Exclusivefocus Summer 2012.pdf - National Association of ...

Exclusivefocus Summer 2012.pdf - National Association of ...

Exclusivefocus Summer 2012.pdf - National Association of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Insurance Pr<strong>of</strong>essionals:IS IT TIME TO BECOME THE OWNER OFYOUR OWN INDEPENDENT INSURANCE AGENCY?• Are you locked with a captive and all <strong>of</strong> the mounting restrictions?• Are you tired <strong>of</strong> trying to write the business “they” want you to write?• Are you just tired <strong>of</strong> working for someone else?IF YOU ANSWERED “YES” TO ANY OF THESE QUESTIONS,THEN IT’S TIME TO CONTACT EQUITY ONE!Our GlobalGreen Insurance Agencies have access to:• Multiple Carriers for EVERY Insurance Need• S<strong>of</strong>tware Support• State <strong>of</strong> the Art Agency Management System• Bonus ProgramCall or E-mail us today forthe Opportunity <strong>of</strong> a Lifetime!636-536-5005or Toll Free 877-452-5476ask for Jeff Wilson orjwilson@globalgreeninsuranceonline.comVisit us online to see our growing list <strong>of</strong> carriers:GlobalGreenInsuranceOnline.comTravelers Insurance Company’s2009 Agency <strong>of</strong> the Year

LAPPROVALWe’re lending to Allstate agents. Check us out.With 80+ combined years <strong>of</strong> experience in agency lending, we know there’s aprosperous future for Allstate agents. At Capital Resources, we’ve originated more than$250 million in Allstate loans. It’s our specialty. We <strong>of</strong>fer key benefits you won’t find atevery lender. A highly efficient loan approval process. Lower down payments than mosttraditional lenders. Competitive interest rates with a variety <strong>of</strong> repayment options. Solid,sizeable resources. Ready to make your mark? Give us a call at 866-523-6641.www.CapitalResources.com Your ©2011 personalized Capital Resources. Allstate lender is a trademark <strong>of</strong> Allstate Insurance Company.CA Residents: Loans made pursuant to a Department <strong>of</strong> Corporations California Finance Lenders License.

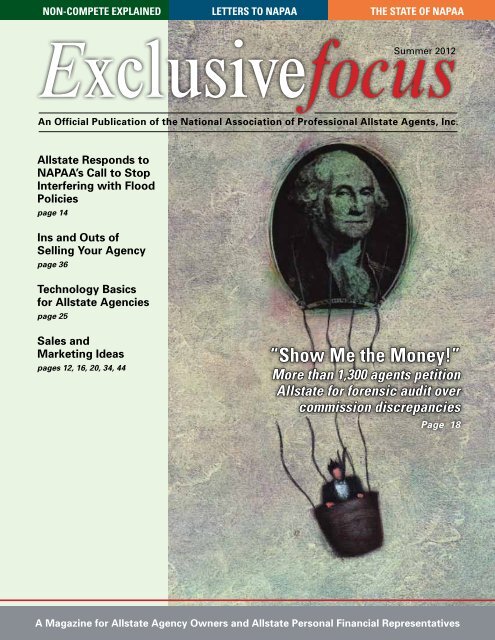

<strong>Exclusivefocus</strong><strong>Summer</strong> 2012An Official Publication <strong>of</strong> the <strong>National</strong> <strong>Association</strong> <strong>of</strong>Pr<strong>of</strong>essional Allstate Agents, Inc.Features18 NAPAA Letter Requesting Forensic Accounting Audit<strong>of</strong> Agent Commissions23 Terminated? What’s the Big Deal?by Dave Thorpe36 Preparing for the Future: The Ins and Outs <strong>of</strong> Selling your Agencyby John McKenzie46 Adjuster Pay Stymied: A Field Adjuster’s Perspective48 SabotageBusiness12 Creating a Mega Agency without a Mega BudgetBy Robyn Sharp16 Grassroots Marketing: Back to the BasicsBy Lezlee Liljenberg20 How to Book More Life Insurance AppointmentsBy Bill GoughTechnology25 Has Allstate Ever Told You toContact Your Own IT Support?By Dan HeltonLegal14 Allstate Responds to NAPAA’sCall to Stop Interfering withFlood Policies38 One Year and One Mile:Understanding theNon-Compete Provisions<strong>of</strong> the AllstateR3001 AgreementBy Attorney Dirk BeamerHumour47 Words with Allstateby Brian Spillman30 Don’t Allow Debt Aversion to Stunt Business GrowthBy Carissa Newton34 On Allstate’s DimeBy Lezlee Liljenberg41 PIIGS on the Wing (and Other Sightings)By Marcus Bruderer44 Overcome Objections and Close the Saleby John BoeA Magazine for Allstate Agency Owners and AllstatePersonal Financial RepresentativesDepartments6 President’s Letter8 Letters to NAPAA59 Membership Application60 NAPAA Market Place4 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

president’s letterThe State <strong>of</strong> NAPAAand NAPAA’S <strong>National</strong> EA Conference& Annual Board MeetingIn SolidarityBob IsacsenPresidentNAPAA/OPEIUGuild 17I just returned home today from New Orleansafter participating in our annual conference andboard meeting at Harrah’s Hotel & Casino, June20-22. The board meeting was held the day beforethe formal conference began and was attended bythe full board and several guests. With transparencyat the center <strong>of</strong> all we do, NAPAA membersare customarily invited and encouraged to attend.The board meeting lasted all day and into theevening. We reviewed our financial condition andagreed on the final budget for 2012 to 2013. I ampleased to report that NAPAA remains in strongfinancial condition and able to meet all <strong>of</strong> its financialobligations.In today’s economy, growing membership at allassociations is both difficult and challenging, butthanks to Allstate’s recent moves – such as cuttingagent compensation, extending TPP paymentsto 24 months and carrying out its unsavory andunwarranted agent termination plan – NAPAAsucceeded in growing its membership during thefiscal year that ended May 31st. Interestingly, thisdouble-digit growth in membership is taking placewhile the agency owner population is dramaticallyshrinking.It would appear that Allstate agents are muchbrighter than the company thinks, because in spite<strong>of</strong> Allstate’s attempts to stymie the growth <strong>of</strong>NAPAA, agents have not been fooled by the company’smore than obvious efforts to lull them into afalse sense <strong>of</strong> security. Even those agents who havebeen around for just a few years have seen theirdreams begin to shatter as the management teamhas waged war – albeit inconspicuously at times –on the agents <strong>of</strong> this great company. While mostagents understand that it is not possible to changea leopard’s spots, company leaders have recentlydonned a new face because they know they’ve gonetoo far and pushed too hard. If truth be told, theydon’t like you any more than they did last year; theyare simply trying to preserve their jobs. If leadershipwas really serious about making amends tothe agency force, Matt Winter would be the newCEO and Tom Wilson would be standing in theunemployment line. Thankfully, most <strong>of</strong> you seethrough the smoke and mirrors.Michael Goodwin, president, and Kevin Kistler,vice president <strong>of</strong> the Office and Pr<strong>of</strong>essionalEmployees International Union (OPEIU), bothattended the conference. Michael Goodwin addressedthe board as well as the conference attendeesand has personally assisted us in our growthinitiatives and long-term strategies. OPEIU hasfurther enhanced our member benefit packagewhile giving us the resources and intellectual capitalthat is helping to level the playing field whendealing with a corporation the size <strong>of</strong> Allstate.When we affiliated with OPEIU, our membersbecame eligible to utilize their member benefits. Iam pleased to announce that one <strong>of</strong> our membersin the Capital Region won the $6,500 HowardCoughlin Memorial Scholarship award <strong>of</strong>feredthrough our affiliation with OPEIU. We have alsohad several agents take advantage <strong>of</strong> the E&Odeductible reimbursement benefit, which was designedespecially for NAPAA. This benefit pays20% <strong>of</strong> your E&O deductible up to $500. In thesedifficult and uncertain economic times, agentsneed all the help they can get.The following two additional member benefitshave been approved by your board and will be announcedshortly:• De-regulation <strong>of</strong> energy in Washington D.C,TX, MD, DE, PA, NJ, NY, CT, MA and IL hascreated an opportunity for NAPAA to sponsora discount Green Energy program provided byViridian and Ambit Energy, two <strong>of</strong> the leadingenergy providers in the U.S.• A new Prescription Drug purchasing paradigmis being sponsored by NAPAA and <strong>of</strong>feredby BidRx. Discounts over standard pricing are ashigh as 80% and are generally lower than the copaymentunder your prescription drug health plan.The guest speaker program at the annualContinued on page 8.6 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

