2003 - KNM Steel Sdn Bhd

2003 - KNM Steel Sdn Bhd

2003 - KNM Steel Sdn Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

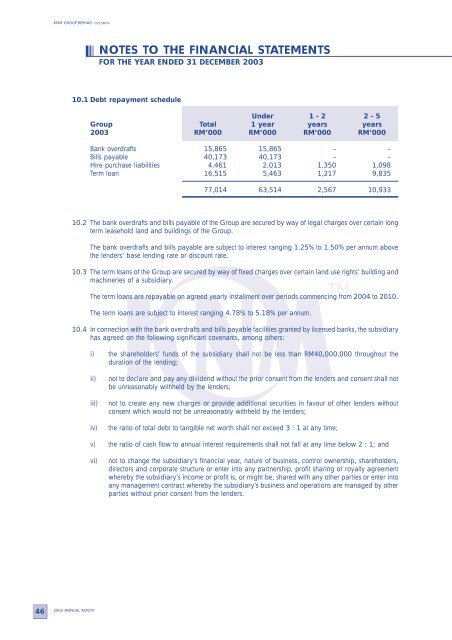

<strong>KNM</strong> GROUP BERHAD (521348-H)NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER <strong>2003</strong>10.1 Debt repayment scheduleUnder 1 - 2 2 - 5Group Total 1 year years years<strong>2003</strong> RM’000 RM’000 RM’000 RM’000Bank overdrafts 15,865 15,865 – –Bills payable 40,173 40,173 – –Hire purchase liabilities 4,461 2,013 1,350 1,098Term loan 16,515 5,463 1,217 9,83577,014 63,514 2,567 10,93310.2 The bank overdrafts and bills payable of the Group are secured by way of legal charges over certain longterm leasehold land and buildings of the Group.The bank overdrafts and bills payable are subject to interest ranging 1.25% to 1.50% per annum abovethe lenders’ base lending rate or discount rate.10.3 The term loans of the Group are secured by way of fixed charges over certain land use rights’ building andmachineries of a subsidiary.The term loans are repayable on agreed yearly installment over periods commencing from 2004 to 2010.The term loans are subject to interest ranging 4.78% to 5.18% per annum.10.4 In connection with the bank overdrafts and bills payable facilities granted by licensed banks, the subsidiaryhas agreed on the following significant covenants, among others:i) the shareholders’ funds of the subsidiary shall not be less than RM40,000,000 throughout theduration of the lending;ii)iii)iv)not to declare and pay any dividend without the prior consent from the lenders and consent shall notbe unreasonably withheld by the lenders;not to create any new charges or provide additional securities in favour of other lenders withoutconsent which would not be unreasonably withheld by the lenders;the ratio of total debt to tangible net worth shall not exceed 3 : 1 at any time;v) the ratio of cash flow to annual interest requirements shall not fall at any time below 2 : 1; andvi)not to change the subsidiary’s financial year, nature of business, control ownership, shareholders,directors and corporate structure or enter into any partnership, profit sharing or royalty agreementwhereby the subsidiary’s income or profit is, or might be, shared with any other parties or enter intoany management contract whereby the subsidiary’s business and operations are managed by otherparties without prior consent from the lenders.46<strong>2003</strong> ANNUAL REPORT