news bulletin - NFIFWI

news bulletin - NFIFWI

news bulletin - NFIFWI

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWS BULLETINOF INSURANCE FIELD WORKERSVol XXIII Book No 7 July 2008CONTENTSPage NoChief EditorR. JayprakashAssociate EditorsK. VenkateshS. SreekumarEditorsJ. BaburajanM. B. VinodEditorial BoardA. GopakumarShaji T ThellyP. K. AjayakumarHari T. PillaiPlease send yoursuggestions, articlesand contribution toThe EditorNews BulletinKalvit BhavanCapital HeightsPlamoodu, PattomTrivandrum - 4ormail ateditornf@gmail.comEDITORIAL1. VIEW POINT 2National President Com. Uttam Jagdane speaks2. PERSPECTIVE 3Secretary General’s Desk3. COVER STORY 4Indo - US Civilian Nuclear Deal andAppeal by Nuclear Scientists4. ORGANISATIONAL ROUND UP 9Letters by Secretary General and more5. CLIA - A NEW TRIAL 13Article by Com. Mohinder Singh6. MEDIA WATCH 15News regarding Insurance in the media7. HEALTH WATCH 20How depressed are you ?The views &opinion expressedin the articles neednot necessarily bethat of <strong>NFIFWI</strong>

PERSPECTIVEDear Comrades,The organizational activities across thecountry is going on well. All our efforts are being putin to follow up on the representations initiated alongwith the Parliament march and Yogakshema march.As decided in our NEC at Mussoorie and informedearlier, we have taken up the matter of thecontroversial CLIA Scheme with our Chairman andsubmitted our Petition to IRDA. We have alsorepresented the matter before the Government.We are fighting the CLIA Scheme in a systematicmanner. As directed, take all necessary steps totake control of agents. Educate them on the fall outand ill effects of CLIA scheme. CLIA scheme isonly designed to help the management achieve thefigures on agency recruitment. Today the number ofagents in private sector is around 9,50,000 and inLIC it is 11,40,000. If the management had notdemotivated and discouraged the Developmentofficers with Graded system of credit and Penaltyfor termination of agents today LIC’s agency strengthwould have been atleast more than 25,00,000. ForCLIA Scheme the management has given arecruitment expense. This proves that themanagement is fully aware of the need to give thecosts and encouragement. The negative steps in ourcase is only a pointer to the fact that they want todemotivate, alienate and pull down Developmentofficers. The CLIA Scheme diversifies the CLIAagents to run behind recruitment of agents at thecost of the CLIA agent losing his business. The CLIAagent doing this for peanuts is losing a huge chunkof his individual business and thereby losing heavilyon Renewal commission. Tell the CLIA agents thatif the management is genuinely interested in theagents then the management should restore the“RESERVATION OF 50% OF DEVELOPMENTOFFICERS VACANCIES FOR OUR AGENTS”.The Development officer’s job gives the agents agrowth opportunity, job security and application ofskills of a successful agent. When the CLIA Schemeis introduced, simultaneously 4,500 Developmentofficers are being recruited but without anyconsideration for our agents.The competition for Branch officials wherethe focus is on making maximum persons a CLIAagent and the CLIA recruiting agents are a pointerto the fact that nobody is bothered about businessand that branch officials are totally concentratingon CLIA only for their benefit of going toMauritius and Singapore. There is no benefitfor CLIA agents. The management is ignoring thefact that the Market share of LIC is going downdrastically. The market share is only around 40%and in the metros the marketshare is still lower. Thealternate channels of Corporate agents,Bancassurance and Brokers in LIC has been afailure. The time tested successful channel ofDevelopment officer –Agent is being destroyed todestabilize LIC.We have to continue focus on qualityrecruitment of agents and conventional business. Ourexperience is that part time agents are better qualified,more professional and ethical. Regularly conductyour unit meeting of agents and ensure that all clubmember agents attend the meeting. Do not tolerateany kind of fraudulent practices by any agent. Takeimmediate action against any CLIA agents doingfraudulent practices. Do not shield or connive withany fraudulent persons as it is harmful to the interestsof LIC. To tackle CLIA follow the directions giventhrough the Divisional secretaries and Presidents.We have placed our various issues forsettlement by the management with favourablesolutions. We are awaiting the positive response fromthe management. These letters are already circulatedand also published in this News Bulletin. Continueour strategies, conduct regular organizationalactivities, keep up the courage and confidence. Toughtimes have to be countered and believe that “ToughTimes do not last and only Tough people will last” .Information sharing session is being held at Centraloffice on 17 th and 18 th of July’2008. Keep marchingahead strongly, Victory is ours.March on comrades to achieve our goals…. Restwe shall not, until our goals are achieved…National Federation Zindabad…..Development officers unity Zindabad……Yours faithfullyR. JayprakashSecretary General5

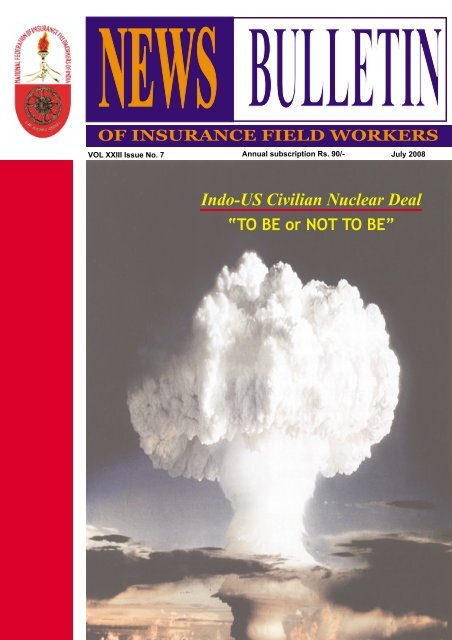

COVER STORYIndo-US Civilian Nuclear dealBilly I AhmedThe latest buzz on the political cacophony circuit isthe bi-lateral treaty on nuclear cooperation underSection 123 of the US Atomic Energy Act, dubbedas Indo-US Civilian Nuclear deal.Despite a month-long display of conspicuousopposition to the civilian nuclear co-operation treatythat India’s United Progressive Alliance (UPA)coalition government has struck with the Bushadministration, the Communist Party of India(Marxist)-led Left Front has abandoned.Atomic Energy Commission Chairman Anil Kakodaris in Vienna to negotiate with International AtomicEnergy Agency (IAEA) to clinch the deal. The USis optimistic. There were indications from China thatBeijing may not stand in the way of the deal whenIndia goes to the 45 countries of the Nuclear SuppliersGroup (NSG) that has to clear it.In brevity, the Indo US Civilian Nuclear deal is asfollows:IntroductionOn July 18, 2005, President Bush and Indian PrimeMinister Manmohan Singh reached a landmarkagreement on civilian nuclear energy cooperation.The deal which marks a notable warming of US-India relations, would lift the US moratorium onnuclear trade with India, provide US assistance toIndia’s civilian nuclear energy program, and expandUS-Indian cooperation in energy and satellitetechnology. The critics in the United States say theagreement would fundamentally reverse half acentury of US nonproliferation efforts, undermineattempts to prevent states like Iran and North Koreafrom acquiring nuclear weapons, and potentiallycontribute to a nuclear arms race in Asia.What are the terms of the deal?The details of the agreement are still being negotiated,but experts say some clear points are emerging. Theyinclude the following:* India agrees to allow inspectors from the IAEA,the United Nations’ nuclear watchdog group,access to its civilian nuclear program. But Indiawould decide which of its many nuclear facilitiesto classify as civilian.* India agrees to prevent the spread of enrichmentand reprocessing technologies to states thatdon’t possess them and to support internationalnonproliferation efforts.* US companies will be allowed to build nuclearreactors in India and provide nuclear fuel for itscivilian energy program. US companies arelikely to get contract of at least US$150 billion.What kind of technology would India receivein return?India would be eligible to buy US dual-use nucleartechnology, including materials and equipment thatcould be used to enrich uranium or reprocessplutonium, potentially creating the material for nuclearbombs. It would also receive imported fuel for itsnuclear reactors.What do proponents say about the deal?Proponents of the agreement argue it will bring Indiacloser to the United States at a time when the twocountries are forging a strategic relationship to pursuetheir common interests in fighting terrorism,spreading democracy, and preventing the dominationof Asia by any single power.Other experts sayThe deal would encourage India to acceptinternational safeguards on facilities it has not allowedto be inspected before. This is a major step, expertssay, because the existing nonproliferation regime hasfailed either to force India to give up its nuclearweapons or make it accept international inspectionsand restrictions on its nuclear facilities. IAEA6

