NCUA - First Entertainment Credit Union

NCUA - First Entertainment Credit Union

NCUA - First Entertainment Credit Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• • • • • • • • • • • • • • • • • • • • • • • • • • •<br />

PRESIDENT’S<br />

MESSAGE<br />

Bucking the trend again with<br />

good news and plenty of growth.<br />

• • • • • • • • • • • • • • • • • • • • • • • • • • •<br />

2011 was a year of growth and new opportunities for <strong>First</strong> <strong>Entertainment</strong>. We<br />

started with the relocation of our Valencia branch to the Promenade Shopping<br />

Center in Santa Clarita. This move got an enthusiastic thumbs-up from our<br />

members. So much so, that in just 12 months we outgrew the new space and<br />

will be looking to relocate in 2012 to a larger branch location.<br />

Throughout the year, we offered members a number of products and services<br />

to improve their financial life. Among these was our annual Debt Consolidation<br />

Loan, real estate and auto loan promotions, and a highly successful summer<br />

auto loan refinance promotion tied to our sponsorship of Santa Clarita’s<br />

Concerts in the Park.<br />

We continue to look for ways to improve delivery of products and services<br />

through technology. Around mid-year, we launched our free Mobile Banking<br />

App, which has proven to be as popular as it is convenient.<br />

In August, we opened our first West Valley branch in Encino and members have<br />

shared that they love the convenience, not to mention the easy parking, free<br />

WiFi, and gourmet coffee. To support the community around our new location,<br />

we worked with Radio Disney to provide financial education seminars at local<br />

elementary schools in the Encino area.<br />

More than 8,000 new members joined our credit union in 2011. This was due<br />

in part to the Bank Transfer Day movement in November. To get an idea of the<br />

swell in discontentment from bank customers, consider this: normally we open<br />

about 500 new accounts per month. In October, we opened 1,041 and in<br />

November, we opened 1,262. Consumers voted with their feet to find an<br />

Alternative (and less expensive) Way to Bank.<br />

Number-wise, the credit union continues to be sound and healthy. At press<br />

time, assets were approaching $900 million and Capital, our reserves to<br />

cover unanticipated expenses, was just over 9%. During the year, we were<br />

audited by both State and Federal auditors as well as our own independent<br />

auditors. I’m pleased to tell members that we once again completed all of these<br />

examinations successfully.<br />

At a time when many organizations are struggling, we’re happy to report that<br />

<strong>First</strong> <strong>Entertainment</strong> continues to thrive. We expect 2012 to be another great year<br />

