Corporatization for MSMEs - msme-mentor.in

Corporatization for MSMEs - msme-mentor.in

Corporatization for MSMEs - msme-mentor.in

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

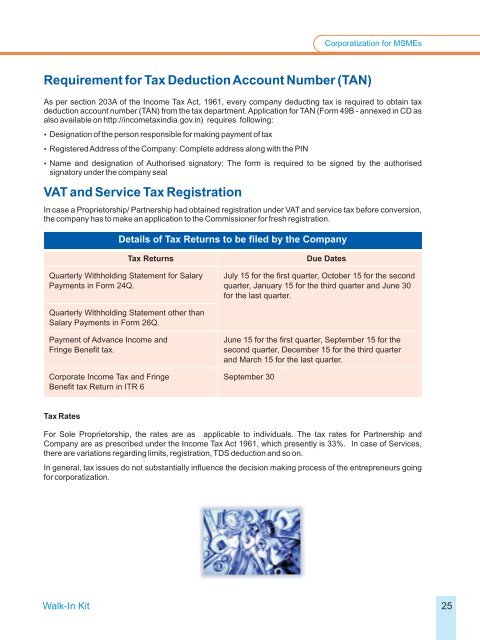

<strong>Corporatization</strong> <strong>for</strong> <strong>MSMEs</strong>Requirement <strong>for</strong> Tax Deduction Account Number (TAN)As per section 203A of the Income Tax Act, 1961, every company deduct<strong>in</strong>g tax is required to obta<strong>in</strong> taxdeduction account number (TAN) from the tax department. Application <strong>for</strong> TAN (Form 49B - annexed <strong>in</strong> CD asalso available on http://<strong>in</strong>cometax<strong>in</strong>dia.gov.<strong>in</strong>) requires follow<strong>in</strong>g:Designation of the person responsible <strong>for</strong> mak<strong>in</strong>g payment of taxRegistered Address of the Company: Complete address along with the PINName and designation of Authorised signatory: The <strong>for</strong>m is required to be signed by the authorisedsignatory under the company sealVAT and Service Tax RegistrationIn case a Proprietorship/ Partnership had obta<strong>in</strong>ed registration under VAT and service tax be<strong>for</strong>e conversion,the company has to make an application to the Commissioner <strong>for</strong> fresh registration.Details of Tax Returns to be filed by the CompanyTax Returns Due DatesQuarterly Withhold<strong>in</strong>g Statement <strong>for</strong> Salary July 15 <strong>for</strong> the first quarter, October 15 <strong>for</strong> the secondPayments <strong>in</strong> Form 24Q. quarter, January 15 <strong>for</strong> the third quarter and June 30<strong>for</strong> the last quarter.Quarterly Withhold<strong>in</strong>g Statement other thanSalary Payments <strong>in</strong> Form 26Q.Payment of Advance Income andFr<strong>in</strong>ge Benefit tax.June 15 <strong>for</strong> the first quarter, September 15 <strong>for</strong> thesecond quarter, December 15 <strong>for</strong> the third quarterand March 15 <strong>for</strong> the last quarter.Corporate Income Tax and Fr<strong>in</strong>ge September 30Benefit tax Return <strong>in</strong> ITR 6Tax RatesFor Sole Proprietorship, the rates are as applicable to <strong>in</strong>dividuals. The tax rates <strong>for</strong> Partnership andCompany are as prescribed under the Income Tax Act 1961, which presently is 33%. In case of Services,there are variations regard<strong>in</strong>g limits, registration, TDS deduction and so on.In general, tax issues do not substantially <strong>in</strong>fluence the decision mak<strong>in</strong>g process of the entrepreneurs go<strong>in</strong>g<strong>for</strong> corporatization.Walk-In Kit25