Extraordinary Banker - The Emmerich Group

Extraordinary Banker - The Emmerich Group

Extraordinary Banker - The Emmerich Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

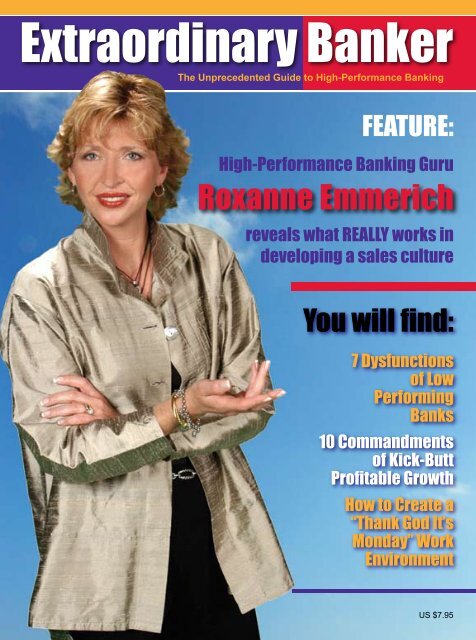

<strong>Extraordinary</strong> <strong>Banker</strong><strong>The</strong> Unprecedented Guide to High-Performance BankingFEATURE:High-Performance Banking GuruRoxanne <strong>Emmerich</strong>reveals what REALLY works indeveloping a sales cultureYou will find:7 Dysfunctionsof LowPerformingBanks10 Commandmentsof Kick-ButtProfitable GrowthHow to Create a“Thank God It’sMonday” WorkEnvironmentUS $7.95

table ofContentsSales CulturesThat Rock4FEATURE4610141820FEATURESSales Cultures That RockInterview Questions That Cut to the Chase10 Commandments of Kick-Butt Profitable GrowthBranch Manager Checklist10 Cornerstones of Employee Motivation7 Dysfunctions of Low Performing BanksSEMINARS20Dysfunctions ofLow Performing7 Banks7 | Profit-Growth Train the Trainer8 | ZERORISK Seminar9 | Permission to Be <strong>Extraordinary</strong> Summit11 | Profit-Growth Management Development12/13 | Marketing & Sales Management Boot Camp15 | Marketing & Sales Management Boot Camp II16 | Profit-Rich Sales Seminar17 | Profit-Rich Sales Management Seminar19 | Fast-Track Strategy Think Tank6Powerful InterviewQuestions<strong>Extraordinary</strong> <strong>Banker</strong> is published byLeadership Avenue Press8500 Normandale Lake Blvd, Suite 180Minneapolis, MN 554371-800-236-5885 ~ 952-820-0360www.<strong>Emmerich</strong>Financial.comAll contents © Leadership Avenue Press and Roxanne <strong>Emmerich</strong>3

Sales Cultures ThatHow a small handful of banks are drastically growing their balancesheet and bottom line while the masses sleep in a state of unawareness.4Why is it that a $450 million bank thathad not had any organic growth in 9years had an annualized growth rate of35 percent within 30 days of one cultureintervention?Why is it that a $920 million bank,consistently ranking in the fourth quartileand blaming it on the fact they were ina low-income, shrinking market, movedto the first quartile with over 20 percentgrowth and a significant profit reversalof tripling ROE within three years withno improvement to their market?Both of these banks had done salestraining for years with virtually NOimpact on growth or profits.Until they “got it.”“It” is the understanding of what makesa sales culture work.But what didn’t they “get” before?1) Marketing is not a departmentMarketing is a mindset, and everyonemust understand that. Marketingkeeps the top of the sales funnel fulland positions your organization forpremium pricing. Most banks thinkmarketing is advertising; they wasteresources buying “fluff-slogan” ads thathave minimal ROI.Every person at your bank should:1) know your target markets, 2) knowhow to efficiently and effectivelycommunicate to target prospects inthose markets, 3) clearly understandthe unique selling proposition for thatmarket that positions you for premiumpricing, and makes you desirableenough to pull business away fromincumbents.If you don’t instill this mindset in yourpeople, sales training is a waste. Withno clear understanding of uniqueselling propositions, you will alwaysbe dragged down to the pricing of yourleast mentally gifted or most desperatecompetitor.2) Employee buy-in is the cornerstoneUntil you engage employees’ hearts,

Rockyou have no chance of a powerful orsustainable breakthrough. Accordingto research done by the CorporateExecutive Board of 50,000 employees,employees who are “true believers”—who value, enjoy, and believe in whatthey do—displayed 57 percent morediscretionary effort and were 87 percentless likely to leave a job.Until your people are called to a“higher purpose,” nothing great willhappen. And making a higher ROA isnot a higher purpose.A vision of extraordinary impactenrolls hearts and minds. Your peoplemust believe they are called to be “ona mission.”When an employee feels like what theydo matters and that you’re noticingthe progress they’re making towardthat vision, turnaround is rapid andprofound.3) Small steps with extreme focus,sense of urgency, “no-wiggle”accountability, and wild celebrationMost bank managers think salescultures happen because of salestraining and incentives. That would begreat, but evidence suggests otherwise:it only shows you’re working hard atworking hard.<strong>Banker</strong>s have to learn the basics oforganizational development. <strong>The</strong>ymust understand that all initiativesmust be broken down: where peoplelearn to crawl withimpeccable gracebefore they walk,and only begin to runwhen the walking isperfect. Sales is therunning. Service isthe crawling andwalking. Servicemust be broken down and perfected.Simply stated, it is a waste of resourcesto do sales training until you haveshored up all the leaks in your customerservice execution.One CEO said in his Southern drawl,“Roxaaaaaaanne, when we didthat kick-off thing with that phonestandard process with shopping onMost bank managers thinksales cultures happen becauseof sales training and incentives.That would be great, butevidence suggests otherwise:it only shows you’re workinghard at working hard.those standards, we noticed that crosssaleswent up by 34 percent, referralsdoubled, and our deposit and loansgrowth rate was up over 200 percent!Funny, we haven’t even worked onteaching them any sales techniqueyet. But most importantly, my peopleare confident—they think they can doaaaaanything.”Bingo. He got it. That’s the missingelement in most sales culture attempts.Managers don’t know how to build theconfidence of their people and helpthem understand that they CAN doanything. That base of success makes itmuch easier for them to learn.4) Ban dysfunctional behaviorIf you build a house on a foundationwith holes, it’s a problem. Think ofdysfunctional behaviors as holes.Unfortunately, the level of dysfunctionalbehavior is huge in many companies,and those behaviors are accepted as thenorm.<strong>The</strong>y only exist because you allowthem.People start operating at their peak whenthey’re in a safe work environment.Help create that by getting everyone toagree that, as a firm, you won’t toleratebehavior such as whining, victim hood,excuses and stories, gossip, and otherchaotic behaviors that undermine—anddestroy—the safety of the workplace.Train employees so they know what todo when they see those behaviors, nomatter the positionof the violator.When a “problem”employee is identifiedand coached onimproving theirbehavior, it isimperative that youexpect resolution or departure. Eightysevenpercent of employees say thatworking with a low-performer hasdecreased their productivity, hamperedtheir development, and made themwant to, at some point, leave that job.Ninety-six percent of employees saythey would be thrilled if their companymore aggressively managed lowperformers.Protect the psyche of your people; highperformers leave when dysfunctionalbehavior is allowed.5) <strong>The</strong> only way to improve controlis to give up controlThat’s right. <strong>The</strong> way to have the mostcontrol of your culture is to give upcontrol. When a team representing across-section of the bank is given aclearly defined process and objectivesfor advancing the culture, magic beginsto happen.<strong>The</strong>se “hoopla teams” always makea bigger impact on the advancementof the bank than a senior managementteam ever does. Make sure the hooplateam knows exactly what to do and howto do it—and that they encourage it allto be fun, fun, fun.As you can see, EVERYTHINGabout sales culture goes back toleadership. Until leadership becomesaccountable and stops blaming thesales staff, there is no hope for a shiftin culture.Roxanne <strong>Emmerich</strong>, CEO and Founderof <strong>The</strong> <strong>Emmerich</strong> <strong>Group</strong>, Inc., hashelped over 150 banks double theircustomer service scores within 30 days,and double, triple, and quadruple theirgrowth rates within six months. She is theauthor of Profit-Growth Banking, andthe newly released Profit-Rich Sales forLenders, Brokers, and Private <strong>Banker</strong>s.Visit www.<strong>Emmerich</strong>Financial.comfor free templates and informationon transforming your sales culture.Roxanne can be reached atInfo@<strong>Emmerich</strong><strong>Group</strong>.com.5

