2012 Annual Report - Financial Statements (English) - Khaleeji ...

2012 Annual Report - Financial Statements (English) - Khaleeji ...

2012 Annual Report - Financial Statements (English) - Khaleeji ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

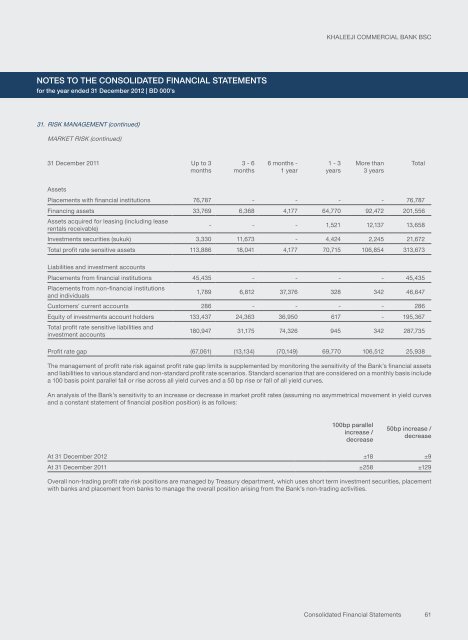

KHALEEJI COMMERCIAL BANK BSCNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSfor the year ended 31 December <strong>2012</strong> | BD 000’s31. RISK MANAGEMENT (continued)MARKET RISK (continued)31 December 2011 Up to 3months3 - 6months6 months -1 year1 - 3yearsMore than3 yearsTotalAssetsPlacements with financial institutions 76,787 - - - - 76,787Financing assets 33,769 6,368 4,177 64,770 92,472 201,556Assets acquired for leasing (including leaserentals receivable)- - - 1,521 12,137 13,658Investments securities (sukuk) 3,330 11,673 - 4,424 2,245 21,672Total profit rate sensitive assets 113,886 18,041 4,177 70,715 106,854 313,673Liabilities and investment accountsPlacements from financial institutions 45,435 - - - - 45,435Placements from non-financial institutionsand individuals1,789 6,812 37,376 328 342 46,647Customers’ current accounts 286 - - - - 286Equity of investments account holders 133,437 24,363 36,950 617 - 195,367Total profit rate sensitive liabilities andinvestment accounts180,947 31,175 74,326 945 342 287,735Profit rate gap (67,061) (13,134) (70,149) 69,770 106,512 25,938The management of profit rate risk against profit rate gap limits is supplemented by monitoring the sensitivity of the Bank’s financial assetsand liabilities to various standard and non-standard profit rate scenarios. Standard scenarios that are considered on a monthly basis includea 100 basis point parallel fall or rise across all yield curves and a 50 bp rise or fall of all yield curves.An analysis of the Bank’s sensitivity to an increase or decrease in market profit rates (assuming no asymmetrical movement in yield curvesand a constant statement of financial position position) is as follows:100bp parallelincrease /decrease50bp increase /decreaseAt 31 December <strong>2012</strong> ±18 ±9At 31 December 2011 ±258 ±129Overall non-trading profit rate risk positions are managed by Treasury department, which uses short term investment securities, placementwith banks and placement from banks to manage the overall position arising from the Bank’s non-trading activities.Consolidated <strong>Financial</strong> <strong>Statements</strong>61