londonaccountant - ICAEW

londonaccountant - ICAEW

londonaccountant - ICAEW

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

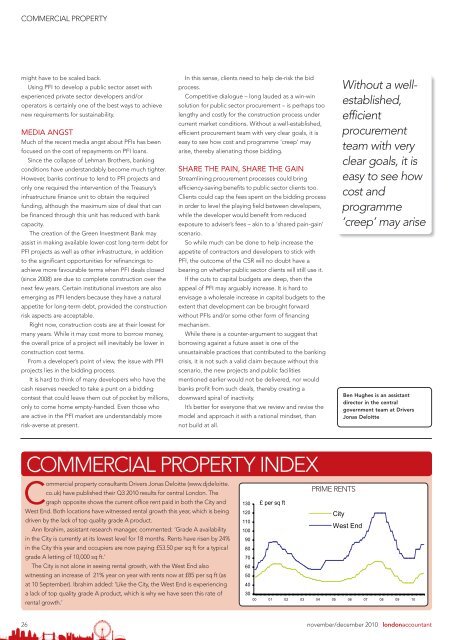

COMMERCIAL PROPERTYmight have to be scaled back.Using PFI to develop a public sector asset withexperienced private sector developers and/oroperators is certainly one of the best ways to achievenew requirements for sustainability.MEDIA ANGSTMuch of the recent media angst about PFIs has beenfocused on the cost of repayments on PFI loans.Since the collapse of Lehman Brothers, bankingconditions have understandably become much tighter.However, banks continue to lend to PFI projects andonly one required the intervention of the Treasury’sinfrastructure finance unit to obtain the requiredfunding, although the maximum size of deal that canbe financed through this unit has reduced with bankcapacity.The creation of the Green Investment Bank mayassist in making available lower-cost long-term debt forPFI projects as well as other infrastructure, in additionto the significant opportunities for refinancings toachieve more favourable terms when PFI deals closed(since 2008) are due to complete construction over thenext few years. Certain institutional investors are alsoemerging as PFI lenders because they have a naturalappetite for long-term debt, provided the constructionrisk aspects are acceptable.Right now, construction costs are at their lowest formany years. While it may cost more to borrow money,the overall price of a project will inevitably be lower inconstruction cost terms.From a developer’s point of view, the issue with PFIprojects lies in the bidding process.It is hard to think of many developers who have thecash reserves needed to take a punt on a biddingcontest that could leave them out of pocket by millions,only to come home empty-handed. Even those whoare active in the PFI market are understandably morerisk-averse at present.In this sense, clients need to help de-risk the bidprocess.Competitive dialogue – long lauded as a win-winsolution for public sector procurement – is perhaps toolengthy and costly for the construction process undercurrent market conditions. Without a well-established,efficient procurement team with very clear goals, it iseasy to see how cost and programme ‘creep’ mayarise, thereby alienating those bidding.SHARE THE PAIN, SHARE THE GAINStreamlining procurement processes could bringefficiency-saving benefits to public sector clients too.Clients could cap the fees spent on the bidding processin order to level the playing field between developers,while the developer would benefit from reducedexposure to adviser’s fees – akin to a ‘shared pain-gain’scenario.So while much can be done to help increase theappetite of contractors and developers to stick withPFI, the outcome of the CSR will no doubt have abearing on whether public sector clients will still use it.If the cuts to capital budgets are deep, then theappeal of PFI may arguably increase. It is hard toenvisage a wholesale increase in capital budgets to theextent that development can be brought forwardwithout PFIs and/or some other form of financingmechanism.While there is a counter-argument to suggest thatborrowing against a future asset is one of theunsustainable practices that contributed to the bankingcrisis, it is not such a valid claim because without thisscenario, the new projects and public facilitiesmentioned earlier would not be delivered, nor wouldbanks profit from such deals, thereby creating adownward spiral of inactivity.It’s better for everyone that we review and revise themodel and approach it with a rational mindset, thannot build at all.Without a wellestablished,efficientprocurementteam with veryclear goals, it iseasy to see howcost andprogramme‘creep’ may ariseBen Hughes is an assistantdirector in the centralgovernment team at DriversJonas DeloitteCOMMERCIAL PROPERTY INDEXCommercial property consultants Drivers Jonas Deloitte (www.djdeloitte.co.uk) have published their Q3 2010 results for central London. Thegraph opposite shows the current office rent paid in both the City andWest End. Both locations have witnessed rental growth this year, which is beingdriven by the lack of top quality grade A product.Ann Ibrahim, assistant research manager, commented: ‘Grade A availabilityin the City is currently at its lowest level for 18 months. Rents have risen by 24%in the City this year and occupiers are now paying £53.50 per sq ft for a typicalgrade A letting of 10,000 sq ft.’The City is not alone in seeing rental growth, with the West End alsowitnessing an increase of 21% year on year with rents now at £85 per sq ft (asat 10 September). Ibrahim added: ‘Like the City, the West End is experiencinga lack of top quality grade A product, which is why we have seen this rate ofrental growth.’PRIME RENTS130 £per sq ft120110100CityWest End9080706050403000 01 02 03 04 05 06 07 08 09 1026november/december 2010 <strong>londonaccountant</strong>