POWERFUL (REAL) INTERVIEW QUESTIONSTo reduce the risk of hiring a person who does a great interview… and then tanks!<strong>The</strong> big problem in hiring people is that there are a plethora of courses on how to interview. Consequently, peopledo a better job representing their capabilities than their true capabilities reveal, as witnessed by the buyers remorsethat often happens within 24 hours of the employees first day. <strong>The</strong> manager wonders who the person is that startedwork and how they are related to the person who they interviewed.Questions that probe into their goals, strengths, and weaknesses are prone to getting “staged” answers. Instead,ask questions that get to the deeper level consciousness of the person you’re interviewing. Remember, it’s in thelistening where you learn. Listen closely for what their issues are because you’ll soon be employing all those issues.● What was the best thing you did at your present job thatmade an impact on the organization? Clearly depicts theirability to see what isn’t there and make it happen.● Describe the relationship you have with your current boss.Look for patterns they may project and blame on others as itmay have more to do with their recurring issues.● What kind of supervision do you have? How would youchange that level of supervision to increase youreffectiveness?● What was your most significant accomplishment at work?High performance people know exactly what it was. Be waryof candidates who can’t identify something quickly.● What did you learn from that success?● What frustrates you about your current job? Expect the same.● What do you like doing the most in your present job?● If you could do anything in the world and money wasn’t anobject, what kind of work would you do? Read between thelines.● What was the most challenging task that you havecompleted?● What would your boss tell me aboutyour performance?● Tell me about the best boss you’ve had. Look for patterns ofprojection.● Tell me about the worst boss you’ve had. Look for patterns ofprojection.● If I were to call five people who knew you well, what wouldbe three words they would use to describe you?● Why do you want this job?● If you were offered this job, how would you make ourinvestment in you the best return on investment we’ve evermade?● If you were in my chair, hiring someone for this position,what qualities would you look for in an applicant?● On your last job, what did you do to improve your effectiveness?● If we were meeting here three years from today, whatwould have had to happen during that period, both personallyand professionally, for you to feel happy about yourprogress? If they can’tanswer this questionsuccinctly, the chanceof professional jobsuccess is limited.● Why do you want to leave yourcurrent job?● What motivates you… really?● Why do you think you will besuccessful in this job?6(<strong>The</strong>se interview questions are offered to you to help reduce your hiring risks. No claim is made as to legal appropriateness.)

March 7, 2006Minneapolis►Equivalent to two (2) Fast-Track Seminar Certificates$995For executives, department heads, trainers, and human resource professionals who will lead a cultural revolution.How do you get all your people rowing in the same direction? Equip those who are in charge of disseminating themessage with tools to create high-impact cultural changes and training initiatives that yield powerful results.• Discover a proven and practical methodology to tie training to dramatic results.• Reduce “time to proficiency” by 30 to 50 percent.• Understand how to make sure your training results sustain themselves.• Understand your role in creating a cultural revolution.• Make your training fun and engaging.“Train the Trainer helped give me a “hands on” experience in planning, delivering and coachingthat really results in behavior changes—not just for the time in the session, but actual on-the-jobchanges.”—Sue Hovell, Senior Vice President, Merchants National Bank“Words fail me.”—Greg Trowbridge, President, Rahway Savings Institution“<strong>The</strong> best of Roxanne. I feel like I can take this right out of the box and use it.”—Dave Updegraff, Vice President Human Resources, Ohnward Banchares, Inc.“I came away with a ‘can do’ attitude. Training can be fun!” —Kathy Patton, Vice President, Emporia State Bank“Great energy, great spokesperson. Train the Trainer seminar provides so many great ideas to conductfun learning skills for all levels of employees.” —Tracy Williams, Loan Officer, Panhandle State Bank“I can hardly wait to get back to the bank & implement what I’ve learned. I have high hopes forgreat changes!”—Kathy Neels, Cashier, First Independent Bank“This opened my eyes that not everyone learns like I do.” —Travis Kaul, Vice President, Panhandle State Bank“<strong>The</strong> program makes me so aware of the importance of training. Roxanne is so full of energy thatyou just want ‘to do it.’ Way to go! Best yet!”—Rhonda Longmire, President, First National Bank of La Follette“Train the Trainer provided me the necessary tools to build an effective training program for mybank that would drive results. Training and coaching are two sides of the same coin!”—Tammy Thompson, AVP Retail Banking, Citizens National Bank“Roxanne ignites a fire that will illuminate your entire bank upon return from this session.Awesome! Thank you!”—Kara Marr, Marketing, Gateway State BankCall 800-236-5885 today7

ZERORISK Hiring SystemTraining SeminarMarch 8, 2006Minneapolis►Equivalent to two (2) Fast-Track Seminar Certificates$1495This information-packed seminar will leverage your organization’s best usage of the ZERORISK Hiring System toassist in identifying top talent and more importantly, dramatically decrease your hiring mistakes. This one-daycertification class is a must for every HR manager, CEO, executive, or hiring manager who wants to reducehiring mistakes by over 67 percent.• Discover how to place the right people in the right job wherethey can win.• Discover how to conduct a job analysis audit to identifycritical success competencies for various roles withinyour organization.• Master the skills to interpret profile scores.• Discover how best to manage and motivate their employees.• Explore ZERORISK’s Kinsel-Hartman Value Profile measuresand the science behind it.• Discuss legal issues pertaining to candidate testing.• Discover how to use behavioral interviewing techniques.• Receive the financial industry’s 40+ hiring benchmarksfor position“This program gives you great insights into development and how to create an environment with the bestchemistry. It goes without saying that it greatly enhances the accuracy of your hiring decisions.”—Steve Anderson, COO, River Valley State BankPlacing the right individual in the rightposition can have dramatic results –increased profits, higher productivity andimproved morale.Research proves that over 70 percentof the abilities deemed essential foreffective performance are emotionalcompetencies, not personality.How can you start to benefit fromthis remarkably effective tool?Call 800-236-5885 todayfor aFREE trial assessment.“This tool will give me the ability to not only hire the rightpeople but also realign people into the right jobs.”—Jerry Renk, President, BNC National Bank“This tool will allow me to be a more effective coach andunderstand individuals’ gifts.”—Steve Flage, Regional Manager, River Valley State Bank“I believe that to be a “top producing” bank, you must firstevaluate the dynamics of your personnel. ZeroRisk hiringgives you insight into how your people relate and allowsyou to put your people into jobs where they can growand succeed!”—Karen Sommers, VP Marketing, Emporia State Bank“<strong>The</strong> ZERORISK Hiring System is a valuable tool whenmaking hiring decisions on all levels within theorganization.”—Jean Lohman, Marketing Director, Citizens Bank Minnesota8Call 800-236-5885 today