“Is your agencyplanted in good soil,supported wIth deep roots andreally growing?”Scan with smartphone tolearn how ASNOA can helpyour business grow.http://asnoa.com/video/mobile/index.html• More control over your future withIncreased Independence• 70% total premium growth in 2010We are Insurance Pr<strong>of</strong>essionalshelping other Insurance Pr<strong>of</strong>essionalsrealize their full business potential.See how the ASNOA Advantage canhelp your agency grow. Watch thevideo at: www.asnoa.com/video• Increase your revenue faster “I was looking for a variety <strong>of</strong> insurancethan you ever thought possible products from <strong>National</strong> & Regional carriers• A Proven Network <strong>of</strong> Success plus more control over my future. I have seenphenomenal growth with ASNOA when most®• Secure Carrier Marketsagencies are going backwards in revenue.”• A stellar support system forChristine Newton, Chesterton, INSouth Shore Insurance<strong>Summer</strong>Independent2012Agentswww.asnoa.com<strong>Exclusivefocus</strong> — 7© Copyright 2011

letters to NAPAAYou’ve done it again. You put togethera great convention and helped agentsmore than you know. And we know theactual convention is just the tip <strong>of</strong> theiceberg. You two are so dedicated, and weare lucky to have you at the helm.Thank you for inviting us to presentour ideas to the group and for includingus in every activity. You have been sogenerous to us. It was like a wonderfulvacation with the perk <strong>of</strong> learning waysto improve what we do. It was an extremelyPOSITIVE meeting.We love you both and look forward toour next get together!because it was an operations act, not anagency act. All the examples I sent incame back with the same answer.My question is: if this theory holds,should our commission stay the same ifoperations did endorsements to lower apolicy premium?This is such a scam. I am asking you topublish this scenario, and to encourageagents to submit WSRs to Agent Compto inquire at least about their homeownerpolicy commissions. I am so angry thatwe have to take our time to explain theserate increases to our irate customers andwe are not compensated for it.Editor’s response: Thanks for writing.NAPAA has heard from lots <strong>of</strong> agents overthe past several months who have echoedyour sentiments. In response, NAPAAmounted an email campaign on May 7th toadvise the agency force that it had created anonline petition to address the issue. The ideawas to garner enough support to present itto the Allstate Board <strong>of</strong> Directors, whichwe did in a letter to the Chair <strong>of</strong> the AuditCommittee on May 17th, just days beforethe shareholder meeting on May 22nd.NAPAA’s letter to the Audit Committee canbe found elsewhere in this issue <strong>of</strong> <strong>Exclusivefocus</strong>magazine (see page 18).I am an Allstate agent who complainedto management about the bigdrop in commissions in December andJanuary. Naturally, I did not hear fromanyone, nor did anyone bother to lookinto my case.Another agent and I spent hours andhours in commission auditing and checking.We concluded that the auto commissionwas too complex to audit. However,the property commission was relativelyeasy, and we discovered that a wholebunch <strong>of</strong> policies were UNDERPAID!When we brought it up to management,they simply asked us to submit aWSR to contact Agent Comp. Since wecould only inquire about one policy at atime, we submitted a whole slew <strong>of</strong> them,asking why we were underpaid. The answerwe got was such a scam. I am surethat all agents, at least in my state, havebeen ripped <strong>of</strong>f.Here’s a typical homeowner’s policyexample:2011 coverage was $100,000. Premiumwas $500. Commission $50. The 2012Renewal: coverage increased to $120,000.Premium went up to $700, but the commissionis still at $50, when it should havebeen $70. The explanation for the shortage?Commission on the increased coverageis not payable because the coverageincrease was due to a company endorsement,not an agent endorsement. Agentcomp stated that agent did not earn itpresident’s letterContinued from page 6.NAPAA Conference is one <strong>of</strong> our most valuable benefits <strong>of</strong> attendance. The ideas andinformation derived by attending the conference are just immeasurable. The cost benefitanalysis <strong>of</strong> the Conference Cost versus the Cost <strong>of</strong> Knowledge Gained from ourspeakers just can’t be measured. For a complete list <strong>of</strong> conference speakers and contactinformation, please contact NAPAA Headquarters via email at HQ@napaaUSA.orgor by phone at 877-627-2248.Our conference vendor line-up this year was just outstanding. The following companieswere in attendance. Take a moment to review their websites and if you’re in themarket for any <strong>of</strong> their products or services, please contact them and be sure to mentionthat NAPAA sent you!• Capital Resources – www.capitalresources.com• The Woodlands Financial Group – www.TWFG.com• Agency Support Network <strong>of</strong> America – www.asnoa.com• BGI Marketing Systems – www.BGImarketing.com• Smart Choice – www.smartchoiceagents.com• IHT – www.ihtagency.com• Hartford Flood – dale.ensminger@thehartford.com• Premier Group Insurance – www.ThinkPremierFirst.com• InsureZone.com – www.insurezone.com• Insurance Quote Exchange – www.iquotex.com• The Kindness Revolution – www.thekindnessrevolution.net• Legally Mine – www.legallymine.orgSoon we will be working on next year’s conference and I hope you’ll plan to join us.We will be seeking innovative speakers and vendors who can <strong>of</strong>fer fresh ideas to helpyou grow your Allstate agency.If you’re a member, thank you from all <strong>of</strong> us in the NAPAA family. If you’re not amember, please join NAPAA/OPEIU Guild 17. Not only does it pay to belong, youowe it to yourself and your family to help build the only organization dedicated 100%to your well being and success. Remember, our goal is 10,000 members; let it startwith you. Thank you in advance for your support.8 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

Allstate AgentsGet a FREE T-Mobile 4G MobileHotspot with your iPad3!Introducing the Apple iPad3 withT-Mobile 4G Mobile Hotspot BundleOnly $ 459.99* while supplies last!(compare to Verizon & AT&T @ $629.99)Apple iPad3 and T-Mobile 4GMobile Hotspot SolutionStay connected on multiple devicesUp to five separate portable Wi-Fi-enableddevices — laptops, tablets, iPads® and more— can be connected at the same time to theSonic 4G Mobile HotSpot. It’s perfect forsmall <strong>of</strong>fices and travelers with multipleportable devices.T-Mobile operates America's largest4G networkT-Mobile's nationwide 4G network canachieve theoretical peak download speeds <strong>of</strong>42Mbps - and is up to six times faster thanon today's standard 3G networks.iPad3 32GB and 64GB models also available‣ $410 estimated total savings comparedto Verizon and AT&T iPad <strong>of</strong>fers**‣ As networks evolve, our bundled solutionis forward compatible. Your iPad getsfaster as networks get fasterFor information and ordering contact:Tom KokkinesPhone: 773-444-5559Email: thomas.kokkines@t-mobile.com*Requires minimum activation on a $39.99 5GB Unlimited data plan. iPad3 16GB Model. Upgrade charge for iPad3 32GB model is $100.00, $200.00 for iPad3 64GB model.**As compared to current Verizon and AT&T published data plan pricing over a 2 year term.T-Mobile’s HSPA+ network, including increased speeds, is not available everywhere. See coverage details at www.T-Mobile.com.Capable device required to reach 4G speeds. See Terms and Conditions (including arbitration provision) at www.T-Mobile.com for coverage maps, device options andadditional <strong>Summer</strong> information. 2012 T-Mobile and the magenta color are registered trademarks <strong>of</strong> Deutsche Telekom AG. © 2011 T-Mobile USA, Inc. <strong>Exclusivefocus</strong> — 9

