Madhya Pradesh Udyog Nivesh Samvardhan Sahayata Yojana

Madhya Pradesh Udyog Nivesh Samvardhan Sahayata Yojana

Madhya Pradesh Udyog Nivesh Samvardhan Sahayata Yojana

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6. Description of proposed items of manufacture & annual capacity(for which registration is sought)6.1 For New UnitsNo.Name of ItemAnnualCapacityEstimatedAnnual SalesRealization (inRs. lakhs)Estimated payable amount of Tax(VAT + CST) in which tax on rawmaterial is not included (` in lakhs)6.2 In case of expansion/diversification/ technology upgradationNo.NameofItemExistingAnnualCapacity orAverageProduction oflast 3 years(which ever ismore) – Pleaserefer to rule 3.7ProposedAdditional / NewCapacity forexpansion /diversification /Technology upgradationTotalAnnualCapacityEstimatedSalesRealizationfromadditionalcapacity/ newcapacity forone yearEstimated payableamount of Tax(VAT + CST) foradditional/ newcapacity, in whichtax paid on rawmaterialspurchased is notincluded7. (A) Number and date of EM Part-1, issuedby GM DTIC:(B)Number and date of EM Part-2, issuedby GM DTIC:8. Number and date of IEM issued byGovt. of India, Secretariat for IndustrialApproval/ Letter of intent/IndustrialLicence/Other approval:9. Power requirement (KVA) :4

Form No. 3Format for application for issuing a Certificate showing the Sales Tax paid by theUnit during the year, for which the Certificate is being issued.From: ................................(Name of the unit)................................ (Address)To,Sir,The Commercial Tax Officer,<strong>Madhya</strong> <strong>Pradesh</strong>, District .............................(M.P.)I request you to issue a certificate to the General Manager, District Trade andIndustries Centre, ................ and Managing Director, M.P. Trade & InvestmentFacilitation Corporation Ltd., Bhopal, under <strong>Madhya</strong> <strong>Pradesh</strong> <strong>Udyog</strong> <strong>Nivesh</strong><strong>Samvardhan</strong> <strong>Sahayata</strong> <strong>Yojana</strong> 2010, in Form No.4.1. Name of the unit/dealer and address ..........................................................................................................2. Project status New unit / Expansion/ Diversification /Tech.upgradation.3. Registration No. of the ......................................................dealer under the VAT Act 2002 & .....................................................Central Sales Tax Act, 1956.(whether the goods shown in columnNo. 5 are specified in the registrationCertificate)4. Registration No. & date of the dealer ......................................................issued by Managing Director ......................................................M P Trade & Investment FacilitationCorporation Ltd., Bhopal under <strong>Udyog</strong><strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong> <strong>Yojana</strong> 20101

5. Items of manufacture/annual capacity/actual sales/actual tax paid (for whichassistance is sought)(i)No.For New Units (for the claimed Year……………) (Tax paid on sales of items ofmanufactured in which tax paid on raw material purchased is not included)Actual & Assesed Tax AmountActual Sales inPaid (VAT+ CST) in which taxyear…………..paid on raw material purchasedName of Annualis not included inItem Capacityyear……………QuantityAmount(Rs.in lakh)MPCT/ VATCST Total(ii)(a)In case of expansion/diversification/ technology upgradationDetermination of Average Production of last 3 years.No.Name ofItemExistingannualcapacityProductionof last 1 styear ....Productionof last 2 ndyear ....Productionof last 3 rdyear ....AverageProduction oflast 3 yearsQty. Amt. Qty. Amt. Qty. Amt. Qty. Amt.(b)Production (for the claimed year …….....…)No.Nameof ItemExisting AnnualCapacity orAverageProduction oflast 3 years,which ever ismore refer RuleAdditional/New Capacityfor expansion/Diversification/TechnologyUpgradationTotalAnnualCapacityExisting/AveragecapacityActual Production in theyear…………Additional/ NewcapacityTotalQty. Amt. Qty. Amt. Qty. Amt.2

(c)NoTax paid on sales of goods (for the claimed year…...………) in which taxpaid on raw material purchased is not includedName ofthe ItemTax paid on sales ofExisting/Averagecapacity in the year………….. in whichtax paid on rawmaterial purchasedis not includedTax paid on sales ofAdditional/New capacityfor Expansion/diversification/Tech.upgradation in theyear …………… in whichtax paid on raw materialpurchased is not includedTotal Tax paid inthe year………. inwhich tax paid onraw materialpurchased is notincludedMPCT/VATCSTTotalMPCT/VATCSTTotalMPCT/VATCSTTotal6.(a) Tax paid on sales of goods under : Rs. (in words) ..................................the M.P. VAT Act 2002for the year ............., in which taxpaid on raw material purchased isnot included(b) Central Sales Tax paid under CST : Rs. (in words) ..................................Act 1956 on sales of Inter Statetrade or commerce madefrom M.P. for the year.............in which tax paid on raw materialpurchased is not included(c) Total Tax (a) + (b) paid for the : Rs.(in figure)....................................year ............................. Rs. (in words) ..................................7. Name of the Bank and it's branch: ......................................................with Bank account No.& challan No.through the payment was made.8. Total <strong>Udyog</strong> <strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong> taken upto the date of thisapplication by the unit.(A) Eligible fixed investment - Amount in Rs..............................(B) Amount of assistance taken by - Amount in Rs..............................the unit upto date of this application(C) Amount to be sanction in current - Amount in Rs..............................year under MPIIPAS (50% or 75%of tax deposited by unit)3