Director-General Mohammed El Baradei hasstrongly endorsed the deal, calling it a pragmatic wayto bring India into the nonproliferation community.The U.S. deal would reward the Indian governmentfor its voluntary controls and give New Delhiincentive to continue them, against the demands ofIndian hardliners who question what India gets outof placing such limits on itself.What are the objections to the agreement?Critics call the terms of the agreement overlybeneficial for India and lacking sufficient safeguardsto prevent New Delhi from continuing to producenuclear weapons. While India has pledged that anyU.S. assistance to its civilian nuclear energy programwill not benefit its nuclear weapons program, expertssay India could use the imported nuclear fuel to feedits civilian energy program while diverting its ownnuclear fuel to weapons production.Other objections raised by experts include: Thesafeguards apply only to facilities and materialmanufactured by India beginning when theagreement was reached. It doesn’t cover the fissilematerial produced by India over the last severaldecades of nuclear activity.The deal does not require India to cap or limit itsfissile material production. It does not require Indiato restrict the number of nuclear weapons it plans toproduce.Who needs to approve the agreement?The final terms of the nuclear deal need approvalfrom several sources before they can beimplemented. The bodies required to approve thedeal include:Under the U.S. Atomic Energy Act, which regulatesthe trade of nuclear material, congressional approvalis needed to pass the exemptions to U.S. lawsrequired for the nuclear deal to be implemented.Members of Congress are showing resistance, withsome calling for India to commit to strict limits on itsnuclear weapons program before the deal goesthrough. The 45-country of The Nuclear SuppliersGroup (NSG) wants the safeguards agreement tobe approved by the board to carry out the furtherprocess.What effect will the US -India deal have on theNPT?It could gut the agreement, experts say. Article 1 ofthe treaty says nations that possess nuclear weaponsagree not to help states that do not possess weaponsto acquire them. David Albright, president of theInstitute for Science and International SecuritysaysSecurity, says that without additional measuresto ensure a real barrier exists between India’smilitary and civilian nuclear programs, the agreement“could pose serious risks to the security of the UnitedStates” by potentially allowing Indian companies toproliferate banned nuclear technology around theworld. In addition, it could lead other suppliersincluding Russia and China to bend the internationalrules so they can sell their own nuclear technologyto other countries, some of them hostile to the UnitedStates.What role does China play in the US-Indiannuclear deal?It is a motivating factor in the deal, some expertssay. China’s rise in the region is prompting the UnitedStates to seek a strategic relationship with India.“The United States is trying to cement its relationshipwith the world’s largest democracy in order tocounterbalance China,” says Charles D. Ferguson,science and technology fellow at the council onForeign Relations. The Bush administration is“hoping that latching onto India as the rising star ofAsia could help them handle China,” Henry Sokolski,executive director of the Nonproliferation PolicyEducation Center says.But other experts say the growing economicrelationship between China and India is so critical toNew Delhi that its interests in China cannot bethreatened or replaced by any agreement with theUnited States.What effect will the deal have on US and Indianrelations with Pakistan?Pakistan’s President Pervez Musharraf, who hassuffered fierce criticism at home for his strongalliance with the United States since 9/11, has notreceived a similar deal on nuclear energy fromWashington. Some experts say this apparent U.S.favoritism toward India could increase the nuclear7

ivalry between the intensely competitive nations,and potentially raise tensions in the already dangerousregion. Other experts say the two countries, bothadmittedly now nuclear, could be forced to deal morecautiously with each other.What’s the history of India’s nuclear program?In the 1950s, the United States helped India developnuclear energy under the Atoms for Peace program.The United States built a nuclear reactor for India,provided nuclear fuel for a time, and allowed Indianscientists study at U.S. nuclear laboratories. In 1968,India refused to sign the NPT, claiming it was biased.In May 18, 1974, India tested its first nuclear bomb,showing it could develop nuclear weapons withtechnology transferred for peaceful purposes. Onmay 11, 1998, three tests was were conducted byIndia, which included a fusion device (of 12 kilotons),a low yield device (of 0.2 kiloton capacity), and athermonuclear device (of 0.2 kiloton capacity). Asa result of 1974 nuclear testing by India,, the UnitedStates isolated India for twenty-five years, refusingnuclear cooperation and trying to convince othercountries to do the same. But since 2000, the UnitedStates has moved to build a “strategic partnership”with India, increasing cooperation in fields includingspaceflightspace flight, satellite technology, andmissile defense.UpshotThe deal is controversial in India, with manyparliamentarians arguing it will limit India’ssovereignty and hurt its security. Some Indian nuclearexperts are protesting what they see as excessiveU.S. participation in deciding which of India’s nuclearfacilities to define as civilian, and open to internationalinspections under the plan.The percentage of power provided by nuclearreactors is only 3% and it is the costliest source toproduce. At the same time there is no technologystill in the world to deal with the nuclear wastes thatcan be harmful for 1000 years. And France is alreadysuffering from this. The US stands to gain contractsworth of at least US$100 billion in the deal.The benefits that India is going to reap are almostcompo mentis but the question is what will the US isgoing to have be getting in return and why are theyso interested in having the deal with India. The motivebehind it could be, India and China’s has shown aprodigious growth and US’s is having confrontationwith Iraq, Iran and turbulent Pakistan. So the US issearching for a new loyal strategic partner andAmerica knows that it is much better to maintain agood relationships with India than with China orPakistan for the moment.However, loyalty is an unknown term for the US.As long as the US needs or requires something, itmaintains a happy-go-relation with its partner, butwhen its needs are fulfilled the US simply dumps hisits loyal partner as spent force.[The author is a columnist and researcher.]SECRETARY GENERAL ANSWERS YOUThe Secretary General of <strong>NFIFWI</strong> will answer questions raised by youregarding organizational matters.You can e-mail your questions to :nfifwisecgen@gmail.com or editornf@gmail.comfor clarification over telephone please call preferablybetween 12.00 noon and 2.00 pm8

