Vietcombank (HSX: VCB) - VCSC - Content Management System

Vietcombank (HSX: VCB) - VCSC - Content Management System

Vietcombank (HSX: VCB) - VCSC - Content Management System

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

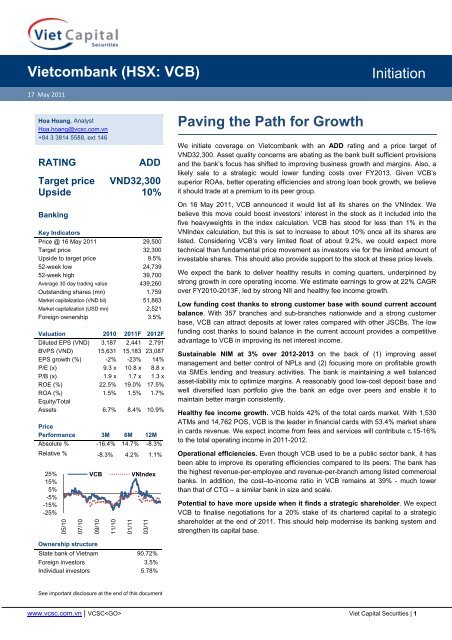

<strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>)Initiation17 May 2011Hoa Hoang, AnalystHoa.hoang@vcsc.com.vn+84 3 3814 5588, ext 146RATINGADDTarget price VND32,300Upside 10%BankingKey IndicatorsPrice @ 16 May 2011 29,500Target price 32,300Upside to target price 9.5%52-week low 24,73952-week high 39,700Average 30 day trading value 439,260Outstanding shares (mn) 1,759Market capitalization (VND bil) 51,883Market capitalization (USD mn) 2,521Foreign ownership 3.5%Valuation 2010 2011F 2012FDiluted EPS (VND) 3,187 2,441 2,791BVPS (VND) 15,631 15,183 23,087EPS growth (%) -2% -23% 14%P/E (x) 9.3 x 10.8 x 8.8 xP/B (x) 1.9 x 1.7 x 1.3 xROE (%) 22.5% 19.0% 17.5%ROA (%) 1.5% 1.5% 1.7%Equity/TotalAssets 6.7% 8.4% 10.9%PricePerformance 3M 6M 12MAbsolute % -16.4% 14.7% -8.3%Relative % -8.3% 4.2% 1.1%25%15%5%-5%-15%-25%05/1007/10<strong>VCB</strong>09/1011/1001/11VNIndex03/11Paving the Path for GrowthWe initiate coverage on <strong>Vietcombank</strong> with an ADD rating and a price target ofVND32,300. Asset quality concerns are abating as the bank built sufficient provisionsand the bank’s focus has shifted to improving business growth and margins. Also, alikely sale to a strategic would lower funding costs over FY2013. Given <strong>VCB</strong>’ssuperior ROAs, better operating efficiencies and strong loan book growth, we believeit should trade at a premium to its peer group.On 16 May 2011, <strong>VCB</strong> announced it would list all its shares on the VNIndex. Webelieve this move could boost investors’ interest in the stock as it included into thefive heavyweights in the index calculation. <strong>VCB</strong> has stood for less than 1% in theVNIndex calculation, but this is set to increase to about 10% once all its shares arelisted. Considering <strong>VCB</strong>’s very limited float of about 9.2%, we could expect moretechnical than fundamental price movement as investors vie for the limited amount ofinvestable shares. This should also provide support to the stock at these price levels.We expect the bank to deliver healthy results in coming quarters, underpinned bystrong growth in core operating income. We estimate earnings to grow at 22% CAGRover FY2010-2013F, led by strong NII and healthy fee income growth.Low funding cost thanks to strong customer base with sound current accountbalance. With 357 branches and sub-branches nationwide and a strong customerbase, <strong>VCB</strong> can attract deposits at lower rates compared with other JSCBs. The lowfunding cost thanks to sound balance in the current account provides a competitiveadvantage to <strong>VCB</strong> in improving its net interest income.Sustainable NIM at 3% over 2012-2013 on the back of (1) improving assetmanagement and better control of NPLs and (2) focusing more on profitable growthvia SMEs lending and treasury activities. The bank is maintaining a well balancedasset-liability mix to optimize margins. A reasonably good low-cost deposit base andwell diversified loan portfolio give the bank an edge over peers and enable it tomaintain better margin consistently.Healthy fee income growth. <strong>VCB</strong> holds 42% of the total cards market. With 1,530ATMs and 14,762 POS, <strong>VCB</strong> is the leader in financial cards with 53.4% market sharein cards revenue. We expect income from fees and services will contribute c.15-16%to the total operating income in 2011-2012.Operational efficiencies. Even though <strong>VCB</strong> used to be a public sector bank, it hasbeen able to improve its operating efficiencies compared to its peers. The bank hasthe highest revenue-per-employee and revenue-per-branch among listed commercialbanks. In addition, the cost–to-income ratio in <strong>VCB</strong> remains at 39% - much lowerthan that of CTG – a similar bank in size and scale.Potential to have more upside when it finds a strategic shareholder. We expect<strong>VCB</strong> to finalise negotiations for a 20% stake of its chartered capital to a strategicshareholder at the end of 2011. This should help modernise its banking system andstrengthen its capital base.Ownership structureState bank of Vietnam 90.72%Foreign investors 3.5%Individual investors 5.78%See important disclosure at the end of this documentwww.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 1

