licensing and notification under the - Colorado Attorney General

licensing and notification under the - Colorado Attorney General

licensing and notification under the - Colorado Attorney General

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LICENSING ANDNOTIFICATION UNDER THECOLORADO UNIFORMCONSUMER CREDIT CODELicensing <strong>and</strong> NotificationRequirements for Lenders, RetailSellers, Sales FinanceCompanies, <strong>and</strong> Rent to OwnCompaniesPrepared by <strong>the</strong>State of <strong>Colorado</strong>Department of LawJohn W. Su<strong>the</strong>rs,<strong>Attorney</strong> <strong>General</strong>1525 Sherman Street, 7th FloorDenver, CO 80203Licensing: (303) 866-4527Notification: (303) 866-4494Fax: (303) 866-5474E-mail: uccc@state.co.uscoloradoattorneygeneral.gov/ucccINTRODUCTIONThe <strong>Colorado</strong> Uniform Consumer Credit Code("UCCC") was passed into law by <strong>the</strong> <strong>Colorado</strong><strong>General</strong> Assembly in 1971 to make uniform <strong>the</strong>various laws in <strong>the</strong> State relating to consumer credit.The goal of <strong>the</strong> UCCC is to balance a creditor's rightto reasonable profits with a consumer's right toprotections from unreasonable practices. TheUCCC regulates only consumer credit - credit forpersonal, family, or household purposes. Creditextended for business, commercial, <strong>and</strong> agriculturalpurposes is exempt from <strong>the</strong> UCCC. First mortgageresidential acquisition loans <strong>and</strong> refinances of thoseloans are exempt from most of <strong>the</strong> UCCC, including<strong>licensing</strong> requirements <strong>and</strong> rate <strong>and</strong> fee limitations.Under <strong>the</strong> UCCC, some creditors must obtain asupervised lender's license while o<strong>the</strong>rs must filecredit <strong>notification</strong>. This pamphlet describes<strong>licensing</strong> <strong>and</strong> <strong>notification</strong> requirements. It is notintended to constitute legal advice nor describemaximum rates, fees, <strong>and</strong> disclosure requirements.You should contact your own attorney if moreinformation is needed.The UCCC <strong>and</strong> o<strong>the</strong>r credit laws are enforced by <strong>the</strong>Administrator of <strong>the</strong> UCCC in <strong>the</strong> <strong>Colorado</strong>Department of Law. Additional staff consists ofcompliance examiners <strong>and</strong> attorneys.CONSUMER CREDIT NOTIFICATIONCredit sellers <strong>and</strong> retail merchants that regularlyextend consumer credit <strong>and</strong> sales finance companiesthat regularly collect consumer credit contracts –referred to below as “creditors” – must file UCCC<strong>notification</strong>.Activities CoveredCredit sellers <strong>and</strong> retail merchants that regularlyextend credit (“regularly” has <strong>the</strong> same meaning asin <strong>the</strong> federal Truth in Lending Act – more than 25times if secured by o<strong>the</strong>r collateral or unsecured,more than 5 times if secured by a dwelling, or morethan once for a mortgage subject to <strong>the</strong> federalHome Ownership & Equity Protection Act, in<strong>the</strong> current or prior calendar year) must fileconsumer credit <strong>notification</strong> <strong>and</strong> pay<strong>notification</strong> fees. A credit contract is one thatincludes a finance charge or interest or that has5 or more installments. It may be in <strong>the</strong> form of<strong>the</strong> sale of goods or services on credit, forexample <strong>the</strong> sale of an automobile or applianceswith payment deferred. Note: if <strong>the</strong> creditcontract is payable in installments but <strong>the</strong>re isno finance charge or