Understanding Equity Options - The Options Clearing Corporation

Understanding Equity Options - The Options Clearing Corporation

Understanding Equity Options - The Options Clearing Corporation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

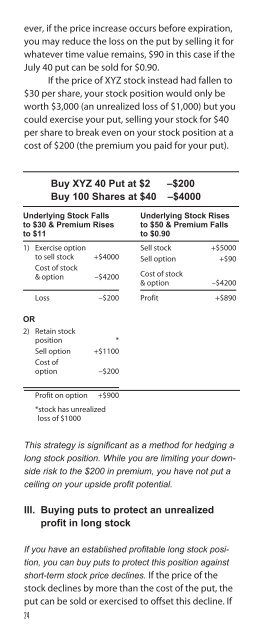

ever, if the price increase occurs before expiration,you may reduce the loss on the put by selling it forwhatever time value remains, $90 in this case if theJuly 40 put can be sold for $0.90.If the price of XYZ stock instead had fallen to$30 per share, your stock position would only beworth $3,000 (an unrealized loss of $1,000) but youcould exercise your put, selling your stock for $40per share to break even on your stock position at acost of $200 (the premium you paid for your put).Buy XYZ 40 Put at $2 –$200Buy 100 Shares at $40 –$4000Underlying Stock Fallsto $30 & Premium Risesto $111) Exercise optionto sell stock +$4000Cost of stock& option –$4200Loss –$200Underlying Stock Risesto $50 & Premium Fallsto $0.90Sell stock +$5000Sell option +$90Cost of stock& option –$4200Profit +$890OR2) Retain stockposition *Sell option +$1100Cost ofoption –$200Profit on option +$900*stock has unrealizedloss of $1000This strategy is significant as a method for hedging along stock position. While you are limiting your downsiderisk to the $200 in premium, you have not put aceiling on your upside profit potential.III. Buying puts to protect an unrealizedprofit in long stockIf you have an established profitable long stock position,you can buy puts to protect this position againstshort-term stock price declines. If the price of thestock declines by more than the cost of the put, theput can be sold or exercised to offset this decline. If24