Nuclear scientist’s appeal to India’s parliamentariansEminent nuclear scientists have issued an appealto India’s parliamentarians, asking them to insist onthe ground rules for the Indo-US nuclear deal atthis stage itself, since they believe the deal, in theform approved by the US House of Representatives,infringes on India’s independence for carrying outresearch and development in nuclear science andtechnology.The nuclear scientists :Dr H N Sethna, former chairman, Atomic EnergyCommission;Dr M R Srinivasan, former chairman, AtomicEnergy Commission;Dr P K Iyengar, former chairman, Atomic EnergyCommission;Dr A Gopalakrishnan, former chairman, AtomicEnergy Regulatory Board;Dr S L Kati, former managing director, NuclearPower Corporation;Dr A N Prasad, former director, Bhabha AtomicResearch Centre;Mr Placid Rodriguez, former director of the IndiraGandhi Centre for Atomic Research andDr Y S R Prasad, former chairman & managingdirector, Nuclear Power Corporation;-said in their appeal that the representatives inParliament need to ensure that decisions taken todaydo not inhibit our future ability to develop and pursuenuclear technologies for the benefit of the nation.This is the text of their appeal:While the nation and Parliament discuss the Indo-US nuclear deal from various angles, we feel it isour responsibility to place before the nation our wellconsideredviews on the impact of this deal on thefuture of Indian nuclear science and technology, andits effects on the energy security of the nation. Wehave all worked in the field of atomic energy fromthe very early years after India’s independence.From very small beginnings, we have now reacheda stage where we are in possession of all thetechnologies needed for the production of electricityfrom indigenous nuclear minerals, and havesuccessfully applied these technologies in diversesectors from health, agriculture and industry tonational and energy security. All this has been possiblewith the support of the people represented in thegovernment through Parliament, and the outstandingstatesmen who have guided and supported our plans.We therefore feel it is our obligation to make publicour perceptions for the effective and continuednurturing and utilisation of this technology in thecountry. Science is universal. Knowledge can becreated in any part of the world, and technologycomes with experimentation and the willingness totake risks. We have followed all these paths to reachthe present stage of development. We are amongstthe most advanced countries in the technology offast-breeder reactors, which is crucial to the futureof our energy security. Along the way we havederived benefits from international collaboration. Atthe same time, we have also shared some of ourabilities in this field with the world. Indian scientistshave been ambassadors, with knowledge andcreativity as their tools. It is of prime importance touphold these cherished traditions.It is significant that the most advanced country innuclear science and technology has come forwardto accept us into the international nuclear community,by the historic document signed by our PrimeMinister with President Bush on July 18, 2005. Thebasic principles for cooperation were well laid out inthis bilateral understanding and the prime ministerhas appraised our Parliament of this. No doubt itneeds the concurrence of the other nationscomprising the Nuclear Suppliers Group, and of theInternational Atomic Energy Agency.Based on this agreement, the US lawmakers andthe administration are in the process of re-framingtheir laws, which could change the nature of relationsbetween the two countries. This is a most welcomeinitiative of the United Progressive Alliancegovernment, and is a continuation of the processessentially begun during the previous NationalDemocratic Alliance government. Thus, there is noquestion of any political partisanship on this matter.9

However, the lawmakers of the US Congress havemodified, both in letter and spirit, the implementationof such an agreement. At this juncture, among otheraspects, it is essential that we insist on the followingfour central themes:India should continue to be able to hold on to hernuclear option as a strategic requirement in the realworld that we live in, and in the ever-changingcomplexity of the international political system. Thismeans that we cannot accede to any restraint inperpetuity on our freedom of action. We have notdone this for the last 40 years after the Non-Proliferation Treaty came into being, and there is noreason why we should succumb to this now. Universalnuclear disarmament must be our ultimate aim, anduntil we see the light at the end of the tunnel on thisimportant issue, we cannot accept any agreement inperpetuity.After 1974, when the major powers discontinuedcooperation with us, we have built up our capabilityin many sensitive technological areas, which neednot and should not now be subjected to externalcontrol. Safeguards are understandable whereexternal assistance for nuclear materials ortechnologies are involved. We have agreed to thisbefore, and we can continue to agree to this in thefuture too, but strictly restricted to those facilities andmaterials imported from external sources.We find that the Indo-US deal, in the form approvedby the US House of Representatives, infringes onour independence for carrying out indigenous researchand development in nuclear science and technology.Our R&D should not be hampered by externalsupervision or control, or by the need to satisfy anyinternational body. Research and technologydevelopment are the sovereign rights of any nation.This is especially true when they concern strategicnational defence and energy self-sufficiency.While the sequence of actions to implement thecooperation could be left for discussion between thetwo governments, the basic principles on which suchactions will rest is the right of Parliament and thepeople to decide. The prime minister has alreadytaken up with President George Bush the issue ofthe new clauses recommended by the US House ofRepresentatives. If the US Congress, in its wisdom,passes the bill in its present form, the ‘product’ willbecome unacceptable to India, and, diplomatically, itwill be very difficult to change it later. Hence it isimportant for our Parliament to work out, and insiston, the ground rules for the nuclear deal, at this stageitself.We therefore request you, the Parliamentarians, todiscuss this deal and arrive at a unanimous decision,recognizing the fundamental facts of India’sindigenous nuclear science and technologyachievements to date, the efforts made to overcomethe unfair restrictions placed on us and the imaginativepolicies and planning enunciated and followed in theyears after Independence. The nation, at this criticaljuncture, depends on its representatives in Parliamentto ensure that decisions taken today do not inhibitour future ability to develop and pursue nucleartechnologies for the benefit of the nation.LIC introduces strict claim norms for AgentsThe state-owned life insurer Life Insurance Corporation of India (LIC) has decided to introduce strict norms foragents in a move to arrest fraudulent and early claims (arising after first year of the policy). The corporation found thatearly claims arose due to poor underwriting and moral hazards.A senior LIC executive said the corporation had identified agents with a high incidence of early claims. An index filecalled “watch-listed agents” has been created to track these agents’ records. Whenever a new business proposalis registered by these agents, a message will flash on the screen saying “the agent has a history of adverse earlyclaim experience”. In 2006-07, LIC settled total claims worth over Rs 127.93 crore. The corporation settles morethan 45,800 claims on every working day or 2.21 claims a second. The corporation has centralised its claimprocessing system to manage claims worth over Rs 20,000 crore out of the total one crore policies annually. LIC hasintroduced differential underwriting rules for watch-listed agents. Proposals submitted by such agents would beregistered only after 100 per cent implementation of know your customer (KYC) norms. Such agents will only beallowed to procure business under the medical and non-medical (special) categories, but not under the nonmedical(general) category. If the case is non-medical (special), a duly signed certificate will have to be procuredfrom the employer of the prospective policy buyer and attached with the records of leave taken on medical groundsin the last five years. Medical examinations would have to be conducted by third party administrators (TPAs),irrespective of the sum assured, or by examiners and specialists in the LIC panel in the absence of TPAs. The policybuyer must provide his photo identity during the medical examination. The policy documents will be handed to theinsured on the basis of photo identification or sent by post.10