(D) Remaining balance amount of - Amount in Rs..............................<strong>Udyog</strong> <strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong>= [A – (B + C)]I duly verify that all the facts and figures furnished above are correct.Copy to :Signature.......................................Name & Status of the Applicant in the unit .....................................................................................................................................1. Managing Director, M P Trade & Investment Facilitation Corpn. Ltd., “AVNTower”, 192, Zone-I, M.P. Nagar, Bhopal - for necessary action please.2. General Manager, District Trade & Industries Centre .........................- fornecessary action please.3. Dy. Commissioner, Commercial Tax Division…………..Signature .......................................Name & Status of the Applicant in the unit ....................................................................................................................................4

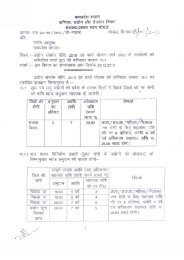

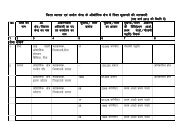

QkeZ&4dk;kZy; okf.kfT;d dj vf/kdkjhftyk-----------------------------------------------------------------------------------Øekad----------------------------- fnukad ---------------------------izfr]egkizca/kd]ftyk O;kikj ,oa m|ksx dsUnz]ftyk-----------------------------------------fo"k;%& vkS|ksfxd bdkbZ esllZ------------------------------------------------------------------------------------------------ds o"kZ ------------------------ esa tek dj jkf'k dh iqf"V ckcr~ A e/;izns'k m|ksxfuos'k lao/kZu lgk;rk ;kstuk 2010 ds vUrxZrAvkS|ksfxd bdkbZ esllZ ---------------------------------------------------------------------------------------------ds laca/k esa fuEu rF;ksa dk lR;kiu fd;k tkrk gS %&1- bdkbZ dk uke o irk %& ------------------------------------------------------2- ewY; lao)Zu dj vf/kfu;e 2002 ds %& ------------------------------------------------------vUrxZr iath;u Øekad3- dsUnzh; foØ; dj vf/kfu;e 1956 ds %& ------------------------------------------------------vUrxZr iath;u Øekad4- mDr nksuksa vf/kfu;eksa ds vUrxZr iathd`r%& ------------------------------------------------------oLrq,a5- e-iz- VªsM ,.M bUosLVesaV QsflfyVs'ku iath;u Ø- -------------------------------------dkiksZjs'ku fy- }kjk tkjh iath;u Ø- fnukad ----------------------------------------------,oa fnukad ,oa ntZ mRikfnr gksusokyh oLrqvksa dk C;kSjkØ-oLrq dk ukeuohu bdkbZokf"kZd {kerkfoLrkfjr bdkbZLFkkfirfoLrkfjrdqy6- o"kZ --------------------------------- esa bdkbZ Onkjk e/; izns'k esa mRikfnr fd;s x;soLrqvksa ds foØ; i'pkr~ tek dh x;h jkf'k] ftldk ewY; lao)Zu dj,oa dsUnzh; foØ; dj jkf'k dk vlslesaV bl foHkkx Onkjk fd;k tk pqdkgSA ¼lgk;rk ds izFke o"kZ ds fy;s dj fu/kkZj.k lR;kiu vko';d ughagSA½1

