An introduction to LDI - Insight Investment

An introduction to LDI - Insight Investment

An introduction to LDI - Insight Investment

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

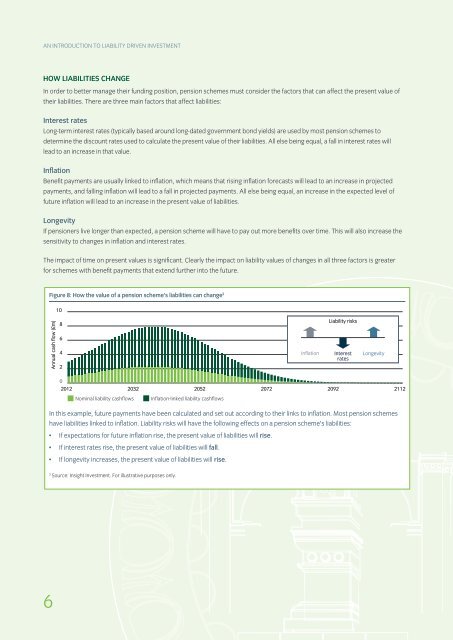

AN INTRODUCTION TO LIABILITY DRIVEN INVESTMENTHOW LIABILITIES CHANGEIn order <strong>to</strong> better manage their funding position, pension schemes must consider the fac<strong>to</strong>rs that can affect the present value oftheir liabilities. There are three main fac<strong>to</strong>rs that affect liabilities:Interest ratesLong-term interest rates (typically based around long-dated government bond yields) are used by most pension schemes <strong>to</strong>determine the discount rates used <strong>to</strong> calculate the present value of their liabilities. All else being equal, a fall in interest rates willlead <strong>to</strong> an increase in that value.InflationBenefit payments are usually linked <strong>to</strong> inflation, which means that rising inflation forecasts will lead <strong>to</strong> an increase in projectedpayments, and falling inflation will lead <strong>to</strong> a fall in projected payments. All else being equal, an increase in the expected level offuture inflation will lead <strong>to</strong> an increase in the present value of liabilities.LongevityIf pensioners live longer than expected, a pension scheme will have <strong>to</strong> pay out more benefits over time. This will also increase thesensitivity <strong>to</strong> changes in inflation and interest rates.The impact of time on present values is significant. Clearly the impact on liability values of changes in all three fac<strong>to</strong>rs is greaterfor schemes with benefit payments that extend further in<strong>to</strong> the future.Figure 8: How the value of a pension scheme’s liabilities can change 210<strong>An</strong>nual cash flow (£m)8642InflationLiability risksInterestratesLongevity02012 2032 2052 2072 2092 2112■ Nominal liability cashflows ■ Inflation-linked liability cashflowsIn this example, future payments have been calculated and set out according <strong>to</strong> their links <strong>to</strong> inflation. Most pension schemeshave liabilities linked <strong>to</strong> inflation. Liability risks will have the following effects on a pension scheme’s liabilities:• If expectations for future inflation rise, the present value of liabilities will rise.• If interest rates rise, the present value of liabilities will fall.• If longevity increases, the present value of liabilities will rise.2Source: <strong>Insight</strong> <strong>Investment</strong>. For illustrative purposes only.6