KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

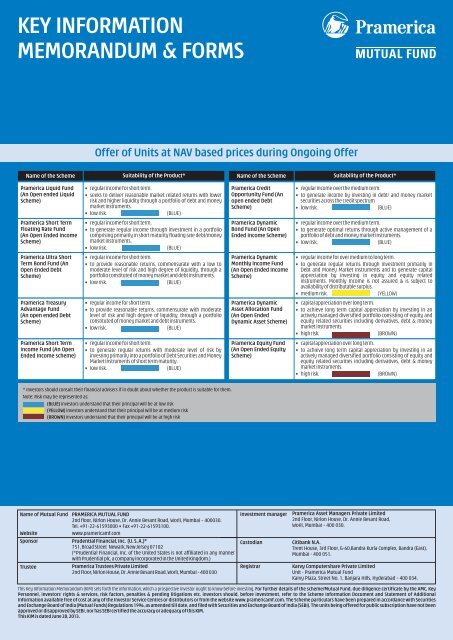

<strong>KEY</strong> <strong>INFORMATION</strong><strong>MEMORANDUM</strong> & <strong>FORMS</strong>Offer of Units at NAV based prices during Ongoing OfferName of the Scheme Suitability of the Product* Name of the Scheme Suitability of the Product*Pramerica Liquid Fund(An Open ended LiquidScheme)Pramerica Short TermFloating Rate Fund(An Open Ended IncomeScheme)Pramerica Ultra ShortTerm Bond Fund (AnOpen Ended DebtScheme)Pramerica TreasuryAdvantage Fund(An open ended DebtScheme)Pramerica Short TermIncome Fund (An OpenEnded Income scheme)• regular income for short term.• seeks to deliver reasonable market related returns with lowerrisk and higher liquidity through a portfolio of debt and moneymarket instruments.• low risk.(BLUE)• regular income for short term.• to generate regular income through investment in a portfoliocomprising primarily in short maturity floating rate debt/moneymarket instruments.• low risk. (BLUE)• regular income for short term.• to provide reasonable returns, commensurate with a low tomoderate level of risk and high degree of liquidity, through aportfolio constituted of money market and debt instruments.• low risk. (BLUE)• regular income for short term.• to provide reasonable returns, commensurate with moderatelevel of risk and high degree of liquidity, through a portfolioconstituted of money market and debt instruments.• low risk.(BLUE)• regular income for short term.• to generate regular returns with moderate level of risk byinvesting primarily into a portfolio of Debt Securities and MoneyMarket Instruments of short term maturity.• low risk.(BLUE)Pramerica CreditOpportunity Fund (Anopen ended DebtScheme)Pramerica DynamicBond Fund (An OpenEnded Income Scheme)Pramerica DynamicMonthly Income Fund(An Open Ended IncomeScheme)Pramerica DynamicAsset Allocation Fund(An Open EndedDynamic Asset Scheme)Pramerica Equity Fund(An Open Ended EquityScheme)• regular income over the medium term.• to generate income by investing in debt/ and money marketsecurities across the credit spectrum• low risk.(BLUE)• regular income over the medium term.• to generate optimal returns through active management of aportfolio of debt and money market instruments.• low risk.(BLUE)• regular income for over medium to long term.• to generate regular returns through investment primarily inDebt and Money Market Instruments and to generate capitalappreciation by investing in equity and equity relatedinstruments. Monthly Income is not assured & is subject toavailability of distributable surplus.• medium risk.(YELLOW)• capital appreciation over long term.• to achieve long term capital appreciation by investing in anactively managed diversified portfolio consisting of equity andequity related securities including derivatives, debt & moneymarket instruments.• high risk.(BROWN)• capital appreciation over long term.• to achieve long term capital appreciation by investing in anactively managed diversified portfolio consisting of equity andequity related securities including derivatives, debt & moneymarket instruments.• high risk.(BROWN)* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.Note: Risk may be represented as:(BLUE) investors understand that their principal will be at low risk(YELLOW) investors understand that their principal will be at medium risk(BROWN) investors understand that their principal will be at high riskName of Mutual FundWebsiteSponsorTrusteePRAMERICA MUTUAL FUND2nd floor, Nirlon House, Dr. Annie Besant Road, Worli, Mumbai – 400030.Tel. +91-22-61593000 • Fax +91-22-61593100.www.pramericamf.comPrudential Financial, Inc. (U. S. A.)*751, Broad Street Newark, New Jersey 07102(*Prudential Financial, Inc. of the United States is not affiliated in any mannerwith Prudential plc, a company incorporated in the United Kingdom.)Pramerica Trustees Private Limited2nd Floor, Nirlon House, Dr. Annie Besant Road, Worli, Mumbai – 400 030Investment managerCustodianRegistrarPramerica Asset Managers Private Limited2nd Floor, Nirlon House, Dr. Annie Besant Road,Worli, Mumbai – 400 030.Citibank N.A.Trent House, 3rd Floor, G-60,Bandra Kurla Complex, Bandra (East),Mumbai - 400 051.Karvy Computershare Private LimitedUnit - Pramerica Mutual FundKarvy Plaza, Street No. 1, Banjara Hills, Hyderabad – 400 034.This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the scheme/Mutual Fund, due diligence certificate by the AMC, KeyPersonnel, investors’ rights & services, risk factors, penalties & pending litigations etc. investors should, before investment, refer to the Scheme Information Document and Statement of AdditionalInformation available free of cost at any of the Investor Service Centres or distributors or from the website www.pramericamf.com. The Scheme particulars have been prepared in accordance with Securitiesand Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not beenapproved or disapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM.This KIM is dated June 28, 2013.