Are you ready to discover your impact and what itreally could be? Be prepared to challenge everythingyou thought you knew to be true about how to leadhigh-impact results. Discover proven concepts tolead with power instead of force and create dramaticbreakthroughs in your people and your organization.Journey of the <strong>Extraordinary</strong>:<strong>The</strong> Calling of Quantum MagnitudeMay 16-17, 2006Minneapolisfor executives, leaders, and those identified to bepotential executivesMay 23-24, 2006Minneapolisfor CEOs and presidents of high-performingorganizations (by invitation only)►Equivalent to four (4) Fast-Track Seminar Certificates$1995 (Public) $2295 (Private)• Radically rewire your mind about your possibilities and your ability to transform others and lead.• Raise your consciousness and tap into your power to lead extraordinary change, far beyond the applaudedsuccesses you’ve already created.• Discover how to redefine success to its highest level possible.• Explore how to get “unstuck” from your current limiting beliefs.“You will NEVER understand how profound Permission to Be <strong>Extraordinary</strong> is untilyou have the experience!”—Jay Brew, Sr. Managing Partner & CEO, BNK Advisory <strong>Group</strong>“Nothing has made our potential and future more clear to me! It was excellent.”—Phil Koning, President and CEO, Macatawa Bank“I must say it was a milestone in my personal and professional career—just what I was searching forto cause me to question everything and then identify my future calling.”—Archie R. McDonnell, Jr., President & CEO, Citizens National Bank“Roxanne has the unique ability to break the ‘banker mentality’ and create true marketing CEO’s.”—Curt Hecker, President and CEO, Intermountain Community Bancorp“I have been an association professional development executive as well as at this bank and this isthe best executive development program I’ve seen.”—Mike Riley, CEO, St. Stephen State Bank“<strong>The</strong> personal and professional growth transformation that I made at the Summit was exponential.”—Jim Wayman, President/CEO, Emporia State Bank & Trust Co.“It challenged me to think way beyond my normal range for the benefit of my entire organization.”—Jeff Hawkins, President, Anchor Bank“This was a life changing experience. Thanks Roxanne!”—Dave Updegraff, Vice President, Ohnward Bancshares Inc.“It was a personal and professional enlightenment.”—Jeff Coleman, Retail Branch Manager, Eastwood Bank“This was the best seminar I have ever attended. I finally discovered my breakthrough. ThanksRoxanne!”—Tom Aleshire, CFO, Eastwood BankCall 800-236-5885 today9

Ten Commandments ofKick-Butt Profitable Growth for 2006 PlanningI. Thou Shalt Never See Marketingas a DepartmentMarketing is a mindset and everybody,everybody, everybody in your organizationmust own this mindset. Every employeemust understand why customers shouldcome to you and not your competitors andwhich customers and prospects you aretargeting. Every function, from how thereceptionist answers the phone to how theback office handles a customer that justhad an overdraft, must know that everycustomer contact is an opportunity toexpand and solidify the relationship—andeach function must know how.II. Thou Shalt Differentiate<strong>The</strong>re is no reason for a customer to pay youany pricing but the lowest UNLESS there isa good reason to pay you more. And theremust be. If there’s no story to tell, there’sno reason to come to your party—andthere certainly isn’tany reason to pay up.Every product musthave a Unique SellingProposition thatspells out its dramaticdifference defined asan overt benefit andsaid in such a way that it compels prospectsto turn away from your competition’salternatives.III. Thou Shalt Not Cut MarketingInvestments during Tough YearsMcGraw-Hill researched 600 company’smarketing spending patterns from 1980–1985. <strong>The</strong>y observed that companies thatmaintained their marketing investing duringthe 1981–1982 recession boasted an averagesales increase of 275 percent over the next5 years. Those companies that cut theiradvertising saw paltry sales growth overthe next 5 years of just 19 percent. As myeconomics professor repeated incessantly,“Always invest your most important dollarsin marketing first.”IV. Thou Shalt Understand ThatMarketing Is NOT Advertising<strong>The</strong> best return on your marketing dollarscomes from investing in your employees’learning and then incentives followedby investing in marketing to your bestcustomers. Prospecting high-potentialclients follows. Advertising to the massesoffers the worst return on investment.V. Thou Shalt Be a Giver—Not aTakerYour relationship with clients, prospects,and centers of influence should be based ongiving. <strong>The</strong>y should hear from you every90 days—lest they forget you and acquaintthemselves with your competition. No,sending a statement DOES NOT count.Information mailings like a “Top 10 Tipsfor Preparing for the Tax Season” sheetand free tickets or coupons from one ofyour retail clients are great ways to addvalue to the correspondence. As opposedto a “taker” approach—sending “buy me,”four-color, glossy brochures— that willcreate almost no response. Givers alwaysget better results than takers.VI. Thou Shalt Love Your Top 100List—and Let <strong>The</strong>m Know ItWhile 80 percent of profits come from thetop 20 percent of clients, why wouldn’t youcreate a rock-solid “contact every month”plan for your top 100 prospects and clients?Not only will those clients appreciate yourconstant information“<strong>The</strong>re is no reason for acustomer to pay you anypricing but the lowest UNLESSthere is a good reason to payyou more. And there must be.”sharing, smallgifts, and specialinvitations, theywill buy more fromyou, “sneeze” aboutyou to others, andbecome evangelistswith their friends. What better way to bringin more profitable accounts than to recruityour profitable accounts to be on your“sales team?”VII. Thou Shalt Hire the Best and FreeUp the Future of Those Who Aren’tIt is far more importantto hire those who havethe right emotionalintelligence than thosewho have the pedigreeor credentials. This isthe number one hiringmistake in banking.With the ZERORISKHiring tool, a 15-minuteInternet test reveals if acandidate is at high risk for the position—which incidentally benchmarks to haveonly a 10 percent chance of being in thatposition 1 year later. Contrast that to a lowriskcandidate who has a 90 percent chanceof being in that position with productiveresults. With embezzlement opportunities,work-ethic issues, and over 30 percentof people falsifying their resumes, whocan afford to hire without an emotionalintelligence test that can predict work ethic,ability to sell, likelihood to steal, ability towork with others, as well as many otherthings?“<strong>The</strong> best return on yourmarketing dollars comesfrom investing in youremployees’ learning andthen incentives followedby investing in marketingto your best customers.”By Roxanne <strong>Emmerich</strong>VIII. Thou Shalt Start All MarketingEfforts with a GoalIt is amazing how many marketingcampaigns are run with NO reflection aboutthe goal. Even if it as simple as, “We wantABC demographic to contact us aboutattending our estate-transfer seminar”or “We want to target current mortgagecustomers to have them take advantage ofa one-time special, no-cost to set up homeequityline,” spell out the result you wishto accomplish so all efforts can align withthat vision.IX. Thou Shalt Understand theGame Is about Winning Hearts…those of your employees and yourcustomers. No greatness has ever beenaccomplished with a rational presentation.ALL people buy for emotional reasons,and you must start first by winning overthe hearts of your employees. Once theybelieve you are the best and the ONLYchoice for prospects, the prospects’ heartswill quickly be won over.X. Thou Shalt Teach Your Employeesthe Discipline of WinningBehaviorsDo your employees have the disciplinesand skills to compete against your toughestcompetitors? From knowing how to flip aclient from a conversation of rate to one ofvalue to having the disciplines of how tomove clients through the sales funnel processand how to target high-profit accounts, thedays of bankers who wait for money tofall in the door are over.Winners of the MalcolmBaldridge QualityAward benchmarkedthat for every dollar theyinvested in training theirpeople, they received a30-1 return. When onebanker remarked that hedidn’t train his peoplebecause they might leave,he didn’t think of the worse nightmare—what if they aren’t trained…and they stay?Now, that’s a scary thought.<strong>The</strong> 10 Commandments of Kick-ButtProfitable Growth are not cast in stone…but they should be posted at your desk. Weall know what happens when we breakthem.10