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDFigure 6: High proportion of net interest income thanks to high NIMUnit: % 2007 2008 2009 2010 2011F 2012F 2013FCredit growth 44.1% 15.5% 25.6% 24.8% 20.0% 20.0% 18.0%NIM 2.5% 3.4% 2.9% 3.1% 3.1% 3.3% 3.2%Net interest income 71.1% 74.1% 70.0% 71.1% 71.4% 70.9% 68.1%Non-interest income 28.9% 25.9% 30.0% 28.9% 28.6% 29.1% 31.9%Source: <strong>VCB</strong>, <strong>VCSC</strong> summaryWe expect the bank will be able to maintain its NIM at 3% over 2013 on the back of (1) improvingasset management and better control of NPLs, and (2) more on profitable growth via SMEs lendingand treasury activities. The bank is maintaining a well balanced assets-liability mix to optimizemargins. A reasonably good low-cost deposit base and well diversified loan portfolio give the bank anedge over peers and enable it to maintain better margins consistently.Improving asset management thanks to prudence control of NPL – lowering NPL with largebalance in provision reservesAs an ex-SOCB with a large exposure to SOEs, <strong>VCB</strong>’s lending structure has been geared toward biggovernmental projects and SOEs. Inefficiencies of large governmental projects beset the bank’s loanquality which is why its NPLs (non performing loans) have consistently been higher than those ofJSCBs.Since 2010, in advance of the SBV requirements in compliance with international standards, <strong>VCB</strong>applied a new qualitative credit scoring system which classifies credit based on both quality andquantity. The new classification system may be imposed by the SBV by the end of 2011 when a newcircular on credit rating is promulgated, which could lead to significant increase in the industry NPLs.At this point, only BIDV and <strong>VCB</strong> have applied the new credit scoring system. Thanks to largeprovisions made in prior years, NPLs at <strong>VCB</strong> have gradually dropped but remain well above its peers.Figure 7: NPLs have returned to manageable level at2.8%...Figure 8: But still high compared to other peers5.0%4.0%3.0%2.0%1.0%0.0%4.6%3.6%3.3%2.7%2.5% 2.8%300%250%200%150%100%50%0%Provisions/NPL %2.8%NPL % (LHS)0.7%0.3% 0.5% 1.4%3.0%2.5%2.0%1.5%1.0%0.5%0.0%2005 2006 2007 2008 2009 2010<strong>VCB</strong> CTG ACB STB EIBSource: <strong>VCB</strong>, <strong>VCSC</strong> summaryThe bank has in the past exercised prudence as far as provisioning is concerned,consistently providing more than the industry average. In 2010, the bank set aside VND5,600bnprovisions, equivalent to the bank’s PBT that year. At their current level, <strong>VCB</strong>’s provisions fully coverits NPLs. As the high interest rate environment persists, large balances of provision reserves assure<strong>VCB</strong>’s credit quality and should buffer its bottom line.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 4

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDFigure 9: High NPL (% NPL/total loans)Figure 10: But sound provision reserves (%provision/NPL)5.0%4.0%3.0%2.0%1.0%0.0%4.6%3.6%3.3%2.7%2.5% 2.8%2005 2006 2007 2008 2009 2010VND bn Loan Provisions % provision/NPL (rhs)6,000140%5,000120%4,000100%3,00080%60%2,00040%1,00020%-0%2005 2006 2007 2008 2009 2010Source: <strong>VCB</strong>, <strong>VCSC</strong> summaryThe NPL is expected to moderate in the coming years once the bank restructures its loan portfoliotowards retail and SMEs lending which can afford higher interest rates and have better projectfeasibility resulting in lower risks.Figure 11: NPL ratios2007 2008 2009 2010 2011F 2012F 2013FNPL (%) 3.3% 4.6% 2.5% 2.8% 2.8% 2.8% 2.8%Provision coverage 65% 80% 132% 114% 123% 122% 117%Source: <strong>VCSC</strong>Focusing more on profitable growth via SMEs lending and treasury activitiesSOEs and large corporations are <strong>VCB</strong>’s largest depositors and they are also its main borrowers –accounting for around 62% of total lending in 2010. From 2008, <strong>VCB</strong> has reduced its lending exposureto SOEs from 47% of total outstanding loans to 35% in 2010, partly because of the privatisationprocess of some SOEs. The bank has shifted its focus to lending to higher yielding segments retailand SMEs, consequently total outstanding loans to these segments have increased from 35% in 2008to 38% in 2010.Figure 12: Change in <strong>VCB</strong> composition of loan portfolio toward retail and SMEs lendingSMEs26%Retails9%2008SOEs47%SMEs28%Retails10%2010SOEs35%Largecorp.18%Largecorp.27%Source: <strong>VCB</strong>, <strong>VCSC</strong> summarywww.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 5

