Download Rest Pages - Rrfinance.com

Download Rest Pages - Rrfinance.com

Download Rest Pages - Rrfinance.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

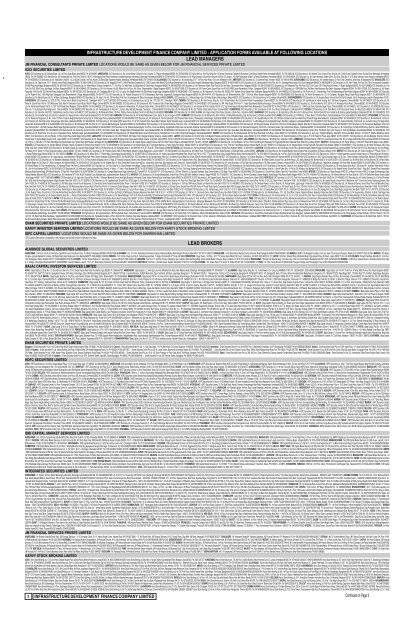

INFRASTRUCTURE DEVELOPMENT FINANCE COMPANY LIMITED : APPLICATION FORMS AVAILABLE AT FOLLOWING LOCATIONS3INFRASTRUCTURE DEVELOPMENT FINANCE COMPANY LIMITEDLEAD BROKERSINFRASTRUCTURE DEVELOPMENT FINANCE COMPANY LIMITED : COLLECTION CENTRES FOR APPLICATION FORMAXIS BANK LIMITEDAHMEDABAD: Trishul-Opposite Samartheshwar Templelaw Garden, Ellis Bridgeahmedabad 380006 Gujarat, Tel: 079-66306102. BANGALORE: No. 9, M.G. Road, Block Abangalore 560001 Karnataka, Tel: 080-25317830. BHOPAL: Plot No 165A & 166, Star Arcadem P Nagar, Zone 1Bhopal 462011 Madhya Pradesh, Tel: 0755-4085010/12. BHUBANESHWAR: Archbishops Housesatyanagarbhubaneshwar 751007 Orissa, Tel: 0674-2571834/735. BOKARO: Hotel Blue Diamond, 15 D/1 Western Avenueground Floor, Bokaro Steel Citybokaro 827001Jharkhand, Tel: 06542-226123, 42, 44,. CALICUT: Axis Bank Ltd, Marina Mallymca Cross Roadkozhikode 673001 Kerala, Tel: 0495-4020598/97. CHENNAI: 82 Dr Radhakrishnan Salaimylapore, Chennaichennai 600004 Tamil Nadu, Tel: 044-28306800. DLF, GURGAON: Sg-21 & 22, Galleria Shopping Mall, Phase-iv, Dlf Qutab Enclave Complexgurgaon 122002 Haryana, Tel: 0124-4050595/96/97. GWALIOR: Kanwal Complex, Shrmant Madhav Raoscindia Marggwalior 474002 Madhya Pradesh, Tel: 0751-2233770, 80, 90. HYDERABAD: 6-3-879/B First Floor, G Pulla Reddy Blgreenlands, Begumpet Roadhyderabad 500016 Andhra Pradesh, Tel: 040-23400732/731. INDORE: Kamal Palace, 1 Yeshwant Colonyyeshwant Niwas Roadindore 452003 Madhya Pradesh, Tel: 0731-4295201/333. JABALPUR: Grd & 1st Flr, Panchratna Blgplot No.902, Model Rd, Wright Townjabalpur 482002 Madhya Pradesh, Tel: 0761-4027700/1/2/3/4. JAIPUR: O-15, Green Houseashok Marg, C-Schemejaipur 302001 Rajasthan, Tel: 0141-4061111. KALYAN: Old Suchak Niwas, Cts No.3203murbad Roadkalyan(West) 421301 Maharashtra, Tel: 0251-2315819/21. KANPUR: 16/104 A, Civil Lines, Infront Of Icai Bhawankanpur 208001 Uttar Pradesh, Tel: 0512-2346206/9/10. KOCHI: 41/419, Ground Floor Chicago Plaza, Rajaji Road, Ernakulamkochi 682035 Kerala, Tel: 0484-4411044/05. KOLKATA : 7, Shakespeare Saranikolkatakolkata 700071 West Bengal, Tel: 033-2822933/496. LUCKNOW: 25 B, Ashok Marg, Sikander Bagh Chauraha, Lucknowlucknow 226001 Uttar Pradesh, Tel: 0522-4152000/1-32. LUDHIANA: Shop No.3, LGF, Surya Towers108The Mallludhiana 141001 Punjab, Tel: 0161-4684680. MUMBAI: Fortune 2000, Ground Floor, Bandra-Kurla Complex, Bandra(E)Mumbai 400051 Maharashtra, Tel: 022-30620066/7/71. NAGPUR: M. G. House, Rabindranath Tagore Road, Besides Board Office, Civil Linesnagpur 440001 Maharashtra, Tel: 0712-6621800/6621801. NEW DELHI: Statesman House, 148, Barakhamba Roadnew Delhi 110001 Delhi, Tel: 011-23311047/051HDFC BANK LIMITEDAhmedabad : HDFC Bank Ltd., Astral Tower, Near Mithakhali Six Raod,Navrnagpura, Ahmedabad-380 009, Tel: 079-32423470/093740 21787/079-65440373/093761 09247/079-65440373/093270 88696. Allahabad : 58, SP Marg Civil Lines Allahabad (, 211003, Tel: 3982510505514/9335070679. Amritsar : 26 Kennedy Avenue First Floor Amritsar, Amritsar-143001, Tel: 0183-3018603 and 606. Anand : HDFC Bank Ltd. 1st Floor, Sanket Complex, Next to Sales India, Grid cross road, Anand-388001, Tel: RIM-093275 68094, Tata-02692-653195,Fax-02692 246430. Aurangabad : HDFC Bank Ltd., Divekar Plaza,CTS No 18272, IInd Floor,Railway Station Road,Padampura, Aurangabad 431001, Tel: 0240-6604355, 9371619597. Bangalore : HDFC Bank Ltd., Cash Management Services “SALCO CENTRE” # 8/24, Richmond Road, Bangalore-560025, Tel: 8066633131 09343790037. Baroda : 1st Floor, Fortune Tower,Vadodara Stock Exchange Building,Opp. Parsi Agiyari,Sayajigunj, Baroda-390005, Tel: 0265 6585517, /93247468108. Bharuch : HDFC Bank Ltd., 127, Alfa Society, LinkRoad, Bharuch-392001, Tel: 9327468094/02642-650882. Bhavnagar : 1st floor, Sterling Point, Waghawadi Road, Bhavnagar-364001, Tel: 0278-2561625/9327568121. Bhopal : Asha Avenue, 1st Floor, Z-1, Zone-1 M P Nagar, Bhopal-462011, Tel: 0755-4002914, 4002916, 4002917, 9302446025. Chandigarh : sco-189-190 Sector 17 C, Chandigharh-160017, Tel: 0172-4603770-5088306/09316175094. Chennai : No. 115, Dr. Radhakrishnan Salai, 2nd Floor, Opp. to CSI Kalyani Hospital, Mylapore, Chennai-600004. Tel: 9381750927. Coimbatore: WBO ,1552,B7, First floor, Classic Towers, Trichy Road, Coimbatore-641018, Tel: 0422-4202636/0422-4202646 (RIM :9345728785). Dehradun : WBO Deptt, HDFC Bank, 56, Rajpur Road, Dehradun-248001, Tel: 0135-3245791, 0135-2745295, 9319072148. Delhi : Fig-Ops 1st Floor, Kailash Bldg, New Delhi-110001, Tel: 011-43174071/011-43174072/011-43174073. Dhanbad : Sri Ram Plaza, 1st Floor, Bank More Dhanbad, Jharkhand-826 001, Tel: (0326) 2308831. Gandhidham : Plot No.1, Sector-8, Rabindranath Tagore Road, Gandhidham-370201, Tel: 02836-653251/ 02836-233514/ 9377481871. Gorakhpur : Wholesale Banking Operations,Shreenath Complex, 10, Park Road, Civil Lines, Gorakhpur-273 001, Tel: 0551-2205685/0551-3208666/09335086506. Guwahati : 1st floor,Mishra Complex,Jail Raod, Fancy Bazar,Guwahati-781001, Tel: 0361-2734323. Gwalior : J K Plaza, Gast Ka Tazia, Lashkar, Gwalior-474001, Tel: 07514015007/9300788558. Hissar : 3 & 4 MC Area Red Square Market Railway Road Hisar, Hisar-125000, Tel: 01662-241023. Hosur : NO.24 & 25, MaruthiNagar, SIPCOT PO, Near Dharga, Hosur-635126, Tel: 04344-400554,09345151173. Hyderabad : WBO 1-10-60/3, III Floor, Suryodaya,Begumpet, Hyderabad-500 016, Tel: 040-30472772/2770/2771. Indore : HDFC Bank Ltd., 1st Floor, Brilliant Avenue, Sch No. 94, Sector-B, Behind Bombay Hospital, Ring Road, Indore-452010, Tel: 0731-3912851, 3912856 RIM : 09329766183. Jaipur : HDFC Bank House, 2nd Floor, O-10,Ashok Marg,C-Scheme, Jaipur-302001, Tel: 5103486, 5115476 & 9314274796. Jalandhar : HDFC Bank Ltd., 1st Floor, 911,GT Road, Nr. Narinder Cinema, Jalandhar-144001, Tel: 0181-5017790-92/9316939408/9316915509/9317785643. Jalgaon : HDFC Bank Ltd., 3rd Floor, Sugan Heights,P P NO 324/2, TPS II,Near Central Bus Stand Jalgaon-425001, Tel: Dir :- 0257-2237642, Fax-0257- 2237042, Rim No 9372747743. Jammu : CB-13, Rail Head Commercial Complex, Gandhi Nagar, Jammu-180004, Tel: 0191-2471427, 2475396. Jamnagar : Abhishek3rd Floor ,Saru Section Road,Near Savan appartment,Jamnagar-361008, Tel: PH-02886541963-RIM-9327812378.Jhansi : HDFC Bank Ltd Damroo Cinema <strong>com</strong>plex, CIvil Lines Jhansi 284003, Tel: 0510-2449330 & 9335087889. Jodhpur : HDFC Bank Ltd., Ist Floor, 15, Keshav Comlex, Nimbera House, Paota, Mandore Road, Jodhpur-342010. Tel: LL. 0291-2541839, Rim- 09314158246. Junagadh : Ground Floor,Moti palace, opp.Rayji Nagar, Moti Baugh Road., Junagadh-362001, Tel: 0285-2670067/9327568072. Kolhapur : Gemstone, 517/A/2 E ward New shahupuri, Nr Central Bus Stand Kolhapur-416001, Tel: 0231-2652791/2010099/2651906/9373083495/9373053918. Kolkata : Abhilasha-II, 6 Royd Street (2nd Floor), Kolkata-700016, Tel: 22273761, 9331992557, 9331430891. Kota : 13-14,Main Jhalawar Road, Kota-324007, Tel: 0744-2390485/9314480984. Kottayam : 3rd Floor Unity Buildings, KK Road, Kottayam-686002, Tel: 0481-2302361,9387332717/ 0481-642418,9387332720/ 0481-3206000/0481-6452418. Ludhiana : SCO-54, Phase-2 Urban Estate Dugri, Ludhiana-141001, Tel: 0161-3040060/61/62/63/9316897673. Mangalore : Ideal Towers 1st floor, Opp Sharavu Ganapathi Temple,G T road Mangalore-1, Mangalore-575001, Tel: 0824-6451392/93/rim-9342231594. Meerut : HDFC Bank Ltd., 1st Floor 381, Western Kutchery Rd Meerut U.P, Meerut-250001, Tel: 0121-4028363/65, 09319058981. Mehsana : Prabhu Complex “ Nr Rajkamal Petrol Pump, Highway Road,Mehsana 384002. Tel: 02762 243173/9327568081. Moradabad : HDFC Bank Ltd, First Floor, Chaddha Complex, GMD Road, Moradabad-244001, Tel: 05913208473, 9336015976. Mumbai : Ground Floor, Maneckji Wadia Building,Nanik Motwani Marg,Near KalaGhoda,opp Mumbai University,Fort Mumbai- 400 001, Tel: 022-40801570/1528/1570/1560. Mysore : Mythri Arcade, Saraswathipuram,1st Main, Mysore-570009, Tel: 0821-4255304/9342591264. Nagpur : 2, “ Mile Stone “ Block No 303 & 304, Near Lokmat Square, Wardha