6-1 uohu LFkkfir bdkbZ ds fy;s %& o"kZ ------------------ esa mRikfnr eky dkfoØ; ,oa e/;izns'k esa gq, foØ; ds fo:) tek dj jkf'k] ftlesadPpseky ds Ø; ds fy;s pqdk, x;s dj dh jkf'k lfEefyr ugha gS %&okLrfod dj jkf'k k ftldk djo"kZ ----------- esa fd;kfu/kkZj.k gks pqdk gS ,oa ftlesaokf"kZd {kerk ¼ftykx;k foØ;Ø; fd;s x;s dPpseky dsO;kikj ,oa m|ksxmRiknpqdk, x, dj dh jkf'kØ-dkdsUnz }kjk tkjhlfEefyr ugha gS ¼jkf'k k iw.kZLFkkbZ iath;u izek.kuke:i;ksa esa½i=@mRiknu {kerkizek.k i= vuqlkj½dqyek=kjkf'k VAT CSTjkf'k6-2 foLrkj@'koyhdj.k@rduhdh mUu;u bdkbZ ds fy;s %&v½ foxr 3 o"kksZa ds vkSlr mRiknu dk fu/kkZj.kLFkkfir okf"kZdfoxr izFkefoxr f}rh;foxr r`rh;mRiknu {kerko"kZ ------- esao"kZ ------- esao"kZ ------- esa¼ftyk O;kikjmRiknumRiknumRiknumRikn,oa m|ksxØ-dkdsUnz }kjktkjh LFkkbZukeiath;u izek.kek=k jkf'k ek=k jkf'kek=kjkf'ki=@mRiknu{kerk izek.ki= vuqlkj½foxr rhu o"kksZ esavkSlr mRiknuek=kjkf'kc½bdkbZ }kjk o"kZ ----- esa fd;k x;k okLrfod mRiknu %&Ø-mRikndkukeLFkkfirokf"kZdmRiknu{kerk vFkokfoxr 3 o"kksZadk vkSlrmRiknu tksHkh vf/kd gksvfrfjDrfoLrkj@'koyhdj.k@ rduhdhmUu;u dh{kerkdqyokf"kZd{kerko"kZ ------- esa fd;k x;k okLrfodmRiknuLFkkfir @vfrfjDrdqyvkSlr{kerk dkmRiknumRiknumRiknuek=k jkf'k ek=k jkf'k ek=kjkf'k2

l½foLrkj@'koyhdj.k@rduhdh mUu;u bdkbZ ds fy;s o"kZ ----------- esa ekydk foØ; ,oa e/;izns'k esa gq, foØ; ds fo:) tek dj jkf'k ftlesadPpseky ds Ø; ds fy;s pqdk, x;s dj dh jkf'k lfEefyr ugha gS %&Ø-mRikn dkukeLFkkfir mRiknu {kerk @vkSlr mRiknu {kerk dsfy;s o"kZ ---------- esa pqdk;kx;k dj] ftlesa dPpsekyds Ø; ij pqdk;k x;k djlfEefyr ugha gSvfrfjDr foLrkj @'koyhdj.k@ rduhdhmUu;u dh {kerk dsmRikfnr eky ds o"kZ ---------esa foØ; eky dk pqdk;kx;k dj ftlesa dPpseky ddsØ; ij pqdk;k x;k djlfEefyr ugha gSo"kZ -------------- esa dqy pqdk;k x;kdj ftlesa dPpseky ds Ø; ijpqdk;k x;k dj lfEefyr ughagSVAT CST Total VAT CST Total VAT CST Total7- bdkbZ ds }kjk e/;izns'k VªsM ,.M bUosLVesaV QsflfyVs'ku dkiksZjs'ku fy-]Hkksiky }kjk tkjh iath;u izek.k i= ds vuqØe esa o"kZ ----------------- rdizkIr fuos'k lao)Zu lgk;rk dh dqy jkf'k dk fooj.k &(i) bdkbZ ds LFkkbZ iwath os"Bu vuqlkj ;kstukarxZr ekU; iwath fuos'k :-(ii) ;kstukarxZr iwoZ esa izkIr dqy lgk;rk jkf'k :-(iii) pkyw o"kZ esa bdkbZ }kjk tek dqy dj jkf'k ds fo:) ;kstukarxZrpkgh xbZ lgk;rk jkf'k ¼50 izfr'kr vFkok 75 izfr'kr½:-(iv)m|ksx fuos'k lao)Zu lgk;rk ;kstukarxZr bdkbZ ds fy;s 'ks"k miyC/klgk;rk jkf'k {(i) – [(ii) + (iii)]}:-¼gLrk{kj½okf.kfT;d dj vf/kdkjhftyk-------------------------------------izfrfyfi%&1½ izca/k lapkyd] e-iz- VªsM ,.M bUosLVesaV QsflfyVs'ku dkiksZjs'ku fyfe- 192],-Ogh-,u- VkWoj] tksu&1] ,e-ih- uxj] Hkksiky dh vksj lwpukFkZ A2½ vk;qDr] okf.kfT;d dj] e/;izns'k] bUnkSj dh vksj lwpukFkZ izsf"krA3½ mik;qDr] okf.kfT;d dj foHkkx] laHkkx ------------------ dh vksj lwpukFkZ izsf"krA4½ bdkbZ esllZ ------------------------dh vksj lwpukFkZ ,oa vko';d dk;Zokgh gsrq izsf"krAokf.kfT;d dj vf/kdkjhftyk --------------------------------3