17 May2011<strong>Vietcombank</strong>(<strong>HSX</strong>: <strong>VCB</strong>)ADDFurthermore, as a market leader with a considerable capital base, <strong>VCB</strong> benefits from being a netlender in the interbank market.<strong>VCB</strong> has increased its treasury activities in the interbank marketbyincreasing the proportion of assets-at-other-credit-institutions-over-total-assets from 14% in 2008to26%in 2010.Strong stream offee based income - Income from services and fees, especially card serviceswill play a greater role in income contribution in the years to come.Witha young population and ever increasingdemand formodern payment methods, personal creditcards are expected to have a strong value growth of CAGR9% over the next five years (2011-2015).Figure 13: Financial cards in value (VND trillion)Figure 14: <strong>VCB</strong> is market leader in financial cards70060050040030020010002008 20092010 2011 2012 2013 20142015100%80%60%40%20%0%15.3%ATM26.5%POS53.4%CardrevenueOthersSTBACBCTGBIDVAgribank<strong>VCB</strong>Source: <strong>VCB</strong>, <strong>VCSC</strong> summaryCurrently, <strong>VCB</strong> holds 42% of the total card market including international credit cards (Visa,MasterCard, American Express, JCB and Diners Club) anddomestic debit cards (Connect 24). Havingthe largest POS network in Vietnam with 14, 762 POS connections (26%market share) and second inATMnetworks with 1,530 ATMs (15% market share), <strong>VCB</strong> is in a good position toattract demanddeposits from individuals. In addition, at theend of 2010, <strong>VCB</strong> had 4.7 million domestic debit cardholders (18% market share), 446,000 international debit cardholders (30% market share) and 197, 000credit cardholders(30% market share). Fees and commission incomecontributed 12.3% of <strong>VCB</strong>’stotal operating income in 2010. Expected income increase from this sector is forecastto be 15-16%ofthe total operatingincome in 2011-2012 and 18% in 2013.Figure 15: Fees and commissions will increase their contribution to <strong>VCB</strong>’s non-interest income2007Feee and commissions (VND bn) 601% total operatingincome 10.4%2008 2009 2010 2011F 20102F 2013F791 989 1,4161,967 2,595 3,4208.8% 10. .7% 12.3%14.6% 15.6% 18.0%Source: <strong>VCB</strong>, <strong>VCSC</strong>C summaryHighoperational efficienciesPublic sector banks are usuallyassociated with poor employee productivity and archaic HR practices.However, <strong>VCB</strong> has been able to improve itsoperating efficiencies compared to its peers. The bankhas the highest revenue per employee at VND1.01bn/employee and revenue/branchatVND150bn/branch, among commercial banks. In addition, the cost to income ratio in <strong>VCB</strong> stayss at39%- much lowerthan that of CTG.www.vcsc.com.vn | <strong>VCSC</strong>Viet Capital Securities| 6

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDFigure 16: High operational efficiencyVND bn200Operating income /branchOperating income /employeeVND bn1.51.011500.861000.760.59500.82 1.00.500.0<strong>VCB</strong> CTG ACB STB EIBFigure 17: Low Cost to income ratio60%49%50%39%40%39%43%30%28%20%10%0%<strong>VCB</strong> CTG ACB STB EIBSource: <strong>VCB</strong>, <strong>VCSC</strong> summarySound portfolio investmentTrading and investment securities at <strong>VCB</strong> are mostly debt investments, including government bonds(31%), other financial institutions’ bonds (46%) and corporate bonds (23%). <strong>VCB</strong> has no short-termequity investment.Most of <strong>VCB</strong>’s equity investments are long-term investments at smaller banks. As a large state-ownedcommercial bank, <strong>VCB</strong> invested in its peers such as EIB, MB, OCB to provide financial or strategicsupport. Based on current market values, we estimate an unrealised gain of c.VND1,000bn in longterminvestments.Figure 18: Major long-term equity investmentsUnit: VND mn % ownership Charter cap Market value Book valueUnrealizedgain/lossEIB 8.19% 10,560 1,254,053 582,065 671,988SGB 5.26% 1,800 94,680 123,452 (28,772)MB bank 11.00% 7,300 1,204,500 966,642 237,858Gia Dinh Bank 3.83% 2,000 76,600 116,833 (40,233)OCB 4.67% 2,635 123,055 137,907 (14,853)Petrolimex Insurance 10.00% 400 40,000 67,900 (27,900)PVD 2.56% 2,097 263,048 55,945 207,103Total 3,055,935 2,050,744 1,005,191Source: <strong>VCB</strong>, <strong>VCSC</strong> summaryLarge land assets at low book value<strong>VCB</strong> has 110 properties at prime locations in major cities that are used as the bank’s branches andtrading offices, of which 35% of the properties are owned, 45% are leased for over 50 years and 19%rented with land use rights of less than 50 years.Currently, the combined book value of its land is at VND324bn, which considerably understatescurrent values, considering that the majority of these properties are located in key areas of each city.The most valuable real estate are properties the bank owns in Hanoi, Ho Chi Minh City, Hai Phong, DaNang, and Vung Tau.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 7