Road, Nagpur-440010, Tel: 0712-2454417,2451746 and RIM 9372153142, 9371657462. Nasik : HDFC Bank Ltd., 3rd Floor, Archit Centre, Opp Sandeep Hotel, Chandak Circle Link Road, Near Mahamarg Bus Stand, Nasik 422 002, Tel: 0253-6620251/252/95253-2578322/ 95253-2578322, RIM NO : 93727 48487. Navsari : Gr Flr, Nandani Complex, Station Road, Navsari-396445, Tel: 02637-280901,9327568065. Panipat : 801/4,Opps Railway Road, G.t Road, Panipat-132103, Tel: 9315416685/01804015268. Panjim : 301, Milroc Lar Menezes, Swami Vivekanand Road, Panjim-403001, Tel: 6659744,45, 9326801996, 9372491097. Patiala : Building NO 11520, 1st Floor Leela bhawan, Near Gopal Sweets, Patiala-147001, Tel: 0175-5022000 ,9317664977, 9356055165. Pondicherry : T.S.No.6, 100Ft Road, Ellaipillaichavady,Pondicherry-605005, Tel: 0413-2206575/9362845444. Pune : Fortune Square 3rd Floor, Deep bungalow Chowk, Model Colony, Shivajinagar, Pune-411016, Tel: 020-41224309/ 020-41224328/ 020-41224311/ 020-41224335. Raipur : HDFC BANK LTD, Chawla Towers, Near Bottle House, Shankar Nagar, Raipur, Chhattisgarh 492007, Tel: 0771-4003110/3112. Rajkot : Shivalik-V, 3rd Floor, Gondal Road,Rajkot-360002, Tel: 0281-6536982/09377408494. Siliguri : 136/115 Hill Cart Road, Siliguri-734401, Tel: 0353-2520409/9333744964. Surat :1st Floor, Crossway Mall, Near Ram Chowk, Ghod Dod Road, Surat-395007, Tel: 0261-6677807. Trivendrum : BOB Plaza, Second Floor, T. C. 12/149 ( 3), Pattom ,Trivandrum-695004, Tel: 0471-3083430/9388860244. Vapi : 1 st Floor, Kanta Trade Center, GIDC Char Rasta, Vapi-396195, Tel: 0260-6548104, 09377929205.ICICI BANK LIMITEDAHMEDABAD: JMC House, Opp. Parimal Gardens,Opp Parimal Garden, Ambawadi, Ahmedabad-380 006Tel: (079) 66523717-719. BANGALORE: ICICI Bank Towers, 1, Commissariat Road, Ground Floor, Bangalore-560025, Tel: 080-41296007 . , , ICICI Bank Ltd., No.509, 8th Cross, West of Kanakapura Road, Jayanagar 7th Block, Bangalore -560082, Tel: 080-22449738/41131877/26643500. , , ICICI Bank Ltd, Salarpuria House, # 496, CMH Road, Indira Nagar. -560038, Tel: 080-42171362/41131877/42171364. BELGAUM: Shree Krishna Towers,#14, Khanapur Road, RPD Cross, Tilakwadi, Belgaum. -590006, Tel: 0831 -2404 203, 2404 204,2404 205 . BHARUCH: Blue Chip Complex, Sevashram Road, Panchbatti,Bharuch-392001, Tel: 02642-252451/ 52/53 . BHAVNAGAR: Ground Floor, Plot No. 2569,Ratnadeep, Opp. Central Salt Research Institute,Waghawadi Road, Bhavnagar -364002, Tel: 0278-2573626/27. CHANDIGARH: SCO 9-10-11, Sector 9-D. Chandigarh-160017, Tel: (0172)-5070542 . CHENNAI: 110, Prakash Presidium, Uthamar Gandhi Salai, (Nungambakkam High Road),Chennai-600034, Tel: 044-28228003,4,28220713,28222461,28222399,28256359. ICICI Bank Ltd., 7, Bazullah Road, T.Nagar, Chennai-600017, Tel: 044-42606510/42125747. ICICI Bank Ltd., 2/1, LB Road,Chennai-600 020, Tel: 044-42116434/42116440. ICICI Bank Ltd., P.B.No. 1610, Dare House, Annexe 44, Moore Street, Chennai-600001, Tel: 044- 25341164/42088000/42166789. DURGAPUR: ICICI Bank Ltd, The Legend, Ground Floor, Opp Suhatta Mall,City Centre, Durgapur, West Bengal -713216, Tel: 0343-2544420/6452521/2544439.GHAZIABAD: ICICI Bank Ltd, R- 1/88, Raj Nagar, Ghaziabad, Uttar Pradesh-201001, Tel: 0120-2833868/2833071/2854371/2854372 . GURGAON: ICICI Bank Ltd, SCO 18 & 19, HUDA Shopping Centre, Sector-14, Market Complex, Gurgaon-122001, Tel: 0124-4267151-7. HUBLI: Eureka Junction, Travellers Bungalow Road, Hubli-580029, Tel: 0836-4265212,4265216,4265223,4265240,4265229. JABALPUR: ICICI Bank Ltd, Kailash Automobiles, 124 Napier Town, Model Road, Jabalpur (M.P) -482001, Tel: 0761-4036932/4087027/4087075 .JAIPUR: C-99, Shreeji Towers, Subhash Marg, Near Ahimsa Circle, C Scheme, Jaipur-302001, Tel: 0141-5107444, 0141-2361992. JAMSHEDPUR: Natraj Mansion, Main Road, Bistupur, Jamshedpur-831001, Tel: 0657-2422509/10/2425907/12 . KOLHAPUR: Ground Floor, Vasant Plaza, Rajaram Road, Rajarampuri, Kolhapur-416001, Tel: 0231-2534292/3/4. KOLKATA: 22, R N Mukherjee Road, Kolkata-700001, Tel: 033-22428537/22100995. ICICI Bank Ltd., BJ-140, Sector II, Salt Lake City, Kolkata -700091, Tel: 033-23598064/44026102/44026115. ICICI Bank Ltd., Rishikesh, 1/1, Ashutosh -Chowudhry Avenu Ballygunge Kolkata 700019, Tel: 033-30582536/22807684. MUMBAI : ICICI Bank Ltd., Reis Magos, Sutrale Road, off. Chandavarkar Lane, Borivali (W), Mumbai-400092, Tel: 0712-2540302/5614040 /2561983 /2540294. ICICI Bank Ltd., Galleria Shopping Mall, Hiranandani Gardens, Powai, Mumbai-400076, Tel: 022-25704846/28307777/65257173. ICICI Bank Ltd., Shop No 14,15 & 16, Shri Ganesh CHS, Sector 1, Opp.Apna Bazar, Vashi Navi Mumbai Dist-400703, Tel: 0821-2414006/2412222/2416888. 30,Mumbai Samachar Marg-400001, Tel: 022-22627600. ICICI Bank Ltd., Sagar Avenue, Ground Floor, Opp. Shoppers Stop, S.V. Road, Andheri (W), Mumbai-400058, Tel: 022-26288093/66930384/66390395. ICICI Bank Ltd., 167-C, Poonawadi, Dr. Ambedkar Road, Dadar, Mumbai-400014, Tel: 022-24116203/24116205. ICICI Bank Ltd., Glenmorgan,Veer Savarkar Marg,Panchpakhadi,Thane-400602, Tel: 022-65972498/65972499/65972498. NEW DELHI : 9A, Phelps Building, Inner Circle,Connaught Place, New Delhi-110001, Tel: 0832-2232180/2424217/ 2424225/ 2423444. NOIDA: K-1, Senior Mall, Sector 18, NOIDA-201301, Uttar Pradesh-201301, Tel: 0413-2332237/38/42. PUNE: A-Wing, Shangrila Gardens, Bund Garden Road, Pune-411001, Tel: 0651-2330286,2330654,2330789 . RAJKOT: Jai Hind Press annexe, Opp. Shardabaug, Babubhai Shah Marg, Rajkot-360001, Tel: 0427-2336635/36/39. SURAT: Anjan Shalaka, Lal Bungalow, Athwa Lines, Surat-395007, Tel: 0265-2339923/2339924/2339925/2339927/2339928 . VIJAYWADA: D-40-1-52/5, SainagComplex, M G Road, Vijayawada-520010, Tel: 0866-6677001/6610005/0883-2435776. VISAKHAPATNAM: 47-14-18, Isnar Satyasri Complex, Main Road, Dwarkanagar, Vishakapatnam-530016, Tel: 0891-2762644/6648782.IDBI BANK LIMITEDAGRA : IDBI Bank Ltd., Hall No . H-2, Gr Floor, Padamdeep Tower, G 10/8, Sanjay place, Agra-282002, UP, Tel: (562) -2526704. AHMEDABAD : IDBI Bank Ltd., IDBI Complex, Lal Bungalows Off, CG Road, Ahmedabad Pin : 380006, Gujarat, Tel: (079)-66072623. AHMEDNAGAR : IDBI Bank Ltd., 210, Palashikar Bldg, Near Shami Ganpati, Delhi Gate, Ahmednagar, Pin : 414001, Maharashtra, Tel: (0241)-2345457. ALLAHABAD : IDBI Bank Ltd. Jeevan Prakash Building, 172A/40, M.G Marg, Civil Lines, Allahabad-211001, UP, Tel: (0532)-6451901.AMRITSAR : IDBI Bank Ltd., Adjacent to Hotel Raj Continental, Court Road, Amritsar-143001, Punjab, Tel: (0183)-2224574. BANGALORE : IDBI Bank Ltd., IDBI House, 58 Mission Road, Bangalore Pin : 560027, Karnataka, Tel: 91 (80) 2290447. BAREILLY : IDBI Bank Ltd., 146 Civil Lines, Circuit House, Chouraha., Bareilly Pin-243001, UP, Tel: 0581-2510399. BELGAUM : IDBI Bank Ltd., ’3493/1B, College Road, Belgaum Pin : 590001, Karnataka, Tel: (0831)-2405005. BHILAI : IDBI Bank Ltd., New Era, 19, Priyadarshni Parisar, Nehru Nagar Square,Bhilai Pin : 490020, Chhattisgarh, Tel: (0788)-2292158. BHOPAL : IDBI Bank Ltd., Hall A Centre Point, M P Housing Board Bldg, TT Nagar, Pin:462003, Tel: (0755)-4058553. BOKARO : IDBI Bank Ltd., M/S Classic, A - 1/2, City Centre, Sec - 4, Bokaro Pin : 827004, Jharkhand, Tel: (06542)-233889. CALICUT : IDBI Bank Ltd., Ground Floor & First Floor, City Plaza, YMCA Cross Road. Kozhikode Pin : 673001, Kerala, Tel: (0495) - 2766855. CHENNAI : IDBI Bank Ltd, PM Towers, 37, Greams Road, Chennai Pin : 600006, Tamil Nadu, Tel: (044)-24301731.COCHIN : IDBI Bank Ltd., Dhanwantari Building, Near Padma Theater, MG Road, Kochi Pin : 682035, Kerala, Tel: +91 (484) 382519. COIMBATORE : IDBI Bank Ltd, Door No: 72 Mayflower E Castle, Dr. Balasundaram Road, ATT Colony, Off Avinashi Road( RTO Office road), Coimbatore, Pin : 641018, Tamilnadu, Tel: (0422)-4299010/11. DEHRADUN : IDBI Bank Ltd., 59/4, International Trade Centre, Rajpur Road, Dehradun Pin : 248001, Uttaranchal, Tel: (0135)- 2741225/26/27. DHANBAD : IDBI Bank Ltd., Skylark Complex, Bank More, DhanbadPin : 826001, Bihar, Tel: 03262300761/762. HIMMATNAGAR : IDBI Bank Ltd.Shreeji Complex, Opp: Civil Hospital, District : Sabarkantha, Himmatnagar Pin : 383 001, Gujarat, Tel: (02772)-240281. HOSUR : IDBI Bank Ltd., Ground Floor, No.15, Second Cross, Kamaraj