for the credit union and look forward to making your membership memorable!<br />

T H E S H O W<br />

Charles A. Bruen<br />

President/CEO<br />

LOCATIONS<br />

• • • • • • • • • • • • • • • • • • • • • •<br />

HOURS<br />

A L L B R A N C H E S : M-Th 8:30 am to 5:00 pm<br />

Fri 8:30 am to 6:00 pm<br />

B U R B A N K , E N C I N O, M I R AC L E M I L E ,<br />

S A N TA C L A R I TA & S T U D I O C I T Y B R A N C H E S:<br />

Sat 9:00 am to 2:00 pm<br />

M A I N O F F I C E<br />

6735 Forest Lawn Dr., Hollywood<br />

B U R B A N K<br />

2520 Olive Ave.<br />

C U L V E R C I T Y<br />

Sony Pictures Plaza<br />

10000 West Washington Blvd.<br />

E N C I N O<br />

17656 Ventura Blvd.<br />

M I R A C L E M I L E<br />

5750 Wilshire Blvd.<br />

P A R A M O U N T S T U D I O S<br />

Mae West Building<br />

(This branch restricted to individuals with studio lot access.)<br />

S A N T A C L A R I T A<br />

27093 McBean Parkway<br />

S A N T A M O N I C A<br />

2425 Colorado Ave.<br />

S T U D I O C I T Y<br />

4067 Laurel Canyon Blvd.<br />

W A R N E R B R O S . S T U D I O S<br />

Building 19<br />

(This branch restricted to individuals with studio lot access.)<br />

<strong>First</strong> <strong>Entertainment</strong><br />

T O L L F R E E : 8 8 8 . 8 0 0 . 3 3 2 8<br />

www.firstent.org • mail@firstent.org<br />

www.facebook.com/<br />

<strong>First</strong><strong>Entertainment</strong><br />

Autoland Auto Buying Service<br />

3 2 3 . 8 4 5 . 4 4 3 6<br />

@<strong>First</strong>ent<br />

Armstrong & Associates Insurance Services<br />

3 2 3 . 8 4 5 . 4 4 8 9<br />

<strong>First</strong> <strong>Entertainment</strong> Investment Services<br />

3 2 3 . 8 4 5 . 4 4 3 4<br />

Your savings federally insured to at least $250,000<br />

and backed by the full faith and credit of the United States Government<br />

<strong>NCUA</strong><br />

National <strong>Credit</strong> <strong>Union</strong> Administration, a U.S. Government Agency<br />

Federally Insured by <strong>NCUA</strong><br />

up to at least $250,000<br />

Cover Photo: Tom Keller Photography. The information in the Show is as<br />

current as possible. However, the credit union reserves the right to add,<br />

change or delete services. All rates and terms are subject to change without<br />

notice. the Show is published quarterly by <strong>First</strong> <strong>Entertainment</strong> <strong>Credit</strong> <strong>Union</strong>.<br />

Questions or comments should be directed to: Roy MacKinnon, Vice President<br />

Marketing • rmack@firstent.org

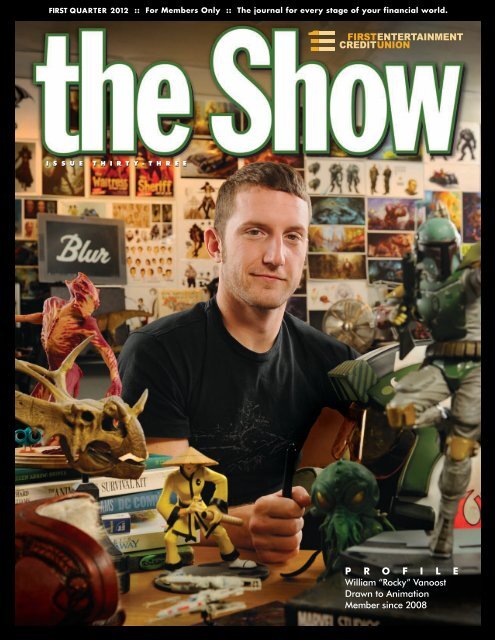

PROFILE<br />

William“Rocky”Vanoost<br />

Lead Character Animator<br />

Blur Studio<br />

Member<br />

• <strong>First</strong> <strong>Entertainment</strong> <strong>Credit</strong> <strong>Union</strong> (4 years)<br />