ORGANISATIONAL ROUND – UPThe Letters sent by the Secretary General to theChairman and MD regarding CLIA & Bi-lateral discussions<strong>NFIFWI</strong>/ 07/ 2008-1019 th June’2008The ChairmanLife Insurance Corporation of IndiaCentral Office, ‘Yogakshema’,Mumbai-400 021Ref: Discussions held on 22 nd of May 2008, 19 thJune ’08 and representation in the matter of CLIA.Dear Sir,We were shocked to see the managementgoing ahead with the concept of supervisory agencythrough a circular on Chief Life Insurance Advisorscheme on the 12 th of April 2008. We have studiedthe scheme in detail and taken feedbacks from allacross the country. We are of the opinion that thisis totally unfair and a unethical decision on thepart of the management . Our stand on CLIAScheme is that Professionally, this is a scheme tryingto create a parallel marketing force diversifying theclub member agents and disturbing the entiremarketing force. Legally, this scheme is in violationto the various provisions of Law governing theInsurance sector, LIC Of India and appointmentof Intermediaries. Our stand is based on thefollowing facts and points:1. The CLIA Scheme is a big blow to the goodperforming Development officers who weremotivated to nurture and groom agents tobecome professional agents and club membersand MDRT’s. This scheme will create a lot ofinfighting and disturb the harmoniousmarketing force of LIC. After fine groomingand nurturing , such Development officers arepenalized by diversifying these professionalagents.2. The Development officer is expected to workat a particular cost norm and this business hasto be procured through one’s own unit agents.When such is the case it is unfair on the part ofthe management to diversify our unit agentsfor the same life insurance business but throughanother channel.3. The management expects growth fromDevelopment officer’s, whereas there is nogrowth requirement from the CLIA agents. AChairman’s club member becoming a CLIA cancontinue as a CLIA even if they become adivisional managers club member or performat lower level of NB figures. The CLIA is notrequired to perform at the same New Businesslevels(On No: of Lives, FPI and SFYPI andsum assured) , bring growth and maintain thesame club membership levels. This is in totalcontradiction of LIC’s direction and policy. Thiscontradiction affects the Development officerand LIC adversely.4. The CLIA who is being allowed to recruit theirrelatives as a agent will only promote benamiagency to earn more commissions. Themanagement is knowingly encouraging benamiagency thereby encouraging reduction ofperformance by the existing club members.Through this scheme the management has alsofacilitated the CLIA agents to earn morecommissions on the life insurance businesscompared to the commission the club memberagent would have otherwise earned. This willdirectly reduce the business in the Developmentofficer’s unit.5. The close relatives of an agent staying underone roof is permitted to take up agency only11

with the same Development officer. This wasto ensure ethical practices. The CLIA Schemecontradicts this and does not restrict the CLIAagent from appointing these close relatives whocan be appointed only by the same D.O so asto avoid intentional diversification of business.6. The area of operation prescribed is theDivisional area which is to only encouragediversification and visiting agents business. Onthe contrary the D.O’s are denied credits forbusiness placed outside the branch area. Similaris the case with denial of credit to D.O’s forMail order business when the LIC encouragesan agent to diversify abroad to do Mail orderbusiness.7. The job of a CLIA is the same as that of aDevelopment officer. By placing theDevelopment officer’s club member agents inthe same shoes the corporation has degradedand humiliated the Development officer’s. Thepower and authority of supervision ofDevelopment officer’s is intentionally diluted bythe management. This will affect the businessperformance very badly, encouragedisobedience by agents and destroy the teamwork. Already this has started happening wherethe CLIA agents refuse to attend unit meetings,discuss business and go on joint calls. Due tothe CLIA scheme, the business figures of Apriland May 2008 reflects the low business andpulling down of Market share of LIC to 44%as reported by the media. The enemity betweenthe D.O and Agent is being encouraged by thisCLIA Scheme.8. The job of a Development officer requires agraduation while there is no minimumqualification prescribed for the CLIA agent.Even old agents with lower classes of educationon the basis of their club membership areappointed as CLIA. The CLIA Scheme is seenas a back door entry for under qualified andnon suitable persons as equivalent toDevelopment officers. This will also deprive themeritorious candidates from the generalmarket as CLIA will reduce the number ofVacancies of Development officer’s. Theimage of a Development officer will betarnished as under qualified and unprofessionalpersons without any written test and properscreening are made CLIA doing the same jobof a Development officer. There is a starkcontradiction in the policy of LIC asDevelopment officers are not allowed to getpromoted as Assistant Administrative Officer’sstating that D.O’s are not qualified for AAO.We fear and apprehend that eventually theDevelopment officer’s cadre will be abolished andalso lead to the destruction of LIC due todestabilization of the strong Marketing force.9. The management is pressurizing andthreatening the club member agents with direconsequences to force them to apply forCLIA. This projects a bad intention on thepart of the managers and destabilizing themarketing force.10. The pressure and pulls from the Developmentofficer on the club member agent on one sideand the Manager on the CLIA on the otherside will only result in destabilizing the agent,drastic reduction of their new business andrenewal commission. This will slowlydemoralize the agency force and lead to thedestabilization of the marketing force and LIC.11. The CLIA Scheme is unfair and illegal violatingthe provisions of LIC of India Act and IRDAact.We call upon your good self to kindly re-examinethe whole matter of CLIA Scheme based on theabove factors and do the needful to withdraw theCLIA Scheme in the best interest of LIC of Indiaand to motivate the Marketing force.With Best Wishes and Regards,Yours SincerelyR.JayprakashSecretary General12

14 th June’2008The ChairmanLife Insurance Corporation of IndiaCentral office,’Yogakshema’, Mumbai-400 021Ref: Discussions held on 22 nd of May 2008 and request for Condonation of EOL & grant of Competition awardsDear Sir,We thank you for the invitation extended to <strong>NFIFWI</strong> for the discussions which was held on 22 nd ofMay 2008. We were happy to have a very good meeting with open hearted discussions. As informed to youtelephonically we have taken a step forward and suspended our protest programmes. We were happy to havethe management’s immediate positive response with the clearance of the long pending issue of “Credit forrevival of lapsed policies” vide a circular on 26 th of May 2008.We have placed our detailed representation of all our issues for settlement during the discussions on22 nd May. We request you to kindly consider the following issues for favourable solution and orders1. Condonation of EOL on 5 th March’2008, 15 th March’2008 and 31 st March’2008.2. Salary cut to be imposed only for the days of protests, 5 th March’08,15 th March’08 & 31 st March’083. Grant of competition prizes under Big Leap competition and other competitions.4. Condonation of EOL imposed in 2004 which has been pending.5. Condonation of EOL of Ahmedabad division and Delhi I divisionWith Best Wishes and Regards,Yours SincerelyR.JayprakashSecretary GeneralBiennial General Body Meeting ofSrinagar DivisionZonal President Com Shrikant Vashishat deliveredhis welcome address to the members and asked themto have faith in the leadership. Zonal Secretary ComK. C. Sankhyan in his marathon address to the housemade the members aware about the stand and futurestrategies of the Organization on all the issuesincluding CLIA, MOU & GOIB etc.The house elected the following Office bearers.President: Com Rakesh Mangotra.Gen Secretary: Com Liaquat Sultan.7 th Biennial Divisional Council Meet ofJalpaiguri Division under Eastern Zone:Jalpaiguri Divisional Unit under Eastern Zone hassuccessfully concluded their 7 th Biennial DivisionalCouncil Meeting at “Pawan Kumar Gour Mancha(Rabindra Bhavan), Cooch Behar on 12 th & 13 thJune 2008.Shri S. B. Ray, Zonal Secretary, Eastern Zone inauguratedthe meeting. Divisional President Shri ParthaChatterjee in his presidential address briefly narratedthe activities of the National Federation at all leveland requested the members to deliberate on theagenda. Shri Tapas Baran Chandra, DivisionalSecretary placed a very exhaustive report.Shri S. B. Ray, Zonal Secretary, Shri Rajesh Ghosh,Zonal Vice President and Shri Dhananjoy Ghosh,Zonal Joint Secretary addressed the house.New Office bearers arePresident:Mr. Partha ChatterjeeGeneral Secretary:Mr. Tapas Baran Chanda13