Colony, Hosur Pin : 635109, Tamil Nadu, Tel: (04344)-220584. HYDERABAD : IDBI Bank Ltd., Mahavir House, Basheerbagh Square, Hyderabad Pin : 500029, Andhra Pradesh, Tel: +91 (40) 66746000/41. JAIPUR : IDBI Bank Ltd., D-24 Durlabh Niwas, Prithviraj Road, C Scheme,Jaipur Pin : 302001, Tel: (0141)-5113456. JALANDHAR : IDBI Bank Ltd, Bombay Palace, 136, Jawahar Nagar, Cool Road, Jalandhar Pin : 144001, Punjab, Tel: (0181)-2227132. JALGAON : IDBI Bank Ltd.Khandesh Mills Complex, Nehru Chowk, Jalgaon Pin : 425001, Maharashtra, Tel: 0257 2229962. JAMMU : IDBI Bank Ltd., IDBI Ltd, Office Block No O.B.26, Grid Bhavan 1st Floor, Rail Head Complex, Jammu Pin : 180012, Jammu & Kashmir, Tel: (0191)-2474337. JAMSHEDPUR : IDBI Bank Ltd., Shantiniketan, Sakchi Boulevard Road, Bistupur,Jamshedpur Pin : 831001, Jharkhand, Tel: +91 (657) 425-452. KAKINADA : IDBI Bank Ltd., R K Electrical Works, Door No 43-1-28, Main Road Kakinada Pin : 533001, Tel: (0884)-2345602. KANPUR : IDBI Bank Ltd., Jeevan Vikas, MG Road, Near Statue Junction, Kanpur Pin : 208001, Uttar Pradesh, Tel: (0512)-2305437. KOLKATA : IDBI Bank Ltd., 44, Shakespeare Sarani, PB No 16102, Kolkata Pin : 700017, West Bengal, Tel: (033)66338866. KOTTAYAM : IDBI Bank Ltd., Thekkekarayan Towers, Muttambalam Post, Kanjikuzhy, Kottayam Pin: 686004, Kerala, Tel: +91 (481) 2573-112. LUCKNOW : IDBI Bank Ltd., UPCB Bldg., 2 MG Road, Lucknow, Pin:226001, Tel: (0522)-2619915. LUDHIANA : IDBI Bank Ltd., SCO 126-128, Kalinga towers, Feroze Gandhi Market, Ludhiana Pin : 141001, Tel: (0161) 2412105. MADURAI : IDBI Bank Ltd, 1/1, Karthik Raja Complex, Vinayaga Nagar, KK Nagar, Madurai Pin : 625020, Tamil Nadu, Tel: (0452)-4391499. MANGALORE : IDBI Bank Ltd., Metalco Plaza, Highland Road, Falnir, Kankanady, Mangalore Pin : 575001, Karnataka, Tel: (0824)-2431000.MORADABAD : IDBI Bank Ltd., Delhi Road, Majhola Chowk, Opp.Dharamkanta, Moradabad Pin : 244001, Uttar Pradesh, Tel: (0591)-2485917. MUMBAI- NARIMAN POINT : IDBI Bank Ltd., Mittal Tower, ‘C’ Wing, Ground Floor, Nariman Point, Mumbai-400021, Maharashtra, Tel: +91 (22) 66588111. MYSORE : IDBI Bank Ltd., Anand Archade, MIG- 11, V.M. Double Road, Saraswathipuram, Kuvempunagar, Mysore Pin : 570009, Karnataka, Tel: 0821-2545424. NADIAD : IDBI Bank Ltd., Shop No 1 & 2, Ground Floor, ISKON ARCADE, College Road,Nadiad, Gujarat, Tel: 0268 2520183. NANDED : IDBI Bank Ltd., Lahoti Complex, Near Parbhat Talkies, Vazirabad P B 24, Nanded, Nanded Pin : 431601, Maharashtra, Tel: 02462-234673. NASHIK : IDBI Bank Ltd., A-1& 2 “Prathamesh”, Thatte Nagar, Gangapur Road, Nashik Pin : 422005, Maharashtra, Tel: 0253- 2317001 / 5627001. NAVSARI : IDBI Bank Ltd., ‘G-1, Hare Krishna Complex, Chimnabai Road, Near Vasant Talkies, Navsari Pin : 396445, Gujarat, Tel: (02637)- 233462/250621. NELLORE : IDBI Bank Ltd., 16-1-655, Ground Floor, L.R.Shine, Jawaharlal Nehru Road, VRC Centre, Nellore Pin : 524001, Andhra Pradesh, Tel: 0861-2341542/43/44. NEW DELHI -K.G.MARG : IDBI Bank Ltd, Surya Kiran Building, Ground Floor, 19 K G Marg, New Delhi Pin : 110001, Delhi (UT - NCT), Tel: (011)-23358290. NEW DELHI- SIRI FORT : IDBI Bank Ltd, Sat Pual Mittal Centre, 1/6, Siri Fort Institutional Area, Khel Gaon Marg, New Delhi Pin : 110049, Delhi (UT - NCT), Tel: (011) 26497104. PATNA : IDBI Bank Ltd., Kashi Palace Complex, Dak Bungalow Road, Opposite Heera Palace, PatnaPin : 800001, Bihar, Tel: (0612)-6510293. RAIPUR : IDBI Bank Ltd., Singhania House, Civil lines, Opp Museum, Raipur Pin : 492001, Chhattisgarh, Tel: (0771)-4044972. RANCHI : IDBI Bank Ltd., 715, Kataruka House, Near Sartaj Hotel, Main Road, Ranchi Pin : 834001, Jharkhand, Tel: (0651) 2202197. SALEM : IDBI Bank Ltd., K.T.Towers, Ground Floor, No. 111, Omallur Main Road, Four Road, Salem, Salem Pin : 636007, Tamil Nadu, Tel: 0427-2411500/600. SATARA : IDBI Bank Ltd., 218, Pratapganj Peth, Veer Sawarkar Marg, Satara City, SataraPin : 415002, Satara Pin : 415002, Tel: 02162 280526, 280527. SHILLONG : IDBI Bank Ltd., Plot No.4, Opposite M.T.C. Building, Jail Road, Police Bazar, Shillong Pin : 793003. Meghalaya, Tel: (0364)-2224632. SHIMLA : IDBI Bank Ltd., Jeevan Jyoti, Lala Lajpatrai Chowk, The Mall, P B No. 52, Shimla Pin : 171001, Himachal Pradesh, Tel: +91-(0177) 2658999. SURAT : IDBI Bank Ltd., ESS EN House, Ghod Dod Road, Surat Pin : 395001, Gujarat, Tel: (0261)-6540385. UDAIPUR : IDBI Bank ltd, Mumal Towers, 16 Saheli Marg. Udaipur Pin : 313001,Rajasthan, Tel: (0294)-5130622. VIJAYAWADA : IDBI Bank Ltd., BSR Plaza, Near Maris Stella College, Ring Road, Vijayawada Pin : 520008, Andhra Pradesh, Tel: (0866)-2496912/14.DHANALAKSHMI BANK LIMITEDAHMEDABAD: 3, Motilal Chambers, In<strong>com</strong>e Tax Circle,, Near ‘Sales India’,Ashram Road, 143- Ahmedabad, Ahmedabad Dist, Gujarat-380 009 Tel: 079 64502690, 64502692, 64502694. CHENNAI: P.b.no.359, 104 & 107,Om Sakthi Towers, Mount Road,, Anna Salai, Chennai, Tamil Nadu-600 002 Tel: 044 64530595, 64530587, 64530580. ERNAKULAM-COCHIN: 32/2383, Kmm Building, Opposite KSEB, S N Junction, 38- Palarivattom, Ernakulam Dist, Kerala-682 025, Tel: 0484 0484-6453447, 6453441. KOLKATA: Ideal Plaza,, Ground Floor,,11/1, Sarat Bose Road, Mento Park, 154- Kolkata, West Bengal-700 020, Tel: 033 22815100. MUMBAI: Ground Floor,Janmabhoomi Bhavan,Plot 11-12, Janmabhoomi Marg, 144- Fort, Mumbai, Maharashtra-400 001 Tel: 022 22871658, 22022943. NEW DELHI: 16/15, W.E.A., J.S.Plaza, Arya Samaj Road, Karol Bagh, New Delhi-110 005, Tel: 011 64508887, 64507036, 64506070, 64509992, 64505419, 64508708. PUNE: Ground & 1st Floor, Radiant Arcade, M.G. Road, (East Street), Pune. Tel: 20 6400105, 6400106. TRICHY: B 35, Sastri Road,Thillainagar, Thiruchirappalli, Tamil Nadu-620 018, Tel: 0431 6450991, 6450992, 6451476. TRIVENDRUM: Dhanlaxmi Bank, P.B.No 5067, Karimpanal Arcade, 57- Fort, Thiruvananthapuram, Kerala-695 023, Tel: 0471 6451227, 6451244, 6451071, 6451079, 6451093, 6451295.INDUSIND BANK LIMITEDAHMEDABAD : World Business House, M. G. RoadNr. Parimal Garden, Ellis BridgeAhmedabad - 380 015, M - 09925221124. CHENNAI : No.3 Village Road NungambakkamChennai - 600 034, M-09003127521. GURGAON : First India Place,Block A, Sushant Lok Phase-1, Gr.Flor, Tower B, Gurgaon 122002, M-09899288617/ 0124-6462117. HYDERABAD : 40/581, S.V.Complex, R. S. RoadKurnool - 518004, M-9652666615. KOLKATA : Megacity Chambers, 1 India Exchange PlaceGround Floor, Kolkata 700 001, M-9836072472. MUMBAI: PremisesNo. 1, Sonawala Building 57, Mumbai Samachar Marg, Fort, Mumbai 400 001, M-09821147300/022-66366593. Mamta House, 231, S.V.Road, Bandra (West), Mumbai- 400 050, M-09930010293, 26458320/22. Shop No.5, Between A&B Wing, Kamala Nagar, M.G.Road, Kandivali (W), Mumbai – 400 067, M: 09833425423/022-28022079/80. NEW DELHI : Dr. Gopal Das Bhawan28, Barakhamba Road, New Delhi - 110 001., M-09873177751/011-23738407.ING VYSYA BANK LIMITEDBANGALORE: 22 Ground Floor Ing Vysya House M.g.road Bangalore-560 001. BHUBANESHWAR: 25A Janpath,Kharvel Nagar,Unit-III Bhubaneswar-751001. CHANDIGARH: SCO 70-71 Ground Floor Sector-8C Madhya Marg Chandigarh-160 018. CHENNAI: 185 Anna Salai Near TVS Chennai-600 006. INDORE: 7/1 K.K. Bapna Arceda Dr. Roshan Singh Bhandari Marg Savrkar Circle Narayan Kothi Indore-452 001. JAIPUR: E-74 Bhagat Singh Marg C-scheme Jaipur-302 001. KAKINADA: 26-1-4/1 Opp. Satyanarayana Swamy Temple StreetKakinada-533 001. KOLKATA: 4/1 Middleton Street Sikkim House Kolkata-700 071. MUMBAI: Mittal Towers A-wing Ground Floor 210 Nariman Point Mumbai-400 021. NEW DELHI: Narian Manzil Ground Floor Shop No. G1 To G5 I Floor Shop No.1001 To 1007 Barakhamba Road New Delhi -110 001. PUNE: 928 Mantri Centre F.C. Road Pune-411 004. SURAT: Surya Plaza, Ground Floor, B/S Gujarat Samachar Bhavan, Near Udhana Darwaja, Ring Road, Surat-395002.Court, 22, Vijaya Raghava Road, T Nagar, Chennai 600 017, Tel: 044-28155967/28153658. Karvy Stock Broking Ltd, Sundar Krishnaplaza, 3rd Floor, No.8, Luckmodoss Street, Sowcarpet, Chennai 600 003, Tel: 044-42051557/1471/1412. Karvy Stock Broking Ltd, F-7 & 8, 3rd Floor, Mahbubani Towers, No. 48, Dr. D N Road, T. Nagar, Chennai 600 017, Tel: 044-42076808/09/30/42067836/31. Karvy Stock Broking Ltd, No. 7, Sriperambadur Road, Thiruvallur, Thiruvallur 