annual report 2009 - Aer Lingus

annual report 2009 - Aer Lingus

annual report 2009 - Aer Lingus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

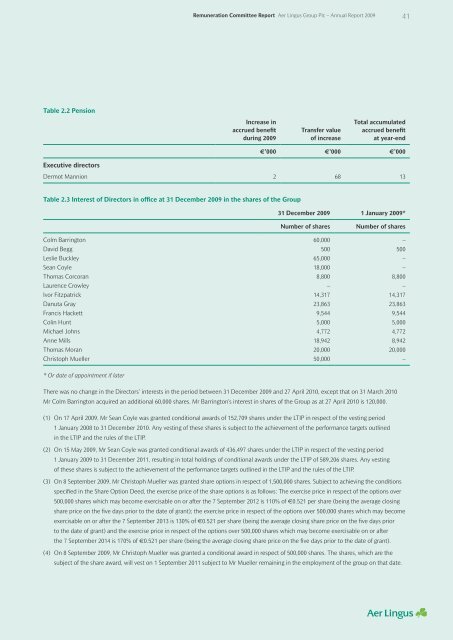

Remuneration Committee Report <strong>Aer</strong> <strong>Lingus</strong> Group Plc – Annual Report <strong>2009</strong>41Table 2.2 PensionIncrease inaccrued benefitduring <strong>2009</strong>Transfer valueof increaseTotal accumulatedaccrued benefitat year-end€’000 €’000 €’000Executive directorsDermot Mannion 2 68 13Table 2.3 Interest of Directors in office at 31 December <strong>2009</strong> in the shares of the Group31 December <strong>2009</strong> 1 January <strong>2009</strong>*Number of sharesNumber of sharesColm Barrington 60,000 –David Begg 500 500Leslie Buckley 65,000 –Sean Coyle 18,000 –Thomas Corcoran 8,800 8,800Laurence Crowley – –Ivor Fitzpatrick 14,317 14,317Danuta Gray 23,863 23,863Francis Hackett 9,544 9,544Colin Hunt 5,000 5,000Michael Johns 4,772 4,772Anne Mills 18,942 8,942Thomas Moran 20,000 20,000Christoph Mueller 50,000 –* Or date of appointment if laterThere was no change in the Directors’ interests in the period between 31 December <strong>2009</strong> and 27 April 2010, except that on 31 March 2010Mr Colm Barrington acquired an additional 60,000 shares. Mr Barrington’s interest in shares of the Group as at 27 April 2010 is 120,000.(1) On 17 April <strong>2009</strong>, Mr Sean Coyle was granted conditional awards of 152,709 shares under the LTIP in respect of the vesting period1 January 2008 to 31 December 2010. Any vesting of these shares is subject to the achievement of the performance targets outlinedin the LTIP and the rules of the LTIP.(2) On 15 May <strong>2009</strong>, Mr Sean Coyle was granted conditional awards of 436,497 shares under the LTIP in respect of the vesting period1 January <strong>2009</strong> to 31 December 2011, resulting in total holdings of conditional awards under the LTIP of 589,206 shares. Any vestingof these shares is subject to the achievement of the performance targets outlined in the LTIP and the rules of the LTIP.(3) On 8 September <strong>2009</strong>, Mr Christoph Mueller was granted share options in respect of 1,500,000 shares. Subject to achieving the conditionsspecified in the Share Option Deed, the exercise price of the share options is as follows: The exercise price in respect of the options over500,000 shares which may become exercisable on or after the 7 September 2012 is 110% of €0.521 per share (being the average closingshare price on the five days prior to the date of grant); the exercise price in respect of the options over 500,000 shares which may becomeexercisable on or after the 7 September 2013 is 130% of €0.521 per share (being the average closing share price on the five days priorto the date of grant) and the exercise price in respect of the options over 500,000 shares which may become exercisable on or afterthe 7 September 2014 is 170% of €0.521 per share (being the average closing share price on the five days prior to the date of grant).(4) On 8 September <strong>2009</strong>, Mr Christoph Mueller was granted a conditional award in respect of 500,000 shares. The shares, which are thesubject of the share award, will vest on 1 September 2011 subject to Mr Mueller remaining in the employment of the group on that date.