You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6<br />

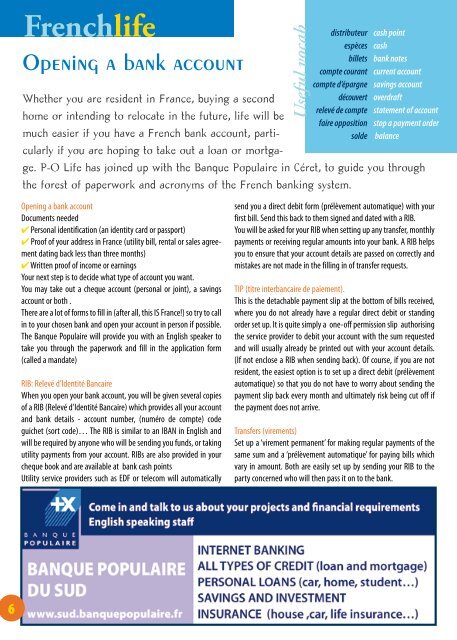

Frenchlife distributeur<br />

espèces<br />

Opening a bank account<br />

Whether you are resident in France, buying a second<br />

home or intending to relocate in the future, life will be<br />

much easier if you have a French bank account, parti-<br />

cularly if you are hoping to take out a loan or mortga-<br />

ge. P-O <strong>Life</strong> has joined up with the Banque Populaire in Céret, to guide you through<br />

the forest of paperwork and acronyms of the French banking system.<br />

Opening a bank account<br />

Documents needed<br />

4 Personal identification (an identity card or passport)<br />

4 Proof of your address in France (utility bill, rental or sales agreement<br />

dating back less than three months)<br />

4 Written proof of in<strong>com</strong>e or earnings<br />

Your next step is to decide what type of account you want.<br />

You may take out a cheque account (personal or joint), a savings<br />

account or both .<br />

There are a lot of forms to fill in (after all, this IS France!) so try to call<br />

in to your chosen bank and open your account in person if possible.<br />

The Banque Populaire will provide you with an English speaker to<br />

take you through the paperwork and fill in the application form<br />

(called a mandate)<br />

RIB: Relevé d’Identité Bancaire<br />

When you open your bank account, you will be given several copies<br />

of a RIB (Relevé d’Identité Bancaire) which provides all your account<br />

and bank details - account number, (numéro de <strong>com</strong>pte) code<br />

guichet (sort code)… The RIB is similar to an IBAN in English and<br />

will be required by anyone who will be sending you funds, or taking<br />

utility payments from your account. RIBs are also provided in your<br />

cheque book and are available at bank cash points<br />

Utility service providers such as EDF or tele<strong>com</strong> will automatically<br />

Useful vocab<br />

billets<br />

<strong>com</strong>pte courant<br />

<strong>com</strong>pte d’épargne<br />

découvert<br />

relevé de <strong>com</strong>pte<br />

faire opposition<br />

solde<br />

cash point<br />

cash<br />

bank notes<br />

current account<br />

savings account<br />

overdraft<br />

statement of account<br />

stop a payment order<br />

balance<br />

send you a <strong>direct</strong> debit form (prélèvement automatique) with your<br />

first bill. Send this back to them signed and dated with a RIB.<br />

You will be asked for your RIB when setting up any transfer, monthly<br />

payments or receiving regular amounts into your bank. A RIB helps<br />

you to ensure that your account details are passed on correctly and<br />

mistakes are not made in the filling in of transfer requests.<br />

TIP (titre interbancaire de paiement).<br />

This is the detachable payment slip at the bottom of bills received,<br />

where you do not already have a regular <strong>direct</strong> debit or standing<br />

order set up. It is quite simply a one-off permission slip authorising<br />

the service provider to debit your account with the sum requested<br />

and will usually already be printed out with your account details.<br />

(If not enclose a RIB when sending back). Of course, if you are not<br />

resident, the easiest option is to set up a <strong>direct</strong> debit (prélèvement<br />

automatique) so that you do not have to worry about sending the<br />

payment slip back every month and ultimately risk being cut off if<br />

the payment does not arrive.<br />

Transfers (virements)<br />

Set up a ‘virement permanent’ for making regular payments of the<br />

same sum and a ‘prélèvement automatique’ for paying bills which<br />

vary in amount. Both are easily set up by sending your RIB to the<br />

party concerned who will then pass it on to the bank.