602 002, Tel: 044-27640552. Karvy Stock Broking Ltd, Doshi Gardens, Shop No.10,2nd Floor D-block No. 174 N.s.k Salai, Chennai 600 026, Tel: 044-42013425/27 42013002/42048307. Coimbatore-Sai Baba Colony: Karvy Stock Broking Ltd, Ground Floor, 29/1, Chinthamani Nagar, N S R Road, Sai Baba Colony, Coimbatore 641 011, Tel: 0422-2452161/162/163. Karvy Stock Broking Ltd, “Jaya Enclave” 1057/1508, Avanashi Road, Coimbatore 641 018, Tel: 0422-4291000 – 30. DEHRADUN: Karvy Stock Broking Ltd, 48/49, Patel Market, Opp: Punjab Jewellers, Near Gandhi Park, Rajpur Road, Dehradun 248 001, Tel: 0135-2713351/2714046 . Karvy Stock Broking Ltd, Kaulagarh Road, Near Sirmour Marg, Dehradun 248 001, Tel: 0135-2754334, 2754336. DURGAPUR: Karvy Stock Broking Ltd, Old Dutta Automobile Building, 1st Floor, Benachity, Malancha Road, Durgapur 713 213, Tel: 0343-2586375 To 77. GANDHIDHAM: Karvy Stock Broking Ltd, 14, Komal Complex, Plot No 305, Near Shivaji Park, Sector 12-b, Gandhidham 370 201, Tel: 02836-228640/30. GHAZIABAD: Karvy Stock Broking Ltd, 1st Floor, C-7, Lohia Nagar , Ghaziabad 201 001, Tel: 0120-2701886/2701891/2700594. GORAKHPUR: Karvy Stock Broking Ltd, Above V.i.p. House, Adjacent, A.d. Girls College, Bank Road, Gorakpur 273 001, Tel: 0551-2346519/2333825/2333814/5513297816/17/19. GURGAON: Karvy Stock Broking Ltd, Shop No 18, Near Huda Office, Ground Floor, Opp. Akd Office, Sec.14, Old Delhi Road, Near Madras <strong>Rest</strong>aurant, Gurgaon 122 001, Tel: 0124-4086419/3243535. GUWAHATI : Karvy Stock Broking Ltd, 2nd Floor, Ram Kumar Plaza, Chatribari Road, Near Himatshinga Petrol Pump, Guwahati 781 001, Tel: 0361-2608016/8102/8122. GWALIOR : Karvy Stock Broking Ltd, Near Nadigate Pul, Mlb Road, Shinde Ki Chawani, Gwalior 474 001, Tel: 0751-4069001, 4069002. Karvy Stock Broking Ltd, 52, Mayur Market, First Floor, Near Petrol Pump, Thatipur, Gandhi Road, Gwalior 474 001, Tel: 0751-2340200/0751-2340201. HISSAR: Karvy Stock Broking Ltd, Sco 17 Red Square Market, 1st Floor, Hissar 125 001, Tel: 01662-225868 (D)/225845/836. HUBLI: Karvy Stock Broking Ltd, Giriraja House, No.451/B, Ward No.1, Club Road, Hubli 580 029, Tel: 0836-2353962, 2353974,2353975. Karvy Stock Broking Ltd, No. G-7 & 8 Sri Bhanashankari Avenue, Ramnagara, Dharwad 580 001, Tel: 0836-2744207/2744208. HYDERABAD : Karvy Stock Broking Ltd, 15-6-464/470, 1st Floor, Salasar Complex, (Near Fish Market), Begum Bazar, Hyderabad 500 012, Tel: 040-23433100. Karvy Stock Broking Ltd, 1st Floor, Plot No.2, 1-1-128/B, Chanda Nagar, Serilingampally, Near Bhel, Hyderabad 500 050, Tel: 040-23030028, 23030029, 23433126/132. Karvy Stock Broking Ltd, Vijetha Golden Empire, Flat No. 103, First Floor, H No.16-11-762/762B & C, Beside Anadal Nilayam, Moosarambagh, Hyderabad 500 036, Tel: 040-23433116/117/135 134/136. Karvy Stock Broking Ltd, 3-5-890, Paras Chambers, Plot No.14-15, Ground Floor, Himayat Nagar, Hyderabad 500 029, Tel: 040-23388771, 23388772. Karvy Stock Broking Ltd, Sai Vikram Towers, 1st Floor, Kukatpally Main Road, Near Kukatpally Bus Stop, Kukatpally, Hyderabad 500 072, Tel: 040-23433137/119. Karvy Stock Broking Ltd, Building No.160 (Part), Opp: Mayfair Complex, Rasoolpura, S P Road, Secunderabad 500 003,Tel: 040-23433110 To 15. Karvy Stock Broking Ltd, 21 , Avenue 4, Street No.1, Banjara Hills, Hyderabad 500 034, Tel: 040-23312454/23320251. Karvy Stock Broking Ltd, Block No 176, Opp. Chola Residency, Old Vasavi Nagar, Kharkana, Secunderabad 500 016, Tel: 040-23433166 -169 . INDORE: Karvy Stock Broking Ltd, 105, 106 & 107,D M Towers, 21/1, Race Cource Road, Near Janjeerwala Chowrah, Indore 452 001, Tel: 0731-3014200-19. JABALPUR: Karvy Stock Broking Ltd, Arun Grover & Associates, Naya Bazar, First Floor Opp ShyamTalkies, Jabalpur 482 001, Tel: 0761-2312009. JAIPUR: Karvy Stock Broking Ltd, S-16/A, Land Mark, 3rd Floor, Opp Jai Club, Mahaveer Marg, C Scheme, Jaipur 302 001, Tel: 0141-2378703/604/605/2363321. JALANDHAR: Karvy Stock Broking Ltd, Prime Tower, Lower Ground Floor Off.no.3, Plot No 28, G T Road, Jalandhar 144 001, Tel: 0181-4634401-14. JALGOAN: Karvy Stock Broking Ltd, Laxminarayan Plaza, 148, Navipeth, Opp. Vijaya Bank, Jalgoan 425 001, Tel: 0257-2227432/2223671/2237431/2226761. JAMMU: Karvy Stock BrokingLtd, 1st Floor, 29 D/C, Near Services Selection Board, Gandhinagar, Jammu 180 004, Tel: 0191-9906297556,9906296948 & 9906296475 . JAMNAGAR: Karvy Stock Broking Ltd, G-12 & 108 Madhav Plaza, Opp: Sbs Bank, Near Lal Bungalow, Jamnagar 361 001, Tel: 0288-2556520/2556260/2556420. JAMSHEDPUR: Karvy Stock Broking Ltd, 2nd Floor, Kanchan Towers, 3 Sb Shop Area, Main Road, Bistupur, Jamshedpur 831 001, Tel: 0657-2487020, 2487045, 2487048. JHANSI: Karvy Stock Broking Ltd, 371/01, Narayana Plaza, Jeevan ShahCrossing, Opp Telephone Exchange, Gwalior Road, Jhansi 284 003, Tel: 0517-2333682-85, 2332141. JODHPUR : Karvy Stock Broking Ltd, 203, Modi Arcade, Chopasni Road, Jodhpur 342 001, Tel: 0291-5103026/5103046. JUNAGADH: Karvy Stock Broking Ltd, 124-125, Punit Shopping Centre, M G Road, Ranavav Chowk, Junagadh 362 001, Tel: 0285-2624140/2624154. KAKINADA: Karvy Stock Broking Ltd, 13-1-46, I Floor, Sri Deepthi Towers, Icici Bank Complex, Main Road, Kakinada 533 001, Tel: 0884-2387382/2387383/2387381/3293518.KANNUR: Karvy Stock Broking Ltd, Ii Floor, Prabhat Road, Fort Road, Kannur 670 141, Tel: 0460-27681120/1130. Karvy Stock Broking Ltd, 15/46, Civil Lines, Near Muir Mills, Stock Exchange Road, Kanpur 208 001, Tel: 0512-2330127, 2331445, 2333395,96. Karvy Stock Broking Ltd, 81/4, Block No. 9, Govindnagar, Kanpur 208 006, Tel: 0512-329600. KOCHI: Karvy Stock Broking Ltd, G 39, Panampilly Nagar, Kochi 682 036, Tel: 0484-2310884 (D)/2322152/2312098/2320431. Karvy Stock Broking Ltd, Room No Xix/135 (16) 1st Floor, “Noor Point”,Opp. Federal Towers, Bank Junction, Aluva 683 101, Tel: 0484-3202627/637/3204811/2629691. Karvy Stock Broking Ltd, 7/462, B 5trans Avenue, Near Ekm Dist Coop Bank Head Quarters , Kakanad, Ernakulam 682 030, Tel: 0484-2423191/3949087. Karvy Stock Broking Ltd, D. No. 6/0290, Opp: Hazi Essa School, Gujarathi Road, Mattancherry 682 002, Tel: 0484-2211229/2211225/2223243 . Karvy Stock Broking Ltd, 1st Floor, Pindys Complex, Xx/773, Market Junction, Tripunithura 682 301, Tel: 0484-2777330/3571041. KOLHAPUR: Karvy StockBroking Ltd, Omkar Plaza” Shop No. F2 & F4, 1st Floor, Rajaram Road, Near Icici Bank, Kolhapur 416 008, Tel: 0231-2520650, 2520655. KOLKATA-DALHOUSIE: Karvy Stock Broking Ltd, 19, R N Mukherjee Road, 2nd Floor, Dalhousie 700 001, Tel: 033-22437863-69/90/89/22303375. Karvy Stock Broking Ltd, 493/C/A, G T Road (S), Block G, 1st Floor, Howrah Maidan 711 101, Tel: 033-26382345/2535/26404213/26370547 . Karvy Stock Broking Ltd, 22N/1, Block A, New Alipore, Kolkata 700 053, Tel: 033-24576203-05/2407 0992/2445 0108. KarvyStock Broking Ltd, Ad-60, Sector-1, Salt Lake, Kolkata 700 064, Tel: 033-23210461-64/0587/23344140. Karvy Stock Broking Ltd, 49, Jatin Das Road, Near Deshpriya Park, Kolkata 700 029, Tel: 033-24634787-89/24647231/32/4891/24650308. Karvy Stock Broking Ltd, P-335, Cit Scheme No. Vi M, ~, Kolkata 700 054, Tel: 033-23648927 ; 23628486. KOTA: Karvy Stock Broking Ltd, 29, Shopping Centre, 1 Floor, Near Lala Lapatrai Circle, Kota 324 007, Tel: 0744-2365145/146/144. KOTTAYAM: Karvy Stock Broking Ltd, 1st Floor, Csi Ascension Square,Collectorate P.o, Kottayam 686 002, Tel: 0481-2302420-21. LUCKNOW : Karvy Stock Broking Ltd, K S M Tower, Cp 1, Sinder Dump, Alambagh, Lucknow 226 005, Tel: 0522-2453168/158/176. Karvy Stock Broking Ltd, Hig 67, Sector E, Aliganj, Lucknow 226 016, Tel: 0522-2329419, 2329938/39. Karvy Stock Broking Ltd, 24, Usha Sadan, Prem Nagar, Ashok Marg, Lucknow 226 001, Tel: 0522-3213183. Karvy Stock Broking Ltd, Tej Krishan Plaza, 313/9, Khun Khunji Road, Chowk, Lucknow 226 003, Tel: 0522-2258454/455/456. Karvy Stock BrokingLtd, Shivani Plaza, Khunkhunji Plaza, 2/54, Vijay Khand, Gomtinagar, Lucknow 226 010, Tel: 0522-2391664/65/2391280. Karvy Stock Broking Ltd, 94, Mahatma Gandhi Marg, Opp: Governor House, Hazratganj, Lucknow 226 001, Tel: 0522-2236819-28, 3817001 (Rim). LUDHIANA : Karvy Stock Broking Ltd, Ground Floor, Sco -3, Feroze Gandhi Market, Ludhiana 