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDFigure 19: Summary of <strong>VCB</strong>’s propertiesProperties % Total area (m2) %Permanent possession 39 35% 38,800 21%Land use right of over 50 years 50 45% 104,028 56%Land use right of less than 50 years 21 19% 43,477 23%Total 110 100% 186,305 100%Source: <strong>VCB</strong> prospectusWe estimate the market value of the 39 fully owned real estate properties could provide an excessvalue to book of around VND1,200bn.Figure 20: Summary of <strong>VCB</strong>’s permanent possession propertiesLocationNo. of Total areas Estimated Total valueproperties (m2) price/m2 (VNDmn)Ha Noi, HCMC 10 4,856 80 388,480Hai Phong, Da Nang, Vung Tau 6 9,111 50 455,550Other provinces 23 24,833 30 744,990Total 39 38,800 160 1,589,020Less: current book value 323,645Excess to book value 1,265,375Source: <strong>VCSC</strong> estimateStrategic shareholders and capital surplusSince its equitisation in 2008, <strong>VCB</strong> has been unable to find a strategic partner due to regulation whichset the price a strategic would have to pay.A change in regulation now allows <strong>VCB</strong> to negotiate with strategic partners which should facilitate theprocess in 2011. <strong>VCB</strong> expects to finalise negotiations for a 20% stake in 2011. This should helpmodernise its banking system and strengthen its capital base.In addition, part of the capital surplus of the IPO, a sum of c.VND987bn, had been withheld until astrategic partner was found. However, at the end of 2010, this amount was brought into the bank’sequity which implies the bank can use these funds to develop its infrastructure.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 8

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDEarnings OutlookCredit and deposit growthThe SBV is tightening monetary policies with credit growth to be lowered below 20%. With a largemarket share in lending activities, we expect <strong>VCB</strong> to have a credit growth of 20% - equivalent to theindustry average.As for deposit growth, official mobilisation rates capped at 14% will inevitably restricts the bank fromattracting more capital from domestic customers. Should banks be allowed to increase deposit rates,we could expect more customers to convert their foreign currencies and gold to Vietnam Dong.Figure 21: Key growth ratios2007 2008 2009 2010 2011F 2012F 2013FAsset growth 18.1% 12.5% 15.0% 20.4% 15.1% 17.5% 14.1%Loans growth 44.1% 15.5% 25.6% 24.8% 20.0% 20.0% 18.0%Deposit growth 26.5% 10.9% 7.6% 21.1% 15.0% 15.0% 15.0%Source: <strong>VCSC</strong>Since Q2/2010, SBV has allowed commercial banks to negotiate lending rates to customers,regardless of the maximum 150% of the prime rate as stated in civil law. With that development,commercial banks have been able to increase their average gross yield, which is equal to interestincome/interest earning assets. The 2011 average funding cost is also estimated to increase slightlycompared with that in 2010, resulting in a net spread of around 2.83% in 2011. In 2012, upon finding astrategic partner, <strong>VCB</strong>’s funding cost should be drop accordingly. We expect <strong>VCB</strong> to have a NIM of3.1% in 2011 and be able to attain a NIM of 3.2% in 2012-2013.Figure 22: Profitability ratios2007 2008 2009 2010 2011F 2012F 2013FAverage funding cost 4.41% 5.65% 4.12% 4.87% 4.95% 4.60% 4.40%Average gross yield 6.86% 8.81% 6.74% 7.68% 7.78% 7.60% 7.40%Net spread 2.45% 3.16% 2.62% 2.81% 2.83% 3.00% 3.00%Net interest margin 2.47% 3.39% 2.86% 3.06% 3.08% 3.27% 3.22%Source: <strong>VCSC</strong>Income growthThe bank’s key earning driver will continue to be net interest income, supported by high lending rates.We see a recovery in import and export activities in 2011, to boost foreign exchange growth to around15% in 2011 and 20% in 2012-2013.Figure 23: Income growth ratios2007 2008 2009 2010 2011F 2012F 2013FNet interest incomegrowth 7.4% 61.5% -1.9% 26.0% 17.2% 22.6% 10.0%Net fee andcommission incomegrowth 9.7% 31.5% 25.1% 43.2% 38.9% 31.9% 31.8%Foreign exchangegrowth 29.6% 169.1% -3.7% -38.8% 15.0% 20.0% 20.0%Dividend growth -33.9% -18.1% 577.4% 24.1% 15.0% 15.0% 15.0%Source: <strong>VCSC</strong>www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 9

