Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

��������<br />

also gave Curetis the opportunity to expand<br />

its staff to 30 people.<br />

Curetis’s investors Life Sciences Partners<br />

and Forbion Capital Partners are based<br />

in the Netherlands and have offices in<br />

Germany. Foreign investors that have<br />

entered the DACH market are a common<br />

sight and demonstrate how the venture<br />

scene has become international over<br />

the years. “Many regional venture capital<br />

firms are out of business, have left the<br />

industry or have raised smaller funds than in<br />

the years before,” says Holger Reithinger, a<br />

GP at Forbion.<br />

Helping hand<br />

To ensure funding for the launch of new<br />

companies and their further growth, the<br />

German government has launched a number<br />

of initiatives to aid funding. High-Tech<br />

Gründerfonds is one attempt to close the<br />

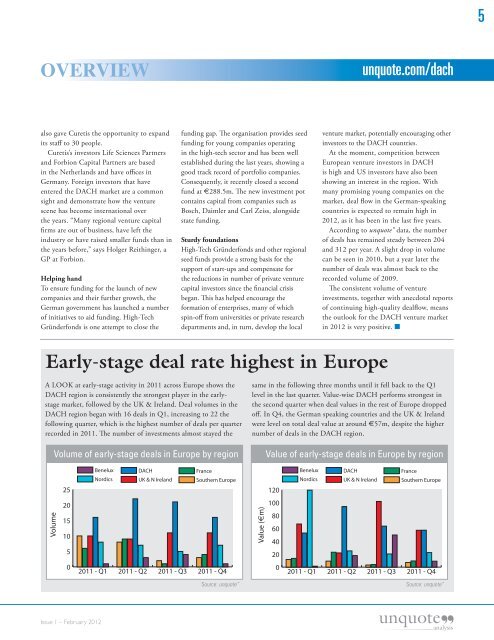

A LOOK at early-stage activity in 2011 across Europe shows the<br />

DACH region is consistently the strongest player in the earlystage<br />

market, followed by the UK & Ireland. Deal volumes in the<br />

DACH region began with 16 <strong>deals</strong> in Q1, increasing to 22 the<br />

following quarter, which is the highest number of <strong>deals</strong> per quarter<br />

recorded in 2011. The number of investments almost stayed the<br />

Issue 1 – February 2012<br />

funding gap. The organisation provides seed<br />

funding for young companies operating<br />

in the high-tech sector and has been well<br />

established during the last years, showing a<br />

good track record of portfolio companies.<br />

Consequently, it recently closed a second<br />

fund at €288.5m. The new investment pot<br />

contains capital from companies such as<br />

Bosch, Daimler and Carl Zeiss, alongside<br />

state funding.<br />

Sturdy foundations<br />

High-Tech Gründerfonds and other regional<br />

seed funds provide a strong basis for the<br />

support of start-ups and compensate for<br />

the reductions in number of private venture<br />

capital investors since the financial crisis<br />

began. This has helped encourage the<br />

formation of enterprises, many of which<br />

spin-off from universities or private research<br />

departments and, in turn, develop the local<br />

unquote.com/dach<br />

venture market, potentially encouraging other<br />

investors to the DACH countries.<br />

At the moment, competition between<br />

European venture investors in DACH<br />

is high and US investors have also been<br />

showing an interest in the region. With<br />

many promising young companies on the<br />

market, deal flow in the German-speaking<br />

countries is expected to remain high in<br />

2012, as it has been in the last five years.<br />

According to unquote” data, the number<br />

of <strong>deals</strong> has remained steady between 204<br />

and 312 per year. A slight drop in volume<br />

can be seen in 2010, but a year later the<br />

number of <strong>deals</strong> was almost back to the<br />

recorded volume of 2009.<br />

The consistent volume of venture<br />

investments, together with anecdotal reports<br />

of continuing high-quality dealflow, means<br />

the outlook for the DACH venture market<br />

in 2012 is very positive. �<br />

Early-stage deal rate highest in Europe<br />

Volume<br />

Volume of early-stage <strong>deals</strong> in Europe by region<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Benelux<br />

Nordics<br />

2011 - Q1<br />

2011 - Q2<br />

DACH<br />

UK & N Ireland<br />

2011 - Q3<br />

France<br />

Southern Europe<br />

2011 - Q4<br />

Source: unquote”<br />

same in the following three months until it fell back to the Q1<br />

level in the last quarter. Value-wise DACH performs strongest in<br />

the second quarter when deal values in the rest of Europe dropped<br />

off. In Q4, the German speaking countries and the UK & Ireland<br />

were level on total deal value at around €57m, despite the higher<br />

number of <strong>deals</strong> in the DACH region.<br />

Value (€m)<br />

Value of early-stage <strong>deals</strong> in Europe by region<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Benelux<br />

Nordics<br />

2011 - Q1<br />

2011 - Q2<br />

DACH<br />

UK & N Ireland<br />

2011 - Q3<br />

France<br />

Southern Europe<br />

2011 - Q4<br />

Source: unquote”<br />

5