<strong>NFIFWI</strong>/ 06/ 2008-1014 th June’2008Shri. D.K.MehrotraManaging DirectorLife Insurance Corporation of IndiaCentral office,’Yogakshema’,Mumbai-400 021Ref: Discussions held on 22 nd of May 2008 andrepresentation of matters concerning DevelopmentofficersDear Sir,We thank you for the invitation extended to<strong>NFIFWI</strong> for the discussions which was held on 22 ndof May 2008. We were happy to have a very goodmeeting with open hearted discussions. As informedto you telephonically we have taken a step forwardand suspended our protest programmes. We werehappy to have the management’s immediate positiveresponse with the clearance of the long pending issueof “Credit for revival of lapsed policies” vide acircular on 26 th of May 2008.We had placed our detailed representation ofall our issues for settlement during the discussionson 22 nd May. We request you to kindly consider thefollowing issues for favourable solution and orders1. Condonation of EOL on 5 th March’2008,15 th March’2008 and 31 st March’2008.2. Salary cut to be imposed only for the daysof protests, 5 th March’08,15 th March’08 &31 st March’083. Grant of competition prizes under Big Leapcompetition and other competitions.4 . Condonation of EOL imposed in 2004 whichhas been pending.5. Condonation of EOL of Ahmedabad division& Delhi I division.6. CLIA Scheme – Unfair conditions of thescheme and request to kindly keep thescheme in abeyance. There is lot of coercionin making the club members apply for CLIAScheme.7. Improvements in GOIB Scheme and it’sreview.8. Special rules 1989- Request to keep it inabeyance now and negotiations for a fairand reasonable modifications addressing allconcerns. The final revised scheme shouldbe a MOU. We had discussed the issue ofspecial rules 1989 with the Finance ministryofficial also in our meeting on 7 th of April2008. The officials had asked us to discussthe issue with the management and cometo an understanding and settlement.9. FCA Increase proportionate to the increasein Petrol, Diesel rates. The increase givenin 2005 was not proportionate. We requestfor a automatic mechanism for increase asand when the prices increase. Oursuggestion would be for payment as Petrolallowance and specification of quantum ofpetrol.10. Agency Allotment – enforcement of circular,modifications of conditions for allotmentand removal of Sum assured condition.11. Tour mileage rates.12. Credit for Mail order business and businessdone by visiting agents.13. Circular for Revival credit (to be receivedfrom 2000 onwards) is issued. There is onecondition inserted “that the agency shouldbe in force”. We request you to kindlyremove this condition as the credit takenaway on lapsation is what is restored oncethe policy is revived. The agency not beingin force does not nullify the effort ofbusiness done and effort for revival whichis more.We also request for regular information sharingand discussions with <strong>NFIFWI</strong> at all levelsregarding Development officers issues,recruitment and providing adequate officeinfrastructure for the new D.O’s.With Best Wishes and Regards,Yours SincerelyR.JayprakashSecretary General14

CLIA - a new TrialCLIA, a new concept is on trial these days in themarketing circles of LIC of India. The term standsfor Chief Life Insurance Advisors. I have gonethrough the circular of the said scheme. Although itlooks to be very innovative scheme, but a carefulstudy of the concept reveals that it is an ill conceivedidea, which has been put on a trial, and it will resultin the production of the orphan agents.In fact the incentive scheme of the Developmentofficers, which looked to the management aslucrative, had always been the bone of contentionbetween the class of Development officers and theLIC management from the very inception of thisscheme. Throughout the world the selling of lifeinsurance products had been a very awesome taskand only those people who have special aptitude,knowledge and courage can sell it. Its selling requiresa special blend of people. The persons bringing inthe good life insurance business had always beenrewarded with good commission or incentives bythe organizations they represent. It is a worldwidephenomenon and the Development officers of LICof India are no exception to that. The managementof the LIC of India had been making a consciouseffort to do away with this class of employees bybrining in some new channels of marketing of thelife insurance products. The management hadforgotten that it is this class alone which isresponsible for its growth from Rs.450 Crores in1956 to Rs.7, 00,000 Crores today.In 1960 after 4 years of the nationalization of thelife insurance business and coming into being of LICof India the new Staff Regulations were introducedand a new Chapter III was also introduced that wasmeant specifically for the class of the Developmentofficers. This Chapter deals with the performanceof the development officers and all the nonperformerswere made answerable. The recruitmentof the development officers continued till 1974 andthen it was stopped for a new trial.The LIC management thought of the idea ofintroducing the new concepts of Career Agents andDirect Agents and subsequently the Rural CareerAgents to whom the LIC management started givingsome additional incentive besides the regularcommission. The special new CAB branches andDAB branches were opened in almost all the metrosto start with. But the schemes of CAB and DABdied its own death due to non-success of thescheme. The lack of proper supervision, which alonea development officer can provide, was the mainreason of the failure of the scheme of the DAB andCAB concepts. Later the DAB and CAB brancheswere converted into the regular branches.After a lapse of 6 years in 1980 the LIC thought ofthe idea to make the recruitment of the DevelopmentOfficers for the growth of the business, which wasalready showing the horizontal graph of the businessgrowth. Thereafter we saw a decade of growth andnormalcy prevailing with the regular recruitment ofthe Development Officers in the organization. Thisgrowth in the business also saw the growth in theearning of incentive bonus by the Developmentofficers. Thereafter the LIC management thoughtof the idea of curtailing the earnings of theDevelopment officers by taking some new steps.The first curtailment was in the shape of introducingthe discredit for the lapseation of the business alreadyintroduced. Then there was the conflict over thefact as to what was a rural business and what not.Then new instructions were issued for the lessercredit of the business done by the agents who hadlong standing or who were club members. Themanagement crippled this way the scheme ofincentive bonus and the class of Developmentofficers was the net looser. In fact all thesecurtailment were mainly responsible for the slowgrowth of the business activities and resentment inthe class particularly in the sphere of newrecruitment because we know that this sort ofactions cannot be said to be moral boosters for anyorganization particularly in the insurance sector.Today the LIC management has started feeling theheat of the achievements of the private life insurersin the country. The private life insurers have startedgrasping the handsome share of the life insurancebusiness in the country. Today the agency strengthof the private insurers jointly has surpassed the total15

strength of agents of LIC. At such a juncture theLIC management should have opted for some specialdrive of recruitment of agents by offering somespecial incentives and monetary benefits to theDevelopment officers for making such recruitments.Instead the LIC management took away some senioragents of almost all the Development officers andoffered them to be the CLIA’s.The CLIA’s had been offered to make furtherrecruitment of the agents for LIC and not for hisdevelopment officer and get Rs.1000 per recruitmentas incentive. This scheme looks to be very innovativeinitially. It is worth mentioning here that it is nothingbut a copy of the BA Model of the Tata AIG LifeInsurance Company Ltd. The business associate ofa Tata AIG is also an agent and is rewardedhandsomely if he makes a successful recruitment ofan agent. The BA is rewarded by a sum of Rs.9, 000per agent plus other normal incentives on theproduction of new business. But this scheme ofTataAIG has almost failed and the rank of TataAIGhas further slipped to lower ranks in the privateinsurers in terms of production of new business.Similarly the scheme of CLIA’s of LIC of India shallalso die its own death soon.The LIC management overlooked the importance ofthe class of Development officers. One mustremember that if a child is born out it counts as onemember in the strength of the population, but to remainas member in the population the child requires propergrooming, care, service and investment in terms oftime and money, which only the parents and alonethe parents can provide. In the present scenario ofCLIA’s the agent who shall be doing his own personalbusiness too shall not be able to impart the practicaltraining and other helps required in the day-to-dayworking of an agent, which a professionalDevelopment Officer can render.The managers appointed to take care of the class ofCLIA’s are also the employees of the organizationas other class I employees who neither have theChapter III attached to their service conditions nordo they have any incentive scheme like we have forthe class of Development officers, with the resultthat their management shall fell sort of the expectedresults.This way it can safely be concluded that either thescheme of CLIA’s which has been introduced onlyas an alternate channel for the recruitment of agentsshall fail to deliver the results but in case it deliversthe results as per the wishes of the management,then soon we shall find that the new entrants in theorganization shall feel as orphans which will be morea liability than an asset for the corporation.(Contributed by : Com. Mohinder SinghKurukshetra BranchKarnal Division)LIC losing ground in overseas marketNew Delhi (PTI):The Hindu ;6 th July 2008.Country’s largest life insurer LIC is losing business in the overseas market year after year as it has failed toattract new customers amid stiff competition. The first premium collection from foreign operations which stoodat Rs 123.41 crore in 2004-05 declined to Rs 120.8 crore in the following year and further to Rs 108.67 crorefor the year ended March 2007, official sources told PTI. Thus, the new business in the overseas marketdeclined by nearly 12 per cent in a span of three years, they said. The decline in the first premium income insuccessive years is mainly because of failure of marketing strategies to attract new customers amid stiffcompetition, the sources said. The sources also attributed the decline to reduction in sale of single premiumpolicies by LIC Bahrain for 2004-05.However, on the back of old policies, renewal premium witnessed a growth. During 2004-05, LIC’s operationsabroad earned renewal premium of Rs 235 crore, which increased to Rs 292 crore the next year. Renewalpremium stood at Rs 341 crore in 2006-07. Despite falling first premium income, LIC has charted aggressiveforeign expansion plan with a view to increase bagging of new policies. The insurer is currently exploringopportunities for expansion in new territories, including Asian countries such as Singapore, the sources said.Besides, it has formed a new joint venture company Saudi Indian Co for Cooperative Insurance in SaudiArabia. The venture has already received certificate of registration.16