Then, at the Allstate Shareholders Meeting,I asked Tom Wilson the following question:“Approximately 1,200 active Allstateagents have signed a petition requesting aforensic audit <strong>of</strong> the company’s recent internalcontrols failures regarding agents’ commissions.These agents are frustrated aboutrecent mistakes disclosed earlier this year inwhich Allstate miscalculated agents’ commissionsand Form 1099 tax statements.We are concerned that these problems haveundermined agents’ faith in the company.It is the job <strong>of</strong> Allstate’s Board <strong>of</strong> Directorsto provide proper oversight <strong>of</strong> managementand to correct any weaknesses in the company’sinternal controls. What have you doneto fix Allstate’s agent commission trackingsystems? And will the Audit Committee hirean independent auditor to conduct a forensicaudit <strong>of</strong> these problems?”Mr. Wilson responded by saying that theboard had received the letter, but went on toassure investors that the financial results <strong>of</strong>the company were “accurate and complete.”He stated that report errors earlier this yeardid not affect agent pay and added, “Our goalis to pay all <strong>of</strong> our agencies the correct amount<strong>of</strong> money, and on time.” Referring to the requestby NAPAA for an independent forensicaudit, Wilson said that the audit committee“will determine the next steps.”We have yet to hear from Allstate, but wedon’t intend to let this matter die. We willsend a follow up letter to the audit committeeto inquire about their progress on this issue.In the meantime, it would be helpful ifyou could forward copies <strong>of</strong> the replies youreceived from Agent Comp, so we have theexact language they used to deny your requests.You can fax those to us at 866-627-2232. It would also be helpful if you couldgo back to the prior year to see if you werepaid on non-agent initiated policy increasesin the past.Heads up! RFG may be gone, but anew “disqualifier” lurks in the <strong>of</strong>fing. Rumorhas it that those agents who are onlyable to get 9% commission for the nexttwo years will face a new round <strong>of</strong> threatletters and possible firings. My deductionis that there will be four or five disqualifiersand any one <strong>of</strong> them can kickan agency back down to 9%.It seems that senior managers I’ve spokento have no clue that by releasing somany <strong>of</strong> our senior baby boomer agents,the company will also lose many <strong>of</strong> itsPersonal Touch Loyalists. I guess theyhaven’t figured out that many PTLs haveloyalty to their agent – not the company –while others won’t tolerate being shiftedfrom agent to agent.I hope Matt Winter has a “secret successformula” up his sleeve to support hisclaim that Allstate will be the best smallbusiness opportunity in the U.S. <strong>of</strong> A. intwo years. Millions will be saved in agentreferral fees.Allstate has stepped up requirementsto remain T-doc and POSIS compliantand will hold that threat over agentsmore and more. I expect they will demand100% compliance – no excuses.I’m getting a bad feeling about my decisionto stay, maybe I’ll reconsider…Enclosed is a letter I received fromAllstate that basically says I now haveto have at least one “licensed” sales producerin my <strong>of</strong>fice in order to “qualify”for the base pay I received in the past. Ialso received a follow-up call Friday toconfirm I received the letter and that Iunderstood what it meant.At no point was I ever told that Iwould have to have a “licensed” salesproducer in order to receive my base pay.Since starting with Allstate, I’ve onlypaid myself $2,000 a month.Any excess has gone into marketing,rent, the loan on my agency and otherbasic <strong>of</strong>fice items.In 2009, I was at the point where I hadbuilt my agency up enough to possiblyhire a staff person, but Allstate startedits downward spiral in my state and beforeI found someone to hire, I was toospooked to commit any funds to hireanyone. Trust me, I’m worn-out from doingeverything myself and nobody wouldappreciate a second person in this <strong>of</strong>ficemore than me. However, I only bringin enough revenue to pay myself whatamounts to $6 or $7 an hour, so there isno way I could to pay someone else. I’veeven attempted to hire a producer on acommission-only basis, but we are so uncompetitive,they would starve.In short, I have two options here; Icould work for Allstate for free and pay alicensed staff person or could continue towork for Allstate at a reduced pay, whichI estimate would be between $5 and $6an hour.Editor’s comment: You must be putting in65 to 70 hours a week if you’re earning $7per hour and working even more if you areearning less than that. The Federal minimumwage is $7.25 per hour. With all theresponsibilities and stresses that come withrunning an agency, it hardly seems worthyour while to stay at Allstate.Many agents put in more hours than the44 hours that are required by Allstate, butif that’s all you worked and you were payingyourself $5.50 per hour, your annualincome – with no vacation time – wouldbe $12,584. At $6 per hour it would be$13,728. The scary part is that in 2010, theHHS poverty threshold for a single personwas $10,890.I would like to take a moment to commendyou and the organization for yourtremendous efforts in standing up for theagents, who have made considerable sacrificesin helping build a well-recognizedbrand. Unfortunately, it may be a littletoo late for me since I have been forcedto sell my agency.However, I would like to advise my fellowagents and business owners to pleaseview NAPAA membership and contributionsto the legal fund as an investmentto protect and grow your business.I was a union member in the past andI’ve witnessed the positives as well as thenegatives. However, I firmly believe thatsolidarity is <strong>of</strong> the utmost importance.I would like to thank you for all thesupport you have provided every time Ihave reached out to you. In life, I believewe meet good people and some not-sogoodpeople. We should always rememberthe good ones who have helped inmaking our lives better. I truly would likeContinued on page 54.10 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

A Smart Choice®for EVERYONEJoin a network <strong>of</strong> over 3,000 successful independent agents.<strong>Summer</strong> 2012 www.smartchoiceagents.com | 888.264.3388<strong>Exclusivefocus</strong> — 11

sales and marketingCreating a Mega AgencyWithout a Mega BudgetBy Robyn SharpMaking sales is a big priority inyour business. There is alwaysa lot <strong>of</strong> pressure to producemore, retain more, and grow your agency.Unfortunately, a lot <strong>of</strong> agents don’t thinkthey can do it because they don’t have abig budget to work with. Between lowercommission rates, payroll and high overhead,marketing can quickly fall behind.But all marketing doesn’t have to beexpensive. When you look beyond directmail and internet leads, you’ll find a lot<strong>of</strong> budget-friendly options that lead tomore prospects and more referrals. Beloware eight cost-effective ways to getstarted creating a mega agency withouthaving a mega budget.Create anAgency Facebook PageFacebook is a free option that only requiresa little time and creativity to keep itfresh and up to date. Sign up for a free accountat www.facebook.com and you canbe up and running in less than 10 minutes.The key to using Facebook to generatemore quotes is by reaching a lot <strong>of</strong> localpeople and increasing your name andbrand awareness while showing that you’rean insurance expert at the same time. You’llneed at least 100 “likes” and be posting atleast one update each day. This will helpyou get out to the most people and ensurethat you’re attracting new business.Speak At Local OrganizationsThink about all <strong>of</strong> those luncheonsand groups that you attend throughoutthe year. There are organizations allover town that are looking for someoneto speak at their next meeting and youcould be just what they need.You don’t have to be a pr<strong>of</strong>essionalspeaker in order to make this a usefuland easy strategy for increasing quotes inyour agency. Half the battle in insuranceagency marketing is awareness. You wantpeople to choose your agency over thehundreds <strong>of</strong> other options available inyour community and on the Internet. Inorder for this to happen consistently, youneed to reach as many people as possible.Start contacting local groups like theKiwanis Club, Lions Club, or Rotary.See if they need a speaker and <strong>of</strong>fer totalk about ways individuals can lower insurancecosts. This is an interesting topicand will give you a chance to help peopleand attract quotes at the same time! Tryto book at least one speaking opportunityevery quarter at a minimum, but aimfor a monthly event. Once you’ve spokena few times, you’ll notice that people willstart contacting you <strong>of</strong>ten.Promote Referral RewardsReferral rewards programs are popularright now. A lot <strong>of</strong> agents reward theirclients for sending a friend to them fora quote by giving away a small gift card,a lottery ticket, or entering them in amonthly drawing for a larger prize likedinner and a movie.Beyond what you use as a reward, thekey to getting more referrals is to ask forthem! You want to make this programsomething you and your staff talk aboutall the time. Make flyers, mention it toevery client that comes in the door, postit on your Facebook page, and do anythingelse you can think <strong>of</strong> to make surethat everyone knows about your rewardsprogram. The more you and your staffmention it, the more likely that peoplewill remember to send business your way.Run an Annual Life InsuranceCampaignRather than just waiting for life insurancesales to trickle in throughout the year,make it a point to go after them. Create amarketing campaign for life insurance t<strong>of</strong>amilies with young children. While youmight not have a way to narrow down thelist specifically, you could easily target all<strong>of</strong> your clients that are married and betweenthe ages <strong>of</strong> 25 and 40.Send postcards, make phone calls, poston social media, and send an email toeveryone on the list. Talk about how importantand affordable life insurance is foryoung families. Make it a point to quoteas many as possible each year. Prospectingfor life insurance should be an ongoingprocess every day. Don’t wait until the end<strong>of</strong> the year when you’re rushing to hit youryear-end Expected Results.12 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