My experience here<br />

has been300,000<br />

times better<br />

than the big bank!<br />

• • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •<br />

He stood up to bullies in grade school.<br />

He moves through space and time<br />

tackling problems and leaving a wake<br />

of solutions. He lives in two and three<br />

dimensions and brings the inanimate to<br />

life. Super-human? Magical conjurer?<br />

Yes, indeed. William “Rocky” Vanoost<br />

seems somehow related to the very<br />

things he brings to life as Lead<br />

Character Animator at Blur Studio.<br />

Rocky (a nickname forged during his<br />

days of defying bullies) started his<br />

profession in typical-kid fashion:<br />

watching cartoons and drawing. “I’ve<br />

loved cartoons ever since I was a kid.<br />

I used to draw a lot growing up.” This<br />

led to working at the local public access<br />

TV station, shooting a few TV programs,<br />

and doing an occasional sketch<br />

comedy. “Then, when I was trying to<br />

figure out what to do for a living and<br />

what to major in at college, I couldn’t<br />

really decide. And my uncle said,<br />

‘Well, you love this animation stuff,<br />

you draw all the time, why don’t you<br />

do that?’” Until then, Rocky never<br />

considered animation as something<br />

people actually got paid for. “It never<br />

struck me that people do this for a<br />

living. I thought, ‘That’s just something<br />

I do with my free time.’”<br />

These days, free time is at a premium.<br />

After studying animation at Columbia<br />

College in Chicago, it was game on<br />

when Rocky got hired at a gaming<br />

studio where he’d interned. From there,<br />

life became a wonderful blur when Blur<br />

Studio in Venice saw his reel and reeled<br />

him in. As Lead Character Animator,<br />

Rocky describes himself as a type of<br />

“lieutenant” supporting the animation<br />

supervisor. He ensures the animators<br />

have everything they need and that the<br />

shots are getting done. “If there are<br />

problems, I’m the one who deals with<br />

them. I make sure that this prop or<br />

character is getting done. I interface<br />

with the other departments to make<br />

sure that if someone needs something,<br />

they get it in a timely manner – it’s a lot<br />

of herding cats.” He also troubleshoots<br />

technical issues. “If a rig is broken, or<br />

there’s something that the animator<br />

needs in the character rig to complete<br />

the shot, I take care of it.” He also<br />

wrangles software if there are constraint<br />

issues or compatibility problems in the<br />

programs, or as Rocky put it, when<br />

“two programs might not be ‘working<br />

nice’ together.”<br />

‘‘‘‘<br />

On top of all of the organizational<br />

duties, Rocky still pulls his weight<br />

animating a full load, just like the<br />

other animators. (This is where the<br />

“super-human” comes in.) The<br />

animation process starts with a script<br />

that goes to the concept department<br />

to become a storyboard. From there,<br />

Rocky and his teammates roughly<br />

block it out in the 3D space, using<br />

cameras and 3D software. “We create<br />

a little rough movie based on the script<br />

and storyboards.” This is the first of<br />

three passes (typically). “We refine it in<br />

the second pass, addressing notes<br />

from the director or client, and then<br />

we take it to our final pass and finish<br />

everything up.”<br />

Rocky describes his time at Blur as a<br />

great deal of work – and play. “It’s one<br />

of those things where you wake up in<br />

the morning and you realize that you’re<br />

getting paid to come into a place filled<br />

with really fun, creative people and<br />

essentially play with action figures all<br />

day,” he laughs. “It’s a lot of hard work,<br />

but it’s also a lot of fun to work at a<br />

place like Blur. It’s really creative and<br />

fast-paced. We’re working on a lot of<br />

different genres, so it’s never boring.”<br />

Recent projects include game trailers for<br />

Star Wars: The Old Republic and Prey 2,<br />

animating the FOX NFL robot, and the<br />

creating the opening credits for The Girl<br />

with the Dragon Tattoo.<br />

So how did the animator get drawn<br />

to <strong>First</strong> <strong>Entertainment</strong>? “When I moved<br />

out here, I was a customer of a big<br />

bank in Chicago. At the time, they<br />

didn’t have branches out here, so that<br />

wasn’t an option. Our HR person<br />

highly recommended the credit union,<br />

and once she started showing me all<br />

of the information, how great the<br />

checking and savings were, and the<br />

rates and everything, I was pretty much<br />

sold. I love the fact that everything is<br />

just so easy and very friendly for the<br />

members. It doesn’t seem like<br />

<strong>First</strong> <strong>Entertainment</strong> is trying to screw<br />

