2012 Annual Report - Financial Statements (English) - Khaleeji ...

2012 Annual Report - Financial Statements (English) - Khaleeji ...

2012 Annual Report - Financial Statements (English) - Khaleeji ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

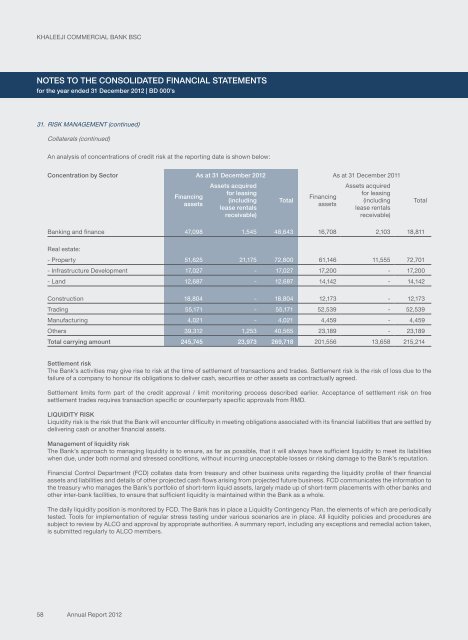

KHALEEJI COMMERCIAL BANK BSCNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSfor the year ended 31 December <strong>2012</strong> | BD 000’s31. RISK MANAGEMENT (continued)Collaterals (continued)An analysis of concentrations of credit risk at the reporting date is shown below:Concentration by Sector As at 31 December <strong>2012</strong> As at 31 December 2011FinancingassetsAssets acquiredfor leasing(includinglease rentalsreceivable)TotalFinancingassetsAssets acquiredfor leasing(includinglease rentalsreceivable)TotalBanking and finance 47,098 1,545 48,643 16,708 2,103 18,811Real estate:- Property 51,625 21,175 72,800 61,146 11,555 72,701- Infrastructure Development 17,027 - 17,027 17,200 - 17,200- Land 12,687 - 12,687 14,142 - 14,142Construction 18,804 - 18,804 12,173 - 12,173Trading 55,171 - 55,171 52,539 - 52,539Manufacturing 4,021 - 4,021 4,459 - 4,459Others 39,312 1,253 40,565 23,189 - 23,189Total carrying amount 245,745 23,973 269,718 201,556 13,658 215,214Settlement riskThe Bank’s activities may give rise to risk at the time of settlement of transactions and trades. Settlement risk is the risk of loss due to thefailure of a company to honour its obligations to deliver cash, securities or other assets as contractually agreed.Settlement limits form part of the credit approval / limit monitoring process described earlier. Acceptance of settlement risk on freesettlement trades requires transaction specific or counterparty specific approvals from RMD.LIQUIDITY RISKLiquidity risk is the risk that the Bank will encounter difficulty in meeting obligations associated with its financial liabilities that are settled bydelivering cash or another financial assets.Management of liquidity riskThe Bank’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilitieswhen due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Bank’s reputation.<strong>Financial</strong> Control Department (FCD) collates data from treasury and other business units regarding the liquidity profile of their financialassets and liabilities and details of other projected cash flows arising from projected future business. FCD communicates the information tothe treasury who manages the Bank’s portfolio of short-term liquid assets, largely made up of short-term placements with other banks andother inter-bank facilities, to ensure that sufficient liquidity is maintained within the Bank as a whole.The daily liquidity position is monitored by FCD. The Bank has in place a Liquidity Contingency Plan, the elements of which are periodicallytested. Tools for implementation of regular stress testing under various scenarios are in place. All liquidity policies and procedures aresubject to review by ALCO and approval by appropriate authorities. A summary report, including any exceptions and remedial action taken,is submitted regularly to ALCO members.58<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>