Support a Charityto Get Facebook FansIf you’re struggling to grow your Facebookfans, here is an affordable option.Choose a local charity to support andannounce that you’ll be donating $1 forevery new “Like” on your page. Make ita short deadline (no more than a week orso) and start promoting.Agents have easily gained 200 fans inonly a few short days with this strategy.It’s a win-win solution that supports agreat cause while giving local residents agreat reason to “like” your business. Andwhen you have more “likes,” you’ll be ableto use Facebook to attract more quotes.Network Three Times a WeekNetworking is an easy way to bringin new quotes without spending a lot<strong>of</strong> money. You probably already belongto your local Chamber <strong>of</strong> Commerce orBoard <strong>of</strong> Realtors. Now it is time to reallyfocus on connecting with the individualsthat you meet.Make a goal to schedule three one-ononenetworking meetings each week. Itcould be a quick lunch or a meeting at ac<strong>of</strong>fee shop. Sit down with someone andlearn more about their business and seehow you can help one another.This helps build your reputation inthe community, while getting connectedwith a lot <strong>of</strong> new potential clients!Celebrate Each VictoryThis might not generate sales directly,but it will help boost morale in your <strong>of</strong>fice.If you want more sales, you need tomake sure that your staff understandshow important it is. Make it a point tocelebrate every time someone sells a newpolicy. Ring a bell, cheer, blow a partyhorn, anything to get everyone smilingand excited.Show your team how much you appreciatetheir hard work. Recognition goesa long way in fueling their performance.Monoline ConversionsWhile it may be out <strong>of</strong> your budgetto send out direct mail each month tounknown prospects, it can be quite affordablewhen your list is a little smaller.Monoline policy holders already knowyou and your agency. They are morelikely to be receptive to your marketing,especially if they have an opportunity tosave on their current policy with a multilinediscount.Send a postcard and have your teamfollow up with a phone call for a quote.You could break the list up and onlysend a few each month to keep it manageable.This will help generate newsales while increasing your retention atthe same time.Implement these eight marketing strategiesand start generating new quotes andgrowing your agency without breakingthe bank. EfRobyn Sharp is a former agency owner andwriter <strong>of</strong> the Mega Agency Marketing blogat www.MegaAgencyMarketing.com. Visitthe website and get a free copy <strong>of</strong> her checklist“59 Ways to Attract All the InsuranceClients You Need.”<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 13

legal updatesAllstate Responds to NAPAA’s Call toStop Interfering with Flood PoliciesOver the course <strong>of</strong> several months,NAPAA received confirmationfrom multiple members in Floridaand elsewhere that Allstate’s Flood ServiceCenter was sending misleading letters tothe policyholders <strong>of</strong> recently terminatedagents. Under the <strong>National</strong> Flood InsuranceProgram (NFIP), when agents terminatewith Allstate, they can continueto service their flood books <strong>of</strong> businessthrough Allstate until renewal. And if theycontinue to work as licensed independentagents, they can roll their flood policiesinto their new books <strong>of</strong> business.NAPAA received copies <strong>of</strong> correspondencesent to flood policyholders withinweeks <strong>of</strong> their agents’ termination withAllstate. In those letters, Allstate told theinsureds:We have been advised that youragent … is no longer available toservice your flood insurance policy.An active property and casualtyinsurance agent must be assigned toevery flood insurance policy writtenwith the <strong>National</strong> Flood InsuranceProgram …. Please contact anotherAllstate Insurance Agent in yourarea, requesting that he/she take overthe servicing <strong>of</strong> your policy.NAPAA then asked its attorney towrite to Allstate to instruct it to ceaseand desist issuing false or misleadingletters to the policyholders <strong>of</strong> its memberswho had terminated with Allstate.NAPAA pointed out that, in most instances,Allstate’s letters were false to theextent they indicated the agent was nolonger available to service the policy andmisleading ins<strong>of</strong>ar as they implied theagent was not actively licensed to renewthe policy.Allstate referred the matter to aprominent Washington, D.C. law firmwith whom it has worked for manyyears, and NAPAA was pleased to receivecorrespondence responding to itsconcerns. Allstate’s attorney explainedthat those concerns were simply theproduct <strong>of</strong> a “misunderstanding” <strong>of</strong> theNFIP by NAPAA and that Allstate’ssole intent was to notify policyholders<strong>of</strong> their renewal options in order toavoid a lapse in coverage. While he didnot acknowledge that Allstate had actedimproperly, he did confirm that Allstatehad discontinued its use <strong>of</strong> the <strong>of</strong>fendingletters.NAPAA appreciates Allstate’s effortsin addressing these issues and for beingresponsive to the legitimate concerns<strong>of</strong> agents and consumers in this matter.NAPAA will continue to do its part tokeep you informed and vows to let Allstateknow when its conduct, whetherintentionally or otherwise, has crossedthe line.Comparetto v. AllstateAs previously reported, a group <strong>of</strong>California agents filed a class action lawsuiton September 1, 2011, in the SuperiorCourt <strong>of</strong> California against AllstateInsurance Company. Earlier this year,Allstate filed a motion asking the courtto dismiss Plaintiffs’ Complaint, allegingthat the Plaintiffs’ claims were invalid.The court, in granting Allstate’s motion,permitted Plaintiffs to amend their complaintto correct certain deficiencies, andPlaintiffs filed their Second AmendedComplaint on May 8, 2012.The Second Amended Complaintfiled by the Plaintiffs includes claimsfor breach <strong>of</strong> covenant <strong>of</strong> good faith andfair dealing, breach <strong>of</strong> written contract,and violation <strong>of</strong> California’s Businessand Pr<strong>of</strong>essions Code, which prohibitsunlawful, unfair, deceptive, and fraudulentbusiness acts and practices. TheComplaint claims that Allstate deliberatelybreached its contracts with agentsby failing to use good faith in exercisingits exclusive judgment regarding theapproval <strong>of</strong> potential buyers for agents’books <strong>of</strong> business. This resulted in significantlyreduced values <strong>of</strong> agency owners’books <strong>of</strong> business and deprived agents<strong>of</strong> the ability to sell their book <strong>of</strong> businessfor fair market value. Plaintiffs alsoallege that they were forced to sell theirbook <strong>of</strong> business far earlier than they hadplanned because Allstate implementeda performance based termination program,although Allstate did not have thecontractual right to do so.Allstate has again filed a motion seekingto dismiss Plaintiffs’ Second AmendedComplaint. The motion is scheduled tobe heard in early August. If the Plaintiffs’Complaint survives Allstate’s motion, thecase will proceed. A jury trial is set to beginat the end <strong>of</strong> February, 2013. Ef14 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 15

ing group and know immediately that itis not for you. Drop the group and saveyour time and money. If you are unsure,go a few times to see if you feel at homewith the group. If you join an organizationremember these pointers:You will not get business immediately,so don’t let this discourage you.If it seems like it is not working out,then trade it for another organization.Always remember you are not marriedto the group.InvolvementBecome a leader as soon as you can.This puts you front and center. I canhear the excuses now… “But I don’tlike speaking in front <strong>of</strong> others.” Or, “Iam not extroverted.” Or, “But, I am notcomfortable with this or that.” It is timeto get out <strong>of</strong> your comfort zone becausethese excuses will not get you morebusiness; they will only serve to inhibityour growth as a successful agency owner.If you have these fears there are remedies.Consider a Dale Carnegie courseor join Toastmasters International. Thisstep will take a little courage and sometime and effort, but the results could farexceed your expectations. If this is toobig a step, then consider becoming thetreasurer or secretary, which will exposeyou to the group, yet limit your speakingtime. I use the word “expose” here inthe most positive manner, so please donot go out and do something silly thatincludes drinks and a table.Being involved and interacting withthe group at this level is much moreproductive than just throwing moneyat an event or sponsorship. Being seen(and heard) at the group’s meetings andfunctions is crucial to getting referrals.The more you are seen, the more businessyou will cultivate.If you can’t attend, send a representative<strong>of</strong> your agency. In my case, peoplewould come up and say, “Lezlee, youare everywhere!” It was true and afterI thought about it, I realized that Ineeded to do it again because it works.There were even other Allstate agentswho got frustrated with me because Iwas “everywhere.” Some <strong>of</strong> them wouldstay away from organizations that I wasa part <strong>of</strong> because they said I was “takingthe business.” That is ridiculous! Thereis plenty <strong>of</strong> business out there for everyoneand people gravitate to differentpersonalities. So if the group allows it,get three Allstate agents into the fold,and be a “force to be reckoned with.” Byteaming up, you may be able to force outthe major players from other insurancecompanies.Remove the Ball and Chainfrom your StaffFind an organization for staff to join.Obviously, there are different types <strong>of</strong>staff; some that can effectively marketand some who are best left in the <strong>of</strong>fice toperform administrative functions. This isnot to disparage those who remain at the<strong>of</strong>fice because they are the glue that keepseverything together. They complete thepaperwork properly and perform otherfunctions that keep the <strong>of</strong>fice hummingalong. Those staff that can handle themarketing end, however, will love thefreedom and trust being <strong>of</strong>fered, whichbuilds morale. Go with them in the beginningto demonstrate how to networkand help them feel at ease. After a couple<strong>of</strong> meetings, set them free.Set expectations for them, such as collectingat least three business cards ateach meeting and have them share theirconversations with you. Whenever youare all together at one event or party,your modus operandi should be to DI-VIDE and CONQUER. Too <strong>of</strong>ten, Ihave watched two or three employeeshuddle together rather than working theroom to gain referrals. This is a waste <strong>of</strong>time and money. They can talk in the <strong>of</strong>ficeall day long, so huddling together innetworking situations should be bannedduring these events.Everyone – including and especiallythe agency owner – must be making newconnections. There is no greater trainingtool than “leading by example,” whichcan only be accomplished when theagency owner jumps into the trencheswith his staff, get his hands dirty, andworks the crowd.We must all remember that this iscalled NetWORKing, not NetSO-CIALizing. That is why it is called“work.” These are not meant to be la-didasocial affairs with no purpose; you arethere to accomplish something and thatis to build relationships, gather referralsand close business.Start back at the roots and grow fromthere. And always be sure to thank yourreferrals in some special way! EfLezlee Liljenberg is an active Allstate agentin Arlington, Texas and is a proud member<strong>of</strong> NAPAA Board <strong>of</strong> Directors.Call us at 1-888-547-8877 or email TPPLoans@amgnational.comMember FDICEqual Housing LenderExpandYour AgencyorRefinanceat a Lower Rate• Lending up to 80% <strong>of</strong> TPP at competitive rates• Experience helping Allstate agents grow their businesses• Community bank service with national reach and resources• Strong and stable national institutionAMG <strong>National</strong> Trust Bankwww.amgnational.com<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 17