High growth rates mean a significant part of aprivate firm’s portfolio is made of early-stagepoliciesNew Delhi: Success can sometimes hurt, aspromoters of most Indian life insurance firms arediscovering. Soaring policy sales are forcing insurersto dig deeper into their pockets to boost capital sothey can cover related costs and underwriting risk,delaying their payback period.Fresh business, or first year premiums, in the sectorgrew by 23.31% to Rs92,989 crore in 2007-08 froma year ago. In the two preceding fiscals, businesshad grown even faster at 94.96% and 47.94%,respectively, according to a report by the InsuranceRegulatory and Development Authority, or Irda.“The payback period has stretched to around 12years from the seven years assumed when theinsurance industry was opened up to competition in2000,” says Sanjay Aggarwal, national industrydirector, financial services, at consulting firm KPMG.High growth rates mean a significant part of a privatefirm’s portfolio is made of early-stage policies. InIndia, expenses for both a life insurer and the insuredare front-loaded, with a big chunk of premium in thefirst year going towards writing off distribution costssuch as an agent’s commission.The returns for an insurer come after a few yearswhen the expenses shrink.MEDIA WATCH“The market has evolved differently from what wasanticipated. No one thought life insurance firmswould be able to extend distribution reach to thisextent,” says Vimal Bha-ndari, country head, India,Aegon NV, the Netherlands-based insurer that hasapplied to Irda for a licence to start a business in thecountry.Aegon is partnering Bennett, Coleman and Co. Ltd(BCCL), publishers of The Times of India and TheEconomic Times, and Religare Enterprises Ltd tostart its local operations.The regulator requires life insurance firms to maintaina 150% solvency margin, or the excess of assetsover liabilities. The margin indicates how prepared afirm is to meet unforeseen requirements. To meetthe regulation, insurers have to build up their reservesand pump in more capital at regular intervals.In January, Aviva Life Insurance Co. India Ltd raisedits capital base by Rs246.3 crore to Rs1,004.5 crore.Kotak Mahindra Old Mutual Life Insurance Ltd isexpected to infuse alm-ost Rs500 crore of equitycapital in three years. ING Vysya Life Insurance Co.Ltd plans an infusion of Rs500 crore in 2008-09. BajajAllianz Life Insurance Co. Ltd has grown to Rs875crore, after an infusion of Rs175 crore in January.Given the high industry growth rate, more capitalinfusion would be needed, experts say.“The break-even considerations are many, but thebiggest factor is new business strain,” saysJambunathan.According to Satyan Jambunathan, senior vicepresidentand head-finance, ICICI Prudential LifeInsurance Co. Ltd, around eight years ago whenthe industry opened up, plans were made assumingthat the growth would be 30-40%. In the recent past,however, fresh business grew faster, sendingprofitability projections haywire, he says.Parliament in 2000 dismantled the monopoly of LifeInsurance Corp. Of India and opened up the sectorto private firms and joint ventures with foreign firms,whose holding was limited to 26%. The growth ofprivate insurance has accelerated after a slow start.Not all new life insurers have failed to break even.SBI Life Insurance Co. Ltd, in which the majorityshareholder is India’s largest bank State Bank ofIndia, recorded a net profit of Rs2.03 crore in 2005-06. “The firm has succeeded in achieving an earlybreak-even on account of its lower cost of operations,as it has been able to leverage the network of itsIndian partner the State Bank of India,” says the2006-07 Irda annual report (the 2007-08 one is yet tobe released).SBI Life is the first private life insurer to break even,but it is not the largest in terms of fresh business. In17

2007-08, ICICI Prudential was the largest amongprivate firms in terms of fresh business. SBI Lifecame in third after Bajaj Allianz.A tight leash on costs is critical for a private lifeinsurer’s success, and the economy-wide escalationof operating exp-enses is expected to hurt thesefirms. Says KPMG’s Aggarwal: “It’s partly due tofaster scaling up. The actual growth in the industryhas been faster than originally planned, but not asprofitable as planned. The reason is that coststructures have gone up in the form of significantlyhigher-than-planned employee costs... Distributioncosts are also very high.”“Everything (increasing cost base and geographicalexpansion) is going to push up the capital cost andgestation period of running a life insurancecompany,” Aggarwal says.Not everyone believes there is a strong case for thedelay in the break-even point. Bhandari says someof the assumptions made in 2000 still hold good, butit would primarily depend on the strategy of aninsurer. “If you follow an aggressive policy, breakevenwill get shifted forward. With a more modestexpansion, keeping capital in mind, you can reachbreak-even in about seven-eight years,” he adds.So far, only SBI Life seems to have got the balanceright.Reliance Life plans new ULIP schemeReliance is Bringing a type of ‘loyalty bonus’ featureinto the ULIP space, Reliance Life Insurance plansto launch a plan, providing guaranteed additionalcontribution for policyholders during the policy term.Reliance Life Insurance’s ‘Super InvestAssurePlan’, which will hit the market later this week, isthe eighth unit-linked insurance product from thecompany, targeted at individuals.Under the additional guarantee contributions,Reliance Life would add 50 per cent of the first year’sbasic premium to the fund value on the 10th policyanniversary and every 5th policy anniversarythereafter so long as the policy is in force.By this, a policyholder could earn up to 250 per centof first year basic premium as guaranteed additionsduring the policy term (30 years).Reliance Life Insurance expects the ‘SuperInvestAssure Plan’ to emerge as its flagship productunder ULIPs and account for about 25 per cent ofthe new premium income for the current fiscal. In2007-08, the company’s new premium collectionsstood at Rs 2,754 crore.Life insurance industry sees 7% drop in <strong>news</strong>alesInsurance buyers are keeping away from unit-linkedinsurance plans (Ulips) due to the continous volatilityin the stock market.The life insurance industry, which was growing over100 per cent last year, registered a negative growthfor the month of April this year, reporting a declineof 6.77 per cent. It gathered a new business premiumof Rs 2,780.11 crore in April this year as against Rs2,982.28 crore in April 2007. Life InsuranceCorporation of India continues to witness reduceddemand from single premium Ulips. It collected anew business premium of Rs 1,247.89 crore in Aprilthis year as against Rs 2,134 crore in thecorresponding period last year, a fall of 41.5 per centin new sales. LIC lost a substantial market share inApril. The public sector behemoth had a share of44.88 per cent during the month, while the privateplayers increased their market share to 55.11 percent. However, the 17 private players have registered80.69 per cent growth in new business premium forthe month of April at Rs 1532.22 crore as against afresh premium of Rs 847.96 crore in April 2007. ACEO of an insurance company, said, “Due to thevolatility in the stock market, pension products, healthinsurance and traditional products will sell more.”R-Adag targets captive customers with new coFirm will focus on marketing life and non-lifeinsurance and other consumer finance productsMumbai: Anil Ambani, the billionaire chairman ofReliance-Anil Dhirubhai Ambani Group (R-Adag),has formed a new company to sell financial productsto the more than 170 million customers his group hasacross the power, telecom, entertainment andfinancial services businesses.Reliance Capital Services Ltd, as the new companyis called, will focus on marketing life and non-lifeinsurance and other consumer finance products togroup customers, according to an R-Adag official.18