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDOperating expensesSince 2008, <strong>VCB</strong> has increased its operating expenses to compensate for the previously low level ofwages in comparison with other joint-stock commercial banks. As such, we expect the cost to incomeratio for <strong>VCB</strong> to be around 39-41% for the period 2011-2013.Figure 24: Expense ratios2007 2008 2009 2010 2011F 2012F 2013FCost to income ratio 28.2% 29.0% 37.6% 39.4% 40.5% 39.4% 40.6%Operating expensegrowth 26.1% 59.3% 34.7% 30.1% 20.0% 20.0% 18.0%Source: <strong>VCSC</strong>ValuationWe initiate coverage on <strong>Vietcombank</strong> with an ADD rating and a price target of VND32,300. Assetquality concerns are abating as the bank built sufficient provisions and the bank’s focus hasshifted to improving business growth and margins. Also, a likely sale to a strategic would lowerfunding costs over FY2013. Given <strong>VCB</strong>’s superior ROAs, better operating efficiencies andstrong loan book growth, we believe it should trade at a premium to its peer group.We expect the bank to deliver healthy results in coming quarters, underpinned by strong growth incore operating income. We estimate earnings to grow at 22% CAGR over FY2010-2013F, led bystrong NII and healthy fee income growth. We have adopted a conservative stance on asset qualityand we have factored in higher credit costs in FY2011. At a PB of 1.4x FY2012F, the risk-reward isfavourable for c.1.6% ROA and c.17.5% ROE over FY2011-2013F.For regional peers, we chose banks in emerging Asia as these countries have some geographicalproximity to and economic development level with Vietnam. Within each country, we select banks withmarket capital from USD500mn to USD10bn, with some adjustments to exclude the outliners. Thesebanks yield an average PB of 1.9x, ROE of 16.4% and ROA of 1.4% in FY2010.Figure 25: Regional peersAvg. MarketcapP/E P/B ROE LF ROA LFCountry(USD mn) (x) (x) (%) (%)China 6,415.3 10.3 1.8 18.8 1.10Thailand 5,365.8 19.1 1.9 12.9 1.19Malaysia 3,267.1 10.4 1.8 14.9 1.01Indonesia 3,084.0 22.0 2.5 16.1 1.67India 2,170.8 8.3 1.4 17.3 1.00Philippines 1,883.4 13.0 1.8 14.8 1.74Pakistan 1,218.3 7.4 1.3 19.0 2.02Sri Lanka 768.8 15.5 2.4 17.3 1.58Average 3,021.7 13.3 1.9 16.4 1.4<strong>VCB</strong> 2,521.1 11.2 2.4 22.2 1.5Source: Bloombergwww.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 10

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDFor local peers, we chose the largest listed joint-stock commercial banks in Vietnam. The average PBand ROA of Vietnamese banks are similar to those of Asia’s emerging markets. As for <strong>VCB</strong>, FY10 PBwas 2.4x due to the fact that the increase in charter capital was recorded only after the balance sheetdate.Figure 26: Local peersMarket Avg. Market Avg. Totalprice capAssetsP/E P/B ROE LF ROA LFBanks(VND bn) (VND bn) (x) (x) (%) (%)CTG VN Equity 29,500 49,731 367,932 12.1 2.4 19.8 1.1ACB VN Equity 22,000 20,539 205,802 8.2 2.6 21.8 1.2EIB VN Equity 15,000 15,840 131,128 8.2 1.8 13.4 2.0STB VN Equity 12,400 11,382 152,561 5.6 1.1 15.2 1.5Average 214,356 8.5 2.0 17.5 1.4<strong>VCB</strong> VN Equity 29,500 51,883 307,615 11.2 2.4 22.0 1.5Source: BloombergRisksHigh interest rate environment and high NPL due to exposure to SOEs debtsHigh interest rates increase risks for banks as only risky projects can accumulate higher profits to payhigh interest rates (19-20%). The possibility of higher non-performing loans can weaken the bottomline with more provision. Also, in a high interest rate environment, banks are exposed to more risksdue to customers defaulting on loans.Figure 27: Short-term deposit rate - now capped at14%/year...16.0 % 14.02010.7 157.08.1106.75014.012.010.08.06.04.02.00.0Figure 28: but overnight interest rates - around 18-20%/year25Jan‐10Feb‐10Mar‐10Apr‐10May‐10Jun‐10Jul‐10Aug‐10Sep‐10Nov‐10Dec‐10Jan‐11Feb‐11Mar‐11Source: <strong>VCSC</strong> summaryExposure to SOEs debt, such as that of Vinashin, will be challenging for <strong>VCB</strong>. However, as the bankhas reduced its lending to SOEs and applied stricter risk management on lending activities, it likely toreduce the possibility of higher NPLs in the future.Changes in banking regulationsMonetary policies have a significant impact on bank operations as tightening monetary policies withhigh interest rates leads to slow credit growth, reducing net interest income as borrowers re-act tohigher financial costs.The SBV has set inflation control as a top priority and has implemented stricter monetary policies torelieve inflationary pressures as of February 2011. These measures include:www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 11

