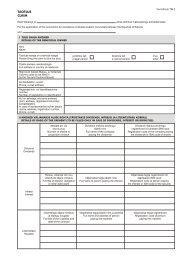

Vorm TM 1 - Maksu- ja Tolliamet

Vorm TM 1 - Maksu- ja Tolliamet

Vorm TM 1 - Maksu- ja Tolliamet

- No tags were found...

Create successful ePaper yourself

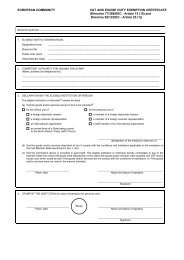

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

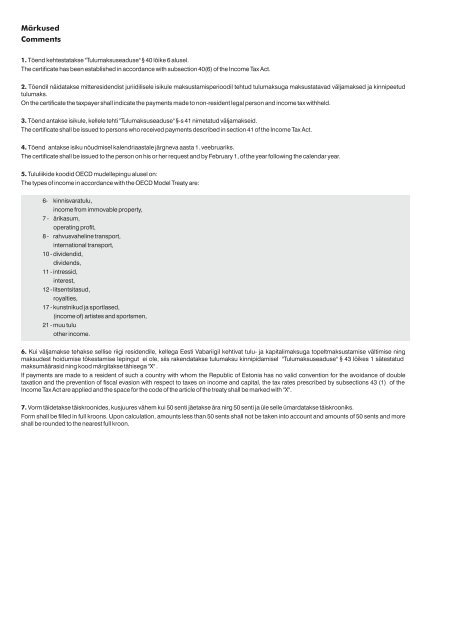

MärkusedComments1. Tõend kehtestatakse "Tulumaksuseaduse" § 40 lõike 6 alusel.The certificate has been established in accordance with subsection 40(6) of the Income Tax Act.2. Tõendil näidatakse mitteresidendist juriidilisele isikule maksustamisperioodil tehtud tulumaksuga maksustatavad väl<strong>ja</strong>maksed <strong>ja</strong> kinnipeetudtulumaks.On the certificate the taxpayer shall indicate the payments made to non-resident legal person and income tax withheld.3. Tõend antakse isikule, kellele tehti "Tulumaksuseaduse" §-s 41 nimetatud väl<strong>ja</strong>makseid.The certificate shall be issued to persons who received payments described in section 41 of the Income Tax Act.4. Tõend antakse isiku nõudmisel kalendriaastale järgneva aasta 1. veebruariks.The certificate shall be issued to the person on his or her request and by February 1, of the year following the calendar year.5. Tululiikide koodid OECD mudellepingu alusel on:The types of income in accordance with the OECD Model Treaty are:6- kinnisvaratulu,income from immovable property,7 - ärikasum,operating profit,8 - rahvusvaheline transport,international transport,10 - dividendid,dividends,11 - intressid,interest,12 - litsentsitasud,royalties,17 - kunstnikud <strong>ja</strong> sportlased,(income of) artistes and sportsmen,21 - muu tuluother income.6. Kui väl<strong>ja</strong>makse tehakse sellise riigi residendile, kellega Eesti Vabariigil kehtivat tulu- <strong>ja</strong> kapitalimaksuga topeltmaksustamise vältimise ningmaksudest hoidumise tõkestamise lepingut ei ole, siis rakendatakse tulumaksu kinnipidamisel "Tulumaksuseaduse" § 43 lõikes 1 sätestatudmaksumäärasid ning kood märgitakse tähisega "X" .If payments are made to a resident of such a country with whom the Republic of Estonia has no valid convention for the avoidance of doubletaxation and the prevention of fiscal evasion with respect to taxes on income and capital, the tax rates prescribed by subsections 43 (1) of theIncome Tax Act are applied and the space for the code of the article of the treaty shall be marked with "X".7. <strong>Vorm</strong> täidetakse täiskroonides, kusjuures vähem kui 50 senti jäetakse ära ning 50 senti <strong>ja</strong> üle selle ümardatakse täiskrooniks.Form shall be filled in full kroons. Upon calculation, amounts less than 50 sents shall not be taken into account and amounts of 50 sents and moreshall be rounded to the nearest full kroon.