You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

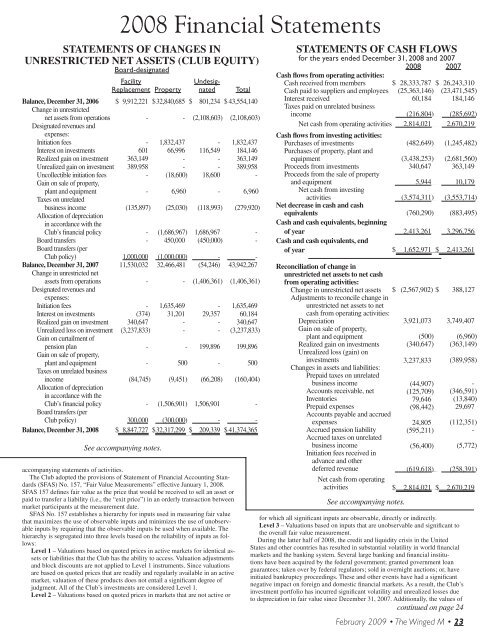

2008 Financial Statements<br />

STaTemenTS Of ChangeS In<br />

UnreSTrICTeD neT aSSeTS (ClUB eqUITy)<br />

Board-designated<br />

Facility Undesig-<br />

Replacement Property nated Total<br />

Balance, Dece<strong>mb</strong>er 31, 2006 $ 9,912,221 $ 32,840,685 $ 801,234 $ 43,554,140<br />

Change in unrestricted<br />

net assets from operations - - (2,108,603) (2,108,603)<br />

Designated revenues and<br />

expenses:<br />

Initiation fees - 1,832,437 - 1,832,437<br />

Interest on investments 601 66,996 116,549 184,146<br />

Realized gain on investment 363,149 - - 363,149<br />

Unrealized gain on investment 389,958 - - 389,958<br />

Uncollectible initiation fees - (18,600) 18,600 -<br />

Gain on sale of property,<br />

plant and equipment - 6,960 - 6,960<br />

Taxes on unrelated<br />

business income (135,897) (25,030) (118,993) (279,920)<br />

Allocation of depreciation<br />

in accordance with the<br />

<strong>Club</strong>’s financial policy - (1,686,967) 1,686,967 -<br />

Board transfers - 450,000 (450,000) -<br />

Board transfers (per<br />

<strong>Club</strong> policy) 1,000,000 (1,000,000) - -<br />

Balance, Dece<strong>mb</strong>er 31, 2007 11,530,032 32,466,481 (54,246) 43,942,267<br />

Change in unrestricted net<br />

assets from operations - - (1,406,361) (1,406,361)<br />

Designated revenues and<br />

expenses:<br />

Initiation fees - 1,635,469 - 1,635,469<br />

Interest on investments (374) 31,201 29,357 60,184<br />

Realized gain on investment 340,647 - - 340,647<br />

Unrealized loss on investment (3,237,833) - - (3,237,833)<br />

Gain on curtailment of<br />

pension plan - - 199,896 199,896<br />

Gain on sale of property,<br />

plant and equipment - 500 - 500<br />

Taxes on unrelated business<br />

income (84,745) (9,451) (66,208) (160,404)<br />

Allocation of depreciation<br />

in accordance with the<br />

<strong>Club</strong>’s financial policy - (1,506,901) 1,506,901 -<br />

Board transfers (per<br />

<strong>Club</strong> policy) 300,000 (300,000) - -<br />

Balance, Dece<strong>mb</strong>er 31, 2008 $ 8,847,727 $ 32,317,299 $ 209,339 $ 41,374,365<br />

See accompanying notes.<br />

accompanying statements of activities.<br />

The <strong>Club</strong> adopted the provisions of Statement of Financial Accounting Standards<br />