NEW!October 24, 2006Chicago►Equivalent to two (2) Fast-Track Seminar Certificates$1295For presidents, executives, regional managers, and branch managers, heads of retail and commercial and thosewith responsibilities for managing people and resources.It is estimated that over 50% of all professionals who hold management positions still act like individualcontributors. Another 25% of managers are caught between the roles of individual contributor and manager.<strong>The</strong>y seem unable to move fully into the manager role.Why is that a problem? Professionals in manager positions, who are still acting like individual contributors, are seenas contributing 3.5 times less to the organization than those professionals who have fully transitioned intothe manager role.It’s time the rubber meets the road. This session will forever transform the way you lead people forhigh-performance.Discover what they didn’t teach you in management courses. Explore the most successful techniques andapproaches to managing people, time, and resources that get results. We guarantee that when you leave, youwon’t understand how you managed to survive without these high-impact “get-it-done” systems.• Explore a process that builds a powerful execution ofresults with extraordinary accountability.• Understand how to double the productivity of EVERY taskyou manage.• Find out how to get your people wildly excited to cometo work each day—no kidding.• Get 57 percent more productivity out of everyemployee—guaranteed.• Explore why high performing companies are 150 percentmore likely to tackle low-performer issuesthan are lower performing companies.• Create a system and practice a process to coach a lowperformer to a higher level of performance.• Discover why you must reverse the common mistake mostmanager’s make—93 percent of managers spend moretime with low performers than high performers.Offered as a public seminar for the first time this year.A long-time favorite of our clientsExpected to be our most in-demandsession to date.Call 800-236-5885 today11

A great place to start.January 18-19, 2006 - DallasApril 26-27, 2006 - MinneapolisOctober 4-5, 2006 - Chicago►Equivalent to one (1) Fast-Track Seminar Certificate$895 for the first attendee$495 for additional attendees from the same organizationAre You Making <strong>The</strong>se Sales and Marketing Mistakes?• After spending money to attract prospects, your people, when asked for a rate, give the rate and hang up thephone with no attempt to help the customer.• Your mortgage lenders don’t consistently capture at least 5–6 additional products and services with each newmortgage.• You haven’t already protected yourself from a “Wal-Mart” bank opening across the street.• You’ve spent BIG MONEY on traditional “sales training”—but when you tell the truth, you admit you’ve receivedNO return on investment AND both your customers AND employees are alienated.• Your marketing budget is spent on advertising—the lowest return on investment approach—and you find thatafter spending that money, 80 percent of the customers you attract LOSE YOU MONEY.• Your people compete on price and negotiate away your profits.• …and worst of all, after decades of attempting to create a sales and marketing organization, your peopleremain “order takers.”Almost every bank is dead wrongwith their sales management and marketing strategy!Finally, an integrated Marketing & Sales Management Boot Camp from the author of Profit-Growth Banking:How to Master 7 Breakthrough Strategies of Top-Performing Banks.Why do 98 percent of Boot Camp attendees ask for a Boot Camp II?PROFIT-RICH MARKETING STRATEGIES• Discover a simple marketing system to double your profits overnight! (An astonishingly easy techniqueused by smart marketers...but IGNORED by 99 percent of all banks.)• Receive 7 PROVEN examples of successful marketing campaigns you can use immediately...no matterwhat market you’re in. Plus, get a proven template for your own mega-pulling target market campaign—anamazing “how to do it yourself” shortcut map.• Create product bundles that will immediately increase your profit per customer and retain them 3 timeslonger.• Create a buzz that starts the stampede to your door.• Get more results...with half the budget!• Develop a customer retention system that bonds customers to you and turns them into evangelists for yourbank!• PLUS...participate in a “table topics” sharing session where you’ll brainstorm and share best practices withsome of the top bank markets in the country.12HYPER-GROWTH SALES MANAGEMENT TEMPLATES• Create sure-fire accountable sales systems your staff will understand and deliver.• Determine what to measure to maximize your results...and the most common mistakes bank salesmanagers make!• Discover a proven sales management template to manage your sales team for maximum results.• Create profit-rich referral systems to better help every customer.• Explore a proven 3-step process guaranteed to double your customer retention.• Understand how to profile for each sales position to reduce costly hiring mistakes.• Discover a powerful approach to win the hearts of those who have their heels dug in and don’t want to sell.• Discover a hiring tool with a proven track record of decreasing turnover by 67 percent!and soooooooo much more!

Send three or more at the same time so you’ll have a critical mass that will allow you to begin implementingimmediately.Past Boot Camp attendees include sales managers, marketing managers, CEOs, COOs, branch managers, headlenders, heads of retail, and even cashiers and head tellers, for a well-rounded team that understands marketing isa mindset—not a department.“<strong>The</strong> information received and the templates provided are PRICELESS! This was definitely a wiseinvestment of time and money.”—Alisha Johnson, Senior VP of Marketing, Highland Bank, past Chair, ABA Marketing Network“Roxanne has “it” figured out and explains “it” in a manner that you can take immediate action upon.I’ve been to dozens of sales seminars and this beats them all!”—Mike Smith, AVP of Marketing, Community Bank & Trust“Absolutely awesome! Great ideas and tons of enthusiastic energy!”—Heather Gossler, Vice President, <strong>The</strong> Quakertown National Bank“Roxanne <strong>Emmerich</strong> is GREAT. Her energy & marketing knowledge has transformed our institutioninto a fun, sales-driven bank.”—Rebecca Berklund, Operations Officer, Heritage Oaks Bank“Action packed! Enjoyed excitement and plethora of ideas to go home with and employ.”—Don Baker, Executive Vice President, American State Bank“Roxanne lays out the plan that any bank can implement regardless of their culture. She made youbelieve you can change the course of your ship.”—Duane Bussey, Senior Vice President, San Luis Valley Federal Bank“This dog does hunt. Roxanne is worth her weight in gold. Profitability does follow culture.”—Lauch McKinnon, President, Rockbridge Commercial Bank“Roxanne has “it” figured out and explains “it” in a manner that you can take immediate action upon.I’ve been to dozens of sales seminars and this beats them all!”—Mike Smith, Assistant Vice President of Marketing, Community Bank & Trust“This was one of the most interesting sales seminars I have attended and will be able to use 90% ofthe information provided.”—Cheri Bliefernich, Vice President, Pulaski Bank“Most thought provoking training I have ever had. Excellent – all employees should have theopportunity to go through Boot Camp.”—Sandy Moll, COO and EVP, Team FinancialFAST-TrackSeminar CertificatesSAVE up to 50% on any ofthese seminars with anadvance purchase of FAST-Track Seminar Certificates.For a limited time, and in limitedquantity, receive substantialdiscounts that can be appliedto any of <strong>The</strong> <strong>Emmerich</strong> <strong>Group</strong>Inc.’s financial industry seminars.Call TODAY for details.800-236-588513

