Annual Report 2007 - Clariant

Annual Report 2007 - Clariant

Annual Report 2007 - Clariant

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

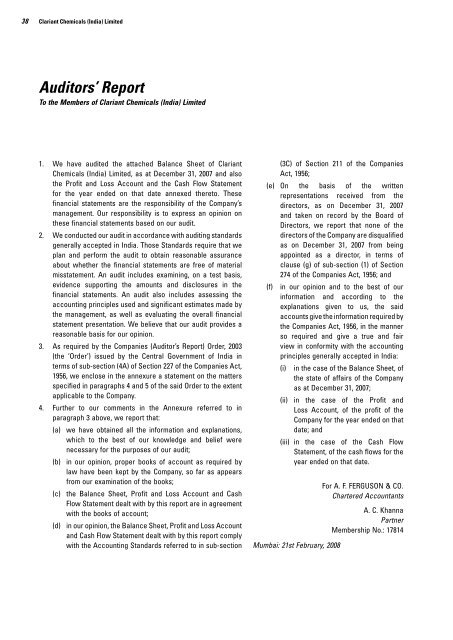

38 <strong>Clariant</strong> Chemicals (India) LimitedAuditors’ <strong>Report</strong>To the Members of <strong>Clariant</strong> Chemicals (India) Limited1. We have audited the attached Balance Sheet of <strong>Clariant</strong>Chemicals (India) Limited, as at December 31, <strong>2007</strong> and alsothe Profit and Loss Account and the Cash Flow Statementfor the year ended on that date annexed thereto. Thesefinancial statements are the responsibility of the Company’smanagement. Our responsibility is to express an opinion onthese financial statements based on our audit.2. We conducted our audit in accordance with auditing standardsgenerally accepted in India. Those Standards require that weplan and perform the audit to obtain reasonable assuranceabout whether the financial statements are free of materialmisstatement. An audit includes examining, on a test basis,evidence supporting the amounts and disclosures in thefinancial statements. An audit also includes assessing theaccounting principles used and significant estimates made bythe management, as well as evaluating the overall financialstatement presentation. We believe that our audit provides areasonable basis for our opinion.3. As required by the Companies (Auditor’s <strong>Report</strong>) Order, 2003(the ‘Order’) issued by the Central Government of India interms of sub-section (4A) of Section 227 of the Companies Act,1956, we enclose in the annexure a statement on the mattersspecified in paragraphs 4 and 5 of the said Order to the extentapplicable to the Company.4. Further to our comments in the Annexure referred to inparagraph 3 above, we report that:(a) we have obtained all the information and explanations,which to the best of our knowledge and belief werenecessary for the purposes of our audit;(b) in our opinion, proper books of account as required bylaw have been kept by the Company, so far as appearsfrom our examination of the books;(c) the Balance Sheet, Profit and Loss Account and CashFlow Statement dealt with by this report are in agreementwith the books of account;(d) in our opinion, the Balance Sheet, Profit and Loss Accountand Cash Flow Statement dealt with by this report complywith the Accounting Standards referred to in sub-section(3C) of Section 211 of the CompaniesAct, 1956;(e) On the basis of the writtenrepresentations received from thedirectors, as on December 31, <strong>2007</strong>and taken on record by the Board ofDirectors, we report that none of thedirectors of the Company are disqualifiedas on December 31, <strong>2007</strong> from beingappointed as a director, in terms ofclause (g) of sub-section (1) of Section274 of the Companies Act, 1956; and(f) in our opinion and to the best of ourinformation and according to theexplanations given to us, the saidaccounts give the information required bythe Companies Act, 1956, in the mannerso required and give a true and fairview in conformity with the accountingprinciples generally accepted in India:(i) in the case of the Balance Sheet, ofthe state of affairs of the Companyas at December 31, <strong>2007</strong>;(ii) in the case of the Profit andLoss Account, of the profit of theCompany for the year ended on thatdate; and(iii) in the case of the Cash FlowStatement, of the cash flows for theyear ended on that date.Mumbai: 21st February, 2008For A. F. FERGUSON & CO.Chartered AccountantsA. C. KhannaPartnerMembership No.: 17814