COMMON APPLICATION FORM(To be used / distributed with Key Information Memorandum)All sections to be completed legibly in English in Black/Blue coloured ink and in BLOCK letters.Please submit separate form for each scheme. Please read the Scheme Information Document / KIM of the scheme and instructions on page no. 19 carefully.Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of various factors including services rendered by the distributor.2. TRANSACTION CHARGES (Please üany one of the below) (Refer Instruction No. 2)I AM A FIRST TIME INVESTOR IN MUTUAL FUNDSOR I AM AN EXISTING INVESTOR IN MUTUAL FUNDS3. UNITHOLDING OPTION Demat Mode Physical ModeDEMAT ACCOUNT DETAILS (Please ensure that the sequence of names as mentioned in the application form matches with that of the account held with any one of theDepository Participant. Demat Account details are compulsory if demat mode is opted above)NationalDepositoryCentralDepositorySecuritiesparticipant NameDepositoryparticipant NameDepository DP ID No.I NSecuritiesLimited Beneficiary Account No.Limited Target ID No.Enclosures : Client Master List (CML) Transaction cum Holding Statement Delivery Instructions Slip (DIS)4. EXISTING INVESTORS(Refer Instruction No. 4A)Existing Folio No.Name of Sole / 1st Applicant(Please fill Section 7 & 9 only)5. APPLICANTS' <strong>INFORMATION</strong> (Refer Instruction No. 4B)stName of Sole/1 Applicant Mr. Ms. M/s. (Please P) Date of BirthProof of Date of BirthD D M M Y Y Y Y (Mandatory in case of Minor)(Please P) (Refer Instruction No. 4C)F I R S T N A M E M I D D L E N A M E L A S T N A M EndName of 2 ApplicantFD D M M Y Y Y YI R S T N A M E M I D D L E N A M E L A S T N A M ErdName of 3 ApplicantMr. Ms. M/s. (Please P) Date of BirthMr. Ms. M/s. (Please P) Date of BirthD D M M Y Y Y YF I R S T N A M E M I D D L E N A M E L A S T N A M EProof of RelationshipName of Guardian/Contact Person Mr. Ms. M/s. (Please P) Relationship with Minor(Mandatory in case of Minor Applicant) (Please P) (Refer Instruction No. 4D)F I R S T N A M E M I D D L E N A M E L A S T N A M E* Mandatory with an attested PAN Proof^ Mandatory for any amount,If Yes, attach proofApplication No.1. DISTRIBUTOR <strong>INFORMATION</strong> (Refer Instruction No. 1)ARN -st1 Applicantnd2 Applicantrd3 ApplicantGuardianst(In case 1 Applicantis a Minor)(Refer Instruction No. 3)Mode of Holding Single Anyone or Survivor Joint (Default Option)(Please Pany one)Status ofResident Individual NRI PIO Trust FII Bank1st Applicant Company/Body Corporate (Pvt. Ltd.) Partnership(Please Pany one) Company/Body Corporate (Public & Others Ltd.)NGO Minor AOP/BOI Club/SocietyGovernment Body HUF Others (Please specify)Occupation Private Sector Service Public Sector / Govt. Service(Please Pany one) Business Professional Agriculturist StudentRetired Housewife Others (Please specify)CONTACT <strong>INFORMATION</strong> Correspondence Address of Sole/First Applicant (P.O. Box address is not sufficient) (Refer Instruction No. 5)City State PIN Code (Mandatory)Overseas Address (Mandatory for NRI/FII applicant) (P.O. Box address is not sufficient)CityARN codePAN*Sub broker ARN codeARN -Incase the Employee Unique Identification Number (EUIN) box has been left blank please refer point 9 related to EUIN.KYC Status^CountryContact Details Tel. No. STD Code Res. Off. Faxst1 Applicant Mobile No. Email ID*nd2 Applicant Mobile No. Email ID*rd3 Applicant Mobile No. Email ID** Investors providing email id would mandatorily receive only E-statement of account in lieu of physical statement of account.YesYesYesYesNoNoNoNoSub broker code (as allotted by ARN holder)Employee Unique Identification Number (EUIN)ZIP CodeACKNOWLEDGEMENT SLIP (To be filled in by the investor)Application No.Received from Mr. / Ms. / M/s. an application for investment in Pramerica Mutual Fund -Scheme NameOption Growth Dividend Bonusfor ` (in figures) vide Instrument no.Bank Branch CityAll purchases are subject to realisation of cheque/demand draft and furnishing of mandatory information/documents. Please retain this slip till you receive your Account Statement.Acknowledgement Stamp & Date01

6. BANK DETAILS(MANDATORY - IF LEFT BLANK, APPLICATION WILL BE REJECTED) (Refer Instruction No. 6)Mention your Core Banking Account No. (if applicable). Please check with your bank, if you do not have the same.Account No. Account Type CA SB NRO NRE FCNR Others (Please specif y)Name of Bank Account HolderBranchMICR code(MICR code is the 9 digit code next to the cheque no.)Lumpsum Investment:I. Cheque / DD Amount `II. DD ChargesIII. Investment Amount``(I + II)M A N D A T O R Y7. INVESTMENT/ PAYMENT DETAILS (Refer Instruction No. 7)Scheme Name : Option Growth* DividendDividend Facility Payout Re-investment* (Default) Dividend FrequencySIP Investment (Please Pany one) Daily Monthly QuarterlySIP THROUGH AUTO DEBIT (ECS/Direct Debit) Please also fill and attach the SIP Auto Debit Facility Form ORSIP THROUGH POST-DATED CHEQUE Second and subsequent Instalment cheque Details (Refer instruction no. 7(II))Cheque Nos. From ToDated From D D M M Y Y Y Y To D D M M Y Y Y YI. First SIP Instalment Details: Mode of Payment (Please P) Cheque Demand Draft#Mode of Payment (P) Cheque#Demand Draft Fund Transfer Instalment Amount `Instrument No.Dated D D M M Y Y Y YDrawn onName of the BankDrawn onName of the BankBranch & CityBranch & CityName of the Bank A/c holderII. Second and Subsequent Instalment Details: (All subsequent instalment amounts should be same as the first instalment.)Instrument No.SIP Date (Please P) 1st 7th 10th 15th 25th All 5 datesDatedD D M M Y Y Y YSIP Period :Please mention Enrolment PeriodName of the Bank A/c holderTill I/We instruct to discontinue the SIP (A)FromTo#Bankers Certificate is must (Refer Instruction No. 7)No. of instalments(B)M M Y YM M Y YNRI / FII Investors, Please indicate source of funds for your investment (Please P) NRE NRO FCNR Others (Please specify)Third party cheque / transfer will not be accepted for investmentIn case of exception to Third party payment, please fill the Third Party Declaration Form.(Refer Instruction No. 7)8. NOMINATION DETAILS (Please Pany one of the below mentioned Option. Nomination is not allowed in case Sole / First Applicant is minor) (Refer Instruction No. 8)I / We do not wish to avail of nomination facility at present. (NOTE: SOLE INDIVIDUAL APPLICANTS ARE ADVISED TO COMPULSORILY NOMINATE).ORI/We do hereby nominate the undermentioned Nominee(s) to receive the Units allotted to my/our credit in my/our folio in the event of my/our death. I/We also understand that all payments andsettlements made to such Nominee(s) and Signature of the Nominee(s) acknowledging receipt thereof, shall be a valid discharge by the AMC/Mutual Fund/Trustees.Name & Address of Nominee(s) PAN Date of Name & Address of the Guardian Signature of Nominee / Guardian Proportion (%)Birth(where Nominee is a minor) should aggregate to 100%(To be furnished in case the Nominee is a Minor)(OPTIONAL)Default : Equal proportion1.2.3.IFSC codeBank Name9. DECLARATION AND SIGNATURES (MANDATORY - APPLICATION WITHOUT SIGNATURE(S) WILL BE REJECTED) (Refer Instruction No. 9)City(IFSC code is the 11 digit no. appearing on your cheque leaf) (Mandatory for credit via NEFT/RTGS)Mandatory to submit a cancelled cheque leaf of thebank account mentioned here.Bonus*Default OptionPlease Pif the EUIN space is left blank: I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this is an “execution-only” transaction without any interaction or advice by the employee/relationshipmanager/sales person of the above distributor or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor and the distributor has not charged any advisory fees onthis transaction.SIGNATURE(S) (ALL APPLICANTS must sign here)Date D D M M Y Y Y Yst nd rdSole/1 Applicant/Guardian/Authorised Signatory/POA 2 Applicant/Guardian/Authorised Signatory/POA 3 Applicant/Guardian/Authorised Signatory/POAIf the investment is being made by a Constituted Attorney please furnish Name and PAN of Power of Attorney Holder (POA) in respect of each applicant below:NamePANst nd rdPOA Holder for 1 Applicant POA Holder for 2 Applicant POA Holder for 3 ApplicantK Y C Compliant* Yes No Yes No Yes No* (if Yes, attach proof)CHECK LIST (Please submit the following documents with your application (where applicable). All documents should be original/true copies Certified by a Director/ Trustee/Company Secretary/ Authorised signatory/ Notary Public.)Documents Ind Co. Soc. Partnership Investment Trusts NRIFirms through POAPAN Card (not required for Micro Investors) PPP P P PPKYC Acknowledgement PPP P P PPBoard Resolution/ Authorisation to invest PP P P PList of authorised signatories with specimen signatures PP P P PMemorandum & Articles of AssociationPTrust DeedPBye-lawsPPartnership DeedPNotarised POA (signed by investor and POA Holder)PProof of Address (for Micro Investors) P PProof of Identity (for Micro Investors) P PFor more information visit us atwww.pramericamf.comE-mail us atcustomercare@pramericamf.comCall us (Toll free) at1800 266 266725.06.201302