Branch Manager Monthly ChecklistSTANDARD PROCEDURESA check mark means you are in 100 percent compliance.Complete at the end of each month and give to your supervisor.Ran a sales meeting where we taught at least one salesskill or some personal development idea was shared.Went over each “Sales Pipeline” report and coachedeach person on:1. How full the top of the pipeline is.2. How well he or she is moving prospects through toclosing.3. Lost business—identify what went wrong andadjusted process.4. Ideas for improvement in sales process.Held a five minute “stand-up-success-share” beforeopening (once per week).Tracked the accounts per the New Client Report.Posted the branch numbers AND gave each personfeedback on how he or she is doing compared to othersin the branch and compared to past performance.Sent “Top 100” mailing at least once a month.(Information or gifts)Featured the Customer Service Standard of the monthprominently, and asked all employees to set goalsaround that standard and report back.Asked all employees to turn in their “better habit” planfor what they’re going to learn or what habit they will beworking on to improve their performance.Gave away a weekly gift certificate drawing. Staffmembers are eligible for the drawing if they submittedor received at least five “way to go” post-it notes on the“way to go” board.Turned in my “Branch Manager’s Improvement” planwhere I commit to a new habit I will work on, a newsystem I will implement, AND a new skill I will learn.Made sure ALL checklists for tellers and CSRs werereceived. Gave a branch prize every time ALL wereturned in on time. (Pizza for all?)Had at least one coaching session with anunderperformer and one with a high performer.Called at least twenty of Top 100.All direct reports participated in BreakthroughBanking videosNew employee orientation for all new employees. Hadeach watch tapes 1 and 2 of Breakthrough Banking onfirst day and tapes 4 and 7 within first week.Closed accounts audit and calls made to rescue allidentified closed accounts.Followed up with accounts that had significant balancechange to determine who to call.Coached staff’s work, habits, and goals.Rewarded desirable behavior through prizes andrecognition.Attended Breakthrough Banking Video session withall direct reports.Held at least two sales meetings showing BreakthroughSales Meetings Video Training.Attended the No More Order Taking Teleseminar withany targeted employees who are direct reports.Made ____ outside bank officer calls.Weekly referral follow-up plan followed by:- Self- StaffPosted successes in cross-sales and other keyindicators:- Top 20% of staff with most referrals- Top 70% of staff with most referralsSpent at least 30 minutes getting to know employeesbetter.Did at least one employee motivation event.Created fun for the staff.Held a monthly meeting with all staff – rewarded,recognized, and shared success stories.Shared new account information with entire staff– where each came from and special needs.Partnered with people on sales calls.Openly committed to a new habit in front of staff.Talked to other people outside of bank about thebank’s USP.Created a monthly incentive celebration.X_________________________________Branch Manager Signature___________DateI need help with:________________________________________________________________________________________________If under 100 percent compliance, my plan to be incompliance next week means I will do the following:________________________________________________________________________________________________14

Sales and Marketing Tools That Will HaveYour Competition Retreating to the HillsOctober 25-26, 2006Chicago►Equivalent to two (2) Fast-Track Seminar Certificates$1295A two-day event for those who have completed Marketing & Sales Management Boot Camp I. Come back foranother round and put the finishing touches on your marketing and sales process. Roxanne will critique yourcurrent projects, strategies, and positioning processes and play devil’s advocate on your processes.Power-packed with high-impact tools.• Complete a Unique Selling Proposition (USP) check-up to make sure the USP you have for every productline is kick-butt and power-packed.• Assess your current sales management process and challenge it to the next level.• Identify your current sales and marketing bottlenecks.• “Hot-seat” opportunities for you to get very personal and direct coaching from Roxanne on how tomake your USPs, incentives, sales processes, and marketing programs infinitely more profitable.• Receive high-level sales and marketing templates restricted for graduates only.“In Boot Camp II I learned more about what I consider to be the greatest sales managementand marketing principles in the world—and I received the straight-forward tools to make it happen.”—Tammy Thompson, Assistant Vice President, Citizens National Bank“Get off your budget and get up here! It’s worth every cent!” —Sheila Houk, Vice President, Security State Bank“Boot Camp II provides a goldmine of customer-focused ideas that will drive our business forward.I gathered $50,000 worth of ideas that I can apply immediately—the hardest part is prioritizing what wedo first.”—Chris Bart, Vice President Marketing, Macatawa Bank“I thought Boot Camp was great but Boot Camp II blew me away! Awesome!”—Melissa Secor, Investment Services Director, Macatawa Bank“Not your typical sales conference! Roxanne brings together highly motivated people and brings themto the next level!”—Karla Wilbur, Vice President, Passumpsic Savings Bank“<strong>The</strong> depth and commitment from all who attended Boot Camp II eclipsed a very impact fullBoot Camp I.”—Bill Habermeyer, Senior Commercial Lending Analyst, First Commerical Bank of Florida“Energetic, exciting, evaluative, educational!”—C.Prescott, President, First Commerical Bank of Florida“Best forum to interact with colleagues and peers that I have ever attended.”—Karen Katz, Marketing/Training Director, River Valley State Bank“An unbelievable session filled with high energy and great ideas that are easily implemented.”—Don Baker, Executive Vice President, American State BankCall 800-236-5885 today15

Proven Secrets for More Profit-Rich Sales ResultsMarch 22, 2006November 15, 2006Minneapolis►Equivalent to two (2) Fast-Track Seminar Certificates$1295To rewire commercial lenders, trust officers, investment reps, insurance agents and private bankers (all those whowant to do more big-ticket, high-margins sales). Stop giving away margins and fees to get the sale and to go afterand win the big elephants. This one-day program will give you the tools and templates to turn even the most analyticallender into a top-performing business attractor who DOESN’T need to win the business on price ever again!• Stop competing on price and close more sales faster.• Retain customers for life—without negotiating price every year.• Present solutions that close—90% of the time.• Discover how to penetrate EVERY account and get ALL of each clients’ business.• Increase your fee income without losing business.“Our sincere thanks for assisting our organization in identifying its marginal value and putting a strategyin place to close more deals. In the ninety days following our most recent session, we landedmore accounts then we did in the previous 6 months!”—Doreen Strand, President, Fintegra Financial Solutions“An extraordinary day of practical methods to increase sales effectiveness.”—Oz Morgan, Regional President, Star Financial Bank“I believe this system is the best approach to professional sales in the market place.”—Dave Hyde, <strong>Banker</strong>, BNC National Bank“Excellent for getting the knots out of your tongue!” —Brian Poch, Business Development Officer, Eastwood Bank“Fantastic content and delivery. I would strongly recommend anyone involved in sales to attend.”—Jeff Nelson, Senior Vice President, Star Financial Bank“Simple step-by-step process to learn how to handle a call, handle negative reactions, and closethe deal.”—Kevin Coats, Vice President, Intermountain Community Bancorp“This is a great, very basic , understandable seminar that I can put into action immediately when Ireturn to work. No frills, no fluff!”—John McCreary, Regional President, Star Financial Bank“This was a great sales presentation. I would recommend anyone in sales or sales training totake this class.”—Janice Farris, Life/Health Insurance Agent, Eastwood Bank“Great tools to use to make sure we ask the right questions early on to eliminate unnecessary workfor me with no results.”—Tim Hoscheit, Vice President, Citizens Bank Minnesota“If you come to the training with an open mind, it is amazing the paradigm shift that will take place inyour overall thought process and how you want to conduct your client interactions moving forward.”—Michelle O’Connor, Investment, Sales Coach, Macatawa Bank“I wish I could implement every idea discussed. <strong>The</strong>re were a lot of great selling techniques. Whowould have thought pain would be a selling tool?” —Kevin Stadler, Senior Vice President, BNC National Bank16