NAPAA Letter Requesting ForensicAccounting <strong>of</strong> Agent CommissionsMay 15, 2012Judith A. SprieserChair <strong>of</strong> Audit Committee, Board <strong>of</strong> Directorsc/o General CounselThe Allstate Corporation2775 Sanders Rd Suite F7Northbrook, IL 60062By e-mail: auditcommittee2@allstate.comEditor’s note: When this letter was written, more than 1,100active Allstate agents had signed our petition calling for a forensicaudit <strong>of</strong> agent commissions. By the time the window to sign thepetition had closed shortly after the annual shareholders meeting,more than 1,300 signatures had been collected.Dear Ms. Sprieser,I am writing on behalf <strong>of</strong> the <strong>National</strong> <strong>Association</strong> <strong>of</strong> Pr<strong>of</strong>essional Allstate Agents (NAPAA) to urge the Audit Committee toreview and strengthen the Allstate Corporation’s internal controls over its commission systems for its exclusive agents.Allstate has recently suffered a series <strong>of</strong> problems in properly accounting for its exclusive agents’ commissions. At the beginning <strong>of</strong>the year, Allstate said that it had mistakenly underreported agents’ commissions for January. [1] Then in February, the company statedthat it had miscalculated Form 1099 tax statements for 4,700 agents. At that time, Allstate also announced that it was correcting errorsin the Customer Satisfaction Retention & Pr<strong>of</strong>itability reports that were used to calculate Allstate agents’ 2011 bonus payments. [2]Additionally, since May 4 th , over 1,100 active Allstate agents have signed a petition calling for a forensic audit <strong>of</strong> Allstate’s agentcommissions. Many <strong>of</strong> these agents are shareholders <strong>of</strong> Allstate and most, if not all prefer to remain anonymous. We will sharethe final, but anonymous, results <strong>of</strong> the petition with the committee upon request via an independent third party <strong>of</strong> our choice. Inlight <strong>of</strong> the recent problems with the company’s internal controls, we urge the Audit Committee to obtain an independent forensicaudit <strong>of</strong> the company’s recent internal controls failures, and to report its findings to shareholders.As you are aware, the Board <strong>of</strong> Directors has a fiduciary duty <strong>of</strong> care to ensure that Allstate has adequate internal controls in place overits accounting procedures. The recent mistakes in Allstate’s commissions for its agents raise concerns about the adequacy <strong>of</strong> the company’sfinancial reporting processes. Although these problems did not result in a restatement <strong>of</strong> Allstate’s financial results, they may indicateweaknesses in Allstate’s internal controls. We believe that a forensic audit supervised by the Audit Committee is therefore warranted.In addition to the potential risks to shareholders from these internal controls problems, the confidence <strong>of</strong> Allstate’s agents in the companyhas been shaken. Allstate’s agents are already on edge regarding Allstate’s planned reduction in base commissions by 10 percent in2013. We believe that concerns about Allstate’s commission reports have undermined the ability <strong>of</strong> Allstate’s agents to invest resourcesinto growing their agencies. As a result, Allstate’s acquisition <strong>of</strong> new customers may suffer until the concerns <strong>of</strong> its agents are addressed.For these reasons, we strongly urge the Audit Committee to investigate these recent miscalculations <strong>of</strong> Allstate’s agent commissions,as well as the overall reliability <strong>of</strong> Allstate’s internal controls over its accounting procedures. Conducting a forensic audit willgo a long way toward reassuring agents and shareholders that Allstate’s internal controls are adequate to prevent future problems. Welook forward to a productive engagement with you on these matters. Please contact me to discuss NAPAA’s concerns in more detail.Sincerely,Jim FishExecutive Director<strong>National</strong> <strong>Association</strong> <strong>of</strong> Pr<strong>of</strong>essional Allstate Agents, Inc.877-269-3474[1]Erik Holm, “Allstate Pay-Reporting Error Further Inflames Agents’ Ire,” Wall Street Journal, 1/12/2012.[2]Erik Holm, “Allstate Warns Agents <strong>of</strong> Tax Errors, Bonus Issues,” Wall Street Journal, 2/10/2012. [http://online.wsj.com/article/SB10001424052970203646004577215533578346866.html] (accessed 2/22/2012).18 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

Break the Shackles...GetEXCITEDAboutInsuranceAgain!Remember Why YouBecame an Insurance Agent!To Build and Run Your Own Independent BusinessWith Freedom, Autonomy and Without LimitsYet With Support and Experienced GuidanceAt PREMIER GROUP INSURANCEMore Than 100 PGI Partners Have it All!• Strong <strong>National</strong> and Regional Property & Casualty Carriers• Direct Carrier Access by You for Your Business Plan and Client Needs• Business Ownership with Lucrative Bonus and Perpetuation Options• Increased Close Ratios AND Higher Commissions with No Life Quotas• Business Tools You Need - E&O, Comparative Rater, AMS, Web-SEO Options• Unparalleled Support with Innovative Programs Dedicated to Your Success!If you’re feeling captive explore your options atwww.ThinkPremierFirst.com orContact Premier’s President, Rex Hickling, CPCU, AIM directly at:(303)818-6218 or via email at RexH@ThinkPremierFirst.com<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 19

sales and marketingHow to Book MoreLife Insurance AppointmentsWarning: Ignore this process at your own peril!By Bill GoughIwas recently asked by an Allstate agentabout my Life Birthday Letter Process.He was curious about how we areable to achieve outstanding results whilehe has gotten very little response to thesame process. He wanted to improve hisresponse rate and book more life appointments.Of course, having a process for this iscritical because it is another way that wecan make the most <strong>of</strong> the biggest advantagethat we have as small business owners– the relationships we have with our customers,prospects, and our centers <strong>of</strong> influence.We need to do everything we can togrow and nurture these relationships – andwhat better way to do it than by wishingyour customer “Happy Birthday?”The Life Birthday Letter Processis a great campaign to use because youare reaching out to your customers on apersonal level. Plus when done the rightway, you’re almost guaranteed to booklife appointment after life appointment.This process can be extremely powerful,especially when you add a “scripted”outbound call. We will get to that in aminute, but first...For maximum results and best ROI,the Life Birthday Letter Process – likeother marketing processes – must be afull-blown marketing campaign usingmultiple steps and multiple media.This process will work if you followthese simple steps. Your EFS should costshare this with you, but if he doesn’t, Isay still do it. Your ROI on this marketingprocess will be awesome.Following are the steps I strongly recommendto achieve maximum results:Step 1 – Voice Broadcast. Schedule thisfor a day or two before expected letterarrival. The script should go somethinglike this:“Hello this is _________, your Allstateagent. I just wanted to call and saythank you for your business, and to letyou know to be on the lookout for a letterI’m sending you. You can’t miss it – itlooks like _______. It is very important,so call my <strong>of</strong>fice when you receive it. Oh,by the way, according to my records, I seeyou have a birthday just around the corner...so here’s an early Happy Birthdaywish from us! Thanks again for your supportand be sure call us at _______ whenyou receive the letter or whenever else wecan help you.”When you describe your mailer, be sureto mention what the envelope/postcardlooks like, including color, size, photo,20 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