Form No. 5Application form for Receiving assistance under<strong>Madhya</strong> <strong>Pradesh</strong> <strong>Udyog</strong> <strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong> <strong>Yojana</strong> 2010(To be submitted in duplicate)1. (a) Name of the applicant :Industrial Unit :(b) Factory Address :Telephone No. :Fax No. :e-mail address :(c) Address of the Registered Office :Telephone No. :Fax No. :e-mail address :(d) Name and Designation of the :contact personTelephone No. :Fax No. :e-mail Address :(e) Details of Fixed Assets/Property :(Please write address specifically ofproperty location or enclose aseparate sheet)(i) Assets/property in the name of :Company/Firm.(ii) Assets/property in the name of :directors/Partners of Company/Firm2. Whether the Project (against which the application for receiving assistance isbeing made) is for (Please write specifically)(a) Establishment of a new unit :(b) Expansion project in the :existing unit (expansion/diversification/technologyupgradation(c) Expansion project in a new :location3. (a) Constitution :Public Ltd./ Private Ltd.Co/Co-operative Society /Partnership Firm(b) Date of incorporation/Registration :of the Company/Co-operative Society4. Location/address of the unit :(A) Location of the project against which the assistance is soughtName of the Location :1

Police Station :Municipality/Block :Post Office :District :Telephone No. :Fax No. :(B) Location of other units(if any) in <strong>Madhya</strong> <strong>Pradesh</strong>Location :District :Location :District :Location :District :5. (A) Number and date of EM Part-1, issued by GM DTIC :(B)Number and date of EM Part-2, issued by GM DTIC:6. Number and date of IEM issued by Govt. of India :Secretariat for Industrial Approval ./Letter of intent/Industrial Licence/Other approval.7. Power load installed & :date of power connection8. Employment provided in the unit :No.ParticularPersons belongs to<strong>Madhya</strong> <strong>Pradesh</strong>Persons Out of<strong>Madhya</strong><strong>Pradesh</strong>Total1. Managerial2. Factory workers3. Other workers4. Total9. Whether the location conforms to :Pollution Control Board normsIf yes , write consent No. and date(a) Under air pollution act(b) Under water pollution act10. Daily requirement of water :and source of supply11. Registration No. of the ......................................................dealer under the VAT Act 2002 &Central Sales Tax Act, 1956. ......................................................2

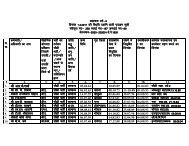

12. Registration No. & date of the dealer .......................................................issued by Managing Director .......................................................M P Trade & Investment FacilitationCorporation Ltd., Bhopal /GM DTIC, under <strong>Udyog</strong><strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong> <strong>Yojana</strong> 201013. Date of commissioning of the commercial production in original unit/date ofcommissioning of the commercial production in expansion/diversification/Tech.upgradation. .................. .................. ..................14. Project Cost / Eligible Investment (Upto the date of commencement ofCommercial Production)14.1(A)For New Units (Please furnish original certificate from Chartered Accountant)ParticularsInvestment made ason date ofcommencement ofcommercialproductionInvestment made in1/2/3 years from thedate ofcommencement ofCommercialProduction as on.........TotalInvestment after1/2/3 yearsLandSite development(10% of cost ofland & Building)BuildingPlant andmachineryElectricalInstallationPollution ControlEquipmentsMisc.fixed assetsTotalPreliminary andpreoperativeexpensesGrand Total3

14.1(B) Means of finance (Please funish certificate from Chartered Accountant)ParticularsShare capital/own fundsTerms Loan fromFinancial Institutions/BanksUnsecured LoansOther (if any)TotalAmount14.2(A) For Expansion/Diversification/Technology Upgradation Scheme: (Pleasefurnish certificate from Chartered Accountant) (Upto the date ofcommencement of Commercial Production)ParticularsLandOriginalInvestment as onDt. .......Actual Investment ason date of productioncommenced inExpansion/Diversification/TechnologyUpgradationExpn. Divr. Tech.upTotalInvestmentInvestmentmade in1/2/3 yearsfrom thedate ofcommencement ofCommercialProductionin Expan./Divr./ Tech.up/ capacityas on .........TotalInvestment after1/2/3yearsSitedevelopment(10% of costof Land &Building)BuildingPlant andmachineryElectricalInstallationPollutionControlEquipments4

Investment inTechnologyUpgradationMisc.fixedassetsTotalPreliminaryandpreoperativeexpensesGrand Total14.2.(B) Means of Finance (Please furnish certificate from Chartered Accountant)ParticularShare capital/Own fundsTerm Loan fromFinancial Institutions/BanksUnsecured LoansOther (if any)TotalAmount15. Items of manufacture/annual capacity/actual sales/actual tax paid (for whichassistance is sought )15.1 For New Units (for the claimed Year……………) (Tax paid on sales of itemsin which tax paid on raw material purchased is not included)No.Name ofItemAnnualCapacityActual Sales inyear…………..Actual & Assesed Tax AmountPaid (VAT+ CST) in which taxpaid on raw material purchasedis not included inyear……………Quantity Amount VAT CST Total5