interest, <strong>the</strong> contract issubject to <strong>the</strong> UCCC but no <strong>notification</strong> filing isrequired. Businesses regularly makingconsumer leases must also file <strong>notification</strong> <strong>and</strong>pay <strong>notification</strong> fees.Sales finance companies that purchase, takeassignment of, or service consumer credit sales<strong>and</strong> consumer lease contracts <strong>and</strong> ei<strong>the</strong>r collectpayments or enforce rights from those contractsmust also file <strong>notification</strong> <strong>and</strong> pay <strong>notification</strong>fees.Credit sellers <strong>and</strong> sales finance companies aresubject to periodic, unannounced complianceexaminations.Notification Fees <strong>and</strong> Due DatesCreditors required to file <strong>notification</strong> <strong>and</strong> pay<strong>notification</strong> fees must do so within 30 days offirst entering into <strong>the</strong> activity <strong>and</strong> by January 31of each year <strong>the</strong>reafter. In addition, salesfinance companies must pay a volume fee basedon <strong>the</strong> prior year’s business. Notification feesare subject to change periodically to meetbudget needs.Once a business files initial <strong>notification</strong>, it willreceive annual <strong>notification</strong> forms prior to <strong>the</strong>January 31 due date. Failure to file <strong>the</strong> required<strong>notification</strong> form <strong>and</strong> pay <strong>the</strong> appropriate feemay result in financial penalties <strong>and</strong> <strong>the</strong>inability to extend credit.Supervised LendersAny company or person that regularly makesor takes assignment of consumer loans in<strong>Colorado</strong> with an annual percentage rate ofmore than 12% per annum, or who collectssuch loans that it previously made, is asupervised lender. A loan is distinguishedfrom o<strong>the</strong>r credit transactions by <strong>the</strong> lender'sdirect extension of funds to <strong>the</strong> borrowerwithout also selling goods or services. Entitiesthat arrange deferred deposit loans (paydayloans) or act as agents for deferred depositlenders must also have a supervised lender’slicense.Activities CoveredA lender is regularly engaged in supervisedlending if it has made, collected, or takenassignment of more than 25 loans, more than 5loans secured by a dwelling, or made,collected, taken assignment of, or brokeredmore than one mortgage loan subject to <strong>the</strong>federal Home Ownership & Equity ProtectionAct, in <strong>the</strong> current or prior calendar year.Supervised loans include both secured <strong>and</strong>unsecured consumer loans, home equity loans<strong>and</strong> o<strong>the</strong>r junior lien mortgages, insurancepremium financing, deferred deposit loans,credit cards, <strong>and</strong> first mortgage loans forpurposes o<strong>the</strong>r than <strong>the</strong> purchase orrefinancing of a home. First mortgageresidential acquisition loans <strong>and</strong> refinances of<strong>the</strong>se loans are exempt from <strong>licensing</strong> <strong>and</strong><strong>notification</strong> fees, although <strong>the</strong>y are subject to<strong>the</strong> high-cost, high-fee provisions of <strong>the</strong><strong>Colorado</strong> Consumer Equity Protection Act, anarticle of <strong>the</strong> Uniform Consumer Credit Code.Information on this law is available on <strong>the</strong>website listed on <strong>the</strong> front of this brochure.Unless <strong>the</strong> supervised lender is a state orfederally-chartered depository institution, itmust be licensed by <strong>the</strong> UCCC as a supervisedlender. A supervised lender includes acompany whose name appears on a