Breakthrough Sustainable Management FormulasGuaranteed to Drive Quantum Sales IncreasesMarch 23, 2006November 16, 2006Minneapolis►Equivalent to two (2) Fast-Track Seminar Certificates$1295For commercial and retail sales managers, presidents, EVPs, or those slotted for key sales management roles.(Profit-Rich Sales Seminar is a prerequisite)Discover the day-to-day approaches of sales managers who create outstanding growth with great margins. You willdiscover how to coach high performers and under performers, measure and reward the RIGHT things, and knowthe 47 high-impact functions of a top-performing sales manager.• Create the essential steps of a no-fail sales process.• Discover a hiring process that is guaranteed 90% of the time.• Create bullet-proof sales forecasts.• Find out the essential elements of sales meetings that work.• Bring down the silos and get your departments to work together toown the WHOLE relationship.“Wow! Information that can be used in all areas of banking that you can’t be without.”—Kevin Coats, Vice President, Intermountain Community Bancorp“Great effective training--the best available.”—Mike Riley, CEO, St. Stephen State Bank“Teaches practical, effective steps in sales. <strong>The</strong> methods taught will not make you feel like a usedcar salesman.”—Jeff Schrotenboer, VP Commercial Loans, Macatawa Bank“I am excited to get back to work and set up a new sales training calendar and individual reaffirmationof their goals.”—Robin Harrison, Vice President Home Loan Mortgage, Panhandle State Bank“Excellent ideas and specific tool for better sales management.”—Oz Morgan, Regional President, Star Financial Bank“This seminar gave me great ways to shorten the sales cycle and eliminate wasteful callingefforts.”—Julie Baumgartner, Vice President, Citizens Bank Minnesota“It is important that I acknowledge you as I bask in the glow of one of my greatest direct sellingachievements to date. <strong>The</strong> prize I’m referring happens to also rank as my company’s best directsale of the quarter and within the Top 5 of the year. I’m so grateful to you for your commitment to thecraft of selling.”—Tom Burke, Sales Manager“Profit-Rich Sales Management will build confidence and give you a bigger and better picture ofthe sales process.”—Brian Duffy, Investment Specialist, RSI Bank17

18By Roxanne <strong>Emmerich</strong>, CSP, CMCTen Cornerstones ofEmployee MotivationContrary to popular belief, if you want tolose weight, all you need to do is exercisemore and eat fewer calories. Thosestruggling with weight will often insist theyeat very little–but just sit across the tablefrom them at a buffet and you realize theyare “breaking the rules” of diet.<strong>The</strong> same applies to workplace motivation.When the rules are followed, moraleimproves. When we break the rules,motivation deteriorates. Managers spendtoo much time in denial by insisting thatthey are building a motivating workplacewhen, in fact, they are often sabotagingit. A motivating work environment isthe responsibility of everyone. Gone arethe days when we look to managers tomotivate. Here are Ten Commandmentsthat must be adhered to by everyone in yourorganization if you want to build the kindworkplace where everyone thrives.1. Build self-respectPositive reinforcement allows people tounderstand that their performance addsvalue to the organization. Receivingpositive strokes gives employees a sense ofsatisfaction that creates the initiative to trynew ideas and take bigger risks.We can never have enough self-respect. Itseems that the office ‘egomaniac’ is usuallythe one who has the lowest self-respect. <strong>The</strong>more obnoxious and toxic they become intheir bragging, the less we feel like feedingtheir egos with strokes.No matter how confident or comfortable weare with who we are, we all have momentsof insecurity where our performance drops.We all need strokes.2. Don’t Be Neurotic (or disguise itwell)Employees deserve to have a clearunderstanding of what behaviors andoutcomes are expected. Many managers areso unclear that they create the perceptionthat they are they are intentionally hidingthe target. Management teams secludethemselves for a strategic planning session,an archaic and bankrupt managementpractice, only to place the book on theshelf with maybe a short review withemployees. If everyone in the organizationisn’t involved in “the plan” at some level,they’re not committed, period.3. Show RespectManagers often treat employees like a childin an adult-child relationship. An adultadulttransaction requires that we allowemployees the latitude to solve problems.Provide guidance with a clear picture ofexpected outcomes and allow people to think.4. Live IntegrityIn the Dr. Seuss book, “Horton Hatches theEgg”, Horton, the elephant gives his word toa lazy bird named Mayzie that he will sit onher egg until she comes back. Mayzie doesn’tcome back and Horton perseveres throughice storms, safari hunters, and even a trip tothe zoo. Through challenges, he continuesto repeat, “I meant what I said and I saidwhat I meant…. An elephant’s faithful, onehundred percent!” It is unquestionably truethat most people would say that they keeptheir word. In any day, however, those samepeople will break their word repeatedly insmall ways. Employees spot all the waysthat managers miss obligations by smallthings like not sending out reports that werepromised delaying meetings, etc. Employeesare quick to spot slips in integrity in peersand managers. Instead of confronting theproblem directly, they too often fall out ofintegrity by blaming, gossiping and whining.Living in integrity means keeping our wordand speaking a deeper truth.5. Be FairIn a world where there isn’t much thatis fair, we need to find ways be as fair aspossible. Fair doesn’t mean equal. Payingfor performance isn’t fair if you cap theincentives that a star performer can receive.If you reward employees for cost savings oran increase in revenue, the additional moneyis always there to share, because the extramoney wouldn’t have been there withouthelp from that employee.6. Value and Reinforce IdeasAccording to an Employee InvolvementAssociation study, the average employee inJapan submits 32 ideas for improvement peryear, compared to the average employee inthe United States who submits 0.17–a ratioof 188-1. <strong>The</strong> root of this problem stemsfrom the fact that only 33 percent of U.S.employees’ ideas are adopted–compared to87 percent from Japanese workers.If we expect people to give us ideas theirideas for improving the organization, weneed to have a serious system for evaluatingand implementing all ideas. People whosubmit ideas are entitled to a quick decisionand reason about the idea they had.7. Give <strong>The</strong>m What <strong>The</strong>y WantMy mother loves crafts. I love books.Every year forChristmas, mymother has givenme crafts. I givemy mother books.What’s wrongwith this picture?We love to give what we actually love toreceive, however sometimes we forget whowe are doing it for.Each of your employees has a differentidea of how they prefer to be rewarded.Money, trips, educational opportunities,promotions, verbal recognition–everyoneprefers it their way. If you don’t know whatthey want, ask them.8. Give Immediate FeedbackWho ever created the yearly performancereview anyway? By itself there is reallynothing wrong with it, but somewhere alongthe path, we assumed that all feedbackgets stuck in a file and delivered yearly.<strong>The</strong> problem with this approach is thatinappropriate behavior becomes habit bythe time the employee hears about it. Worseyet, you lose the benefit of reenergizingyour people with the substantial immediateimpact of positive reinforcement for aproject well done.9. Reinforce the Right ThingsOne of the companies I have done work forbelieved that good employees come to workearly and stay late. Not surprisingly, the CEOcame to work early and stayed late. Whena new CEO came, he placed the emphasison performance and productivity went upmiraculously. Those same employees didmore work in less time. Watch what youreinforce because you will undoubtedly getmore of it.10. Serve OthersWe’ve all seen it in our mission statements.“To be a leading provider of blah, blahservices in our service area providingquality service and a good return to ourstakeholders.” Gag me with a shovel! Tosay we are in business to profit is like sayingwe are alive to breathe. Every thrivingorganization is passionate about servingtheir customers. When we focus on ourcustomers’ success, we enroll our hearts,minds, and souls as opposed to simplyworking from our job descriptions.So, it’s easy. If you want to lose weight,eat less and exercise more. If you want toimprove the motivation of your workplace,follow these Ten Commandments.