141 001, Tel: 0161-4680050 To 4680062 And 4680080. MADURAI : Karvy Stock Broking Ltd, 274, Goods Shed Street, ~, Madurai 625 001, Tel: 0452-2350855 (D)/2350852-854 . MADURAI: Karvy Stock Broking Ltd, Rakesh Towers, Opp Murugappa Motors, No.30, By Pass Road, Madurai 625 010, Tel: 0452-2600851-855. Karvy Stock Broking Ltd, Plot No 654-80 Feet Road, Next To Lakshmi Arasu Kalyana Mandapam, K K Nagar, Madurai 625 020, Tel: 0452-5391700/600/2523109/2530731. MANGALORE: Karvy Stock Broking Ltd, Mahendra Arcade, Ground Floor, No.4-6-577/21/22, Kodial Bail, Mangalore 575 003, Tel: 0824-2492302, 2496332, 2492901. MEERUT: Karvy Stock Broking Ltd, 1st Floor, Medi Centre, Opp Eves Centre,Hapur Road Near Bachha Park, Meerut 250 002, Tel: 0121-2520068. MEHSANA: Karvy Stock Broking Ltd, Ul 47, Apollo Enclave, Opp Simdhear Temple, Modhera Cross Road , Mehsana 384002, Tel: 2762-242950. MORADABAD: Karvy Stock Broking Ltd, Om Arcade, First Floor, Parkar Road, Above Syndicate Bank, Taari Khana Chowk, Moradabad 244 001, Tel: 0591-2310470, 2320470. MUMBAI : Karvy Stock Broking Ltd, 26/30, Fort Foundation Building, Nagindas Master Lane Extn, Opp Msc Bank, Fort Mumbai, Mumbai 400 001, Tel: 022-22062077,2087, 2051, 2023. Karvy Stock Broking Ltd, 29, Patel Shopping Centre, Wst Floor, Opp. Foodland <strong>Rest</strong>aurant Sainath Road, Malad (West), Mumbai 400 064, Tel: 022-28824241/28828281/28895159/28891077. Karvy Stock Broking Ltd, B-153, Vashi Plaza, Sector 17, Vashi, Navi Mumbai 400 705, Tel: 022-67912087, 67912168, 67912169. Karvy Stock Broking Ltd, 7, Andheri Industrial Estate, Off: Veera Desai Road, Andheri (West) 400 053, Tel: 022-26730799/843/311/867/153/292. Karvy Stock Broking Ltd, 7&8, Eric House, Ground Floor, 16th Road,Chembur Gymkhana Road, Near Ambedkar Garden, Chembur, Mumbai 400 071, Tel: 022-25209335, 25209336, 25209337, 25209338. Karvy Stock Broking Ltd, 101 Sapna Building, Above Idbi Bank, S K Bhole Marg, Dadar West, Mumbai 400 028, Tel: 022-24329763, 24322158, 24324378, 24329738, 24324662. Karvy Stock Broking Ltd, 16/26, 16/22, Transworld, Maharashtra Chambers Of, Commerce Lane, Opp Mcs Bank, Fort, Mumbai 400 023, Tel: 022-22819709-11/22819721-24/66331134/22021705/22021706. Karvy Stock Broking Ltd, 115,Arun Chambers, 1st Floor, Next To A/C Market, Tardeo, Mumbai 400 034, Tel: 022-66607042/66607043. Karvy Stock Broking Ltd, 103, 1st Floor, Jeevan Chaya Bldg., Ram Maruti Road, Naupada , Thane (West) 400 602, Tel: 022-25446124/25446121. MYSORE: Karvy Stock Broking Ltd, L-350, Silver Tower, 1st Floor, Ashoka Road, Opp: Clock Tower, Mysore 570 001, Tel: 0821-2524292, 2524294. NADIAD: Karvy Stock Broking Ltd, 104-105, City Point, Near Paras Cinema, Nadiad 387 001, Tel: 0268-2563210/2563245/2563248. NAGPUR : KarvyStock Broking Ltd, 230-231, 3rd Floor, Shriram Shyam Towers, Next To Niit Building, Sardar, Kingsway, Nagpur 440 001, Tel: 0712-6614146/6614145. NANDED: Karvy Stock Broking Ltd, Shop No.1, 2, 3 & 4, First Floor, Opp: Bank Of India, Santkrupa Market, Gurudwara Road, Nanded 431 602, Tel: 02462-325885, 247885. NASIK: Karvy Stock Broking Ltd, F1, Suyojit Sankul Sharanpur Road, Near Rajiv Gandhi Bhavan, Nasik 422 002, Tel: 0253-2577811/5602542 . NAVSARI: Karvy Stock Broking Ltd, 1st Floor, Chinmay Arcade, Opp: Sattapir, SayajiRoad, Navsari 396 445, Tel: 02637-280362, 280363, 280364. NEW DELHI : Karvy Stock Broking Ltd, 110-112, First Floor, Suneja Tower I, Janak Puri District Centre, New Delhi 110 058, Tel: 011-41588242/41511403/25547637. Karvy Stock Broking Ltd, 23, Shivaji Marg, Motinagar, New Delhi 110 015, Tel: 011-45436371/41428630/41428562/259288505. Karvy Stock Broking Ltd, 301, Vishal Bhavan, 95, Nehru Place, New Delhi 110 019, Tel: 011-26447065/26447066/41617868. Karvy Stock Broking Ltd, 103, Savithri Sadan-I, 11, Community Centre,Preet Vihar, New Delhi 110 092, Tel: 011-22460978/22460952/22460940. Karvy Stock Broking Ltd, 402, 4th Floor, Vikrant Tower, Rajendra Place, New Delhi 110 008, Tel: 011-41539961/41539962/41539964. Karvy Stock Broking Ltd, 104, 1st Floor, Nanda Devi Towers, Prashanth Vihar, Central Market, New Delhi 110 085, Tel: 011-27864193/27864281/27864377. Karvy Stock Broking Ltd, 103, 1st Floor, C.S.C. Sector-b, Pocket 8&9, Opp G D Goenka Public School, Vasant Kunj, New Delhi 110 070, Tel: 011-41787159/41787160/41787156. Karvy StockBroking Ltd, G-29, Ansal Chambers-1, Bhikaji Cama Place, New Delhi 110 066, Tel: 011-41659719/47659722/41659723 . Karvy Stock Broking Ltd, 105-108, Arunachal Building, 19, Barakhamba Road, Connaught Place, New Delhi 110 001, Tel: 011-23324401/23324409/43509200. Karvy Stock Broking Ltd, B 2 Dd A Market, Shop No 50, First Floor, Paschim Vihar, New Delhi 110 063, Tel: 011-25263901/25263903/42321024. NOIDA : Karvy Stock Broking Ltd, 307, Jaipuria Plaza, D-68a, 2nd Floor, (Opp Delhi Public School) Sector 26, Noida 201 301,Tel: 0120-2539271, 2539272. PANIPATH: Karvy Stock Broking Ltd, 1st Floor, Krishna Tower, Above Amertex G T Road, Panipath 132 103, Tel: 0180-2644308/2644376. PANJIM: Karvy Stock Broking Ltd, No.7 & 8, El. Dorado Plaza, Heliodoro Salgado Road, Panjim, Panjim 403 001, Tel: 0832-2426870, 2426871, 2426872. PATIALA: Karvy Stock Broking Ltd, Sco 27 D, Chhoti Baradari, ~, Patiala 147 001, Tel: 0175-5051726/27/28. PATNA: Karvy Stock Broking Ltd, Anand Tower, 2nd Floor, Exhibition Road, Near Republic Hotel, Opp: Mithila Motors,Patna 800 001, Tel: 0612-2321354/55/56/57. PONDICHERRY : Karvy Stock Broking Ltd, First Floor, No.7, Thiayagaraja Street, Pondicherry 605 001, Tel: 0413-2220636/2220640/2220633/2220644 . Pune: Karvy Stock Broking Ltd, Off.no.6, 3rd Floor, Rachana Trade Estate, Law College Road, Sndt Circle, Cts No.105, Erandwane, Pune 411 033, Tel: 020-66048790 (5 Lines)/91/92/93. Karvy Stock Broking Ltd, Rameera Towers, 130/24,Pimprichinchwad, New Township Road, Tilak Road, Nigidi, Pune 411 044, Tel: 020-27659116/115. Karvy Stock BrokingLtd, Shop No 2, Ground Floor, Sacred Heart Township, Wanowarie, Pune 411 040, Tel: 020-56610451/56610452/56610453/26850842. RAIPUR: Karvy Stock Broking Ltd, 02& 03, Lower Level, Millennium Plaza, Ground Floor, Behind Indian Coffee House, G E Road, Raipur 492 001, Tel: 0771-2236694-96, 6450194. RAJKOT: Karvy Stock Broking Ltd, 102-103, Siddhi Vinayak Complex, Yagnik Road, Rajkot 360 001, Tel: 0281-3291043, 3291042, 2239338. RANCHI: Karvy Stock Broking Ltd, “Commerce Towers”, 3rd Floor, Beside Mahabir TowersMain Road, Ranchi 834 001, Tel: 0651-2330386, 2330394, 2330320. SALEM: Karvy Stock Broking Ltd, 40, Brindavan Road, Near Perumal Koil, Fair Lands, Salem 636 016, Tel: 0427-2335700/2335705/2335701-704 . Karvy Stock Broking Ltd, First Floor, Old 17, New 49, 50 Fort Main Road, Salem 636 002, Tel: 0427-2210835/836/983. SHILLONG: Karvy Stock Broking Ltd, Mani Bhawan Annexe, Ground Floor, Opp. R K M Elp School, Lower Police Bazar, Shillong 739 001, Tel: 0364-2224175/4186/8172. SHIMLA: Karvy Stock Broking Ltd, TriveniBuilding, By Pass Chowk, Khallini, Shimla 171 002, Tel: 0177-2624453. SILIGURI: Karvy Stock Broking Ltd, Nanak Complex, 2nd Floor, Sevoke Road, Siliguri 734 001, Tel: 0353-2526393, 2526394, 2526395, 2526396, 2526397, 2526399. SURAT : Karvy Stock Broking Ltd, Gf-16, Empire State Building, Nr.udhana Darwaja, Ring Road, Surat 395 002, Tel: 0261-3017151-160. TRICHY: Karvy Stock Broking Ltd, Sri Krishna Arcade, 1st Floor, No.60, Thennur High Road, Thennur, Trichy 621 017, Tel: 0431-2791322/2798200/2793799/2793800 2791000. TRIVANDRUM: Karvy Stock Broking Ltd, 2nd Floor, Akshaya Towers, Sasthamangalam, Trivandrum 695 010, Tel: 0471-2725987, 2725989-991. UDAIPUR: Karvy Stock Broking Ltd, 201-202, Madhav Chambers, Opp.gpo, Madhuban Chetak Circle, Udaipur 313 001, Tel: 0294-5101601/602/603. VADODARA : Karvy Stock Broking Ltd, Ff-4, Shital Plaza, Uday Nagar Soc, Ajwa Road, Vadodara 390 019, Tel: 0265-3240417, 2510318. Karvy Stock Broking Ltd, C-1/2/3, Jalanand Township, Nr. Undera Jakat Naka, Gorwa, Vadodara 390 016, Tel: 0265-3259060, 3240300. Karvy Stock Broking Ltd, SB 3, Amrapaali Complex, Near Muktanand, Water Tank Road, Karelibaug 390 018, Tel: 0265-3950628, 3951011. Karvy Stock Broking Ltd, FF11-12, Rutukalash , Tulasidham Char Rasta, Manjalpur, Vadodara 390 011, Tel: 0265-9725055783/9725010695/96. Karvy Stock Broking Ltd, GF-11/12, Alian Complex, Nr Devdeep Complex, Nizampura, Vadodara 390 002, Tel: 0265-3209888/9725395222/9725396222. Karvy Stock Broking Ltd, T-2, 3rd Floor “Savoy” Complex, Haribhakti Extn, Opp. Abs Tower, OldPadra Road, Vadodara 390 007, Tel: 0265-6456183/6456186/6456187. Karvy Stock Broking Ltd, 38, Payal Complex, Near Vadodara Stock Exch, Sayajigunj, Vadodara 390 005, Tel: 0265-2225168/169, 2361514/2225220. Karvy Stock Broking Ltd, FF4, Chanakya Complex, High Tension Char Rasta, Subhanpura, Vadodara 390 007, Tel: 0265-3259056, 3244634. VAPI: Karvy Stock Broking Ltd, Shop No.5, Bhikhaji Regency, Opp: DCB Bank, Vapi-silvassa Road, Vapi 396 195, Tel: 0260-3206404. 