15.2 In case of expansion/diversification/ technology upgradation(A)No.Determination of Average Production of last 3 years.Name ofItemExistingannualcapacityProductionof last 1 styear ....Productionof last 2 ndyear ....Productionof last 3 rdyear ....AverageProduction oflast 3 yearsQty. Amt. Qty. Amt. Qty. Amt. Qty. Amt.(B)No.Production (for the claimed year ………)ExistingAnnualAdditional/CapacityNew Capacityor Averagefor expansion/ProductionDiversificationof last 3/Technologyyears,Upgradationwhich everis moreNameofItemTotalAnnualCapacityActual Production in theyear…………Existing/AveragecapacityAdditional/ NewcapacityTotalQty. Amt Qty. Amt Qty. Amt.(B)Tax paid on sales of goods (for the claimed year…………) in which tax paidon raw material purchased is not includedNoName ofthe ItemTax paid on sales ofExisting/Averagecapacity in the year………….. in whichtax paid on rawmaterial purchasedis not includedMPCT/VATCSTTotalTax paid on sales ofAdditional/Newcapacity for Expansion/diversification/ Tech.upgradation in the year…………… in whichtax paid on rawmaterial purchased isnot included in whichtax paid on rawmaterial purchased isnot includedMPCT/CST TotalVATTotal Tax paid in theyear………. in whichtax paid on rawmaterial purchased isnot includedMPCT/VATCSTTotal6

16.(a) Tax paid on sales of goods : Rs. (in words) ..................................under the MPVAT Act 2002 for theyear .............in which tax paid onrawmaterial purchased is notincluded.(b) Central Sales Tax paid under CST : Rs. (in words) ..................................Act 1956 on sales of goods of InterState trade or commerce madefrom M.P. for the year..................in which tax paid onraw material purchased is notincluded.(c) Total Tax (a) + (b) paid for the: Rs.(in figure)....................................year .............. in which tax paid onrawmaterial purchased is notincluded. :Rs. (in words) ..................................17. Name of the Bank and it's branch : ........................................................with Bank account No. & Challan No.throughthe payment was made toCommercial Tax Department.18. Total <strong>Udyog</strong> <strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong> taken upto the date of thisapplication by the unit.(A) Eligible fixed investment - Amount in Rs..............................(B) Amount of assistance taken by - Amount in Rs..............................the unit upto date of this application(C) Remaining balance amount of - Amount in Rs..............................<strong>Udyog</strong> <strong>Nivesh</strong> <strong>Samvardhan</strong> <strong>Sahayata</strong>(A – B)7

CERTIFIED that the statement in the application are true to the best of myknowledge and belief.Signature of the applicantName and Status of the SignatoryPlace:Seal of the Industrial unit.Date:8

Annexures(a)A copy of the Registration with Memorandum and Articles of Associationissued by the Registrar of Companies.(b) A Statement of the Name and Residence Address of theDirector/partners/owners of the company, including telephone no., fax no. &e-mail addresses.(c)(d)(e)(f)A copy of the Acknowledgement Reference No. by SIA/Letter ofintent/Industrial licence/other Government of India approval/ Number and dateof EM Part-1&2, issued by GM DTIC.A Project report- including pollution control measures envisaged, from thesecond year claim project report does not require.Photocopy of sanction letter from the Central Financial Institution/StateFinancial Institution etc. sanctioning loan and other financial assistancetowards meeting the cost of the project, certified by a Director of thecompany.Copy of the audited balance-sheet for last 3 years. (in case of expansionproject)(g) A list of plant and machinery installed in the project (List included columns –name of machine – quantity – name of supplier – bill no. – date of purchase –value in Rs.)(h)(i)(j)(k)(l)Statement in respect of raw material consumed in the claimed year. (Listincluded columns – name – quantity – bill no. of supplier – date of bill –purchase value).Existing manufacturing activities in <strong>Madhya</strong> <strong>Pradesh</strong> stating items, annualapproved capacity, annual installed capacity, annual producition during lastthree years (in quantity & value in Rs.).List of sales of finish goods manufactured by the unit in the claimed year. (Listincluded columns – name – quantity – invoice no. – date of invoice – total salevalue – tax ( VAT & CST) amount – net sale value).Copy of the VAT & CST Registrations issued by Commercial TaxDepartment.Copy of Resolution passed by Board of Directors for assigning the powers toAuthorized Signatory.__________9