us every way it can, to put it bluntly.<br />

There are no hidden fees. No BS hiding<br />

around the corner. I don’t have to worry<br />

about anything. Everything is very clean<br />

and clear cut. It’s really nice. When I<br />

first got my auto loan, I had done it<br />

through the dealership, which was a<br />

bad idea. I eventually brought<br />

the loan to <strong>First</strong> <strong>Entertainment</strong> and<br />

refinanced it. I also took advantage of<br />

their consolidation loan. My experience<br />

here has been 300,000 times better<br />

than the big bank!”<br />

So how does Rocky view the future of<br />

animation? He starts with keeping an<br />

eye on the past. “You can learn from<br />

what’s been done before and apply that<br />

to what you’re doing now when you’re<br />

breaking new ground. In terms of<br />

technology, it’s hard to predict what’s<br />

coming because it seems to grow<br />

exponentially. You just need to learn as<br />

many new tools as you can, and try to<br />

stay on top of things. But animation,<br />

essentially, is what the ‘Nine Old Men’<br />

Disney animators called ‘the illusion of<br />

life.’ That’s what you’re creating. It’s<br />

about understanding emotion and<br />

movement and being able to imbue<br />

your characters with that. Good work<br />

is about the story and good characters.<br />

Those are the most important things.<br />

That’s what I mean about keeping an<br />

eye on the past while you’re looking<br />

to the future. Because you can’t rely on<br />

all of the technology to tell the heart<br />

of the story.”<br />

Thank you, Rocky, for the fascinating<br />

peek into the world of animation. And<br />

for bringing <strong>First</strong> <strong>Entertainment</strong> to life in<br />

such a colorful and candid way!<br />

• • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •<br />

T H E S H O W

Once It’s Read ...<br />

It’s Time toShred!<br />

Member Shred Day is<br />

Saturday, February 25, 2012<br />

Member Shred Day is back!<br />

It’s a new year and a new<br />

reason to rid yourself from all<br />

that clutter and paperwork that<br />

has been piling up.<br />

Just bring your papers,<br />

receipts, unwanted credit card<br />

offers, confidential information<br />

– anything paper – to our<br />

Burbank branch on Saturday,<br />

February 25 th . Recall, one of<br />

the most respected and secure<br />

information destruction service<br />

companies in the industry,<br />

will take care of the rest. Your<br />

paper waste will receive<br />

confidential destruction with<br />

complete privacy and security.<br />

Member Shred Day<br />

Saturday, February 25 th<br />

Burbank Branch<br />

2520 W. Olive Avenue<br />

10 a.m. to 2 p.m. or until<br />

the truck is full. It’s first-come,<br />

first-served.<br />

The Trifecta of IRAs –<br />

Traditional, Roth and ESA Coverdell<br />

The first quarter isn’t just about getting rid of<br />

holiday weight and tackling new resolutions.<br />

It’s also known as “IRA Season;” the season for<br />

boosting retirement accounts and/or taming<br />

one’s tax burden.<br />

At <strong>First</strong> <strong>Entertainment</strong>, we’ve got IRAs (Individual<br />

Retirement Accounts) for every goal, all of them<br />

pointed toward a super-secure happily-everafter.<br />

These IRAs, along with our IRA Term<br />

Savings Certificates, are secured with their own<br />

insurance up to $250,000 from the National<br />

<strong>Credit</strong> <strong>Union</strong> Association, a U.S. Government<br />

Agency. This $250,000 is in addition to our<br />

regular account coverage of $250,000.<br />

So what’s your IRA style?<br />

*Not intended as tax advice. Please consult your tax professional.<br />

Traditional IRA<br />

A classic pick, Traditional IRAs earn dividends<br />

on all account balances. Another perk? They’re<br />

often tax-deductible in the year of contribution<br />

and the withdrawals are taxed as income. *<br />

Ironically, our Traditional, as well as all our IRAs,<br />

are actually a bit non-traditional. You can open<br />

one with just $1 and there’s no set-up or annual<br />

fee. You can also set up automatic monthly<br />

transfers and customize withdrawals.<br />

Roth IRA<br />

Unlike Traditional IRAs, Roths don’t allow tax<br />

deductions for contributions. But not to worry,<br />

they’ll still show you plenty of love. If you meet<br />

certain requirements, ALL earnings are tax-free<br />

for you or your beneficiaries. * But wait – there’s<br />

more! Certain withdrawals aren’t subject to<br />

No Strings.<br />

No Obligations.<br />

Just Savings.<br />

Looking for a new car or truck, but don’t have the time to hit<br />

the dealerships? Well look no further than Autoland! Having<br />

partnered with <strong>First</strong> <strong>Entertainment</strong>, Autoland’s experienced<br />