3205955, 3293480. 2423218. VIJAYAWADA: KarvyStock Broking Ltd, 39-10-7, Opp: Municipal Water Tank, Labbipet, Vijayawada 520 010, Tel: 0866-2495200/400/500/600/700/800. Karvy Stock Broking Ltd, 11-1-25, Gmr Plaza, First Floor,BRP Road, Vijayawada 520 001, Tel: 0866-2565536/38. VISHAKAPATNAM: Karvy Stock Broking Ltd, 47-14-4, Eswar Paradise, Dwaraka Nagar Main Road, Vishakapatnam 530 016, Tel: 0891-2752915 To 18 . Karvy Stock Broking Ltd, D. No.180/129, Jhaala Complex, A.V.K.college Bldg., Beside UTI Bank, Old Gajuwaka 530 026, Tel: 0891-2511685, 25116862,2511681.KOTAK SECURITIES LIMITEDAGRA: Kotak Securities Limited., 2/220, Glory Plaza, Suer Sadan Crossing, M.G Rd.P:5538760; AHMEDABAD: Kotak Securities Limited., 207, 2nd Flr, Sakar-II, Ellisbridge Corner, Ashram Rd.P:26587276; Kotak Securities Limited., 201/A, Amruta Arcade, Nr Maninagar, Char Rasta, Nr Rasna <strong>Rest</strong>aurant, Maninagar; Kotak Securities Limited., B/104, 1st Flr, Premium House, Opp Gandhigram Rly Stn.P:26579567; Kotak Securities Limited., B-46, Kamdhenu Complex, Opp.Sahajanand College, Panjara Pole, Ambawadi.P:26308035; ALLAHABAD:Kotak Securities Limited., M-4, Mezzanine Flr, LDA Center, 2, Sardar Patel Marg, Civil Line.P:2561451; AMRITSAR: Kotak Securities Limited., Unit No.FUF-7, Central Mall, 32, Mall Rd; ANAND: Kotak Securities Limited., 3rd Flr, “Sanket”, Near Grid.P:2573311; AURANGABAD: Kotak Securities Limited., Kandi Tower, CTC No 12995, Jalna Rd.P:9923798392; BANGALORE: Kotak Securities Limited., # 68/150/4,9TH Main Rd, Jayanagar 3rd Block,Opp Cradle Hospital. P: 66371800; Kotak Securities Limited., ‘Umiya Landmark’–II Flr., No:10/7 -LavelleRd.P: 66203601; Kotak Securities Limited., 420, Bluemoon Icon, 20th Main, 6th Cross, 6th Block, Koramangala.P:51308031; Kotak Securities Limited., no 201, soundrya sampige <strong>com</strong>plex, Sampige Rd, No 412, 8th Cross, Malleswaram. Ph: 9900133758; Kotak Securities Limited., No 119, 2nd Flr, Radhakrishna Sadana, Gandhi Bazar, Main Rd.P:55128515; Kotak Securities Limited., No.173, 6th cross, 2nd Flr,Above Central Bank of India; Kotak Securities Limited., No.487/1- C M H Rd, Above Indian Overseas Bank, Indra Nagar-1 St Stage, P: 9833283543;BELGAUM: Kotak Securities Limited., 3rd Flr, Takke Bldg, Club Rd.P: 5206654; BHARUCH: Kotak Securities Limited., 235-236, Harihar Complex, Zadeshwar Rd.P:570569; BHILAI: Kotak Securities Limited., ROOM NO -1, 2nd FLR, CHOUHAN ESTATE, G.E.RD, SUPELA, Tel : 6450460.BHOPAL: Kotak Securities Limited., Third Flr, Alankar Palace, 10-11, MP Nagar, Zone 2.P:5248133; BHUBANESHWAR: Kotak Securities Limited., Plot No – 24, 2nd Flr., SCR, Nr Bazaar Kolkata, Bapuji Nagar, Janpath.P: 2597871; CHANDIGARH: Kotak SecuritiesLimited., SCO-14-15, 2nd Flr, Madhya Marg, Sector-8C.P: 5065301; CHENNAI: Kotak Securities Limited., Door No 46, Sir C.P.Ramasamy Iyer Rd, Abhiramapuram, Alwarpet.P:24998368; Kotak Securities Limited., Door No.AC- 7, Second Avenue, Anna Nagar.P:26213279; Kotak Securities Limited., GRR Business Center, No.21, Vaidyaraman Street, T Nagar.P:24303100; Kotak Securities Limited., No.23, General Muthaiah Mudali Street, Sowcarpet.P:42763712; KOCHI: Kotak Securities Limited., 40/1400, 11th Flr, Ensign Enclave, Jos Junction, M.G.Rd.P: 2377386; COIMBATORE: Kotak Securities Limited., 1st Flr, Red rose chamber, 1437,Trichy Rd.P: 6699666; DEHRADUN: Kotak Securities Limited., 1st Flr, Swaraj Complex, 72, Rajpur Rd, Opp Hotel Madhuban.P: 2745870; DHANBAD: Kotak Securities Limited., Commerce House II, Sastri Nagar, Near ICICI Bank, Tel :3294319. GHAZIABAD: Kotak Securities Limited., Office No.8, Plot No. VC-1, Sector-3, Vaishali.P: 4563190; PANAJI: Kotak Securities Limited., 2ND Flr,Gurusai Plaza,Isidoria Baptista Rd,P: 6624833; GORAKHPUR: KotakSecurities Limited., 13-A,Mangalam Tower ; Civil Lines,Golghar ; GURGAON: Kotak Securities Limited., O-107, Shopping Mall, Arjun Nagar, DLF Phase-1.P: 5050551; GUWAHATI: Kotak Securities Limited., Akshay Tower , 4th Flr, Opp. Rupayan Arcade, Fancy Bazar, S.S. Rd.P: 2732243; HISSAR: Kotak Securities Limited., c/o Aashish AggarwalC/o TR Capital Ltd., First Flr, Ravee Arcade,95-97,Green Sqaure Market; HUBLI: Kotak Securities Limited., V A Kalburgi Complex, Ground Flr, Besides Vivekanand corner, Desai Cross,Deshpandenagar.P:2357512; HYDERABAD: Kotak Securities Limited., 9-1-777, 4th Flr, Beside ITC Bldg, S D Rd, (LANE Opp to DBR Diagnosis).P:65326394; INDORE: Kotak Securities Limited., 314, Citi Centre, 570, M.G. Rd.P:2537336; JABALPUR: Kotak Securities Limited., Jain Tower, 3rd Flr, Ruseel Chowk.P: 4085850; JAIPUR: Kotak Securities Limited., 305-308, 3rd Flr, Green House, O-15,Ashok Marg, C-Scheme; Kotak Securities Limited., Second Flr ; Shreenath Tower ; 46-47 Cosmo Colony ; Amrapali Marg ; Vaishali Nagar; JALLANDHAR:Kotak Securities Limited., 2nd Flr, 465, Lajpat Nagar Market; JAMMU: Kotak Securities Limited., 105 A, North Block, Bahu Plaza, Gandhi Nagar.P: 41033; JAMNAGAR: Kotak Securities Limited., 701, 5th Flr, City Point, Station Rd, Near Town Hall.P: 5540355; JAMSHEDPUR: Kotak Securities Limited., Bharat Business Centre, Ho No.2, 2nd Flr, Rm No. 8, Ram Mandir AreaBistupur.P:3090856; JODHPUR: Kotak Securities Limited., 1st Flr, Gulab Bhawan, Chopasani Rd.P: 5101956; KANPUR: Kotak Securities Limited., 312-315, 3rd Flr, 14/113, KanChambers, Civil Lines, Near UP Stock Exchange.P: 3018114; KOLKATTA: Kotak Securities Limited., Govind Bhavan, Ground Flr, 2, Biplabi Trilokya Maharaj Sarani(Brabourne Rd).P: 2235 8105; KOTA: Kotak Securities Limited., D-8 First Flr, Shri Ram Complex, Opposite Multipurpose School, Gumanpura; LUCKNOW: Kotak Securities Limited., 1-2 Ground Flr, Commerce House, Habibullah Estate,11 M.G. Marg.P:3950119; Kotak Securities Limited., B-56-A ; Third Flr ; Near Star House ; Vibhuti Khand ; Gomti Nagar; Kotak Securities Limited., A-1; Ashish Palace,Sector E,Aliganj, P: 3232285; LUDHIANA: Kotak Securities Limited., SCO-122, 2nd Flr, Firoz Gandhi Market.P: 5047214; MADURAI: Kotak Securities Limited., Shop A First Flr, KRV Arcade, AR PLAZA 16 & 17, North velli Street.P: 2341225; MANGALORE: Kotak Securities Limited., No.4, 3rd Flr, The Trade Centre, Jyoti Centre, Bunts Hostel Rd, Near Jyoti Circle.P: 424180; MEERUT: Kotak Securities Limited., NITESH KUMAR GUPTA,shop no.205, 2nd Flr,saraswati plaza;shivaji Rd;near n.a.s. college; Kotak Securities Limited., Saraswatiplaza;shivaji Rd;near n.a.s. college; Kotak Securities Limited., Shop No. G – 33 ; Ground Flr ; Ganga Plaza ; Begum Bridge Rd; MORADABAD: Kotak Securities Limited., 1st Flr, Pili Kothi, Avas Vikas Market, Civil Lines; MUMBAI: Kotak Securities Limited., 32, Gr Flr., Raja Bahadur Compound, Opp Bank of Maharashtra, Fort.P:22655074; MYSORE: Kotak Securities Limited., No: 646 - Kiran Mansion - 2 nd Flr, Above Reliance Fresh, Chamaraja Double Rd, Mysore: 570024, P: 4000861; NAGPUR: Kotak Securities Limited.,Plot no. 5, 3rd Flr, Lotus GorepethLayout WHC Rd , Dharampeth, P:. 