etc. Also, when you wish your customer ahappy birthday, be sure to put a smile inyour voice. I promise they will be able todetect the warmth in your voice.This step alone will drastically increasethe response, but we’re just getting started.Step 2 – The Letter Arrives. You shouldknow the approximate delivery date theletter will reach your customers’ homes.This is critical because all the marketingsteps and media are aligned around thisstep for best results. If you’re using standardor bulk mail, you will not be able todetermine this exactly, but you can stillget a good idea. My suggestion – addyour name to every mailing so you knowwhen it arrives.Step 3 – Send a follow-up Video Email.It is crucial that you capture customeremail addresses every day. Require thatall <strong>of</strong> your employees capture new emailaddresses or update existing email addressesat every opportunity. Some customersdon’t have email or don’t like givingtheir email address out – I get that,but we still need to be asking for them.Video is another type <strong>of</strong> media that isvery effective and extremely powerful –much more than written words. Imaginesending your customers an email containinga video <strong>of</strong> you holding the letterand mentioning your recent phone call.Talk about making them feel special!Following is a script for your videoemail:“Hello, ______ here with a very importantmessage. So important that Irecently called you and sent you this letterregarding life Insurance and your upcomingbirthday... Happy Birthday! Asyou most likely know, life insurance pricingis all about age and health, so as wegrow older, rates for new policies go up.Now is best time to quickly review yourlife insurance to make sure there are nogaps and before rates get higher for you.”Then if you can, insert a quick oneminute (or less) story about a real lifeexperience. This can be critical and veryemotional because as we know, life insuranceis all about emotion. If you don’thave a real life story, borrow one.End the video with a very clear Callto Action. “Just hit the reply button andlet me know the best time to contact youor call me at ________.”Also, be sure to include some <strong>of</strong> thecopy in a summary in the body <strong>of</strong> youremail. Do not assume that each personreceiving the email will click on the videolink and watch the video. By addingsome <strong>of</strong> the video content in text beneaththe video link, we can help ensure thatour customers are receiving the message.I can hear some <strong>of</strong> the agents now;“But Bill, I don’t know how to shoot avideo.” Well, there’s a first time for everything.Remember, successful smallbusiness owners don’t become successfulby whining or making excuses. If youwant this process to work, stop makingexcuses and get busy! If you’re still notsure if you can do it, maybe you’re in thewrong business.Shooting the video will take you a littlepractice. You will be uncomfortable atfirst, but that’s okay – it’s natural to feelthis way. It doesn’t have to be perfect andactually, it is probably better if it’s not.After all, you’re not a TV anchorperson.Step 4 – Outbound Call. This is themoney step. This is you and your teamactually speaking with your customer.Your script is basically a repeat <strong>of</strong> thescript in the video. Make small talk andlet them know the reason for your call.Remind them about your recent communicationswith them – call, letter, andvideo email. The next thing you know,you’re <strong>of</strong>f to the races booking anotherlife appointment.This Life Birthday Letter process isdone best just like all other highly successfulmarketing campaigns – when allthe steps are followed completely! Forthe best results, you must use all <strong>of</strong> thesteps mentioned above, in the right order,and completely. This will enable youto realize the best return possible andmake the most <strong>of</strong> the biggest advantagethat we have as small business owners– the relationships we build with ourcustomers, prospects, and our centers <strong>of</strong>influence. EfBill Gough is President <strong>of</strong> BGI MarketingSystems. BGI is a company dedicated tohelping Allstate agents take their agencies tothe next level <strong>of</strong> growth while maximizingpr<strong>of</strong>its. Bill can be reached at Bill@bgisystems.comor by calling 877- 208-9649.Attention New Agency Ownerswho either Bought an Agency orwere Assigned a Book <strong>of</strong> BusinessAre you frustrated with your FSL for not providing you with“Proven” methods to write more Life and Annuity Businessfrom your Book <strong>of</strong> Business?Let me show you a proven plan to increase your saleswhen you join NAPAA. With my plan, you’ll keep your FSL<strong>of</strong>f your back and make your EFS Happy – or you can do ityourself and put the $$$ in your pocket.For more information, please contact:Gerry FloresNapaa Benefits Representative563-564-180022 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

featureTerminated? What’s the Big Deal?By Dave ThorpeWe all remember FDR’s famousstatement that gave solaceto a frightened nation; “Theonly thing we have to fear, is fear itself.”Many <strong>of</strong> you in various regionsthroughout the country remember acertain high-pr<strong>of</strong>ile RVP who madehis mark by terrifying agents, territorialleaders and local sales leaders. He alsospent a lot <strong>of</strong> time in court defendinghis and Allstate’s actions. His style wasmanagement by intimidation. And itworked. He scared the hell out <strong>of</strong> me. Hewas perhaps best known for the lawsuitshe was party to. I’m not going to use hisname in this article for fear <strong>of</strong> a redux <strong>of</strong>previous litigation. I thought about quittingback then, and to this day wonderwhat would have happened had I doneso. I decided to contact a few agents wholeft Allstate either voluntarily or otherwiseto see if they were better <strong>of</strong>f.I was instrumental in the hiring <strong>of</strong>Wade Rohrs back in the late 1970s.Wade was an adopted child and after hisadoptive parents died, he changed hisname to his biological mother’s name,Hatton. We worked together sharing asales booth in a Sears’ store.Problems surfaced right away. He wasa handsome lad who was easily distractedby the Sears’ girls – and they loved hisattentions as well. He felt restricted inthe confines <strong>of</strong> Sears and thought theagency manager to be slow-witted. Sohe decided to walk out and try his handat catching bigger fish. On his plane rideout <strong>of</strong> town to Newport Beach, he happenedto sit next to a procurement <strong>of</strong>ficerwho worked for a small local airline. The<strong>of</strong>ficer complained about the pedanticattitude <strong>of</strong> his then commercial insuranceagent.Largely as a result <strong>of</strong> that meeting,Wade decided to go into commercialinsurance covering airlines. He kept incontact with the aforementioned procurement<strong>of</strong>ficer and when licensed,wrote up the airline. That segued intoselling coverage for municipalities, titlecompanies, fast food restaurant chainsand global business entities. He becamea multimillionaire and 30 years later,bored by insurance, sold his agency. Hebought a high-end hotel at the foot <strong>of</strong>the San Francisco Peaks in Flagstaff, Arizonaand renamed it the Hatton House.You can say hello to Wade by emailinghim at mhatton2006@yahoo.com.Mike Conley is a bright lad with an artisticbent. He sold a 10-year-old agency<strong>of</strong> medium size in 2000. He wanted thefreedom <strong>of</strong> a self-employed entrepreneur.He started Boundary Waters Pools andSpas. He designs pools, gazebos and<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 23

