Understanding Equity Options - The Options Clearing Corporation

Understanding Equity Options - The Options Clearing Corporation

Understanding Equity Options - The Options Clearing Corporation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

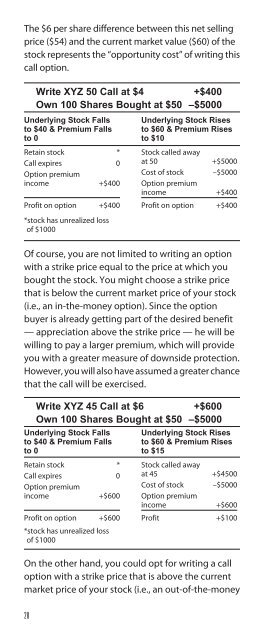

<strong>The</strong> $6 per share difference between this net sellingprice ($54) and the current market value ($60) of thestock represents the “opportunity cost” of writing thiscall option.Of course, you are not limited to writing an optionwith a strike price equal to the price at which youbought the stock. You might choose a strike pricethat is below the current market price of your stock(i.e., an in-the-money option). Since the optionbuyer is already getting part of the desired benefit— appreciation above the strike price — he will bewilling to pay a larger premium, which will provideyou with a greater measure of downside protection.However, you will also have assumed a greater chancethat the call will be exercised.On the other hand, you could opt for writing a calloption with a strike price that is above the currentmarket price of your stock (i.e., an out-of-the-money28Write XYZ 50 Call at $4 +$400Own 100 Shares Bought at $50 –$5000Underlying Stock Fallsto $40 & Premium Fallsto 0Retain stock *Call expires 0Option premiumincome +$400Profit on option +$400*stock has unrealized lossof $1000Underlying Stock Risesto $60 & Premium Risesto $10Stock called awayat 50 +$5000Cost of stock –$5000Option premiumincome +$400Profit on option +$400Write XYZ 45 Call at $6 +$600Own 100 Shares Bought at $50 –$5000Underlying Stock Fallsto $40 & Premium Fallsto 0Retain stock *Call expires 0Option premiumincome +$600Profit on option +$600*stock has unrealized lossof $1000Underlying Stock Risesto $60 & Premium Risesto $15Stock called awayat 45 +$4500Cost of stock –$5000Option premiumincome +$600Profit +$100