NEW!September 13-14, 2006Minneapolis“We always plan too much and always think too little.” –Joseph SchumperMost strategic planning done in banks today is justregurgitation of the old…setting goals and processes builtaround the same old thinking.Moreover, almost every bank’s strategic plan is completelydevoid of strategy…and if there is any strategy, it is oftenbuilt on “old school” assumptions.What if you could lose the 1970s model of strategic planningof Mission, Values and SWOT and replace it with what moversand shakers are doing today?Better yet, what if you could have your executive team do this along sideexecutive teams of some of the other highest performing banks in thecountry who are not competitors so you could share ideas and best practices?When doing graduate work in strategic planning, Roxanne challenged her professor to rethink the course as it wastaught. Her approach was dramatically more focused on creating immediate and sustainable results than what wasbeing taught.With that approach, Roxanne has received and turned down hundreds of requests to facilitate strategic planningdue to time constraints. That said, the FDIC told one of the banks she assisted that it was the best, mostinsightful, and actionable plan they had ever seen.Move quickly to seize the opportunity to capitalize on this unique and powerful approach to planning your dynamicbreakthrough for the future.Only 15 banks will be accepted due to the nature of keeping this session intimate and effective. <strong>The</strong>application deadline is May 15, 2006. First preference will be given to current clients on our full programs andgraduates of Permission to Be <strong>Extraordinary</strong> and Boot Camp II.Process:• Bring up to 5 of your leadership team members for two days of intense work and “think tank” strategy.• Go home with a work plan that is strategically superior to anything you’ve done before…and a process that assures impeccable execution.Call 800-236-5885 to reserve yourteams’ spot today.“Most insightful and actionable plan ever seen.” –FDIC Examiner19

7ofDysfunctionsLow-Performing BanksBy Roxanne <strong>Emmerich</strong>, CSP, CMCW20hile most banks focus on what theyshould do, few seriously evaluate whatthey should not do or allow. Awarenessof the common characteristics of lowperformingbanks can keep you fromfalling victim to any of these practicesbefore you join the group.So what are the most commonmistakesof low-performing banks?#1 Keeping EmployeesWho Have Quit—But StillCome to Work Every DayResearch by the Corporate ExecutiveBoard of 50,000 employees proves thatemployees who are “true believers”—who value, enjoy, and believe in whatthey do—displayed 57 percent morediscretionary effort and were 87 percentless likely to pull up stakes. Even anumber-crunching, poker-faced CFOcan analyze the numbers on this one anddiscover that he or she needs to have apersonality infusion and learn how toengage people.With the cost of replacing an employeeestimated between five to nine monthsof their yearly salary, low-performingorganizations need to take heed thatworkers in the “just doing my job”mindset are four times more likely toleave.Low-performing banks give lip serviceto their misinformed beliefs on whatcreates higher employee performance—higher pay or benefits. High-performingcompanies, who incidentally attractnine times more “true believers,” knowthat employee engagement comes fromletting employees feel they are valuedand necessary, and that the bank hasa “cause” and purpose—far beyondprofits.Do you have a vision that inspirespeople to greatness and a system toconstantly upgrade the culture of yourorganization?#2 Clueless “SalesCulture” Approach—WorseYet…<strong>The</strong>y Don’t Know It IsHow do you keep from chucklingwhen you hear yet another bankersay some outrageously misinformedstatement like, “Sure, we have asales culture. We set goals and haveincentives.” What separates the menfrom the boys is whether the “salesculture” effort goes way beyond goalsand incentives to optimal use of salesfunnels, measurement of frequenciesand competencies that are predictive offuture revenues, understanding of whatare the optimal high-impact activitiesto do in a sales meeting, and at least20 other key items. Facts be known,goals and incentives are minimallysignificant efforts in creating profit-richsales growth in comparison to havingan integrated approach of systems andskill sets.Are you content with less than five ormore products per household—or willyou be sideswiped by a competitorthat’s not?#3 Giving Away theFarm…One Commercial Loanat a Time<strong>The</strong>re aren’t many commercial lenderswho think they need help with theirsales skills and yet the vast majority ofthem consistently price their loans tocut bank margins, accept minimal feeincome, and negotiate to match otherbanks—even after they already have adeal—because they didn’t know how tokeep the customer from taking that stepafter a deal has been agreed upon.Lenders think they are good sales peoplebecause they compare themselves toretail bankers who don’t make calls.Yes, in comparison, they probably arebetter sales people. That said, what otherindustry has sales people who know solittle about the proper approaches tooptimize sales at higher margins? You’llbe hard pressed to find an industrythat has as much lack of sales skill asbanking.Do your lenders have a “rollover”approach to pricing?#4 Gee Wally, I Think <strong>The</strong>reIs Dysfunction in the FamilyWe all know that a Band-Aid applied toan infected wound adds no value. <strong>The</strong>same is true of “sales training,” newsoftware, and other strategic attemptsto improve an organization if they areapplied on top of the dysfunctionalbehaviors allowed within theorganization. Most banks don’t employJune, Ward, Wally, and the Beav.