ock waterfalls and enjoys skills requiringa combination <strong>of</strong> artistic temperamentand construction expertise. Mikenever took a step back income-wise. Hebuilt my pool and waterfall, as well asmy son Jason’s. We couldn’t be happierwith his work. You can contact Michaelthrough his website at www.boundarywaterspools.com.Although the aforementioned RVPdisliked me personally, the then TerritorialManager was a personal friend whointervened and kept saving my job. Butthe RVP really hated Ed DeLorenzo,who did have a huge ego, almost as bigas his boss’s. Ed was a fine agent in theregion, highly productive and earnedArizona’s “Agent <strong>of</strong> the Year” recognitionseveral times. The RVP stayed onEd like a wolf on a treed bobcat. Ed had16 years with the company and simplygrew tired <strong>of</strong> the constant harassment.He quit Allstate and started AmbassadorInsurance in Scottsdale. He currently hasa $10 million book and 12 employees. Ifyou want to say hello to Ed, email him ateddelorenzo@yahoo.com.Tom Wittkopp was nothing if not agenuinely amiable agent, who was esteemedby fellow agents and clientsalike. He started his Allstate career in1975 and enjoyed almost two decades <strong>of</strong>steady growth. Then the same RVP whoharassed Ed stepped into the picture.What’s interesting in this case is that theRVP never came after Tom personally.But Tom couldn’t stand his overbearingattitude and felt the policies <strong>of</strong> the RVPwere a direct cause <strong>of</strong> his decreasing policycount. If nothing else, it was not anenjoyable atmosphere to work in. Manyagents felt management was just lookingfor an excuse to terminate another agentin an attempt to drive production by intimidation.Tom moved to Germany and beganselling Universal Life policies to ourtroops in Swetigen. He came back statesideand enrolled employees <strong>of</strong> riverboatcasinos in health and pension plans in BatonRouge, Louisiana. He’s now retired. Ifyou’re an old bud <strong>of</strong> Tom’s you can reachhim at wittkopp123@gmail.com.I’m saving my favorite guy for last. Notthat he was all that loveable. A little demented,a little rude and certainly surly,he was just my kind <strong>of</strong> guy. I’d knownDerrace Hoey before his Allstate dayswhen we worked in consumer finance.I was also instrumental in getting himhired because I knew he would be successful.And he was. Then he ran afoul“There is lifeafter Allstate.Termination isn’t theend <strong>of</strong> the world. Andfor those <strong>of</strong> you whoare anxious about yourown life after Allstate,you might find solaceand strength in thestories I’ve shared. Ifyou’re leaving, putyour head down andmove forward –it just might bethat you’ll end updoing somethingyou love andmaking more moneywhile you’reat it.“<strong>of</strong> the RVP. I have no idea why theRVP took such umbrage to these guys,but production and integrity didn’t playa part in it. Only subservience to histyranny mattered.* And if he personallydidn’t like you, that was it. He hada reputation for being very vindictive. SoDerrace quit and started his own agencyand it was an instant success. Years later,he sold out his interest to his partner. Heknew I liked to write and invited me toquit Allstate and join him in his motorhome, writing and going to ball games. Isometimes regret I didn’t.Unfortunately, Derrace didn’t get theopportunity to enjoy his newfound freedomand peace <strong>of</strong> mind too awfully long.He died <strong>of</strong> cancer. But he didn’t die at adesk despising the company he was affiliatedwith, and he left his widow Lanetta,very well <strong>of</strong>f.So there you have it; there is life afterAllstate. Termination isn’t the end <strong>of</strong> theworld. And for those <strong>of</strong> you who are anxiousabout your own life after Allstate,you might find solace and strength in thestories I’ve shared. If you’re leaving, putyour head down and move forward – itjust might be that you’ll end up doingsomething you love and making moremoney while you’re at it.A nationally esteemed Allstater oncesaid, “Some people have a great job butmake lousy money while others makegreat money and hate their jobs. I’mlucky enough to have a great job and alsomake great money.” Unfortunately, todaysuch praise is hard to come by. This is notto say that some <strong>of</strong> our company <strong>of</strong>ficersare not enlightened. The Southwest Regionhas a great leader in Dennis Bailey.One last thought. What if those overbearingRVPs <strong>of</strong> yesteryear had beenfound out before they harassed and intimidatedthe many agents that have sinceleft us? How many more policyholderswould we have today? For a clue, checkwith State Farm. Their agents and policyholders are much more important to thecompany than are pompous, tyrannicalRVPs. If you want pro<strong>of</strong>, just comparetheir policyholder count and yearly resultsto Allstate’s. I guarantee you; you’ll beembarrassed by what you see.*I wanted to find a special word todescribe this god-awful representative<strong>of</strong> leadership. What I found is the wordDemogorgon, which is, according tothefreedictionary.com, “A terrifying ancientdeity or demon <strong>of</strong> the underworld.”And that description is as close as I couldget to who he really was. Ef<strong>Exclusivefocus</strong> readers have been very goodat posting me with anecdotes and stories.I want to hear more. You can contact methrough my website www.davethorpe.net.24 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

technologyHas Allstate Ever Told You to ContactYour Own IT Support?By Dan HeltonIn 2008, Allstate made all its agentsbuy their own computers and get theirown internet connection through a localISP (Internet Service Provider). Thistransition has created numerous additionalproblems for Allstate agents. Nownot only do they have to know how toquote and write insurance through theprograms that Allstate provides, theyalso have to be computer literate in theareas <strong>of</strong> PC networking, s<strong>of</strong>tware installationand setup, PC Hardware troubleshooting,and all <strong>of</strong> the other little problemsthat come with maintaining theirown systems – or they need an expertthey can rely on to help them throughthese issues.Unfortunately, most PC vendors don’tknow what is required on the Allstate sideto be able to help resolve problems thatagents are having. During the conversion,many agents purchased computersthrough Dell and were <strong>of</strong>fered remotesupport through Verizon.The support people at Verizon neverbothered to learn how agents used theircomputers to access Allstate programsthrough Gateway or what was requiredto actually get everything to functionproperly. If it was an Internet connectionproblem then Verizon could help. Ifit was a PC hardware problem, they toldagents to contact the vendor who soldthem the computers.Dell, for example, could help withhardware problems, but had no clue howto access the Allstate Gateway. Then ifit was a Gateway issue, such as gettinga printer to print from the Alliance appor Alstar, they would tell the agent to callAlstar Support. But when you called AlstarSupport, they were quick to declarethat if you were having a problem theywere not responsible for, you needed tocontact your own IT support. This leftthe agents frustrated about who was reallyresponsible for fixing their problem, andleft these three support entities playingthe inter-company finger pointing game.I am writing this article to give agentssome insight on how to fix some <strong>of</strong> theseproblems themselves and to shed somelight on some <strong>of</strong> the leftover problemsthat agents are suffering with becausethey were too frustrated to do anythingabout them.ISP ServiceFirst let’s talk about your ISP service.Generally you have two kinds <strong>of</strong> service;DSL provided by a national or local telephonecompany, such as AT&T, or cableservice, provided by your local cablecompany. With DSL (Digital SubscriberLine) you may have either a single DSLModem or a combination modem androuter. If you have a single DSL modem,it is only meant to handle one PCso chances are, you also have a separaterouter. Usually the router will also havewireless capabilities. If they set you upproperly, they will have either disabledthe wireless capability or secured it witha passcode or a passphrase to access yournetwork wirelessly.If you have DSL with a combinationmodem and router all in one unit, the unitwill also usually have wireless capability.This modem/router should also have thewireless either disabled or secured witha passcode or passphrase. Securing yourwireless prevents someone with a laptopfrom pulling up in your parking lotand getting into your network withoutyour knowledge. Most <strong>of</strong> the time it issomeone who just wants to get internetaccess temporarily, but you never know;someone with the right knowledge couldgain access to your entire <strong>of</strong>fice networkand any files on your computers. If youhave wireless capability in your <strong>of</strong>fice, Iwould recommend you check with yourISP to make sure that it is either securedor disabled.There are too many different modemsand routers on the market to getinto how to configure your particularsetup. However, the ISP or IT personwho set you up should be able to walk<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 25