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADD1. Reduced M2 growth in 2010 to 15%-16% (from 21-24%).2. Restraining lending growth to below 20% (from 23%).3. Resolution 11 limits bank exposure to non-productive activities (i.e. real estate, security marketand consumer lending) to 22% of total credit by 30 June 2011 and to 16% by the end of the year.Non-compliant banks will be instructed to double their required reserves ratio and restrict theirbusiness activities.4. Close monitoring of commercial banks that have a higher credit growth in comparison withindustry peers (i.e. an annual credit growth target higher than 20%).5. Reduction of gold deposits and lending and cessation of physical gold trading.6. Regulation of the maximum VND deposit rate to14% in commercial banks (Circular 02/2011/TT-NHNN dated 3 March 2011) and the maximum USD deposit rate to 3% for individual depositors(Circular 09/2011/TT-NHNN dated 09 April 2011). Institutional customers can only enjoy a 1%rate on USD deposit at commercial banks7. Increased discount rate and refinance rate to 13% and 14% respectively, compared with 6-8% asin 2010. Capping the deposit rate at 14% for VND deposits and 3% for USD deposits createsmore difficulties for the banking system in capital mobilization while increasing the discount rateand refinancing rate leads to higher funding costs for small banks which may face liquidityproblems.Figure 29: SBV has increased the discount rate and refinancing rate since February 20111614121086%Discount Rate Refinancing Rate Base Rate8%14%13%9%420Jan-10Feb-10Mar-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10Jan-11Feb-11Mar-11Apr-11May-11Source: <strong>VCSC</strong> summaryThe SBV has also issued new regulations in 2011 that have a different impact on the operation of thebanking system:8. Circular 05/2011/TT-NHNN dated 10 March 2011 allowing banks to charge fees on theprepayment of debts.9. Circular 07/2011/TT-NHNN dated 24 March 2011 regulates foreign currency lending where banksare only allowed to give foreign currency loans to lenders that have export revenue or foreigncurrency revenue to make repayment.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 12