SIP AUTO DEBIT FACILITYREGISTRATION CUM MANDATE FORMAll sections to be completed legibly in English in Black/Blue coloured ink and in BLOCK letters.INVESTORS SUBSCRIBING TO THE SCHEME THROUGH SIP AUTO DEBIT FACILITY TO COMPLETE THIS FORM COMPULSORILY ALONGWITH COMMON APPLICATION FORM (Refer General Guidelines 2A)1. DISTRIBUTOR <strong>INFORMATION</strong> (Refer Instruction No. 1)ARN -3. SIP DETAILS (First SIP cheque and subsequent via Auto Debit Facility in select cities only) (Refer Instruction No. 3)Scheme Name Option Growth* Dividend BonusDefault OptionDividend Facility Payout Re-investment (Default)#SIP Frequency (Please üany one) Daily Monthly Quarterly# Only for Pramerica Dynamic Asset Allocation Fund & Pramerica Equity Fund.Facility available only through select banks. Refer Terms and Conditions - Point 3Instalment Amount (In figures) `Please refer to Instruction 3dSIGNATURE (S)(Applicants must signas per CommonApplication Form)stSole/1 Applicant/Guardian/Authorised Signatory/POADividend FrequencySIP Date for (Monthly / Quarterly) 1st 7th 10th 15th 25th All 5 Dates'Please read the Scheme Information Document of the respective scheme for minimum SIP instalment , minimum SIP period and aggregate amount of investment.'4. PARTICULARS OF BANK ACCOUNT (MANDATORY)Account NumberAccount TypestName of Sole / 1 Account HolderndName of 2 Account HolderrdName of 3 Account HolderName of BankBranch & Citynd2 Applicant/Guardian/Authorised Signatory/POAMICR Code (Mandatory)IFSC Code(9 digit code next to the cheque no. MICR code starting and / or ending with 000 is not valid for ECS). (11 digit no. appearing on your cheque leaf)rd3 Applicant/Guardian/Authorised Signatory/POADECLARATION & SIGNATURE : - I/We hereby, authorise Pramerica Mutual Fund and its authorised service providers, to debit my/our above mentioned bank account directly or by ECS (debit clearing) for collection of SIP payments.SIGNATURE (S)(as in Bank records)ARN codeUpfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of various factors including services rendered by the distributor.2. APPLICANT <strong>INFORMATION</strong> (Refer Instruction No. 2)Application No. / Existing Folio No.stName of Sole/1 ApplicantARN -CA SB NRO NRE FCNRstSole/1 Account Holder as in Bank RecordsSub broker ARN codeIncase the Employee Unique Identification Number (EUIN) box has been left blank please refer point 3 related to EUIN.5. BANKER’S ATTESTATION (Mandatory, if your First SIP instalment is through a Demand Draft/Pay Order)Certified that the signature of account holder andthe Details of Bank account are correct as per our recordsSignature verification request (To be retained by the Customer's Bank)Sub broker code (as allotted by ARN holder)SIP Period : (please üA or B)Till I/We instruct to discontinue the SIP (A)No. of Instalments (B)nd2 Account Holder as in Bank RecordsEmployee Unique Identification Number (EUIN)Please mention Enrolment PeriodFromToM M Y YM M Y YPlease Pif the EUIN space is left blank: I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this is an “execution-only” transaction without any interaction or advice by the employee/relationshipmanager/sales person of the above distributor or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor and the distributor has not charged any advisoryfees on this transaction.PinMandatory to submit a cancelled cheque leaf of the bankaccount mentioned here. (Refer General Guidelines 2B)*(Refer Instruction No. 4)Mention your Core Banking System (CBS) Account Number (if applicable).Please check with your bank, if you do not have the same.rd3 Account Holder as in Bank RecordsSignature of Authorised Official from Bank (Bank stamp and date)(Refer Instruction No. 4(e))25.06.2013AUTHORISATION OF THE BANK ACCOUNT HOLDERThe Branch Manager,This is to inform you that I/We have registered for making payment towards my investments in Pramerica Mutual Fund by debit to my /our above account directly or through ECS (Debit Clearing). I/We hereby authorize tohonour such payments and have signed and endorsed the Mandate Form. Further, I authorize my representative (the bearer of this form) to get the above Mandate verified & executed. Mandate verification charges, if any,may be charged to my/our account.Thanking you,SIGNATURE (S)(as in Bank records)stSole/1 Account Holder as in Bank Recordsnd2 Account Holder as in Bank Recordsrd3 Account Holder as in Bank Records21

a. Please read the Scheme Information Document/Key Information Memorandum of the Scheme carefully before investing.b. Please furnish all information marked as ‘MANDATORY’. In the absence of any mandatory information, the application would be rejected.c. Applications on behalf of minors should be made by natural guardian (i.e. father or mother) or legal guardian (court appointed) and signed by them. The name of the Guardian should be filledin the relevant space provided in the Application Form. No joint applicant/ joint holder is permitted with the minor beneficiary.d. Please strike off sections that are not applicable.GENERAL GUIDELINESINSTRUCTIONS FOR FILLING UP THE COMMON APPLICATION FORM1. DISTRIBUTOR <strong>INFORMATION</strong>a. Upfront commission shall be paid directly by the investor to the AMFI registeredDistributors based on the investors’ assessment of various factors including the servicerendered by the distributor.b. Please mention ‘DIRECT’ in case the application is not routed through any distributor.c. Pursuant to SEBI circular dated September 13, 2012, mutual funds have created a uniqueidentity number of the employee/ relationship manager/ sales person of the distributorinteracting with the investor for the sale of mutual fund products, in addition to the AMFIRegistration Number (ARN) of the distributor. This Employee Unique IdentificationNumber is referred as "EUIN". EUIN aims to assist in tackling the problem of mis-sellingeven if the employee/relationship manager/sales person leaves the employment of thedistributor or his/her sub broker. Quoting of EUIN is mandatory in case of advisorytransactions.d. Distributors are advised to ensure that the sub broker affixes his/her ARN code in thecolumn "Sub broker ARN code" separately provided, in addition to the current practiceof affixing the internal code issued by the main ARN holder in the "Sub broker code (asallotted by ARN holder)" column and the EUIN of the Sales Person (if any) in the"EUIN" column.e. Investors are requested to note that EUIN is applicable for transactions such as Purchases,Switches, Registrations of SIP / STP / Trigger STP / Dividend Transfer Plan and EUIN is notapplicable for transactions such as Installments under SIP/ STP / SWP / STP Triggers,Dividend Reinvestments, Bonus Units, Redemption, SWP Registration, Zero Balance Foliocreation and installments under Dividend Transfer Plans.f. Investors are requested to note that EUIN is largely applicable to sales persons of nonindividual ARN holders only (whether acting in the capacity of the main distributor orsub broker). Further, EUIN will not be applicable for overseas distributors who complywith the requirements as per AMFI circular CIR/ ARN-14/12-13 dated July 13, 2012.2. TRANSACTION CHARGESIn terms of SEBI circular, Cir/ IMD/ DF/13/ 2011 dated August 22, 2011, the distributors of mutualfund products are allowed to be paid transaction charges for purchase transactions :• @ `100/- per subscription of `10,000/- and above in respect of existing unitholders; and• @ 150/- for subscription of `10,000/- and above in respect of a first time investor in mutualfunds.In case of SIPs, the transaction charge if any, shall be applicable only if the total commitmentthrough SIPs aggregates to `10,000/- and above and shall be recovered in 4 installments.The transaction charge shall be deducted from the subscription amount and paid to the distributor;and the balance shall be invested in the Scheme. The transaction charges and the net investmentamount and the number of units allotted will be clearly mentioned in the Account Statementissued by the Mutual Fund.There shall be no transaction charges on(i) ‘Direct’ investments;(ii) subscription below `10,000/- and(iii) switch (including STP) and redemption (including SWP) transactions.Distributors shall be able to choose to opt out of charging the transaction charge. However, the‘opt- out’ shall be at distributor level and not investor level i.e. a distributor shall not charge oneinvestor and choose not to charge another investor.3. UNIT HOLDING OPTION (Demat / Non - Demat Mode)a. Investors can hold units in demat / non-demat mode. In case demat account details are notprovided or details of DP ID / BO ID, provided are incorrect or demat account is not activatedor not in active status, the units would be allotted in non-demat mode.b. Statement of Accounts would be sent to Investors who are allotted units in non-dematmode.c. Units held in dematerialiazed form are freely transferable with effect from October 01, 2011,except units held in Equity link savings Scheme during the lock-in period.4. (A) EXISTING INVESTORS OF PRAMERICA MUTUAL FUND (PMF)If you are an existing investor please fill your existing folio number and fill section 7 & 9only.(B) APPLICANT'S <strong>INFORMATION</strong>a. Please furnish names of all applicants. The name of the Sole /First Applicant should bementioned in the same manner in which it appears in the Income Tax PAN card. Pleasenote the following:• In case the applicant is a Non-Individual investor, the Contact Person’s nameshould be stated in the space provided (Name of Guardian / Contact Person)• In case the applicant is a minor, the Guardian’s name should be stated in the spaceprovided (Name of Guardian / Contact Person). It is mandatory to provide theminor’s date of birth in the space provided.