consultants make it easy for you to get the car you want, at<br />

the best possible price, without the stress of shopping from<br />

dealer to dealer on your own.<br />

Simply give your Autoland Consultant the style, color and<br />

options, and they’ll go find you that exact car, at the best<br />

deal they can. Once they’ve found it, you can either take it<br />

or walk away. No strings, no obligations – you have nothing<br />

to lose … well, except perhaps the opportunity to pay more<br />

at a dealership.<br />

How To Get Started<br />

It’s easy! Contact Aaron Bridges, the Autoland Consultant<br />

located at our Main Office on Forest Lawn Drive. Tell him<br />

what you’re looking for and then sit back and enjoy the<br />

results. You can call Aaron directly at 323.845.4436, or<br />

shoot him an email at abridges@autoland.com.<br />

the early distribution penalty, nor are you<br />

required to take minimum distributions after<br />

age 70½. If you’re not able to benefit from<br />

a tax deduction from the Traditional IRA, the<br />

Roth might be just the ticket for you.<br />

Coverdell ESAs<br />

(Educational Savings Accounts)<br />

These education IRAs can help you save<br />

$2,000 per year, per child. There are no tax<br />

deductions for contributions, but there is<br />

a hefty tax benefit. If you meet the specific<br />

requirements, all earnings are tax-free for you<br />

or your beneficiaries if the money is used for<br />

qualifying education expenses.<br />

Start preparing for your future today by opening<br />

your IRA online at www.firstent.org or calling<br />

us at 888.800.3328! To learn more about your<br />

IRA options, the following free informational<br />

brochures are available at any of our branches,<br />

or just give us a call and we’ll mail them to you.<br />

• “Roth IRAs: Answers To Your Questions”<br />

• “Comparing Your IRA Options”<br />

(also available online at www.firstent.org<br />

under our “Savings > IRA” menus)

F I R S T E N T F R E E C H E C K I N G<br />

No Fee. Yes Free.<br />

And an ATM Network that will Kick their Assets.<br />

Our F R E E C H E C K I N G makes a hero of zero. See just how much we can do with nothing!<br />

Value Checking<br />

No fee, no minimum, no problem! *<br />

Advantage Checking<br />

Earn dividends and no fee with minimum balance. †<br />

Teen Checking<br />

No fee, no minimum. **<br />

What Are You Waiting For?<br />

If you’re a CU.online user, own a smartphone and don’t<br />

have the <strong>First</strong>Ent Mobile App yet – you’re missing out.<br />

<strong>First</strong>Ent Mobile is the simplest, “free-est” way to save<br />

yourself hours of time (and gallons of gas) by accessing<br />

your accounts via your phone. Think about it; no more<br />

driving across town to a branch or looking for a Wi-Fi<br />

Hotspot for your laptop. And it’s easy to set up too, just<br />

pick your brand and get going …<br />

iPhone<br />

Download “<strong>First</strong>Ent Mobile” from the iTunes Store.<br />

Android<br />

Download “<strong>First</strong>Ent Mobile” from the Android Market.<br />

Blackberry<br />

Visit m.firstent.org and use the link at the bottom<br />

of the page to download the shortcut for your device.<br />

No Smartphone?<br />

No worries, you can still use our Text Banking<br />

service for Balance and History Inquiries.<br />

Just register your cell phone number at<br />

www.firstent.org/nosmartphone to<br />

enable this service.<br />

And that’s all there is to it.<br />

Access your account, whenever<br />

you want it – literally in the palm<br />

of your hand. Start enjoying the<br />

freedom of <strong>First</strong>Ent Moblie today!<br />

And if you have questions about<br />

using Mobile Banking and<br />

what you can do with it, visit<br />

www.firstent.org/domoremobilebanking.shtml<br />

or call us at 888.800.3328.<br />

Our fee-free debit cards really get around. The others?<br />

Not so much.<br />

Our CO-OP ATM Network: 28,000+<br />

Bank of America ATMs: 18,000<br />

Chase ATMs: 15,000<br />

Wells Fargo ATMs: 12,000<br />

*Value Checking Accounts feature no monthly service fee, no minimum balance requirement, and earns no dividends.<br />

