Entrepreneur Profile - Planters Development Bank

Entrepreneur Profile - Planters Development Bank

Entrepreneur Profile - Planters Development Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A S p e c i a l P u b l i c a t i o n f o r P l a n t e r s b a n k C l i e n t s a n d F r i e n d s V o l u m e 3 N o . 1 2 0 0 5ENTREPRENEUR PROFILEBuildinga legacyp 6In this issue:2 HOTLINEInternational Yearof MicrocreditDTI beefs BNRS<strong>Planters</strong>bank-AureosLaunch SME Equity Fund9 ENTREPRENEUR GURUThe <strong>Entrepreneur</strong>ial Mindset10 ManagementKnowing What You WereMade To Do11 PRODUCTIVITYUnderstanding the “P” Word12 MARKETINGBig Business PR ForSmall Biz13 MONEY MATTERSComparative Tax Incentivesin Asia14 FRANCHISINGPearls of Wisdom15 BOOKSSales & Marketing Support16 LIFESTYLEHoliday Plaza Hotel17 TECHNOLOGYPDA-Phone Hybrids18 BOTTOMLINETurning Your WorkplaceInto a Profi t Making Machine

HotlineInternational Yearof MICROCREDITfrom plantersbank.com.phLow income peopleoften resort to informallenders to augmenttheir meager capital becausethey lack access to the servicesof financial institutions.Through microfinance, lowincomeentrepreneurs withmicroenterprises are able tosecure small loans to providethem the means to createmore products, improve theirservices, expand their market, andultimately increase their income andeconomic activities. There is sufficientevidence to confirm that low-incomepeople are able to save, repay theirloans and use credit productively.In the Philippines, where poverty isprevalent and where many poor peoplemanage some sort of microenterprise,microfinance seems like a good solution.Recognizing the potential of microfinance as one of the effective tools tomeet the UN’s millenium development goal of reducing by half the incidenceof poverty worldwide by the year 2015, the United Nations declared the year2005 as the International Year of Microcredit.In the Philippines, where poverty is prevalent and where many poor peoplemanage some sort of microenterprise, microfinance seems like a good solution.By invigorating microenterprise, households, communities and local economiesare spurred toward progress. <strong>Planters</strong> <strong>Development</strong> <strong>Bank</strong> declared its full supportfor IYM 2005. Through its own operations and that of Davao-based affiliateMicro Enterprise <strong>Bank</strong>, <strong>Planters</strong>bank aims to widen and deepen the reach ofmicrofinance services to low-income people to help them run better businesses andultimately, live better lives. <strong>Planters</strong>bank affiliated SME virtual community SME.com.ph is sponsoring the official Philippine IYM website www.microfinance.com.phMicrofinance is defined as the provision of a broad range of financial servicestargeted to low-income clients. It includes credit, savings, insurance, remittancesand payment services. Providers of microfinance include non-governmentorganizations, cooperatives, credit unions, rural banks, thrift banks and stateownedbanks.With microfinance, people can move from day-to-day survival towards planningfor the future—investing in better nutrition, housing, health and education fortheir children.2 BUSINESSline

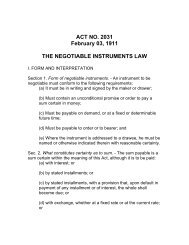

TAX

As entrepreneurs, sales and marketingare two daily realities of running abusiness. Although some of us may no longerbe involved in face-to-face selling to customers,we nonetheless sell and market ideas and initiatives to ourbusiness partners and employees. And for those of us whodo need to actively market our product andservices to a wide base of clients, the high priceof advertising presents a formidable obstacle forwhich we rack our brains to creatively hurdle.There are three books from McGraw’s wide selection of tradetitles that are must-reads for entrepreneurs looking to growtheir expertise in S&M:1

INSTALLMENT LOANGet Instant Cash from P30,000 - P1Millionand pay in 6, 12, 18, 24, 30, or 36monthly installments.