• In case the application is being made on behalf of a minor, he / she shallbe the Sole Holder/Beneficiary. There shall be no joint account with aminor unitholder.b. If there is more than one applicant but the mode of holding is not specified, the samewould be treated as Joint.c. Please indicate the tax status of the sole/1 applicant at the time of investment. Theabbreviations used in this section are :NRI : Non-Resident Indian Individual, PIO : Person of Indian Origin, FII : ForeignInstitutional Investor, NGO : Non Government Organization, AOP : Association ofPersons, BOI : Body of Individuals, HUF : Hindu Undivided Family.d. Please mention your Occupation by ticking the appropriate option.(C) In case of a minor, it is mandatory to submit photocopy of any one of the followingtowards proof of date of birth at the time of initial investment :• Birth certificate of minor, or• School leaving certificate / Mark sheet issued by Higher Secondary Board of respectivestates , ICSE , CBSE etc, containing the minor’s date of birth, or• Passport of minor(D) In case of minor applicants, Guardian in the Folio should either be a natural guardian(i.e father or mother) or a court appointed legal guardian. In both thecases, it is mandatory to submit a document evidencing the relationship (in case ofa natural guardian, if the same is not available as part of the documents submittedas per 4 (C) above) between the minor and the Guardian.(E) KYC/PROOF OF IDENTITY AND ADDRESS DETAILSPlease furnish PAN & KYC details in this section for each applicant/unit holder, including theGuardian and/or Power Of Attorney (POA) holders as explained in (i) & (ii) below.i. PANIt is mandatory for all investors (including guardians, joint holders, NRIs and power ofattorney holders) to provide their Income Tax Permanent Account Number (PAN) andalso submit a photo copy of the PAN card at the time of purchase of Units except forii.iii.investors who are exempted from PAN requirement, please refer to KYC Form forexemption of PAN requirement.Know Your Customer (KYC)KYC compliance is compulsory for all irrespective of the amount of investment.Micro InvestmentWith effect from October 30, 2012, where the aggregate of the lump sum investment(fresh purchase & additional purchase) and Micro SIP installments by an investor in afinancial year i.e April to March does not exceed ` 50,000/- it shall be exempt from therequirement of PAN. However, requirements of Know Your Customer (KYC) shall bemandatory. Accordingly, investors seeking the above exemption for PAN still need tosubmit the KYC Acknowledgement, irrespective of the amount of investment. Thisexemption will be available only to Micro investment made by the individuals beingIndian citizens (including NRIs, Joint holders, minors acting through guardian and soleproprietary firms). PIOs, HUFs, QFIs and other categories of investors will not be eligiblefor this exemption.5. CONTACT <strong>INFORMATION</strong>a. Please furnish the full postal address of the Sole/ First Applicant with PIN/Postal Code andcomplete contact details. (P.O. Box address is not sufficient).b. Please note that all communication i.e. Account statement, Annual Report, News Letters will besent via e-mail, if the e-mail id of the investor is provided in the application form. The Accountstatement will be encrypted with a password before sending the same to the registered emailid. Should the unitholder face any difficulty in accessing/opening the AccountStatements/documents sent via email, the unitholder may call/write to the AMC/Registrar andask for a physical copy.6. BANK DETAILSa. Please furnish complete Bank Account Details of the Sole/First Applicant. This is a mandatoryrequirement and applications not carrying bank account details shall be rejected. Bank detailsprovided in the application form will be considered as the default Bank Mandate for remittingredemption proceeds/dividend amount.b. Please provide your complete Core Banking Account Number, (if applicable), in your BankMandate in the Application Form. In case you are not aware of the Core Banking AccountNumber, kindly check the same with your bankers.c. Please attach a original cancelled cheque leaf if your investment instrument is not from thesame bank account mentioned in the Application form.d. Pramerica Mutual Fund will endeavour to remit the Redemption and Dividend proceeds throughelectronic mode, wherever sufficient bank account details of the unit holder are available.7. INVESTMENT/PAYMENT DETAILSIntroduction of Direct Plan:-The AMC has introduced a separate plan for direct investments (i.e. investments not routed throughan AMFI Registration Number (ARN) Holder (“Distributor”) (hereinafter referred to as “Direct Plan”)with effect from January 1, 2013 (“Effective Date”).• Direct Plan is only for investors who purchase /subscribe Units in a Scheme directly with the••••Fund and is not available for investors who route their investments through a Distributor.Investors may please note that the Direct Plan under the Schemes is meant for investors whounderstand the capital market, mutual funds and the risks associated therewith. The risksassociated with the investments in the Schemes vary depending upon the investmentobjective, asset allocation and investment strategy of the Schemes and the investments maynot be suited for all categories of investors. The AMC believes that investors investing under theDirect Plan of the Schemes are aware of the investment objective, asset allocation, investmentstrategy, risks associated therewith and other features of the Schemes and has taken aninformed investment decision. Please note that Scheme Information Document(s), Statementof Additional Information, Key Information Memorandum or any other advertisements and itscontents are for information only and do not constitute any investment advice or solicitation oroffer for sale of units of the Schemes from the AMC.All Options/Sub-Options offered under the Schemes (hereinafter referred as “Regular Plan”)will also be available for subscription under the Direct Plan. Thus, from the Effective Date, thereshall be 2 Plans available for subscription under the Schemes viz., Regular Plan and Direct Plan.Investors subscribing under Direct Plan of the Schemes should indicate the Scheme/Plan namein the application form as “Scheme Name – Direct Plan” form for e.g. “Pramerica Equity Fund –Direct Plan”. Investors should also indicate “Direct” in the ARN column of the application form.However, in case Distributor code is mentioned in the application form, but “Direct Plan” isindicated against the Scheme name, the Distributor code will be ignored and the applicationwill be processed under Direct Plan.Please note, where application is received for Regular Plan without Distributor code or “Direct”mentioned in the ARN Column, the application will be processed under Direct Plan.Please submit separate application form for each scheme. Please indicate the Scheme and the Optionunder which you wish to invest. Also indicate your choice of dividend payout or re-investment alongwith the dividend frequency (in case there are more than one dividend frequency). If any of theinformation is left blank, the default option will be applicable.Payment may be made only by Cheque or Bank Draft or Electronic Fund Transfer. Cheque/Draftshould be drawn in favour of the "Scheme name", e.g. "PRAMERICA EQUITY FUND" and crossed"Account Payee only".Please tick and fill in the appropriate section based on the Type of Investment i.e. LUMPSUM or SIPinvestment. Please fill an Auto Debit form in case of investment through SIP – Auto Debit Facility.Please note that third party payments shall not be accepted.Third Party Payment” shall mean payment made through an instrument issued from an accountother than that of the beneficiary investor. In case of payment instruments issued from a joint bankaccount, the first named applicant/investor must be one of the joint holders of the bank account fromwhich the payment instrument is issued. ‘Related person/s’ means such persons as may be specifiedby the AMC from time to time.Exceptions: The AMC/ Registrar of PMF will accept subscriptions to schemes of PMF accompanied byThird-Party Payment Instruments only in the following exceptional cases:1. Payment by Parents/Grandparents/related persons on behalf of a minor in consideration ofnatural love and affection or as gift for a value not exceeding ` 50,000/- (each regular purchaseor per SIP installment);2. Payment by employer on behalf of employee under Systematic Investment Plan (SIP) facilitythrough payroll deductions;3. Custodian on behalf of an FII or a ClientThe investors making an application under the above mentioned exceptional cases are19