OFFICE OF THE GENERAL MANAGERDistrict Trade & Industries Centre .......................District ......................., <strong>Madhya</strong> <strong>Pradesh</strong>Form No. 6 (A)MPIIPAS – 2010No.SANCTION ORDERDateIn pursuance of the decision taken by the District Level Industrial AssistanceCommittee in its meeting No. ....................... held on ......................., an amount of Rs.................................... (in words) Rupees.......................................................................................................................... is herebysanctioned as an Industrial Investment Promotion Assistance (IIPA); under the<strong>Madhya</strong> <strong>Pradesh</strong> Industrial Investment Promotion Assistance Scheme – 2010(MPIIPAS) to M/s ...................................................................................................;hereinafter called Assistance Receiver, for the period ........................................,subject to the conditions and particulars mentioned here under :-Particulars1. Name of the unit :2. Location of industry :3. Category of the District :4.Registration Numbersa) under MPIIPAS – 2010 :b) under VAT Act :c) under CST ActPermanent SSI Registration/ EMPart-2, issued by GM DTIC,/No. & Date5. Date of commencement ofcommercial productionIEM::6. Eligible period for assistance :7. Maximum amount of assistance(IIPA) permissible i.e. total eligibleinvestment: Rs.8. Amount of Tax deposited during the : Rs.1

period ...............9. Eligible percentage of VAT & CSTdeposited by the unit for calculationof assistance:10.Amount sanctioned under MPIIPAS.2010,a) Amount sanctioned till previousyear .................b) Amount sanctioned for the period................. vide this order: Rs.: Rs.c) Total sanctioned amount : Rs.11. Maximum remaining eligible amountfor assistance [7 – 10(c)]: Rs.Conditions :1. that the Assistance Receiver shall execute an agreement with the StateGovernment or with their Authorized Representative; hereinafter calledAssistance Provider, in the enclosed format No. 7 with in 30 days of the issueof this order on the required stamp paper.2. that the Assistance Receiver binds himself with the provisions, terms,conditions of the scheme and of the said agreement.3. that the cheque/cheques towards the amount sanctioned through this orderwould be issued in the favour of Commercial Tax Officer ............... District...................... and an deposition would be treated as an advance tax depositedby Assistance Receiver for the particulars stated above. Thus, the amountreceiver acknowledges the receipt of Industrial Promotion Assistance from theAssistance Provider.4. that the assistance may have to be released in installments keeping in view ofthe budget constraints or any other reason and for that no interest would beleviable.5. that the said cheque/cheques would be sent to the concerned Commercial TaxOfficer through a covering letter addressed to him; however the same wouldbe delivered to the Assistance Receiver/ his Authorized Representative fortimely delivery to the concerned officer. It shall be the responsibility of theamount receiver to arrange the receipt of same from concerned officer and toget it delivered to Assistance Provider with in 15 days.General ManagerDistrict Trade & Industries Centre............2

No.DateCopy to :1. Industries Commissioner, Directorate of Industries, Bhopal2. Commissioner, Commercial Tax, Indore3. Managing Director, M.P. Trade & Investment Facilitation Corporation Ltd.,“AVN Tower”, Mezzanine Floor, 192, Zone – I, M.P. Nagar. Bhopal –462011.4. Deputy Commissioner, Commercial Tax Division ............5. Commercial Tax Officer, Distt. ............6. M/s .................................................. (Assistance Receiver)for information and necessary action.General ManagerDistrict Trade & Industries Centre............3

Form No. 6 (B)MPIIPAS – 2010M.P. TRADE & INVESTMENT FACILITATION CORPORATION LIMITED(Government of <strong>Madhya</strong> <strong>Pradesh</strong> Undertaking)AVN Tower”, Mezzanine Floor, 192, Zone – I, M.P. Nagar. Bhopal – 462011No. MPIIPAS-10/CLM/........../2010..../DateSANCTION ORDERIn pursuance of the decision taken by the State Level Industrial InvestmentPromotion Assistance Committee in its meeting No. ....................... held on......................., an amount of Rs...............................(in words Rupees..................................................................................) is hereby sanctioned as anIndustrial Investment Promotion Assistance (IIPA); under the <strong>Madhya</strong> <strong>Pradesh</strong>Industrial Investment Promotion Assistance Scheme – 2010 (MPIIPAS) toM/s .......................................................................................................; hereinaftercalled Assistance Receiver, for the period ........................................, subject to theconditions and particulars mentioned here under :-Particulars1. Name of the unit :2. Location of industry :3. Category of the District :4.Registration Numbersd) under MPIIPAS – 2004 :e) under VAT Act :f) under CST Actg) Permanent SSI Registration /IEM No. & Date5. Date of commencement ofcommercial production::6. Eligible period for assistance :7. Maximum amount of assistance(IIPA) permissible i.e. totaleligible investment8. Amount of Tax deposited duringthe period ...............9. Eligible percentage of VAT &CST deposited by the unit forcalculation of assistance: Rs.: Rs.:1