6620278; NASHIK: Kotak Securities Limited., G-5, Suyojit Avdhoot Tower, Old Gangapur Naka, Gangapur Rd.P: 6609804; NEW DELHI: Kotak Securities Limited., U B – 30, Antriksh Bhawan, K. G. Marg.P: 66313131; NOIDA: Kotak Securities Limited, 2nd Flr, Above Kotak Mahindra Bank, G-31-32, Atta Market, Sector-18.P: 4606911 PATIALA: Kotak Securities Limited., SCO-131, Second Flr, Cabin No-S-10, Chhoti Bardari.P: 56069304; PATNA: Kotak Securities Limited., Office No.7, Twin Tower Hathwa, South GandhiMaidan.P: 2224620; PUNE: Kotak Securities Limited., 2nd Flr, Kumar Business Center,Bund Garden Rd,Opp. Bund Graden,P: 66066129; RAIPUR: Kotak securities Limited., Menzanine Fllor, Chawla Complex, Near Vanijya Bhawan,Devendra Nagar Rd, P: 251555; RAJKOT: Kotak Securities Limited., Nath Complex, 2nd Flr, Opp. Jilla Panchayat, Above Kotak Mahindra Bank, Yagnik Rd.P:2459436; RANCHI: Kotak Securities Limited., Shop no. 24 & 25, 2nd Flr, A.C. Market, G.E.L. Church Complex, Main Rd, P: 2200860. SALEM: Kotak SecuritiesLimited., 5/241, F Rathna Arcade Five Rd,Meyyanur.P: 2335476; SILIGURI: Kotak Securities Limited., Nanak Complex, 2nd Flr, Sevok Rd.P:2530322; SURAT: Kotak Securities Limited., Kotak House, K G Point, 1st Flr, Nr.Ganga Palace, Opp.IDBI Bank, Ghoddod Rd.P: 5532333; TRICHY: Kotak Securities Limited., C-56,1-24-4th cross, Thillai Nagar.P: 2750710; TRIVANDRUM: Kotak Securities Limited., Mahesh Estates, 2nd Flr, T L -15/1805, Vazhuthacadu.P: 2337423; UDAIPUR: Kotak Securities Limited., 222/12, Ist Flr, Mumal Towers, Saheli Marg.P:513901; VADODARA: Kotak Securities Limited., 216, Meghdhanush Complex, Race Course Rd (South).P: 2314455; VIJAYAWADA: Kotak Securities Limited., 40-1-48/1, Labbipet, M.G.Rd.P: 6649061; VISAKHAPATNAM: Kotak Securities Limited., Door No.47-10-15, VRC Complex , 2nd Flr, Railway Station Rd , Dwarka Nagar.P: 6642009.NJ INDIA INVEST PRIVATE LIMITEDAGRA: S-4, Part-1, 2nd Floor, Kailash Plaza, Shah, Market, M G Road, Agra- 282002, Tel: 0562 3277488. AHMEDABAD : 808, Samedh Building, Near Associated Petrol Pump, Panchvati,Cg Road, Ahmedabad 380006, Tel: 079-32955922. AJMER: 1st Floor, K.C. Complex, Near Sundaram Finance, Opp. Daulat Baug, Ajmer-305001, Tel: 0145-3236446. ALLAHABAD: Upper Ground Floor, Shop No. - 7, Vashishtha Vinayak Tower, Tashkant Marg, Near- Icici Bank, Civil Lines, Allahabad-211001. AMBALA: 1st Floor, Classic Complex, Nicholson Road,Ambala Cantt.-133001. AMRITSAR: 103, Sco-6, 1St Floor, Distt Shopping Complex,B-Block, Ranjit Avenue, Amritsar-143001, Tel:. ANAND: Bf-11, Prarthna Vihar Complex,Anand-Vidyanagar Road, Anand 388001. Tel: 02692-249433. AURANGABAD: F-11, Prarthna Vihar Complex, Anand Vidhyanagar Road, Anand-388001 Tel: 0240-3201911. BANGALORE: #5, Gajendra Towers, 2nd Floor, 11th Main, 4th Block, Jayanagar, Bangalore-560011 Tel: 080-32450027. BARAILY: 167-A, Civil Lines, Above Syndicate Bank, Station Road, Bareilly-243001,Tel:. BARODA-FSI: 217-218, Sidharath Complex, Nr. Express Hotel, R.C Dutt Road, Alkapuri, Baroda-5., Tel: 0265-2337757/ 3244885. BHARUCH: 332-333, Aditya Complex, Kasak Circle,Bharuch-392001, Tel: 02642-324339. BHAVNAGAR: 127, Sagar Complex, Near Jashonath Chowk,BHAVNAGAR-364001. , Tel: 0278- 3299844. BHILAI: Shop No.106, Sai Complex, 5/4, Nehrunagar Parisar, Nnhrunagar,Bhilai-490006, Tel:. BHOPAL: HIG-102,Vijay Stambh,Opp. Vishal Megamart, Zone-1,Mp Nagar, Bhopal.462011, Tel: 0755 3296663.BHUBANESWAR: Plot No-1258, Chandan Villa,Road No-8, Unit-9,Bhubaneswar -22, Tel:. BHUJ: 108, Shanti Chambers,New Station Road,Bhuj - 370001, Tel: 02832 325559. BILASPUR: 1st floor, Besides HDFC Bank, Above Katmoss Showroom, Link Road, Bilaspur – 495001 (Chattisgarh), Tel: 07752-327755. BURDWAN: Boronilpure More, G.T.Road (East), Burdwan-713103. , Tel:. CHANDIGARH: 4th Floor, SCO 208-209, Sector 34-A, Chandigarh -160022, Tel: 0172-4560155. CHENNAI : Office # 1C, Ist Floor,Laxmi Bhavan,609, MountRoad,Nungambakkam,Chennai-600006, Tel: 044 32566180,COCHIN: 39/4422, 1st Floor, Thaukalan Chambers, SA Road, Near Medical Trust Hospital, Pallimukku Junction, Kochi - 682 016, Tel: 0484-3253939. COIMBATORE: Arpee Centre, Shop: 46 & 47, 320-N N.S.R Road, Saibaba Colony, Coimbatore-641011, Tel:. DEHRADUN: 82, Cannought Place, Behind Hind Leather Works,Chakrata Road,Dehradun- 248001, Tel: 1353249010. DURGAPUR: Plot No. 224/681, Secon Lane Road, Mahiskapur Plot, Benachity,Durgapur-713213. , Tel: 03433201515. ERODE: O/1, V C T V Road, Gowtham Tower, 2ndFloor,Backside of Lotus TVS, Sathy Road,Erode-638003, Tel: 0424-3249188. FARIDABAD: SCF-73, 3rd Floor, Sector-15, Market, Faridabad-121001, Tel:. GANDHINAGAR: M-8, Suman Towers, Opp. Vijaya Bank, Sector - 11, Gandhinagar-382011, Tel:, 4E Block, Sri Ganganagar-334001. , Tel: 1543206554. GHAZIABAD: 206, 2Nd Floor, Sumedha Market Complex,Ansal Building,Rdc, Rajnagar,Ghaziabad - 201001. Tel: 0120 3229336. GOA: 103, Manguirish Chamber, 18th June Road,Panji,Goa-403001, Tel: 0832 3256700. GURGAON: 2nd Floor, SCO-16, Opp. Huda Office, Nr. Axis Bank,Sector – 14, Gurgaon-122001, Tel: 0124-3208813. GWALIOR: 1st Mazanine Floor, Panin Plaza,Shinde ki Chawani, Lashkar, Gwalior-474001, Tel: 0751-930328312. HIMMATNAGAR: DFF-77/78, New Durga Bazar, Nr. Railway crossing,Himmatnagar-383001, Tel: 02772 324456. HUBLI: Shop No 1,Sona Chambers (South Wing), 124 Club Road. Hubli -580020, Tel:. HYDERABAD: Shop No F4, 1st Floor, Sreeman Rama Towers,Adj to Swagath Hotel,Chaitanyapuri Cross Road, Dilsukhnagar, Hyderabad-500035, Tel: 040 32481002, INDORE: 113, Bansi Trade Centre, M.G.Raod,Indore-452001, Tel: 0731 3294450. JABALPUR: 109, 1St Floor, Rajul Arcade, Russel Chowk, Jabalpur-482001, M.P. Tel:. JAIPUR: M-3 (C), Sangam Tower, Church Road, M.I.Road, Jaipur - 302001, Tel: 0141-3220834. JALANDHAR: B-38, 1st Floor, Globe TVS Building, G.T.Road,Opp. Bus-Stand, Jalandhar-144001. , Tel:. JAMNAGAR: 554-555, 5Th Floor, Indraprasth,Near Pancheshwartower, B/H Super Market, Jamnagar-361001, Tel: 0288-3292891. JAMSHEDPUR: 48, Second Floor, Kamani Center,Bistupur, Jamshedpur-831001,, Tel: 0657 3209606. JODHPUR: Gang Tower, Ground Floor, Chopasni Road, Jodhpur-342003. , Tel:. JUNAGADH: 208, Punit Shopping Center, Ranavav Chowk, M G Road, Junagadh, Tel: 0285-3290575. KANPUR: 507-509, 5Th Floor,No. 63/2 “City Centre”,The Mall, Kanpur-208001, Tel: 0512 3209840. KOLHAPUR: F-06, 1St Floor, Vasant-Prabha Chambers,1125-E, Above Indusind Bank, Major Satyajit Shinde Path, Near Parikh Pool,Sykes Extension, Kolhapur-416001, Tel:. KOLKATA: Room No. 202 D, 2Nd Floor,Marlin Chamber,18, British India Street,Nr. Great Eastern Hotel, Kolkatta-700069, Tel: 033-32445600/5700. : LUCKNOW: S- 201, 2nd FLOOR, SKI HI CHAMBERS,11/ 5, PARK ROAD, HAZRATGANJ,LUCKNOW-226001, Tel: 0522-4041824/3250020. LUDHIANA: 1St - A, Second Floor, Pearl Palace Ghumar Mandi, Ludhiana-141001, Tel:. MEHSANA: 250-251, 2Nd Floor, Sardar Vyapar Sankul, Malgodawn Road, Mehsana-384002, Tel: 02762-325562. MORADABAD:10/11, 1st Floor, Chaddha Complex, GMD Road,Moradabad-244001, Tel:. MUMBAI: Flat No.201, A Wing, Vetex Vikas Chambers, Mv Road, Nr Andheri East, Andheri -400069, Tel: 022-32545280 MYSORE: #1037, 1st Floor, Devaparthiva Road, Off M.G.Road, B/w LAW Courts & RTO Office, Chamarajapuram, Mysore-570004, Tel: 0821-3200018. NADIAD: 203, City Point, Opp. Ipcowala Hall, Nr, Paras Cinema, College Road, Nadiad-387001. , Tel: 0268 3293228. NAGPUR: Shop No. Bs-1, Amarjyoti Palace,Wardha Road, Dhantoli,Nagpur -440012,Tel: 0712 3200807. NASIK: 301, Padma Vishwa Apartment, 4th Floor,Old Pandit Colony,Sharanpur,Nasik-422002, Tel: 0253-3201446. NAVSARI: 214,Manohar Comlex,Opp- Daboo Hospital,Fuvara Road, Navsari -396445, Tel: 02637-253782/325541. NEW DELHI : 717-720, Kirti Shikhar Tower, 11, District Centre, Janakpuri, New Delhi-110058. , Tel: 011- 32627300, NOIDA: Office No.41, Ground Floor, Ansal Fortune Arcade,Near PNB ATM, K-Block, Sector-18, Noida-201301, Tel: 0120-3106622. PALANPUR: 54 Ii Floor City Light Business Center,City Light Road, Pallanpur - 385001, Tel: 02742 324848. PANCHKULA: 2nd Floor, Front Side, SCO-64, Sector-11, Panchkula-134109, Tel:. PANIPAT: 946/8, 2nd Floor, Classic Tower, Battakh Chowk, Grand Trunk Road, Panipat-132103. , Tel: 0180 3200214. PATAN: 43, 1St Floor, City Point Market, Opp. Kohinoor Cinema, Bus Station Road, Patan - 384265, Tel: 02766 326640, 6Th Floor Room No 606, Jagat Trade Center, Fraser Road Patna, Patna 800001, Tel:. PORBANDAR: Shop No. 6, First Floor,Shree Raj Complex,M.G. Road,Porbandar, Tel:0286 3291166. PUNE: 2Nd Floor, Pongal,Above Datar Clinic,Behind Hotel “Panchavati Gaurav”,Off Bhandarkar Road,Nr.Deccan Gymkhana, Deccan,Pune - 411004, Tel: 020 32534699 RAIPUR: 232, Second Floor, Rishabh Complex, M.G. Road, Raipur-492001.Chattishgadh. Tel: 0771-3250422. RAJAMUNDRY: 