1) Pramerica Liquid Fund<strong>KEY</strong> <strong>INFORMATION</strong><strong>MEMORANDUM</strong>Investment ObjectiveAsset Allocation Patternof the schemeRisk Profile of the schemeInvestment StrategyPlans and OptionsThe Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through a portfolio of debt and money market instruments. However,there is no assurance that the investment objective of the Scheme will be realized and the scheme does not assure or guarantee any returns.InstrumentsDebt instruments (including Asset Backed Securities), money market instruments and floatershaving a residual maturity of upto 91 daysIndicative allocations (% of total assets)MinimumMaximum0 100Risk ProfileHigh/Medium/LowInvestments in securitised debt will not exceed 20% of the net assets as at the time of purchase. Investment in debt derivatives instruments will be up to 50% of the net assetsof the Scheme. Further, aggregate asset allocation including exposure to derivatives will not exceed 100% of the net assets; and that same security wise hedge positionswould be excluded from the same. Presently, the scheme does not intend to invest in overseas / foreign securities.Explanation:a. In case of securities where the principal is to be repaid in a single payout, the maturity of the securities shall mean residual maturity. In case the principal is to be repaid inmore than one payout then the maturity of the securities shall be calculated on the basis of weighted average maturity of the security.b. In case of securities with put and call options (daily or otherwise) the residual maturity of the securities shall not be greater than 91 days.c. In case the maturity of the security falls on a Non Business Day, then settlement of securities will take place on the next Business Day.The Scheme retains the flexibility to invest across all the securities in the debt and Money Market Instruments. The Scheme may engage in short selling of securities inaccordance with the framework relating to Short Selling and securities lending and borrowing specified by SEBI. The Scheme may also engage in Securities Lending; providedhowever that the Scheme shall not deploy more than 20% of its net assets in Securities Lending and not more than 5% of the net assets of the Scheme will deployed inSecurities Lending to any single counterparty.Mutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factors whichare summarized below:Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk, Liquidity Risk, Counterparty, Risk and Re-investment Risk. As theprice / value / interest rates of the securities in which the Scheme invests fluctuates, the value of your investment in the Scheme may go up or down.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates and indices,illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to the SID.The investment strategies will focus on constructing fixed income portfolios in line with Investment Objective of the respective schemes. Investment decision will be primarilyguided by fundamental research and analysis. Portfolio managers will manage portfolios based on the outlook on interest rates and liquidity etc. Such outlook will bedeveloped by in-house assessment of various macro factors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Creditportfolio management will be primarily guided by external credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemed appropriate,inputs may be available from financial statement analysis, management review, industry trends, capital structure and covenant analysis to identify securities for inclusion /exclusion from credit portfolios. Efficient portfolio construction will be used to manage interest rate risk across different asset class and duration buckets, and optimise riskadjustedreturns. Portfolio managers will continue to actively monitor and review markets and portfolios so that necessary rebalancing of the portfolios can be done.The Scheme has two plans, i.e. Regular Plan and Direct Plan. Each Plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility at a Daily, Weekly, Fortnightly & Monthly frequency;ii. Dividend Payout facility at a Fortnightly and at Monthly frequency; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 500/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of theScheme.)LowMinimum ApplicationAmount/ Number of UnitsInitial investment under a folioFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 10,000/- & in multiples of ` 1/- Minimum of ` 1,000/- and in multiples of ` 1/-thereafterthereafterMinimum Redemption amount` 500/- or 50 units in respect of each option or the balancein the unitholders folio/account, whichever is lowerBenchmark IndexName of the Fund ManagerName of the Trustee CompanyCRISIL Liquid Fund IndexMr. Mahendra JajooPramerica Trustees Private LimitedPerformance of theschemePeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 9.08% 8.08%Since Inception (CAGR) 9.04% 8.13%#Benchmark is CRISIL Liquid Fund Index.Since inception returns calculated on NAV of ` 1,000/-. Inception date (deemed to bethe date of allotment) : 27 August, 2010. Based on NAV of ` 1,269.8866 (Regular Plan- Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed fromthe date of allotment/1st10.00%April, as the case may be, to8.00%31st March of the respective6.00%financial year.4.57%4.00%2.00%0.00%4.27%9.46% 9.36%8.42% 8.17%FY 10 - 11 FY 11 - 12 FY 12 - 13Scheme Returns (%) Benchmark Returns (%)Expenses of the SchemeLoad StructureActual Expenses for theprevious financial yearEntry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fund schemes. Theupfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder) directly by theinvestor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : Nil.[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 0.10% Direct Plan: 0.03%63

2) Pramerica Ultra Short Term Bond FundInvestment ObjectiveAsset Allocation Patternof the schemeRisk Profile of the schemeInvestment StrategyPlans and OptionsThe objective of the scheme is to provide reasonable returns, commensurate with a low to moderate level of risk and high degree of liquidity, through a portfolio constitutedof money market and debt instruments. However, there is no assurance that the investment objective of the scheme will be realized and the scheme does not assure orguarantee any returns.InstrumentsMoney market and debt securities including government securities, corporate debt and other debtinstruments with residual maturity less than or equal to 400 days*Debt instruments including government securities, corporate debt and other debt instrumentswith residual maturity between 400 days to 3 years.Indicative allocations (% of total assets)MinimumMaximum80010020Risk ProfileHigh/Medium/LowLowLow to Medium* In case of instruments with put options within a period of 400 days, the residual maturity will not exceed 3 years.Presently, the Scheme does not intend to invest in securitized debt and overseas / foreign securities.The Scheme may engage in short selling of securities in accordance with the framework relating to short selling and securities lending and borrowing as specified by SEBI.The Scheme shall not deploy more than 20% of its net assets in securities lending and not more than 5% of the net assets of the Scheme will be deployed in securities lendingto any single counterparty.The Scheme retains the flexibility to invest across all the securities in the debt and money markets instruments. The portfolio may hold cash depending on the marketcondition. The fund manager may use derivative instruments to protect the downside risk. Further, aggregate asset allocation including exposure to derivatives will notexceed 100% of the net assets; and that same security wise hedge positions would be excluded from the same. Investment and disclosure by the Scheme in derivatives will bein line with SEBI Circular no. Cir/ IMD/ DF/ 11/ 2010 dated August 18, 2010.Mutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factors whichare summarized below:Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk, Liquidity Risk, Counterparty, Risk and Re-investment Risk. As theprice / value / interest rates of the securities in which the Scheme invests fluctuates, the value of your investment in the Scheme may go up or down.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates and indices,illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to the SID.The investment strategies will focus on constructing fixed income portfolios in line with Investment Objective of the respective schemes. Investment decision will beprimarily guided by fundamental research and analysis. Portfolio managers will manage portfolios based on the outlook on interest rates and liquidity etc. Such outlook willbe developed by in-house assessment of various macro factors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Creditportfolio management will be primarily guided by external credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemedappropriate, inputs may be available from financial statement analysis, management review, industry trends, capital structure and covenant analysis to identify securities forinclusion / exclusion from credit portfolios. Efficient portfolio construction will be used to manage interest rate risk across different asset class and duration buckets, andoptimise risk-adjusted returns. Portfolio managers will continue to actively monitor and review markets and portfolios so that necessary rebalancing of the portfolios can bedone.The Scheme has two plans, i.e. Regular Plan and Direct Plan. Each Plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility at a Daily, Weekly, Fortnightly & Monthly frequency;ii. Dividend Payout facility at a Fortnightly & Monthly frequency; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 500/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of theScheme.)Minimum ApplicationAmount/ Number of UnitsInitial investment under a folioMinimum of ` 5,000/- and in multiples of ` 1/-thereafterFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 500/- and in multiples of ` 1/-thereafterMinimum Redemption amount` 500/- or 50 units in respect of each option or the balance inthe unitholders folio/account, whichever is lower.Benchmark IndexName of the Fund ManagerCRISIL Liquid Fund IndexMr. Mahendra JajooName of the Trustee CompanyPramerica Trustees Private LimitedPerformance of theschemePeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 9.17% 8.08%Since Inception (CAGR) 9.26% 8.19%#Benchmark is CRISIL Liquid Fund Index.Since inception returns calculated on NAV of ` 1,000/-. Inception date (deemed to bethe date of allotment) : 24 September, 2010. Based on NAV of ` 1,268.3535 (RegularPlan - Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed fromthe date of allotment/1stApril, as the case may be, to31st March of the respective12.00%10.00%financial year.8.00%6.00%4.00%2.00%0.00%4.21%3.81%9.67% 9.34%8.42% 8.17%FY 10 - 11 FY 11 - 12 FY 12 - 13Scheme Returns (%) Benchmark Returns (%)Expenses of the SchemeLoad StructureActual Expenses for theprevious financial yearEntry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fund schemes. Theupfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder) directly by theinvestor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : Nil.[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 0.60% Direct Plan: 0.30%64