1DSL Single Port Modem Provided by Local Phone Company or <strong>National</strong> Phone Company ISPIncoming Phone LinePhone Line ContinuesEthernet Cable to Internet Port onRouter ( Also sometimes calledCat5 Cable Or Patch Cable)These Lines Represent the Cabling in your<strong>of</strong>fice with Patch cables from the Wall toyour PC’s on the PC End and Patch Cablesfrom the Wall to your Router on theRouter EndRouter(Usually NotProvided By TelephoneCompany)2DSL Combo Modem/Router Provided by Local Phone Company or <strong>National</strong> Phone Company ISPIncoming Phone LinePhone Line ContinuesPhone Cable to DSL Port on RouterIn this Diagram all we have done is eliminate theseparate Modem and Router and Combined theminto one unit.Modem/Router(Provided By Telephone Company)These Lines Represent the Cabling in your<strong>of</strong>fice with Patch cables from the Wall toyour PC’s on the PC End and Patch Cablesfrom the Wall to your Router on theRouter End3 Cable Service Modem Provided by Local Cable Company or <strong>National</strong> Cable Company ISPyou through how to configure the wirelessmuch higher speeds, typically starterlybecause most routers and cable mo-settings in your equipment. Typical ing at 12MB/Sec. and going up from dems have four ports. If your <strong>of</strong>fice hasRG-6 Line to otherspeeds with DSL vary with the level <strong>of</strong> Cable Services there. such In as my experience, I’ve found thatIncoming Cable ServiceTV or Phone Modemservice you purchased Line from your ISP. you can get internet service, phone linesmore than four PCs, then the tech doingthe conversion should have connected allWith every internet service Cable you Splitter have and TV service for the same or less than <strong>of</strong> the PCs into the hub or switch. I haveRG-6 Cable to Cable Port onan upload speed and a download speed. you Modem would pay AT&T for phone lines included some diagrams in this article toThese Lines Represent the Cabling in yourWhen the ISP gives the speed, they referalone. Cable companies usually also <strong>of</strong>-<strong>of</strong>fice with illustrate Patch cables from how the Wall everything to should be con-to it in terms <strong>of</strong> the download speed. fer free long distance in the U.S. and from the Wall nected to your Router in your on the <strong>of</strong>fice to work correctly.In this Diagram you would have to add an additionalyour PC’s on the PC End and Patch CablesRouter in order to have Wireless service in your <strong>of</strong>fice.Router EndThe upload speed is usually much slower. Canada, whereas phone CableWireless Router not usually provided by your Cablecompanies makeNormally the highest speed you can get additional chargesModemCompany. This is shown in the next diagram.for their “MetropolitanDiagram 1: Shows DSL Service with awith DSL is 6MB/ Sec. This means theCalling Area Plan” as well as other single port modem provided by the tele-download speed is 6 million bits per secondand thecharges. With cable services, you usuallyneedphone company. In this case, you have to4uploadCablespeedServicewouldModemtypicallyProvided bytoCableaddCompanya router inISPorderwithtoWirelesshaveRouteradd a routerAddedif you have more than 1 PCbe around 1.5MB/Sec. AT&T’s RG-6 Line to U- other wireless in your Cable <strong>of</strong>fice. Modem Although recently in your <strong>of</strong>fice.Cable Services such asverse service works like DSL, but TV or can Phone Modem go I have seen cable (Provided modems By Cable Company) with wirelessIncoming Cable Serviceup to 24MB/Sec.LineHowever, it will costmore to get this speed. Most Cable ISP’s Splitter <strong>of</strong>ferbuilt into them, most cable modems providedby the cable companies do not haveDiagram 2: Shows DSL Service with acombination modem /router provided byRG-6 Cable to Cable Port ona standard <strong>of</strong> 1.5MB/Sec. service for between$20.00 and $30.00/Month. When Another importantwireless.Patch Cable from anyModemthe telephone company. In this instance,Ethernet Port OnCable Modemcomponenttoin our These Lines Represent all we the have Cabling in done your is eliminate the separateInternet Port On<strong>of</strong>fice with Patch cables from the Wall toAllstate was In doing this Diagram the conversions, shows an additional Verizonwas only <strong>of</strong>fering DSL at the lowest When Allstate did the <strong>of</strong>fice conver-Router EndRouter <strong>of</strong>fice in order network to Wirelessis yourRouterswitch or hub. your PC’s on the modem PC End and Patch and Cables router and combined themhave Wireless service in your <strong>of</strong>fice. Wireless Routerfrom the Wall to your Router on thenot usually provided by your Cable Company.into one unit. Since the modem/routerspeed <strong>of</strong> 384KB/Sec. on both the upload sions, the techs doing Wireless the conversions has four ports on it, you can connect upside and the download side for $35.00/Month. So Allstate and Verizon didn’tdo anybody any favors by <strong>of</strong>fering thisservice. If they had done a little morenegotiating, they probably could havegotten AT&T to provide the service for$20.00 a month or so.But that is all water under the bridgenow. Cable service generally <strong>of</strong>fersshould have left the hub Router or switch in theon-site black box. Originally, the datacommunications equipment that Allstateand MCI provided included a 3Com 8Port Hub and at some point, Allstateupgraded most <strong>of</strong>fices to a LinkSys 16Port Switch. If your <strong>of</strong>fice has four PCsor less, this hub or switch would not beneeded for your network to work prop-to four PCs on your network.Diagram 3: Shows cable modem service.As you can see, it is connected verysimilar to DSL service, but most cablemodems have four ports on them as theyare combination modem/routers. If youhave four or less PCs they can all beplugged into the cable modem. To have26 — <strong>Exclusivefocus</strong> <strong>Summer</strong> 2012

separate Modem and Router and Combined theminto one unit.(Provided By Telephone Company)3Cable Service Modem Provided by Local Cable Company or <strong>National</strong> Cable Company ISPIncoming Cable ServiceLineCable SplitterRG-6 Line to otherCable Services such asTV or Phone ModemRG-6 Cable to Cable Port onModemIn this Diagram you would have to add an additionalRouter in order to have Wireless service in your <strong>of</strong>fice.Wireless Router not usually provided by your CableCompany. This is shown in the next diagram.CableModemThese Lines Represent the Cabling in your<strong>of</strong>fice with Patch cables from the Wall toyour PC’s on the PC End and Patch Cablesfrom the Wall to your Router on theRouter End4Cable Service Modem Provided by Cable Company ISP with Wireless Router AddedIncoming Cable ServiceLineRG-6 Line to otherCable Services such asTV or Phone ModemCable SplitterRG-6 Cable to Cable Port onModemIn this Diagram shows an additional Router in order tohave Wireless service in your <strong>of</strong>fice. Wireless Routernot usually provided by your Cable Company.Cable Modem(Provided By Cable Company)Patch Cable from anyEthernet Port OnCable Modem toInternet Port OnWireless RouterWirelessRouterThese Lines Represent the Cabling in your<strong>of</strong>fice with Patch cables from the Wall toyour PC’s on the PC End and Patch Cablesfrom the Wall to your Router on theRouter Endwireless service, you usually have to adda wireless router yourself, as depicted inDiagram #4Diagram 4: Shows cable modem servicewith a wireless modem added. Inthis case, if you have four or less PCs inyour <strong>of</strong>fice you would connect all PCsinto the wireless router in order to havethem all on the same network.Diagram 5: Shows that if you havemore than four PCs, how you would usethe hub or switch to connect all <strong>of</strong> yourPCs together also with a wireless routeradded.Diagram 6: Shows how you could connectall <strong>of</strong> your PCs together if you havemore than four PCs, but this is NOT thecorrect way to connect because it putsthe PCs on two separate networks; onenetwork controlled by the router section<strong>of</strong> the cable modem, and one networkcontrolled by the wireless router.In this example, all PCs would haveinternet access, but if you use the “P”drive, or public drive, to share files orshare printers in your <strong>of</strong>fice, only the PCsconnected to the network that includesthe file sharing PC would have access tothose files, and only the PCs on the samenetwork as the PC sharing the printerwould have access to the shared printer.I’ll talk more about the correct networksetup in future articles to be published inthis magazine.Troubleshootingyour Internet ConnectionI get many calls from agents who callto tell me they suddenly lost access to theInternet. They usually tell me that theAgency Gateway has stopped working.There are many reasons that could causethis; rainy days with lightning, theirISP decided they needed to reset someequipment, and power outages are themost common culprits. When I get thesecalls, I usually have to determine if it’s aproblem with one computer or all <strong>of</strong> thecomputers in the <strong>of</strong>fice. The next step isto ascertain if it is the Gateway programsthat are experiencing the problem or ifit’s the Internet that is down. The agentor support staff can usually answer thesequestions right away. If all the computersin the <strong>of</strong>fice are affected, I ask if they areable to open Internet Explorer and go todifferent websites. If they say no, and allthey get is a message that Internet Explorercannot display the web page, thisusually can be resolved by power cyclingyour data communications equipment.The key is to know the proper order topower everything back up.If they can go to different websiteswith no problem, the problem is mostlikely that the Allstate servers are down.In this case, all they can do is wait forAllstate to get the servers back up andonline. This is very rare, but I have seenit happen once or twice. If they callAlstar Support, they usually receive amessage that the support center alreadyknows about the problem and are workingto resolve it.Now back to our troubleshooting. Ifwe determine that the problem is withonly one computer, rebooting the computerwill usually resolve the problem. Ifthe problem is that all computers in the<strong>of</strong>fice have no internet connection, weusually can power cycle the Data communicationsequipment and this willrestore service. After power cycling thedata communications equipment, I generallyhave them reboot all <strong>of</strong> the PCs inthe <strong>of</strong>fice, just to start out fresh. Whenpower cycling the data communicationsequipment, we have to determine if thereis only one unit we have to power cycle or<strong>Summer</strong> 2012 <strong>Exclusivefocus</strong> — 27