangement was closed to new members.Money Purchase SchemeFrom 1 January 1999 new members of the Scheme were eligible to jointhe new money purchase element of the pension scheme. Contributionspayable under the money purchase element are charged to the incomeand expenditure account in the period to which they relate.This schemewas replaced by a hybrid scheme from 1st July 2004.Hybrid SchemeThe Club has introduced a new hybrid scheme for all existing and newentrants not included in the original defined benefit scheme that closedto new members at the end of December 1998. This replaces the moneypurchase scheme previously put in place and consists of an element ofboth defined benefit and defined contribution.This scheme commencedon 1st July 2004.Deferred IncomeDeferred income includes subscriptions for life membership which are notrepayable, and are being credited to the income and expenditure accountat the rate equivalent to the annual subscription each year.Candidates’ registration fees are shown in long term deferred incomeas amounts received in advance. They are credited to the income andexpenditure account in the year when candidates are elected as Members.2. Subscriptions2007 2006£000 £000Subscriptions Full Members 3,613 3,504Associate Members 539 517Life Members 137 240Entrance Fees 204 218VAT reclaimed on subscriptions ( see below ) 152 3144,645 4,793The VAT reclaim in 2006 includes a refund of overpaid VAT fromprevious years.3. Match Receipts2007 2006£000 £000Major match Staging Agreement payments from E.C.B.Match staging fees 3,293 2,706Commission on ticket and programme sales 1,494 1,887Receipts from additional E.C.B. seat scheme 1,153 1,1345,940 5,727Other matchesM.C.C. matches 192 167Middlesex C.C.C. 53 103245 270Box and hospitality income 3,403 2,751Overall match receipts 9,588 8,748The current Staging Agreement between M.C.C. and E.C.B. continuesuntil 2009. Under the agreement M.C.C. receive a per diem access fee formajor international matches at Lord’s commencing at £175,000 in 2003increasing in line with average ticket price growth in future years.Commission is received on ticket sales at 12.5%.Access fees for 2007 were£274,000 per day ( 2006 - £225,000 per day) M.C.C. have agreed toguarantee a minimum return to E.C.B. set at between 50% and 75% ofthe estimated match target surplus. In return for the guarantee, M.C.C.share any profits over and above the match target surplus on a 50:50basis with E.C.B.In 2007 overall match surpluses exceeded guarantees but were belowmatch targets. As a result M.C.C. received no additional ticket commissionthis year (2006 - £681,000).Major Matches —Contribution to E.C.B.2007 2006£000 £000Ticket Sales 10,947 8,850Match Expenses (2,267) (2,041)Match Income before staging fees and commission 8,680 6,809Payments to M.C.C. as per Staging Agreement (5,940) (5,727)Net Contribution to E.C.B. 2,740 1,0824. Catering Income and Expenditure2007 2006£000 £000Income 9,871 8,443Expenditure (6,804) (5,855)Net catering profit 3,067 2,588Rebates received in the year have been offset against expenditure and theprior year comparative has been reclassified on the same basis.5. Other Income and Expenditure2007 2006Gross Gross Gross GrossIncome Expenses Income Expenses£000 £000 £000 £000Advertising 1,412 (187) 1,089 (168)Rents Receivable& Lease Extensions 319 - 212 -Retail ( On site and On - Line ) 1,386 (1,469) 1,600 (1,475)Marketing Income 393 - 174 -Tennis and Squash 146 (204) 145 (187)Indoor School & Gymnasium 584 (390) 516 (374)Pavilion Dining Room 217 (261) 218 (256)Arts and Library 73 (767) 57 (566)Tour of Lord’s 284 (151) 219 (128)Licencing Income 75 - 75 -Debenture Premiumand issue costs 61 (68) - -4,950 (3,497) 4,305 (3,154)Arts and Library expenditure includes the costs of acquisitions of cricket &real tennis memorabilia totalling £350,000 (2006: £175,000). During 2007we have issued new <strong>debenture</strong>s which have a premium element towardsseating rights for between 3 to 8 years. This premium and the costs ofissuing the scheme are being written back to the income and expenditureaccount so as to spread the costs over the period of the rights. PavilionDining Room sales in the prior year have been amended to reflect theelimination of internal sales on a basis consistent with the current year.6.Administration2007 2006£000 £000Payroll Costs included in administrationManagement and secretaries 1,070 1,031Marketing and public affairs 389 346Legal and human resources 326 245Accounts and IT 581 512Club and ticket offices 859 693Cricket 130 112Security 388 364Printing 125 107Medical insurance premium 119 110Restructuring costs 76 84,063 3,528Pavilion and office expenses 2,283 1,894Rent,rates and insurance 978 930Marketing and public affairs 316 192Travel and motor expenses 144 213Official hospitality 120 96Committee and sub-committee expenses 96 74Legal and professional charges 138 149Non audit-related fees paid to auditorsDirect tax 169 106Indirect tax 30 51Audit Fee 62 62AGM and SGM meeting expenses 86 388,485 7,333The cost of salaries and wages is charged, where appropriate, to each ofthe Club’s activities individually.The total cost of salaries and wages (excluding casuals) of the Club wasas follows :2007 2006£000 £000Salaries and wages 6,646 6,367Social security costs 709 619Pension contributions 587 4617,942 7,447The average number of persons (excluding temporary and casual staff)employed by the Club at the end of the year was:2007 2006Office and administration 86 79Ground supervision 20 20Cricket activities 25 25Other activities ( including catering ) 51 50182 174During the year the Club employed a total of 1,082 people including full,part-time and casual staff.The number of employees who received emoluments (excluding pensioncontributions) in the following ranges were:2007 2006£1 - £20,000 53 62£20,001 - £40,000 104 93£40,001 - £60,000 12 10£60,001 - £80,000 6 6£80,001 - £100,000 3 1£100,001 - £120,000 1 1£120,001 - £140,000 1 -£140,001 - £160,000 - 1£160,001 - £180,000 1 -£180,001 - £200,000 1 -182 1747.Maintenance of Buildings2007 2006£000 £000Payroll costs 660 567Routine maintenance 784 868Project expenditure 717 480Safety repairs 24 1522,185 2,0678.Exceptional Expenditure2007 2006£000 £000Pavilion refurbishment - 85Special pension contribution 400 487Development plan 106 185506 757The Club has committed to paying a special contribution to the pensionfund of £400,000 per year, for three years, in order to reduce the pensiondeficit (see note 23). The final agreed payment will be made in 2008.