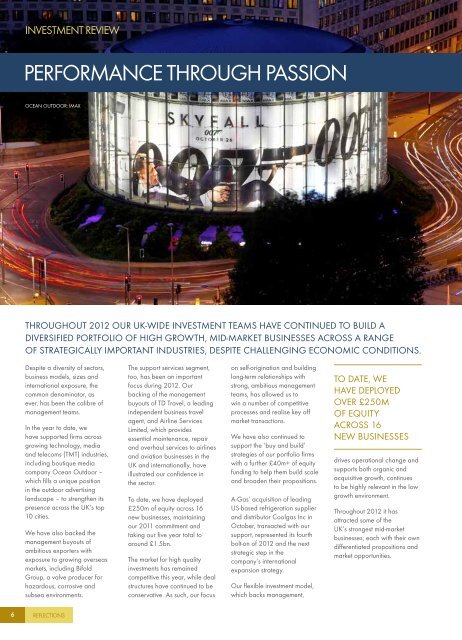

INVESTMENT REVIEWPERFORMANCE THROUGH PASSIONOCEAN OUTDOOR: IMAXThroughout 2012 our UK-wide investment teams have continued to build adiversified portfolio of high growth, mid-market businesses across a rangeof strategically important industries, despite challenging economic conditions.Despite a diversity of sectors,business models, sizes andinternational exposure, thecommon denominator, asever, has been the calibre ofmanagement teams.In the year to date, wehave supported firms acrossgrowing technology, mediaand telecoms (TMT) industries,including boutique mediacompany Ocean Outdoor –which fills a unique positionin the outdoor advertisinglandscape – to strengthen itspresence across the UK’s top10 cities.We have also backed themanagement buyouts ofambitious exporters withexposure to growing overseasmarkets, including BifoldGroup, a valve producer forhazardous, corrosive andsubsea environments.The support services segment,too, has been an importantfocus during 2012. Ourbacking of the managementbuyouts of TD Travel, a leadingindependent business travelagent, and Airline ServicesLimited, which providesessential maintenance, repairand overhaul services to airlinesand aviation businesses in theUK and internationally, haveillustrated our confidence inthe sector.To date, we have deployed£250m of equity across 16new businesses, maintainingour 2011 commitment andtaking our five year total toaround £1.5bn.The market for high qualityinvestments has remainedcompetitive this year, while dealstructures have continued to beconservative. As such, our focuson self-origination and buildinglong-term relationships withstrong, ambitious managementteams, has allowed us towin a number of competitiveprocesses and realise key offmarket transactions.We have also continued tosupport the ‘buy and build’strategies of our portfolio firmswith a further £40m+ of equityfunding to help them build scaleand broaden their propositions.A-Gas’ acquisition of leadingUS-based refrigeration supplierand distributor Coolgas Inc inOctober, transacted with oursupport, represented its fourthbolt-on of 2012 and the nextstrategic step in thecompany’s internationalexpansion strategy.Our flexible investment model,which backs management,To date, wehave deployedOVER £250mof equityacross 16new businessesdrives operational change andsupports both organic andacquisitive growth, continuesto be highly relevant in the lowgrowth environment.Throughout 2012 it hasattracted some of theUK’s strongest mid-marketbusinesses, each with their owndifferentiated propositions andmarket opportunities.6<strong>REFLECTIONS</strong>

INVESTMENT REVIEW2012 INVESTMENTS<strong>LDC</strong> continues to invest right across the UK and in all sectors.Since 2003 <strong>LDC</strong> has supported 137 UK businesses, investing over £2bn.In June, our North West team backed thesecondary buyout of Manchester-basedMetronet (UK), an internet service provider, witha £13m investment to support the expansion ofits wireless network across the UK.Founded in 2003, the company providesbusiness critical data infrastructure, includingwireless and fibre leaded lines and metropolitanethernet networks, to over 500 UK companies.We will provide expertise to enhance the firm’smarketing and sales functions, as well as investin its infrastructure, to enable Metronet (UK)to become one of the UK’s market leadingsuppliers of commercial wireless services.Having formed Boom Pictures alongside seniormembers of Boomerang PLC’s managementteam and Lorraine Heggessey, a formerController of BBC One, we completed thepublic-to-private acquisition of the AIM-listedmedia production group in June.An ideal platform for the new business,Boomerang is a thriving production groupestablished in 1992. It comprises a range ofcompanies whose activities include programmeproduction, post-production services,television facilities and talent management.Boom Pictures is now targeting bolt-onacquisitions of independent and creativeTV companies which would benefit fromadditional investment and the expertise ofsenior industry executives. The deal furtherdemonstrates our commitment to the TMTsector, in which we have invested in over50 companies.In the sixth transaction from our £200mspecialist engineering and manufacturing sectorcommitment, our Midlands-based team invested£10.5m to support the management buyout ofDale Power Solutions from TT electronics plc.The £30m turnover company was formedmore than 75 years ago and operates throughtwo established brands, Dale and Erskine.The firm provides secure power and businesscontinuity solutions to major national andinternational customers in the petro-chem,telecommunications, rail, financial servicesand industrial sectors.Having completed the transaction in Augustand appointed experienced industry chairmanDenzil Lee, Dale Power Solutions’ highlycapable management team will pursueappropriate acquisition opportunities in relatedproduct areas in the UK and internationally,as well as continuing to expand organically.In only the second private equity-backedtransaction to complete under the AlternativeBusiness Structure model introduced by theLegal Services Act, we invested for a minority22.5 per cent shareholding in Keoghs, one ofthe UK’s leading providers of claims-relatedlegal services to the insurance sector.The firm, which employs over 1,200 peopleacross offices in Bolton, Coventry andManchester, combines its legal andinsurance expertise with market-leadingprocesses and technology to defend andprocess a wide range of claims.Our support will enable Keoghs tocontinue investing in its people, processesand technology infrastructure, whileproviding capital for potential strategicacquisitions to add complementaryservices and scale to its operation.WINTER 2012 7