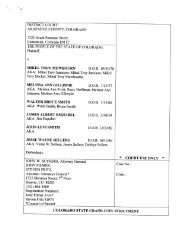

promissory note as <strong>the</strong> creditor to whom <strong>the</strong> debt isoriginally payable even if <strong>the</strong> loan is immediatelyor later sold, assigned, or funded by ano<strong>the</strong>rcompany or financing source. This may be called"table funding." Companies that buy, takeassignment of, or service supervised loans are alsoconsidered supervised lenders. A mortgage brokerwhose name does not appear as <strong>the</strong> creditor orlender on <strong>the</strong> promissory note is not a supervisedlender, but a mortgage loan originator license maybe required. Contact <strong>the</strong> <strong>Colorado</strong> Division of RealEstate for more information at (303) 894-2166 orwww.dora.state.co.us/realestate/mortgagebrokerregistration.htm.A supervised lender's license application requiresbackground information on <strong>the</strong> applicant <strong>and</strong> itsofficers, members, <strong>and</strong> partners; proof of financialresponsibility; <strong>and</strong> corporate status <strong>and</strong> trade namerecords. A supervised lender is subject to periodicunannounced compliance examinations, mustrespond to examination reports, <strong>and</strong> must file anannual statistical report each June 1.Licensing Fees <strong>and</strong> Due DatesA supervised lender’s license is needed for eachlocation where supervised lending activities occur.After <strong>the</strong> initial master license is issued, branchoffice applications must be filed. Licenses arerenewed each January 31 by <strong>the</strong> filing of asupervised lender <strong>notification</strong> form <strong>and</strong> payment of<strong>the</strong> license fee for that year for each master <strong>and</strong>branch office license. Fees are subject to changeperiodically to meet budget needs.Licensed supervised lenders receive annual licenserenewal forms prior to <strong>the</strong> January 31 due date.Failure to file <strong>the</strong> required <strong>notification</strong> form <strong>and</strong>pay <strong>the</strong> appropriate license renewal fees may resultin financial penalties, license expiration, <strong>and</strong> <strong>the</strong>inability to extend credit.Rent To Own NotificationThe <strong>Colorado</strong> Rental Purchase Agreement Act wasenacted in 1990. It regulates <strong>the</strong> rent to ownbusiness <strong>and</strong> is enforced by <strong>the</strong> UCCCAdministrator.Activities CoveredA rental purchase agreement is an agreement for <strong>the</strong>use of personal property for an initial term of 4months or less. It may be cancelled by <strong>the</strong> consumerat any time without fur<strong>the</strong>r obligation <strong>and</strong> may beautomatically extended. Some agreements offer <strong>the</strong>consumer <strong>the</strong> right to own <strong>the</strong> property after anumber of payments have been made. A rent to ownbusiness is one that regularly enters into rentalpurchase agreements in <strong>Colorado</strong>.Notification Fees <strong>and</strong> Due DatesA rent to own <strong>notification</strong> form must be filed with<strong>the</strong> UCCC Administrator. The initial <strong>notification</strong>fee <strong>and</strong> fee must be filed within 30 days afterentering into rental purchase agreements. Eachlocation must pay a renewal fee due each January31.After <strong>the</strong> initial <strong>notification</strong>, rent to own businesseswill receive annual <strong>notification</strong> forms prior to <strong>the</strong>January 31 due date. Failure to file <strong>and</strong> pay <strong>the</strong>required <strong>notification</strong> may result in financial penalties<strong>and</strong> <strong>the</strong> inability to enter into rental purchaseagreements.Reference TableListed below is a table to locate <strong>the</strong> portion of thisbrochure applicable to specific businesses.CreditorAppliance DealerAgricultural CreditAssigneesAuto DealerBanksBusiness CreditCheck HolderCommercial CreditConsumer LeasingDeferred Deposit LendersDepartment StoresFinance CompaniesFirst Mortgage LoansFurniture DealersHardware DealersIndustrial LoanCompaniesLease CompaniesMedical ProvidersMortgage BrokersMortgage BankersMortgage CompaniesPayday LendersPost-Dated CheckcashersRent to OwnSales Finance CompaniesSmall Loan CompaniesSupervised LendersBrochure SectionConsumer Credit NotificationIntroductionConsumer Credit Notification orSupervised Lender LicenseConsumer Credit NotificationConsumer Credit Notification orSupervised Lender LicenseIntroductionSupervised Lender LicenseIntroductionConsumer Credit NotificationSupervised Lender LicenseConsumer Credit NotificationSupervised Lender LicenseIntroductionConsumer Credit NotificationConsumer Credit NotificationSupervised Lender LicenseConsumer Credit NotificationConsumer Credit NotificationSupervised Lender LicenseSupervised Lender LicenseSupervised Lender LicenseSupervised Lender LicenseSupervised Lender LicenseRent to Own <strong>notification</strong>Consumer Credit NotificationSupervised Lender LicenseSupervised Lender LicenseIf you have questions about whe<strong>the</strong>r your businessactivity must file consumer credit <strong>notification</strong> or belicensed as a supervised lender, you may contact <strong>the</strong>UCCC office. You should also consult a privateattorney for legal advice.1/10