† For the Advantage Checking Account, to avoid a monthly service fee, a minimum daily balance of $1,000 or a combined daily balance of $4,000 between checking and savings accounts is required.<br />

**Teen Checking Accounts available to members ages 13-17, with a parent or legal guardian as joint owners. Joint owners must qualify for an Advantage or Value Checking Account in their own right. If the<br />

joint owners has a <strong>First</strong> <strong>Entertainment</strong> Checking Account, it must be maintained in good standing. Teen Checking Accounts have a minimum opening deposit of $1.00, do not earn dividends, and have no<br />

minimum balance requirement.<br />

Use your QR Reader to<br />

visit our Mobile Banking<br />

page! To download your<br />

FREE QR Reader, visit<br />

www.i-nigma.mobi<br />

on your phone.<br />

T H E S H O W F O U R T H Q U A R T E R 2 0

Winner of the Holiday Art Contest!<br />

ThankYou<br />

to E V E RYO N E for<br />

Making UsSmile!<br />

Congratulations to winner Hannah<br />

Watkins whose artwork generated<br />

countless smiles this holiday season.<br />

When we announced our holiday art contest, we<br />

asked you to make us smile. And smiles came from<br />

miles! The submissions brought everything from<br />

warm ahhhs and grins, to wry smirks, and even a<br />

smattering of laugh-out-loud guffaws.<br />

Ultimately, the winning grin came from Hannah,<br />

age 5. Our youngest winner ever! The judges felt this<br />

card captured the joy of the season. Congratulations<br />

Hannah! We hope the $200 Savings Bond made you<br />

smile too.<br />

Our Holiday Art Contest is an annual favorite with<br />

members (and us). The creativity is amazing and we<br />

can’t wait to see what you’ll come up with next year!<br />

Many members, either preparing for<br />

parenthood or already with younger children,<br />

eventually get around to asking me questions<br />

about college savings programs. With the<br />

start of a new year, I thought I’d get ahead<br />

of the curve by discussing the two most<br />

common college saving plans – the Coverdell<br />

Educational Savings Account (ESA), and the<br />

529 College Savings Plan (529) and most<br />

importantly … how they differ.<br />

The Coverdell ESA vs.<br />

The 529 College Savings Plan<br />

To start off with, both plans have some<br />

similar features: contributions are nondeductible,<br />

earnings grow tax-deferred and<br />

withdrawals are tax-free for qualified higher<br />

education expenses. 529 Plans and Coverdell<br />

ESAs are also viewed the same for financial<br />

aid purposes, with both considered the assets<br />

of the custodian (the person who opened the<br />

account), and having their withdrawals by the<br />

beneficiary (the child) not considered taxable<br />

income when used for college expenses.<br />

Both plans can be transferred to another<br />

beneficiary without penalties or fees, and<br />

both plans allow investment choices of stocks,<br />

bonds, mutual funds and term certificates.<br />

However, that is where the similarities end<br />

and the differences – some major – begin.<br />

The Coverdell ESA starts off with a few<br />

advantages over the 529 Plan, including the<br />

ability to use the funds for K-12 and higher<br />

education. You can also make unlimited<br />

changes to asset allocation. Unfortunately,<br />

these advantages are balanced by the<br />

Coverdell’s disadvantages. These include the<br />

ESA’s $2,000 annual contribution limit, its<br />

under age 18 contribution limit, the fact that<br />

you have to use the funds by age 30 or have<br />

them taxed, and finally your Adjusted Gross<br />

Saving for<br />

College?<br />

Income must be less than $95,000 (single)<br />

and $190,000 (joint) to qualify for the<br />

maximum annual $2,000 contribution.<br />

The 529 Plan in turn appears to have<br />

more advantages over the Coverdell. You<br />

can contribute up to $350,000 over the<br />

life of the account, the parent controls the<br />

account assets and withdrawals, there are<br />

no restrictions on when the funds must be<br />

used, there is no income limit to qualify<br />

for contributions, and you may receive a<br />

