'Vagina Monologues' to stay off campus

'Vagina Monologues' to stay off campus

'Vagina Monologues' to stay off campus

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

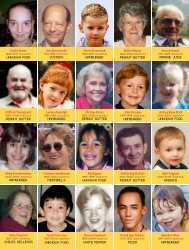

Closer LookPAGE 10The Marquete TribuneTHURSDAY, MARCH 4, 2010UP TO 30 DAYS31-60 DAYS61-90 DAYSOVER 90 DAYSMINIMUM PAYMENTTOTAL DUE $35,756,471.00Marquette vs. <strong>to</strong>p competi<strong>to</strong>rs*It’s possible for students <strong>to</strong> survive thedetriments of debt — but at what cost?than their parents make in a yearalso s<strong>to</strong>ps many low-incomestudents from enrolling in college.University of Wisconsin-Madison· Total cost of attendance = $18,155· Average debt of graduates = $21,12351percent ofstudents graduatewith debtMarquette University· Total cost ofattendance = $37,748· Average debt of graduates =$30,563percentstudents graduatewith debt63percent ofLoyola University Chicago· Total cost ofattendance = $40,798· Average debt of graduates= $32,13458percent ofstudents graduatewith debtUniversity of Illinois atUrbana-Champaign52 with debt*All figures are from 2007-’08, the most recent dataavailable. Total cost is for on-<strong>campus</strong> students. Publicinstitutions’ costs are only for in-state residents.Sources: The Institute for College Access & Success, College InSightBy Kaellen Hesselkaellen.hessel@marquette.edu· Total cost of attendance = $23,150· Average debt of graduates = $17,930Dozens of all-nighters. Hundredsof tests. Thousands ofpages written. Days gone bywithout showering becausethere just isn’t time. More sleepdeprivation-related illnessesthan have been diagnosed.Finally — thankfully — it allcomes <strong>to</strong> an end.After years of strenuous learning,nothing can put adamper on graduation.That is, exceptdebt.Megan Kenny,a fifth-year seniorin the Col-percent ofstudents graduateSaint Louis University· Total cost of attendance = $44,286· Average debt of graduates = $29,29867percentwith deb<strong>to</strong>fstudents graduatelege of Nursing,will graduatethis May with$86,000 inloans. That’smore than threetimes the medianamount of debt of aMarquette graduate in2009. Half of these loansare private loans, which haveoften have lower interest ratesand fees than federal or stateloans.Each year when Kenny <strong>to</strong>okout a small loan, she said itdidn’t look that bad. But nowthe <strong>to</strong>tal number is staring backat her.Kenny can’t help but wonderif there’s something she couldhave done <strong>to</strong> borrow less.But she did all she could.Kenny worked during summersand had <strong>campus</strong> jobs. Forthree-and-a-half years, she evenhad her room and board paid bythe Office of Residence Life byworking as a resident assistantand facility manager.Sound familiar?The graduatingclass of2010 will havepaid $105,644in tuition andfees overfour years atMarquette. Ifgraduates borrowedfederalloans, they’llhave a six <strong>to</strong>nine month graceperiod beforethey must beginrepayment. If they’veborrowed private loans,they may have <strong>to</strong> start payingthem back immediately.As soon as graduates havetheir diplomas in hand, they enterthe real world — in the red.Student loans: Not such‘charitable gifts’The median debt of 2009Marquette graduates was$25,635, said Susan Teerink,direc<strong>to</strong>r of the Office of StudentFinancial Aid. The average debtwas $31,469.In 2008, 63 percent of graduatesleft Marquette with debt,according <strong>to</strong> the Project on StudentDebt, an initiative by theInstitute for College Access &Success.The source of this debt is studentloans.“Loans are not reallygenerosity or philanthropy.”For the 2009-’10 schoolyear, the <strong>to</strong>talamountborrowed byM a r q u e t t estudents was$35,756,471,according <strong>to</strong> the Office of InstitutionalResearch and Assessment.This marks a 51 percentincrease from 2003-’04 adjustingfor inflation.Approximately 90 percen<strong>to</strong>f undergraduates currentlyreceive financial aid, whichincludes loans, grants, scholarshipsand work study.Although loans appear inmost financial aid packages,they shouldn’t be “confused asa charitable gesture,” said MarkKantrowitz, publisher of FinAid.org and FastWeb.com, Web sitesthat guide students through thefinancial aid process and helpthem find scholarships.Loans have <strong>to</strong> be repaid andare profitable for lenders — includingthe government — becauseof the interest rates thatare charged on loans, he said.“Loans are not really generosityor philanthropy,” Kantrowitzsaid. “It’s a way of paying thebills over time.”Loans <strong>off</strong>er a source of cashflow because few people can afford<strong>to</strong> write a check right awayfor the cost of their <strong>to</strong>tal education,he said.But debt doesn’t just affect individualstudents.It limits graduates’ career options,deters them from going <strong>to</strong>graduate school and getting inmore debt, and delays the purchaseof their first homes, aswell as other major purchases,said Edie Irons, communicationsdirec<strong>to</strong>r for the Institutefor College Access and Success,which works <strong>to</strong> make higher educationaffordable and possiblefor students.“We need more college graduates,not less, in order <strong>to</strong> <strong>stay</strong>competitive (as a nation),” Ironssaid.Kantrowitz added that theneed <strong>to</strong> borrow more moneyMA R K KA N T R O W I T ZFinAid.org and FastWeb.com PublisherThe dangers of defaultingDefaulting occurs when studentsare unable <strong>to</strong> make a paymen<strong>to</strong>n their student loans asscheduled in a legal contractwhen they <strong>to</strong>ok out the loan.Student loans do not disappeareven if a student declares bankruptcy.If a student defaults ona federal loan, the governmentwill be paid back, Kantrowitzsaid.The government can sue students,garnish their wages up <strong>to</strong>15 percent of their take-homepay, deduct up <strong>to</strong> 25 percent ofthe monthlyloan paymentfor collectioncharges, preventgraduatesfrom renewingtheir professionallicenses,collect their social security benefitsand take the full amountfrom any state and federal incometax refunds, he said.Although private lenders donot have as much power <strong>to</strong> reclaimtheir borrowings, they areable <strong>to</strong> garnish wages — notlimited <strong>to</strong> 15 percent — witha court order, as well as leavenasty phone messages, he said.“It can be devastating <strong>to</strong> havepeople be unable <strong>to</strong> pay <strong>off</strong> theirloans and end up ruining theircredit,” Kantrowitz said.Poor credit ratings make itdifficult <strong>to</strong> get other loans andloans with low interest rates.They can also prevent the purchaseof a car or a home.Most students who default ontheir loans do so within the firstfive years, Kantrowitz said.Defaulting primarily occurswhen students are unable <strong>to</strong> findjobs after graduation, if theyhave high interest rates on theirloans, or if they don’t graduateat all. Students are three timesmore likely <strong>to</strong> default if theydon’t receive a diploma, Kantrowitzsaid.Of the 45 percent of 2009Marquette graduates that completedthe Graduating SeniorsSurvey late last April, only 26percent had been <strong>off</strong>ered a fulltimejob.Despite this number, Marquettestill has a low defaultrate.While the fiscal year 2007national cohort default rate was6.7 percent, Marquette’s ratewas 1.1 percent.Kantrowitz said it’s typicalfor four-year, nonprofit universities<strong>to</strong> have such low ratesbecause their students tend <strong>to</strong>be wealthier, and thus are lesslikely <strong>to</strong> default.Teerink said this low rate is atestament <strong>to</strong> Marquette students’