(SFAS) No. 157, “Fair Value Measurements” effective January 1, 2008.<br />

SFAS 157 defines fair value as the price that would be received to sell an asset or<br />

paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between<br />

market participants at the measurement date.<br />

SFAS No. 157 establishes a hierarchy for inputs used in measuring fair value<br />

that maximizes the use of observable inputs and minimizes the use of unobservable<br />

inputs by requiring that the observable inputs be used when available. The<br />

hierarchy is segregated into three levels based on the reliability of inputs as follows:<br />

level 1 – Valuations based on quoted prices in active markets for identical assets<br />

or liabilities that the <strong>Club</strong> has the ability to access. Valuation adjustments<br />

and block discounts are not applied to Level 1 instruments. Since valuations<br />

are based on quoted prices that are readily and regularly available in an active<br />

market, valuation of these products does not entail a significant degree of<br />

judgment. All of the <strong>Club</strong>’s investments are considered Level 1.<br />

level 2 – Valuations based on quoted prices in markets that are not active or<br />

STaTemenTS Of CaSh flOwS<br />

for the years ended Dece<strong>mb</strong>er 31, 2008 and 2007<br />

Cash flows from operating activities:<br />

Cash received from me<strong>mb</strong>ers<br />

Cash paid to suppliers and employees<br />

Interest received<br />

Taxes paid on unrelated business<br />

income<br />

Net cash from operating activities<br />

Cash flows from investing activities:<br />

Purchases of investments<br />

Purchases of property, plant and<br />

equipment<br />

Proceeds from investments<br />

Proceeds from the sale of property<br />

and equipment<br />

Net cash from investing<br />

activities<br />

net decrease in cash and cash<br />

equivalents<br />

Cash and cash equivalents, beginning<br />

of year<br />

Cash and cash equivalents, end<br />

of year<br />

See accompanying notes.<br />

2008 2007<br />

$ 28,333,787<br />

(25,363,146)<br />

60,184<br />

(216,804)<br />

2,814,021<br />

(482,649)<br />

(3,438,253)<br />

340,647<br />

5,944<br />

(3,574,311)<br />

(760,290)<br />

2,413,261<br />

$ 1,652,971<br />

$ 26,243,310<br />

(23,471,545)<br />

184,146<br />

(285,692)<br />

2,670,219<br />

(1,245,482)<br />

(2,681,560)<br />

363,149<br />

10,179<br />

(3,553,714)<br />

(883,495)<br />

3,296,756<br />

$ 2,413,261<br />

reconciliation of change in<br />

unrestricted net assets to net cash<br />

from operating activities:<br />

Change in unrestricted net assets $ (2,567,902) $ 388,127<br />

Adjustments to reconcile change in<br />

unrestricted net assets to net<br />

cash from operating activities:<br />

Depreciation<br />

Gain on sale of property,<br />

3,921,073 3,749,407<br />

plant and equipment<br />

(500) (6,960)<br />

Realized gain on investments<br />

Unrealized loss (gain) on<br />

(340,647) (363,149)<br />

investments<br />

Changes in assets and liabilities:<br />

Prepaid taxes on unrelated<br />

3,237,833 (389,958)<br />

business income<br />

Accounts receivable, net<br />

Inventories<br />

Prepaid expenses<br />

Accounts payable and accrued<br />

(44,907)<br />

-<br />

(125,709) (346,591)<br />

79,646 (13,840)<br />

(98,442) 29,697<br />

expenses<br />

Accrued pension liability<br />

Accrued taxes on unrelated<br />

24,805 (112,351)<br />

(595,211)<br />

-<br />

business income<br />

Initiation fees received in<br />

advance and other<br />

(56,400) (5,772)<br />

deferred revenue<br />

Net cash from operating<br />

(619,618) (258,391)<br />

activities<br />

$ 2,814,021 $ 2,670,219<br />

for which all significant inputs are observable, directly or indirectly.<br />

level 3 – Valuations based on inputs that are unobservable and significant to<br />

the overall fair value measurement.<br />

During the latter half of 2008, the credit and liquidity crisis in the United<br />

States and other countries has resulted in substantial volatility in world financial<br />

markets and the banking system. Several large banking and financial institutions<br />

have been acquired by the federal government; granted government loan<br />

guarantees; taken over by federal regulators; sold in overnight auctions; or, have<br />

initiated bankruptcy proceedings. These and other events have had a significant<br />

negative impact on foreign and domestic financial markets. As a result, the <strong>Club</strong>’s<br />

investment portfolio has incurred significant volatility and unrealized losses due<br />

to depreciation in fair value since Dece<strong>mb</strong>er 31, 2007. Additionally, the values of<br />

continued on page 24<br />

February 2009 • The Winged M • 23