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDSummary of financialsIncome (bn VND) 2009 2010 2011F 2012F 2013F Growth (%) 2009 2010 2011F 2012F 2013FInterest income 15,294 20,581 24,267 27,301 29,739 Asset growth 15% 20% 15% 17% 14%Interest expense (8,795) (12,392) (14,672) (15,538) (16,794) Loans growth 26% 25% 20% 20% 18%Net interest income 6,499 8,188 9,596 11,763 12,945 Deposit growth 8% 21% 15% 15% 15%Fee & com. income 1,372 1,919 2,590 3,367 4,377 Charter capital growth 0% 9% 49% 20% 0%Fee & com. expense (383) (502) (623) (772) (957) Equity growth 20% 24% 45% 52% 11%Net fee & com. income 989 1,416 1,967 2,595 3,420 Earnings growth 45% 7% 14% 37% 16%Foreign exchange gain 918 562 646 775 930 Net interest income gth -2% 26% 17% 23% 10%Income fr. trading securities 183 18 20 24 29 Noninterest income gth 25% 43% 39% 32% 32%Income fr. investment 173 268 161 193 232 Operating expense 35% 30% 20% 20% 18%Other income 128 580 493 591 710Equity income 396 492 566 651 748 Indicators 2009 2010 2011F 2012F 2013FTotal operating income 9,287 11,525 13,448 16,593 19,013 Liquidity RatiosOperating expenses (3,494) (4,544) (5,453) (6,544) (7,722) Liquid assets/TA 43% 41% 38% 36% 34%Pre-provision profits 5,793 6,980 7,995 10,049 11,292 Loans/Cust. deposit 84% 86% 90% 94% 96%Provision loss (789) (1,501) (1,642) (1,339) (1,159) Interbank /Total deposit 17% 22% 21% 20% 20%Profit before tax 5,004 5,479 6,354 8,710 10,132Income tax (1,060) (1,243) (1,525) (2,090) (2,432) Profitability RatiosNet profit 3,945 4,236 4,829 6,620 7,700 ROAE % 25.6% 22.5% 19.0% 17.5% 16.0%Minority interests (23) (21) (21) (21) (21) ROAA % 1.6% 1.5% 1.5% 1.7% 1.7%Net profit for SH 3,921 4,215 4,807 6,598 7,679 Average funding cost 4.1% 4.9% 5.0% 4.6% 4.4%Average gross yield 6.7% 7.7% 7.8% 7.6% 7.4%Balance (bn VND) 2009 2010 2011F 2012F 2013F Net interest margin 2.9% 3.1% 3.1% 3.3% 3.2%Cash & Equivalents 4,485 5,233 9,419 5,957 6,851 Cost to income ratio 38% 39% 41% 39% 41%Balances with State bank 25,175 8,240 23,547 27,079 31,141Loans to others banks 47,457 79,654 63,723 70,095 77,105 Asset QualityTrading securities 6 7 6 6 6 NPL ratio 2.47% 2.83% 2.80% 2.80% 2.80%Derivatives - 35 - - - Loan loss coverage 132% 114% 123% 122% 117%Loans to clients 136,996 171,125 204,846 245,942 290,613 Equity/Total Assets 6.5% 6.7% 8.4% 10.9% 10.6%Investment securities 32,635 32,811 38,813 44,583 48,546 Equity multiplier 15.4 15.0 11.9 9.2 9.5Long term investments 3,638 3,955 4,351 4,786 5,264Fixed assets 1,505 1,586 3,428 6,660 10,829 BVPS (1,000 VND) 13,809 15,631 17,005 23,087 21,284Other assets 3,600 4,851 5,883 10,756 4,127 EPS (VND) 3,241 3,187 2,733 3,350 3,249Total Assets 255,496 307,496 354,016 415,866 474,482 EPS diluted (VND) 3,241 3,187 2,441 2,791 3,249DPS (VND) 1,200 1,200 1,200 1,200Deposits & Loans fr. SBV 22,578 10,077 8,565 9,850 11,328Deposits from CI 38,836 59,536 65,489 72,038 79,242 Valuation 2009 2010 2011F 2012F 2013FCustomer deposits 169,072 204,756 235,469 270,790 311,408 At market price of 29,500 29,500 29,500 29,500 29,500Liabilities fr. derivatives 82 - 82 82 82 P/E 9.1 9.3 10.8 8.8 9.1Bonds & cert. of deposits 386 3,564 5,346 8,019 12,028 P/B 2.1 1.9 1.7 1.3 1.4Other liabilities 7,723 8,774 9,037 9,489 9,964Total Liabilities 238,676 286,707 323,989 370,268 424,052 At target price 32,300 32,300 32,300 32,300 32,300P/E 10.0 10.1 11.8 9.6 9.9Equity and other funds 16,710 20,669 29,907 45,478 50,310 P/B 2.3 2.1 1.9 1.4 1.5Charter Capital 12,101 13,224 19,698 23,638 23,638Others Cap 45 45 45 45 45Capital surplus - 987 987 8,866 8,866Funds & others 1,460 1,762 1,549 2,819 4,297Retained earnings 3,104 4,652 7,628 10,110 13,464Minor interests 109 120 120 120 120Total Resources 255,387 307,376 353,896 415,746 474,362www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 13