3) Pramerica Short Term Income FundInvestment ObjectiveThe objective of the Scheme is to generate regular returns with moderate level of risk by investing primarily into a portfolio of Debt Securities and Money MarketInstruments of short term maturity. However, there is no assurance that the investment objective of the Scheme will be realized and the scheme does not assure orguarantee any returns.Asset Allocation Patternof the schemeInstrumentsDebt and Money market instruments with residual maturity upto 3 yearsDebt and Money market instruments with residual maturity not exceeding 5 years and 3 monthsIndicative allocations (% of total assets)MinimumMaximum65010035Risk ProfileHigh/Medium/LowLow to MediumLow to MediumNote: The average maturity of the Scheme's portfolio will not exceed 3 years.Presently, the Scheme does not intend to invest in securitised debt and overseas / foreign securities.The Scheme retains the flexibility to invest across all the securities in the debt and money markets instruments, within the abovementioned asset allocation. The portfoliomay hold cash depending on the market outlook. The fund manager may use derivative instruments as permitted under the Regulations from time and as may be deemedappropriate. Further, aggregate asset allocation including exposure to derivatives will not exceed 100% of the net assets; and that same security wise hedge positions wouldbe excluded from the same. Investment and disclosure by the Scheme in derivatives will be in line with SEBI Circular no. Cir/ IMD/ DF/ 11/ 2010 dated August 18, 2010.Risk Profile of the schemeInvestment StrategyPlans and OptionsMutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factors whichare summarized below:Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk, Liquidity Risk, Counterparty, Risk and Re-investment Risk. As theprice / value / interest rates of the securities in which the Scheme invests fluctuates, the value of your investment in the Scheme may go up or down.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates and indices,illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to the SID.The objective of the Scheme is to generate regular returns with moderate level of risk by investing primarily in Debt Securities and Money Market Instruments of short termmaturity, and the investment strategies will focus on constructing fixed income portfolios in line with above objective. Accordingly, the Scheme, would invests at least 65% inDebt and Money market instruments with residual maturity upto 3 years and upto 35 % in Debt and Money market instruments with residual maturity not exceeding 5 yearsand 3 months (while the average maturity of the Scheme's portfolio will not exceed 3 years). The Scheme is a short-term investment option that provides the flexibility tocounter a dynamic environment by actively managing its portfolio in line with the evolving interest rate scenario. The Scheme will follow an active duration managementstrategy.The fund manager will manage the fund based on the outlook on interest rates and liquidity etc. Such outlook will be developed by in-house assessment of various macrofactors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Credit portfolio management will be primarily guided byexternal credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemed appropriate, inputs may be available from financial statementanalysis, management review, industry trends, capital structure and covenant analysis to identify securities for inclusion / exclusion from credit portfolios. Efficient portfolioconstruction will be used to manage interest rate risk across different asset class and duration buckets, and optimise risk-adjusted returns. The Scheme may use debtderivative instruments like interest rate swaps like Overnight Indexed Swaps (“OIS”), forward rate agreements, interest rate futures or such other derivative instruments asmay be permitted under the applicable regulations. Derivatives may be used for the purpose of hedging, and portfolio balancing and such other purpose as may bepermitted under the regulations and Guidelines from time to time. The fund manager/s will actively monitor and review markets and portfolios so that necessary rebalancingof the portfolios can be done.The Scheme has two plans, i.e. Regular Plan and Direct Plan. Each Plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility at a Weekly, Fortnightly, Monthly & Quarterly frequency;ii. Dividend Payout facility at a Fortnightly, Monthly & Quarterly frequency; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 500/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of theScheme.)Minimum ApplicationAmount/ Number of UnitsBenchmark IndexName of the Fund ManagerName of the TrusteeCompanyInitial investment under a folioMinimum of ` 5,000/- and in multiples of ` 1/-thereafterCRISIL Short Term Debt IndexMr. Mahendra JajooPramerica Trustees Private LimitedFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 1,000/- and in multiples of ` 1/-thereafterMinimum Redemption amount`1,000 /- or equivalent no. of units in respect of each option orthe balance in the unitholders folio/account, whichever is lowerPerformance of theschemePeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 9.38% 9.57%Since Inception (CAGR) 9.98% 9.02%#Benchmark is CRISIL Short Term Debt IndexSince inception returns calculated on NAV of ` 1,000/-. Inception date (deemed to bethe date of allotment) : 4 February, 2011. Based on NAV of ` 1,247.0303 (RegularPlan - Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed fromthe date of allotment/1st12.00%April, as the case may be, to10.00%31st March of the respective8.00%financial year.6.00%4.00%2.00%0.00%1.68%1.39%10.15%8.26%9.27%9.05%FY 10 - 11 FY 11 - 12 FY 12 - 13Scheme Returns (%) Benchmark Returns (%)Expenses of the SchemeLoad StructureActual Expenses for theprevious financial yearEntry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fundschemes. The upfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder)directly by the investor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : Nil[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 1.50% Direct Plan: 1.00%65

4) Pramerica Treasury Advantage FundInvestment ObjectiveAsset Allocation Patternof the schemeThe objective of the Scheme is to provide reasonable returns, commensurate with moderate level of risk and high degree of liquidity, through a portfolio constituted ofmoney market and debt instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the scheme does not assure orguarantee any returns.InstrumentsMoney market and debt securities including government securities, corporate debt, and otherdebt instruments with residual maturity less than or equal to 550 days or have put optionswithin a period not exceeding 550 days.Debt instruments including government securities, corporate debt, and other debt instrumentswith residual maturity greater than 550 days.Indicative allocations (% of total assets)MinimumMaximum65010035Risk ProfileHigh/Medium/LowLowLow to MediumPresently, the Scheme does not intend to invest in securitised debt and overseas / foreign securities.The Scheme retains the flexibility to invest across all the securities in the debt and money markets instruments, within the above asset allocation. The portfolio may hold cashdepending on the market outlook. The fund manager may use derivative instruments as may be permitted from time and as may be deemed appropriate. Further, aggregateasset allocation including exposure to derivatives will not exceed 100% of the net assets; and that same security wise hedge positions would be excluded from the same.Investment and disclosure by the Scheme in derivatives will be in line with SEBI Circular no. Cir/ IMD/ DF/ 11/ 2010 dated August 18, 2010.Risk Profile of the schemeInvestment StrategyMutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factorswhich are summarized below:Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk, Liquidity Risk, Counterparty, Risk and Re-investment Risk.As the price / value / interest rates of the securities in which the Scheme invests fluctuates, the value of your investment in the Scheme may go up or down.