KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

KEY INFORMATION MEMORANDUM & FORMS - IFIN LTD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

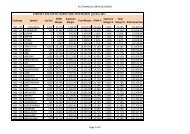

COMPARISON WITH THE EXISTING SCHEMES, NUMBER OF FOLIOS AND ASSETS UNDER MANAGEMENT (AUM) (Contd.)Name of the Scheme Investment Objective Asset Allocation PatternPramerica CreditOpportunities FundTo generate income byinvesting in debt /andInstrumentsmoney market securitiesacross the credit spectrum.The scheme would alsoseek to maintain reasonable Money market instruments & Debt securitiesliquidity within the fundIndicative allocation(% of total assets)Min. Max.0 100RiskProfileLow toMediumAUM ` Cr. No. of FoliosAs on 31-05-2013298.16 3,158Product Differentiation Pramerica Credit Opportunities Fund would mainly invest in securities which have relatively higher credit spreads & would aim to benefit from compression in such spreadsdue to improving fundamentals and hence the ratings. Such securities are expected to offer higher yield as compared to better rated securities for similar maturity before any +ve re-rating takes place& hence higher expected portfolio accruals.Name of the Scheme Investment Objective Asset Allocation PatternPramerica DynamicBond FundThe objective of the schemeis to generate optimalreturns through activemanagement of a portfolioof debt and money marketinstruments. However, thereis no assurance that theinvestment objective of thescheme will be realized andthe scheme does not assureor guarantee any returns.InstrumentsMoney market instruments & Debt securitiesIndicative allocation(% of total assets)Min. Max.0 100RiskProfileLow toMediumAUM ` Cr. No. of FoliosAs on 31-05-2013123.20 1,102Product Differentiation Pramerica Dynamic Bond Fund is an Open Ended Income Scheme that would invest upto 100% in Money Market securities & may also hold upto 100% in cash & cashequivalents. The portfolio of the scheme would be positioned across the yield spectrum depending on the interest rate trends & would aim to benefit from such opportunities.Name of the Scheme Investment Objective Asset Allocation PatternPramerica Short TermFloating Rate FundTo generate regular incomethrough investment in aportfolio comprising primarilyin short maturity floating ratedebt/money marketinstruments. However, there isno assurance that theinvestment objective of theScheme will be realized andthe Scheme does notguarantee any returns.InstrumentsFloating rate debt securities with residual maturity of less than400 days (including fixed rate debt instruments swapped forfloating rate returns) & money market instruments*Floating rate & other debt securities with residual maturitybetween 400 days & upto 3 Years (including fixed rate debtinstruments swapped for floating rate returns)Indicative allocation(% of total assets)Min. Max.65 1000 35RiskProfileLow toMediumLow toMediumAUM ` Cr.No. of FoliosAs on 31-05-2013Product Differentiation Pramerica Short Term Floating Rate Fund is an Open Ended Income Scheme that would invest at least 65% in Floating rate debt securities with residual maturity of less than 91days (including fixed rate debt instruments swapped for floating rate returns & money market instruments) and the balance in Floating rate debt securities with residual maturity between 91 days and400 days (including fixed rate debt instruments swapped for floating rate returns and money market instruments).96.97540Name of the Scheme Investment Objective Asset Allocation PatternPramerica DynamicAsset Allocation Fund(w.e.f. June 28, 2013)(earlier known asTo achieve long termcapital appreciation byinvesting in an activelymanaged diversifiedPramerica Dynamic Fund) portfolio consisting ofequity and equity relatedsecurities includingderivatives, debt andmoney marketInstruments.InstrumentsIndicative allocation(% of total assets)RiskProfileMin. Max.Equity and equity related instruments (including equity derivatives) 30 100 HighDebt and money market securities (including fixed income derivatives) 0 70 Low to MediumThe allocation between equities and debt shall be based on a Valuation Matrix viz., Pramerica DynamicAsset Rebalancing Tool (Pramerica DART) developed and maintained by the AMC. (pl. see details of“Pramerica DART” given below under the section “Investment Strategy”). Subject to applicable regulatoryguidelines, the Scheme may also invest in foreign securities. Under normal circumstances the Schemeshall not have an exposure of more than 25% of its net assets in foreignsecurities. Presently, the schemedoes not intend to invest in securitised debt.AUM ` Cr. No. of FoliosAs on 31-05-201361.98 8,429Product Differentiation Pramerica Dynamic Asset Allocation Fund is Open Ended Dynamic Asset Scheme which invests 30% to 100% in Equity and Equity related instruments and upto 70% in debtand money market instruments.Name of the Scheme Investment Objective Asset Allocation PatternPramerica Equity FundTo achieve long termcapital appreciation byinvesting in an activelymanaged diversifiedportfolio consisting ofequity & equity relatedsecurities includingderivatives, debt & moneymarket Instruments.InstrumentsEquity and equity related instruments (including equity derivatives)Indicative allocation(% of total assets)Min. Max.65 100RiskProfileDebt and money market securities (including fixed income derivatives) 0 35 Low to MediumUnder normal circumstances the Scheme shall not have an exposure of more than 25% of its net assets inforeign securities.Presently, the scheme does not intend to invest in securitised debt.Product Differentiation Pramerica Equity Fund is Open Ended Equity Scheme which invests 65% to 100% in Equity & Equity related instrumentsHighAUM ` Cr. No. of FoliosAs on 31-05-201336.98 6,441Place: MumbaiDate : June 28, 201376