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDAnalyst CertificationI, Hoa Hoang, hereby certify that the views expressed in this report accurately reflect my personal views about thesubject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly,related to the specific recommendations or views expressed in this report. The equity research analysts responsiblefor the preparation of this report receive compensation based upon various factors, including the quality andaccuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from,among other business units, Institutional Equities and Investment Banking.<strong>VCSC</strong>’s Rating <strong>System</strong> and Valuation MethodologyAbsolute performance, long term (fundamental) rating key: The recommendation is based on impliedabsolute upside/downside for the stock from the target price, defined as (target price – current price)/current price,and is not related to market performance. This structure applies from 1 November 2010.Equity rating keyBUYADDHOLDREDUCESELLNOT RATEDRATING SUSPENDEDDefinitionIf the target price is 20% higher than the market priceIf the target price is 10-20% higher than the market priceIf the target price is 10% below or 10% above the market priceIf the target price is 10-20% lower than the market priceIf the target price is 20% lower than the market priceThe company is or may be covered by the Research Department but no rating ortarget price is assigned either voluntarily or to comply with applicable regulationand/or firm policies in certain circumstances, including when <strong>VCSC</strong> is acting in anadvisory capacity in a merger or strategic transaction involving the company.The investment rating and target price for this stock have been suspended as thereis not a sufficient fundamental basis for determining an investment rating or target.The previous investment rating and target price, if any, are no longer in effect forthis stock.Unless otherwise specified, these performance parameters only reflect capital appreciation and are set with a 12-month horizon. Future price volatility may cause temporary mismatch between upside/downside for a stock basedon market price and the formal recommendation, thus these performance parameters should be interpreted flexibly.Small Cap Research: <strong>VCSC</strong> Research covers companies with a market capitalisation of up to USD50mn,inclusively. Clients should note that coverage may not be consistent and that <strong>VCSC</strong> may drop coverage of smallcaps at any time without notice.Target price: In most cases, the target price will equal the analyst's assessment of the current fair value of thestock. The target price is the level the stock should currently trade at if the market were to accept the analyst's viewof the stock, provided the necessary catalysts were in place to effect this change in perception within theperformance horizon. However, if the analyst doesn't think the market will reassess the stock over the specifiedtime horizon due to a lack of events or catalysts, then the target price may differ from fair value. In most cases,therefore, our recommendation is an assessment of the mismatch between current market price and ourassessment of current fair value.Valuation Methodology: To derive the target price, the analyst may use different valuation methods, including,but not limited to, discounted free cash-flow and comparative analysis. The selection of methods depends on theindustry, the company, the nature of the stock and other circumstances. Company valuations are based on a singleor a combination of one of the following valuation methods: 1) Multiple-based models (P/E, P/cash flow, EV/sales,EV/EBIT, EV/EBITA, EV/EBITDA), peer-group comparisons, and historical valuation approaches; 2) Discountmodels (DCF, DVMA, DDM); 3) Break-up value approaches or asset-based evaluation methods; and 4)Economic profit approaches (Residual Income, EVA). Valuation models are dependent on macroeconomicfactors, such as GDP growth, interest rates, exchange rates, raw materials, on other assumptions about theeconomy, as well as risks inherent to the company under review. Furthermore, market sentiment may affect thevaluation of companies. Valuations are also based on expectations that might change rapidly and without notice,depending on developments specific to individual industries.Risks: Past performance is not necessarily indicative of future results. Foreign currency rates of exchange mayadversely affect the value, price or income of any security or related instrument mentioned in this report. Forinvestment advice, trade execution or other enquiries, clients should contact their local sales representative.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 14

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDHistory of recommendationDate Recommendation Closing price Target price17 May 2011 ADD 29,500 32,300ContactsHead office67 Ham Nghi, District 1, HCMC+84 8 3914 3588Transaction office136 Ham Nghi, District 1, HCMC+84 8 3914 3588Hanoi branch18 Ngo Quyen St, Hoan Kiem District, Hanoi+84 4 6262 6999Transaction office236 - 238 Nguyen Cong Tru, District 1, HCMC+84 8 3914 3588ResearchHead of ResearchMarc Djandji, M.Sc., CFA, ext 116marc.djandji@vcsc.com.vnResearch Team+84 8 3914 3588research@vcsc.com.vnManager, Hoang Thi Hoa, ext 146 Senior Analyst, Vu Thanh Tu, ext 105Senior Economist, Doan Thi Thu Hoai, ext 139 Analyst, Hoang Huong Giang, ext 142Senior Analyst, Ngo Phung Hiep, ext 130 Analyst, Nguyen Thi Ngoc Lan, ext 147Senior Analyst, Dinh Thi Nhu Hoa, ext 140 Analyst, Tran Tuan Anh, ext 145Senior Analyst, Pham Cam Tu, ext 120Institutional Sales & BrokerageForeign SalesMichel Tosto+84 8 3914 3588, ext 102michel.tosto@vcsc.com.vnVietnamese SalesNguyen Quoc Dung+84 8 3914 3588, ext 136dung.nguyen@vcsc.com.vnRetail Sales & BrokerageHo Chi Minh CityChau Thien Truc Quynh+84 8 3914 3588, ext 222quynh.chau@vcsc.com.vnHanoiLe Duc Cuong+84 4 6262 6999, ext 333cuong.le@vcsc.com.vnwww.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 15

17 May 2011 <strong>Vietcombank</strong> (<strong>HSX</strong>: <strong>VCB</strong>) ADDDisclaimerCopyright 2011 Viet Capital Securities Company. All rights reserved. This report has been prepared on the basis ofinformation believed to be reliable at the time of publication. <strong>VCSC</strong> makes no representation or warranty regardingthe completeness and accuracy of such information. Opinions, estimates and projection expressed in this reportrepresent the current views of the author at the date of publication only. They do not necessarily reflect the opinionsof <strong>VCSC</strong> and are subject to change without notice. This report is provided, for information purposes only, toinstitutional investor and retail clients of <strong>VCSC</strong>, and does not constitute an offer or solicitation to buy or sell anysecurities discussed herein in any jurisdiction. Investors must make their investment decisions based uponindependent advice subject to their particular financial situation and investment objectives. This report may not becopied, reproduced, published or redistributed by any person for any purpose without the written permission of anauthorized representative of <strong>VCSC</strong>. Please cite sources when quoting.www.vcsc.com.vn | <strong>VCSC</strong> Viet Capital Securities | 16