It’s the first move by R-Adag, whose stable includesthe non-banking financial services firm RelianceCapital Ltd, to tap its internal customer base forselling such products.The group recently set up Reliance HR Services Ltd,a human resources firm that’s targeting therecruitment of half-a-million people for R-Adag inthe next four years.“We already have an existing relationship with over170 million customers through our various groupcompanies. We intend to leverage this relationshipand offer specialized products to these set ofcustomers through this new company, whereverpossible,” said Sam Ghosh, group chief executive ofReliance Capital.Reliance Capital also has two insurance firms underits fold—Reliance General Insurance Co. Ltdand Reliance Life Insurance Co. Ltd. Anothergroup arm, Reliance Capital Asset ManagementLtd, had Rs98,431 crore worth of assets undermanagement as on 31 May, about 16% of the totalat India’s mutual fund industry.Its broking arm, Reliance Money, also distributesfinancial products and Reliance Consumer Finance,another division, has advanced more than Rs7,000crore as home loans, car loans and personal loans.The new firm would initially start with a staff of 200that will be scaled up aggressively. Reliance CapitalServices will have a pan-India footprint and look atservicing internal customers of the group acrossregions.R-Adag has about 50 million customers in thetelecom business, controlled by RelianceCommunications Ltd and 20 million customersacross financial services. Reliance InfrastructureLtd has more than 30 million customers, whileReliance Entertainment Ltd boasts of 70 millioncustomers.“We plan to complement the marketing anddistribution efforts of individual firms that are focusedon selling their individual products. This initiative addsto their already aggressive growth momentum,”Ghosh said.LIC plays it safe in volatile marketsMumbai June 19, 2008Stability in the stock markets will hold the key toLife Insurance Corporation’s investment strategy inthe coming months. The insurer is India’s largestdomestic institutional investor. While LIC’s appetitefor equity stays, the public sector insurer, which hopesto invest around Rs 45,000 crore in the stock marketsthis year, may shift a few thousand crores to thedebt market if Dalal Street remains volatile. Whileit’s still early days, LIC Managing Director ThomasMathew T told Business Standard that he expectsthe stock markets to stay volatile till October-November. “The debt market is attractive at themoment and we may look at a higher exposure. Ourprimary job is to ensure safety of our policyholderswho have entrusted us with their money,” he said.LIC’s investible corpus was estimated at Rs 1,50,000crore last year and is expected to exceed Rs 1,75,000crore. The investment in debt will rise from Rs 30,000crore in 2007-08 to Rs 45,000 crore this year. Forthe moment, however, LIC is betting big on equityand a lot of it has to do with investor preference.According to the business plan, LIC hopes to mopup around Rs 57,000 crore through the sale of newpolicies compared with Rs 43,000 crore last year.Of this, 70 per cent, or nearly Rs 40,000 crore, isexpected to come from the sale of Ulips. In addition,LIC is expected to earn over Rs 100,000 crore aspremium from policies sold earlier. Of this, Mathewsaid, 8-10 per cent will be earmarked for equities.“If the market conditions improve, we may look toscale it up a little in the fourth quarter,” Mathewsaid. While the stock market boom in recent yearshas meant that the share of profits from equities inthe company’s investment income has moved up from25 per cent a couple of years ago to around 33 percent. Mathew said that the volatility in the stockmarkets may mean that the profits from the segmentstay around last year’s level of Rs 9,800 crore. In2007-08, LIC’s investment income was around Rs40,000 crore. The market value of its equity portfoliorose to Rs 7,51,000 crore at the end of March thisyear compared with around Rs 6,00,000 crore at theend of March 2007. “LIC’s total income been rising15-20 per cent every year. The total investmentincome for the current year will be Rs 40,000 to45,000 crore depending on stock market conditions,”Mathew said. During the first two-and-a-half months19

of the current financial year, LIC has investedaround Rs 8,000 crore in the stock markets from itstotal investment of nearly Rs 30,000 crore.Pre-existing diseases to get cover from 4th yrHolders of health insurance policies issued from June1 onwards will benefit.Buyers of health insurance policies will now get theirpre-existing diseases covered from the fourth yearof their policy. Pre-existing disease has long been agrey area and the biggest reason for dispute amonginsurance companies and medical insurancepolicyholders. Insurers under the aegis of the GeneralInsurance Council – a body of all general insurancecompanies – have now agreed to adopt a standarddefinition of pre-existing diseases from this month.All new health insurance policies that are issuedfrom June 1 this year, besides renewal of old healthinsurance policies, will adopt the new standarddefinition of pre-existing diseases. Insurancecompanies have said they have also got the nod fromthe Insurance Regulatory and DevelopmentAuthority (Irda) in this regard. The new uniformdefinition of a pre-existing disease is: “Any condition,ailment or injury or related condition(s), for whichyou had signs or symptoms and/or were diagnosed,and/or received medical advice/treatment within 48months prior to your first policy with us.” Theexclusion wording says: “Benefits will not beavailable for any condition(s) as defined in the policy,until 48 months of continuous coverage has elapsed,since inception of the first policy with us.” Earlier,each insurance company followed its own definitionof pre-existing disease and the exclusion periodvaried and created confusion for policyholders. “Asan industry, we deliberated the issue and have nowagreed on the standard definition. That means, afterthe fourth policy year, an insurance company willhave to cover all pre-existing diseases,” GeneralInsurance Council General Secretary K N Bhandarisaid. Insurers earlier argued that people oftenpurchased health insurance to get their medicaltreatment covered.DOP announces bonus on RPLI PoliciesTuesday, Jun 24, 2008CHANDIGARH: The Department of Posts (DoP)announced a bonus of Rs 60 per Rs 1,000 sumassured for the Whole Life Assurance scheme inthe Rural Postal Life Insurance (RPLI) segment. Abonus of Rs 50 per Rs 1,000 sum assured would bepayable on the Anticipated Endowment Assuranceplan of the RPLI, a DoP spokesman said here today.The bonus of Rs 55 and Rs 52 per Rs 1,000 sumassured has been announced on the EndowmentAssurance scheme for policies exceeding 10-yearterm and upto 10-year term respectively, he said.He said that the DoP has assured a bonus of Rs 874crore on around 1,22,000 live RPLI policies in Punjaband Chandigarh.LIC to relaunch three popular schemesPress Trust of India / Kolkata June 24, 2008,The Life Insurance Corporation of India (LIC), whichhad a marketshare was 63.64 per cent till March31,has chalked up plans to revive some of its popularproducts to further widen its base in the country.”Wehave been considering relaunching schemes like‘Jeevan Anand’, ‘Jeevan Sathi’ and ‘JeevanTarang’in a renewed form in view of these being widelypopular and promise higher returns,” LIC’sZonalManager R R Dash said launching Market Plus- 1 scheme here today.Dash said that LIC’s grossinvestment in 2007-08 was over Rs 1.50 lakh crore,and the income generated from it was Rs 40,655crore.Stating that company’s profit from sale of equitylast year was Rs 10,000 crore, he said, “LIC wasnotaffected by fluctuations in the market as itsinvestments were long-term.”He said that LIC’sinvestment in infrastructure development was Rs11,630 crore last year, while the cumulative figurewas Rs 56,691 crore.Investments in the Socially-Oriented Sector last year was Rs 5,635 crore andcumulative investment Rs32,321 crore, he said.LIC’sloan to the West Bengal government for developmentprojects stood at Rs 1,583.26 crore, which wassecond highest in the country after the loan given tothe Maharashtra government which was atRs1,622.58 crore,. He added.The new schemelaunched today is a unit-linked deferred pension planand one of its highlights is the enhanced limit forinvestment in the equity market for secured andbalanced funds.Bancassurance contributes major chunk forprivate playersChennai, June 29The insurance sector has witnessed a phenomenalgrowth over the past few years. In 2007-08, growth20