possible state tax credit/deduction when<br />

funds are withdrawn (depending on the<br />

state). As a result, the 529 Plan is generally<br />

considered a more versatile plan, especially<br />

if you will have other people contributing<br />

money toward your child’s education – as<br />

the $2,000 limit for ESA contributions makes<br />

it more difficult to track when there are<br />

multiple people contributing.<br />

The good news is that you can have both<br />

plans for your children and should you<br />

choose, you can even roll a Coverdell ESA<br />

over into a 529 College Savings Plan. These<br />

plans have a lot of small print and conditions,<br />

so I recommend reading the details for your<br />

state’s 529 Plan, or reading more about the<br />

Coverdell ESA before opening an account<br />

and making contributions.<br />

As always, I’m here to answer any questions<br />

you have about college education savings or<br />

any other financial planning concerns. Give<br />

me a call at 323.845.4434 or email me<br />

today at jeffre.stjohn@lpl.com to set up<br />

a free 30-minute consultation.<br />

The opinions voiced in this material are for general information only and are not intended to<br />

provide specific advice or recommendations for any individual.<br />

Prior to investing in a 529 Plan, investors should consider whether the investor’s or designated<br />

beneficiary’s home state offers any state tax or other benefits that are only available for<br />

investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are<br />

federally tax-free. Tax treatment at the state level may vary. To determine which investment(s) and<br />

strategies may be appropriate for you, consult your financial and/or tax advisor prior to investing.<br />

Jeffre St. John is a registered representative with, and Securities offered through, LPL Financial,<br />

Member FINRA/SIPC. Insurance products offered through, LPL Financial or licensed affiliates.<br />

Not <strong>NCUA</strong> Insured. No <strong>Credit</strong> <strong>Union</strong> Guarantee. May Lose Value.<br />

You’ve<br />

Got<br />

Choices!<br />

Jeffre St. John<br />

CFP ® , LPL Financial Advisor<br />

<strong>First</strong> <strong>Entertainment</strong> Investment Services<br />

<strong>First</strong> <strong>Entertainment</strong> <strong>Credit</strong> <strong>Union</strong> is not a registered broker/dealer and is not affiliated with LPL<br />

Financial. LPL Financial Advisors do not offer tax advice. Please consult a tax professional.<br />

F I R S T Q U A R T E R 2 0 1 2

Annual Meeting & Elections<br />

<strong>First</strong> <strong>Entertainment</strong>’s annual membership<br />

meeting and elections will be held at 6:00 PM,<br />

Thursday, April 26, 2012 at our Main Office on<br />

Forest Lawn Drive. Up for election this year are<br />

three (3) positions on the Board of Directors,<br />

each with a three-year term. Also up for<br />

election is one (1) Supervisory Committee<br />

position, also with a three-year term.<br />

Nominations for all open positions must be<br />

made by petition. All eligible signers of the<br />

petition must be individuals, members in good<br />

standing of <strong>First</strong> <strong>Entertainment</strong> <strong>Credit</strong> <strong>Union</strong>,<br />

and at least 18 years of age. Such petitions<br />

must be signed within 11 months prior to the<br />

Annual Meeting by at least 500 members.<br />

Petitions must be delivered (or postmarked)<br />

to the <strong>Credit</strong> <strong>Union</strong>, Attn: Nominating<br />

Committee, PO Box 100, Hollywood, CA<br />

90078-0100 no later than March 1, 2012.<br />

If there is only one nominee for each position<br />

to be filled, the election will not be conducted<br />

by ballot and there will be no nominations<br />

from the floor. Only one vote per member<br />

is permitted.<br />

F I R S T Q U A R T E R 2 0 1 2

010112<br />

P.O. BOX 100 • HOLLYWOOD, CA 90078-0100<br />

Your savings federally insured to at least $250,000<br />

and backed by the full faith and credit of the United States Government<br />

<strong>NCUA</strong><br />

National <strong>Credit</strong> <strong>Union</strong> Administration, a U.S. Government Agency<br />