10.Amount sanctioned under MPIIPAS.2010,d) Amount sanctioned tillprevious year .................e) Amount sanctioned for theperiod ................. vide thisorder: Rs.: Rs.f) Total sanctioned amount : Rs.11. Maximum remaining eligibleamount for assistance [7 – 10(c)]Conditions :: Rs.6. that the Assistance Receiver shall execute an agreement with the StateGovernment or with their Authorized Representative; hereinafter calledAssistance Provider, in the enclosed format No. 7 with in 30 days of the issueof this order on the required stamp paper.7. that the Assistance Receiver binds himself with the provisions, terms,conditions of the scheme and of the said agreement.8. that the cheque/cheques towards the amount sanctioned through this orderwould be issued in the favour of Commercial Tax Officer ............... District...................... and this deposition would be treated as an advance tax depositedby Assistance Receiver for the particulars stated above. Thus, the amountreceiver acknowledges the receipt of Industrial Promotion Assistance from theAssistance Provider.9. that the assistance may have to be released in installments keeping in view ofthe budget constraints or any other reason and for that no interest would beleviable.10. that the said cheque/cheques would be sent to the concerned Commercial TaxOfficer by registered post with the intimation to the Assistance Receiver. Itshall be the responsibility of the Assistance Receiver to arrange the receipt ofsame from concerned Commercial Tax Officer and submitting it to theAssistance Provider within 15 days.Managing DirectorM.P. Trade & Investment FacilitationCorporation Ltd., Bhopal2

No. MPIIPAS-04/CLM/........./200..../Copy to :Date1. Industries Commissioner, Directorate of Industries, Bhopal2. Commissioner, Commercial Tax, M.G. Road, Moti Bungalow Parisar, Indore3. General Manager, District Trade & Industries Centre, ....................4. Deputy Commissioner, Commercial Tax Division ............5. Commercial Tax Officer, Distt. ............6. M/s .................................................. (Assistance Receiver)for information and necessary action.Managing DirectorM.P. Trade & Investment FacilitationCorporation Ltd., Bhopal3

Form No. 7AGREEMENT REGARDING ASSISTNACE RECEIVED UNDER UDYOGNIVESH SAMVARDHAN SAHAYATA YOJANA 2010,his agreement is made on this ................... day of ............ 20.... between theGovernor of <strong>Madhya</strong> <strong>Pradesh</strong>, acting through the MANAGING DIRECTOR,MADHYA PRADESH TRADE AND INVESTMENT FACILITATIONCORPORATION LIMITED, BHOPAL (herein after called the "Assistance Provider"which expression shall, where the context so admits include his successors in office)on the one part and Shri ................................................S/o ...................................Resident of ............................................................... in the tehsil of .........................district ........................ on behalf of M/s. ……...............................................................(hereinafter called the "Assistance Receiver" which expression shall, where thecontext so admits include his heirs, administrators, representatives and assigns) onthe other part.WHEREAS the Assistance Provider has sanctioned assistance under <strong>Madhya</strong><strong>Pradesh</strong> Industrial Investment Promotion Assistance Scheme 2010; hereinaftermentioned as MPIIPAS to the Assistance Receiver subject to the terms andconditions herein after mentioned:-AND WHEREAS the Assistance Receiver accepted the above assistanceunder MPIIPAS on the terms and conditions herein after mentioned.Now, therefore, the agreementfollows:-witnesses and it is hereby agreed as1. That this agreement shall always be subject to the terms and conditions andinstructions of MPIIPAS.2. That in persuance of MPIIPAS the Assistance Provider has sanctioned anamount of Rs. ............../- (in words Rs. ....................................................)for the period ................. to ................ as an assistance to Assistance Receivervide sanction order No. ........... dt............3. That this assistance is not be available in respect of the purchase tax on theraw material consumed or used, incidental goods used in manufacturing ofgoods in such industrial units and pakaging materials used in the packing ofgoods; manufactured in the industrial unit, and is available only on – .....%of tax deposited after the sales of the principal products manufactured in thesaid industrial unit and by-products, waste products obtained in the course ofmanufacture in such units in previous year.4. (a) that if Assistance Receiver establishes a new industrial unit but closesdown or deliberately reduces production substantially in an existingindustrial unit within the state, engaged in production of the same1