After 16 years of doing “sales andservice culture revolutions,” nothingis more clear than this: <strong>The</strong> solutionfor breakthrough to a higher level ofperformance ALWAYS lies solidly inchanging the mindsets and skill setsof those on the leadership team—howthey work together and what they allowand disallow from their people.It is rare to find a leadership teamthat doesn’t have “issues” or one thatdoesn’t allow its people to play outtheir “issues”—and display them soconsistently that they are discernable tothe trained eye within 10 minutes.Whether it’s the passive-aggressivepersonality who doesn’t take a standfor what he or she believes but goeson to sabotage the commitment of thedepartment, to people talking behindothers’ backs, to “whiners” —yourleadership team MUST develop the skillsto disallow dysfunctional behaviors.<strong>The</strong>n engage people to apply new andbetter habits, mindsets, and behaviors toreplace all the freed time that becomesavailable when dysfunctional behaviorsare not allowed.Do you allow ANY dysfunctionalbehaviors, or have you identifiedthem and enforce their eliminationimpeccably?#5 Wrong People on theBus—Many Sitting in theWrong SeatNOTHING is more predictive ofjob performance than emotionalintelligence—not past job performance,not personality, not intellect, and noteven IQ.Most low-performing banks do notundertake emotional intelligence testingprior to hiring or with their currentteams. If they do any testing at all,they do “personality testing” or “selfevaluation”testing with DISC, ProfilesInternational, and other tools that eitherhave a low correlation to predict futurejob performance or can be manipulatedby employees with an IQ over 12 toanswer what they think you want tohear.If you’re tired of the “school of hardknocks”hiring approach, consider atool we’ve found—it takes only 10minutes on the Internet and requiresan investment of less than an hour ortwo of payroll time if you choose tohire the person. And, this tool has beenbenchmarked to show that those whoare identified as “low risk” have a 90percent probability of being with yourfirm one year after hiring while thoseidentified as “high risk” have a 10percent chance of being with you oneyear out.A Texas bank, that benchmarked allemployees using this tool, found itreduced employee count by 30 percentwithin one year while increasingperformance and growth of the bank. Bygetting the right people on the bus andmoving their seats so their emotionalintelligence best matches the benchmarkof the position they fill, you can reducethe highest expense on your P&L—payroll—while dramatically increasingeach person’s performance.#6 Wasteful Use ofResources—‘Cuz We’veAlways Done It That WayJust because it has always been donethat way doesn’t make it worth doingagain. Advertising is a perfect exampleof this old adage.Low-performing banks spend theirmarketing budgets on advertising.Worse yet, they spend it on the worstpossible types of advertising—imageand rates.High-performing banks know thatadvertising hits too wide of a swathand that what they really want to do ismarket to the niches and to the currentcustomers who will bring the mostopportunity to the financial institution.Most high-performing banks spend lessthan 10 percent of their marketing budgeton media “advertising” and insteadreallocate those resources to highimpact,low-cost marketing approachessuch as training and incenting theiremployees, and marketing to currentcustomers, high-profit prospects, andhigh-potential customers.Have you reallocated your marketingdollars away from advertising to profitrichmarketing strategies that costlittle?#7 Fluffy Thinking—Lackof Understanding ROI andHow to Get <strong>The</strong>reYou can be sure that there isn’t a boardmember alive that would encouragea bank employee or manager to missa high ROI opportunity because theinvestment monies weren’t in thebudget…yet, that excuse is given everyday as leaders pass over high ROIopportunities—leveraging your peopleby sending them to an educational eventthat pays for it self in one month or less,gifts to your top 100 client list that willmake those clients want to do morebusiness, and many others.“It’s not in the budget” is the thinkingof low performers. High performersalways ask, “How long will it take toget our return on this investment?”“Critical-thinking skills” is the otherarea of breaking through fluffythinking. High-performing banksare exacting in their diagnosis andprocess to resolve their issues. Lowperformingbank leadership teams sayfluffy things like, “We have a problemwith communication” as opposed tohigh-performers who say, “We need toimprove the way we disseminate ourstrategic initiatives and keep peopleapprised of the process by setting upboth a weekly posting to our Intranetand an occasional game quiz withprizes to make sure people are readingthe information and remembering it.”Specific linear thinking always wins outover “fluff” and “not-in-the budget”thinking.Most banks, if truly honest, know thatthey have at least some symptoms ofthese seven dysfunctions. Recognitionis the first law of learning andbreakthrough. Action to rectify is thesecond! ◄Roxanne <strong>Emmerich</strong> is the authorof Profit-Growth Banking: How toMaster 7 Breakthrough Strategies ofTop-Performing Banks. CEO of <strong>The</strong><strong>Emmerich</strong> <strong>Group</strong>, Inc., she is renownedfor her work with helping many of thetop-performing banks in the countrystay miles ahead of their competitors.For additional articles and templates,visit :www.<strong>Emmerich</strong>Financial.com or call800-236-5885.21

JustReleasedStop Losing Deals to YourCompetitor’s Lowball PricingFinally, a step-by-step sales process that can improveyour closing ratio to 90%--guaranteedFrom the author of Profit-GrowthBanking, the book that set the path fortop-performing banks, comes a newlyreleased book that will revolutionizethe way you sell!• Consider what it would mean if your closingratio was 90% on all sales presentations ANDyou were consistently paid a premium overyour competitors.• How many times have you solved a prospect’sfinancial problem, only to find thebusiness was awarded to a competitor whosaid, “I can do that too --- for less.”• Are your sales people using the excuse thatthey could close more deals IF they could offerbetter rates?Visit www.<strong>Emmerich</strong>Financial.comto read a FREE chapter.“Finally…a book that realizes bankers bringvalue to a deal that transcends commodity,and sets forth a simple, step-by-stepprocess to ensure we get paid whatwe’re worth!”--Archie R. McDonnell, Jr., CEOCitizens National Bank“This book should be required reading forall bank presidents, directors, lending officers—evenyour tellers! Want to know howto gain and retain the great customerswithout “buying” their business? It’s inyour hands!”--Mike Hannley, President and CEOBank of TucsonRead it beforeyour competition does!Call 800-236-5885to order today.

2006 <strong>Emmerich</strong> <strong>Group</strong> Public EventsMarketing & Sales Management Boot CampShoe-String Strategies for a Profit-Rich Sales & Marketing BreakthroughsJanuary 18-19, 2006 -- DallasApril 26-27, 2006 -- MinneapolisOctober 4-5, 2006 -- ChicagoMarketing & Sales Management Boot Camp IIMarketing and Sales Tools That Will Have Your Competition Running to the HillsOctober 25-26, 2006 -- ChicagoProfit-Growth Train the TrainerMarch 7, 2006 -- MinneapolisZERORISK Hiring System Training SeminarMarch 8, 2006 -- MinneapolisProfit-Rich Sales SeminarMarch 22, 2006 -- MinneapolisNovember 15, 2006 -- MinneapolisProfit-Rich Sales Management SeminarMarch 23, 2006 -- MinneapolisNovember 16, 2006 -- MinneapolisPermission to Be <strong>Extraordinary</strong> SummitMay 16-17, 2006May 24-25, 2006-- Minneapolis (for executives, leaders and those identified to bepotential executives)-- Minneapolis (CEOs and presidents by invitation only)Permission to Be <strong>Extraordinary</strong> Graduate Program, date TBDFast-Track Strategy Think Tank Deadline to apply is May 15September 13-14, 2006 -- MinneapolisProfit-Growth Management Development SeminarOctober 24, 2006 -- ChicagoFAST-Track Seminar Certificate ProgramSAVE up to 50% or more on all of the <strong>Emmerich</strong> <strong>Group</strong>’s public events with an advancepurchase of FAST-Track Seminar Certificates, if ordered immediately. Your advancepurchase allows us to negotiate and arrange the proper size meeting space. We thenpass our hotel savings on to you.Hurry, this offer is only available for a limited time. Only 27 additional banks will beallowed into this program.Regular Price:$895/$495or1 Fast-Track CertificateRegular Price:$1295or2 Fast-Track CertificatesRegular Price:$995or2 Fast-Track CertificatesRegular Price:$1495or2 Fast-Track CertificatesRegular Price:$1295or2 Fast-Track CertificatesRegular Price:$1295or2 Fast-Track CertificatesRegular Price:$1995 or $2295or4 Fast-Track CertificatesCall 800-236-5885Regular Price:$1295or2 Fast-Track CertificatesSave 50%+LIMITED TIME OFFERCall 800-236-5885Call TODAY for details.800-236-5885*Only 10 banks are accepted into our comprehensive Sales Culture Package Program each year.Call for information to see if this is right for you.23

Would you like to have the seven simple secrets thatturn ordinary banks into top-performing banks?<strong>The</strong>se secrets lie in within the answers to one profoundquestion Roxanne <strong>Emmerich</strong> asked 100 CEO’s oftop-performing banks: “What are you doing to make yourbank a top-performer?”Receive a FREE order of Better <strong>Banker</strong> Mem-Cardsand a chance to win a FREE registration for ourMarketing & Sales Management Boot Camp.Call 800-236-5885 today to order your copy.Visit www.<strong>Emmerich</strong>Financial.com for a FREE chapter.This special is offered for a LIMITED time only.“Roxanne <strong>Emmerich</strong> strikes gold with this must read for all bankers. This book draws the map that cancreate major shareholder value!”–Jeff Schmid, President, American National Bank, Omaha, Nebraska“<strong>The</strong> bible of successful banking.”–Jim Smitherman, President and CEO, Security State Bank8500 Normandale Lake Blvd., Suite 180Minneapolis, MN 55437