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates andindices, illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to the SID.The Scheme is a short-term investment option that provides the flexibility to counter a dynamic environment by actively managing its portfolio in line with the evolvinginterest rate scenario. The Scheme will follow an active duration management strategy. The investment strategies will focus on constructing fixed income portfolios in linewith above objective. The fund manager will manage the fund based on the outlook on interest rates and liquidity etc. Such outlook will be developed by in-houseassessment of various macro factors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Credit portfolio management willbe primarily guided by external credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemed appropriate, inputs may be availablefrom financial statement analysis, management review, industry trends, capital structure and covenant analysis to identify securities for inclusion / exclusion from creditportfolios. Efficient portfolio construction will be used to manage interest rate risk across different asset class and duration buckets, and optimise risk adjusted returns. TheScheme may use debt derivative instruments like interest rate swaps like Overnight Indexed Swaps (“OIS”), forward rate agreements, interest rate futures or such otherderivative instruments as may be permitted under the applicable regulations. Derivatives may be used for the purpose of hedging, and portfolio balancing and such otherpurpose as may be permitted under the regulations and Guidelines from time to time. The fund manager/s will actively monitor and review markets and portfolios so thatnecessary rebalancing of the portfolios can be done.Plans and OptionsThe Scheme has two plans, i.e. Regular Plan and Direct Plan. Each Plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility at a Daily, Weekly, Fortnightly & Monthly frequency;ii. Dividend Payout facility at a Fortnightly & Monthly frequency; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 500/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of theScheme.)Minimum ApplicationAmount/ Number of UnitsBenchmark IndexName of the Fund ManagerName of the Trustee CompanyInitial investment under a folioMinimum of ` 5,000/- and in multiples of ` 1/-thereafterCRISIL Short Term Debt IndexMr. Mahendra JajooPramerica Trustees Private LimitedFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 1,000/- and in multiples of ` 1/-thereafterMinimum Redemption amount`500 /- or equivalent no. of units in respect of each option orthe balance in the unitholders folio/account, whichever is lowerPerformance of theschemePeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 8.07% 9.57%Since Inception (CAGR) 9.03% 9.30%#Benchmark is CRISIL Short Term Debt IndexSince inception returns calculated on NAV of ` 1,000/-. Inception date (deemed to bethe date of allotment) : 3 June, 2011. Based on NAV of ` 1,188.0883 (Regular Plan -Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed from10.00%the date of allotment/1stApril, as the case may be, to8.00%31st March of the respective 6.00%financial year.4.00%2.00%0.00%7.81%7.30%8.78%FY 11 - 12 FY 12 - 139.05%Scheme Returns (%) Benchmark Returns (%)Expenses of the SchemeLoad StructureActual Expenses for theprevious financial yearEntry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fundschemes. The upfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder)directly by the investor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : If redeemed/switch-out on or before 456 days from the date of allotment – 1.25%.If redeemed/switch-out after 456 days from the date of allotment - Nil[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 1.50% Direct Plan: 1.00%66

5) Pramerica Credit Opportunities FundInvestment ObjectiveAsset Allocation Patternof the schemeThe objective of the scheme is to generate income by investing in debt/ and money market securities across the credit spectrum. The scheme would also seek tomaintain reasonable liquidity within the fund. However, there is no assurance that the investment objective of the scheme will be realized and the scheme does notassure or guarantee any returns.InstrumentsMoney market instruments & Debt securitiesIndicative allocations (% of total assets)MinimumMaximum0 100Risk ProfileHigh/Medium/LowLow to MediumPresently, the Scheme does not intend to invest in securitised debt and overseas / foreign securities.The Scheme retains the flexibility to invest across all the securities in the debt and money markets instruments. The portfolio may hold cash depending on the marketoutlook. The fund manager may use derivative instruments as permitted under the Regulations from time and as may be deemed appropriate, to protect thedownside risk. Further, aggregate asset allocation including exposure to derivatives will not exceed 100% of the net assets; and that same security wise hedge positionswould be excluded from the same. Investment and disclosure by the Scheme in derivatives will be in line with SEBI Circular no. Cir/ IMD/ DF/ 11/ 2010 dated August 18,2010.Risk Profile of the schemeInvestment StrategyPlans and OptionsMutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factorswhich are summarized below:Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk, Liquidity Risk, Counterparty, Risk and Re-investment Risk.As the price / value / interest rates of the securities in which the Scheme invests fluctuates, the value of your investment in the Scheme may go up or down.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates andindices, illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to theSID.The Scheme is a short to medium term investment option that provides the flexibility to counter a dynamic environment by actively managing its portfolio in line with theevolving interest rate scenario. The investment strategies will focus on constructing fixed income portfolios across the credit spectrum in line with above objective,maintaining an optimum balance of credit quality, liquidity and yield. The Scheme will follow an active duration management strategy.The fund manager will manage the fund based on the outlook on interest rates and liquidity etc. Such outlook will be developed by in-house assessment of various macrofactors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Credit portfolio management will be primarily guided byexternal credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemed appropriate, inputs may be available from financial statementanalysis, management review, industry trends, capital structure and covenant analysis to identify securities for inclusion / exclusion from credit portfolios. Efficient portfolioconstruction will be used to manage interest rate risk across different asset class and duration buckets, and optimise risk-adjusted returns. The Scheme may use debtderivative instruments like interest rate swaps like Overnight Indexed Swaps (“OIS”), forward rate agreements, interest rate futures or such other derivative instruments asmay be permitted under the applicable regulations. Derivatives may be used for the purpose of hedging, and portfolio balancing and such other purpose as may bepermitted under the regulations and guidelines from time to time. The fund manager will actively monitor and review markets and portfolios and rebalance the portfolios asand when necessary.The Scheme has two plans, i.e. Regular Plan and Direct Plan. Each plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility;ii. Dividend Payout facility; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 500/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of theScheme.)Minimum ApplicationAmount/ Number of UnitsBenchmark IndexName of the Fund ManagerName of the Trustee CompanyInitial investment under a folioMinimum of ` 5,000/- and in multiples of ` 1/-thereafterCRISIL Long Term Debt IndexMr. Mahendra JajooPramerica Trustees Private LimitedFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 1,000/- and in multiples of ` 1/-thereafterMinimum Redemption amount`1,000 /- or equivalent no. of units in respect of each option orthe balance in the unitholders folio/account, whichever is lowerPerformance of theschemePeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 10.49% 12.64%Since Inception (CAGR) 10.81% 11.57%#Benchmark is CRISIL Long Term Debt Fund Index.Since inception returns calculated on NAV of ` 1,000/-. Inception date (deemed to bethe date of allotment) : 31 October, 2011. Based on NAV of ` 1,176.4729 (RegularPlan - Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed from12.00%the date of allotment/1st10.00%April, as the case may be, to8.00%31st March of the respective 6.00%financial year.4.00%2.00%0.00%4.55%4.01%10.01%9.24%FY 11 - 12 FY 12 - 13Scheme Returns (%) Benchmark Returns (%)Expenses of the SchemeLoad StructureActual Expenses for theprevious financial yearEntry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fundschemes. The upfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder)directly by the investor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : If the units are redeemed/switch-out on or before 365 days of allotment – 2%.If the units are redeemed/switch-out after 365 days, but on or before 455 days of allotment – 0.50%.If the units are redeemed/switch-out after 455 days – Nil[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 1.85% Direct Plan: 1.35%67