46-7-22, 1st Floor, Jetty Towers,Danavaipeta, Rajahmundry-533103. , Tel: 0883 3244440. RAJKOT: 401,Star Chambers, Harihar Chowk, Rajkot-360001., Tel: 0281 3290809. RANCHI: F1-F2, 1st Floor, Amarnath Complex, Kailash BabuStreet, Behind Daily Market Police Station, Daily Market, Main Road, Ranchi-834001, Tel: 0651-3244044. RATLAM: 734, Chatri Pool Road, Fatema Market, Ratlam-457001, Tel:. SAGAR: 1st Floor, F-8, Dwarkaji Complex,7, Civil Lines, Sagar-470002, Tel:. SANGLI: 4th Floor, Shiv- Meridian, Azaad Chowk, Opposite Collector’s Bunglow, Sangli-416416. , Tel:. SURAT-FSI: NJ Fundz Network, 7 th Floor Vishwakarma Arcade, Ring Road, Majuragate Surat, Tel: 3013957. TRICHY: 2Nd Floor, 86, Gp Raja Tower, Madurai Road,Bharathiar Salai, Trichy - 620008, Tel:. UDAIPUR: 303-Third Floor, Akruti Complex,New Fatehpura, Opp. St. Mary School,Udaipur-313001, Tel: 0294-3204257. VALSAD: 6, 1St Floor,Ava Bai Complex, Halar Road,Valsad-396 001. Tel: 02632 320520. VAPI: 102, Bhanu Darshan Appt. Opp. Parth Complex, Gunjan, Vapi., Tel: 0260 3255778. VARANASI: Shop No.20, 1St Floor, Abc Tower, Shastri Nagar Chowk, Sigra, Varanasi-221001, Tel:. VIJAYWADA: 40-5-2, Maruthi Towers, Gr.Floor, 3rd Flat, Tikkle Road, Vijaywada-520010. Tel:. VISHAKHAPATNAM: 47-15-14/27, VRC Complex,Dwarakanagar, Vishakhaptnam – 530016. Tel: 0891 3260600.RR EQUITY BROKERS (P) LIMITEDAGRA: RR Equity Brokers Pvt. Ltd. 9, SBI Colony, 1st Floor, Opp. Subhash Park, M.g.road, Agra, UP, Tel: 9319087289. AHMEDABAD: RR Equity Brokers Pvt. Ltd. 401, Abhijit-1, Opp. Bhuj Mercantile Bank, Mithakhali, 6 Road, Navrangpura, Ahmedabad-390009, Tel: 079- 40211888. ANAND: RR Equity Brokers Pvt Ltd - G-1,Silver Oaks,Opp. Swayambar Party Plot V.v.road Anand GujaraT 388001, Tel: 9377306968,. BANGALORE: RR Equity Brokers Pvt. Ltd. S-111,Manipal Centre,47,Deckenson Road,Banglore-42, Tel: 080-42477177. BHAWNAGAR:RR Equity Brokers Pvt Ltd - 251 Madhav Darshan,Waghawadi Road Bhavnagar Gujarat 364001, Tel: 0278-2522120, 9426235681. BHUBANESHWAR: RR Equity Brokers Pvt Ltd - 3-4 Anand Plaza, Laxmi Sagar ,Square Cuttack Road, Bhubaneshwar Orissa 751009, Tel: 9861196880, 9861196880. BOKARO: RR Equity Brokers Pvt Ltd - Ga-18,City Center Sector-4 Bakaro Steel City, Jharkhand-827004, Tel: 9835139765, 9835377584. CHANDIGARH: RR Equity Brokers Pvt. Ltd. SCO-222-223,Gr. Floor,Sector-34A, Chandigarh, Tel: 0172-2624896.CHENNAI: RR Equity Brokers Pvt. Ltd. 3rd Flr.,Percision Plaza,New -397, Teynampet, anna Salai, Chennai- 600018, Tel: 044-42077370/71. DEHRADUN: RR Equity Brokers Pvt. Ltd. 56, 1st Floor, Rajpur Road,Opp. Madhuban, Dehradun, Uttaranchal- 248001, Tel: 0135-3258181. DELHI: RR Equity Brokers Pvt. Ltd. 106, Pankaj Chambers, Preet Vihar Community Centre, Delhi - 110092, Tel: 011-42421238-39, 49504400. DELHI: RR Equity Brokers Pvt. Ltd. Shop No. 24, FD Market, Near Madhuban Chowk, Pitampura, Delhi - 110034, Tel: 011 - 27311419.DHANBAD: RR Equity Brokers Pvt Ltd - 218,Sri Ram Plaza 2nd,Floor Bank More,Dhanbad Jharkhand-826000, Tel: 9431721838, 9431159178. DURGAPUR: RR Equity Brokers Pvt Ltd - Banerjee House- Dakshinayan Durgapur-713218 West Bengal, Tel: 0343-2556908, 9434009475. FARIDABAD: RR Equity Brokers Pvt. Ltd. Shop No. 55, 1st Floor, Near Flyover,Neelam Chowk,NIIT, Faridabad - 121001, Haryana, Tel: 0129-02427361. GHAZIABAD: RR Equity Brokers Pvt. Ltd. 114, Satyam Complex, Raj Nagar DC, Raj Nagar, Ghaziabad - 201002,Uttar Pradesh, Tel: 0120-2828090. GORAKHPUR: RR Equity Brokers Pvt Ltd - Gupta Metal Stores, Harbans Gali, Hindi Bazar Gorakhpur U.P 273005, Tel: 0551-2205986, 9936590296. GURGAON: RR Equity Brokers Pvt Ltd - 101,Apna Bazaar Gurgaon Haryana 122001, Tel: 0124-5108108, 9212048108. INDORE: RR Equity Brokers Pvt. Ltd. 206 Gold Arcade, 1/3 New Palasia, Indore M.P- 452001, Tel: 9826062666. JABALPUR: RR Equity Brokers Pvt Ltd - Shop No. 5, Unique Tower, Shashtri Bridge Chowk,Opp. Icici Bank. Jabalpur Madhya Pradesh482002, Tel: 9827066823, 9827066823. JAIPUR: RR Equity Brokers Pvt. Ltd. 7,Katewa Bhawan,Opp. Ganapati Plaza, MI Road,Jaipur- 302001, Tel: 0141-3235456. JODHPUR: RR Equity Brokers Pvt Ltd - 77, Prem Vihar, Opp-chopasni School,Chopasni Road Jodhpur Rajasthan 342003, Tel: 9928388322,. KANPUR: RR Equity Brokers Pvt Ltd - 26 L.G.F. Roland Tower 17/5 The Mall Kanpur Uttar Pradesh 208001, Tel: 2079930, 9336219040. KOLKATA: RR Equity Brokers Pvt. Ltd. 704,Krishna Bldg.,224,AJC Bose Road, Kolkata- 700017, Tel: 033-22802963/22806878. LUCKNOW: RR Equity Brokers Pvt. Ltd. G-32,Shriram Tower,13- A,Ashok Marg, Lucknow- 226001, Tel: 0522- 4057612. MANGLORE: RR Equity Brokers Pvt Ltd - F - 2 1st Floor Adithi Arcade Karangalpay mangalore - 575003 Karnataka, Tel: 9845288557,. MUMBAI: RR Equity Brokers Pvt. Ltd. 18 First Floor,105 bombay Samachar Marg.,Fort, Mumbai- 400023, Tel: 022-40544201/224. MUMBAI: RR Equity Brokers Pvt. Ltd. 133A, Mittal Tower, A Wing, 13th Floor, Nariman Point, Mumbai- 400021, Tel: 9324804084. NEW DELHI:RR Equity Brokers Pvt. Ltd. 47, M.M. Road, Rani Jhansi Marg, Jhandewalan, New Delhi – 110055, Tel: 011-23636363/62. NEW DELHI: RR Equity Brokers Pvt. Ltd. 105, Anchal Plaza,Nelson Mandela Road Vasant Kunj,New Delhi-110070, Tel: 011-26891262,26134764. NEW DELHI: RR Equity Brokers Pvt. Ltd. 105, Pratap Bhawan, Bahadur Shah Zafar Marg, New Delhi - 110001, Tel: 011- 49505500,41509018. NEW DELHI: RR Equity Brokers Pvt. Ltd. 118, Gagandeep Building, Rajendra Place, New Delhi- 110008, Tel: 011- 25764872,41538956.NEW DELHI: RR Equity Brokers Pvt. Ltd.N-24 - 25, Connaught Place, New Delhi - 110001, Tel: 011- 41523306, 46308803, 41523229. NEW DELHI: RR Equity Brokers Pvt. Ltd. 111, Jyotishikhar, 8 Distt. Centre, Janakpuri, New Delhi - 110018, Tel: 011- 25617654. NOIDA: RR Equity Brokers Pvt. Ltd. P-5,Sector - 18,Noida- 201301, Uttar Pradesh, Tel: 0120-4336992. PATNA: RR Equity Brokers Pvt Ltd - 422-23, 4th Floor,Ashiyana Harniwas Complex,New Dak Bunglow Road Patna Bihar 800001, Tel: 9334114868, 9334114868. ROHTAK: RR EquityBrokers Pvt Ltd - 103 Balaji Financial House Scf-28 Huda Complex Rohtak Haryana 124001, Tel: 9215011706, 9896001705. SURAT: RR Equity Brokers Pvt Ltd - 9-Ravi Raj Society, Behind Gayatri Mandir,New City Light Road Surat Gujarat 395002, Tel: 0261-2265818, 9925233692. VADODARA: RR Equity Brokers Pvt. Ltd. 222 Siddharth Complex,RC Dutta Road.,Vadodra- 390007, Tel: 0265-3256190/2353195. VARANASI: RR Equity Brokers Pvt. Ltd.Shop no. 38, Ground Floor Kuber Complex, Rath Yatra, Tel: 9415201997.SHAREKHAN LIMITEDAHMEDABAD : 201/202, Dynamic House, Near Vijay Cross Road, Navrangpura-380009, Tel : 079 – 66060141, ALWAR : 2/539, Aravali Vihar, Kala Kua Housing Board-301001, Tel : 0144-2360880. AMRITSAR : 5 Deep Complex, 1st floor, Opp Doaba Automobiles, Court Road-143001, Tel : 0183 – 6451903, Anand : F/5, Prarthana Vihar Complex, 1st Floor, Near Panchal Hall, Vidyanagar Road-388001, Tel : 02692 – 245615, AURANGABAD : Office no 1, 2, 3, ist Floor, Varad Towers, Khokadpura, Near Shivaji High School-431001, Tel : 0240-2361240,BANGALORE : #2307, Swanlines Building, 12th Main Road, 3rd Block East, Jayanagar-560011, Tel : 080 - 42876666, BETTIAH : Near Hotel Bharat Jalpan, Lal Bazar-845438, Tel : 06254-241512, BETUL : “ Housing Board Colony “, Gurudwara Road, Ganj-460001, Tel : 07141 – 233233, BHAVNAGAR : Gangotri Plaza, Plot No-8A, 3 rd Floor, Opp Dakshinamurti School, Waghawadi Road-364001, Tel : 0278 – 2573938, BHOPAL : Shop No. 114, 115 & 116, 1st Floor, Plot No. 2, Akansha Parisar, Zone-1, M.P. Nagar-462011, Tel : 0755 – 4291600,BHUBANESHWAR : 50-Forest Park, Near Airport Square, Udyan Marg, Bhubaneswar-751009-751009, Tel : 0674-2595883, CALICUT : 1st Floor, 6/1002 F, City Mall, Opp. YMCA, Kannur Road-673001, Tel : 0495 – 6450307, CHENNAI : G-2, Salzburg Square, 107-Harrington Road, Chetpet-600031, Tel : 044 – 28362800, COIMBATORE : Vigneswar Cresta, 2nd Block, 3rd Floor, 1095-Avinashi Road, P N Palayam-641037, Tel : 0422 – 2213434, ERODE : Akhil Complex, Block No.1, T.S.No.121, Perundurai Road, Opp.to Padmam <strong>Rest</strong>aurant, - 638011,Tel : 0424 2241001, GUNTUR : D.No.5-87-89, 2nd Lane, 2nd Floor, Lakshipuram Main Road-522007, Tel : 0863 – 6452334, GURGAON : GF 10 JMD Regent Square, DLF Phase II, Near