(b)product, the assistance shall be liable to be cancelled by the authoritysanctioning and such cancellation shall take effect from the date onwhich such substantial reduction in production has taken place.that a substantial reduction in production shall be deemed to haveoccurred if the production of the same product has fallen below thelevel of the average production of the preceding 3 years of existingindustrial unit.5. Assistance Receiver confirms that in his claim the non eligible items asdeclared by the government with reference to this scheme have not beenincluded.6. that the Assistance Receiver shall maintain or cause to be maintained ingood condition the premises, building, machinery, tools etc., described in theschedule attached and shall ensure the running of industial unit not onlyduring the eligibility period i.e. from the date ................. up to date ................but also continue to do so for a period of five years from the date of expiry ofthe period of eligibility.7. (a) The Assistance Receiver shall not change the location of the whole orpart of the industrial unit or effect any substantial contraction or disposeoff any substantial part of his total capital investment or effect anychange in the ownership during the period for which assistance underMPIIPAS has been availed of and also within a period of five years fromthe date of expiry of the period of receiving the assitance without theprior permission of the Managing Director, <strong>Madhya</strong> <strong>Pradesh</strong> Trade &Investment Facilitation Corporation Limited, Bhopal in writing.(b)that in case a change in ownership is permitted all the rights andliabilities under MPIIPAS shall pass on the new owner.8. that the Assistance Receiver shall be bound to permit the Assistance Provideror any person deputed or authorized by general or special order in writing inthis behalf by the Assistance Provider to inspect the Property (Premises,building, plants and machinery, tool etc.,) and Books of Accounts & theindustry business or enterprise.9. that the Assistance Receiver shall maintain a ledger/Books of Accountsincluding details of materials purchased and products sold for which facilityof receiving of Assistance under MPIIPAS has been availed of and shallfurnish annual statement of production and sales to the General Manager,District Industries Centre and also to the appropriate Sales Tax Officer within60 days from the close of the accounting year, for the eligibility period andthereafter another 5 years.10. that the Assistance receiver shall provide employment to bonafide residents ofthe State of <strong>Madhya</strong> <strong>Pradesh</strong>, which shall not be less than 50% during eachyear of the period of eligibility, of the total number of employees in hisindustrial unit, and such assistance receiver shall submit an affidavit for each2

year, and such affidavit may be verified on sample basis by the officers of theCommerce, Industry and Employment Department, i.e. concerned GeneralManager, DTIC.11. that the Assistance Receiver expressly agrees that the Assistance Providerhas granted the said assistance under MPIIPAS relying on the statementmade in the application dated ................... for sanctioning the assistance andinformation furnished by the Assistance Receiver. The Assistance Receiverconfirms that the information furnished by him are true to his knowledge andbeliefs and no facts have been suppressed and has not been obtained bymis-representation as to the essential facts or by furnishing false information.In case after issue of sanction order under MPIIPAS or releasing theassistance, it is revealed that the assistance had been obtained bymisrepresentation of facts or information, the amount of the assistanceavailed by the Assistance Receiver till date shall be recoverable from him atonce together with penal interest at the rate of 24% per annum.12. that on breach of any of the conditions of the agreement and of any contidionof MPIIPAS, the amount of Assistance shall be recovered from the AssistanceReceiver at once together with interest @ 24 per annum.13. that any amount due under this agreement may be recovered from theAssistance Receiver as an arrear of land revenue.14. that if any dispute arises between the parties hereto, in respect of thisagreement or any of the provision herein contained or any thing arising hereabout, the same shall be referred to Principal Secretary / Secretary to theGovernment of <strong>Madhya</strong> <strong>Pradesh</strong>] Commerce, Industries & EmploymentDepartment for arbritation and whose deicision thereon shall be final andbinding on the parties.In witness where of the parties here to have signed this agreement on thedate and year written in each case.Witness :1................................................……………………………….2................................................………………………………..Witness :1................................................……………………………….2. .............................................Assistance Provider( )Managing Director, <strong>Madhya</strong><strong>Pradesh</strong> Trade and InvestmentFacilitation Corporation Ltd.,Bhopal /On behalf of the Governor of<strong>Madhya</strong> <strong>Pradesh</strong>Assistance Receiver(------------------)Signature & Namefor M/s. -----------------------------(Scheduled attached as per conditions 6 of the agreement)3

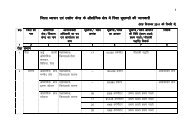

SCHEDULE(As per condition No. 6)The Assistance Receiver shall maintain or cause to be maintained in goodcondition the premises, building, machinery, tools etc., described in the scheduleattached and shall ensure the running of industial unit not only during the eligibilityperiod i.e. from the date ----------------- up to date ----------------- but also continue todo so for a period of five years from the date of expiry of the period of eligibility.S. No. Particulars Total Investment(Rs. in Lakhs)1 LandLocation2 BuildingTotal Constructed Area ……………………….3 Plant & MachineryList enclosed ………………….4 Pollution Control EquipmentsList enclosed5 Misccelleneous fxed AssetsList enclosedTotalAssistance Receiver(-------------------------)For M/s ------------------------------------------Address ----------------------------------------Assistance Provider( )Managing Director, <strong>Madhya</strong> <strong>Pradesh</strong>Trade and Investment FacilitationCorporation Ltd., BhopalOn behalf of the Governer of <strong>Madhya</strong><strong>Pradesh</strong>.4