6) Pramerica Dynamic Monthly Income FundInvestment ObjectiveAsset Allocation Patternof the schemeRisk Profile of the schemeInvestment StrategyPlans and OptionsMinimum ApplicationAmount/ Number of UnitsThe objective of the scheme is to generate regular return through investment primarily in debt and money market instruments and to generate capital appreciation byinvesting in equity and equity related instruments. Monthly income is not assured and is subject to availability of distributable surplus. However, there is no assurancethat the investment object of the scheme will be realized and the scheme does not assure or guarantee any returns.InstrumentsFixed Income SecuritiesInitial investment under a folioMinimum of ` 5,000/- and in multiples of ` 1/-thereafterFor subsequent investments (i.e., Addl.purchase) under an existing folioMinimum of ` 1,000/- and in multiples of ` 1/-thereafterIndicative allocations (% of total assets)MinimumMaximum70 95Minimum Redemption amountRisk ProfileHigh/Medium/LowLow to MediumEquity and Equity related instruments5 30 HighThe allocation between equities and debt shall be based on a Valuation Matrix viz., Pramerica Dynamic Asset Rebalancing Tool (Pramerica DART) developed andmaintained by the AMC. (pl. see details of “Pramerica DART” given below under the section “Investment Strategy”)Presently, the scheme does not intend to invest in securitised debt, overseas / foreign securities and also does not intend to engage in securities lending andborrowing.The Scheme may engage in short selling of securities in accordance with the framework relating to short selling as specified by SEBI.The Scheme retains the flexibility to invest across all the securities in the debt and money markets instruments. The portfolio may hold cash depending on the marketcondition. The fund manager can use derivative instruments to protect the downside risk. Further, aggregate asset allocation including exposure to derivatives will notexceed 100% of the net assets; and that same security wise hedge positions would be excluded from the same.Mutual Fund Units involve investment risks including the possible loss of principal. Investment in Mutual fund schemes involves certain Scheme specific Risk Factorswhich are summarized below:The Schemes carries risk associated with investing in equity/debt and money market instruments. Equity & equity related securities may be volatile and hence prone toprice fluctuation on a daily basis. Investment in equities involves a high degree of risk and investors with low risk appetite should not invest in the equity orientedschemes, as there is a risk of losing their investment. Investment in debt and money market instruments are subject to Interest Rate Risk, Credit Risk, Spread Risk,Liquidity Risk, Counterparty, Risk and Re-investment Risk. As the price / value / interest rates of the securities in which the Scheme invests fluctuates, the value of yourinvestment in the Scheme may go up or down. Investment in PDMIF (Equity portion) carries risk associated with investing in equities.The risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditionalinvestments. Other risks include risk of mispricing or improper valuation and the inability of the derivative to correlate perfectly with underlying assets, rates andindices, illiquidity risk whereby the Scheme may not be able to sell or purchase derivative quickly enough at a fair price. For detailed risk factors, please refer to theSID.The Scheme is a medium to long-term investment option that provides the flexibility to counter a dynamic environment by actively managing its portfolio in line with theevolving interest rate scenario. The investment strategies of the Scheme will focus on constructing a robust portfolio in line with the above objective. Under normal marketconditions, majority of the portfolio of the Scheme will be invested in fixed income securities issued by corporate and/or State and Central Government across a range ofmaturities, while some portion will be invested in equity and equity related securities.The debt portfolio will be managed actively based on the AMC’s outlook on interest rates and liquidity. Such outlook will be developed by in-house assessment of variousmacro factors like economic growth, inflation, credit pick-up, liquidity and other such factors as considered relevant. Credit portfolio management will be primarily guided byexternal credit ratings assigned by any of the recognized credit rating agency. Additionally, as may be deemed appropriate, inputs may be sourced from financial statementanalysis, management review, industry trends, capital structure and covenant analysis to identify securities for inclusion / exclusion from credit portfolios. Efficient portfolioconstruction will be used to manage interest rate risk across different asset class and duration buckets, and optimise risk-adjusted returns. The Scheme will follow an activeduration management strategy. The Scheme may use debt derivative instruments like interest rate swaps like Overnight Indexed Swaps (“OIS”), forward rate agreements,interest rate futures or such other derivative instruments as may be permitted under the applicable regulations. Derivatives may be used for the purpose of hedging, andportfolio balancing and such other purpose as may be permitted under the regulations and Guidelines from time to time.The fund manager will select equities on a top-down and bottom-up, stock-by-stock basis, with due consideration given to price-to-earnings, price-to-book, and price-tosalesratios, as well as growth, margins, asset returns, and cash flows, amongst others. The fund manager will use a disciplined quantitative analysis of financial operatingstatistics. In selecting individual investment opportunities for the portfolio, the fund manager will conduct in-house research in order to identify various investmentopportunities. The company-wise analysis will focus, amongst others, on the historical and current financial condition of the company, potential value creation/unlocking ofvalue and its impact on earnings growth, capital structure, business prospects, policy environment, strength of management, responsiveness to business conditions, productprofile, brand equity, market share, competitive edge, research, technological know–how and transparency in corporate governance. The fund manager/s will activelymonitor and review markets and portfolios so as to ensure rebalancing of the portfolios as and when necessary. Within the limits indicated in the asset allocation table, theallocation between equities and debt shall be based on a valuation matrix, namely, Pramerica DART, developed and maintained by the AMC.The Scheme has two plans, i.e. Regular Plan and Direct Plan. Each plan has three Options, namely, Growth Option, Dividend Option and Bonus Option.• Dividend Option has the following three facilities:i. Dividend Reinvestment facility at Monthly frequency;ii. Dividend Payout facility at Monthly frequency; andiii. Dividend Transfer facility(If the amount of Dividend payable under the Dividend payout facility is ` 100/- or less, then the Dividend would be compulsorily reinvested in the Dividend Option of the Scheme.)` 500 /- or 50 units in respect of each option or the balancein the unitholders folio/account, whichever is lowerBenchmark IndexCRISIL MIP Blended IndexName of the Fund Manager Mr. Mahendra Jajoo & Mr. Bramhaprakash Singh (W.e.f. the close of business hours of August 31, 2012)Name of the Trustee Company Pramerica Trustees Private LimitedPerformance of theschemeExpenses of the SchemeLoad StructureActual Expenses for theprevious financial yearPeriod (As on May 31, 2013) Scheme Returns (%) Benchmark Returns (%)Last One Year (CAGR) 12.17% 13.39%Since Inception (CAGR) 8.30% 9.00%#Benchmark is CRISIL MIP Blended IndexSince inception returns calculated on NAV of ` 10/-. Inception date (deemed to be thedate of allotment) : 29 March, 2011. Based on NAV of ` 11.8935 (Regular Plan -Growth Option) as on 31 May, 2013. The calculations of returns shall assumereinvestment of all payouts at the then prevailing NAV. Past performance may ormay not be sustained in future.Absolute returns for each financial yearReturns are computed fromthe date of allotment/1stApril, as the case may be, to10.00%31st March of the respective8.00%financial year.Entry load: Not Applicable[SEBI vide its circular no. SEBI / IMD / CIR No. 4 / 168230 / 09 dated June 30, 2009 has decided that there shall be no Entry Load for all mutual fundschemes. The upfront commission on investment made by the investor, if any, shall be paid to the distributor (AMFI registered distributor / ARN Holder)directly by the investor, based on the investor’s assessment of various factors including service rendered by the distributor]Exit Load : If the units are redeemed/switch-out on or before 365 days of allotment – 1%.If the units are redeemed/switch-out after 365 days – Nil.[with effect from October 1, 2012 the entire exit load (net of service tax), charged, if any, shall be credited to the Scheme].Total recurring expenses as a percentage of daily net assets:Regular Plan : 2.45% Direct Plan: 1.95%6.00%4.00%2.00%0.00%0.00%0.27%6.25%5.24%8.21%9.06%FY 10 - 11 FY 11 - 12 FY 12 - 13Scheme Returns (%) Benchmark Returns (%)68