Federally Insured by <strong>NCUA</strong><br />

up to at least $250,000<br />

the<br />

11 For<br />

T E L L M E M O R E A B O U T<br />

S A V I N G S<br />

L O A N S<br />

E S E R V I C E S O T H E R S E R V I C E S<br />

• <strong>First</strong>500, Money Market • Vehicle, Personal • Online Banking • Family Membership<br />

Accounts & Term Savings & Secured Loans • Mobile Banking • Financial Planning<br />

Certificates<br />

• Home Purchase, • Online Billpay • Deposit by Mail Envelopes<br />

• Checking Services & Refinance & Home • Electronic Statements • Travel Services<br />

Debit Card<br />

Equity Loans<br />

• Email Alerts<br />

• Theme Park Discounts<br />

• IRAs & Health Savings<br />

• Discount Legal Services<br />

Accounts<br />

• • • • • • materials, email marketing@firstent.org. Include your full name and mailing address. • • • • • •<br />

H O L I D A Y H O U R S <strong>First</strong> <strong>Entertainment</strong> will be closed in observance of the following holidays:<br />

Monday, January 16 th , Martin Luther King, Jr. Day Monday, February 20 th , Presidents’ Day<br />

P R S R T S T D<br />

U . S . P O S T A G E<br />

P A I D<br />

P E R M I T N O . 8<br />

NORTH HOLLYWOOD, CA<br />

Unlock Greater Convenience with Shared Branches<br />

Out and about and not sure where our nearest<br />

branch is? That’s where <strong>Credit</strong> <strong>Union</strong> Service<br />

Centers (CU Service Centers) come in.<br />

As part of their network, <strong>First</strong> <strong>Entertainment</strong><br />

is linked with 400 other credit unions, kind<br />

of like one big happy financial family. What’s<br />

the benefit? How does being able to walk into<br />

another credit union’s branch to access your<br />

<strong>First</strong> <strong>Entertainment</strong> account sound? Can you<br />

imagine wandering into Chase or B of A to<br />

do some banking with Wells Fargo? Not<br />

exactly. But that’s the magic of credit union<br />

shared branching.<br />

Need a branch but nowhere near us? Relax. We’ve got you covered.<br />

Branches-away-from-branches can do:<br />

• Deposits and withdrawals<br />

• Loan payments and advances<br />

• Visa and/or MasterCard cash advances<br />

Most locations also offer:<br />

• Transfers between sub-accounts<br />

• Statement printouts<br />

• Check withdrawals<br />

• Faxes and photo copies<br />

• Money orders and traveler’s checks<br />

• Notary services<br />

Using a CU Service Center is easy. All you<br />

need is the name of our credit union, your<br />

account number, and a valid, governmentissued<br />

photo ID.<br />

All credit union services may not be available at all CU Service Center locations. Not all members qualify for CU Service Center access. Call the credit union for details.<br />

If you haven’t tried a shared branch, you’re<br />

in for a pleasant surprise. Whether on<br />

vacation, on location, or just down the street<br />

and need the convenience of here-and-now<br />

banking, give it a go. It’s like increasing the<br />

number of our branches exponentially! To<br />

take advantage of this wonderful member<br />

benefit (and 28,000+ ATMs in our<br />

network) use:<br />

• Our ATM/Shared Branching Locator<br />

at www.firstent.org.<br />

• The ATM Locator link within our <strong>First</strong>Ent<br />

Mobile Banking App<br />

• The Shared Branching site:<br />

www.cuswirl.com/members-access<br />

W W W . F I R S T E N T . O R G<br />

8 8 8 . 8 0 0 . 3 3 2 8