BRIGADE ENTERPRISES LIMITED - Brigade Group

BRIGADE ENTERPRISES LIMITED - Brigade Group

BRIGADE ENTERPRISES LIMITED - Brigade Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

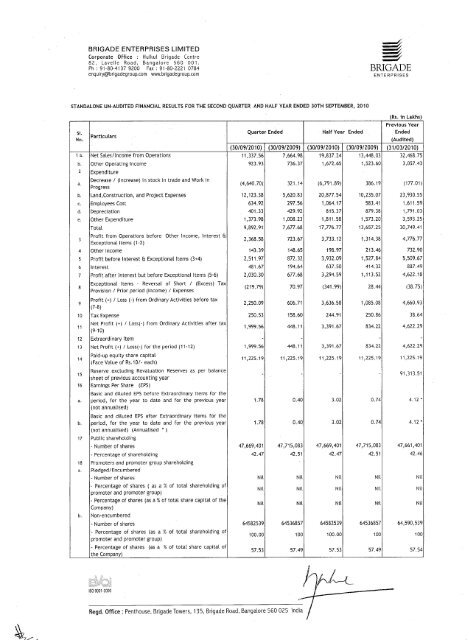

<strong>BRIGADE</strong> <strong>ENTERPRISES</strong> <strong>LIMITED</strong>Corporate Office : Hulkul <strong>Brigade</strong> Centre82, Lavelle Road, Bangalore 560 001.Ph: 91-80-4137 9200 Fax: 91-80-2221 0784enquiry@brigadegroup.com www.brigadegroup.com <strong>ENTERPRISES</strong>STANDALONE UN-AUDITED FINANCIAL RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30TH SEPTEMBER, 201051.No.ParticularsPreviousQuarter Ended Half Year Ended Ended(Audited)(3010912010) (3010911009) (3010912010) (3010912009) (31/0312010)1 a. Net Sales/lncome from Operations 11,337.56 7,664.98 19,837.24 13,448.03 32,468.75b. Other Operating Income 923.93 736.37 1,672.65 1,523.60 3,057.432 Expenditurea.Decrease / (Increase) in stock in trade and Work inProgressYear(4,640.70) 321. 14 (6,791.89) 386.19 (177.01)b. Land,Construction, and Project Expenses 12,123.38 5,620.83 20,877.54 10,235.07 23,930.55c. Employees Cost 634.92 297.56 1,064.17 583.41 1,611.59d. Depreciation 401.33 429.92 815.37 879.38 1,791.03e. Other Expenditure 1,373.98 1,008.23 1,811.58 1,573.20 3,593.253Total 9,892.91 7,677.68 17,776.77 13,657.25 30,749.41Profit from Operations before Other Income, Interest ftExceptional Items (1-2)2,368.58 723.67 3,733.12 1,314.38 4,776.774 Other Income 143.39 148.65 198.97 213.46 732.905 Profit before Interest & Exceptional Items (3+4) 2,511.97 872.32 3,932.09 1,527.84 5,509.676 Interest 481.67 194.64 637.50 414.32 887.497 Profit after Interest but before Exceptional Items (5-6) 2,030.30 677.68 3,294.59 1,113.52 4,622.1889Exceptional Items - Reversal of Short / (Excess) TaxProvision / Prior period (Income) / ExpensesProfit (+) / Loss (-) from Ordinary Activities before tax(7-8)(219.79) 70.97 (341. 99) 28.44(38.75)2,250.09 606.71 3,636.58 1,085.08 4,660.9310 Tax Expense 250.53 158.60 244.91 250.86 38.6411Net Profit (+) / Loss(-) from Ordinary Activities after tax(9-10)12 Extraordinary Item1,999.56 448.11 3,391.67 834.22 4,622.2913 Net Profit (+) / Loss(-) for the period (11-12) 1,999.56 448.11 3,391.67 834.22 4,622.291415Paid-up equity share capital(Face Value of Rs.l0/- each)Reserve excluding Revaluation Reserves as per balancesheet of previous accounting year16 Earnings Per Share (EPS)11,225.19 11,225.19 11,225.19 11,225.19 11,225.1991,313.51Basic and diluted EPS before Extraordinary items for thea. period, for the year to date and for the previous year 1.78 0.40 3.02 0.74 4.12 •(not annualised)Basic and diluted EPS after Extraordinary items for theb. period, for the year to date and for the previous year 1.78 0.40 3.02 0.74 4.12 •(not annualised) (Annualised .)17 Public shareholding- Number of shares 47,669,401 47,715,083 47,669,401 47,715,083 47,661,401- Percentage of shareholding 42.47 42.51 42.47 42.51 42.4618 Promoters and promoter group shareholdinga. Pledged/Encumbered- Number of shares Nil Nil Nil Nil Nil- Percentage of shares ( as a % of total shareholding ofpromoter and promoter group)- Percentage of shares (as a % of total share capital of theCompany)b. Non-encumberedNil Nil Nil Nil NilNil Nil Nil Nil Nil- Number of shares 64582539 64536857 64582539 64536857 64,590,539- Percentage of shares (as a % of total shareholding ofpromoter and promoter group)- Percentage of shares (as a % of total share capital ofthe Company)100.00 100 100.00 100 10057.53 57.49 57.53 57.49 57.54(Rsin Lakhs)ISO 9001-2000Regd. Office: Penthouse, <strong>Brigade</strong> Towers, 135, <strong>Brigade</strong> Road, Bangalore 560 025

Notes:The above results have been reviewed by the Audit Committee and taken on record by the Board of Directors in its meeting held on 9thNovember, 20102 The statement of assets and liabilities are as below:(Rsin lakhs)Particulars 30.09.2010 30.09.2009Shareholders Fund:(a) Capital 11,225.19 11,225.19(b) Reserves and Surplus 94,690.27 89,101.37Loan Funds 76,887.20 57,582.73Total 1,82,802.66 1,57,909.29Fixed Assets 120,752.97 89,089.94Investments 1,812.58 3,417.60Current Assets, Loans & Advances:(a) Inventories 46,812.88 51,304.90(b) Sundry Debtors 7,427.48 920.51(c) Cash and Bank balances 3,846.51 2,032.95(d) Other current assets 42,024.56 35,226.23less: Current liabilites and Provisions(a) Current liabilities 34,798.72 25,712.99(b) Provisions 6,290.40 394.51Miscellaneous Expenditure (not written off or adjusted) 1,214.80 2,024.66Profit and Loss AccountTotal 1,82.802.66 1,57,909.29There were no complaints pending redressal at the beginning of the quarter i.e. 1st July, 2010.During the quarter a total of 91 complaintswere received which were duly redressed. There was no complaints pending redressal at the end of the quarter.4 Segmentwise reporting as required under Accounting Standard 17 is not applicable as the Company operates under a single Segment.The figures for the previous year has been regrouped I reclassified wherever necessary.for<strong>BRIGADE</strong> <strong>ENTERPRISES</strong> l TDBangalore9th November, 2010?~<strong>BRIGADE</strong><strong>ENTERPRISES</strong>