in premiums was over 40 per cent. Many privateplayers are growing at rates above 70 per cent.Insurance premium collections have touched 4.1 percent of the GDP. Growth in life insurance premiumsstill come primarily through the efforts of individualagents. But another channel that is fast emergingas a significant source of premium income isbancassurance - especially for private lifeinsurers.Bancassurance currently contributes closeto 35 per cent of the premium collected by privateplayers. In 2006-07, that figure was about 17 percent. The growth in the bancassurance for insurancecompanies entirely rests on the number of bankbranches that actively distributes these products.For HDFC Standard life insurance, bancassurancecontributed 38 per cent of the new business incomein 2007-08, while for Kotak Life and Birla Sun Lifethe figure was 27 per cent. For SBI this segmentcontributed close to 41 per cent of the new premiumcollected in 2008 and grew at over 100 per cent.SBI sold 7 million policies through this channel lastyear.On the other hand, ING Vysya Life Insurancewitnessed 71 per cent growth on year-on-year basis.In 2005-06 ING Vysya had a tie-up with 37 cooperativebanks and it mopped up Rs 7 crore. Today,the number of tie-ups stands at 162 banks and itbought revenue of Rs 46 crore. Asked about theprospects of bancassurance for ING and for theindustry, Mr Rene Van Poel, Director AlternateChannels, explains that according to a recentanalysis, bancassurance is likely to generateapproximately 35 per cent of private insurers’premium income by 2008. However, growth inbancassurance in India will fall short of its potentialunless the perceived lack of sales culture and visionbegin to get addressed by the banks, he said.Bothbankers and insurers are bullish about the futureoutlook of bancassurance and expect that it wouldcontribute about 50 per cent or more in the lifesegment in the year 2010. Mr Ajay Srinivasan, ChiefExecutive, Financial Services, Aditya BirlaManagement Corporation, said that in India, thenumber of bank accounts is not even half of thenumber of mobiles. If further penetration of bankstakes place it will bring more business to the entirefinancial services industry and increase thecontribution of bancassurance, he said.Chidambaram’s request for simplicity getscomplex answersFinance minister P Chidambaram fired a salvo atthe insurance industry asking for simple products tobe designed that can be understood by commonpeople. He was speaking at the launch of the HSBC-Canara-Oriental Bank of Commerce launch of theirlife insurance venture.“Plain vanilla is still the best flavour for an icecream,”he said quoting an analogy. “People in Indiaare simple folks, who work hard and save. I believethat simpler the product, better will be the reception.”Those selling insurance products to rural customers,should understand their language, attend to theirconcerns, he said while stating that products shouldbe such that they could easily comprehend and claimbenefit quickly.“The finance minister’s quest for simplicity is wellreceived,” said SB Mathur, chairman, Life InsuranceCouncil and former chairman, Life InsuranceCorporation. “Life insurance companies have reachedout to rural parts of the country, unlike the mutualfunds industry, whose revenues and subscribers aremostly based in cities and towns.”Servicing such a network, he said, involves costs.“One has to depend on agents for reaching out torural parts of the country.”That products need to be simplified is well understoodby the industry. “We are already simplifying ourproducts and working on it further,” said P Nandgopal,chief executive officer, Reliance Life Insurance. “Ourmicro insurance product which we are working onwill be fairly simplified.”A top insurance industry official, not willing to bequoted, was more candid: “Insurance products arebeing launched keeping agents in mind due to theirunreasonable power and influence.”What consumers need while buying insuranceproducts is protection, which only a term policy offers.“Insurance companies must sell term insuranceproducts to people who are looking for insurance,”said D Sundararajan, a Mumbai-based financialplanner.21

HEALTH WATCHDepressionWhat is depression?When doctors talk about depression, they mean themedical illness called major depression. Someonewith major depression has symptoms like those listedin the box below nearly every day, all day, for 2 weeksor longer.If you’re depressed, you may also have headaches,other aches and pains, digestive problems andproblems with sex. An older person with depressionmay feel confused or have trouble understandingsimple requests.Symptoms of depression• Feeling sad, hopeless and having frequent cryingspells• Losing interest or pleasure in things you used toenjoy (including sex)• Feeling guilty, helpless or worthless• Thinking about death or suicide• Sleeping too much, or having problems sleeping• Loss of appetite and unintended weight loss orgain• Feeling very tired all the time• Having trouble paying attention and makingdecisions• Having aches and pains that don’t get better withtreatment• Feeling restless, irritated and easily annoyedWhat causes depression?Depression seems to be related to a chemicalimbalance in the brain that makes it hard for the cellsto communicate with one another. Depression alsoseems to be hereditary (to run in families).Depression can be linked to stressful events in yourlife, such as the death of someone you love, a divorceor loss of you a job. Taking certain medicines, abusingdrugs or alcohol or having other illnesses can alsolead to depression. Depression isn’t caused bypersonal weakness, laziness or lack of will power.How is depression diagnosed?If you’re having symptoms of depression, be sure totell your doctor so you can get help. Don’t expectyour doctor to be able to guess that you’re depressedjust by looking at you. The sooner you seek treatment,the sooner the depression will lift.Once you tell your doctor how you’re feeling, he orshe may ask you some questions about yoursymptoms, about your health and about your familyhistory of health problems. Your doctor may also giveyou a physical exam and do some tests.How is depression treated?Depression can be treated with medicines, withcounseling or with both.What about medicines?Many medicines can be used to treat depression.These medicines are called antidepressants. Theycorrect the chemical imbalance in the brain thatcauses depression.Antidepressants work differently for different people.They also have different side effects. So, even ifone medicine bothers you or doesn’t work for you,another may help. You may notice improvement assoon as 1 week after you start taking the medicine.But you probably won’t see the full effects for about8 to 12 weeks. You may have side effects at first butthey tend to decrease after a couple of weeks.How long will I need medicine?How long you’ll need to take the medicine dependson your depression. Your doctor may want you totake medicine for 4 to 6 months or longer. You needto take the medicine long enough to reduce thechance that the depression will come back. Talk withyour doctor about any questions you have about yourmedicine22