2003 - KNM Steel Sdn Bhd

2003 - KNM Steel Sdn Bhd

2003 - KNM Steel Sdn Bhd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

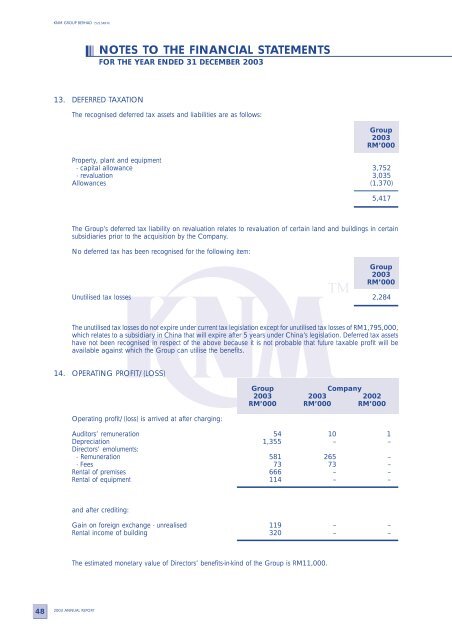

<strong>KNM</strong> GROUP BERHAD (521348-H)NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER <strong>2003</strong>13. DEFERRED TAXATIONThe recognised deferred tax assets and liabilities are as follows:Group<strong>2003</strong>RM’000Property, plant and equipment- capital allowance 3,752- revaluation 3,035Allowances (1,370)5,417The Group’s deferred tax liability on revaluation relates to revaluation of certain land and buildings in certainsubsidiaries prior to the acquisition by the Company.No deferred tax has been recognised for the following item:Group<strong>2003</strong>RM’000Unutilised tax losses 2,284The unutilised tax losses do not expire under current tax legislation except for unutilised tax losses of RM1,795,000,which relates to a subsidiary in China that will expire after 5 years under China’s legislation. Deferred tax assetshave not been recognised in respect of the above because it is not probable that future taxable profit will beavailable against which the Group can utilise the benefits.14. OPERATING PROFIT/(LOSS)Operating profit/(loss) is arrived at after charging:GroupCompany<strong>2003</strong> <strong>2003</strong> 2002RM’000 RM’000 RM’000Auditors’ remuneration 54 10 1Depreciation 1,355 – –Directors’ emoluments:- Remuneration 581 265 –- Fees 73 73 –Rental of premises 666 – –Rental of equipment 114 – –and after crediting:Gain on foreign exchange - unrealised 119 – –Rental income of building 320 – –The estimated monetary value of Directors’ benefits-in-kind of the Group is RM11,000.48<strong>2003</strong> ANNUAL REPORT