REFLECTIONS - LDC

REFLECTIONS - LDC

REFLECTIONS - LDC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

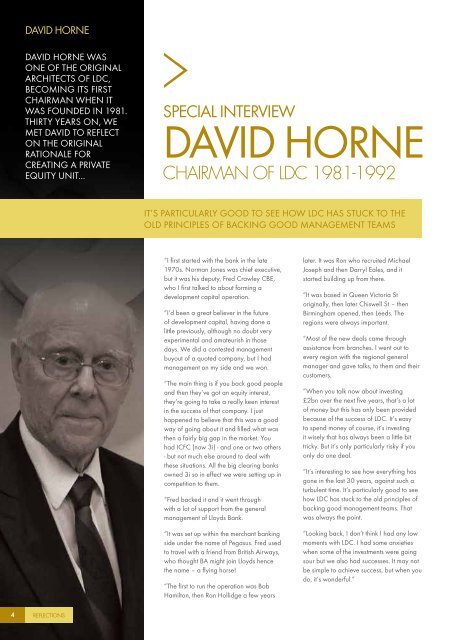

DAVID HORNEDavid Horne wasone of the originalarchitects of <strong>LDC</strong>,becoming its firstchairman when itwas founded in 1981.Thirty years on, wemet David to reflecton the originalrationale forcreating a privateequity unit...SPECIAL INTERVIEWDAVID HORNECHAIRMAN OF <strong>LDC</strong> 1981-1992It’s particularly good to see how <strong>LDC</strong> has stuck to theold principles of backing good management TEAMS“I first started with the bank in the late1970s. Norman Jones was chief executive,but it was his deputy, Fred Crawley CBE,who I first talked to about forming adevelopment capital operation.“I’d been a great believer in the futureof development capital, having done alittle previously, although no doubt veryexperimental and amateurish in thosedays. We did a contested managementbuyout of a quoted company, but I hadmanagement on my side and we won.“The main thing is if you back good peopleand then they’ve got an equity interest,they’re going to take a really keen interestin the success of that company. I justhappened to believe that this was a goodway of going about it and filled what wasthen a fairly big gap in the market. Youhad ICFC (now 3i) - and one or two others- but not much else around to deal withthese situations. All the big clearing banksowned 3i so in effect we were setting up incompetition to them.“Fred backed it and it went throughwith a lot of support from the generalmanagement of Lloyds Bank.“It was set up within the merchant bankingside under the name of Pegasus. Fred usedto travel with a friend from British Airways,who thought BA might join Lloyds hencethe name – a flying horse!“The first to run the operation was BobHamilton, then Ron Hollidge a few yearslater. It was Ron who recruited MichaelJoseph and then Darryl Eales, and itstarted building up from there.“It was based in Queen Victoria Storiginally, then later Chiswell St – thenBirmingham opened, then Leeds. Theregions were always important.“Most of the new deals came throughassistance from branches. I went out toevery region with the regional generalmanager and gave talks, to them and theircustomers.“When you talk now about investing£2bn over the next five years, that’s a lotof money but this has only been providedbecause of the success of <strong>LDC</strong>. It’s easyto spend money of course, it’s investingit wisely that has always been a little bittricky. But it’s only particularly risky if youonly do one deal.“It’s interesting to see how everything hasgone in the last 30 years, against such aturbulent time. It’s particularly good to seehow <strong>LDC</strong> has stuck to the old principles ofbacking good management teams. Thatwas always the point.“Looking back, I don’t think I had any lowmoments with <strong>LDC</strong>. I had some anxietieswhen some of the investments were goingsour but we also had successes. It may notbe simple to achieve success, but when youdo, it’s wonderful.”4<strong>REFLECTIONS</strong>